North America Acidulants Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.49 Billion

USD

2.62 Billion

2024

2032

USD

1.49 Billion

USD

2.62 Billion

2024

2032

| 2025 –2032 | |

| USD 1.49 Billion | |

| USD 2.62 Billion | |

|

|

|

|

Segmentación del mercado de acidulantes en Norteamérica por tipo ( ácido cítrico , citrato de sodio, citrato de potasio, ácido acético, ácido fórmico, ácido glucónico, ácido málico, ácido fosfórico y sales, ácido tartárico, ácido láctico, ácido tánico, ácido fumárico, ácido succínico y otros), forma (seca y líquida), función (control de pH, potenciador del sabor ácido, conservantes y otros), canal de distribución (B2B y B2C), usuario final (doméstico/minorista, sector de procesamiento de alimentos y sector de servicios de alimentación): tendencias y pronóstico de la industria hasta 2032.

Tamaño del mercado de acidulantes en América del Norte

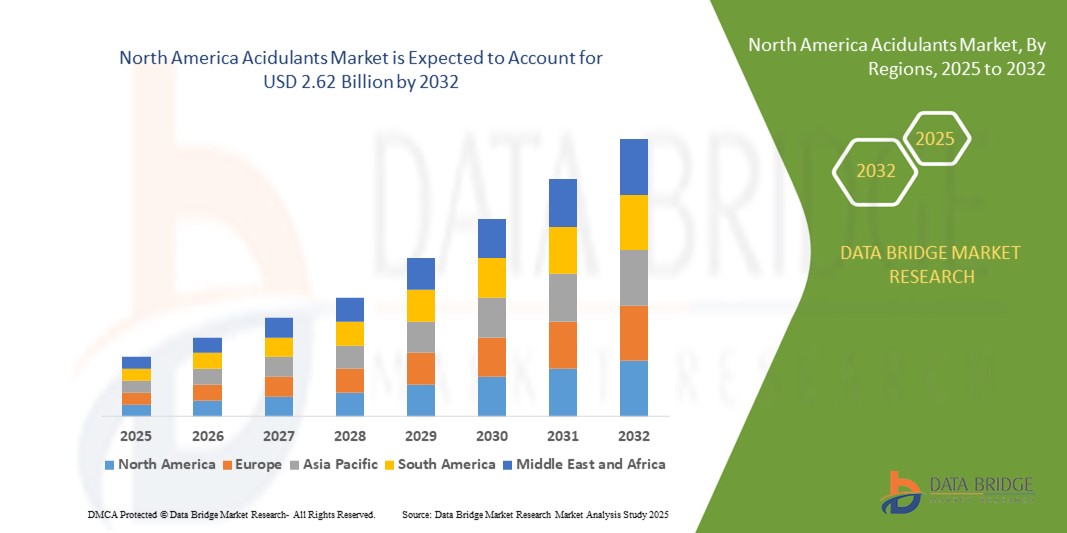

- El tamaño del mercado de acidulantes de América del Norte se valoró en USD 1.49 mil millones en 2024 y se espera que alcance los USD 2.62 mil millones para 2032 , con una CAGR del 7,70% durante el período de pronóstico.

- El mercado de acidulantes en Norteamérica experimenta un crecimiento constante, impulsado por la sólida infraestructura sanitaria de la región y el creciente énfasis en la eficiencia de la cadena de suministro médico. La creciente prevalencia de enfermedades crónicas ha incrementado la demanda de suministros médicos seguros, estables y bien regulados, donde los acidulantes desempeñan un papel vital, en particular para garantizar la integridad del producto, el equilibrio del pH y la estabilidad microbiana.

- La digitalización de la atención médica en Norteamérica está transformando aún más las operaciones logísticas y de almacenamiento. Esta transición digital no solo optimiza el inventario y el transporte, sino que también integra sistemas de control de calidad que utilizan acidulantes para diversas formulaciones farmacéuticas. Como resultado, los acidulantes son cada vez más cruciales para mantener la eficacia de los productos médicos durante todo el proceso de distribución.

Análisis del mercado de acidulantes en América del Norte

- El mercado norteamericano de acidulantes está experimentando un crecimiento acelerado debido a la creciente demanda de una infraestructura logística eficiente y que cumpla con las normas, adaptada a productos de grado médico. Los sistemas de acidulantes desempeñan un papel fundamental para mantener la calidad, la seguridad y el cumplimiento normativo de los suministros sanitarios, especialmente aquellos que requieren integridad de la cadena de frío, trazabilidad y monitoreo en tiempo real.

- Los principales impulsores del crecimiento incluyen la expansión de la infraestructura de atención de la salud, el crecimiento del comercio transfronterizo de productos farmacéuticos y dispositivos médicos, y el creciente escrutinio regulatorio relacionado con el manejo de productos sensibles a la temperatura y la estandarización logística.

- Estados Unidos dominó el mercado de acidulantes en América del Norte, representando el 81,2 % de los ingresos totales en 2024. Este liderazgo está respaldado por la avanzada red de prestación de servicios de salud del país, la alta adopción de soluciones de seguimiento basadas en IoT y las importantes inversiones en centros de almacenamiento inteligente y distribución farmacéutica por parte de gigantes de la logística.

- Se espera que Canadá registre la tasa de crecimiento más alta en el mercado de acidulantes de América del Norte, con una CAGR del 9,8 % durante 2025-2032, debido al aumento de las importaciones de equipos médicos de alto valor, el crecimiento de la I+D biofarmacéutica y los esfuerzos para mejorar la prestación de servicios de salud en regiones desatendidas a través de una logística con temperatura controlada.

- El segmento de forma seca dominó el mercado de acidulantes de América del Norte con una participación de mercado del 61,3 % en 2024, atribuido a su estabilidad, facilidad de manejo e idoneidad para formulaciones en polvo y alimentos procesados.

Alcance del informe y segmentación del mercado de acidulantes en América del Norte

|

Atributos |

Perspectivas del mercado de acidulantes en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de acidulantes en América del Norte

Tendencias avanzadas de distribución y cumplimiento que están transformando el mercado de acidulantes en América del Norte

- El mercado norteamericano de acidulantes se está transformando a medida que aumenta la demanda de acidulantes de alta pureza utilizados en la fabricación de productos farmacéuticos, la nutrición clínica y las formulaciones de alimentos de grado médico. Fabricantes y proveedores están adoptando tecnologías logísticas y de cumplimiento normativo más inteligentes para garantizar la calidad, la seguridad y la trazabilidad en toda la cadena de suministro.

- Dada la importancia crucial de acidulantes como el ácido cítrico, el ácido láctico, el ácido fumárico y el ácido málico para mantener el equilibrio del pH, la estabilidad y la biodisponibilidad en la producción de medicamentos y alimentos médicos, las empresas están integrando sistemas de monitoreo en tiempo real que rastrean los parámetros ambientales durante el almacenamiento y el transporte. Esto reduce el riesgo de contaminación o degradación.

- En EE. UU. y Canadá, se utilizan sistemas automatizados de dosificación y dosificación en centros de distribución de acidulantes para minimizar la manipulación manual y garantizar la precisión de la formulación. Estos sistemas son fundamentales al trabajar con acidulantes concentrados o reactivos que contribuyen a la fabricación de fármacos estériles o productos de nutrición parenteral.

- Para cumplir con las regulaciones de la FDA y Health Canada, los proveedores utilizan la trazabilidad digital de lotes, el código de barras y la serialización. Esto garantiza que los acidulantes utilizados en aplicaciones farmacéuticas y clínicas cumplan con las Buenas Prácticas de Manufactura (cGMP) vigentes y se puedan rastrear desde el origen hasta la aplicación.

- Los acidulantes sensibles a la temperatura y la humedad, como los utilizados en recubrimientos de medicamentos orales o nutrición enteral, se almacenan en almacenes climatizados y equipados con sensores en puntos de distribución clave de Norteamérica. Estas instalaciones están equipadas con alarmas inteligentes y sistemas integrados en la nube para mantener condiciones óptimas de almacenamiento y evitar costosas pérdidas de producto.

- Las alianzas estratégicas entre fabricantes de acidulantes y proveedores de logística externa (3PL) permiten el desarrollo de modelos de entrega personalizados para clientes farmacéuticos. Estos incluyen empaques especializados, protocolos de transporte que cumplen con los requisitos normativos regionales y documentación automatizada.

- A medida que crece la complejidad de los productos sanitarios, los proveedores norteamericanos de acidulantes invierten en plataformas logísticas basadas en IA para optimizar rutas, prever inventarios y reabastecer según la demanda. Estas herramientas ayudan a garantizar el suministro ininterrumpido de acidulantes para ciclos de producción urgentes en plantas farmacéuticas y biofarmacéuticas.

- La convergencia del almacenamiento inteligente, las herramientas de cumplimiento automatizadas y las soluciones de manejo de acidulantes específicas para cada aplicación está transformando el mercado de acidulantes de América del Norte, posicionándolo para un crecimiento estable e impulsado por la innovación hasta 2032, particularmente en los EE. UU., que continúa dominando la demanda regional debido a su base de fabricación avanzada para el cuidado de la salud.

Dinámica del mercado de acidulantes en América del Norte

Conductor

La creciente demanda de acidulantes impulsada por la expansión de la atención médica y el desarrollo de la cadena de frío

- El mercado de acidulantes de América del Norte está experimentando un fuerte crecimiento, impulsado en gran medida por la expansión de la infraestructura de atención médica y la creciente demanda de acidulantes en aplicaciones farmacéuticas, nutracéuticas y de nutrición médica.

- Los acidulantes como el ácido cítrico, el ácido láctico y el ácido fosfórico se utilizan ampliamente en la formulación de soluciones electrolíticas, fluidos intravenosos, sales de rehidratación oral y diversos suplementos dietéticos, todos los cuales requieren condiciones de almacenamiento y distribución estrictamente controladas.

- Con las crecientes inversiones en infraestructura de cadena de frío en los EE. UU. y Canadá, existe una capacidad cada vez mayor para almacenar y transportar de forma segura acidulantes sensibles a la temperatura y la humedad, lo que garantiza la calidad y la eficacia en aplicaciones tanto de grado alimenticio como farmacéutico.

- Por ejemplo, la creciente demanda de bebidas fortificadas, alimentos funcionales procesados y productos de nutrición clínica está acelerando el uso de acidulantes como potenciadores del sabor, reguladores del pH y conservantes.

- Además, la adopción de monitoreo de temperatura basado en IoT y seguimiento en tiempo real en logística alimentaria y farmacéutica está mejorando la eficiencia operativa y el cumplimiento, lo que apoya aún más el crecimiento del uso de acidulantes en sectores donde la estabilidad y la vida útil del producto son fundamentales.

Restricción/Desafío

Altos costos y deficiencias en la cadena de frío en zonas rurales y de baja densidad

- A pesar de un entorno de mercado favorable, el mercado de acidulantes de América del Norte enfrenta desafíos notables, en particular en regiones rurales y marginadas donde el acceso a almacenamiento frigorífico confiable y a una infraestructura logística de calidad alimentaria sigue siendo limitado.

- Los fabricantes de alimentos y bebidas pequeños y medianos a menudo enfrentan dificultades para mantener la estabilidad de los acidulantes a lo largo de la cadena de suministro debido al transporte refrigerado inadecuado, los altos costos de instalación para el almacenamiento especializado y el acceso limitado a los centros de distribución regionales.

- El costo de establecer y mantener instalaciones que cumplan con los estándares de seguridad alimentaria y de grado farmacéutico para acidulantes puede ser significativo, especialmente cuando se manipulan productos en formas secas y líquidas que requieren diferentes necesidades de temperatura y envasado.

- Además, el cumplimiento normativo en los segmentos alimentario y farmacéutico (como los requisitos de la FDA para aditivos o las certificaciones GRAS (generalmente reconocido como seguro)) puede crear barreras de entrada y retrasar el tiempo de comercialización de nuevas formulaciones de acidulantes.

- Para abordar estos problemas, existe una creciente necesidad de iniciativas público-privadas e inversiones en almacenamiento regional, así como apoyo técnico para los actores más pequeños para garantizar una calidad constante del acidulante en toda la cadena de suministro en América del Norte.

Alcance del mercado de acidulantes en América del Norte

El mercado está segmentado según tipo, forma, función, canal de distribución y usuario final.

- Por tipo

Según el tipo, el mercado norteamericano de acidulantes se segmenta en ácido cítrico, citrato de sodio, citrato de potasio, ácido acético, ácido fórmico, ácido glucónico, ácido málico, ácido fosfórico y sus sales, ácido tartárico, ácido láctico, ácido tánico, ácido fumárico, ácido succínico, entre otros. El segmento del ácido cítrico dominó el mercado con la mayor participación en los ingresos, con un 28,6%, en 2024, gracias a su amplia aplicación en la conservación de alimentos, bebidas, productos farmacéuticos y suplementos dietéticos.

Se proyecta que el segmento de ácido láctico crecerá a la CAGR más rápida del 10,8 % entre 2025 y 2032, impulsado por un uso creciente en alimentos funcionales, productos lácteos fermentados y polímeros biodegradables.

- Por formulario

En cuanto a su presentación, el mercado norteamericano de acidulantes se segmenta en formas secas y líquidas. El segmento de forma seca representó la mayor participación de mercado, con un 61,3 %, en 2024, gracias a su estabilidad, facilidad de manejo e idoneidad para formulaciones en polvo y alimentos procesados.

Se espera que el segmento de forma líquida sea testigo de la CAGR más alta del 9,5 % durante el período de pronóstico (2025-2032), impulsado por la creciente demanda de jarabes, bebidas y suspensiones farmacéuticas que requieren una solubilidad rápida.

- Por función

En función de su función, el mercado norteamericano de acidulantes se segmenta en control de pH, potenciadores del sabor ácido, conservantes y otros. El segmento de control de pH mantuvo una cuota de mercado dominante del 39,7 % en 2024, dado que los acidulantes se utilizan ampliamente para estabilizar formulaciones en la fabricación de alimentos, bebidas y medicamentos.

Se proyecta que el segmento de potenciadores del sabor ácido crecerá a la CAGR más rápida del 10,4 % entre 2025 y 2032, respaldado por un mayor uso en salsas, bocadillos y bebidas carbonatadas para mejorar el sabor y la sensación en boca.

- Por canal de distribución

Según el canal de distribución, el mercado norteamericano de acidulantes se segmenta en B2B y B2C. El segmento B2B lideró el mercado con una participación dominante del 74,5 % en 2024, gracias a las compras a gran escala por parte de procesadores de alimentos, empresas farmacéuticas y fabricantes de bebidas.

Se espera que el segmento B2C registre la CAGR más alta del 11,3 % durante 2025-2032, impulsado por la creciente disponibilidad minorista de acidulantes de grado alimenticio y el aumento de los consumidores domésticos preocupados por la salud .

- Por el usuario final

En cuanto al usuario final, el mercado norteamericano de acidulantes se segmenta en los sectores doméstico/minorista, de procesamiento de alimentos y de servicios de alimentación. El sector de procesamiento de alimentos se posicionó como el principal usuario final, con una cuota de mercado del 52,1 % en 2024, gracias a su uso generalizado en alimentos enlatados, lácteos, productos de panadería y carnes procesadas.

Se prevé que el sector de servicios de alimentos crezca a la CAGR más rápida del 9,9 % entre 2025 y 2032, impulsado por la rápida expansión de los restaurantes de comida rápida, las empresas de catering y los proveedores de alimentos institucionales que adoptan cada vez más acidulantes para estabilizar el sabor y extender la vida útil.

Análisis regional del mercado de acidulantes en América del Norte

- América del Norte representó el 18,4 % de los ingresos del mercado mundial de acidulantes en 2024, respaldada por la sólida producción médica y farmacéutica de la región, la creciente demanda de reguladores de pH y conservantes a base de acidulantes y una sólida infraestructura logística que facilita la distribución regulada de productos en los EE. UU., Canadá y México.

- Los sistemas de acidulantes se están convirtiendo en parte integral de la cadena logística de grado médico de Norteamérica, lo que permite el almacenamiento sensible a la temperatura, la monitorización en tiempo real y la distribución, conforme al cumplimiento normativo, de acidulantes farmacéuticos y de grado alimentario. Estos sistemas son especialmente críticos para el transporte de acidulantes utilizados en formulaciones de fármacos inyectables, nutrición clínica y productos alimenticios médicos.

- El crecimiento del mercado está impulsado por el aumento del comercio transfronterizo de acidulantes, el aumento del consumo en la fabricación de productos biofarmacéuticos y nutracéuticos y la aplicación de normas regulatorias estrictas para la seguridad química, la garantía de calidad y la trazabilidad.

Perspectiva del mercado de acidulantes en EE. UU.

Los acidulantes estadounidenses dominaron el mercado con una participación en los ingresos del 81,2 % en 2024, gracias a su liderazgo en la fabricación de productos farmacéuticos y alimentos funcionales, el alto consumo de acidulantes en formulaciones relacionadas con la salud y la presencia de empresas de logística globales que invierten en infraestructura de cadena de frío. La implementación generalizada de sistemas de almacenamiento con IoT, unidades automatizadas de dosificación y herramientas de cumplimiento digital impulsa a los proveedores estadounidenses de acidulantes a mantener la calidad regulatoria en el transporte y almacenamiento de ácidos como el cítrico, el láctico y el acético. Se prevé que el mercado estadounidense mantenga un crecimiento constante, impulsado por la capacidad de producción nacional, la innovación en aplicaciones de acidulantes de grado alimentario y farmacéutico, y la continua inversión en tecnología de distribución.

Análisis del mercado canadiense de acidulantes

Se proyecta que Canadá será el país con mayor crecimiento en el mercado norteamericano de acidulantes, con una tasa de crecimiento anual compuesta (TCAC) del 9,8 % entre 2025 y 2032. Esto se atribuye a la creciente dependencia de acidulantes importados para productos biofarmacéuticos y alimentos funcionales, junto con el aumento de las inversiones en almacenamiento refrigerado sostenible y logística digital. Canadá está experimentando un auge en la modernización de sus sistemas de almacenamiento regional, con la adopción de sistemas inteligentes de gestión de inventario para gestionar la volatilidad de la demanda y garantizar el cumplimiento normativo, especialmente en la distribución de acidulantes utilizados en productos de salud orgánicos y de etiqueta limpia.

Análisis del mercado de acidulantes en México

Los acidulantes mexicanos representaron una participación estimada del 5.7% del mercado norteamericano en 2024 y se perfila como un actor regional gracias a su sólida base de fabricación por contrato de productos farmacéuticos y suplementos dietéticos. Con una tasa de crecimiento anual compuesta (TCAC) proyectada del 7.1% entre 2025 y 2032, el crecimiento de México se sustenta en el aumento de las inversiones en armonización regulatoria, las reformas sanitarias impulsadas por el gobierno y la modernización de los sistemas de cadena de frío para gestionar las importaciones y exportaciones de reguladores de pH, conservadores y acidulantes de grado alimenticio. La ubicación estratégica de México, su proximidad a Estados Unidos y la creciente producción de fármacos genéricos están consolidando su posición en la cadena de suministro de acidulantes en Norteamérica.

Cuota de mercado de acidulantes en América del Norte

La industria del mercado de acidulantes está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- ADM (EE. UU.)

- Bartek Ingredients Inc. (Canadá)

- Brenntag SE (Alemania)

- Cargill, Incorporated (EE. UU.)

- Corbion (Países Bajos)

- DAIRYCHEM (EE. UU.)

- Ingredientes alimentarios directos (Reino Unido)

- Industrias FBC (EE. UU.)

- Corporación Internacional Foodchem (China)

- INDUSTRIAL TECNICA PECUARIA, SA (España)

- Jungbunzlauer Suisse AG (Suiza)

- Grupo más rico (China)

- Tate & Lyle (Reino Unido)

Últimos avances en el mercado de acidulantes en América del Norte

- En septiembre de 2024, Jungbunzlauer, productor líder de ácido cítrico y sales, anunció una ampliación de 200 millones de dólares canadienses de su planta de fermentación en Port Colborne, Ontario. Esta modernización impulsará significativamente el suministro de ácido cítrico, citrato de sodio y citrato de potasio de alta pureza en Norteamérica para aplicaciones farmacéuticas y alimentarias, lo que satisfará la demanda de acidulantes en los sectores regulados de la salud y los nutracéuticos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.