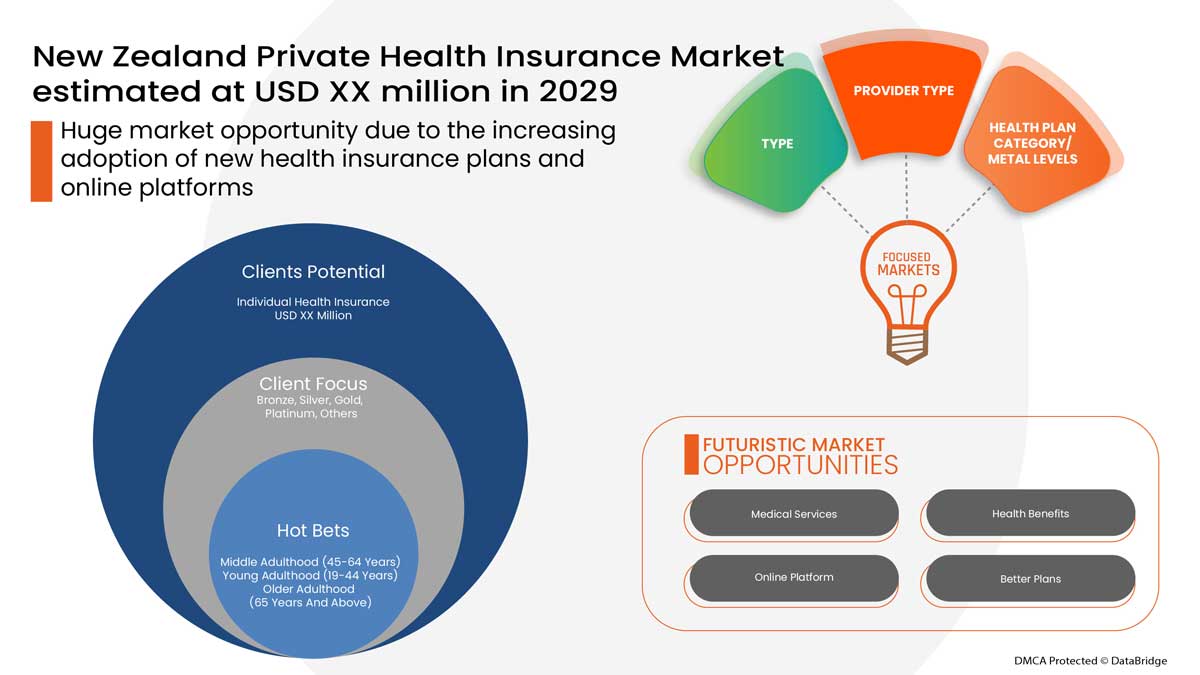

Mercado de seguros de salud privados de Nueva Zelanda , por tipo (seguro de enfermedades graves, seguro de salud individual, seguro de salud familiar, seguro específico de enfermedad y otros), categoría de plan de salud/niveles de metal (bronce, plata, oro, platino y otros), tipo de proveedor (organizaciones de mantenimiento de la salud (HMOS), organizaciones de proveedores preferidos (PPOS), organizaciones de proveedores exclusivos (EPOS), planes de punto de servicio (POS), planes de salud con deducible alto (HDHPS) y otros), grupo de edad (adultez joven (19-44 años), adultez media (45-64 años) y adultez mayor (65 años y más)), canal de distribución (compañías de seguros directos, agregadores de seguros y otros), tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado

Una póliza de seguro médico consta de varios tipos de características y beneficios. Brinda cobertura financiera a los asegurados contra determinados tratamientos, ofrece ventajas como hospitalización sin pago en efectivo, cobertura previa y posterior a la hospitalización, reembolso y varios complementos.

En el plan de seguro médico, existen varios tipos de cobertura: sin efectivo o con reembolso. El beneficio sin efectivo está disponible cuando el asegurado recibe tratamiento en los hospitales de la red de la compañía de seguros. Si el asegurado recibe tratamiento en hospitales que no están en la red de la lista, en ese caso, el asegurado cubre todos los gastos médicos y luego solicita el reembolso a la compañía de seguros presentando todas las facturas médicas.

El seguro médico privado brinda apoyo financiero al asegurado, ya que cubre todos los gastos médicos cuando el asegurado está hospitalizado para recibir tratamiento. Data Bridge Market Research analiza que se espera que el mercado de seguros médicos privados alcance los USD 671,64 millones para el año 2029, con una CAGR del 1,1% durante el período de pronóstico. El "seguro médico individual" representa el segmento de tipo más destacado en el mercado respectivo debido al aumento del seguro médico privado. El informe de mercado curado por el equipo de Data Bridge Market Research incluye un análisis experto en profundidad, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y escenario de la cadena climática.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por tipo (seguro de enfermedades graves, seguro de salud individual, seguro de salud familiar, seguro específico para enfermedades y otros), categoría de plan de salud/niveles de metal (bronce, plata, oro, platino y otros), tipo de proveedor (organizaciones de mantenimiento de la salud [HMOS], organizaciones de proveedores preferidos [PPOS], organizaciones de proveedores exclusivos [EPOS], planes de punto de servicio [POS], planes de salud con deducible alto [HDHPS] y otros), grupo de edad (adultez joven [19 a 44 años], adultez media [45 a 64 años] y adultez mayor [65 años y más]), canal de distribución (compañías de seguros directos, agregadores de seguros y otros) |

|

País cubierto |

Nueva Zelanda |

|

Actores del mercado cubiertos |

Cigna (EE. UU.), AIA Group Limited (Hong Kong), HCF (Australia), Allianz (Alemania), Suncorp Group (Australia), HSBC Group (Hong Kong), Tokio Marine (Japón), UniMed (Nueva Zelanda), Southern Cross, Accuro Health Insurance (Nueva Zelanda), Partners Life (Nueva Zelanda) |

Definición de mercado

El seguro médico es un tipo de seguro que brinda cobertura para todo tipo de gastos quirúrgicos y tratamientos médicos derivados de una enfermedad o lesión. El seguro médico se aplica a una gama integral o limitada de servicios médicos que cubren los costos totales o parciales de servicios específicos. El seguro médico brinda apoyo financiero al asegurado, ya que cubre todos los gastos médicos cuando el asegurado está hospitalizado para recibir tratamiento. El seguro médico también cubre los gastos previos y posteriores a la hospitalización.

Marco regulatorio

La Ley de Seguros (Supervisión Prudencial) de 2010 es administrada por el Banco de la Reserva para:

- Promover el mantenimiento de un sector de seguros sólido y eficiente; y

- Promover la confianza pública en el sector asegurador.

La ley se aplica a todas las aseguradoras que realizan negocios en Nueva Zelanda (según lo define la ley) e incluye:

- Un sistema de licencias para las aseguradoras, basado en el cumplimiento de los requisitos prudenciales de la ley;

- La supervisión por parte del banco de reserva del cumplimiento de los requisitos prudenciales; y

- Poderes que la ley otorga al Banco de la Reserva con respecto a las aseguradoras que atraviesan dificultades financieras u otras dificultades.

El COVID-19 tuvo un impacto mínimo en el mercado de seguros de salud privados

El COVID-19 afectó a varias industrias manufactureras y de prestación de servicios en el año 2020-2021, ya que provocó el cierre de lugares de trabajo, la interrupción de las cadenas de suministro y las restricciones al transporte. El desequilibrio entre la demanda y la oferta y su impacto en los precios se considera de corto plazo y se espera que se recupere a medida que esta pandemia llegue a su fin. Debido al brote de COVID-19 en todo el mundo, la demanda de seguros médicos privados ha aumentado enormemente. Además, el miedo a la pandemia y el aumento del costo de los servicios médicos ayudaron a que el mercado de seguros médicos creciera durante una pandemia. Además, las compañías de seguros médicos introdujeron paquetes y soluciones para cubrir los costos médicos del tratamiento de las aseguradoras infectadas con COVID-19. Por lo tanto, aunque las otras industrias sufrieron mucho durante el brote de covid19, la industria de seguros médicos privados creció significativamente.

La dinámica del mercado de seguros de salud privados incluye:

Impulsores/Oportunidades

- Aumento del coste de los servicios médicos

El seguro médico ofrece apoyo financiero en caso de enfermedad grave o accidente. El aumento de los costes de los servicios médicos por cirugías y estancias hospitalarias ha creado una nueva epidemia financiera en todo el mundo. El coste de los servicios médicos se compone del coste de la cirugía, los honorarios del médico, el coste de la estancia hospitalaria, el coste de la sala de urgencias y el coste de las pruebas diagnósticas, entre otros. Por tanto, este aumento del coste de los servicios médicos impulsa el crecimiento del mercado.

- Creciente número de procedimientos de guardería

Los procedimientos ambulatorios son aquellos tipos de procedimientos médicos o quirúrgicos que requieren principalmente un menor tiempo de estancia en los hospitales. En los procedimientos ambulatorios, los pacientes deben permanecer en el hospital durante un breve período. La mayoría de las compañías de seguros de salud cubren ahora los procedimientos ambulatorios en sus planes de seguro y, para la reclamación de este tipo de cirugías, no existe obligación de pasar 24 horas en el hospital, que es la estancia mínima en el seguro de reclamación hospitalaria. Si bien la mayoría de los planes de seguro de salud cubren las estancias hospitalarias y las cirugías importantes, los asegurados también pueden reclamar procedimientos ambulatorios en virtud de su póliza de seguro de salud, lo que impulsa la demanda del mercado.

- Opción obligatoria de seguro de salud en el sector público y privado

La contratación de una póliza de seguro médico es una obligación para los empleados de los sectores público y privado. El seguro médico ofrece importantes beneficios médicos de los que puede disfrutar el empleado mientras trabaja en una empresa. En caso de emergencia o problemas médicos, la cobertura del seguro médico es muy útil para cubrir los gastos del tratamiento. El seguro médico del empleado es un beneficio adicional que el empleador individual ofrece a sus empleados. El seguro médico brinda cobertura al empleado y a sus familiares bajo el mismo plan de póliza. Además, en ciertos casos, el empleador puede pagar una parte de la prima o la cobertura del seguro médico.

- Aumento de la población de edad avanzada

Las personas mayores son propensas a enfermarse más o tener problemas de salud debido al envejecimiento y a un sistema inmunológico débil, como problemas dentales, problemas cardíacos, cáncer y enfermedades terminales. Un buen seguro de salud para personas mayores puede ayudar a las personas mayores a optar por buenos servicios de seguro de salud para reducir las preocupaciones financieras futuras. Por lo tanto, el aumento del número de personas mayores puede impulsar la demanda del mercado de seguros de salud.

- Aumentar la conciencia sobre los beneficios del seguro de salud

Ante una emergencia médica, el seguro médico permite a los consumidores olvidarse del estrés relacionado con los costos de la atención médica y concentrarse en el tratamiento. Las emergencias médicas pueden ocurrir en cualquier momento, independientemente de nuestra buena salud actual o nuestro estilo de vida disciplinado. Por lo tanto, es importante planificar y proteger a nuestras familias y a nosotros mismos de cualquier situación médica imprevista, especialmente cuando hay padres ancianos en casa, ya que son más susceptibles a infecciones u otras enfermedades.

Restricciones y desafíos que enfrenta el mercado de seguros de salud

- Alto costo de las primas

El seguro médico cubre todo tipo de costes de tratamiento médico. Proporciona apoyo financiero al asegurado, ya que cubre todos los gastos médicos cuando el asegurado está hospitalizado para el tratamiento. El seguro médico también cubre los gastos previos y posteriores a la hospitalización. El asegurado tiene que pagar primas de seguro regularmente para mantener activa la póliza de seguro médico y poder adquirir un seguro médico. El coste de la prima del seguro es elevado en la mayoría de los casos según el plan de seguro, lo que está obstaculizando el crecimiento del mercado.

- Desconocimiento de los seguros de salud

En el ámbito de la atención sanitaria, una gran parte de la población mundial aún desconoce los beneficios de las pólizas de seguro médico. Los gastos de atención médica están aumentando en todo el mundo con los avances que se producen en este campo. Gracias a los avances tecnológicos, el sector sanitario es uno de los segmentos en crecimiento. Sin embargo, la tasa de penetración de las pólizas de seguro médico sigue siendo baja debido a la falta de conocimiento sobre los beneficios que ofrecen.

Este informe sobre el mercado de seguros de salud privados proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado por categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de seguros de salud privados, comuníquese con Data Bridge Market Research para obtener un informe de analista. Nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Acontecimientos recientes

- En marzo de 2022, Allianz Ayudhya Capital PCL (AYUD) acordó adquirir el 100 % de las acciones de Aetna Tailandia, un actor destacado en el mercado de seguros de salud tailandés. La adquisición reafirma su compromiso de seguir invirtiendo y expandir su negocio de seguros de salud para beneficiar a los clientes en Tailandia.

- En julio de 2021, Accuro Health Insurance se asoció con Montoux, la plataforma de ciencia de decisiones para aseguradoras de vida y salud, en un programa piloto para identificar intervenciones tempranas que pudieran ayudar a sus miembros a evitar cirugías invasivas importantes. Este desarrollo ayudó a la empresa a expandir su negocio.

Alcance del mercado de seguros de salud privados de Nueva Zelanda

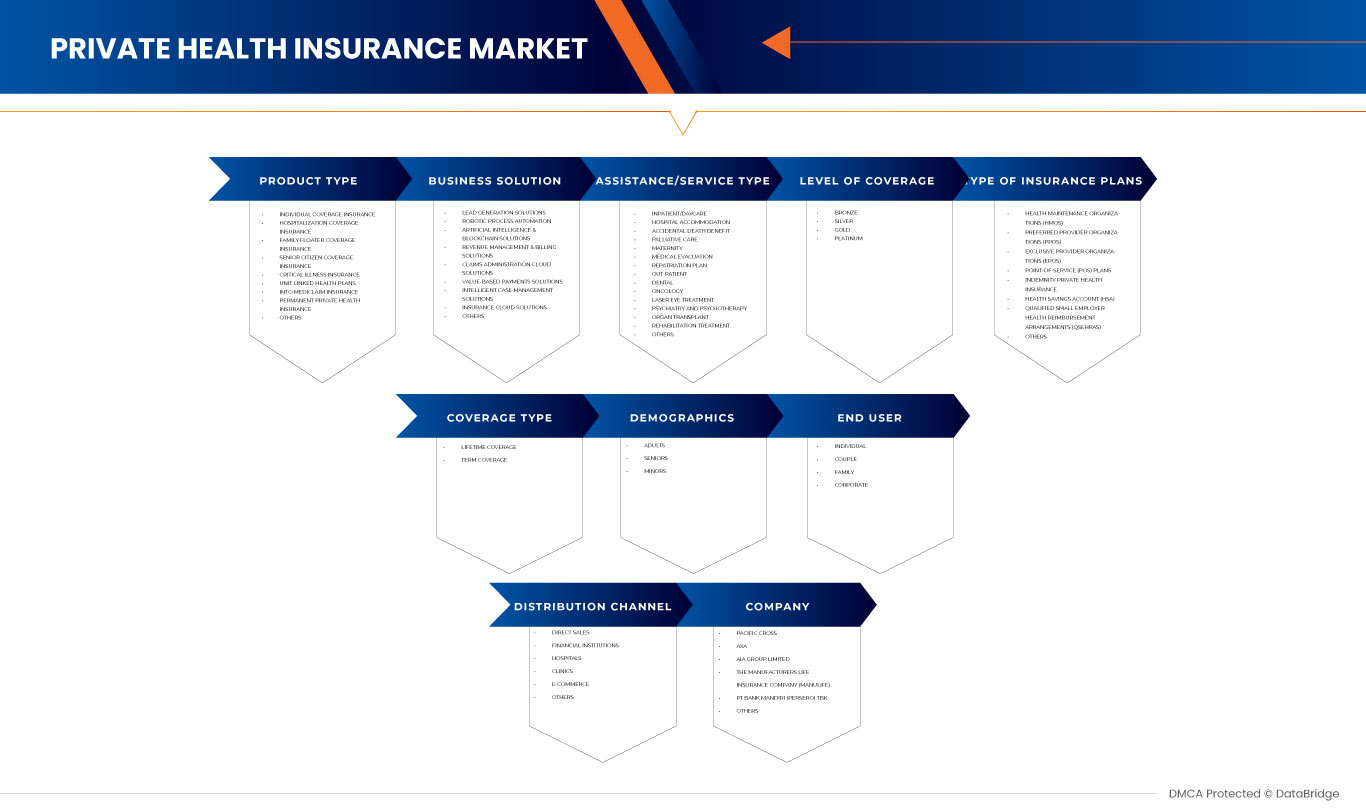

El mercado de seguros médicos privados está segmentado en función del tipo, la categoría del plan de salud/niveles de metal, el tipo de proveedor, el grupo de edad y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Seguro de enfermedades graves

- Seguro de salud individual

- Seguro de salud familiar

- Seguro específico para enfermedades

- Otros

Según el tipo, el mercado está segmentado en seguro de enfermedades graves, seguro de salud individual, seguro de salud familiar, seguro para enfermedades específicas y otros.

Categoría del plan de salud/Niveles de metal

- Bronce

- Plata

- Oro

- Platino

- Otros

Según la categoría del plan de salud/niveles de metal, el mercado está segmentado en bronce, plata, oro, platino y otros.

Tipo de proveedor

- Organizaciones de mantenimiento de la salud (HMOS)

- Organizaciones de proveedores preferidos (PPOS)

- Organizaciones de proveedores exclusivos (EPOS)

- Planes de punto de servicio (POS)

- Planes de salud con deducible alto (HDHPS)

- Otros

Según el tipo de proveedor, el mercado está segmentado en organizaciones de mantenimiento de la salud (HMOS), organizaciones de proveedores preferidos (PPOS), organizaciones de proveedores exclusivos (EPOS), planes de punto de servicio (POS), planes de salud con deducible alto (HDHPS) y otros.

Grupo de edad

- Edad adulta joven (19-44 años)

- Edad adulta media (45-64 años)

- Adultos mayores (65 años y más)

Según el grupo de edad, el mercado está segmentado en adultos jóvenes (19 a 44 años), adultos medios (45 a 64 años) y adultos mayores (65 años y más).

Canal de distribución

- Compañías de seguros directos

- Agregadores de seguros

- Otros

Según el canal de distribución, el mercado está segmentado en compañías de seguros directos, agregadores de seguros y otros.

Análisis del panorama competitivo y de la cuota de mercado de los seguros de salud privados

The private health insurance market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, New Zealand presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to private health insurance market.

Some of the major players operating in the private health insurance market are Cigna (U.S.), AIA Group Limited (Hong Kong), HCF (Australia), Allianz (Germany), Suncorp Group (Australia), HSBC Group (Hong Kong), Tokio Marine (Japan), UniMed (New Zealand), Southern Cross, Accuro Health Insurance (New Zealand), partners life (New Zealand), among others.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 AGE GROUP LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SOUTH EAST ASIA PRIVATE HEALTH INSURANCE MARKET- PESTEL ANALYSIS

4.1.1 OVERVIEW

4.1.2 POLITICAL FACTORS

4.1.3 ENVIRONMENTAL FACTORS

4.1.4 SOCIAL FACTORS

4.1.5 TECHNOLOGICAL FACTORS

4.1.6 ECONOMICAL FACTORS

4.1.7 LEGAL FACTORS

4.1.8 CONCLUSION

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 SOUTH EAST ASIA INSURANCE SCENARIO VS GLOBAL

4.4 CUSTOMIZED DELIVERABLE

4.4.1 HOW ARE INSURANCE CLAIMS EVALUATED (I.E., PROCESS FOR FILING FROM HOSPITALS, PHYSICIAN JUSTIFICATION)

4.4.2 DATA INTERPRETATION

5 INDUSTRY INSIGHTS

5.1 DEMOGRAPHIC TRENDS:-

5.1.1 AGE

5.1.2 GENDER

5.1.3 OCCUPATION

5.1.4 FAMILY SIZE

5.2 NUMBER OF CLAIMS BY TYPE

5.2.1 CASHLESS VS. REIMBURSEMENT CLAIMS

5.3 EXTRA CARE/TOP-UP INSURANCE OFFERINGS BY COMPANIES

5.4 INVESTMENT & FUNDING

5.5 PENETRATION OF PRIVATE INSURANCE & DENSITY

5.6 INTERVIEWS WITH KEY HOSPITALS AND INSURANCE COMPANIES

5.7 POLICY SUPPORT FOR LIFE INSURANCE IN SOUTH EAST ASIA

5.7.1 MALAYSIA

5.7.2 PHILIPPINES

5.7.3 THAILAND

5.7.4 VIETNAM

5.8 PUBLIC VS PRIVATE HEALTH INSURANCE

5.9 OTHER KOL SNAPSHOTS

5.1 PREMIUM/COPAY/COINSURANCE

6 REGULATORY FRAMWORK

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING COST FOR MEDICAL SERVICES

7.1.2 GROWING NUMBER OF DAY CARE PROCEDURES

7.1.3 MANDATORY OPTING FOR HEALTH INSURANCE IN PUBLIC AND PRIVATE SECTOR

7.1.4 INCREASING OLD AGE POPULATION

7.2 RESTRAINTS

7.2.1 HIGH COST OF PREMIUM

7.2.2 STRICT DOCUMENTATION PROCESS FOR CLAIM REIMBURSEMENT

7.3 OPPORTUNITIES

7.3.1 INCREASING AWARENESS ABOUT THE BENEFITS OF HEALTH INSURANCE

7.3.2 INCREASING HEALTH CARE EXPENDITURE

7.3.3 GROWING MEDICAL TOURISM AMONG COUNTRIES

7.4 CHALLENGE

7.4.1 LACK OF AWARENESS REGARDING HEALTH INSURANCE

8 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET, BY TYPE

8.1 OVERVIEW

8.2 INDIVIDUAL HEALTH INSURANCE

8.3 FAMILY HEALTH INSURANCE

8.4 CRITICAL ILLNESS INSURANCE

8.5 DISEASE-SPECIFIC INSURANCE

8.6 OTHERS

9 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET, BY HEALTH PLAN CATEGORY/METAL LEVELS

9.1 OVERVIEW

9.2 BRONZE

9.3 SILVER

9.4 GOLD

9.5 PLATINUM

9.6 OTHERS

10 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET, BY PROVIDER TYPE

10.1 OVERVIEW

10.2 HEALTH MAINTENANCE ORGANIZATIONS (HMOS)

10.3 PREFERRED PROVIDER ORGANIZATIONS (PPOS)

10.4 EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS)

10.5 POINT-OF-SERVICE (POS) PLANS

10.6 HIGH-DEDUCTIBLE HEALTH PLANS (HDHPS)

10.7 OTHERS

11 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET, BY AGE GROUP

11.1 OVERVIEW

11.2 MIDDLE ADULTHOOD (45-64 YEARS)

11.3 YOUNG ADULTHOOD (19-44 YEARS)

11.4 OLDER ADULTHOOD (65 YEARS AND ABOVE)

12 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT INSURANCE COMPANIES

12.3 INSURANCE AGGREGATORS

12.4 OTHERS

13 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET, BY COUNTRY

13.1 NEW ZEALAND

14 NEW ZEALAND PRIVATE HEALTH INSURANCE THERMAL INSULATION PACKAGING MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NEW ZEALAND

14.2 MERGER & ACQUISITION

14.3 EXPANSIONS

14.4 NEW PRODUCT DEVELOPMENT

14.5 PARTNERSHIP

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 AETNA INC. (A SUBSIDIARY OF CVS HEALTH)

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 CIGNA

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 AIA GROUP LIMITED

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT UPDATE

16.4 HCF

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT UPDATES

16.5 ALLIANZ

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT UPDATES

16.6 SUNCORP GROUP

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT UPDATES

16.7 MEDIBANK PRIVATE LIMITED

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 DAI-ICHI LIFE VIETNAM

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT UPDATE

16.9 HSBC GROUP

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT UPDATE

16.1 ACCURO HEALTH INSURANCE

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT UPDATE

16.11 AIG ASIA PACIFIC INSURANCE PTE. LTD

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT UPDATE

16.12 ASSICURANZIONI GENERALI S.P.A.

16.12.1 COMPANY SNAPSHOT

16.12.2 FINANCIAL ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT UPDATES

16.13 AXA

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT UPDATE

16.14 BNI LIFE

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT UPDATES

16.15 BUPA GLOBAL

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT UPDATE

16.16 ETIQA

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT UPDATE

16.17 GREAT EASTERN HOLDINGS LIMITED

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT UPDATE

16.18 HONG LEONG ASSURANCE BERHAD

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT UPDATES

16.19 INCOME

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT UPDATES

16.2 MANULIFE HOLDINGS BERHAD

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT UPDATES

16.21 NIB NZ LIMITED

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT UPDATE

16.22 NOW HEALTH INTERNATIONAL

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 PACIFIC CROSS

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT UPDATE

16.24 PARTNERS LIFE

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT UPDATES

16.25 PRUDENTIAL ASSURANCE MALAYSIA BERHAD

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT UPDATE

16.26 RAFFLES MEDICAL GROUP

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT UPDATE

16.27 SOUTHERN CROSS

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT UPDATES

16.28 THE ROYAL AUTOMOBILE CLUB OF WA (INC.).

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT UPDATES

16.29 TOKIO MARINE

16.29.1 COMPANY SNAPSHOT

16.29.2 PRODUCT PORTFOLIO

16.29.3 RECENT UPDATE

16.3 UNIMED

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT UPDATES

16.31 ZURICH

16.31.1 COMPANY SNAPSHOT

16.31.2 REVENUE ANALYSIS

16.31.3 PRODUCT PORTFOLIO

16.31.4 RECENT UPDATES

17 QUESTIONNAIRES

18 RELATED REPORTS

Lista de Tablas

TABLE 1 NUMBER OF ADULTS HAVE PRIVATE HEALTH INSURANCE, BY AGE GROUP, MILLION, 2021

TABLE 2 NUMBER OF ADULTS HAVE PRIVATE HEALTH INSURANCE, BY INSURANCE COMPANY, MILLION, 2021

TABLE 3 NUMBER OF ADULTS HAVE PRIVATE HEALTH INSURANCE, BY PROVIDER TYPE, MILLION, 2021

TABLE 4 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 5 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF HEALTH MAINTENANCE ORGANIZATIONS (HMOS), BY TYPE , USD MILLION, 2021

TABLE 6 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF PREFERRED PROVIDER ORGANIZATIONS (PPOS), BY TYPE , USD MILLION, 2021

TABLE 7 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS), BY TYPE , USD MILLION, 2021

TABLE 8 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF POINT-OF-SERVICE (POS) PLANS, BY TYPE , USD MILLION, 2021

TABLE 9 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF HIGH-DEDUCTIBLE HEALTH PLANS (HDHPS), BY TYPE , USD MILLION, 2021

TABLE 10 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF OTHERS, BY TYPE , USD MILLION, 2021

TABLE 11 DETAILS OF CIGNA OF HEALTH MAINTENANCE ORGANIZATIONS (HMOS), BY TYPE , USD MILLION, 2021

TABLE 12 DETAILS OF CIGNA OF PREFERRED PROVIDER ORGANIZATIONS (PPOS), BY TYPE , USD MILLION, 2021

TABLE 13 DETAILS OF CIGNA OF EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS), BY TYPE , USD MILLION, 2021

TABLE 14 DETAILS OF CIGNA OF POINT-OF-SERVICE (POS) PLANS, BY TYPE , USD MILLION, 2021

TABLE 15 DETAILS OF CIGNA OF HIGH-DEDUCTIBLE HEALTH PLANS (HDHPS), BY TYPE , USD MILLION, 2021

TABLE 16 DETAILS OF CIGNA OF OTHERS, BY TYPE , USD MILLION, 2021

TABLE 17 DETAILS OF AIA GROUP LIMITED OF HEALTH MAINTENANCE ORGANIZATIONS (HMOS), BY TYPE , USD MILLION, 2021

TABLE 18 DETAILS OF AIA GROUP LIMITED OF PREFERRED PROVIDER ORGANIZATIONS (PPOS), BY TYPE , USD MILLION, 2021

TABLE 19 DETAILS OF AIA GROUP LIMITED OF EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS), BY TYPE , USD MILLION, 2021

TABLE 20 DETAILS OF AIA GROUP LIMITED OF POINT-OF-SERVICE (POS) PLANS, BY TYPE , USD MILLION, 2021

TABLE 21 DETAILS OF AIA GROUP LIMITED OF HIGH-DEDUCTIBLE HEALTH PLANS (HDHPS), BY TYPE , USD MILLION, 2021

TABLE 22 DETAILS OF AIA GROUP LIMITED OF OTHERS, BY TYPE , USD MILLION, 2021

TABLE 23 CHIEF MEDICAL OFFICER

TABLE 24 LIST OF DAY CARE PROCEDURES

TABLE 25 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET, BY HEALTH PLAN CATEGORY/METAL LEVELS, 2020-2029 (USD MILLION)

TABLE 27 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET, BY PROVIDER TYPE, 2020-2029 (USD MILLION)

TABLE 28 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 29 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 30 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 31 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET, BY HEALTH PLAN CATEGORY/METAL LEVELS, 2020-2029 (USD MILLION)

TABLE 33 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET, BY PROVIDER TYPE, 2020-2029 (USD MILLION)

TABLE 34 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 35 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 2 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET: DATA TRIANGULATION

FIGURE 3 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET: DROC ANALYSIS

FIGURE 4 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET: NEW ZEALAND VS. REGIONAL MARKET ANALYSIS

FIGURE 5 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET: THE AGE GROUP LIFE LINE CURVE

FIGURE 7 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET: MULTIVARIATE MODELLING

FIGURE 8 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 13 MANDATORY OPTING FOR HEALTH INSURANCE IN PUBLIC AND PRIVATE SECTOR IS DRIVING THE NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 INDIVIDUAL HEALTH INSURANCE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET IN 2022 & 2029

FIGURE 15 SOUTH EAST ASIA PRIVATE HEALTH INSURANCE MARKET: PESTEL ANALYSIS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET

FIGURE 17 HEALTHCARE EXPENDITURE IN MALAYSIA, (RM MILLION)

FIGURE 18 MALAYSIA REVENUE TRAVEL INDUSTRY SIZE, BY REVENUE (RM MILLION)

FIGURE 19 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET: BY TYPE, 2021

FIGURE 20 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET: BY HEALTH PLAN CATEGORY/METAL LEVELS, 2021

FIGURE 21 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET: BY PROVIDER TYPE, 2021

FIGURE 22 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET: BY AGE GROUP, 2021

FIGURE 23 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 24 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET: SNAPSHOT (2021)

FIGURE 25 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET: BY COUNTRY (2021)

FIGURE 26 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET: BY TYPE (2022-2029)

FIGURE 29 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.