Mercado de polímeros de Oriente Medio, por producto (polietileno (PE), polipropileno (PP), acrilonitrilo butadieno estireno, poliamida (PA) y otros), tendencia de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de polímeros de Oriente Medio

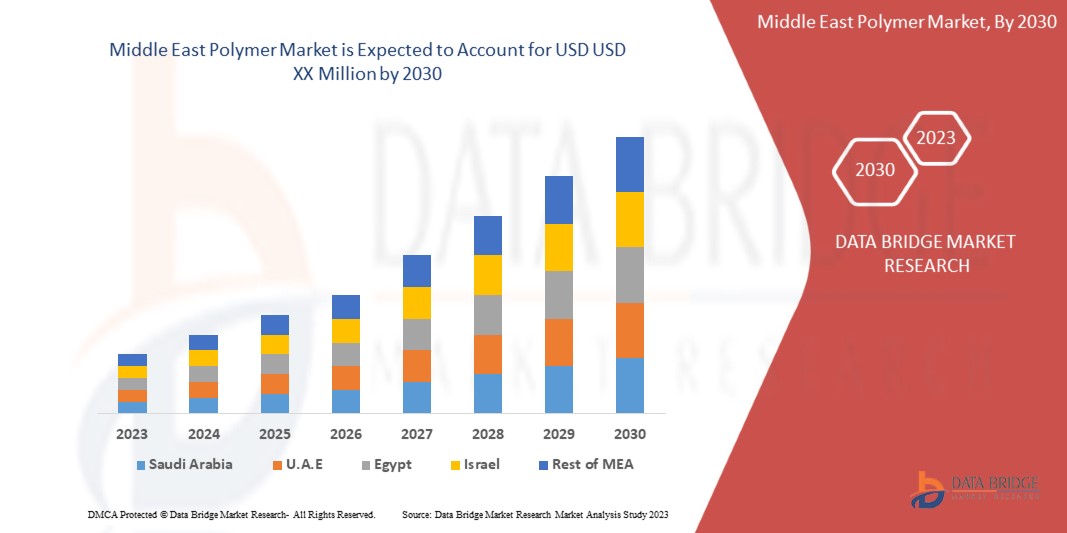

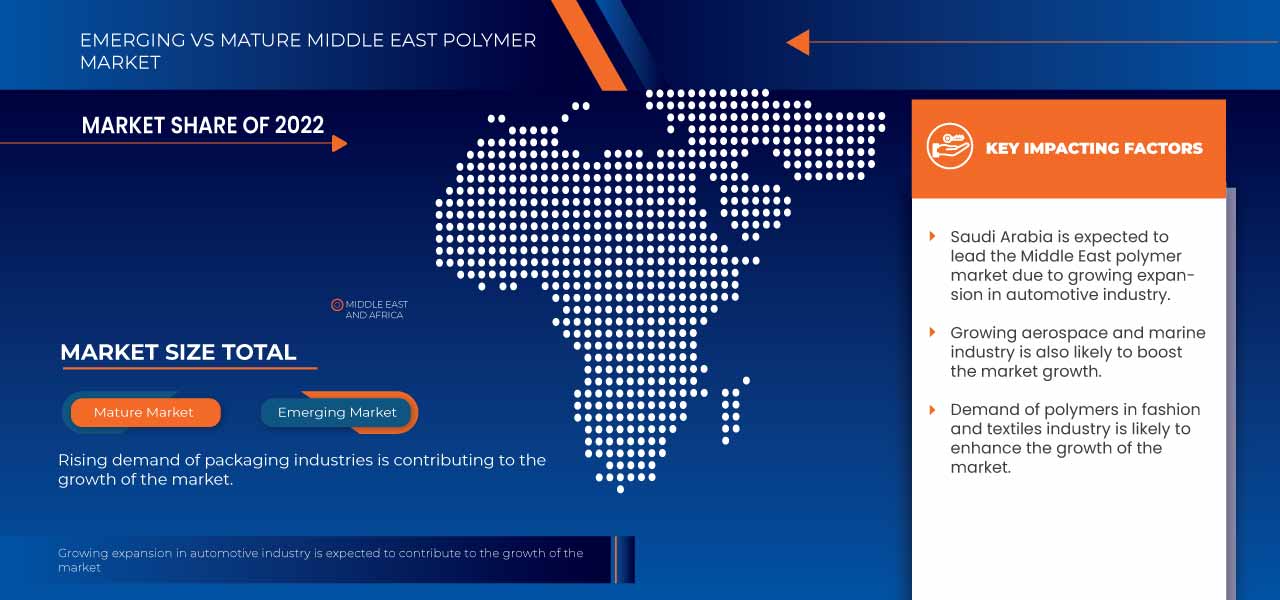

Se espera que el mercado de polímeros de Oriente Medio gane un crecimiento significativo en el período de pronóstico de 2023 a 2030. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 4,7% en el período de pronóstico de 2023 a 2030 y se espera que alcance los USD 75.295,96 millones para 2030. El principal factor que impulsa el crecimiento del mercado de polímeros de Oriente Medio es la creciente demanda de productos a base de polímeros de sectores industriales como los materiales de embalaje, la automoción, la aeroespacial, la marina y la construcción, entre otros.

Los polímeros están formados por múltiples unidades de moléculas pequeñas llamadas monómeros mediante el proceso llamado polimerización. Según la fuente de origen, el polímero se clasifica en polímeros naturales y sintéticos. Polímeros naturales, también conocidos como biopolímeros, como seda, caucho, celulosa, lana y muchos otros. Los polímeros sintéticos son productos de base química, que utilizan principalmente petróleo como materia prima, agregado con otros catalizadores y enzimas que se preparan mediante reacciones químicas en laboratorios, por ejemplo, como poliestireno, nailon, silicona, neopreno, polietileno y muchos otros. Los polímeros se utilizan ampliamente de diversas formas posibles en varias industrias que van desde la automotriz, aeroespacial, marina, materiales de construcción, embalajes y textiles, hogares, productos médicos y farmacéuticos.

El informe del mercado de polímeros de Oriente Medio proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen analítico; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2020-2016) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Subproducto ( polietileno (PE), polipropileno (PP), acrilonitrilo butadieno estireno, poliamida (PA) y otros), |

|

Países cubiertos |

País (EAU, Arabia Saudita, Israel, Omán, Qatar, Kuwait, Bahréin y el resto de Oriente Medio). |

|

Actores del mercado cubiertos |

Las empresas que participan en el proyecto son: SABIC, Lyondellbasell Industries Holdings BV, BASF SE, Sumitomo Chemical Co. Ltd., Saudi Polymer LLC, Qatar Petrochemical Company (QAPCO)QPJSC, Venus Petrochemicals (Bombay) Pvt. Ltd, Middle East Polymers & Chemicals LLC, Petro Rabigh, Exxon Mobil Corporation, Borouge y Reliance Industries Limited. |

Definición de mercado

El polímero tiene muchas propiedades útiles que lo hacen adecuado para diversas aplicaciones industriales de uso final. Tiene baja resistencia y dureza, pero es muy dúctil y tiene buena resistencia al impacto; se estirará en lugar de romperse. Los productos a base de polímeros tienen un buen aislante eléctrico, ofreciendo resistencia a la arborización eléctrica, pero pueden cargarse electrostáticamente. Por lo tanto, debido a estas propiedades, la demanda de polímeros está ganando impulso en varias industrias como la automotriz, eléctrica y electrónica, alimentos y bebidas y bienes de consumo. En la industria automotriz, los fabricantes se están enfocando en aumentar la eficiencia de los vehículos reduciendo su peso. El material polimérico es preferido ya que es liviano y ofrece fácil procesabilidad, sellado y propiedades de rigidez. En la industria de alimentos y bebidas, el consumo de polímeros está creciendo a un ritmo rápido debido a la creciente demanda de producción de materiales de embalaje para alimentos y bebidas. Los fabricantes prefieren embalajes efectivos para reducir la posibilidad de contaminación de los alimentos y pérdida de calidad. El uso de polímeros en moda, deportes y juguetes está creciendo debido a su capacidad para resistir tensiones físicas y durabilidad, proporcionar flexibilidad en el embalaje y permitir un fácil moldeado de productos. En la industria agrícola, la aplicación de polímeros está creciendo debido a la creciente demanda de goteros, microtubos, boquillas y tuberías emisoras en los campos de riego.

Dinámica del mercado de polímeros en Oriente Medio

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Creciente expansión en la industria automotriz

En este mundo moderno, los automóviles y los vehículos han sido los principales productos para que las personas se desplacen de un lugar a otro. Las personas también utilizan los automóviles para el transporte de una variedad de otros propósitos, como el traslado de bienes y servicios entre ubicaciones. En esencia, un vehículo consta de un motor, chasis, parte de la carrocería, neumáticos, transmisión y dirección, suspensión, frenos y equipo eléctrico que se combinan para lograr la funcionalidad. Aparte de esto, se agrega algún equipo de lujo adicional según el tipo y la categoría del automóvil para mejorar el aspecto, la funcionalidad y la comodidad. La creciente demanda de un nuevo desarrollo en la industria automotriz por parte de un cliente de nuevas características de diseño y comodidad, junto con varias medidas de regulación y seguridad impuestas por varios gobiernos, ha dado como resultado la adición de equipo adicional, que contribuye al peso total de los vehículos. Las restricciones ambientales de los organismos gubernamentales y la eficiencia del combustible son el factor crucial principal para el diseño de vehículos. Para compensar el peso adicional y la eficiencia del combustible de los vehículos, es crucial desarrollar un diseño y un producto que tengan una estructura liviana. Esto se puede lograr mediante el uso de productos a base de polímeros como polipropileno, poliuretano, poliamidas y PVC, acrilonitrilo butadieno estireno, policarbonato (PC) y muchos otros, que son livianos en comparación con sus contrapartes de metal. Debido a su funcionalidad confiable, peso ligero, dureza y resistencia al desgaste, los elastómeros termoplásticos (TPE) de alto rendimiento y los cauchos líquidos como polímeros encontraron su camino hacia la fabricación de piezas automotrices como neumáticos, exterior, interior, debajo del capó, ruido, vibración, aspereza (NVH) y amortiguación e iluminación, ayudan a brindar seguridad y comodidad al mismo tiempo que reducen las emisiones. Se espera que la creciente expansión de la industria automotriz aumente la demanda de polímeros en el mercado de polímeros de Medio Oriente.

- Crecimiento de la industria aeroespacial y marina

La industria aeroespacial es una de las más importantes en Oriente Medio debido a su crecimiento durante muchos años. Oriente Medio es una conexión popular para los viajeros y el comercio internacionales y también es un destino importante para los pasajeros de negocios, turismo y ocio. Al construir una aeronave, es esencial encontrar un equilibrio seguro entre gran resistencia y bajo peso. Para resistir las muchas fuerzas que se producen en un avión mientras está en vuelo, las estructuras de las aeronaves deben ser ligeras, resistentes y rígidas. Además, deben ser lo suficientemente fuertes como para soportar estas tensiones durante toda la vida útil de la aeronave. La capacidad de carga útil, el precio, el alcance, la velocidad, la eficiencia del combustible, la durabilidad, los niveles de ruido, la longitud de pista necesaria y una serie de otros criterios se equilibran cuidadosamente entre sí en cada diseño de aeronave. Los polímeros tienen un componente importante en la industria aeroespacial. Debido a su peso ligero, resistencia a la corrosión, resistencia al impacto, resistencia química, durabilidad y rentabilidad, los polímeros se utilizan ampliamente en la fabricación de componentes aeroespaciales, y las funciones de navegación, elementos estructurales y componentes interiores que contribuyen a reducir el peso y la eficiencia del combustible son una preocupación importante. Cuando se trata de aviones militares, los polímeros livianos ayudan a extender el alcance de vuelo para evadir la detección del radar.

Oportunidades

- Desarrollo de polímeros de base biológica

La eliminación de plásticos y otros productos de polímeros es la principal preocupación para el medio ambiente, los plásticos basados en polímeros se producen en grandes cantidades y se utilizan con mayor frecuencia en la vida diaria, lo que tiene un impacto negativo en el medio ambiente. Para contrarrestar esto, se están desarrollando polímeros biodegradables para reemplazar los materiales poliméricos no biodegradables. Los polímeros biodegradables, también conocidos como biopolímeros, son materiales que son ecológicos y pueden degradarse después de su uso y están hechos de una variedad de desechos o fuentes biológicas, como desechos alimentarios, desechos animales, desechos agrícolas y otras fuentes como almidón y celulosa. Los materiales biodegradables se están volviendo cada vez más populares en los últimos años para su aplicación en envases, agricultura, medicina y otros campos. Se cree que el uso de productos poliméricos biodegradables tendrá un buen impacto en el medio ambiente y la economía al reducir y, en consecuencia, reducir la contaminación. Se espera que el desarrollo de polímeros sostenibles y ecológicos brinde oportunidades para el mercado de polímeros de Medio Oriente.

- Inversión y apoyo del gobierno para aumentar la infraestructura y la manufactura

El gobierno de Oriente Medio se está centrando en la inversión en nuevos proyectos de infraestructura que estén directamente relacionados con el desarrollo económico del país. Teniendo en cuenta la ubicación estratégica de Oriente Medio en el mundo, Oriente Medio se ha convertido en un centro de crecimiento para el comercio y el turismo, sin olvidar su floreciente industria petrolera. Con el desarrollo de la ciencia y las tecnologías de los materiales, los materiales poliméricos han mostrado su potencial en las industrias de la construcción debido a sus cualidades superiores, como impermeabilidad, resistencia al desgaste, anticorrosión, antisísmicos, peso ligero, buena resistencia, aislamiento acústico, aislamiento térmico, buen aislamiento eléctrico y colores brillantes. Los materiales poliméricos, incluida la capa aislante de las tuberías de suministro de agua y drenaje, los cables y alambres, y el material de aislamiento de las paredes, se han utilizado ampliamente en la construcción debido a sus cualidades excepcionales. convertido en betún o alquitrán a través de un modificador convencional. Los materiales de construcción a base de polímeros se han utilizado ampliamente en revestimientos de edificios, salvaguardan los materiales de construcción, mejoran su atractivo estético y proporcionan funcionalidades únicas, que incluyen revestimientos resistentes al fuego, impermeables, aislantes del calor, autocurativos, esterilizantes y anticorrosivos. Además, el uso de aglutinantes poliméricos mejoraría de manera efectiva las capacidades de unión del cemento o el mortero. Se espera que la atención que prestan los organismos gubernamentales a la financiación y la inversión en nuevos proyectos de infraestructura y el desarrollo de diversos proyectos de construcción de muchas infraestructuras futuras actúen como una oportunidad para que los fabricantes y productores de polímeros crezcan si prestamos la debida atención y aplicamos el enfoque adecuado.

Restricciones/ Desafíos

- Regulaciones gubernamentales estrictas sobre productos basados en polímeros

Los polímeros están compuestos por la unión de muchas unidades químicas pequeñas llamadas monómeros, la mayoría de los cuales se consideran una amenaza tanto para los seres humanos como para el medio ambiente. Para superar y contrarrestar el riesgo para la salud y el medio ambiente que presentan los productos poliméricos, varios organismos gubernamentales y ONG están implementando una regulación estricta e impuestos sobre el abastecimiento y el transporte de productos. Como resultado, la situación se ha vuelto cada vez más difícil de cumplir. Las cuestiones ambientales, sociales y de gobernanza (ESG) se están volviendo cada vez más críticas para las industrias de polímeros, y los consumidores están dando más importancia a los productos que tienen poco o ningún componente social y ambiental. Además, se espera que varias situaciones complejas impuestas por el gobierno en la importación y exportación, tanto a nivel nacional como internacional, sumada a la restricción del impacto ambiental, restrinjan el mercado de polímeros en la región de Medio Oriente.

- Impacto nocivo de los polímeros sobre el medio ambiente

A pesar de sus ventajas y popularidad en varias industrias, los polímeros son altamente peligrosos para el medio ambiente debido a su alta resistencia a la corrosión y a su naturaleza no degradable, especialmente los plásticos usados una vez que se usan, terminan principalmente como desechos en los vertederos que gradualmente terminan en los cuerpos de agua como ríos y océanos dañando tanto la vida acuática como la terrestre. Por ejemplo, las botellas de agua y otros materiales similares hechos de tereftalato de polietileno (PET), que es un polímero derivado del petróleo que tarda hasta 450 años en descomponerse. Compuestos poliméricos y productos terminados de polímero debido a su gran cantidad. El reciclaje de desechos de polímeros incluye muchos procesos, que son la separación del compuesto polimérico, la molienda y la separación de impurezas, lo que comprende un alto costo. La dificultad de descomponer el polímero presenta muchas dificultades y desafíos para el fabricante debido a su efecto adverso sobre el medio ambiente, y la contribución a los desechos actuará como un desafío para el crecimiento del mercado de polímeros.

Acontecimientos recientes

- En diciembre de 2014, en una revista de Toyota (GB) PLC se afirma que Toyota creó una nanoarcilla poliamida conocida como Nylon-6, una arcilla sintética exfoliada hasta alcanzar un espesor de alrededor de cinco átomos entre capas de material de base de polímero de nailon. La tecnología ha avanzado para reducir la resistencia a la rodadura de los neumáticos y crear recubrimientos protectores ultraduros para la pintura, el parabrisas y los faros. Este material tiene usos más amplios, como parachoques, paneles de carrocería y tanques de combustible.

- En diciembre de 2018, un informe de Bicerano & Associates Consulting, LLC afirmó que tanto los interiores como los neumáticos de los aviones utilizan compuestos de matriz polimérica. Muchas piezas interiores de los aviones, incluidos los paneles interiores, los paneles de instrumentos, las superficies de las mesas, las barras, las encimeras, las puertas, los armarios, las molduras, las carcasas y los compartimentos de almacenamiento superiores, están hechos de polímeros y compuestos de matriz polimérica.

Alcance del mercado de polímeros en Oriente Medio

El mercado de polímeros de Oriente Medio se clasifica en función del producto. El crecimiento entre los segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas a fin de identificar las principales aplicaciones del mercado.

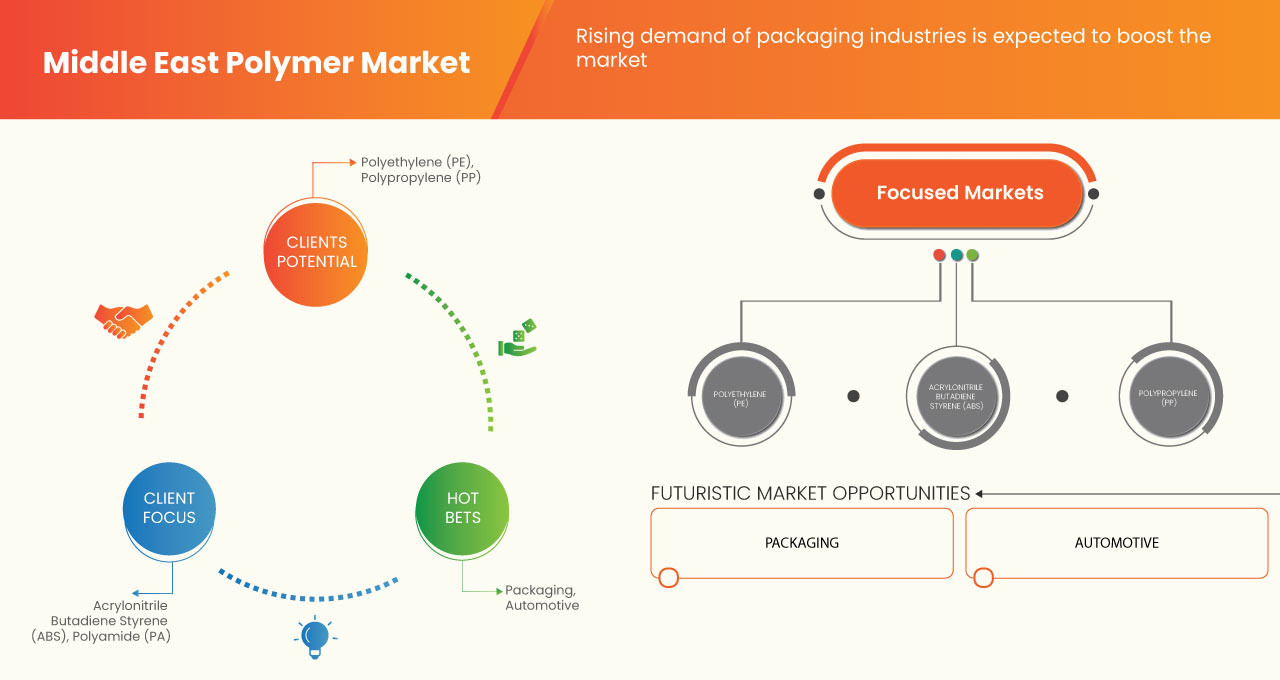

Productos

- Polietileno (PE)

- Polipropileno (PP)

- Acrilonitrilo butadieno estireno

- Poliamida (PA)

Según el producto, el mercado de polímeros de Oriente Medio se clasifica en polietileno (PE), polipropileno (PP), acrilonitrilo butadieno estireno y poliamida (PA).

Análisis y perspectivas regionales del mercado de polímeros de Oriente Medio

El mercado de polímeros de Oriente Medio está segmentado en función del tamaño del producto y del mercado y se proporcionan tendencias según lo mencionado anteriormente.

Los países cubiertos en el mercado de polímeros de Medio Oriente son los Emiratos Árabes Unidos, Arabia Saudita, Israel, Omán, Qatar, Kuwait, Bahréin y el resto de Medio Oriente.

Este informe regional proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos del análisis de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para cada país. Además, se consideran la presencia y disponibilidad de marcas internacionales y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales al proporcionar un análisis de pronóstico de los datos del país.

Análisis de la cuota de mercado de polímeros en Oriente Medio

El panorama competitivo del mercado de polímeros de Oriente Medio proporciona detalles por competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de vida útil de los productos. Los puntos de datos proporcionados anteriormente solo están relacionados con el enfoque de las empresas en el mercado de polímeros de Oriente Medio.

Algunos de los participantes destacados que operan en el mercado de polímeros de Medio Oriente son SABIC, Lyondellbasell Industries Holdings BV, BASF SE, Sumitomo Chemical Co. Ltd., Saudi Polymer LLC, Qatar Petrochemical Company (QAPCO)QPJSC, Venus Petrochemicals (Bombay) Pvt. Ltd, Middle East Polymers & Chemicals LLC, Petro Rabigh, Exxon Mobil Corporation, Borouge, Reliance Industries Limited, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST POLYMER MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 RAW MATERIAL LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 IMPORT EXPORT SCENARIO

4.5 PRICE ANALYSIS

4.6 PRODUCTION CAPACITY OVERVIEW

4.7 PRODUCTION CONSUMPTION ANALYSIS

4.8 RAW MATERIAL COVERAGE

4.9 SUPPLY CHAIN ANALYSIS

4.1 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.11 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING EXPANSION IN THE AUTOMOTIVE INDUSTRY

6.1.2 GROWTH IN THE AEROSPACE AND MARINE INDUSTRY

6.1.3 DEMAND FOR POLYMERS IN THE FASHION AND TEXTILES INDUSTRY

6.1.4 RISING DEMAND PACKAGING INDUSTRIES

6.2 RESTRAINTS

6.2.1 STRICT GOVERNMENT REGULATIONS ON POLYMER BASED PRODUCT

6.2.2 VOLATILITY IN PRICE OF RAW MATERIAL

6.3 OPPORTUNITIES

6.3.1 DEVELOPMENT OF BIO-BASED POLYMERS

6.3.2 GOVERNMENT INVESTMENT AND SUPPORT FOR INCREASING INFRASTRUCTURE AND MANUFACTURING

6.4 CHALLENGES

6.4.1 HARMFUL IMPACT OF POLYMERS ON THE ENVIRONMENT

7 MIDDLE EAST POLYMER MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 POLYETHYLENE (PE)

7.2.1 BY TYPE

7.2.1.1 HDPE (HIGH DENSITY POLYETHYLENE)

7.2.1.2 LDPE (LOW DENSITY POLYETHYLENE)

7.2.1.3 MDPE (MEDIUM DENSITY POLYETHYLENE)

7.2.2 BY TECHNOLOGY

7.2.2.1 BLOW MOLDING

7.2.2.2 PIPE EXTRUSION

7.2.2.3 FILMS & SHEET EXTRUSION

7.2.2.4 INJECTION MOLDING

7.2.2.5 OTHERS

7.2.3 BY END-USE

7.2.3.1 PACKAGING

7.2.3.2 AUTOMOTIVE

7.2.3.3 INFRASTRUCTURE & CONSTRUCTION

7.2.3.4 CONSUMER GOODS/LIFESTYLE

7.2.3.5 HEALTHCARE & PHARMACEUTICALS

7.2.3.6 ELECTRICAL & ELECTRONICS

7.2.3.7 AGRICULTURE

7.2.3.8 OTHERS

7.3 POLYPROPYLENE (PP)

7.3.1 BY TYPE

7.3.1.1 HOMOPOLYMER

7.3.1.2 COPOLYMER

7.3.1.2.1 BLOCK COPOLYMER

7.3.1.2.2 RANDOM COPOLYMER

7.3.2 BY PROCESS

7.3.2.1 INJECTION MOLDING

7.3.2.2 BLOW MOLDING

7.3.2.3 EXTRUSION

7.3.2.4 OTHERS

7.3.3 BY APPLICATION

7.3.3.1 FIBER

7.3.3.2 FILM AND SHEET

7.3.3.3 RAFFIA

7.3.3.4 FOAM

7.3.3.5 TAPE

7.3.3.6 OTHERS

7.3.4 BY END-USE

7.3.4.1 PACKAGING

7.3.4.2 BUILDING AND CONSTRUCTION

7.3.4.3 AUTOMOTIVE

7.3.4.4 FURNITURE

7.3.4.5 ELECTRICAL AND ELECTRONICS

7.3.4.6 MEDICAL

7.3.4.7 CONSUMER PRODUCTS

7.3.4.8 OTHERS

7.4 ACRYLONITRILE BUTADIENE STYRENE

7.4.1 BY SOURCE

7.4.1.1 ACRYLONITRILE MONOMERS

7.4.1.2 BUTADIENE MONOMERS

7.4.1.3 STYRENE MONOMERS

7.4.2 BY PROCESS

7.4.2.1 INJECTION MOLDING

7.4.2.2 EXTRUSION

7.4.3 BY ADDITIVES

7.4.3.1 GLASS

7.4.3.2 POLYVINYLCHLORIDE (PVC)

7.4.3.3 OTHERS

7.4.4 BY APPEARANCE

7.4.4.1 OPAQUE

7.4.4.2 TRANSPARENT

7.4.4.3 COLOURED

7.4.5 BY APPLICATION

7.4.5.1 CONSTRUCTION

7.4.5.2 AUTOMOTIVE

7.4.5.3 MARINE

7.4.5.4 FURNITURE

7.4.5.5 PLUMBING

7.4.5.6 OTHERS

7.5 POLYAMIDE (PA)

7.5.1 BY TYPE

7.5.1.1 PA 6

7.5.1.2 PA 66

7.5.1.3 BIO POLYAMIDES

7.5.1.4 SPECIALTY POLYAMIDES

7.5.1.5 OTHERS

7.5.2 BY CLASS

7.5.2.1 ALIPHATIC POLYAMIDES

7.5.2.2 SEMI-AROMATIC

7.5.2.3 AROMATIC POLYAMIDES

7.5.3 BY APPLICATION

7.5.3.1 FIBERS

7.5.3.2 WIRE AND CABLES

7.5.3.3 3D PRINTING

7.5.3.4 SPORTS EQUIPMENT

7.5.3.5 ENGINE COMPONENTS

7.5.3.6 BRAKES AND TRANSMISSION PARTS

7.5.3.7 HOUSEHOLD GOODS AND APPLIANCES

7.5.3.8 OTHERS

7.5.4 BY END-USE

7.5.4.1 AUTOMOTIVE

7.5.4.2 ELECTRICAL AND ELECTRONICS

7.5.4.3 TEXTILE

7.5.4.4 AEROSPACE AND DEFENCE

7.5.4.5 PACKAGING

7.5.4.6 CONSUMER GOODS

7.5.4.7 OTHERS

7.6 OTHERS

8 MIDDLE EAST POLYMER MARKET, BY COUNTRY

8.1 SAUDI ARABIA

8.2 U.A.E.

8.3 ISRAEL

8.4 QATAR

8.5 OMAN

8.6 KUWAIT

8.7 BAHRAIN

8.8 REST OF MIDDLE EAST

9 MIDDLE EAST POLYMER MARKET COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: MIDDLE EAST

9.2 PRODUCT LAUNCH

9.3 COLLABORATIONS

9.4 EXPANSIONS

9.5 ACHIEVEMENT

9.6 DEVELOPMENTS

9.7 PARTNERSHIP

10 SWOT ANALYSIS

11 COMPANY PROFILES

11.1 SABIC

11.1.1 COMPANY SNAPSHOT

11.1.2 PRODUCT PORTFOLIO

11.1.3 SWOT

11.1.4 REVENUE ANALYSIS

11.1.5 RECENT DEVELOPMENTS

11.2 LYONDELLBASELLINDUSTRIES HOLDINGS B.V

11.2.1 COMPANY SNAPSHOT

11.2.2 PRODUCT PORTFOLIO

11.2.3 SWOT

11.2.4 REVENUE ANALYSIS

11.2.5 RECENT DEVELOPMENTS

11.3 BASF SE

11.3.1 COMPANY SNAPSHOT

11.3.2 PRODUCT PORTFOLIO

11.3.3 SWOT

11.3.4 REVENUE ANALYSIS

11.3.5 RECENT DEVELOPMENT

11.4 SUMITOMO CHEMICAL CO. LTD.

11.4.1 COMPANY SNAPSHOT

11.4.2 PRODUCT PORTFOLIO

11.4.3 SWOT

11.4.4 REVENUE ANALYSIS

11.4.5 RECENT DEVELOPMENTS

11.5 EXXON MOBIL CORPORATION

11.5.1 COMPANY SNAPSHOT

11.5.2 PRODUCT PORTFOLIO

11.5.3 SWOT

11.5.4 REVENUE ANALYSIS

11.5.5 RECENT DEVELOPMENTS

11.6 BOROUGE

11.6.1 COMPANY SNAPSHOT

11.6.2 PRODUCT PORTFOLIO

11.6.3 SWOT

11.6.4 RECENT DEVELOPMENTS

11.7 MIDDLE EAST POLYMERS & CHEMICALS.L.L.C

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 SWOT

11.7.4 RECENT DEVELOPMENT

11.8 PETRO RABIGH

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 SWOT

11.8.4 REVENUE ANALYSIS

11.8.5 RECENT DEVELOPMENT

11.9 QATAR PETROCHEMICAL COMPANY(QAPCO)Q.P.J.S.C

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 SWOT

11.9.4 RECENT DEVELOPMENT

11.1 RELIANCE INDUSTRIES LIMITED

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 SWOT

11.10.4 REVENUE ANALYSIS

11.10.5 RECENT DEVELOPMENT

11.11 SAUDI POLYMER LLC

11.11.1 COMPANY SNAPSHOT

11.11.2 SWOT

11.11.3 PRODUCT PORTFOLIO

11.11.4 RECENT DEVELOPMENT

11.12 VENUS PETROCHEMICALS (BOMBAY) PVT.LTD

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 SWOT

11.12.4 RECENT DEVELOPMENT

12 QUESTIONNAIRE

13 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF POLYMERS OF PROPYLENE OR OTHER OLEFINS, IN PRIMARY FORMS; HS CODE – 3902 (USD THOUSAND)

TABLE 2 EXPORT DATA OF POLYMERS OF PROPYLENE OR OTHER OLEFINS IN PRIMARY FORMS; HS CODE – 3902 (USD THOUSAND)

TABLE 3 MIDDLE EAST POLYMER MARKET, AVERAGE SELLING PRICE, BY POLYMER, 2021-2030 (USD/KILO TONS)

TABLE 4 REGULATORY FRAMEWORK

TABLE 5 MIDDLE EAST POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 6 MIDDLE EAST POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 7 MIDDLE EAST POLYETHYLENE (PE) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 MIDDLE EAST POLYETHYLENE (PE) IN POLYMER MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 9 MIDDLE EAST POLYETHYLENE (PE) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST POLYPROPYLENE (PP) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST COPOLYMER IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST POLYPROPYLENE (PP) IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST POLYPROPYLENE (PP) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST POLYPROPYLENE (PP) IN POLYMER MARKET, BY END-USE, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY ADDITIVES 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPEARANCE, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 20 MIDDLE EAST POLYAMIDE (PA) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST POLYAMIDE (PA) IN POLYMER MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 22 MIDDLE EAST POLYAMIDE (PA) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 23 MIDDLE EAST POLYAMIDE (PA) IN POLYMER MARKET, BY END-USE, 2021-2030 (USD MILLION)

TABLE 24 MIDDLE EAST POLYMER MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 25 MIDDLE EAST POLYMER MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 26 SAUDI ARABIA POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 27 SAUDI ARABIA POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 28 SAUDI ARABIA POLYETHYLENE (PE) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 SAUDI ARABIA POLYETHYLENE (PE) IN POLYMER MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 30 SAUDI ARABIA POLYETHYLENE (PE) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 31 SAUDI ARABIA POLYPROPYLENE (PP) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 SAUDI ARABIA COPOLYMER IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 SAUDI ARABIA POLYPROPYLENE (PP) IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 34 SAUDI ARABIA POLYPROPYLENE (PP) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 35 SAUDI ARABIA POLYPROPYLENE (PP) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 36 SAUDI ARABIA ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 37 SAUDI ARABIA ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 38 SAUDI ARABIA ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY ADDITIVE, 2021-2030 (USD MILLION)

TABLE 39 SAUDI ARABIA ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPEARANCE, 2021-2030 (USD MILLION)

TABLE 40 SAUDI ARABIA ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 41 SAUDI ARABIA POLYAMIDE (PA) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 SAUDI ARABIA POLYAMIDE (PA) IN POLYMER MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 43 SAUDI ARABIA POLYAMIDE (PA) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 44 SAUDI ARABIA POLYAMIDE (PA) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 45 U.A.E. POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 46 U.A.E. POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 47 U.A.E. POLYETHYLENE (PE) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 U.A.E. POLYETHYLENE (PE) IN POLYMER MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 49 U.A.E. POLYETHYLENE (PE) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 50 U.A.E. POLYPROPYLENE (PP) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 U.A.E. COPOLYMER IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 U.A.E. POLYPROPYLENE (PP) IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 53 U.A.E. POLYPROPYLENE (PP) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 54 U.A.E. POLYPROPYLENE (PP) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 55 U.A.E. ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 56 U.A.E. ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 57 U.A.E. ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY ADDITIVE, 2021-2030 (USD MILLION)

TABLE 58 U.A.E. ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPEARANCE, 2021-2030 (USD MILLION)

TABLE 59 U.A.E. ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 60 U.A.E. POLYAMIDE (PA) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 U.A.E. POLYAMIDE (PA) IN POLYMER MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 62 U.A.E. POLYAMIDE (PA) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 63 U.A.E. POLYAMIDE (PA) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 64 ISRAEL POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 65 ISRAEL POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 66 ISRAEL POLYETHYLENE (PE) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 ISRAEL POLYETHYLENE (PE) IN POLYMER MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 68 ISRAEL POLYETHYLENE (PE) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 69 ISRAEL POLYPROPYLENE (PP) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 ISRAEL COPOLYMER IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 ISRAEL POLYPROPYLENE (PP) IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 72 ISRAEL POLYPROPYLENE (PP) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 73 ISRAEL POLYPROPYLENE (PP) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 74 ISRAEL ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 75 ISRAEL ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 76 ISRAEL ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY ADDITIVE, 2021-2030 (USD MILLION)

TABLE 77 ISRAEL ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPEARANCE, 2021-2030 (USD MILLION)

TABLE 78 ISRAEL ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 79 ISRAEL POLYAMIDE (PA) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 ISRAEL POLYAMIDE (PA) IN POLYMER MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 81 ISRAEL POLYAMIDE (PA) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 82 ISRAEL POLYAMIDE (PA) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 83 QATAR POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 84 QATAR POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 85 QATAR POLYETHYLENE (PE) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 QATAR POLYETHYLENE (PE) IN POLYMER MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 87 QATAR POLYETHYLENE (PE) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 88 QATAR POLYPROPYLENE (PP) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 QATAR COPOLYMER IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 QATAR POLYPROPYLENE (PP) IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 91 QATAR POLYPROPYLENE (PP) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 92 QATAR POLYPROPYLENE (PP) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 93 QATAR ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 94 QATAR ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 95 QATAR ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY ADDITIVE, 2021-2030 (USD MILLION)

TABLE 96 QATAR ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPEARANCE, 2021-2030 (USD MILLION)

TABLE 97 QATAR ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 98 QATAR POLYAMIDE (PA) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 QATAR POLYAMIDE (PA) IN POLYMER MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 100 QATAR POLYAMIDE (PA) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 101 QATAR POLYAMIDE (PA) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 102 OMAN POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 103 OMAN POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 104 OMAN POLYETHYLENE (PE) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 OMAN POLYETHYLENE (PE) IN POLYMER MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 106 OMAN POLYETHYLENE (PE) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 107 OMAN POLYPROPYLENE (PP) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 OMAN COPOLYMER IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 OMAN POLYPROPYLENE (PP) IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 110 OMAN POLYPROPYLENE (PP) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 111 OMAN POLYPROPYLENE (PP) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 112 OMAN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 113 OMAN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 114 OMAN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY ADDITIVE, 2021-2030 (USD MILLION)

TABLE 115 OMAN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPEARANCE, 2021-2030 (USD MILLION)

TABLE 116 OMAN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 117 OMAN POLYAMIDE (PA) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 OMAN POLYAMIDE (PA) IN POLYMER MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 119 OMAN POLYAMIDE (PA) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 120 OMAN POLYAMIDE (PA) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 121 KUWAIT POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 122 KUWAIT POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 123 KUWAIT POLYETHYLENE (PE) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 124 KUWAIT POLYETHYLENE (PE) IN POLYMER MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 125 KUWAIT POLYETHYLENE (PE) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 126 KUWAIT POLYPROPYLENE (PP) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 127 KUWAIT COPOLYMER IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 KUWAIT POLYPROPYLENE (PP) IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 129 KUWAIT POLYPROPYLENE (PP) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 130 KUWAIT POLYPROPYLENE (PP) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 131 KUWAIT ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 132 KUWAIT ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 133 KUWAIT ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY ADDITIVE, 2021-2030 (USD MILLION)

TABLE 134 KUWAIT ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPEARANCE, 2021-2030 (USD MILLION)

TABLE 135 KUWAIT ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 136 KUWAIT POLYAMIDE (PA) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 KUWAIT POLYAMIDE (PA) IN POLYMER MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 138 KUWAIT POLYAMIDE (PA) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 139 KUWAIT POLYAMIDE (PA) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 140 BAHRAIN POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 141 BAHRAIN POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 142 BAHRAIN POLYETHYLENE (PE) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 143 BAHRAIN POLYETHYLENE (PE) IN POLYMER MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 144 BAHRAIN POLYETHYLENE (PE) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 145 BAHRAIN POLYPROPYLENE (PP) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 BAHRAIN COPOLYMER IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 BAHRAIN POLYPROPYLENE (PP) IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 148 BAHRAIN POLYPROPYLENE (PP) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 149 BAHRAIN POLYPROPYLENE (PP) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 150 BAHRAIN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 151 BAHRAIN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 152 BAHRAIN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY ADDITIVE, 2021-2030 (USD MILLION)

TABLE 153 BAHRAIN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPEARANCE, 2021-2030 (USD MILLION)

TABLE 154 BAHRAIN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 155 BAHRAIN POLYAMIDE (PA) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 156 BAHRAIN POLYAMIDE (PA) IN POLYMER MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 157 BAHRAIN POLYAMIDE (PA) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 158 BAHRAIN POLYAMIDE (PA) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 159 REST OF MIDDLE EAST POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 160 REST OF MIDDLE EAST POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

Lista de figuras

FIGURE 1 MIDDLE EAST POLYMER MARKET

FIGURE 2 MIDDLE EAST POLYMER MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST POLYMER MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST POLYMER MARKET: MIDDLE EAST MARKET ANALYSIS

FIGURE 5 MIDDLE EAST POLYMER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST POLYMER MARKET: THE RAW MATERIAL LIFE LINE CURVE

FIGURE 7 MIDDLE EAST POLYMER MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST POLYMER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST POLYMER MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST POLYMER MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 MIDDLE EAST POLYMER MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 MIDDLE EAST POLYMER MARKET: SEGMENTATION

FIGURE 13 GROWING EXPANSION IN THE AUTOMOTIVE INDUSTRY IS EXPECTED TO DRIVE THE MIDDLE EAST POLYMER MARKET IN THE FORECAST PERIOD

FIGURE 14 THE POLYETHYLENE (PE) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST POLYMER MARKET IN 2022 & 2029

FIGURE 15 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE MIDDLE EAST POLYMER MARKET

FIGURE 17 MIDDLE EAST POLYMER MARKET, BY PRODUCT, 2022

FIGURE 18 MIDDLE EAST POLYMER MARKET: SNAPSHOT (2022)

FIGURE 19 MIDDLE EAST POLYMER MARKET: BY COUNTRY (2022)

FIGURE 20 MIDDLE EAST POLYMER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 MIDDLE EAST POLYMER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 MIDDLE EAST POLYMER MARKET: BY PRODUCT (2023-2030)

FIGURE 23 MIDDLE EAST POLYMER MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.