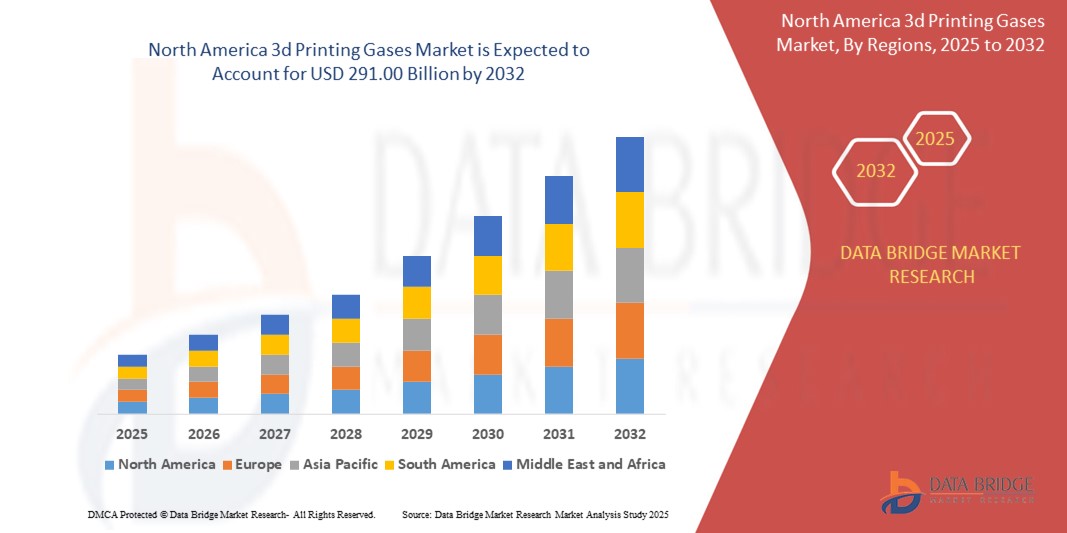

North America 3d Printing Gases Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

29.90 Billion

USD

291.00 Billion

2024

2032

USD

29.90 Billion

USD

291.00 Billion

2024

2032

| 2025 –2032 | |

| USD 29.90 Billion | |

| USD 291.00 Billion | |

|

|

|

|

Segmentación del mercado de gases de impresión 3D en Norteamérica por tipo (argón, nitrógeno, hidrógeno, helio y otros), tecnología (estereolitografía [SLA], sinterización selectiva por láser [SLS], modelado por deposición fundida [FDM], proceso digital de luz [DLP], fusión multichorro [MJF], polichorro, sinterización directa de metal por láser [DMLS], fusión por haz de electrones [EBM], polichorro y otros), material (plásticos, metal, alumuro, madera y otros), almacenamiento y distribución (cilindros, líquidos comerciales y tonelaje), función (aislamiento, iluminación, refrigeración y otros), usuario final (industrial, automotriz, aeroespacial, bienes de consumo, medicina, construcción, joyería, alimentos, juguetes, artes visuales, robótica y otros) - Tendencias y pronóstico de la industria hasta 2032

Tamaño del mercado de gases de impresión 3D

- El tamaño del mercado de gases de impresión 3D de América del Norte se valoró en USD 29,90 mil millones en 2024 y se espera que alcance los USD 291,00 mil millones para 2032 , con una CAGR del 32,9% durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a la rápida adopción de tecnologías de fabricación aditiva en los sectores aeroespacial, automotriz y médico de América del Norte, que demandan gases de alta pureza como argón y nitrógeno para mantener entornos de impresión controlados durante la impresión 3D basada en metal.

- Además, el aumento de la inversión pública y privada en manufactura avanzada, junto con una sólida base industrial e infraestructura de I+D, impulsa la integración de la impresión 3D en la producción en masa. Estos factores convergentes están acelerando significativamente la demanda de sistemas confiables de suministro de gases y soluciones de optimización de procesos, impulsando así el mercado de gases para impresión 3D en la región.

Análisis del mercado de gases para impresión 3D

- Los gases de impresión 3D, como el argón, el nitrógeno y el hidrógeno, desempeñan un papel fundamental en el mantenimiento de condiciones inertes y estables durante la fabricación aditiva, especialmente en tecnologías de impresión de metales como DMLS y EBM. Estos gases previenen la oxidación, garantizan la integridad del material y contribuyen a una calidad constante de las piezas en industrias de alto rendimiento.

- El creciente despliegue de instalaciones de impresión 3D industrial a gran escala, el enfoque creciente en la fabricación de componentes livianos y complejos y los avances en tecnologías de manejo y purificación de gases son factores clave que mejoran la expansión del mercado en América del Norte.

- Estados Unidos dominó el mercado de gases de impresión 3D con una participación del 55,7 % en 2024, gracias a su liderazgo en la adopción de la fabricación aditiva en los sectores aeroespacial, de defensa y sanitario. La presencia de centros de fabricación avanzada, las cuantiosas inversiones en I+D y la alta demanda de impresión 3D de metal en aplicaciones críticas como piezas de turbinas, implantes y componentes ligeros de automoción están impulsando la fuerte adopción de gases inertes de alta pureza como el argón y el nitrógeno.

- Se espera que Canadá sea la región de más rápido crecimiento en el mercado de gases de impresión 3D durante el período de pronóstico debido a las crecientes iniciativas respaldadas por el gobierno para integrar la fabricación aditiva en los sectores aeroespacial, energético y médico.

- El segmento de argón dominó el mercado con una cuota de mercado del 42,1 % en 2024, gracias a su naturaleza inerte y a su amplio uso en procesos de fabricación aditiva de metales, como la sinterización directa de metales por láser (DMLS) y la fusión por haz de electrones (EBM). El argón garantiza un entorno estable y libre de contaminación, crucial para prevenir la oxidación durante la fusión de metales, lo que lo convierte en una opción preferida en aplicaciones industriales y aeroespaciales.

Alcance del informe y segmentación del mercado de gases de impresión 3D

|

Atributos |

Perspectivas clave del mercado de los gases de impresión 3D |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de gases de impresión 3D

Creciente demanda de gases especializados

- El mercado de gases de impresión 3D de América del Norte se está expandiendo a medida que los fabricantes y los laboratorios de investigación requieren cada vez más gases especializados de alta pureza, como argón, nitrógeno y mezclas de gases personalizadas para procesos de fabricación aditiva, cruciales para garantizar la calidad del producto y minimizar la oxidación y la contaminación en aplicaciones de alta precisión.

- Por ejemplo, en EE. UU., sectores como el aeroespacial, la defensa y la atención médica, incluidas empresas involucradas en implantes médicos personalizados y componentes de alto rendimiento, han impulsado inversiones significativas en soluciones de gas avanzadas para mantener estándares estrictos de precisión e integridad de las piezas durante la producción de impresión 3D.

- El segmento de mezclas de gases ha surgido como el submercado más grande y de más rápido crecimiento, lo que refleja la creciente complejidad de los materiales y aplicaciones impresos en 3D, lo que exige un control atmosférico personalizado para obtener resultados de impresión óptimos.

- El cambio de la creación de prototipos a la producción en masa en campos como el aeroespacial y el automotriz aumenta la necesidad de entornos de gas controlados, ya que incluso una contaminación o porosidad menor afecta directamente el rendimiento y la seguridad de las piezas críticas para la misión.

- Los principales proveedores de gases industriales de América del Norte están lanzando productos de gas innovadores y ampliando las capacidades de producción para abordar los requisitos cambiantes, al mismo tiempo que colaboran con fabricantes de impresoras 3D y usuarios finales para obtener soluciones específicas para cada aplicación.

- La posición de América del Norte como uno de los primeros en adoptar la impresión 3D, combinada con una sólida cadena de suministro local tanto para hardware como para gases especiales, continúa reforzando el crecimiento del mercado, en particular a medida que más industrias integran tecnologías de bioimpresión y metales.

Dinámica del mercado de gases de impresión 3D

Conductor

Crecimiento de la industria de la impresión 3D

- El rápido avance de la industria de la impresión 3D en América del Norte, con una creciente implementación en los sectores aeroespacial, de atención médica, automotriz y de bienes de consumo, es el principal catalizador de la mayor demanda de gases de impresión 3D de alta calidad.

- Por ejemplo, Estados Unidos se ha convertido en el mercado líder debido a su infraestructura de fabricación altamente avanzada, la adopción temprana de la fabricación aditiva y las aplicaciones de alto valor (como la creación de piezas de aviación, prótesis dentales y maquinaria compleja) que requieren estándares estrictos de uso de gas.

- Las aplicaciones como la fabricación aditiva de metales y la bioimpresión son especialmente intensivas en gas, ya que los entornos inertes son cruciales para producir productos de alto rendimiento y sin defectos con especificaciones metalúrgicas estrictas.

- A medida que la impresión 3D se expande desde la creación rápida de prototipos hasta la fabricación a gran escala y la integración de la cadena de suministro, crece la demanda de soluciones de gas precisas y confiables, lo que impulsa a los productores de gas a mantenerse al día con los avances tecnológicos y las necesidades de mayor volumen.

- La innovación continua de los proveedores de gas, en colaboración con los fabricantes de equipos y los sectores de usuarios finales, ha agilizado los procesos de producción y mejorado la calidad de los materiales, impulsando aún más la trayectoria de crecimiento de ambas industrias.

Restricción/Desafío

“Altos costos iniciales”

- La alta inversión inicial requerida para la infraestructura de gases especiales y equipos avanzados de impresión 3D representa una barrera importante, especialmente para las pequeñas y medianas empresas que buscan adoptar o ampliar la fabricación aditiva.

- Por ejemplo, establecer y mantener sistemas controlados de almacenamiento y entrega, y soluciones de monitoreo para gases como argón y nitrógeno, además de adquirir impresoras 3D de alta gama, puede aumentar sustancialmente los costos iniciales del proyecto.

- Los procesos avanzados de bioimpresión e impresión 3D de metales también exigen un suministro continuo de gases de pureza ultraalta, lo que aumenta los gastos operativos constantes más allá de la inversión inicial.

- La complejidad de capacitar al personal en el manejo de gas y la operación de equipos, junto con el cumplimiento de las normas regulatorias y de la industria, puede aumentar los requisitos de tiempo y recursos para los nuevos participantes.

- Si bien el costo se compensa con el tiempo con una mejora en la eficiencia y la calidad, estas demandas de capital pueden desacelerar la adopción en segmentos sensibles a los costos y limitar la flexibilidad, especialmente para organizaciones centradas en I+D con presupuestos limitados.

Alcance del mercado de gases de impresión 3D

El mercado está segmentado según tipo, tecnología, material, almacenamiento y distribución, función y uso final.

- Por tipo

Según el tipo, el mercado de gases para impresión 3D se segmenta en argón, nitrógeno, hidrógeno, helio y otros. El segmento de argón dominó la mayor cuota de mercado con un 42,1 % en 2024, principalmente debido a su naturaleza inerte y a su amplio uso en procesos de fabricación aditiva de metales, como la sinterización láser directa de metales (DMLS) y la fusión por haz de electrones (EBM). El argón garantiza un entorno estable y libre de contaminación, crucial para prevenir la oxidación durante la fusión de metales, lo que lo convierte en una opción preferida en aplicaciones industriales y aeroespaciales.

Se prevé que el segmento del hidrógeno experimente el mayor crecimiento entre 2025 y 2032, impulsado por su creciente adopción en tecnologías de impresión de metales de vanguardia que exigen una mayor eficiencia energética y una combustión más limpia. El potencial del hidrógeno para mejorar la calidad de impresión en aplicaciones específicas de alta temperatura está cobrando impulso en entornos de impresión experimentales y de investigación.

- Por tecnología

Según la tecnología, el mercado se segmenta en estereolitografía (SLA), sinterización selectiva por láser (SLS), modelado por deposición fundida (FDM), proceso digital de luz (DLP), fusión multichorro (MJF), polichorro, sinterización directa de metal por láser (DMLS), fusión por haz de electrones (EBM), polichorro y otros. El DMLS tuvo la mayor cuota de mercado en 2024, debido a su amplio uso en los sectores aeroespacial, automotriz y médico para la producción de componentes metálicos de alta precisión que requieren atmósferas controladas, en particular argón y nitrógeno, para garantizar la integridad del material.

Se prevé que la fusión por haz de electrones (EBM) registre el mayor crecimiento hasta 2032, gracias a su capacidad única para procesar aleaciones reactivas y de alto rendimiento. La dependencia de la EBM del vacío y de los entornos de gases inertes impulsa la demanda de gases de alta pureza, especialmente en aplicaciones especializadas como la fabricación de superaleaciones a base de titanio y níquel.

- Por material

Según el material, el mercado se segmenta en plásticos, metales, alumuros, madera y otros. El segmento de metales registró la mayor participación en los ingresos en 2024, impulsado por la creciente demanda de componentes duraderos y funcionales en sectores como el aeroespacial, el médico y el automotriz, donde los polvos metálicos se procesan en atmósferas de gas protector.

Se proyecta que el segmento de alumuro registre la mayor tasa de crecimiento anual compuesta (TCAC) entre 2025 y 2032 debido a su creciente adopción en componentes estructurales ligeros y prototipos. Su compatibilidad con la tecnología SLS y el requisito de entornos de gas controlados durante la sinterización aumentan aún más su relevancia en el mercado.

- Por Almacenamiento y Distribución

En función del almacenamiento y la distribución, el mercado se segmenta en cilindros, líquidos comerciales y tonelaje. El segmento de cilindros lideró el mercado en 2024 gracias a su idoneidad para operaciones de impresión 3D de pequeña y mediana escala y a su facilidad de transporte y manejo in situ, especialmente en laboratorios académicos y de prototipado.

Se prevé que el segmento de tonelaje crezca al ritmo más rápido durante el período de pronóstico, impulsado por el creciente número de instalaciones de fabricación aditiva industrial a gran escala que demandan un suministro de gas continuo y de gran volumen para una producción ininterrumpida.

- Por función

En función de su función, el mercado se segmenta en aislamiento, iluminación, refrigeración y otros. El segmento de aislamiento representó la mayor participación en los ingresos en 2024, ya que muchos procesos de impresión 3D, en particular los basados en metal, requieren estabilidad térmica y mantas de gas inerte para evitar la oxidación y mantener temperaturas de proceso constantes.

Se espera que el segmento de refrigeración se expanda rápidamente entre 2025 y 2032 debido a la mayor demanda de refrigeración de precisión en procesos de alta energía, especialmente en tecnologías como DMLS y EBM, donde la gestión térmica influye significativamente en la calidad de la construcción.

- Por uso final

Según el uso final, el mercado se segmenta en industria, automoción, aeroespacial, bienes de consumo, medicina, construcción, joyería, alimentación, juguetes, artes visuales, robótica, entre otros. El segmento aeroespacial lideró el mercado en 2024, gracias a la gran dependencia del sector de la impresión en metal de alto rendimiento, que requiere un estricto control de gases para garantizar la calidad, la fiabilidad y el cumplimiento normativo de las piezas.

Se proyecta que el segmento médico será testigo de la tasa de crecimiento más rápida durante el período de pronóstico, impulsado por el uso creciente de la impresión 3D en la producción de implantes específicos para pacientes, herramientas quirúrgicas y dispositivos dentales, donde la precisión asistida por gas y la esterilización son fundamentales.

Análisis regional del mercado de gases para impresión 3D

- Estados Unidos dominó el mercado de gases de impresión 3D con la mayor cuota de mercado, un 55,7 % en 2024, impulsado por su liderazgo en la adopción de la fabricación aditiva en los sectores aeroespacial, de defensa y sanitario. La presencia de centros de fabricación avanzada, las cuantiosas inversiones en I+D y la alta demanda de impresión 3D de metal en aplicaciones críticas como piezas de turbinas, implantes y componentes ligeros de automoción están impulsando la fuerte adopción de gases inertes de alta pureza como el argón y el nitrógeno.

- El país alberga a varios importantes proveedores de gas y fabricantes de equipos originales (OEM) de impresión 3D que colaboran para desarrollar soluciones personalizadas de suministro de gas, garantizando un control atmosférico constante durante trabajos de impresión complejos. El crecimiento también se ve respaldado por iniciativas de financiación federal para la innovación en la fabricación nacional y los objetivos de sostenibilidad, que fomentan el uso de tecnologías de gas eficientes.

- El mercado estadounidense continúa beneficiándose del auge de los centros de impresión industrial a gran escala y la rápida adopción de la impresión 3D de metal y polímero, tanto para la creación de prototipos como para piezas de uso final. Los avances tecnológicos en sistemas de monitorización de gases y la creciente penetración de las prácticas de la Industria 4.0 consolidan aún más su dominio en el mercado norteamericano.

Análisis del mercado canadiense de gases para impresión 3D

Se proyecta que Canadá registrará la tasa de crecimiento anual compuesta (TCAC) más rápida en el mercado norteamericano de gases para impresión 3D entre 2025 y 2032, gracias al creciente apoyo de iniciativas gubernamentales para integrar la fabricación aditiva en los sectores aeroespacial, energético y médico. La creciente presencia de instituciones de investigación y centros de innovación universitarios está estimulando la demanda de suministros de gases de grado de investigación. La creciente adopción de la impresión 3D en metal, especialmente en Ontario y Quebec, está impulsando el uso de gases argón y nitrógeno para entornos de fabricación controlados.

Análisis del mercado de gases para impresión 3D en México

Se prevé que México experimente un crecimiento sostenido en el mercado de gases de impresión 3D entre 2025 y 2032, impulsado por la expansión de la manufactura automotriz y la producción localizada de bienes de consumo y herramental. La creciente inversión en parques industriales e instalaciones de fabricantes de equipos originales (OEM), especialmente en el norte de México, está impulsando la adopción de tecnologías de impresión 3D y, en consecuencia, de gases de alta pureza para la optimización de procesos. El mercado también se ve impulsado por una creciente colaboración transfronteriza con empresas estadounidenses de fabricación aditiva y un mejor acceso a las cadenas de suministro de gases industriales.

Cuota de mercado de gases de impresión 3D

La industria de gases de impresión 3D está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- DuPont (EE. UU.)

- NIPPON SANSO HOLDINGS CORPORATION (Japón)

- ExOne (EE. UU.)

- 3D Systems, Inc. (EE. UU.)

- Renishaw plc (Reino Unido)

- Universal Industrial Gases Inc. (EE. UU.)

- Messer SE & Co. KGaA (Alemania)

- Bronkhorst (Países Bajos)

- Stratasys (Israel)

- General Electric (EE. UU.)

- Höganäs AB (Suecia)

- Metalurgia de polvos GKN (Alemania)

- Equispheres (Canadá)

- Sandvik AB (Suecia)

- Air Products and Chemicals, Inc. (EE. UU.)

- AIR LIQUIDE (Francia)

- Evonik Industries AG (Alemania)

- BASF SE (Alemania)

- Linde PLC (Irlanda)

Últimos avances en el mercado de gases para impresión 3D en América del Norte

- En febrero de 2021, 3D Systems reforzó su presencia en el mercado de gases de impresión 3D con el lanzamiento del sistema de impresión 3D «High Speed Fusion», diseñado para aplicaciones aeroespaciales y automotrices. Esta estrategia refleja la demanda de la industria de productos de alta fiabilidad, en línea con la expansión de la cartera de la compañía en respuesta a las necesidades del mercado.

- En febrero de 2021, AMEXCI colaboró con SLM Solutions, demostrando un esfuerzo conjunto para impulsar la industrialización de la fabricación aditiva. Con el objetivo de apoyar a las empresas en la implementación de tecnologías de fabricación avanzadas, esta colaboración destaca el papel de los gases de impresión 3D para facilitar la producción en serie de piezas metálicas complejas en un mercado en constante evolución.

- En enero de 2021, Equispheres lanzó tres polvos de aluminio de alto rendimiento con el objetivo de mejorar la resistencia, la precisión y la velocidad de impresión. Esta estrategia impulsó los ingresos de la empresa y diversificó su cartera de productos, posicionándola para el crecimiento en el mercado de materiales de impresión 3D.

- En mayo de 2020, GENERAL ELECTRIC alcanzó un hito tecnológico al colaborar con la Fuerza Aérea de EE. UU. para imprimir en 3D una tapa de cárter para el motor del F110. Esta exitosa colaboración demostró avances en la fabricación aditiva de metal y contribuyó al crecimiento de los ingresos de GENERAL ELECTRIC gracias a una mayor participación en aplicaciones aeroespaciales.

- En marzo de 2020, Stratasys colaboró con m2nxt Solutions, lo que marcó una colaboración crucial en el mercado de gases de impresión 3D. Esta alianza buscaba optimizar las soluciones de impresión 3D y las aplicaciones de fabricación aditiva, ayudando a las empresas a adoptar la Industria 4.0 y a definir el panorama cambiante de las tecnologías de impresión 3D.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.