Mercado de vehículos de superficie no tripulados (USV) en Oriente Medio y África, por tipo (superficie y subsuperficie), aplicación (defensa, comercial, investigación científica y otras), resistencia (100-500 horas, 1000 horas), operación (vehículo de superficie operado a distancia y vehículo de superficie autónomo), sistema (propulsión, material del chasis, carga útil, componente, software y comunicación), tipo de casco (catamarán (cascos gemelos), kayak (casco único), trimarán (cascos triples) y casco inflable rígido), tamaño (mediano (4 a 8 M), pequeño (menos de 4 M), grande (8 a 12 M) y extragrande (más de 12 M)) Tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de vehículos de superficie no tripulados (USV) en Oriente Medio y África

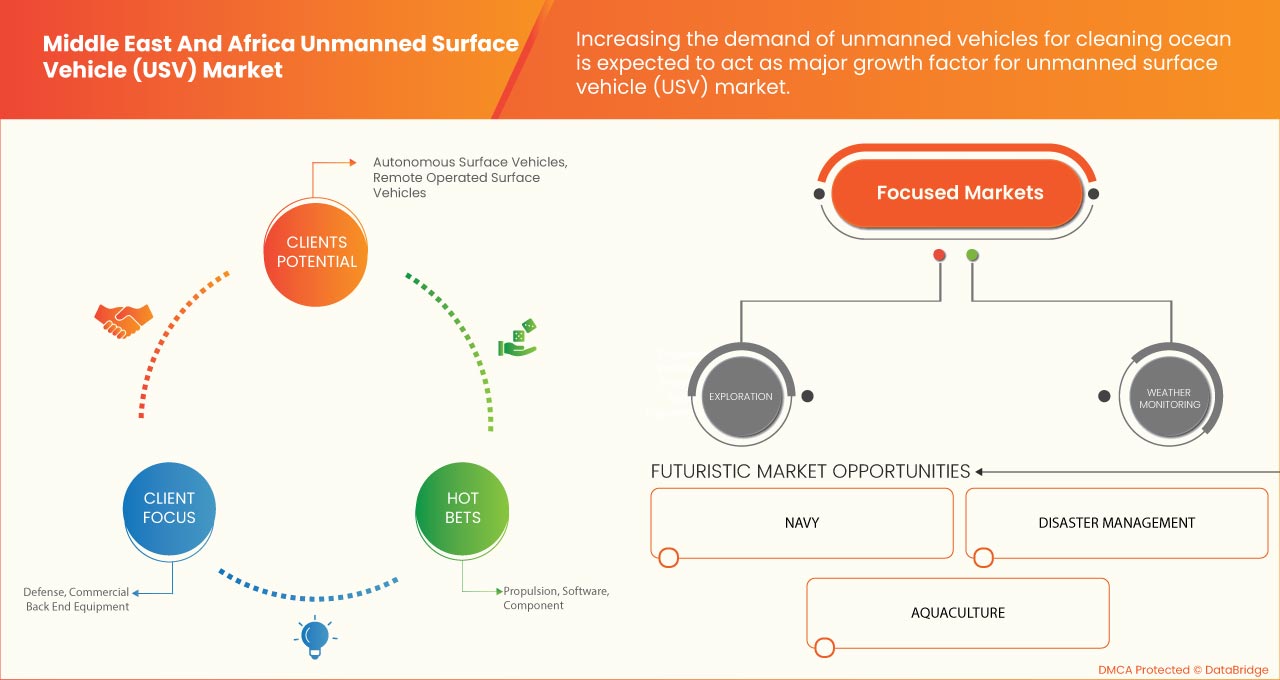

El uso cada vez mayor de baterías solares para alimentar los vehículos autónomos de superficie (ASV) está acelerando el crecimiento de los vehículos no tripulados de superficie (USV). La creciente demanda de monitoreo de la calidad del agua debido al aumento de los niveles de contaminación y el mapeo de datos oceánicos, que permite a los científicos estudiar las condiciones climáticas pasadas, está impulsando el crecimiento de los vehículos no tripulados de superficie (USV). Además, las crecientes amenazas a la seguridad marítima están impulsando a las armadas de Oriente Medio y África a incorporar vehículos autónomos de superficie (ASV) a su flota, lo que les da una ventaja y acelera aún más el crecimiento del mercado de vehículos no tripulados de superficie (USV) en Oriente Medio y África. Sus usos diversificados en servicios de gestión de desastres, especialmente en búsqueda y rescate y mantenimiento preventivo, para proteger la integridad de áreas territoriales y aguas cerradas. Se espera que la rápida adopción en la industria de la acuicultura, que les permite un monitoreo en tiempo real para atender la creciente demanda de productos pesqueros en todo el mundo, cree fuertes oportunidades para el mercado de vehículos no tripulados de superficie (USV) en Oriente Medio y África. Sin embargo, las nacientes tecnologías de detección de colisiones y las complejidades tecnológicas adicionales asociadas con el proceso de hacerlos verdaderamente autónomos plantean un desafío para el crecimiento del mercado de vehículos de superficie no tripulados (USV) en Medio Oriente y África.

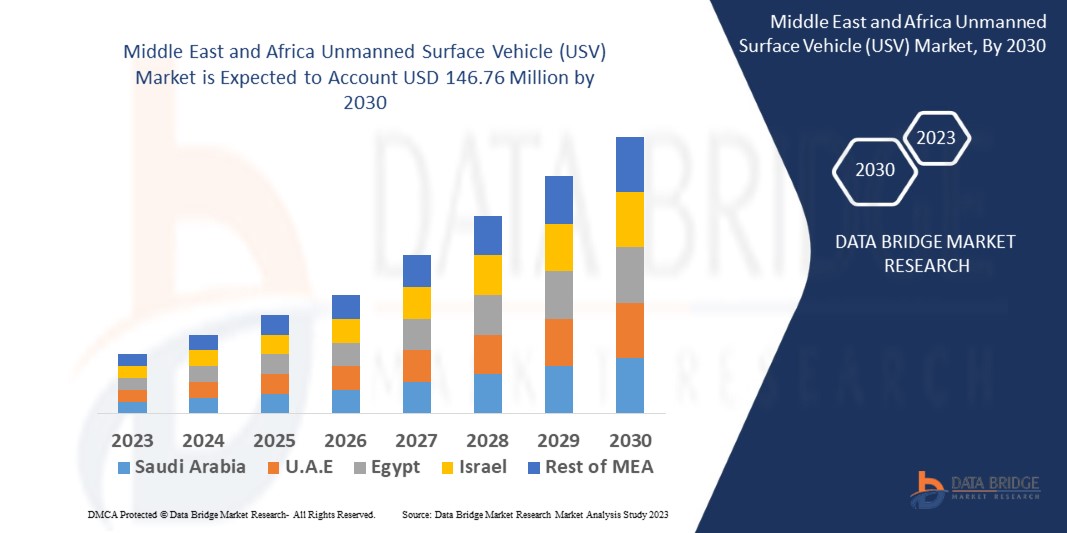

Data Bridge Market Research analiza que se espera que el mercado de vehículos de superficie no tripulados (USV) de Oriente Medio y África alcance un valor de 146,76 millones de dólares en 2030, con una CAGR del 12,1 % durante el período de pronóstico. El informe de mercado de vehículos de superficie no tripulados (USV) también cubre en profundidad el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2020 - 2016) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por tipo (superficie y subsuperficie), aplicación (defensa, comercial, investigación científica y otras), resistencia (100-500 horas, <100 horas, 500-1000 horas y >1000 horas), operación (vehículo de superficie operado a distancia y vehículo de superficie autónomo), sistema (propulsión, material del chasis, carga útil, componente, software y comunicación), tipo de casco (catamarán (cascos gemelos), kayak (casco único), trimarán (cascos triples) y casco inflable rígido), tamaño (mediano (4 a 8 M), pequeño (menos de 4 M), grande (8 a 12 M) y extra grande (más de 12 M)). |

|

Países cubiertos |

Arabia Saudita, Sudáfrica, Egipto, Israel, Resto de Medio Oriente y África (MEA) |

|

Actores del mercado cubiertos |

Maritime Robotics AS, Elbit Systems Ltd., Rafael Advanced Defense Systems Ltd., Boeing, Utek, Seafloor Systems, Inc., SeaRobotics Corporation, Saildrone Inc., Deep Ocean Engineering, Inc., Zhuhai Yunzhou Intelligent Technology Co., Ltd., Kongsberg Maritime, Tecnologies, Inc., OCIUS, ATLAS ELEKTRONIK GmbH, Clearpath Robotics Inc., Teledyne Technologies Incorporated, Textron Inc., ECA GROUP y 5G Maritime |

Definición de mercado

El vehículo de superficie no tripulado (USV) es una embarcación acuática que puede operar sin necesidad de operadores humanos a bordo. Puede ser operado de forma remota por un operador o estar preprogramado para funcionar por sí solo. Suele funcionar con baterías de iones de litio de recarga rápida o con energía solar y se utiliza principalmente para la exploración oceánica y con fines marítimos.

El vehículo de superficie no tripulado ofrece varias ventajas y puede utilizarse para distintos tipos de aplicaciones, como aplicaciones comerciales y de investigación, fines de defensa, búsqueda y rescate, y muchas más. Su adopción está creciendo de forma constante en diversos sectores industriales, como la acuicultura, y tiene un enorme potencial para ser un vehículo ideal que puede utilizarse para fines de gestión de desastres.

Dinámica del mercado de vehículos de superficie no tripulados (USV) en Oriente Medio y África

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Creciente demanda de vehículos no tripulados para limpiar los océanos

La contaminación marina, o contaminación de los océanos, ha ido aumentando con el paso de los años. Además, aproximadamente el 75% de la superficie de la Tierra está cubierta de agua, de la cual el 97,5% está ocupada por el océano y el 2,5% por agua dulce. El rápido aumento de la población ha provocado una creciente necesidad de agua dulce para beber y para otros fines.

Aunque el crecimiento de la industrialización en Oriente Medio y África ha provocado un aumento de la contaminación del agua, se están vertiendo enormes cantidades de residuos plásticos en el océano, lo que está contaminando el agua. Además, la historia de la exploración y el transporte de petróleo y gas ha sido testigo de varios derrames de petróleo que han destruido la vida acuática y la calidad del agua. Junto con esto, la contaminación química es preocupante por razones de salud, ambientales y económicas, lo que ha llevado a la demanda de limpiar estos recursos hídricos.

- Aumento de las amenazas asimétricas y uso de vehículos de superficie no tripulados (USV) en defensa

Los vehículos de superficie no tripulados están revolucionando el ámbito naval en los últimos años. Estos vehículos han ido evolucionando desde herramientas para realizar múltiples tareas hasta sistemas capaces de operar con un alto grado de autonomía. Además, la mayoría de los países se enfrentan a una guerra asimétrica debido a las diferentes estrategias elaboradas por los distintos departamentos de defensa.

Sin embargo, la guerra asimétrica puede describir conflictos. Dichos conflictos a menudo implican estrategias y tácticas de guerra no convencional. Los recursos de las amenazas asimétricas pueden denominarse ataques por parte de individuos, organizaciones o naciones dirigidos contra cualquier gobierno, ejército o algún activo valioso con el fin de adquirir el activo o destruir el estado. Estos ataques deben ser monitoreados continuamente por los países para protegerlos de cualquier forma de ataque o cualquier otro tipo de aplicación, como el tráfico ilegal de drogas, accidentes aéreos, investigaciones de búsqueda marítima, entrega de carga útil y muchos otros.

Oportunidades

- Creciente demanda de USV para gestión de desastres

Los desastres, ya sean naturales o provocados por el hombre, tienen consecuencias despiadadas para las vidas humanas, el medio ambiente y también las construcciones artificiales. Los desastres provocados por el hombre pueden abarcar desde derrames de petróleo y metales pesados hasta incendios forestales, en particular el derrame de petróleo de Deep Water Horizon (2010), el desastre de Chernóbil (1986) y los incendios forestales de California (2018), entre otros.

Con el paso de los años, la concienciación sobre los desastres ha ido en aumento y, aunque se han utilizado robots terrestres, aéreos y submarinos para la gestión de desastres, los vehículos de superficie apenas están empezando a ganar popularidad. Aunque se utilizan principalmente para fines de búsqueda y rescate, se pueden utilizar para detectar deformaciones de la corteza terrestre con la ayuda de sismómetros de a bordo y otros sensores de presión en la costa.

Restricciones/Desafíos

- Falta de capacidad de detección de colisiones de los vehículos de superficie no tripulados (USV)

El uso de vehículos de superficie no tripulados (USV) está aumentando debido a su amplia gama de aplicaciones comerciales, militares y de investigación. Estos vehículos pueden funcionar por sí solos y ser totalmente autónomos, o un operador puede controlarlos para que naveguen por su rumbo y controlen su funcionamiento.

Los vehículos autónomos se enfrentan a la complejidad tecnológica de la detección de colisiones. Como estos vehículos pueden colisionar fácilmente con cualquier otro vehículo marino, la falta de un sistema de colisión adecuado en el vehículo actúa como una importante limitación para el mercado.

- Aumentar las inversiones de los gobiernos y los actores privados

Hace más de medio siglo, las guerras se libraban mediante demostraciones de fuerza, ya que los países se centraban en ataques con toda su fuerza. Sin embargo, a medida que el tiempo avanzaba y las tecnologías avanzaban, varias economías se desarrollaban simultáneamente y dependían más de otros factores, como el reconocimiento y la vigilancia. Por ello, los líderes de Oriente Medio y África han cambiado su enfoque hacia los vehículos autónomos de superficie (ASV) para hacerlos más eficientes. Se pueden utilizar generalmente para acompañar a grandes buques de guerra y acorazados, así como para detectar minas y trampas submarinas.

Cada vez es más necesario aumentar la inversión en plataformas no tripuladas con una red de mando impenetrable. Los USV tienen el potencial de convertirse en la pieza central de diversas operaciones marítimas. Esto se ve impulsado aún más por las crecientes escaramuzas entre diversas economías que dan lugar a guerras comerciales, capturas ilegales de tierras y vigilancia. Como resultado, el aumento de las inversiones de las fuerzas navales de Oriente Medio y África para reforzar su capacidad, así como las inversiones de entidades privadas, es el factor que creará una oportunidad para el crecimiento del mercado.

Impacto posterior a la COVID-19 en el mercado de vehículos de superficie no tripulados (USV) en Oriente Medio y África

La COVID-19 generó un impacto negativo en el mercado de vehículos de superficie no tripulados (USV) debido al rápido cierre de las instalaciones de fabricación en todas las industrias.

La pandemia de COVID-19 ha afectado al mercado de vehículos de superficie no tripulados (USV) de manera negativa. La creciente adopción de USV para la cartografía oceánica ha ayudado al mercado a crecer después de la pandemia. Además, se espera que haya un crecimiento sectorial considerable en el futuro cercano.

Los fabricantes y proveedores de soluciones están tomando diversas decisiones estratégicas para mejorar sus ofertas en el escenario posterior a la COVID-19. Las empresas están llevando a cabo múltiples actividades de investigación y desarrollo para mejorar la tecnología involucrada en el vehículo de superficie no tripulado (USV). Con esto, las empresas traerán tecnologías avanzadas al mercado.

Desarrollo reciente

- En octubre de 2022, ECA GROUP diseñó Critical Design Review para promover los sistemas robóticos autónomos en el programa MCM de tercera generación. Este producto ha ayudado a la empresa a ampliar su cartera de productos y mejorar la oferta a los clientes.

- En abril de 2019, KONGSBERG lanzó un nuevo vehículo de superficie no tripulado (USV) y un sistema USV con sonda. El sistema USV con sonda es una plataforma multipropósito que fue diseñada para funcionar en diferentes segmentos del mercado, incluidos los estudios topográficos. Esto ha ayudado a la empresa a mejorar su oferta de productos y a crecer en el mercado.

Alcance del mercado de vehículos de superficie no tripulados (USV) en Oriente Medio y África

El mercado de vehículos de superficie no tripulados (USV) de Oriente Medio y África se divide en seis segmentos importantes, que se basan en el tipo, la aplicación, la resistencia, el funcionamiento, el sistema, el tipo de casco y el tamaño. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Superficie

- Subsuperficie

Según el tipo, el mercado de vehículos de superficie no tripulados (USV) de Oriente Medio y África se segmenta en superficie y subsuperficie.

Solicitud

- Defensa

- Comercial

- Investigación científica

- Otros

Sobre la base de la aplicación, el mercado de vehículos de superficie no tripulados (USV) de Medio Oriente y África está segmentado en defensa, comercial, investigación científica y otros.

Resistencia

- 100-500 horas

- <100 horas

- 500-1000 horas

- >1000 horas

Sobre la base de la resistencia, el mercado de vehículos de superficie no tripulados (USV) de Medio Oriente y África está segmentado en 100-500 horas, <100 horas, 500-1000 horas y >1000 horas.

Operación

- Vehículo de superficie operado a distancia

- Vehículo de superficie autónomo

Sobre la base de la operación, el mercado de vehículos de superficie no tripulados (USV) de Medio Oriente y África está segmentado en vehículos de superficie operados a distancia y vehículos de superficie autónomos.

Sistema

- Propulsión

- Material del chasis

- Carga útil

- Componente

- Software

- Comunicación

Sobre la base del sistema, el mercado de vehículos de superficie no tripulados (USV) de Oriente Medio y África está segmentado en propulsión, material del chasis, carga útil, componentes, software y comunicaciones.

Tipo de casco

- Catamarán (cascos gemelos)

- Kayak (monocasco)

- Trimarán (Triple Casco)

- Casco inflable rígido

Sobre la base del tipo de casco, el mercado de vehículos de superficie no tripulados (USV) de Medio Oriente y África está segmentado en catamarán (cascos dobles), kayak (casco simple), trimarán (cascos triples) y casco inflable rígido.

Tamaño

- Mediano (4 a 8 M)

- Pequeño (menos de 4 M)

- Grande (8 a 12 M)

- Extra grande (más de 12 m)

En función del tamaño, el mercado de vehículos de superficie no tripulados (USV) de Oriente Medio y África se segmenta en mediano (de 4 a 8 m), pequeño (menos de 4 m), grande (de 8 a 12 m) y extra grande (más de 12 m).

Análisis y perspectivas regionales del mercado de vehículos de superficie no tripulados (USV) en Oriente Medio y África

Se analiza el mercado de vehículos de superficie no tripulados (USV) de Medio Oriente y África, y se proporcionan información y tendencias del tamaño del mercado por país, tipo, aplicación, resistencia, operación, sistema, tipo de casco y tamaño como se menciona anteriormente.

Los países cubiertos en el informe del mercado de vehículos de superficie no tripulados (USV) son Arabia Saudita, Sudáfrica, Egipto, Israel y el resto de Medio Oriente y África (MEA).

Se espera que en 2023, Israel domine el mercado de vehículos de superficie no tripulados (USV) de Medio Oriente y África debido a las políticas e iniciativas gubernamentales para impulsar los avances tecnológicos en este país.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas arriba y aguas abajo, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Medio Oriente y África y sus desafíos afrontados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los vehículos de superficie no tripulados (USV) en Oriente Medio y África

El panorama competitivo del mercado de vehículos de superficie no tripulados (USV) de Oriente Medio y África proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Oriente Medio y África, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos, el dominio de la aplicación. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de vehículos de superficie no tripulados (USV).

Algunos de los principales actores que operan en el mercado de vehículos de superficie no tripulados (USV) de Oriente Medio y África son Maritime Robotics AS, Elbit Systems Ltd., Rafael Advanced Defense Systems Ltd., Boeing, Utek, Seafloor Systems, Inc., SeaRobotics Corporation, Saildrone Inc., Deep Ocean Engineering, Inc., Zhuhai Yunzhou Intelligent Technology Co., Ltd., Kongsberg Maritime, Tecnologies, Inc., OCIUS, ATLAS ELEKTRONIK GmbH, Clearpath Robotics Inc., Teledyne Technologies Incorporated, Textron Inc., ECA GROUP y 5G Maritime, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 MARKET APPLICATION COVERAGE GRID

2.1 TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR UNMANNED VEHICLES FOR CLEANING OCEAN

5.1.2 INCREASING ASYMMETRIC THREATS AND USE OF UNMANNED SURFACE VEHICLES (USV) IN DEFENSE

5.1.3 INCREASING USE OF UNMANNED SURFACE VEHICLES (USV) IN COMMERCIAL EXPLORATION

5.1.4 INCREASING USE OF UNMANNED SURFACE VEHICLE (USV) FOR OCEANOGRAPHY

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF UNMANNED UNDERWATER VEHICLE (UUV) AS AN ALTERNATIVE

5.2.2 LACK OF COLLISION DETECTION CAPABILITY OF UNMANNED SURFACE VEHICLE (USV)

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR USV FOR DISASTER MANAGEMENT

5.3.2 APPLICATION IN TERRITORIAL AND PROTECTED WATERS

5.3.3 INCREASING INVESTMENTS BY GOVERNMENTS AND PRIVATE PLAYERS

5.3.4 REAL TIME MONITORING OF AQUACULTURE ENVIRONMENTS

5.4 CHALLENGES

5.4.1 DECREASING NAVY BUDGET OF VARIOUS COUNTRIES

6 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE

6.1 OVERVIEW

6.2 SURFACE

6.3 SUB-SURFACE

7 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 DEFENSE

7.2.1 TYPE

7.2.1.1 SURFACE

7.2.1.2 SUB-SURFACE

7.3 COMMERCIAL

7.3.1 BY PURPOSE

7.3.1.1 OCEANOGRAPHY AND ENVIRONMENTAL SCIENCES

7.3.1.2 OIL AND GAS

7.3.1.3 EXPLORATION

7.3.2 BY TYPE

7.3.2.1 SURFACE

7.3.2.2 SUB-SURFACE

7.4 SCIENTIFIC RESEARCH

7.4.1 TYPE

7.4.1.1 SURFACE

7.4.1.2 SUB-SURFACE

7.5 OTHERS

8 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE

8.1 OVERVIEW

8.2 100-500 HOURS

8.3 <100 HOURS

8.4 500-1000 HOURS

8.5 >1000 HOURS

9 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION

9.1 OVERVIEW

9.2 REMOTE OPERATED SURFACE VEHICLE

9.3 AUTONOMOUS SURFACE VEHICLE

10 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM

10.1 OVERVIEW

10.2 PROPULSION

10.3 CHASSIS MATERIAL

10.4 PAYLOAD

10.5 COMPONENT

10.6 SOFTWARE

10.7 COMMUNICATION

11 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE

11.1 OVERVIEW

11.2 CATAMARAN (TWIN HULLS)

11.3 KAYAK (SINGLE HULL)

11.4 TRIMARAN (TRIPLE HULLS)

11.5 RIGID INFLATABLE HULL

12 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE

12.1 OVERVIEW

12.2 MEDIUM (4 TO 8 M)

12.3 SMALL (LESS THAN 4 M)

12.4 LARGE (8 TO 12 M)

12.5 EXTRA LARGE (ABOVE 12 M)

13 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 ISRAEL

13.1.2 SAUDI ARABIA

13.1.3 U.A.E.

13.1.4 SOUTH AFRICA

13.1.5 EGYPT

13.1.6 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 L3HARRIS TECHNOLOGIES, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 BOEING

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 KONGSBERG

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 TEXTRON, INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 5G MARINE

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 ATLAS ELEKTRONIK GMBH

16.7.1 COMPANY SNAPSHOT

16.7.2 SOLUTION PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 CLEARPATH ROBOTICS INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 DEEP OCEAN ENGINEERING, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 ECA GROUP

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 ELBIT SYSTEMS LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 IXBLUE SAS

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 MARITIME ROBOTICS AS

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 OCIUS

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 SAILDRONE, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 TECHNOLOGY PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 SEAFLOOR SYSTEMS, INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 SEAROBOTICS CORPORATION

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 TELEDYNE TECHNOLOGIES INCORPORATED

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 ZHUHAI YUNZHOU INTELLIGENT TECHNOLOGY CO., LTD.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA SURFACE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA SUB-SURFACE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA OTHERS IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA 100-500 HOURS IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA <100 HOURS IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA 500-1000 HOURS IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA >1000 HOURS IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA REMOTE OPERATED SURFACE VEHICLE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA AUTONOMOUS SURFACE VEHICLE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA PROPULSION IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA CHASSIS MATERIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA PAYLOAD IN UNMANNED SURFACE VEHICLES (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA COMPONENT IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA SOFTWARE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA COMMUNICATION IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA CATAMARAN (TWIN HULLS) IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA KAYAK (SINGLE HULL) IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA TRIMARAN (TRIPLE HULLS) IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA RIGID INFLATABLE HULL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE, 2021-2030 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA MEDIUM (4 TO 8 M) SEGMENT IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA SMALL (LESS THAN 4 M) IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA LARGE (8 TO 12 M) IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA EXTRA LARGE (ABOVE 12 M) IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 50 ISRAEL UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 ISRAEL UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 52 ISRAEL DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 ISRAEL COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 54 ISRAEL COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 ISRAEL SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 ISRAEL UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 57 ISRAEL UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 58 ISRAEL UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 59 ISRAEL UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 60 ISRAEL UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 61 SAUDI ARABIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 SAUDI ARABIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 63 SAUDI ARABIA DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 SAUDI ARABIA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 65 SAUDI ARABIA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 SAUDI ARABIA SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 SAUDI ARABIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 68 SAUDI ARABIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 69 SAUDI ARABIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 70 SAUDI ARABIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 71 SAUDI ARABIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 72 U.A.E. UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 U.A.E. UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 74 U.A.E. DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 U.A.E. COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 76 U.A.E. COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 77 U.A.E. SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 U.A.E. UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 79 U.A.E. UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 80 U.A.E. UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 81 U.A.E. UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 82 U.A.E. UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 83 SOUTH AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 SOUTH AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 85 SOUTH AFRICA DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 SOUTH AFRICA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 87 SOUTH AFRICA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 88 SOUTH AFRICA SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 SOUTH AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 90 SOUTH AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 91 SOUTH AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 92 SOUTH AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 93 SOUTH AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 94 EGYPT UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 EGYPT UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 96 EGYPT DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 EGYPT COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 98 EGYPT COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 EGYPT SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 EGYPT UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 101 EGYPT UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 102 EGYPT UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 103 EGYPT UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 104 EGYPT UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 105 REST OF MIDDLE EAST AND AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: MULTIVARIATE MODELING

FIGURE 10 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: TYPE TIMELINE CURVE

FIGURE 12 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: SEGMENTATION

FIGURE 13 INCREASING USE OF UNMANNED SURFACE VEHICLES (USV) IN COMMERCIAL EXPLORATION IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET IN THE FORECAST PERIOD

FIGURE 14 SURFACE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET IN 2023 & 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET

FIGURE 16 PLASTICS PRODUCTION ACROSS GLOBE

FIGURE 17 CRUDE OIL PRODUCTION DATA, BY REGION

FIGURE 18 DEFENCE EXPENDITURE ACROSS THE GLOBE

FIGURE 19 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY TYPE, 2022

FIGURE 20 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY APPLICATION, 2022

FIGURE 21 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY ENDURANCE, 2022

FIGURE 22 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY OPERATION, 2022

FIGURE 23 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY SYSTEM, 2022

FIGURE 24 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY HULL TYPE, 2022

FIGURE 25 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY SIZE, 2022

FIGURE 26 MIDDLE EAST AND AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: SNAPSHOT (2022)

FIGURE 27 MIDDLE EAST AND AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY COUNTRY (2022)

FIGURE 28 MIDDLE EAST AND AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 MIDDLE EAST AND AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 MIDDLE EAST AND AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY TYPE (2023 - 2030)

FIGURE 31 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.