Middle East And Africa Wheat Gluten Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

73.71 Million

USD

108.14 Million

2021

2029

USD

73.71 Million

USD

108.14 Million

2021

2029

| 2022 –2029 | |

| USD 73.71 Million | |

| USD 108.14 Million | |

|

|

|

|

Mercado de gluten de trigo de Oriente Medio y África, por categoría (orgánico e inorgánico), función (emulsionante, solidificador, aglutinante y otros), forma (líquida y seca), aplicación ( alimentos y bebidaspiensos y otros), embalaje (botella/tarro, bolsas y bolsas, cajas y otros), canal de distribución (minoristas en tiendas y minoristas fuera de tiendas), usuario final (hogar/minorista y comercial): tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado del gluten de trigo en Oriente Medio y África

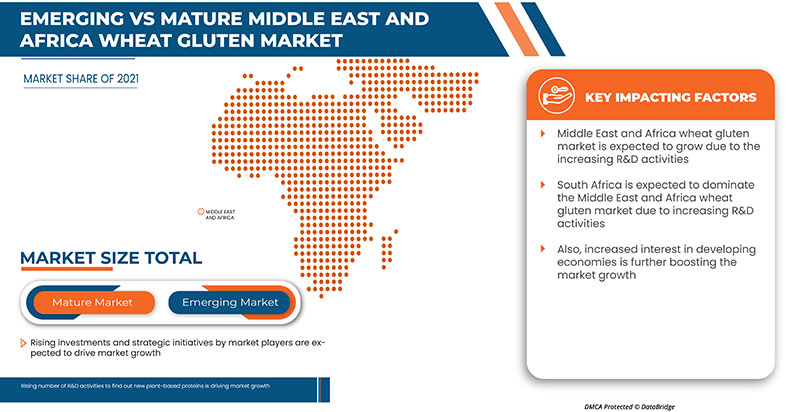

El mercado de gluten de trigo de Oriente Medio y África está creciendo en el año de pronóstico debido al aumento de los actores del mercado y la disponibilidad de varias alternativas de carne de origen vegetal en el mercado. Junto con esto, el número de actividades de I+D para descubrir nuevas proteínas de origen vegetal ha aumentado en el mercado, lo que está impulsando aún más el crecimiento del mercado. Sin embargo, el aumento de los casos de trastornos hereditarios y crónicos debido a la intolerancia al gluten podría obstaculizar el crecimiento del mercado en el período de pronóstico.

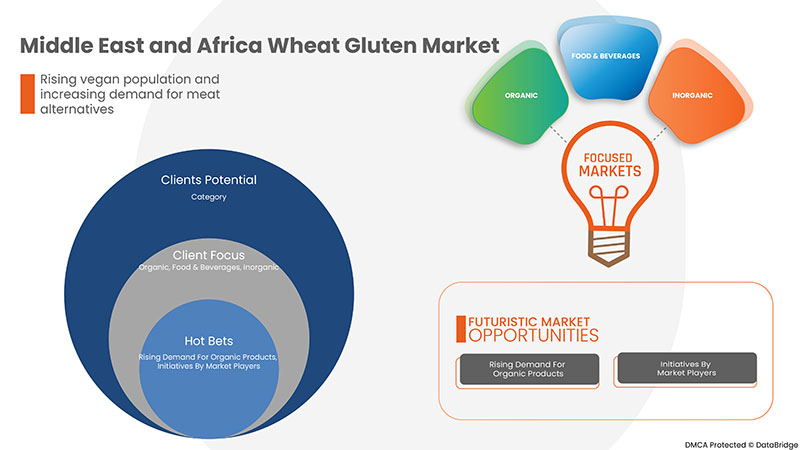

La creciente conciencia sobre los beneficios de las proteínas de origen vegetal, la creciente demanda de productos orgánicos y las iniciativas de los actores del mercado están brindando oportunidades al mercado. Sin embargo, el aumento del costo de producción y fabricación, la sensibilidad al gluten y las reacciones autoinmunes en las personas son los principales desafíos para el crecimiento del mercado.

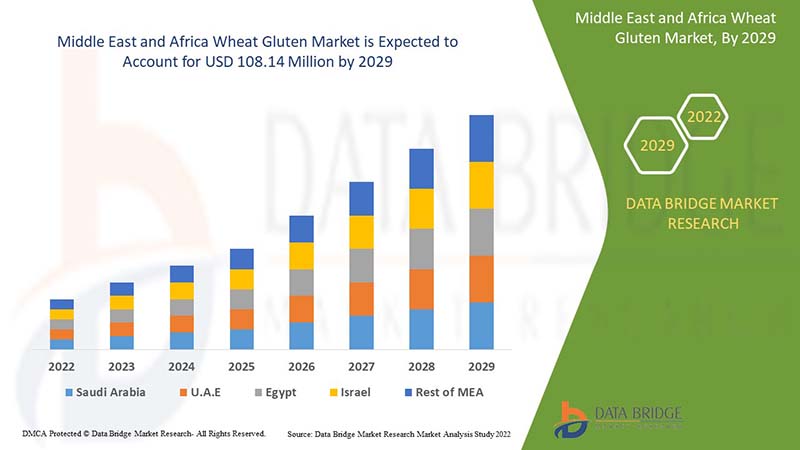

Se espera que el mercado de gluten de trigo de Oriente Medio y África gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 5,1% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 108,14 millones para 2029 desde USD 73,71 millones en 2021.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Año histórico |

2020 (Personalizable para 2014-2019) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por categoría (orgánico e inorgánico), función (emulsionante, solidificador, aglutinante y otros), forma (líquido y seco), aplicación (alimentos y bebidas, piensos para animales y otros), embalaje (botellas/tarros, bolsas, cajas y otros), canal de distribución (minoristas con sede en tiendas y minoristas sin sede en tiendas), usuario final (hogar/minorista y comercial) |

|

Países cubiertos |

Sudáfrica, Omán, Qatar, Arabia Saudita, Emiratos Árabes Unidos, Kuwait y resto de Oriente Medio y África. |

|

Actores del mercado cubiertos |

Cargill, Incorporated, ADM, Crespel & Deiters Group, Glico Nutrition Co., Ltd., Sedamyl, Manildra Group, MGP, Roquette Frères, CropEnergies AG, Anhui Ante Food Co., Ltd., ARDENT MILLS, Bryan W Nash and Sons, Pioneer Industries Private Limited, Henan Tianguan Group Co. Ltd, Permolex, Meelunie BV, Mühlenchemie GmbH & Co. KG, Royal Ingredients Group, Kröner Stärke y z&f sungold corporation, entre otros. |

Definición de mercado

El gluten de trigo también se conoce como seitán, carne de trigo, carne de gluten o gluten. El gluten de trigo es una proteína que se encuentra de forma natural en el trigo o la harina de trigo. Se elabora lavando la masa de harina de trigo en agua hasta que se eliminan todos los gránulos de almidón. El polvo de gluten de trigo se elabora hidratando la harina de trigo dura para activar el gluten. Después de eso, la masa hidratada se procesa para eliminar el almidón y dejar atrás el gluten. Finalmente, el gluten se seca y se muele hasta convertirlo en polvo. Algunas variedades de gluten tienen una textura fibrosa o masticable similar a la de la carne.

Dinámica del mercado del gluten de trigo en Oriente Medio y África

Conductores

- Aumento de la población vegana y creciente demanda de alternativas a la carne

El gluten es una proteína que se encuentra de forma natural en algunos cereales como el trigo, la cebada y el centeno. El gluten de trigo está formado por fracciones proteicas de gliadinas y gluteninas. Las gliadinas contienen una única cadena polipeptídica asociada a enlaces de hidrógeno, enlaces hidrofóbicos e interacciones disulfuro intramoleculares, mientras que las gluteninas contienen interacciones disulfuro intermoleculares. El gluten de trigo y el almidón de trigo son coproductos económicamente importantes que se producen durante el procesamiento húmedo de la harina de trigo. El gluten de trigo es un ingrediente alimentario básico y sus aplicaciones se dan predominantemente en productos horneados y productos cárnicos procesados. Tiene propiedades únicas, como que, cuando se hidrata y se mezcla, forma una estructura muy extensible y elástica que es responsable de la capacidad de retención de gas de la masa de pan. Se puede utilizar en combinación con harina de trigo y otros aditivos para producir un producto texturizado sin soja.

La población vegana está aumentando en todo el mundo y también lo está haciendo la demanda de alternativas a la carne. Las personas son más conscientes de los beneficios para la salud de las proteínas de origen vegetal y están adoptando estilos de vida veganos en los que el gluten de trigo puede actuar como una alternativa a la carne.

- Creciente preferencia de los consumidores por dietas ricas en proteínas

La mayoría de los consumidores prefieren dietas ricas en proteínas por varias razones. Algunas de ellas son: la proteína es el componente básico del cuerpo humano y de los músculos; es vital para las actividades del cuerpo y del cerebro; es importante para una vida sana y activa. El gluten es uno de los alimentos ricos en proteínas que se pueden extraer del trigo. El gluten tiene un alto contenido de proteínas junto con vitaminas y minerales como antioxidantes, fibra, vitamina B, vitamina E , magnesio, hierro, ácido fólico y otros.

Además, en los últimos años, las dietas y productos ricos en proteínas han tenido un impacto real en la nutrición y han cambiado la actitud de los consumidores con respecto a la ingesta de proteínas, ya que una nutrición adecuada es un aspecto importante de un estilo de vida saludable para todas las personas. Varios estudios han demostrado los beneficios para la salud de las proteínas de origen vegetal y la conciencia pública ha aumentado en mayor medida. Como resultado, los consumidores prefieren dietas ricas en proteínas.

- Aumenta el número de actividades de I+D para descubrir nuevas proteínas de origen vegetal

La demanda de dietas ricas en proteínas está aumentando entre las personas y, por lo tanto, ha aumentado la cantidad de investigaciones para descubrir las proteínas. Como las proteínas de origen animal son las que causan la mayoría de los riesgos para la salud, las personas están adoptando gradualmente estilos de vida veganos en todo el mundo. Las proteínas de origen vegetal son ricas en vitaminas y minerales y tienen grandes beneficios para la salud según estudios recientes. El gluten de trigo es una de las proteínas vegetales que la mayoría de las personas en todo el mundo utilizan como alternativa a la carne y como dieta rica en proteínas.

La mayor parte de la población humana prefiere dietas ricas en proteínas de origen vegetal debido a los diversos beneficios para la salud y para superar las enfermedades provocadas por la ingesta de dietas proteínicas de origen animal. Por ello, cada vez se realizan más investigaciones para descubrir nuevas proteínas de origen vegetal de diversas formas que satisfagan la demanda.

Oportunidades

-

Creciente conciencia sobre los beneficios de las proteínas de origen vegetal

En el mercado hay varios productos proteicos de origen vegetal debido a los cambios en las preferencias gustativas de los consumidores. Uno de ellos es el gluten de trigo y sus productos, que tienen una gran demanda. El mercado de proteínas de origen vegetal, como el gluten de trigo, tiene una fuerte demanda y crecimiento en panaderías, bebidas funcionales y otros alimentos. Las proteínas de origen vegetal están fácilmente disponibles debido a su amplio uso en varias industrias. El gluten de trigo se utiliza en varios productos, como productos de alimentación animal, que ayudan a minimizar la dependencia de los agricultores de las fuentes tradicionales de proteínas. El gluten de trigo y los productos proteicos de origen vegetal incluyen varios nutrientes y están enriquecidos con proteínas y sabores. La creciente conciencia sobre los estilos de vida saludables y el control de la pérdida de peso, junto con la demanda de barras de proteínas de origen vegetal entre los consumidores.

Como resultado, la necesidad de gluten de trigo en diversos productos actuará como una oportunidad para el crecimiento del mercado. Mientras tanto, el gluten de trigo se utiliza en productos carbonatados para realzar los sabores añadidos.

-

Creciente demanda de productos orgánicos

La demanda de productos orgánicos está aumentando a gran velocidad. Los ingredientes alimentarios orgánicos, como las proteínas de origen vegetal, son una alternativa proteica perfecta a la carne u otros productos no vegetarianos que los consumidores pueden consumir a diario. Todos los aminoácidos esenciales y el alto contenido de fibra presentes en los productos orgánicos los convierten en un sustituto ideal de las proteínas animales.

La demanda de ingredientes orgánicos en el gluten de trigo y sus productos se debe a planes de dieta nutricionales, ya que tienen diversos beneficios para la salud, como bajo riesgo de diabetes, fácil digestión, salud cardiovascular y otros. La creciente conciencia entre los consumidores sobre los beneficios para la salud que ofrecen los ingredientes orgánicos, como las proteínas de origen vegetal, aumentó la demanda de productos alimenticios y bebidas.

Restricciones/Desafíos

- Aumento del coste de producción y fabricación

El gluten de trigo ha abierto puertas para mejorar y apoyar la salud, lo que desempeña un papel fundamental en la industria de alimentos y bebidas. Pero, por otro lado, ha conllevado importantes costos involucrados en su producción y fabricación.

En algunos países del mundo, el gluten de trigo se considera una solución al problema de mantener un estilo de vida saludable. Sin embargo, su fabricación y producción se enfrentan a una multitud de desafíos, como la mano de obra intensiva, la cantidad cada vez mayor de materias primas y la necesidad de una producción más rápida debido al aumento de la demanda. Estas demandas deben satisfacerse de manera eficaz y eficiente. El gluten de trigo implica una gran inversión de capital para mantener la I+D. La nueva maquinaria y el equipo incluyen una gran cantidad de pruebas para probar el funcionamiento, lo que genera altas inversiones de capital para las pequeñas y medianas empresas.

- Aumentan los casos de trastornos hereditarios y crónicos debidos a la intolerancia al gluten

El gluten es un tipo de proteína extraída del trigo y otros cereales. Hay muchos casos en los que se ha encontrado intolerancia al gluten. Existen varias causas potenciales de intolerancia al gluten, incluida la enfermedad celíaca, la sensibilidad al gluten no celíaca y la alergia al trigo. Las tres formas de intolerancia al gluten pueden causar síntomas generalizados. La enfermedad celíaca es la forma más grave de intolerancia al gluten. Es una enfermedad autoinmune que afecta a aproximadamente el 1% de la población y puede provocar daños en el sistema digestivo. Puede causar una amplia gama de síntomas, incluidos problemas de piel, problemas gastrointestinales, cambios de humor y más. Los síntomas comunes asociados con la enfermedad no celíaca son hinchazón, dolor de cabeza, dolor de estómago, fatiga, diarrea y estreñimiento, entre otros. Del mismo modo, los síntomas asociados con la alergia al trigo son sarpullido en la piel, problemas digestivos, congestión nasal y anafilaxia, entre otros.

Debido al impacto de la intolerancia al gluten, se están produciendo varios trastornos, entre ellos la enfermedad celíaca, la no celíaca y las alergias al trigo, que en algunos casos son crónicas y hereditarias.

Impacto de la COVID-19 en el mercado del gluten de trigo en Oriente Medio y África

La COVID-19 ha afectado negativamente al mercado de gluten de trigo de Oriente Medio y África. Los confinamientos y el aislamiento durante la pandemia provocaron el cierre de la mayoría de las tiendas y el suministro de dietas proteicas de origen vegetal se vio afectado en mayor medida. Las compras en línea de alternativas a la carne de origen vegetal habían aumentado. Por tanto, la COVID-19 afectó negativamente al mercado.

Desarrollo reciente

- En enero de 2022, ADM anunció la apertura de su primer Centro de Ciencia y Tecnología en China para establecer su desarrollo de alta calidad en la industria de la nutrición y la salud. Esto ha ayudado a la empresa a brindar mejores servicios a los consumidores a través de dichas innovaciones en la organización.

Panorama del mercado del gluten de trigo en Oriente Medio y África

El mercado de gluten de trigo de Oriente Medio y África está segmentado en siete segmentos notables según la categoría, la función, la forma, la aplicación, el envasado, el canal de distribución y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y proporcionará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas a fin de identificar las principales aplicaciones del mercado.

Por categoría

- Orgánico

- Inorgánico

Según la categoría, el mercado se segmenta en orgánico e inorgánico.

Por función

- Emulsionante

- Solidificador

- Aglutinante

- Otros

Según la función, el mercado está segmentado en emulsionante, solidificador, aglutinante y otros.

Por formulario

- Líquido

- Seco

Según la forma, el mercado se segmenta en líquido y seco.

Por aplicación

- Alimentos y bebidas

- Alimento para animales

- Otros

Según la aplicación, el mercado está segmentado en alimentos y bebidas, alimentos para animales y otros.

Por embalaje

- Botella/tarro

- Bolsas y bolsos

- Cajas

- Otros

En función del embalaje, el mercado está segmentado en botellas/tarros, bolsas y bolsas, cajas y otros.

Por canal de distribución

- Minoristas con sede en tiendas

- Minoristas que no tienen establecimientos físicos

Según el canal de distribución, el mercado está segmentado en minoristas con tiendas físicas y minoristas sin tiendas físicas.

Por el usuario final

- Hogar/venta al por menor

- Comercial

Según el usuario final, el mercado se segmenta en hogares/minoristas y comerciales.

Análisis y perspectivas regionales del mercado del gluten de trigo en Oriente Medio y África

Se analiza el mercado de gluten de trigo de Oriente Medio y África y se proporcionan información y tendencias del tamaño del mercado por país, categoría, función, forma, aplicación, embalaje, canal de distribución y usuario final.

El mercado de gluten de trigo de Oriente Medio y África comprende los países de Sudáfrica, Omán, Qatar, Arabia Saudita, Emiratos Árabes Unidos, Kuwait y el resto de Oriente Medio y África. Sudáfrica domina el mercado de gluten de trigo de Oriente Medio y África en términos de participación de mercado e ingresos de mercado y seguirá aumentando su dominio durante el período de pronóstico.

La creciente conciencia sobre los beneficios de las proteínas de origen vegetal está impulsando aún más el crecimiento del mercado. Además, la creciente demanda de productos orgánicos y las iniciativas de los actores del mercado también están impulsando el crecimiento del mercado.

Panorama competitivo y análisis de la cuota de mercado del gluten de trigo en Oriente Medio y África

El panorama competitivo del mercado de gluten de trigo en Oriente Medio y África proporciona detalles por competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en I+D, las nuevas iniciativas de mercado, la presencia en Oriente Medio y África, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado.

Algunos de los principales actores que operan en el mercado de gluten de trigo de Oriente Medio y África son Cargill, Incorporated, ADM, Crespel & Deiters Group, Glico Nutrition Co., Ltd., Sedamyl, Manildra Group, MGP, Roquette Frères, CropEnergies AG, Anhui Ante Food Co., Ltd., ARDENT MILLS, Bryan W Nash and Sons, Pioneer Industries Private Limited, Henan Tianguan Group Co. Ltd, Permolex, Meelunie BV, Mühlenchemie GmbH & Co. KG, Royal Ingredients Group, Kröner Stärke y z&f sungold corporation, entre otros.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con tamaños de muestra grandes. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen la cuadrícula de posicionamiento de proveedores, el análisis de la línea de tiempo del mercado, la descripción general y la guía del mercado, la cuadrícula de posicionamiento de la empresa, el análisis de la participación de mercado de la empresa, los estándares de medición, Oriente Medio y África frente a la región y el análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar a nuestros clientes existentes y nuevos datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores como necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 CATEGORY LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PATENT ANALYSIS OF MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET

4.2 CONSUMER BUYING BEHAVIOR

4.3 BRAND ANALYSIS

4.4 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET SUPPLY CHAIN ANALYSIS

4.4.1 RAW MATERIAL PROCUREMENT

4.4.2 MANUFACTURING

4.4.3 TRANSPORTATION OR LOGISTICS

4.4.4 MARKETING AND DISTRIBUTION

4.4.5 END-USER

4.5 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET UPCOMING TECHNOLOGIES AND TRENDS

4.5.1 CRISPR/CAS9 GENE EDITING OF GLUTEN IN WHEAT

4.5.2 RNA INTERFERENCE IN WHEAT GLUTEN

4.5.3 COLD ETHANOL TECHNOLOGY

5 REGULATORY FRAMEWORK

5.1 FDA

5.1.1 REGULATIONS ON ALLERGEN LABELING

5.2 EUROPEAN UNION (EU)

5.3 REGULATIONS IN INDIA

5.3.1 FSSAI PROPOSES STANDARDS RELATING TO GLUTEN AND NON-GLUTEN FOODS

5.4 REGULATIONS IN CHINA

5.5 REGULATIONS IN THE U.S.

5.6 REGULATIONS IN CANADA

5.7 REGULATIONS IN THAILAND

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING VEGAN POPULATION AND INCREASING DEMAND FOR MEAT-ALTERNATIVES

6.1.2 RISING PREFERENCE OF CONSUMERS TOWARDS HIGH PROTEIN-RICH DIETS

6.1.3 RISING NUMBER OF RESEARCH AND DEVELOPMENT ACTIVITIES TO FIND OUT NEW PLANT-BASED PROTEINS

6.2 RESTRAINTS

6.2.1 RISING CASES OF HEREDITARY AND CHRONIC DISORDERS DUE TO GLUTEN INTOLERANCE

6.2.2 HIGHER COST OF PLANT-BASED PROTEINS

6.3 OPPORTUNITIES

6.3.1 GROWING AWARENESS REGARDING THE BENEFITS OF PLANT-BASED PROTEINS

6.3.2 RISING DEMAND FOR ORGANIC PRODUCTS

6.3.3 INITIATIVES BY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 INCREASED COST OF PRODUCTION AND MANUFACTURING

6.4.2 RISING PREVALENCE OF DISEASES

6.4.3 GLUTEN SENSITIVITY AND AUTOIMMUNE REACTIONS IN PEOPLE

7 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY CATEGORY

7.1 OVERVIEW

7.2 ORGANIC

7.3 INORGANIC

8 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY FUNCTION

8.1 OVERVIEW

8.2 BINDER

8.3 EMULSIFIER

8.4 SOLIDIFIER

8.5 OTHERS

9 MIDDLE EAST & AFRICA WHEAT GLUTEN, BY FORM

9.1 OVERVIEW

9.2 DRY

9.3 LIQUID

10 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FOOD & BEVERAGES

10.2.1 BAKERY & CONFECTIONARY PRODUCTS

10.2.1.1 CAKES, MUFFINS & DOUGHNUTS

10.2.1.2 BREADS

10.2.1.3 COOKIES, CRACKERS

10.2.1.4 PIE CRUSTS & PIZZA DOUGH

10.2.1.5 BATTER

10.2.1.6 OTHERS

10.2.2 CONVENIENCE FOOD

10.2.2.1 NOODLES AND PASTA

10.2.2.2 SOUPS & SAUCES

10.2.2.3 SEASONING & DRESSING

10.2.2.4 SNACKS & EXTRUDED SNACKS

10.2.2.5 READY TO EAT MEALS

10.2.2.6 OTHERS

10.2.3 MEAT ANALOGUES

10.2.4 SPORTS NUTRITION

10.2.5 BREAKFAST CEREALS

10.2.6 MEAT & POULTRY PRODUCTS

10.2.7 NUTRITIONAL BARS

10.2.8 BEVERAGES

10.2.9 OTHERS

10.3 ANIMAL FEED

10.3.1 PET FOOD

10.3.2 RUMINANT

10.3.3 SWINE

10.3.4 POULTRY

10.3.5 OTHERS

10.4 OTHERS

11 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY PACKAGING

11.1 OVERVIEW

11.2 POUCH & BAGS

11.3 BOXES

11.4 BOTTLE/JAR

11.4.1 PLASTIC

11.4.2 GLASS

11.4.3 METAL

11.4.4 PAPER

11.5 OTHERS

12 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 STORE BASED RETAILERS

12.2.1 HYPERMARKETS/SUPER MARKETS

12.2.2 CONVENIENCE STORES

12.2.3 GROCERY STORES

12.2.4 SPECIALITY STORES

12.2.5 OTHERS

12.3 NON-STORE BASED RETAILERS

13 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY END USER

13.1 OVERVIEW

13.2 COMMERCIAL

13.2.1 BAKERY STORES

13.2.2 RESTAURANTS AND CAFES

13.2.3 HOTELS

13.2.4 CLOUD KITCHEN

13.2.5 OTHERS

13.3 HOUSEHOLD/RETAIL

14 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SOUTH AFRICA

14.1.2 U.A.E

14.1.3 SAUDI ARABIA

14.1.4 OMAN

14.1.5 QATAR

14.1.6 KUWAIT

14.1.7 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 CARGILL, INCORPORATED

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 ADM

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 CRESPEL & DEITERS GROUP

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 GLICO NUTRITION CO., LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 SEDAMYL

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENT

17.6 ANHUI ANTE FOOD CO.,LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 ARDENT MILLS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 BRYAN W NASH AND SONS

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 CROPENERGIES AG

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 HENAN TIANGUAN GROUP CO., LTD.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 KRÖNER-STÄRKE GMBH

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 MANILDRA GROUP

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 MEELUNIE B.V.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 MGP

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT

17.15 MUHLENCHEMIE GMBH & CO. KG

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 PERMOLEX

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 PIONEER INDUSTRIES PRIVATE LIMITED

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 ROQUETTE FRÈRES

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 ROYAL INGREDIENTS GROUP

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 Z&F SUNGOLD CORPORATION

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA ORGANIC IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA INORGANIC IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA BINDER IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA EMULSIFIER IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA SOLIDIFIER IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA OTHERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA DRY IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA LIQUID IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, APPLICATION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA OTHERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA POUCH & BAGS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA BOXES IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA OTHERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA STORE-BASED RETAILERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION

TABLE 28 MIDDLE EAST & AFRICA NON-STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA COMMERCIAL IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA HOUSEHOLD/RETAIL IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 48 SOUTH AFRICA WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 49 SOUTH AFRICA WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 50 SOUTH AFRICA WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 51 SOUTH AFRICA WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 SOUTH AFRICA FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 SOUTH AFRICA BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 SOUTH AFRICA CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 SOUTH AFRICA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 SOUTH AFRICA WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 57 SOUTH AFRICA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 58 SOUTH AFRICA WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 59 SOUTH AFRICA STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 60 SOUTH AFRICA WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 61 SOUTH AFRICA COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 62 U.A.E. WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 63 U.A.E. WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 64 U.A.E. WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 65 U.A.E. WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 U.A.E. FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 U.A.E. BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 U.A.E. CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 U.A.E. ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 U.A.E. WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 71 U.A.E. BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 72 U.A.E. WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 73 U.A.E. STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 74 U.A.E. WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 U.A.E. COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 76 SAUDI ARABIA WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 77 SAUDI ARABIA WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 78 SAUDI ARABIA WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 79 SAUDI ARABIA WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 SAUDI ARABIA FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 SAUDI ARABIA BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 SAUDI ARABIA CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 SAUDI ARABIA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 SAUDI ARABIA WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 85 SAUDI ARABIA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 86 SAUDI ARABIA WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 87 SAUDI ARABIA STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 SAUDI ARABIA WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 89 SAUDI ARABIA COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 OMAN WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 91 OMAN WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 92 OMAN WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 93 OMAN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 OMAN FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 OMAN BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 OMAN CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 OMAN ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 OMAN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 99 OMAN BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 100 OMAN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 101 OMAN STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 102 OMAN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 103 OMAN COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 QATAR WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 105 QATAR WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 106 QATAR WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 107 QATAR WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 QATAR FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 QATAR BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 QATAR CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 QATAR ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 QATAR WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 113 QATAR BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 114 QATAR WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 115 QATAR STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 116 QATAR WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 117 QATAR COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 118 KUWAIT WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 119 KUWAIT WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 120 KUWAIT WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 121 KUWAIT WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 KUWAIT FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 123 KUWAIT BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 124 KUWAIT CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 KUWAIT ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 KUWAIT WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 127 KUWAIT BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 128 KUWAIT WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 129 KUWAIT STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 130 KUWAIT WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 131 KUWAIT COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 132 REST OF MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: SEGMENTATION

FIGURE 11 THE GROWING EXPENDITURE ON WHEAT GLUTEN TECHNOLOGY IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ORGANIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET

FIGURE 14 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY CATEGORY, 2021

FIGURE 15 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY CATEGORY, 2022-2029 (USD MILLION)

FIGURE 16 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY CATEGORY, CAGR (2022-2029)

FIGURE 17 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY CATEGORY, LIFELINE CURVE

FIGURE 18 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FUNCTION, 2021

FIGURE 19 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FUNCTION, 2022-2029 (USD MILLION)

FIGURE 20 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FUNCTION, CAGR (2022-2029)

FIGURE 21 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FUNCTION, LIFELINE CURVE

FIGURE 22 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FORM, 2021

FIGURE 23 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FORM, 2022-2029 (USD MILLION)

FIGURE 24 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FORM, CAGR (2022-2029)

FIGURE 25 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FORM, LIFELINE CURVE

FIGURE 26 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: APPLICATION, 2021

FIGURE 27 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: APPLICATION, 2022-2029 (USD MILLION)

FIGURE 28 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: APPLICATION, CAGR (2022-2029)

FIGURE 29 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FORM, LIFELINE CURVE

FIGURE 30 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY PACKAGING, 2021

FIGURE 31 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY PACKAGING, 2022-2029 (USD MILLION)

FIGURE 32 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY PACKAGING, CAGR (2022-2029)

FIGURE 33 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY PACKAGING, LIFELINE CURVE

FIGURE 34 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: DISTRIBUTION CHANNEL, 2021

FIGURE 35 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 36 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 37 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY END USER, 2021

FIGURE 39 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 40 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY END USER, CAGR (2022-2029)

FIGURE 41 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY END USER, LIFELINE CURVE

FIGURE 42 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET: SNAPSHOT (2021)

FIGURE 43 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET: BY COUNTRY (2021)

FIGURE 44 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET: BY COUNTRY (2022 & 2029)

FIGURE 45 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET: BY COUNTRY (2021 & 2029)

FIGURE 46 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET: CATEGORY (2022-2029)

FIGURE 47 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.