Middle East Glass Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

2.56 Billion

USD

4.33 Billion

2024

2032

USD

2.56 Billion

USD

4.33 Billion

2024

2032

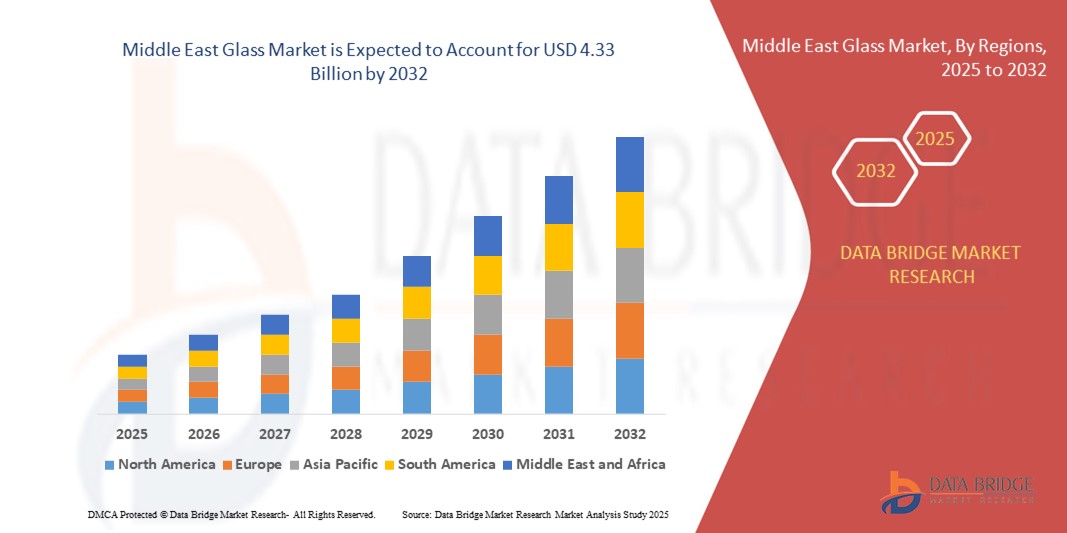

| 2025 –2032 | |

| USD 2.56 Billion | |

| USD 4.33 Billion | |

|

|

|

|

Segmentación del mercado del vidrio en Oriente Medio por tipo (vidrio flotado, vidrio arquitectónico, vidrio fundido, vidrio soplado, vidrio transparente, vidrio tintado, vidrio estampado o texturizado, vidrio armado, vidrio extraclaro, vidrio especial, vidrio de seguridad, envases de vidrio, etc.), producto (revestido y sin revestimiento), función (vidrio con filtro UV, vidrio con aislamiento térmico, acristalamiento de seguridad, acristalamiento insonorizado, vidrio autolimpiable, vidrio de intercambio iónico, etc.), espesor (4 mm, 5 mm, 6 mm, 8 mm, 2 mm, 3 mm, 10 mm, 12 mm y más de 12 mm), aplicación (construcción, automoción, aeroespacial, electrodomésticos, energía solar, embalaje, mobiliario, etc.): tendencias y pronóstico del sector hasta 2032.

Tamaño del mercado del vidrio

- El tamaño del mercado de vidrio de Oriente Medio se valoró en 2.560 millones de dólares en 2024 y se espera que alcance los 4.330 millones de dólares en 2032 , con una CAGR del 6,8 % durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la rápida urbanización, la evolución de las tendencias arquitectónicas y el creciente énfasis en materiales de construcción energéticamente eficientes y sostenibles en los sectores residencial, comercial e industrial.

- Además, la creciente demanda de soluciones de vidrio avanzadas (como vidrio aislante, recubierto y de seguridad), impulsada por las preferencias de diseño modernas y los mandatos regulatorios para el rendimiento térmico, está acelerando significativamente la expansión y la adopción del mercado en múltiples industrias de uso final.

Análisis del mercado del vidrio

- El vidrio es un material fundamental en la construcción, la automoción, la electrónica y la energía solar, ofreciendo una combinación de transparencia estructural, aislamiento y atractivo estético. Las innovaciones en tecnologías de recubrimiento, vidrio inteligente y características de seguridad están transformando el vidrio tradicional en un material de alto rendimiento para la infraestructura moderna.

- La creciente demanda de edificios energéticamente eficientes, sistemas de energía renovable y componentes automotrices de alta especificación impulsa principalmente la adopción de vidrios especializados. Esta transición se ve respaldada por códigos de construcción sostenible, crecientes inversiones en infraestructura y el impulso a la sostenibilidad en sectores económicos clave.

- Arabia Saudita dominó el mercado del vidrio en 2024, debido al rápido crecimiento en proyectos de construcción e infraestructura alineados con la Visión 2030, que enfatiza la arquitectura moderna y el desarrollo urbano inteligente.

- Se espera que los Emiratos Árabes Unidos sean el país de más rápido crecimiento en el mercado del vidrio durante el período de pronóstico debido a un aumento en los desarrollos inmobiliarios, proyectos de hotelería de lujo e iniciativas de ciudades inteligentes como el Plan Maestro Urbano de Dubái 2040.

- El segmento de vidrio revestido dominó el mercado con una cuota del 57,9 % en 2024, debido a los crecientes requisitos de eficiencia energética en edificios y vehículos. Los recubrimientos de baja emisividad (Low-E), los recubrimientos reflectantes y las películas de control solar ayudan a gestionar la transferencia de calor y a reducir el deslumbramiento, lo que disminuye el consumo energético. El vidrio revestido se utiliza ampliamente en acristalamientos arquitectónicos, muros cortina y ventanas de automóviles, contribuyendo al aislamiento térmico y al confort de los ocupantes. A medida que las certificaciones de sostenibilidad como LEED y BREEAM cobran mayor relevancia, se prevé un aumento de la demanda de vidrio revestido. El producto también está ganando terreno en aplicaciones de interior donde la estética y el rendimiento se combinan.

Alcance del informe y segmentación del mercado del vidrio

|

Atributos |

Perspectivas clave del mercado del vidrio |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado del vidrio

Creciente integración de tecnologías de vidrio inteligente y electrocrómico

- El mercado del vidrio está experimentando una rápida adopción de vidrio inteligente y electrocrómico (que puede alterar la transparencia, el color o la transmisión de calor mediante control eléctrico), impulsado por objetivos de eficiencia energética, códigos de construcción ecológica y la demanda de los consumidores de comodidad y privacidad.

- Por ejemplo, líderes de la industria como Saint-Gobain (SageGlass), AGC Glass y View Inc. están ampliando la instalación de acristalamiento dinámico en edificios comerciales, aeropuertos y vehículos premium, lo que permite el control solar en tiempo real, la mitigación del deslumbramiento y experiencias ambientales personalizadas.

- La tendencia está respaldada por mayores inversiones en I+D en vidrio integrado con IoT, revestimientos autolimpiables, sistemas de ventanas activados por voz y envolventes de edificios habilitados para datos que optimizan la iluminación y el clima en respuesta a la ocupación y el clima.

- A medida que los gobiernos establecen mandatos más estrictos sobre el consumo de energía, el vidrio electrocrómico y conmutable se elige cada vez más para fachadas, tragaluces, particiones y transporte público, lo que proporciona libertad arquitectónica junto con sostenibilidad.

- El rápido crecimiento de las ciudades inteligentes y la necesidad de infraestructura conectada digitalmente impulsan proyectos de colaboración entre empresas de tecnología, fabricantes de vidrio y empresas de construcción.

- En los sectores automotriz y de movilidad, las aplicaciones de vidrio electrocrómico se están expandiendo para techos solares, espejos retrovisores y ventanas, mejorando las características de lujo, la comodidad de los ocupantes y la seguridad a través del tintado adaptativo.

Dinámica del mercado del vidrio

Conductor

Aumento del desarrollo de la construcción y la infraestructura

- La urbanización sostenida y el aumento de los megaproyectos de infraestructura aumentan significativamente la demanda de vidrio de alto rendimiento en los sectores residencial, comercial, de transporte y de infraestructura pública.

- Por ejemplo, proyectos importantes en Asia-Pacífico, Medio Oriente y América del Norte están obteniendo vidrio arquitectónico avanzado (suministrado por Guardian Glass, Schott AG y, a nivel regional, por Saint-Gobain) para rascacielos, hospitales, institutos educativos y viviendas sustentables, donde la iluminación natural, el aislamiento y el rendimiento de seguridad son fundamentales.

- La construcción de centros de transporte, edificios de oficinas inteligentes, hospitales ecológicos y complejos comerciales requieren vidrio especializado (como variantes con aislamiento, resistentes al fuego y a prueba de sonido) que respalde el crecimiento continuo del mercado y la innovación.

- La creciente necesidad de materiales estéticamente agradables, livianos y que ahorren energía posiciona al vidrio como una opción preferida para desarrolladores y arquitectos que responden a estándares de vida más altos y regulaciones de eficiencia más estrictas.

- La renovación y modernización de la infraestructura existente, junto con eventos internacionales (exposiciones, deportes) e inversión pública, impulsan la demanda de vidrio tanto para entornos construidos nuevos como renovados.

Restricción/Desafío

Competencia de materiales alternativos

- La creciente disponibilidad y penetración en el mercado de plásticos, compuestos y policarbonatos de alta resistencia desafían a la industria del vidrio, ofreciendo menor peso, mejor resistencia al impacto y, a veces, un mejor rendimiento de costos en aplicaciones como la automotriz, la electrónica, el embalaje y la construcción.

- Por ejemplo, los fabricantes de bienes de consumo y los fabricantes de automóviles utilizan cada vez más PET y bioplásticos en botellas y piezas de automóviles, y polímeros avanzados para ventanas livianas, lo que impacta la demanda de vidrio en estos segmentos.

- La transparencia y la resistencia que ofrecen los acrílicos, los polímeros de ingeniería y las cerámicas transparentes atraen a los sectores de la electrónica, los dispositivos médicos y las especialidades que buscan opciones más allá del vidrio tradicional.

- Un menor costo de innovación, un moldeo más sencillo y un peso más ligero mantienen la presión competitiva, especialmente donde la infraestructura de reciclaje del vidrio está por detrás de la de los plásticos y los compuestos.

- El desafío se ve agravado por el aumento de los costos de las materias primas y la necesidad de una importante I+D para mejorar aún más la reciclabilidad del vidrio, las funcionalidades inteligentes y la producción rentable para mantener su participación en los mercados en evolución de alta tecnología e impulsados por el consumidor.

Alcance del mercado del vidrio

El mercado está segmentado según tipo, producto, función, grosor y aplicación.

- Por tipo

Según el tipo, el mercado del vidrio se segmenta en vidrio flotado, vidrio arquitectónico, vidrio fundido, vidrio soplado, vidrio transparente, vidrio tintado, vidrio estampado o texturizado, vidrio armado, vidrio extraclaro, vidrio especial, vidrio de seguridad, vidrio para envases, entre otros. El segmento del vidrio flotado dominó la cuota de mercado en 2024 gracias a su espesor uniforme, transparencia y rentable proceso de producción en masa. Sirve como material base para numerosas aplicaciones posteriores, como vidrio revestido, vidrio laminado y unidades de vidrio aislante. La industria de la construcción depende en gran medida del vidrio flotado para ventanas, fachadas y mamparas. Su amplia disponibilidad y adaptabilidad a tratamientos adicionales como el templado y el esmerilado amplían aún más su uso. El segmento también se beneficia de las continuas innovaciones en la automatización de las líneas de producción de vidrio flotado y las mejoras en la sostenibilidad.

Se prevé que el segmento del vidrio de seguridad registre el mayor crecimiento entre 2025 y 2032, impulsado por la creciente demanda de materiales resistentes a impactos e intrusiones en infraestructuras comerciales y públicas. Esta categoría incluye el vidrio laminado y templado, que ofrece protección multicapa contra allanamientos, incendios y balística. La creciente preocupación por el vandalismo, el robo y el terrorismo ha hecho que este tipo de vidrio sea esencial para bancos, aeropuertos, embajadas y comercios minoristas. Su creciente incorporación en vehículos de lujo y hogares inteligentes también impulsa la demanda. Los avances en la tecnología de intercapas de vidrio están mejorando la transparencia, manteniendo al mismo tiempo altos estándares de seguridad.

- Por producto

Según el producto, el mercado se segmenta en vidrio con y sin recubrimiento. El segmento de vidrio con recubrimiento representó la mayor participación en los ingresos, con un 57,9 %, en 2024, impulsado principalmente por las crecientes exigencias de eficiencia energética en edificios y vehículos. Los recubrimientos de baja emisividad (Low-E), los recubrimientos reflectantes y las películas de control solar ayudan a gestionar la transferencia de calor y a reducir el deslumbramiento, lo que disminuye el consumo de energía. El vidrio con recubrimiento se utiliza ampliamente en acristalamiento arquitectónico, muros cortina y ventanas de automóviles, contribuyendo al aislamiento térmico y al confort de los ocupantes. A medida que las certificaciones de sostenibilidad como LEED y BREEAM cobran mayor relevancia, se prevé un aumento de la demanda de vidrio con recubrimiento. El producto también está ganando terreno en aplicaciones de interior donde la estética y el rendimiento se combinan.

El segmento del vidrio sin recubrimiento, aunque más tradicional, mantiene una cuota de mercado significativa debido a su papel esencial en acristalamientos interiores, espejos, tableros de mesa y muebles. Se prefiere en aplicaciones que priorizan la rentabilidad y la transparencia básica sin necesidad de propiedades de ahorro energético o filtrado de luz. El vidrio sin recubrimiento también sirve como base para procesos posteriores, como el templado, el grabado ácido o la serigrafía, ofreciendo flexibilidad de diseño. Su relevancia en sectores como el diseño de interiores, la señalización y la construcción a pequeña escala sigue siendo sólida, especialmente en los mercados emergentes sensibles a los costes.

- Por función

Según su función, el mercado del vidrio se segmenta en vidrio con filtro UV, vidrio con aislamiento térmico, vidrio de seguridad, vidrio insonorizado, vidrio autolimpiable, vidrio de intercambio iónico, entre otros. El segmento de vidrio de seguridad lideró el mercado en 2024, impulsado por el aumento de las regulaciones de seguridad en los sectores de la construcción y el transporte. Este segmento incluye vidrio templado y laminado, diseñados para prevenir la rotura y reducir el riesgo de lesiones por impacto o rotura. Gobiernos y organizaciones de seguridad de todo el mundo han hecho obligatorio el uso de vidrio de seguridad en escuelas, hospitales, ascensores y parabrisas de automóviles. Su durabilidad, resistencia térmica y mayor capacidad de carga también propician un uso más amplio en la construcción de edificios de gran altura y en infraestructuras.

Se proyecta que el segmento de vidrio autolimpiable crecerá a su ritmo máximo hasta 2032, impulsado por la urbanización y la adopción de materiales de bajo mantenimiento en espacios comerciales y residenciales. Este tipo de vidrio cuenta con un recubrimiento hidrófilo o fotocatalítico que descompone la suciedad orgánica y permite que el agua de lluvia la enjuague. Es muy apreciado en edificios de gran altura, tragaluces, paneles solares e invernaderos, donde la limpieza manual requiere mucha mano de obra o es peligrosa. Su combinación de funcionalidad, higiene y ahorro de costos a largo plazo resulta atractiva tanto para arquitectos como para administradores de instalaciones y defensores de la sostenibilidad. La creciente concienciación sobre la higiene ambiental también está impulsando su popularidad en entornos sanitarios y hoteleros.

- Por grosor

Según el espesor, el mercado se segmenta en 2 mm, 3 mm, 4 mm, 5 mm, 6 mm, 8 mm, 10 mm, 12 mm y más de 12 mm. El segmento de 6 mm generó los mayores ingresos en 2024 gracias a su óptimo equilibrio entre resistencia, transparencia y asequibilidad, lo que lo hace ideal para usos arquitectónicos comunes. Se utiliza comúnmente en acristalamientos residenciales y comerciales, puertas de vidrio, paneles de exhibición y mamparas interiores. Este segmento se ve reforzado por su amplia disponibilidad y compatibilidad con tratamientos de seguridad y térmicos como el templado, la laminación y el doble acristalamiento. Los fabricantes prefieren este espesor por su estandarización, facilidad de transporte y menor desperdicio de material durante el procesamiento.

Se prevé que el segmento de más de 12 mm sea el de mayor crecimiento, impulsado por la creciente demanda de vidrio estructuralmente resistente para aplicaciones arquitectónicas y de carga. Estas incluyen pisos de vidrio, escalones de escaleras, barandillas estructurales, paredes de acuarios e instalaciones de alta seguridad. Con el auge de los elementos arquitectónicos transparentes y los diseños sin marco, se está adoptando vidrio de mayor espesor para garantizar la seguridad sin comprometer la estética. Los avances tecnológicos permiten que las láminas más gruesas mantengan la claridad óptica a la vez que resisten presiones extremas y la exposición ambiental. El creciente énfasis en la arquitectura moderna de espacios abiertos seguirá impulsando la demanda de soluciones de vidrio ultraespesor.

- Por aplicación

Según su aplicación, el mercado se segmenta en edificación y construcción, automoción, aeroespacial, electrodomésticos, energía solar, embalaje, mobiliario, entre otros. Este segmento lideró el mercado en 2024, impulsado por el auge de la urbanización, el desarrollo de infraestructuras y la demanda de materiales energéticamente eficientes. El vidrio desempeña un papel fundamental para mejorar la penetración de la luz natural, el aislamiento térmico y la estética de los edificios. Desde fachadas y marquesinas hasta mamparas y barandillas, el vidrio es fundamental para los edificios ecológicos y las infraestructuras inteligentes. Las exigencias gubernamentales de construcción sostenible, especialmente en Europa y Asia, también están acelerando el crecimiento del segmento. Los vidrios decorativos y especiales están ganando terreno en el diseño de interiores, lo que añade un nuevo impulso.

Se prevé que el segmento de la energía solar experimente el mayor crecimiento entre 2025 y 2032, impulsado por las inversiones globales en energías renovables y la disminución de los costos de los paneles solares. El vidrio es esencial en los módulos solares, especialmente en las cubiertas frontales, las láminas traseras y los concentradores, donde debe ofrecer alta transmitancia de luz, durabilidad y bajo contenido de hierro. A medida que la capacidad de energía solar se expande tanto en países desarrollados como en desarrollo, aumenta la demanda de vidrio solar de alto rendimiento. Los avances tecnológicos en recubrimientos antirreflectantes y autolimpiables también están mejorando la eficiencia y la confiabilidad de las instalaciones solares. Los subsidios gubernamentales favorables y las políticas de medición neta impulsan aún más la aceleración del mercado en este segmento.

Análisis regional del mercado del vidrio

- Arabia Saudita dominó el mercado del vidrio con la mayor participación en los ingresos en 2024, impulsada por un rápido crecimiento en proyectos de construcción e infraestructura alineados con la Visión 2030, que enfatiza la arquitectura moderna y el desarrollo urbano inteligente.

- La demanda es particularmente fuerte para el vidrio flotado, el vidrio revestido y el acristalamiento de seguridad utilizados en edificios de gran altura, complejos comerciales y megaproyectos liderados por el gobierno como NEOM y el Proyecto del Mar Rojo.

- El mercado también está respaldado por la expansión de la fabricación nacional, las crecientes inversiones en materiales de construcción energéticamente eficientes y el apoyo regulatorio para prácticas de construcción sustentables que utilizan soluciones de vidrio avanzadas.

Perspectivas del mercado del vidrio de Omán

Se proyecta que el mercado del vidrio en Omán crecerá de forma sostenida hasta 2032, impulsado por un aumento en los proyectos de construcción residencial y turística en Mascate, Duqm y Salalah. La diversificación de infraestructuras impulsada por el gobierno en el marco de la Visión 2040, junto con la mayor demanda de vidrio arquitectónico transparente y tintado en los sectores de la hostelería y el comercio minorista, está impulsando el consumo de vidrio en el país. La dependencia de las importaciones y la prioridad en el vidrio de alto rendimiento están configurando aún más las tendencias del mercado.

Perspectivas del mercado del vidrio en los EAU

Se prevé que los Emiratos Árabes Unidos crezcan a la tasa de crecimiento anual compuesta (TCAC) más alta durante el período de pronóstico de 2025 a 2032, impulsado por un auge en desarrollos inmobiliarios, proyectos hoteleros de lujo e iniciativas de ciudades inteligentes como el Plan Maestro Urbano Dubái 2040. La fuerte demanda de vidrios de alto rendimiento, como los de control solar, filtro UV y doble acristalamiento, se ve reforzada por las regulaciones de construcción ecológica y el objetivo del país de cero emisiones netas. Las importantes inversiones en arquitectura sostenible e ingeniería avanzada de fachadas están impulsando el mercado.

Cuota de mercado del vidrio

La industria del vidrio está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Şişecam (Turquía)

- Guardian Industries Holdings (EE. UU.)

- IKKGlass (Arabia Saudita)

- AGC Inc. (Japón)

- Inversiones en Dubái (EAU)

- Alma (Arabia Saudita)

- Compañía Árabe de Procesamiento de Vidrio (Arabia Saudita)

- Glas Trösch Holding AG (Suiza)

- Compañía de vidrio Obeikan (Arabia Saudita)

- QGI – Fábrica de juntas alemanas de Qatar (Catar)

- REGIONGLASS (Rusia)

- Saint-Gobain (Francia)

- Zoujaj – Compañía Nacional de Industrias del Vidrio (Arabia Saudita)

Últimos avances en el mercado del vidrio en Oriente Medio

- En octubre de 2023, durante el primer semestre del año, Şişecam firmó una carta de intención para invertir en ICRON, una empresa turca que ofrece servicios de optimización de decisiones operativas y estratégicas. Şişecam ahora profundiza en este enfoque. Şişecam e ICRON tienen un acuerdo de colaboración. Como parte del acuerdo, la participación inicial de Şişecam en ICRON será del 15,7 %, con una tasa de asociación final del 33,1 % mediante inversiones progresivas. Con este acuerdo, Şişecam espera expandirse con ICRON y llevar su excelencia operativa y enfoque de optimización al siguiente nivel, lo que marca su primera inversión en el sector de la innovación de software.

- En septiembre de 2023, Şişecam acelerará las inversiones para impulsar su crecimiento. En respuesta a la creciente competitividad mundial y la creciente demanda de vidrio automotriz, Sisecam inauguró una nueva línea de vidrio automotriz con un valor aproximado de 4000 millones de liras turcas (190 millones de dólares estadounidenses) y una inversión de capital adicional en su planta de fabricación de Lüleburgaz. La nueva línea tendrá una capacidad anual de 200 000 toneladas y creará 114 puestos de trabajo adicionales. Se dedicará exclusivamente al vidrio arquitectónico, lo que aumentará la capacidad y la eficiencia.

- En agosto de 2023, SABIC, Home of Innovation, apoyó la obtención de la certificación LEED Platino, un vidrio de control solar para edificios residenciales en Oriente Medio. En esta construcción, todas las ventanas y algunas puertas están acristaladas con Guardian SunGuard SuperNeutral 30T, un vidrio de control solar con doble capa de plata que transmite selectivamente la luz natural, a la vez que limita la ganancia de calor solar y la necesidad de aire acondicionado de alto consumo energético. Esto ayuda a la empresa a obtener un mayor reconocimiento por sus esfuerzos medioambientales.

- En febrero de 2023, AGC Inc. y Saint-Gobain, dos de los principales productores de vidrio plano del mundo en términos de sostenibilidad, anunciaron una colaboración para el diseño de un prototipo de línea de vidrio plano innovadora que se prevé que reduzca considerablemente las emisiones directas de CO2.

- En septiembre de 2022, Guardian Glass presentó Guardian Clarity Neutral, un revolucionario vidrio con revestimiento antirreflejo que ofrece la máxima transparencia de cualquier producto Guardian Glass hasta la fecha, permitiendo vistas más realistas y naturales a través del vidrio. Guardian Clarity Neutral reduce los reflejos y el deslumbramiento en aplicaciones especiales como escaparates, exhibiciones en museos, marcos de fotos y puertas de refrigeradores comerciales, haciendo que el vidrio sea casi invisible y permitiendo vistas más claras, ininterrumpidas y naturales a través del mismo. Esto ayuda a la organización a mejorar su productividad e ingresos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.