Mercado de pérdida de peso y control de la obesidad en Oriente Medio y África, por tipo de producto ( suplementos dietéticos y sustitutos de comidas), forma del producto (geles blandos, tabletas, cápsulas, polvos, gomitas y jaleas, premezclas, líquidos y otros), naturaleza (convencional y de etiqueta limpia), categoría (con receta y sin receta (OTC)), demografía del usuario final (menores de 18 años, de 18 a 35 años, de 35 a 50 años y más de 50 años), canal de distribución (en tiendas y fuera de ellas), países (Sudáfrica, Emiratos Árabes Unidos, Arabia Saudita, Omán, Kuwait y el resto de Oriente Medio y África), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas de mercado : mercado de pérdida de peso y control de la obesidad en Oriente Medio y África

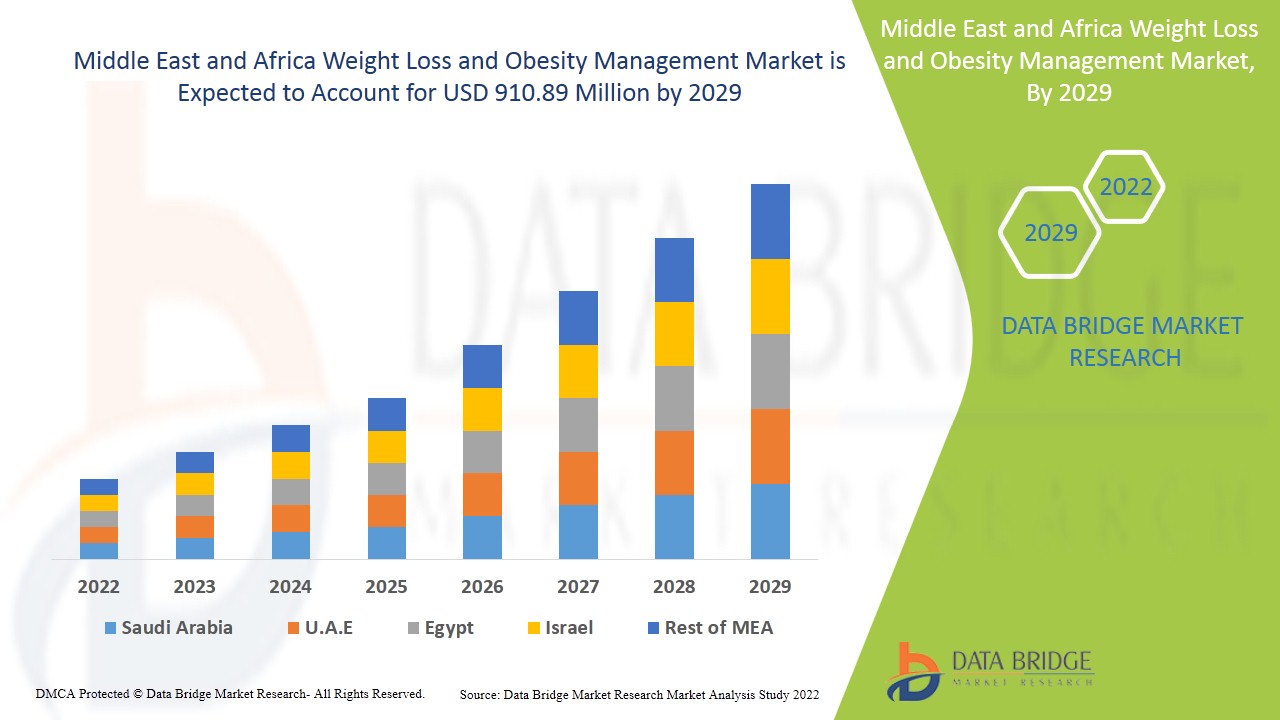

Se espera que el mercado de pérdida de peso y gestión de la obesidad en Oriente Medio y África obtenga un crecimiento significativo en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 8,8% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 910,89 millones para 2029.

Se espera que el aumento de la cantidad de casos de obesidad entre la población mundial impulse el crecimiento del mercado de la pérdida de peso y el control de la obesidad. Se espera que el aumento de la prevalencia de enfermedades crónicas, como la hipertensión y la diabetes, causado por el aumento en la adopción de patrones de vida poco saludables y sedentarios y el aumento en la cantidad de cirugías bariátricas aceleren el crecimiento del mercado de la pérdida de peso y el control de la obesidad.

- Además, el aumento de la preferencia por la comida chatarra, la inactividad física, la rutina agitada y el creciente estrés están provocando que las personas consuman comida rápida, lo que influirá aún más en el crecimiento del mercado de la pérdida de peso y el control de la obesidad. Además, la creciente adopción de programas de pérdida de peso y control del peso en línea, las iniciativas gubernamentales para crear conciencia y el aumento de los ingresos disponibles en las economías en desarrollo afectarán positivamente el crecimiento del mercado de la pérdida de peso y el control de la obesidad. Además, el aumento de la tasa de obesidad infantil y las naciones emergentes amplían las oportunidades rentables para el mercado de la pérdida de peso y el control de la obesidad.

Sin embargo, se espera que los altos costos asociados con las dietas bajas en calorías y los problemas con las prácticas de marketing engañosas obstaculicen el crecimiento del mercado de la pérdida de peso y el control de la obesidad. Se espera que el aumento en la implementación de regulaciones y normas estrictas desafíe aún más el crecimiento del mercado.

El informe de mercado de pérdida de peso y control de la obesidad en Oriente Medio y África proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, comuníquese con nosotros para obtener un resumen de analistas; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de pérdida de peso y control de la obesidad en Oriente Medio y África

El mercado de pérdida de peso y control de la obesidad en Medio Oriente y África está segmentado en seis segmentos notables según el tipo de producto, la forma del producto, la naturaleza, la categoría, la demografía del usuario final y el canal de distribución.

- En función del tipo de producto, el mercado de pérdida de peso y control de la obesidad en Oriente Medio y África se segmenta en suplementos dietéticos y sustitutos de comidas. En 2022, se espera que el segmento de suplementos dietéticos domine el mercado debido al aumento de la población obesa y la creciente conciencia de los consumidores sobre los alimentos y bebidas bajos en calorías en las economías en desarrollo.

- En función de la forma del producto, el mercado de pérdida de peso y control de la obesidad en Oriente Medio y África se segmenta en geles blandos, comprimidos, cápsulas, polvos, gomitas y gelatinas , premezclas, líquidos y otros. En 2022, se espera que el segmento de polvos domine el mercado debido a la facilidad de uso de la forma en polvo en comparación con otras formas de pérdida de peso y control de la obesidad.

- En función de la naturaleza, el mercado de la pérdida de peso y el control de la obesidad en Oriente Medio y África se segmenta en productos convencionales y de etiqueta limpia. En 2022, se espera que el segmento convencional domine el mercado debido a la creciente demanda de productos orgánicos y de cultivo natural.

- En función de la categoría, el mercado de pérdida de peso y control de la obesidad en Oriente Medio y África se segmenta en medicamentos recetados y de venta libre (OTC). En 2022, se espera que el segmento de venta libre (OTC) domine el mercado debido a la creciente popularidad de los medicamentos de venta libre para la pérdida de peso y el control de la obesidad.

- En función del usuario final, el mercado de pérdida de peso y control de la obesidad en Oriente Medio y África se segmenta en menores de 18 años, de 18 a 35 años, de 35 a 50 años y mayores de 50 años. En 2022, se espera que el segmento de 18 a 35 años domine el mercado debido al aumento de la tasa de obesidad infantil.

- En función del canal de distribución, el mercado de pérdida de peso y control de la obesidad de Oriente Medio y África se segmenta en el segmento basado en tiendas y el segmento no basado en tiendas. En 2022, se espera que el segmento no basado en tiendas domine el mercado debido a la pandemia emergente de COVID-19.

Análisis a nivel de país del mercado de control de la obesidad y pérdida de peso

Se analiza el mercado de pérdida de peso y control de la obesidad de Medio Oriente y África y se proporciona información sobre el tamaño del mercado en función del tipo de producto, la forma del producto, la naturaleza, la categoría, la demografía del usuario final y el canal de distribución.

Los países reportados en esta región en el mercado de pérdida de peso y manejo de la obesidad son Sudáfrica, Emiratos Árabes Unidos, Arabia Saudita, Omán, Kuwait y el resto de Medio Oriente y África.

Se espera que América del Norte crezca con la tasa de crecimiento más prometedora en el período de pronóstico de 2022 a 2029, ya que los principales industriales se están centrando en el desarrollo de productos para bajar de peso para satisfacer las demandas de los consumidores.

Demanda creciente de tratamientos para la pérdida de peso y el control de la obesidad

El mercado de pérdida de peso y control de la obesidad en Oriente Medio y África también le proporciona un análisis detallado del mercado para el crecimiento de cada país en la industria con ventas, ventas de componentes e impacto de lanzamientos consistentes y cambios en escenarios regulatorios con su apoyo al mercado. Los datos están disponibles para el período histórico de 2022 a 2029.

Análisis del panorama competitivo y de la cuota de mercado de la pérdida de peso y el control de la obesidad

El panorama competitivo del mercado de pérdida de peso y control de la obesidad en Oriente Medio y África proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de supervivencia de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de pérdida de peso y control de la obesidad en América del Sur.

Algunos de los principales actores que operan en el mercado de pérdida de peso y control de la obesidad son Herbalife International of America, Inc., ABH Pharma Inc., Vitaco, Amway Corp., Stepan Company, GNC Holdings, LLC, GlaxoSmithKline plc., Glanbia PLC, Abbott, Shaklee Corporation, Nu Skin Enterprises, Atlantic Multipower UK Ltd., Nature's Sunshine Products, Inc., Ajinomoto Co., Inc., Bionova, DSM, American Health, Omega Protein Corporation, Integrated BioPharma, Inc., Bio-Tech Pharmacal, The Himalaya Drug Company, Pharmavite, Ricola, BLACKMORES, entre otros.

Las empresas de todo el mundo también están iniciando diversos desarrollos de productos, lo que también está acelerando el crecimiento del mercado de pérdida de peso y control de la obesidad.

Por ejemplo,

- En octubre de 2020, según GlobeNewswire, Inc., Meticore lanzó un nuevo suplemento para bajar de peso para hombres y mujeres. El suplemento ayuda a estimular el metabolismo, ya que ayuda a aumentar la temperatura de las células internas, lo que da como resultado la regeneración del metabolismo. La fórmula está hecha con la ayuda de seis nutrientes vegetales de calidad superior y extractos de hierbas combinados con píldoras Meticore.

Las asociaciones, las empresas conjuntas y otras estrategias mejoran la participación de mercado de la empresa con una mayor cobertura y presencia. También benefician a las organizaciones a la hora de mejorar su oferta de productos de gestión de derechos mediante una gama más amplia de tamaños.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPARATIVE ANALYSIS (HERBAL SUPPLEMENTS VS SYNTHETIC SUPPLEMENTS)

4.2 PRICING ANALYSIS FOR WEIGHT LOSS & OBESITY MANAGEMENT SUPPLEMENTS-

4.3 VALUE CHAIN FOR MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET

4.4 SUPPLY CHAIN OF MIDDLE EAST AND AFRICA WEIGHT LOSS & OBESITY MANAGEMENT MARKET

4.5 BRAND COMPARATIVE ANALYSIS

4.6 CLEAN LABELED PRODUCT LAUNCHES

4.7 CONSUMER TRENDS

4.8 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET- GROWTH STRATEGIES ADOPTED BY KEY PLAYERS

4.9 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET- INDUSTRY TRENDS AND FUTURE PERSPECTIVES

5 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET- REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING RATES IN CHRONIC DISEASES

6.1.2 INCREASING PREVALENCE OF OBESITY

6.1.3 INCREASE IN GERIATRIC POPULATION

6.1.4 INCREASING BARIATRIC SURGERIES

6.2 RESTRAINTS

6.2.1 STRINGENT RULES & REGULATIONS

6.2.2 HIGH COST ASSOCIATED WITH THE LOW-CALORIE DIETS

6.3 OPPORTUNITIES

6.3.1 RISING DISPOSABLE INCOME ENHANCING THE PURCHASING POWER OF RELATED WEIGHT LOSS PRODUCTS

6.3.2 GROWING CONSUMPTION OF PROCESSED FOOD

6.3.3 RISE IN STRATEGIC INITIATIVES BY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 LACK OF AWARENESS IN LOWER INCOME COUNTRIES

6.4.2 INCREASE IN PRODUCT RECALL

7 IMPACT OF COVID-19 ON THE MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET

7.1 AFTERMATH OF COVID-19

7.2 IMPACT ON DEMAND AND SUPPLY CHAIN

7.3 IMPACT ON PRICE

7.4 CONCLUSION

8 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 DIETARY SUPPLEMENTS

8.2.1 SUPPLEMENT TYPE

8.2.1.1 Herbal/Natural

8.2.1.2 Synthetic

8.2.2 ACTIVE INGREDIENT TYPE

8.2.2.1 Green Tea Extract

8.2.2.2 Chitosan

8.2.2.3 Pyruvate

8.2.2.4 Probiotics

8.2.2.5 Conjugated Linoleic Acid

8.2.2.6 Green Coffee Bean Extract

8.2.2.7 Caffeine

8.2.2.8 Chromium

8.2.2.9 Bitter Orange (Citrus Aurantium L.)

8.2.2.10 Carnitine

8.2.2.11 African Mango (Irvingia Gabonensis)

8.2.2.12 White Kidney Bean (Phaseolus Vulgaris)

8.2.2.13 Others

8.3 MEAL REPLACEMENTS

8.3.1 POWDERED MIXES

8.3.2 READY TO DRINK BEVERAGES/SHAKES

8.3.3 PROTEIN BARS

8.3.4 OTHERS

9 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM

9.1 OVERVIEW

9.2 POWDERS

9.3 CAPSULE

9.4 LIQUIDS

9.5 TABLETS

9.6 PREMIXES

9.7 SOFT GELS

9.8 GUMMIES & JELLIES

9.9 OTHERS

10 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 STORE BASED

10.2.1 PHARMACIES

10.2.2 SPECIALTY STORES

10.2.3 HEALTH AND BEAUTY STORES

10.2.4 CONVENIENCE STORE

10.2.5 SUPERMARKET/HYPERMARKET

10.2.6 OTHERS

10.3 NON STORED BASED

10.3.1 ONLINE (THIRD PARTY ONLINE RETAILERS)

10.3.2 COMPANY OWNED WEBSITE

11 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY

11.1 OVERVIEW

11.2 TO 35 YEARS

11.3 TO 50 YEARS

11.4 ABOVE 50 YEARS

11.5 UNDER 18 YEARS

12 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SOUTH AFRICA

12.1.2 U.A.E

12.1.3 SAUDI ARABIA

12.1.4 OMAN

12.1.5 KUWAIT

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

TABLE 1 MOST OBESE COUNTRIES OF ASIA-PACIFIC 2020

TABLE 2 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST AND AFRICA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST AND AFRICA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST AND AFRICA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST AND AFRICA MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA POWDERS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA CAPSULE IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA LIQUIDS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA TABLETS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST AND AFRICA PREMIXES IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA SOFT GELS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA GUMMIES & JELLIES IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA OTHERS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION))

TABLE 18 MIDDLE EAST AND AFRICA STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA 18 TO 35 YEARS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA 35 TO 50 YEARS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA ABOVE 50 YEARS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA UNDER 18 YEARS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 37 SOUTH AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 38 SOUTH AFRICA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 39 SOUTH AFRICA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 40 SOUTH AFRICA MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 SOUTH AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 42 SOUTH AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 43 SOUTH AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 44 SOUTH AFRICA STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 45 SOUTH AFRICA NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 46 U.A.E WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 U.A.E DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 48 U.A.E DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.A.E MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 U.A.E WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 51 U.A.E WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 52 U.A.E WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 U.A.E STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 54 U.A.E NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 55 SAUDI ARABIA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 56 SAUDI ARABIA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 57 SAUDI ARABIA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 58 SAUDI ARABIA MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 59 SAUDI ARABIA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 60 SAUDI ARABIA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 61 SAUDI ARABIA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 62 SAUDI ARABIA STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 63 SAUDI ARABIA NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 64 OMAN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 OMAN DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 66 OMAN DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 67 OMAN MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 68 OMAN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 69 OMAN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 70 OMAN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 OMAN STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 72 OMAN NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 73 KUWAIT WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 KUWAIT DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 75 KUWAIT DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 76 KUWAIT MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 77 KUWAIT WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 78 KUWAIT WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 79 KUWAIT WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 80 KUWAIT STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 81 KUWAIT NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 82 REST OF MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET : DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: MIDDLE EAST AND AFRICA VS REGIONAL ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: DBMR POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: SEGMENTATION

FIGURE 10 INCREASE IN OBESE POPULATION IS DRIVING THE GROWTH OF MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 DIETARY SUPPLEMENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET IN 2022 & 2029

FIGURE 12 SUPPLY CHAIN OF WEIGHT LOSS & OBESITY MANAGEMENT MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET

FIGURE 14 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY PRODUCT FORM, 2021

FIGURE 16 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 17 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2021

FIGURE 18 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: SNAPSHOT (2021)

FIGURE 19 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY COUNTRY (2021)

FIGURE 20 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 21 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 22 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 23 MIDDLE EAST AND AFRICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.