Middle East And Africa Unmanned Ground Vehicle Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

182.17 Million

USD

323.62 Million

2025

2033

USD

182.17 Million

USD

323.62 Million

2025

2033

| 2026 –2033 | |

| USD 182.17 Million | |

| USD 323.62 Million | |

|

|

|

|

Segmentación del mercado de vehículos terrestres no tripulados en Oriente Medio y África, por tamaño (Micro UGVS (2000 LBS)), por sistema (cargas útiles, unidades de control, sistema de potencia, sistema de navegación, sistema de chasis, sistema de comunicación, otros), por movilidad (con ruedas, con orugas, con patas, híbrido, movilidad de serpiente/articulada), por propulsión (eléctrico, híbrido, diésel/gasolina, UGVS de pila de combustible de hidrógeno, UGVS asistido por energía solar), por modo de operación (teleoperado, atado, autónomo), por aplicación (comercial, militar, aplicación de la ley federal, aplicación de la ley), carga útil (servicio ligero (menos de 50 kg, servicio medio (50-200 kg), servicio pesado (200-1000 kg), servicio ultrapesado (1000 kg), tendencias de la industria y pronóstico hasta 2033

Tamaño del mercado de vehículos terrestres no tripulados en Oriente Medio y África

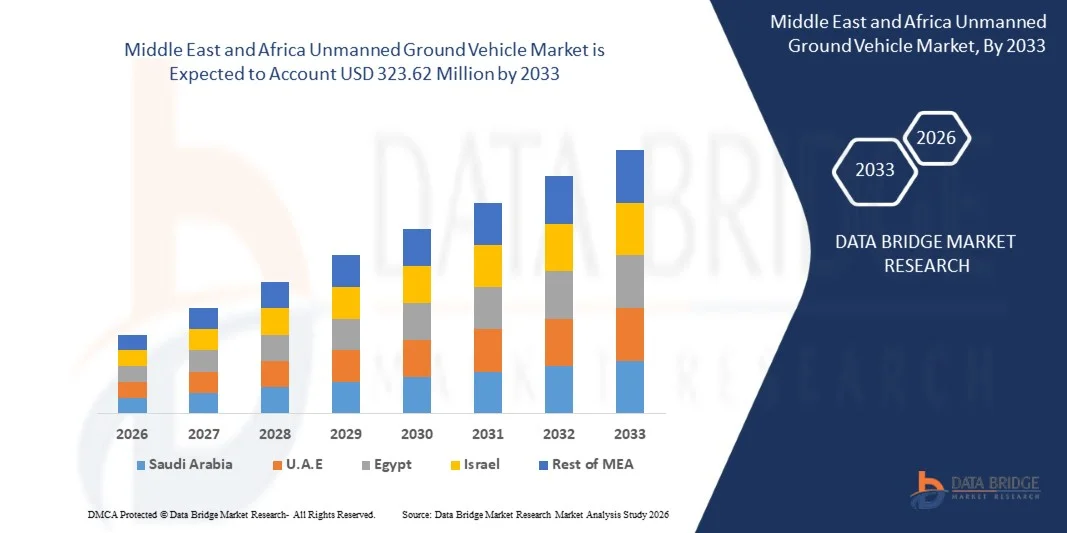

- El tamaño del mercado de vehículos terrestres no tripulados de Oriente Medio y África se valoró en 182,17 millones de dólares en 2025 y se espera que alcance los 323,62 millones de dólares en 2033 , con una CAGR del 7,9 % durante el período de pronóstico.

- El mercado de vehículos terrestres no tripulados (UGV) en Oriente Medio y África se refiere a la industria centrada en el diseño, la producción y el despliegue de sistemas robóticos terrestres que operan sin presencia humana a bordo. Estos vehículos se utilizan para aplicaciones militares, comerciales e industriales, como vigilancia, logística, desactivación de artefactos explosivos, minería, agricultura e inspección de infraestructuras.

Análisis del mercado de vehículos terrestres no tripulados en Oriente Medio y África

- El mercado de vehículos terrestres no tripulados (UGV) representa un segmento crucial en el panorama de defensa, seguridad y automatización industrial de Oriente Medio y África, con aplicaciones en operaciones militares, seguridad fronteriza, aplicación de la ley, minería, agricultura y respuesta ante desastres. Los UGV se caracterizan por su operación remota o autónoma, alta movilidad y capacidad para realizar tareas en entornos peligrosos o inaccesibles.

- El crecimiento del mercado se ve impulsado por el aumento de los programas de modernización de defensa y la creciente demanda de sistemas autónomos y semiautónomos para reducir el riesgo humano en combate, vigilancia y desactivación de artefactos explosivos (EOD). Los avances en inteligencia artificial, sensores, sistemas de navegación y tecnologías de comunicación están acelerando la adopción de UGV en los sectores de defensa y comercial.

- Se prevé que el sector militar y de defensa siga siendo el segmento dominante en el mercado de vehículos terrestres no tripulados (UGV), gracias a la creciente inversión en vehículos de reconocimiento, apoyo logístico y apoyo de combate. Las fuerzas armadas se benefician de la capacidad de los UGV para mejorar la conciencia situacional, optimizar la eficiencia de las misiones y operar de forma continua en condiciones extremas.

- Se proyecta que Arabia Saudita liderará el mercado de vehículos terrestres no tripulados en Oriente Medio y África con una cuota de mercado del 25,77 % en 2025, y se prevé que registre el crecimiento más rápido durante el período de pronóstico. El crecimiento en Arabia Saudita se sustenta en el aumento de los presupuestos de defensa, el desarrollo de robótica autóctona y la expansión de las aplicaciones en seguridad nacional y automatización industrial.

- Se prevé que el segmento de vehículos terrestres no tripulados (UGV) PEQUEÑOS (de 4,5 a 90 kg) ocupe la mayor cuota de mercado, con un 35,78 % para 2025, gracias a su diseño ligero, alta maniobrabilidad y rentabilidad. Estos UGV se utilizan ampliamente para tareas de vigilancia, reconocimiento, desactivación de artefactos explosivos (EOD) e inspección, lo que los hace muy versátiles en aplicaciones militares y comerciales.

Alcance del informe y segmentación del mercado de vehículos terrestres no tripulados en Oriente Medio y África

|

Atributos |

Perspectivas clave del mercado de vehículos terrestres no tripulados en Oriente Medio y África |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis experto en profundidad, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis pestle. |

Tendencias del mercado de vehículos terrestres no tripulados en Oriente Medio y África

Diseños modulares de carga útil que abren nuevos segmentos de aplicación para vehículos terrestres no tripulados (UGV)

- Las arquitecturas modulares de carga útil para misiones permiten reconfigurar rápidamente los vehículos terrestres no tripulados (UGV) para funciones operativas específicas (transporte, inteligencia, vigilancia y reconocimiento, evacuación de heridos, antidrones, desactivación de artefactos explosivos y efectos de precisión), ampliando así los mercados potenciales en los ámbitos de defensa y comercial. Las interfaces de carga útil de arquitectura abierta, las placas de montaje estandarizadas y las abstracciones de software reducen el tiempo de implementación de nuevas capacidades, reducen los costes de integración para los clientes y permiten a los proveedores escalar las familias de plataformas mediante kits de misión en lugar de vehículos a medida.

- En abril de 2025, Overland AI anunció el vehículo táctico autónomo ULTRA que integra y despliega múltiples cargas útiles modulares (incluidos sistemas aéreos no tripulados y herramientas de violación), demostrando un ejemplo comercial de integración de carga útil modular destinada a operaciones terrestres tácticas.

- En abril de 2024, DARPA describió públicamente el progreso de la Fase 2 de RACER (agregar plataformas más pesadas y demostrar la portabilidad de la autonomía entre vehículos), una actividad que sustenta los conceptos de carga útil modular al permitir una autonomía e interfaces comunes en diferentes tamaños de chasis de UGV.

Dinámica del mercado de vehículos terrestres no tripulados en Oriente Medio y África

Conductor

Los programas de modernización de la defensa aceleran la adquisición de vehículos no tripulados en Oriente Medio y África

- Los programas de modernización de defensa en todo el mundo han acelerado la adquisición de vehículos terrestres no tripulados (UGV) mediante la creación de requisitos operativos explícitos, líneas de financiación y vías de adquisición aceleradas que convierten la experimentación en programas formales de registro. Las fuerzas armadas están priorizando los UGV para tareas que abarcan desde la logística y el despeje de rutas hasta el reconocimiento y la protección de la fuerza, lo que a su vez impulsa la inversión de los proveedores en plataformas comunes, arquitecturas abiertas y cargas útiles modulares para misiones.

- En febrero de 2025, la Dirección General de Adquisiciones de Defensa (DGA) francesa notificó un acuerdo marco (DROIDE) para la robótica terrestre, estableciendo una vía de adquisición para poner en servicio innovaciones robóticas terrestres a través de un acuerdo marco oficial y facilitando la cooperación entre múltiples socios y las contribuciones de la industria.

- En septiembre de 2024, el Departamento de Defensa de Australia publicó un artículo que describe el despliegue y uso de un sistema terrestre no tripulado (GUS) para tareas de inteligencia, vigilancia y reconocimiento, lo que demuestra la adopción operativa de UGV por parte de las unidades australianas y la intención de integrar dichos sistemas en las actividades rutinarias de la fuerza.

- En abril de 2024, el Ministerio de Defensa del Reino Unido publicó un discurso ministerial y materiales asociados que enfatizaban la robótica militar y los sistemas autónomos como prioridades de adquisición, y describían ensayos y demostraciones de capacidad que informarían la futura adquisición e integración de UGV en las estructuras de fuerza del Reino Unido.

Restricción/Desafío

Los altos costos de desarrollo e integración limitan una implementación más amplia

- Los elevados costos de desarrollo e integración de los vehículos terrestres no tripulados (UGV) siguen siendo un importante obstáculo para la expansión del mercado, ya que la autonomía avanzada, los conjuntos de sensores robustos, las arquitecturas de comunicaciones seguras y las cargas útiles específicas para cada misión requieren una inversión sustancial en investigación, pruebas y certificación de sistemas. Estos gastos limitan una adopción más amplia, especialmente entre agencias y empresas comerciales con presupuestos de capital limitados, y a menudo retrasan la transición de las etapas de prototipo a la implementación a gran escala.

- En febrero de 2024, Reuters informó que la inversión y las adquisiciones en algunos sectores de robótica se desaceleraron en medio de presiones económicas y de costos, y señaló que las empresas y los compradores estaban retrasando los pedidos porque los costos más altos y los presupuestos más ajustados reducían las compras a corto plazo; el elemento demuestra la sensibilidad a los costos comerciales que afecta la adopción de plataformas robóticas avanzadas.

- En julio de 2024, Defence Equipment & Support (UK MOD / DE&S) publicó su Informe Anual y Cuentas 2023 a 2024, que documenta las presiones de sostenimiento y adquisición en las plataformas terrestres y destaca el riesgo del programa y la incertidumbre de los costos en el equipamiento y el apoyo a nuevas tecnologías, como la colocación de nuevos vehículos autónomos.

Alcance del mercado de vehículos terrestres no tripulados en Oriente Medio y África

El mercado de vehículos terrestres no tripulados de Oriente Medio y África está segmentado en siete segmentos según el tamaño, el sistema, la movilidad, la propulsión, el modo de operación, la aplicación y la carga útil.

• Por tamaño

Sobre la base del tamaño, el mercado está segmentado en Micro UGVS (<10 LBS), Pequeño (10 - 200 LBS), Mediano (200 - 500 LBS), Grande (500 - 1000 LBS), Muy Grande (1000 - 2000 LBS), Extremadamente Grande (>2000 LBS). En 2026, se espera que el segmento pequeño (10-200 LBS) domine el mercado de vehículos terrestres no tripulados de Oriente Medio y África con una participación del 35,42 % y una CAGR del 6,8 %, impulsado por la creciente demanda de sistemas ligeros y portátiles. Estos UGV se adoptan ampliamente para reconocimiento, vigilancia, desactivación de municiones explosivas y logística táctica debido a su facilidad de despliegue y menores costes de adquisición. El creciente énfasis militar en la movilidad rápida, las operaciones urbanas y la protección de la fuerza respalda aún más el crecimiento de este segmento.

• Por sistema

Según el sistema, el mercado se segmenta en Cargas Útiles, Unidades de Control, Sistema de Potencia, Sistema de Navegación, Sistema de Chasis, Sistema de Comunicación y Otros. En 2026, se prevé que el segmento de cargas útiles domine el mercado de vehículos terrestres no tripulados (UTV) en Oriente Medio y África, con una cuota del 34,09 % y una tasa de crecimiento anual compuesta (TCAC) del 6,7 %, impulsado por la creciente demanda de sistemas de misión modulares. La creciente adopción de sensores avanzados, estaciones de armas, equipos de inteligencia, vigilancia y seguridad (ISR) y cargas útiles logísticas permite que los UGV desempeñen diversas funciones operativas. El enfoque de las fuerzas de defensa en arquitecturas abiertas y una rápida reconfiguración impulsa aún más la inversión en tecnologías de carga útil.

• Por Movilidad

En función de la movilidad, el mercado se segmenta en movilidad con ruedas, con orugas, con patas, híbrida y articulada. En 2026, se prevé que el segmento de vehículos terrestres no tripulados (UGV) domine el mercado de Oriente Medio y África, con una cuota del 53,78 % y una tasa de crecimiento anual compuesta (TCAC) del 7,8 %, gracias a su superior velocidad, movilidad y menores requisitos de mantenimiento. Los UGV con ruedas se utilizan ampliamente en misiones de logística, reconocimiento y patrullaje, ofreciendo flexibilidad operativa en terrenos urbanos y semiestructurados. La creciente demanda de sistemas terrestres rentables y de rápido despliegue impulsa aún más el crecimiento del segmento.

• Por propulsión

En cuanto a la propulsión, el mercado se segmenta en vehículos terrestres no tripulados (UGV) eléctricos, híbridos, diésel/gasolina, de pila de combustible de hidrógeno y con asistencia solar. En 2026, se prevé que el segmento eléctrico domine el mercado de vehículos terrestres no tripulados (UGV) en Oriente Medio y África, con una cuota del 64,14 % y una tasa de crecimiento anual compuesta (TCAC) del 8,1 %, gracias a su sólida capacidad de I+D, su amplia capacidad de producción y sus contratos de defensa consolidados. Estas empresas están invirtiendo fuertemente en tecnologías avanzadas de UGV, plataformas modulares y sistemas autónomos, lo que les permite satisfacer la creciente demanda militar y de seguridad en Oriente Medio y África. Las colaboraciones estratégicas y los acuerdos marco refuerzan aún más su liderazgo en el mercado.

• Por modo de operación

Según el modo de operación, el mercado se segmenta en teleoperado, anclado y autónomo. En 2026, se prevé que el segmento teleoperado domine el mercado de vehículos terrestres no tripulados (UGV) en Oriente Medio y África, con una cuota del 66,76 % y una tasa de crecimiento anual compuesta (TCAC) del 7,6 %, impulsado por la demanda de sistemas de control remoto que mejoran la seguridad y la precisión operativas. Estos UGV se utilizan ampliamente en misiones de reconocimiento, desactivación de artefactos explosivos y en entornos peligrosos, lo que permite al personal operar a una distancia segura. El crecimiento de las aplicaciones militares y de seguridad, junto con los avances tecnológicos en los sistemas de comunicación y control, impulsa aún más el crecimiento del segmento.

• Por aplicación

Según su aplicación, el mercado se segmenta en Comercial, Militar, Fuerzas del Orden Federales y Fuerzas del Orden. En 2026, se prevé que el segmento militar domine el mercado de vehículos terrestres no tripulados (UGV) en Oriente Medio y África, con una cuota del 45,50 % y una tasa de crecimiento anual compuesta (TCAC) del 8,2 %, impulsado por las crecientes iniciativas de modernización de la defensa y la creciente demanda de sistemas autónomos y operados remotamente. Los UGV se utilizan ampliamente para reconocimiento, logística, protección de fuerzas y apoyo en combate, lo que mejora la eficiencia operativa y reduce el riesgo para el personal. La creciente inversión en IA, integración de sensores y cargas útiles modulares acelera aún más su adopción en aplicaciones militares.

• Por carga útil

Sobre la base de la carga útil, el mercado está segmentado en servicio ligero (menos de 50 kg), servicio medio (50-200 kg), servicio pesado (200-1.000 kg), servicio ultra pesado (>1.000 kg. En 2025, servicio ligero (menos de 50 kg. En 2026, se espera que el segmento de servicio ligero (menos de 50 kg) domine el mercado de vehículos terrestres no tripulados de Oriente Medio y África con una participación del 52,96% y una CAGR del 7,5%, impulsado por la creciente necesidad de sistemas altamente portátiles y de fácil implementación. Estos UGV son ideales para misiones de reconocimiento, vigilancia y apoyo táctico, ofreciendo una movilidad rápida y una carga logística reducida. La creciente adopción por parte de usuarios militares, policiales y comerciales de operaciones flexibles y rentables impulsa aún más el crecimiento del mercado.

Análisis regional del mercado de vehículos terrestres no tripulados en Oriente Medio y África

Arabia Saudita domina el mercado de vehículos terrestres no tripulados en Oriente Medio y África, con la mayor cuota de mercado, un 25,70 % en 2026. Este mercado está impulsado por la modernización de la defensa, el refuerzo de la seguridad fronteriza y las iniciativas Visión 2030. El aumento de las inversiones en vehículos terrestres no tripulados (UGV) autónomos de patrullaje, reconocimiento y logística refuerza la preparación militar y reduce el riesgo para el personal en terrenos difíciles.

Perspectiva del mercado de vehículos terrestres no tripulados en Israel, Oriente Medio y África

El mercado de vehículos terrestres no tripulados de Israel para Oriente Medio y África superó la cuota de mercado de Israel en Oriente Medio y África en 2025. Este mercado se ve impulsado por la I+D avanzada en defensa, las constantes amenazas a la seguridad y una sólida experiencia nacional en robótica. La alta demanda de vehículos terrestres no tripulados (UGV) autónomos de vigilancia, desactivación de artefactos explosivos (EOD) y apoyo al combate impulsa la rápida innovación y el despliegue temprano en las fuerzas de defensa.

Cuota de mercado de vehículos terrestres no tripulados en Oriente Medio y África

El mercado de vehículos terrestres no tripulados de Oriente Medio y África está liderado principalmente por empresas bien establecidas, entre las que se incluyen:

- General Dynamics Land Systems (EE. UU.)

- Rheinmetall AG (Alemania)

- Elbit Systems Ltd. (Israel)

- Textron Systems (EE. UU.)

- Thales (Francia)

- Teledyne FLIR Defense Inc. (EE. UU.)

- Leonardo SpA (Italia)

- QinetiQ (Reino Unido)

- ST Engineering (Singapur)

- Peraton (Estados Unidos)

- AeroVironment, Inc. (EE. UU.)

- Grupo Hanwha (Corea del Sur)

- HYUNDAI ROTEM COMPANY (Corea del Sur)

- DOK-ING Ltd. (Croacia)

- Equipo robot (Israel)

- Industrias Aeroespaciales de Israel (IAI) (Israel)

- Ghost Robotics (EE. UU.)

- Milrem AS (Estonia)

- Edgeforce (Reino Unido)

- ASELSAN A.Ş. (Turquía)

Últimos avances en el mercado de vehículos terrestres no tripulados en Oriente Medio y África

- En diciembre de 2025, General Dynamics Land Systems (GDLS) anunció una demostración exitosa del lanzador de municiones merodeadoras PERCH desarrollado en conjunto con AeroVironment, mostrando la integración de las municiones merodeadoras Switchblade 300 y Switchblade 600 en vehículos de combate blindados para mejorar las capacidades de vigilancia y letalidad más allá de la línea de visión durante una demostración en el evento Machine Assisted Rugged Sapper del Ejército de EE. UU.

- En diciembre de 2025, Thales presentó Sonar 76Nano, un nuevo sistema de detección acústica miniaturizado diseñado para revolucionar el conocimiento del espacio de batalla submarino al extender las capacidades avanzadas del sonar (incluida la detección mejorada por IA, el mapeo del fondo marino y la mensajería de baja probabilidad de detección) a través de una gama más amplia de plataformas navales, incluidos vehículos submarinos no tripulados, en apoyo de las prioridades de seguridad marítima del Reino Unido y sus aliados.

- En marzo de 2025, AV, a través de su filial Telerob, se adjudicó un importante contrato para el suministro de 41 vehículos terrestres no tripulados (UGV) telemax™ HT300 de gran tamaño y avanzados a las Fuerzas Armadas Federales Alemanas. Las entregas iniciales comenzarán en el verano de 2025 y los pedidos adicionales se extenderán hasta 2027. Seleccionado tras un proceso de adquisición competitivo, el HT300 está diseñado específicamente para misiones de alto riesgo contra artefactos explosivos improvisados (EOD) y artefactos explosivos improvisados (IED), y ofrece un brazo manipulador avanzado, tracción excepcional y movilidad en terrenos complejos e inestables. Los sistemas se fabricarán en las instalaciones de vanguardia de Telerob en Ostfildern (Alemania), lo que refuerza la colaboración estratégica de AV con las Fuerzas Armadas Alemanas y fortalece su reputación y presencia en el mercado de soluciones avanzadas de UGV.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 SIZE TIMELINE CURVE

2.8 MARKET APPLICATION COVERAGE GRID

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 CASE STUDY ANALYSIS

4.2.1 CASE STUDY: DEPLOYMENT OF THEMIS UNMANNED GROUND VEHICLE AND ITS IMPACT ON MILITARY LOGISTICS AND COMBAT SUPPORT OPERATIONS

4.2.1.1 BACKGROUND AND STRATEGIC CONTEXT

4.2.1.2 OPERATIONAL CHALLENGES PRIOR TO UGV INTEGRATION

4.2.1.2.1 HIGH PERSONNEL RISK IN FRONTLINE AND SUPPORT MISSIONS

4.2.1.2.2 LOGISTICAL CONSTRAINTS IN CONTESTED AND REMOTE TERRAIN

4.2.1.2.3 DEMAND FOR ENHANCED SITUATIONAL AWARENESS

4.2.1.3 TECHNOLOGICAL AND OPERATIONAL MEASURES INTRODUCED

4.2.1.3.1 MODULAR UGV ARCHITECTURE

4.2.1.3.2 REMOTE AND SEMI-AUTONOMOUS OPERATION

4.2.1.3.3 INTEGRATION WITH EXISTING FORCE STRUCTURES

4.2.1.4 IMPACT ON MILITARY OPERATIONS AND LOGISTICS EFFICIENCY

4.2.1.4.1 IMPROVED LOGISTICS CONTINUITY

4.2.1.4.2 REDUCED EXPOSURE OF HUMAN PERSONNEL

4.2.1.4.3 ENHANCED OPERATIONAL FLEXIBILITY

4.2.1.4.4 SUPPORT FOR MULTI-DOMAIN OPERATIONS

4.2.1.5 LIMITATIONS AND LESSONS LEARNED

4.2.1.5.1 DEPENDENCE ON COMMUNICATIONS AND CONTROL SYSTEMS

4.2.1.5.2 CONSTRAINTS ON FULL AUTONOMY IN COMPLEX ENVIRONMENTS

4.2.2 CASE STUDY: MULTIFUNCTIONAL UNMANNED GROUND VEHICLES IN EMERGENCY RESPONSE AND PUBLIC SAFETY OPERATIONS

4.2.2.1 BACKGROUND AND STRATEGIC CONTEXT

4.2.2.2 OPERATIONAL CHALLENGES BEFORE UGV DEPLOYMENT

4.2.2.2.1 HIGH RISK TO FIRST RESPONDERS

4.2.2.2.2 DELAYS IN INCIDENT ASSESSMENT

4.2.2.3 TECHNOLOGICAL MEASURES INTRODUCED

4.2.2.3.1 INTEGRATED SENSORS AND MANIPULATION TOOLS

4.2.2.3.2 REMOTE COMMAND AND CONTROL OPERATIONS

4.2.2.4 IMPACT ON EMERGENCY RESPONSE EFFECTIVENESS

4.2.2.4.1 IMPROVED RESPONDER SAFETY

4.2.2.4.2 FASTER AND MORE INFORMED DECISION-MAKING

4.3 CONSUMER BUYING BEHAVIOUR

4.4 CONSUMER PURCHASE DECISION PROCESS

4.4.1 PROBLEM RECOGNITION

4.4.2 INFORMATION SEARCH

4.4.3 ALTERNATIVE EVALUATION

4.4.4 PURCHASE DECISION

4.4.5 POST-PURCHASE BEHAVIOR

4.4.6 INFLUENCING FACTORS

4.5 KEY STRATEGIC INITIATIVES

4.5.1 INTEGRATION OF UGVS INTO MULTI-DOMAIN DEFENCE AND SECURITY ARCHITECTURES

4.5.1.1 CONVERGENCE OF LAND, AIR, AND COMMAND-AND-CONTROL SYSTEMS

4.5.1.2 INTEROPERABILITY WITH EXISTING MILITARY AND HOMELAND SECURITY ASSETS

4.5.1.3 Coordination of Multimodal Transport Networks

4.5.2 EMPHASIS ON AUTONOMY, ARTIFICIAL INTELLIGENCE AND ADVANCED SENSING

4.5.2.1 ADVANCEMENT OF SEMI-AUTONOMOUS AND AUTONOMOUS NAVIGATION

4.5.2.2 INTEGRATION OF MULTI-SENSOR AND PERCEPTION SYSTEMS

4.5.3 PLATFORM MODULARITY AND MISSION-SPECIFIC CONFIGURABILITY

4.5.3.1 DEVELOPMENT OF MODULAR PAYLOAD AND CHASSIS DESIGNS

4.5.3.2 SUPPORT FOR DUAL-USE AND CIVIL–MILITARY APPLICATIONS

4.5.4 LOCALISATION, DOMESTIC MANUFACTURING AND SUPPLY CHAIN RESILIENCE

4.5.4.1 ALIGNMENT WITH NATIONAL DEFENCE INDUSTRIAL POLICIES

4.5.4.2 STRENGTHENING OF REGIONAL SUPPLY AND MAINTENANCE ECOSYSTEMS

4.5.5 CYBERSECURITY, RELIABILITY AND OPERATIONAL RESILIENCE

4.5.5.1 INTEGRATION OF SECURE COMMUNICATION AND CYBER HARDENING

4.5.5.2 DESIGN FOR HARSH AND CONTESTED ENVIRONMENTS

4.5.6 EXPANSION OF INTERNATIONAL COLLABORATIONS AND DEFENCE PARTNERSHIPS

4.5.6.1 CROSS-BORDER TECHNOLOGY COLLABORATION AND JOINT PROGRAMS

4.5.6.2 PARTICIPATION IN MIDDLE EAST AND AFRICA DEFENCE MODERNISATION PROGRAMS

4.6 REGIONAL GROWTH OPPORTUNITIES

4.6.1 NORTH AMERICA — ADVANCED DEFENCE DOCTRINE AND TECHNOLOGY LEADERSHIP

4.6.1.1 INSTITUTIONALISATION OF ROBOTIC AND AUTONOMOUS GROUND SYSTEMS

4.6.1.2 BORDER SECURITY, BASE PROTECTION AND HOMELAND APPLICATIONS

4.6.2 EUROPE — MULTINATIONAL COOPERATION AND TERRITORIAL SECURITY

4.6.2.1 COLLECTIVE DEFENCE AND INTEROPERABILITY-DRIVEN DEMAND

4.6.2.2 HEIGHTENED FOCUS ON BORDER SURVEILLANCE AND INFRASTRUCTURE PROTECTION

4.6.3 ASIA–PACIFIC — STRATEGIC TENSIONS AND DUAL-USE EXPANSION

4.6.3.1 BORDER MANAGEMENT AND TERRAIN-INTENSIVE OPERATIONS

4.6.3.2 DISASTER RESPONSE, URBAN SAFETY AND CIVIL APPLICATIONS

4.6.4 MIDDLE EAST — BORDER CONTROL AND CRITICAL ASSET SECURITY

4.6.4.1 PROTECTION OF ENERGY AND STRATEGIC INFRASTRUCTURE

4.6.4.2 LOCAL DEFENCE INDUSTRIAL DEVELOPMENT

4.6.5 CONCLUSION

4.7 TECHNOLOGICAL ADVANCEMENTS

4.7.1 OVERVIEW

4.7.2 AUTONOMOUS NAVIGATION AND ADVANCED SLAM CAPABILITIES

4.7.3 ARTIFICIAL INTELLIGENCE–DRIVEN PERCEPTION AND SENSOR FUSION

4.7.4 EDGE COMPUTING AND ON-BOARD AUTONOMY

4.7.5 SWARMING TECHNOLOGIES AND MULTI-VEHICLE COORDINATION

4.7.6 MODULAR DESIGN AND OPEN-SYSTEM ARCHITECTURES

4.7.7 DIGITAL TWINS, SIMULATION, AND SYNTHETIC TRAINING ENVIRONMENTS

4.7.8 CONCLUSION

4.8 PRICING ANALYSIS

4.9 COMPANY COMPARATIVE ANALYSIS: TOP SELLING MODEL VS PRICE RANGE

4.1 IMPORT EXPORT SCENARIO

4.10.1 COUNTRY-LEVEL PATTERNS

4.10.2 COMPANY-LEVEL TRADE BEHAVIOR

4.11 SUSTAINABILITY INITIATIVES

4.11.1 SUSTAINABILITY DRIVERS IN THE UGV MARKET:

4.11.2 REAL-TIME EXAMPLES: SUSTAINABILITY IN PRACTICE

4.11.2.1 Defense Sector: Hybridization and Fuel Reduction

4.11.2.2 Active Combat Logistics: Resource Optimization

4.11.2.3 Agriculture: Direct Environmental Sustainability Impact

4.11.2.4 Disaster Response & Hazard Mitigation

4.11.3 CROSS-CUTTING SUSTAINABILITY THEMES

4.11.4 STRATEGIC IMPLICATIONS FOR THE UGV MARKET

4.12 TECHNOLOGICAL TRENDS

4.13 SUPPLY CHAIN ANALYSIS

4.13.1 RAW MATERIALS AND FOUNDATIONAL INPUTS

4.13.2 CORE COMPONENT MANUFACTURING

4.13.3 SENSORS, ELECTRONICS, AND SUBSYSTEMS

4.13.4 SOFTWARE, AUTONOMY, AND CONTROL SYSTEMS

4.13.5 SYSTEM INTEGRATION AND FINAL ASSEMBLY

4.13.6 DISTRIBUTION, DEPLOYMENT, AND LIFECYCLE SUPPORT

5 REGULATORY STANDARDS

5.1 DEFENSE AND MILITARY PROCUREMENT FRAMEWORKS

5.1.1 NATIONAL DEFENSE ACQUISITION SYSTEMS

5.1.2 REGULATIONS ON WEAPONIZATION AND AUTONOMOUS ENGAGEMENT

5.2 SAFETY AND OPERATIONAL COMPLIANCE STANDARDS

5.2.1 INTERNATIONAL ROBOTICS AND FUNCTIONAL SAFETY STANDARDS

5.2.2 SECTOR-SPECIFIC OPERATIONAL SAFETY REQUIREMENTS

5.3 COMMUNICATION, SPECTRUM, AND CYBERSECURITY REGULATIONS

5.3.1 RADIOFREQUENCY SPECTRUM GOVERNANCE

5.3.2 CYBERSECURITY AND ENCRYPTION COMPLIANCE

5.4 ARTIFICIAL INTELLIGENCE, AUTONOMY AND ETHICAL GOVERNANCE

5.4.1 INTERNATIONAL AI PRINCIPLES AND HUMAN-CONTROL REQUIREMENTS

5.4.2 NATIONAL AND REGIONAL AI REGULATORY POLICIES

5.5 EXPORT CONTROL AND CROSS-BORDER TRADE REGULATIONS

5.5.1 CONTROL OF DUAL-USE TECHNOLOGIES

5.5.2 SANCTIONS AND MARKET ACCESS LIMITATIONS

5.6 CERTIFICATION, TESTING, AND FIELD DEPLOYMENT STANDARDS

5.6.1 DEFENSE OPERATIONAL TESTING AND EVALUATION

5.6.2 INDUSTRIAL AND COMMERCIAL COMPLIANCE PATHWAYS

5.7 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVER

6.1.1 DEFENCE MODERNIZATION PROGRAMS ACCELERATING MIDDLE EAST AND AFRICA UGV PROCUREMENT MOMENTUM

6.1.2 ADVANCEMENTS IN AI AND SENSORS ENABLING HIGHER-AUTONOMY CAPABILITIES

6.1.3 EXPANDING COMMERCIAL ADOPTION ACROSS MINING, AGRICULTURE, AND LOGISTICS

6.1.4 GROWING USAGE OF UNMANNED GROUND VEHICLES IN AREAS AFFECTED BY CBRN ATTACKS

6.2 RESTRAINT

6.2.1 HIGH DEVELOPMENT AND INTEGRATION COSTS LIMITING WIDER DEPLOYMENT

6.2.2 EXPORT CONTROLS AND POLICY RESTRICTIONS CONSTRAINING MIDDLE EAST AND AFRICA SALES

6.3 OPPORTUNITIES

6.3.1 MODULAR MISSION-PAYLOAD DESIGNS UNLOCKING DIVERSIFIED APPLICATION SEGMENTS OF UGV

6.3.2 EXPANDING ROLE OF UNMANNED SYSTEMS IN MULTI-DOMAIN OPERATIONS

6.3.3 AFTERMARKET SERVICE AND SOFTWARE EXPANDING UGV PROFITABILITY POTENTIAL

6.4 CHALLENGES

6.4.1 CYBERSECURITY VULNERABILITIES CREATING OPERATIONAL AND SAFETY RISKS

6.4.2 RELIABILITY ISSUES IN HARSH, CONTESTED, AND REMOTE ENVIRONMENTS

7 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SIZE

7.1 OVERVIEW

7.2 MICRO UGVS (<10 LBS)

7.3 SMALL (10 - 200 LBS)

7.4 MEDIUM (200 - 500 LBS)

7.5 LARGE (500 – 1,000 LBS)

7.6 VERY LARGE (1,000 – 2,000 LBS)

7.7 EXTREMELY LARGE (>2,000 LBS)

7.8 MIDDLE EAST AND AFRICA MICRO UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.8.1 ASIA-PACIFIC

7.8.2 EUROPE

7.8.3 NORTH AMERICA

7.8.4 SOUTH AMERICA

7.8.5 MIDDLE EAST & AFRICA

7.9 MIDDLE EAST AND AFRICA SMALL IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.9.1 ASIA-PACIFIC

7.9.2 EUROPE

7.9.3 NORTH AMERICA

7.9.4 SOUTH AMERICA

7.9.5 MIDDLE EAST & AFRICA

7.1 MIDDLE EAST AND AFRICA MEDIUM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.10.1 ASIA-PACIFIC

7.10.2 EUROPE

7.10.3 NORTH AMERICA

7.10.4 SOUTH AMERICA

7.10.5 MIDDLE EAST & AFRICA

7.11 MIDDLE EAST AND AFRICA LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.11.1 ASIA-PACIFIC

7.11.2 EUROPE

7.11.3 NORTH AMERICA

7.11.4 SOUTH AMERICA

7.11.5 MIDDLE EAST & AFRICA

7.12 MIDDLE EAST AND AFRICA VERY LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.12.1 ASIA-PACIFIC

7.12.2 EUROPE

7.12.3 NORTH AMERICA

7.12.4 SOUTH AMERICA

7.12.5 MIDDLE EAST & AFRICA

7.13 MIDDLE EAST AND AFRICA EXTREMELY LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.13.1 ASIA-PACIFIC

7.13.2 EUROPE

7.13.3 NORTH AMERICA

7.13.4 SOUTH AMERICA

7.13.5 MIDDLE EAST & AFRICA

8 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM

8.1 OVERVIEW

8.2 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

8.2.1 PAYLOADS

8.2.2 CONTROLLER UNITS

8.2.3 POWER SYSTEM

8.2.4 NAVIGATION SYSTEM

8.2.5 CHASSIS SYSTEM

8.2.6 COMMUNICATION SYSTEM

8.2.7 OTHERS

8.3 MIDDLE EAST AND AFRICA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.3.1 CAMERAS

8.3.2 SENSORS

8.3.3 GPS ANTENNAS

8.3.4 LASERS

8.3.5 RADARS

8.3.6 MOTOR ENCODERS

8.3.7 ARTICULATED ARMS

8.3.8 OTHERS

8.4 MIDDLE EAST AND AFRICA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.4.1 ASIA-PACIFIC

8.4.2 EUROPE

8.4.3 NORTH AMERICA

8.4.4 SOUTH AMERICA

8.4.5 MIDDLE EAST & AFRICA

8.5 MIDDLE EAST AND AFRICA CONTROLLER IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.5.1 ASIA-PACIFIC

8.5.2 EUROPE

8.5.3 NORTH AMERICA

8.5.4 SOUTH AMERICA

8.5.5 MIDDLE EAST & AFRICA

8.6 MIDDLE EAST AND AFRICA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.6.1 ELECTRIC NON SOLAR RECHARGEABLE BATTERY

8.6.2 SOLAR RECHARGEABLE BATTERY

8.7 MIDDLE EAST AND AFRICA ELECTRIC NON SOLAR RECHARGABLE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.7.1 LITHIUM ION

8.7.2 LEAD ACID

8.7.3 NICKEL METAL HYDRIDE

8.7.4 NICKEL CADMIUM

8.8 MIDDLE EAST AND AFRICA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.8.1 ASIA-PACIFIC

8.8.2 EUROPE

8.8.3 NORTH AMERICA

8.8.4 SOUTH AMERICA

8.8.5 MIDDLE EAST & AFRICA

8.9 MIDDLE EAST AND AFRICA NAVIGATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.9.1 ASIA-PACIFIC

8.9.2 EUROPE

8.9.3 NORTH AMERICA

8.9.4 SOUTH AMERICA

8.9.5 MIDDLE EAST & AFRICA

8.1 MIDDLE EAST AND AFRICA CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.10.1 MOTOR

8.10.2 ACTUATOR

8.11 MIDDLE EAST AND AFRICA CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.11.1 ASIA-PACIFIC

8.11.2 EUROPE

8.11.3 NORTH AMERICA

8.11.4 SOUTH AMERICA

8.11.5 MIDDLE EAST & AFRICA

8.12 MIDDLE EAST AND AFRICA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.12.1 RF COMMUNICATION

8.12.2 SATELLITE COMMUNICATION

8.12.3 4G/5G COMMUNICATION

8.13 MIDDLE EAST AND AFRICA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.13.1 ASIA-PACIFIC

8.13.2 EUROPE

8.13.3 NORTH AMERICA

8.13.4 SOUTH AMERICA

8.13.5 MIDDLE EAST & AFRICA

8.14 MIDDLE EAST AND AFRICA OTHERS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.14.1 ASIA-PACIFIC

8.14.2 EUROPE

8.14.3 NORTH AMERICA

8.14.4 SOUTH AMERICA

8.14.5 MIDDLE EAST & AFRICA

9 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY

9.1 OVERVIEW

9.2 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

9.2.1 WHEELED

9.2.2 TRACKED

9.2.3 LEGGED

9.2.4 HYBRID

9.2.5 SNAKE/ARTICULATED MOBILITY

9.3 MIDDLE EAST AND AFRICA WHEELED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.3.1 ASIA-PACIFIC

9.3.2 EUROPE

9.3.3 NORTH AMERICA

9.3.4 SOUTH AMERICA

9.3.5 MIDDLE EAST & AFRICA

9.4 MIDDLE EAST AND AFRICA TRACKED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.4.1 ASIA-PACIFIC

9.4.2 EUROPE

9.4.3 NORTH AMERICA

9.4.4 SOUTH AMERICA

9.4.5 MIDDLE EAST & AFRICA

9.5 MIDDLE EAST AND AFRICA LEGGED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.5.1 ASIA-PACIFIC

9.5.2 EUROPE

9.5.3 NORTH AMERICA

9.5.4 SOUTH AMERICA

9.5.5 MIDDLE EAST & AFRICA

9.6 MIDDLE EAST AND AFRICA HYBRID IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.6.1 ASIA-PACIFIC

9.6.2 EUROPE

9.6.3 NORTH AMERICA

9.6.4 SOUTH AMERICA

9.6.5 MIDDLE EAST & AFRICA

9.7 MIDDLE EAST AND AFRICA SNAKE/ARTICULATED MOBILITY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.7.1 ASIA-PACIFIC

9.7.2 EUROPE

9.7.3 NORTH AMERICA

9.7.4 SOUTH AMERICA

9.7.5 MIDDLE EAST & AFRICA

10 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION

10.1 OVERVIEW

10.2 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

10.2.1 TELEOPERATED

10.2.2 TETHERED

10.2.3 AUTONOMOUS

10.3 MIDDLE EAST AND AFRICA TELEOPERATED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

10.3.1 ASIA-PACIFIC

10.3.2 EUROPE

10.3.3 NORTH AMERICA

10.3.4 SOUTH AMERICA

10.3.5 MIDDLE EAST & AFRICA

10.4 MIDDLE EAST AND AFRICA TETHERED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

10.4.1 ASIA-PACIFIC

10.4.2 EUROPE

10.4.3 NORTH AMERICA

10.4.4 SOUTH AMERICA

10.4.5 MIDDLE EAST & AFRICA

10.5 MIDDLE EAST AND AFRICA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

10.5.1 SEMI-AUTONOMOUS

10.5.2 FULLY AUTONOMOUS

10.6 MIDDLE EAST AND AFRICA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

10.6.1 ASIA-PACIFIC

10.6.2 EUROPE

10.6.3 NORTH AMERICA

10.6.4 SOUTH AMERICA

10.6.5 MIDDLE EAST & AFRICA

11 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD

11.1 OVERVIEW

11.2 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

11.2.1 LIGHT DUTY (LESS THAN 50 KG

11.2.2 MEDIUM DUTY (50–200 KG)

11.2.3 HEAVY DUTY (200–1,000 KG)

11.2.4 ULTRA-HEAVY DUTY (>1,000 KG)

11.3 MIDDLE EAST AND AFRICA LIGHT DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

11.3.1 ASIA-PACIFIC

11.3.2 EUROPE

11.3.3 NORTH AMERICA

11.3.4 SOUTH AMERICA

11.3.5 MIDDLE EAST & AFRICA

11.4 MIDDLE EAST AND AFRICA MEDIUM DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

11.4.1 ASIA-PACIFIC

11.4.2 EUROPE

11.4.3 NORTH AMERICA

11.4.4 SOUTH AMERICA

11.4.5 MIDDLE EAST & AFRICA

11.5 MIDDLE EAST AND AFRICA HEAVY DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

11.5.1 ASIA-PACIFIC

11.5.2 EUROPE

11.5.3 NORTH AMERICA

11.5.4 SOUTH AMERICA

11.5.5 MIDDLE EAST & AFRICA

11.6 MIDDLE EAST AND AFRICA ULTRA HEAVY DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

11.6.1 ASIA-PACIFIC

11.6.2 EUROPE

11.6.3 NORTH AMERICA

11.6.4 SOUTH AMERICA

11.6.5 MIDDLE EAST & AFRICA

12 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION

12.1 OVERVIEW

12.2 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

12.2.1 ELECTRIC

12.2.2 HYBRID

12.2.3 DIESEL/GASOLINE POWERED

12.2.4 HYDROGEN FUEL CELL UGVS

12.2.5 SOLAR-ASSISTED UGVS

12.3 MIDDLE EAST AND AFRICA ELECTRIC IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.3.1 ASIA-PACIFIC

12.3.2 EUROPE

12.3.3 NORTH AMERICA

12.3.4 SOUTH AMERICA

12.3.5 MIDDLE EAST & AFRICA

12.4 MIDDLE EAST AND AFRICA HYBRID IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.4.1 ASIA-PACIFIC

12.4.2 EUROPE

12.4.3 NORTH AMERICA

12.4.4 SOUTH AMERICA

12.4.5 MIDDLE EAST & AFRICA

12.5 MIDDLE EAST AND AFRICA DIESEL/GASOLINE POWERED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.5.1 ASIA-PACIFIC

12.5.2 EUROPE

12.5.3 NORTH AMERICA

12.5.4 SOUTH AMERICA

12.5.5 MIDDLE EAST & AFRICA

12.6 MIDDLE EAST AND AFRICA HYDROGEN FUEL CELL UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.6.1 ASIA-PACIFIC

12.6.2 EUROPE

12.6.3 NORTH AMERICA

12.6.4 SOUTH AMERICA

12.6.5 MIDDLE EAST & AFRICA

12.7 MIDDLE EAST AND AFRICA SOLAR ASSISTED UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.7.1 ASIA-PACIFIC

12.7.2 EUROPE

12.7.3 NORTH AMERICA

12.7.4 SOUTH AMERICA

12.7.5 MIDDLE EAST & AFRICA

13 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

13.2.1 COMMERCIAL

13.2.2 MILITARY

13.2.3 FEDERAL LAW ENFORCEMENT

13.2.4 LAW ENFORCEMENT

13.3 MIDDLE EAST AND AFRICA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.3.1 FIREFIGHTING

13.3.2 AUTONOMOUS DELIVERY

13.3.3 CBRN

13.3.4 PHYSICAL SECURITY

13.3.5 AGRICULTURE

13.3.6 DOMESTIC

13.3.7 OIL & GAS

13.3.8 WAREHOUSE & LOGISTICS

13.3.9 OTHERS

13.4 MIDDLE EAST AND AFRICA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.4.1 SPRAYING

13.4.2 MOWING

13.4.3 TILLING

13.5 MIDDLE EAST AND AFRICA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.5.1 INSPECTION

13.5.2 HAULAGE

13.6 MIDDLE EAST AND AFRICA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.6.1 SORTING ROBOTS

13.6.2 PALLET MOVERS

13.7 MIDDLE EAST AND AFRICA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

13.7.1 ASIA-PACIFIC

13.7.2 EUROPE

13.7.3 NORTH AMERICA

13.7.4 SOUTH AMERICA

13.7.5 MIDDLE EAST & AFRICA

13.8 MIDDLE EAST AND AFRICA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.8.1 TRANSPORTATION

13.8.2 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE (ISR)

13.8.3 EXPLOSIVE ORDNANCE DISPOSAL

13.8.4 SEARCH & RESCUE

13.8.5 FIREFIGHTING

13.8.6 COMBAT SUPPORT

13.8.7 MINE CLEARANCE

13.8.8 OTHERS

13.9 MIDDLE EAST AND AFRICA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

13.9.1 ASIA-PACIFIC

13.9.2 EUROPE

13.9.3 NORTH AMERICA

13.9.4 SOUTH AMERICA

13.9.5 MIDDLE EAST & AFRICA

13.1 MIDDLE EAST AND AFRICA FEDERAL LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

13.10.1 ASIA-PACIFIC

13.10.2 EUROPE

13.10.3 NORTH AMERICA

13.10.4 SOUTH AMERICA

13.10.5 MIDDLE EAST & AFRICA

13.11 MIDDLE EAST AND AFRICA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.11.1 BOMB DISPOSAL UNITS

13.11.2 RIOT CONTROL ROBOTS

13.11.3 URBAN SURVEILLANCE ROBOTS

13.12 MIDDLE EAST AND AFRICA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

13.12.1 ASIA-PACIFIC

13.12.2 EUROPE

13.12.3 NORTH AMERICA

13.12.4 SOUTH AMERICA

13.12.5 MIDDLE EAST & AFRICA

14 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SAUDI ARABIA

14.1.2 ISRAEL

14.1.3 UNITED ARAB EMIRATES

14.1.4 EGYPT

14.1.5 SOUTH AFRICA

14.1.6 KUWAIT

14.1.7 OMAN

14.1.8 QATAR

14.1.9 BAHRAIN

14.1.10 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET

15.1 COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 GENERAL DYNAMICS LAND SYSTEMS

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 RHEINMETALL AG

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 ELBIT SYSTEMS LTD.

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 TEXTRON SYSTEMS

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 THALES

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 AEROVIRONMENT, INC

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 ASELSAN A.Ş.

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 DOK-ING

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 EDGEFORCE

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 GHOSTROBOTICS.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 HANWHA AEROSPACE

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENT

17.12 HYUNDAI ROTEM COMPANY.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 IAI

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 LEONARDO S.P.A.

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT

17.15 MILREM AS

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 PERATON

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 QINETIQ

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 ROBOTEAM

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 ST ENGINEERING

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENT

17.2 TELEDYNE FLIR DEFENSE INC.

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 COMPANY COMPARATIVE ANALYSIS

TABLE 2 TECHNOLOGICAL DEVELOPMENT

TABLE 3 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA MICRO UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA SMALL IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA MEDIUM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA VERY LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA EXTREMELY LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA CONTROLLER IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA ELECTRIC NON SOLAR RECHARGABLE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA NAVIGATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA OTHERS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA WHEELED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA TRACKED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA LEGGED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA HYBRID IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA SNAKE/ARTICULATED MOBILITY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA TELEOPERATED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA TETHERED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA LIGHT DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA MEDIUM DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA HEAVY DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA ULTRA HEAVY DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA ELECTRIC IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA HYBRID IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA DIESEL/GASOLINE POWERED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA HYDROGEN FUEL CELL UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA SOLAR ASSISTED UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA FEDERAL LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY COUNTRY, 2019-2033 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY COUNTRY, 2019-2033 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA

TABLE 59 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA ELECTRIC NON SOLAR RECHARGABLE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 78 SAUDI ARABIA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 79 SAUDI ARABIA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 80 SAUDI ARABIA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 81 SAUDI ARABIA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 82 SAUDI ARABIA ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 83 SAUDI ARABIA CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 84 SAUDI ARABIA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 85 SAUDI ARABIA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 86 SAUDI ARABIA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 87 SAUDI ARABIA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 88 SAUDI ARABIA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 89 SAUDI ARABIA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 90 SAUDI ARABIA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 91 SAUDI ARABIA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 92 SAUDI ARABIA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 93 SAUDI ARABIA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 94 SAUDI ARABIA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 95 SAUDI ARABIA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 96 SAUDI ARABIA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 97 ISRAEL UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 98 ISRAEL UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 99 ISRAEL PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 100 ISRAEL POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 101 ISRAEL ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 102 ISRAEL CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 103 ISRAEL COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 104 ISRAEL UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 105 ISRAEL UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 106 ISRAEL AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 107 ISRAEL UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 108 ISRAEL UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 109 ISRAEL UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 110 ISRAEL COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 111 ISRAEL AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 112 ISRAEL OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 113 ISRAEL WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 114 ISRAEL MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 115 ISRAEL LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 116 UNITED ARAB EMIRATESUNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 117 UNITED ARAB EMIRATESUNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 118 UNITED ARAB EMIRATESPAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 119 UNITED ARAB EMIRATESPOWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 120 UNITED ARAB EMIRATESELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 121 UNITED ARAB EMIRATESCHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 122 UNITED ARAB EMIRATESCOMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 123 UNITED ARAB EMIRATESUNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 124 UNITED ARAB EMIRATESUNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 125 UNITED ARAB EMIRATESAUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 126 UNITED ARAB EMIRATESUNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 127 UNITED ARAB EMIRATESUNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 128 UNITED ARAB EMIRATESUNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 129 UNITED ARAB EMIRATESCOMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 130 UNITED ARAB EMIRATESAGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 131 UNITED ARAB EMIRATESOIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 132 UNITED ARAB EMIRATESWAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 133 UNITED ARAB EMIRATESMILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 134 UNITED ARAB EMIRATESLAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 135 EGYPT UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 136 EGYPT UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 137 EGYPT PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 138 EGYPT POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 139 EGYPT ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 140 EGYPT CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 141 EGYPT COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 142 EGYPT UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 143 EGYPT UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 144 EGYPT AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 145 EGYPT UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 146 EGYPT UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 147 EGYPT UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 148 EGYPT COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 149 EGYPT AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 150 EGYPT OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 151 EGYPT WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 152 EGYPT MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 153 EGYPT LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 154 SOUTH AFRICA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 155 SOUTH AFRICA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 156 SOUTH AFRICA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 157 SOUTH AFRICA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 158 SOUTH AFRICA ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 159 SOUTH AFRICA CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 160 SOUTH AFRICA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 161 SOUTH AFRICA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 162 SOUTH AFRICA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 163 SOUTH AFRICA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 164 SOUTH AFRICA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 165 SOUTH AFRICA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 166 SOUTH AFRICA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 167 SOUTH AFRICA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 168 SOUTH AFRICA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 169 SOUTH AFRICA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 170 SOUTH AFRICA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 171 SOUTH AFRICA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 172 SOUTH AFRICA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 173 KUWAIT UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 174 KUWAIT UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 175 KUWAIT PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 176 KUWAIT POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 177 KUWAIT ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 178 KUWAIT CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 179 KUWAIT COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 180 KUWAIT UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 181 KUWAIT UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 182 KUWAIT AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 183 KUWAIT UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 184 KUWAIT UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 185 KUWAIT UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 186 KUWAIT COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 187 KUWAIT AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 188 KUWAIT OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 189 KUWAIT WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 190 KUWAIT MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 191 KUWAIT LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 192 OMAN UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 193 OMAN UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 194 OMAN PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 195 OMAN POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 196 OMAN ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 197 OMAN CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 198 OMAN COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 199 OMAN UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 200 OMAN UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 201 OMAN AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 202 OMAN UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 203 OMAN UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 204 OMAN UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 205 OMAN COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 206 OMAN AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 207 OMAN OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 208 OMAN WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 209 OMAN MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 210 OMAN LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 211 QATAR UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 212 QATAR UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 213 QATAR PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 214 QATAR POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 215 QATAR ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 216 QATAR CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 217 QATAR COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 218 QATAR UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 219 QATAR UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 220 QATAR AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 221 QATAR UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 222 QATAR UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 223 QATAR UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 224 QATAR COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 225 QATAR AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 226 QATAR OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 227 QATAR WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 228 QATAR MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 229 QATAR LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 230 BAHRAIN UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 231 BAHRAIN UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 232 BAHRAIN PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 233 BAHRAIN POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 234 BAHRAIN ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 235 BAHRAIN CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 236 BAHRAIN COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 237 BAHRAIN UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 238 BAHRAIN UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 239 BAHRAIN AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 240 BAHRAIN UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 241 BAHRAIN UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 242 BAHRAIN UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 243 BAHRAIN COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 244 BAHRAIN AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 245 BAHRAIN OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 246 BAHRAIN WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 247 BAHRAIN MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 248 BAHRAIN LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 249 REST OF MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 250 REST OF MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 251 REST OF MIDDLE EAST AND AFRICA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 252 REST OF MIDDLE EAST AND AFRICA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 253 REST OF MIDDLE EAST AND AFRICA ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 254 REST OF MIDDLE EAST AND AFRICA CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 255 REST OF MIDDLE EAST AND AFRICA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 256 REST OF MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 257 REST OF MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 258 REST OF MIDDLE EAST AND AFRICA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 259 REST OF MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 260 REST OF MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 261 REST OF MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 262 REST OF MIDDLE EAST AND AFRICA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 263 REST OF MIDDLE EAST AND AFRICA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 264 REST OF MIDDLE EAST AND AFRICA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 265 REST OF MIDDLE EAST AND AFRICA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 266 REST OF MIDDLE EAST AND AFRICA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 267 REST OF MIDDLE EAST AND AFRICA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

Lista de figuras

FIGURE 1 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET

FIGURE 2 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET: MULTIVARIATE MODELLING

FIGURE 7 UNMANNED GROUND VEHICLE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET: SEGMENTATION

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 SIX SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SIZE

FIGURE 15 ASIA-PACIFIC IS EXPECTED TO BE THE DOMINANT AND FASTEST GROWING REGION IN THE MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 16 DEFENSE MODERNIZATION PROGRAMS ACCELERATING MIDDLE EAST AND AFRICA UGV PROCUREMENT MOMENTUM IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET DURING THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 17 SMALL (10 - 200 LBS) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET IN 2026 & 2033

FIGURE 18 ASIA-PACIFIC IS THE FASTEST-GROWING REGION FOR THE MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 19 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, 2025-2033, AVERAGE SELLING PRICE (USD PER UNIT)

FIGURE 20 SWOT ANALYSIS

FIGURE 21 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2025

FIGURE 22 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2025

FIGURE 23 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2025

FIGURE 24 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2025

FIGURE 25 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2025

FIGURE 26 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2025

FIGURE 27 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2025

FIGURE 28 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, SNAPSHOT (2025)

FIGURE 29 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET: COMPANY SHARE 2025 (%)

Metodología de investigación