Mercado de software de tesorería de Oriente Medio y África, por sistema operativo (Windows, Linux, IOS, Android, MAC), aplicación (gestión de liquidez y efectivo, gestión de inversiones, gestión de deuda, gestión de riesgo financiero, gestión de cumplimiento, planificación fiscal, otros), modo de implementación (en las instalaciones, en la nube), tamaño de la organización (grandes empresas y pequeñas y medianas empresas), vertical (banca, servicios financieros y seguros, gobierno, fabricación, atención médica, bienes de consumo, productos químicos , energía y otros) - Tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de software de tesorería en Oriente Medio y África

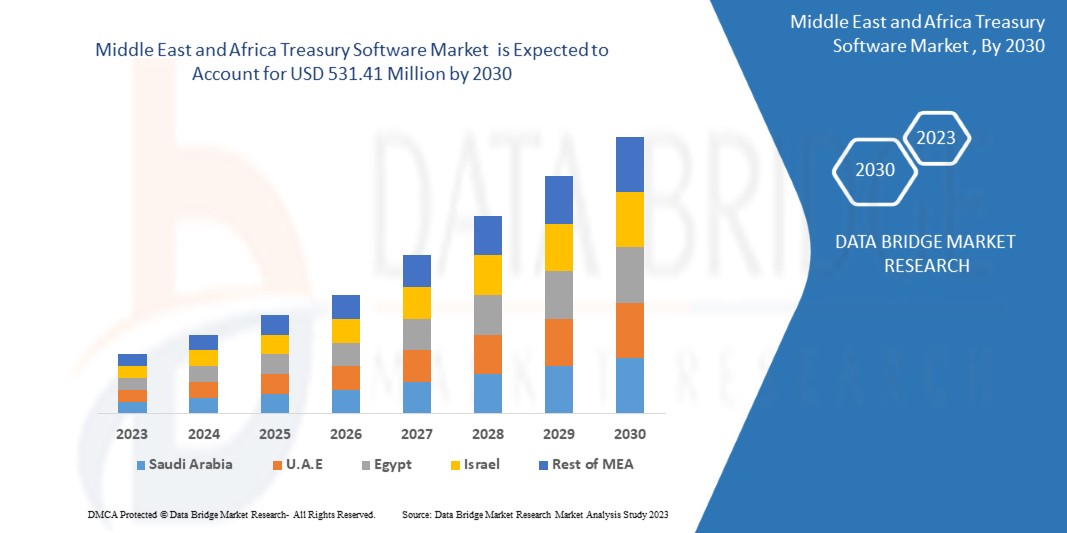

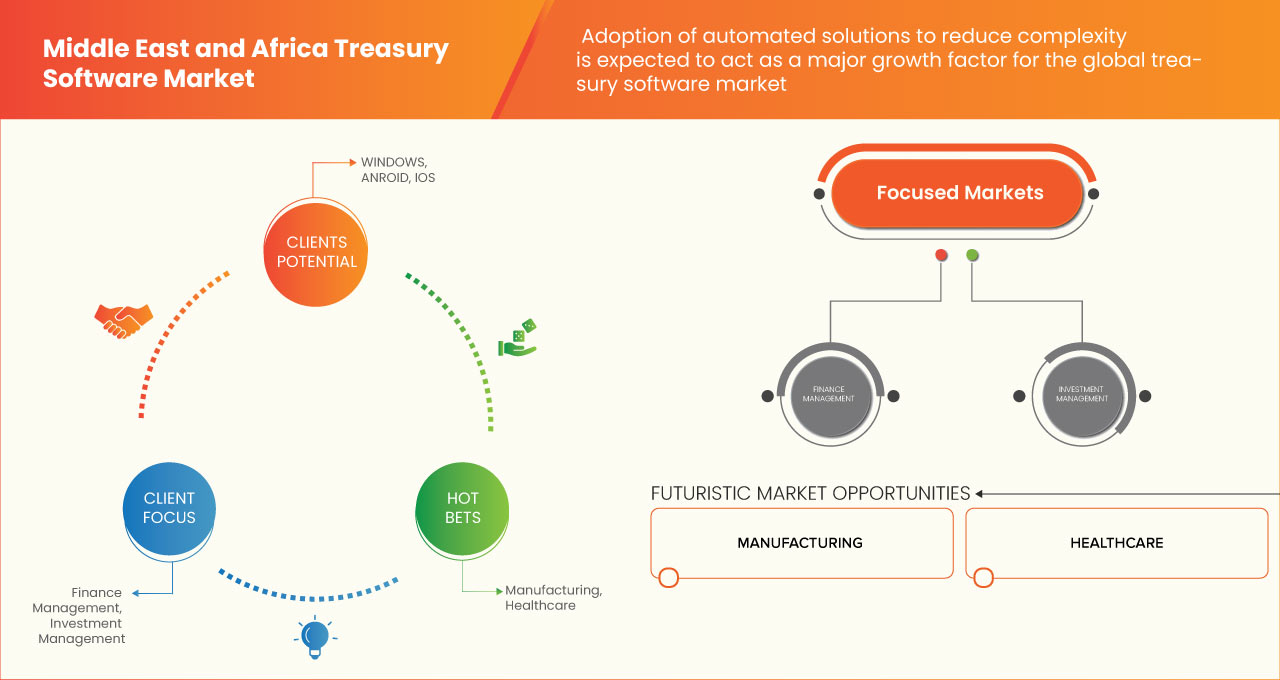

Se espera que el mercado de software de tesorería de Oriente Medio y África gane crecimiento de mercado en el período de pronóstico de 2023 a 2030. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 2,5% en el período de pronóstico de 2023 a 2030 y se espera que alcance los USD 531,41 millones para 2030. Se espera que el aumento en el requisito de un proceso de toma de decisiones rápidas en biotecnología impulse significativamente el crecimiento del mercado.

El informe de mercado de software de tesorería de Oriente Medio y África proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2020-2016) |

|

Unidades cuantitativas |

Ingresos en miles de USD, precios en USD |

|

Segmentos cubiertos |

Sistema operativo (Windows, Linux, IOS, Android, MAC), aplicación (gestión de liquidez y efectivo, gestión de inversiones, gestión de deuda, gestión de riesgo financiero, gestión de cumplimiento, planificación fiscal, otros), modo de implementación (local, nube), tamaño de la organización (grandes empresas, pequeñas y medianas empresas), vertical (banca, servicios financieros y seguros, gobierno, fabricación, atención médica, bienes de consumo, productos químicos, energía y otros) |

|

Países cubiertos |

Sudáfrica, Israel, Emiratos Árabes Unidos, Arabia Saudita, Egipto, Resto de Oriente Medio y África |

|

Actores del mercado cubiertos |

Finastra, ZenTreasury Ltd, Emphasys Software, SS&C Technologies, Inc., CAPIX, Adenza, Coupa Software Inc., DataLog Finance, FIS, Access Systems (UK) Limited, Treasury Software Corp., MUREX SAS, EdgeVerve Systems Limited (una subsidiaria de propiedad absoluta de Infosys), Financial Sciences Corp., Broadridge Financial Solutions, Inc., CashAnalytics, Oracle, Fiserv, Inc, ION, SAP, Solomon Software, ABM CLOUD y, entre otros. |

Definición de mercado

El software de tesorería es una aplicación que automatiza las actividades financieras de una empresa, como el flujo de efectivo, los activos y las inversiones. Proporciona un sistema de gestión de tesorería que rastrea la capacidad de una empresa para convertir activos en efectivo para cumplir con una obligación financiera. Los gerentes financieros y de cuentas utilizan el software de gestión de tesorería para monitorear la liquidez y la capacidad de convertir activos en efectivo para cumplir con las obligaciones financieras. El software automatiza y agiliza las funciones de gestión de tesorería, reduciendo los riesgos financieros y de reputación, ahorrando costos y mejorando la eficiencia y la eficacia operativas. La mayor visibilidad, análisis y previsión que proporciona el sistema de gestión de tesorería mejora la toma de decisiones y ayuda a crear estrategias financieras organizacionales.

Dinámica del mercado de software de tesorería en Oriente Medio y África

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Creciente demanda de sistemas avanzados de gestión de tesorería para mejorar la experiencia del cliente

Los sistemas de gestión de tesorería (TMS) son software que ayudan a automatizar los procesos manuales de tesorería. Ofrecer una mayor visibilidad del efectivo y la liquidez, al mismo tiempo que se obtiene el control de las cuentas bancarias, se mantiene el cumplimiento normativo y se gestionan las transacciones financieras, ha mejorado la satisfacción del cliente. El sistema de gestión de tesorería ofrece básicamente siete beneficios fundamentales en la organización que pueden mejorar las capacidades, entre ellos:

- Aumentar la productividad

- Disponibilidad de datos precisos y en tiempo real

- Reducción de errores de entrada y cálculo manuales

- Limite los costos bancarios y cambiarios redundantes

- Seguimiento detallado de la actividad

- Flexibilidad bancaria y de conectividad

- Cumplimiento normativo y mitigación de riesgos

Según Coupa Software Inc., la adopción de soluciones TMS puede verse afectada por varios factores, como la volatilidad cambiaria en un 52%, el flujo de caja y la exposición al riesgo financiero en un 43%, la repatriación de efectivo en un 40%, la infraestructura de tesorería inadecuada en un 30%, los impactos de la reforma fiscal en Medio Oriente y África en un 24%, el riesgo operativo y de fraude debido a los métodos tradicionales en un 20%, el costo operativo de tesorería en un 12% y otros factores en un 12%.

- Adopción masiva de inteligencia artificial en la gestión de tesorería

En los últimos tiempos, la inteligencia artificial ha desempeñado un papel fundamental en el fortalecimiento y la transformación de las industrias en todo el mundo. Desde organismos gubernamentales y grandes organizaciones hasta pequeñas empresas en línea, la inteligencia artificial (IA) está siendo utilizada por múltiples entidades en múltiples plataformas en todo el mundo.

En 2020, según la encuesta realizada por NewVantage, el 91,5 % de las principales empresas invirtieron mucho en IA. Aunque las empresas que invierten en IA utilizan tecnologías de IA a un ritmo modesto, solo el 14,6 % de ellas utiliza la tecnología de IA de forma extensiva dentro de su organización. De este porcentaje, más de la mitad (el 51,2 %) tiene IA implementada en producción limitada y el 26,8 % la está probando. Esto indica el aumento de la cantidad de tecnologías de IA y el aumento de su adopción por parte de las empresas.

La inteligencia artificial (IA) ya ha demostrado su increíble potencial para la gestión de efectivo y la previsión de tesorería. La IA intenta resolver problemas que antes se creía que solo podían resolverse con la intervención humana.

Oportunidades

- Penetración de soluciones de analítica avanzada en el sector bancario

En la actualidad, los bancos utilizan cada vez más la analítica para obtener una ventaja competitiva y sacar conclusiones y perspectivas basadas en la información y la recopilación de datos. La analítica avanzada se puede utilizar para predecir el comportamiento y las preferencias de los clientes y para mejorar la evaluación de riesgos. En ocasiones, los datos generados por los sectores bancario y financiero son de gran escala y el banco no puede gestionarlos con su base de datos tradicional. Por lo tanto, la analítica ha allanado el camino para que las industrias financieras puedan gestionar una gran cantidad de datos a la vez.

Además, el mundo digital ha supuesto una revolución en el sector bancario. La mayoría de las soluciones de análisis avanzado para la banca se componen de cuatro componentes diferentes: informes, análisis descriptivos, análisis predictivos y análisis prescriptivos. Las instituciones financieras ahora pueden dirigirse a los clientes y captarlos de forma continua, y no solo cuando van a una sucursal. Su alcance ahora incluye a los clientes que utilizan aplicaciones móviles, cajeros automáticos y aplicaciones de banca en línea. Los bancos también pueden utilizar el análisis para ofrecer productos, servicios y ofertas personalizados a los clientes en función de sus perfiles e historiales. Además, el análisis en el mundo bancario también ayuda a identificar y prevenir el fraude. Los bancos utilizan análisis avanzados para comparar los patrones de uso de los clientes con sus propios indicadores de fraude y pueden tomar medidas de inmediato cuando se detecta una actividad potencialmente fraudulenta. La penetración general del análisis en la banca todavía es relativamente baja en comparación con su uso en otras industrias. Sin embargo, la penetración del análisis en el sector bancario está creando muchas oportunidades para que crezca el mercado del software de tesorería.

Restricciones/Desafíos

- Aumento de las amenazas cibernéticas y las violaciones de datos

Debido al COVID-19, los delitos cibernéticos y los problemas de ciberseguridad aumentaron un 600% en 2020. Los piratas informáticos aprovechan las fallas en la seguridad de la red para realizar acciones no autorizadas dentro de un sistema.

Según Purple Sec LLC, en 2018, las variantes de malware para dispositivos móviles aumentaron un 54%, de las cuales el 98% del malware para dispositivos móviles se dirige a varios dispositivos Android inteligentes. Se estima que el 25% de las empresas han sido víctimas de cryptojacking. Las empresas incluyen bancos y equipos de gestión financiera de varias empresas/industrias.

En los últimos tiempos, las empresas y las industrias están adoptando con fuerza la digitalización. Los sectores bancario, de compras, de viajes y otros están evolucionando hacia modelos digitales para mejorar las experiencias de los consumidores. La digitalización genera una enorme cantidad de datos e información de los clientes, lo que plantea problemas de seguridad, y estos datos siempre han estado en mayor riesgo de sufrir ciberataques y filtraciones de datos. A través de esta información y estos datos, los estafadores y los ciberatacantes pueden imitar o robar fácilmente la identidad de un individuo, lo que puede utilizarse para diversos delitos.

Según un estudio de S&P Middle East and Africa sobre la proporción de incidentes de ciberataques en Oriente Medio y África en todas las industrias en los últimos cinco años, de 2016 a 2021, las instituciones financieras encabezaron la lista con un 26% de incidentes de ciberseguridad, seguidas por la atención médica con un 11%, los servicios de software y tecnología con un 7% y el comercio minorista con un 6%.

Impacto posterior a la COVID-19 en el mercado de software de tesorería de Oriente Medio y África

La pandemia de COVID-19 ha tenido un impacto significativo en el mercado de software de tesorería de Oriente Medio y África. La pandemia ha provocado importantes perturbaciones en las cadenas de suministro, los mercados financieros y las actividades económicas de Oriente Medio y África, lo que ha provocado un cambio en las prioridades y estrategias de los departamentos de tesorería de todo el mundo.

Uno de los impactos más significativos de la pandemia en el mercado de software de tesorería ha sido el aumento de la demanda de soluciones basadas en la nube. La pandemia obligó a muchas organizaciones a realizar una rápida transición al trabajo remoto, lo que puso de relieve la importancia de contar con soluciones de tesorería seguras, accesibles y escalables basadas en la nube. Como resultado, ha habido un aumento significativo en la demanda de soluciones de software de tesorería basadas en la nube.

Otro impacto de la pandemia en el mercado de software de tesorería es el mayor enfoque en la previsión de efectivo y la gestión de liquidez. La pandemia ha creado importantes incertidumbres y riesgos para las empresas, lo que hace que la previsión precisa de efectivo y la gestión de liquidez sean fundamentales para la supervivencia. Las soluciones de software de tesorería que pueden proporcionar previsiones de efectivo, gestión de liquidez y evaluación de riesgos precisas y en tiempo real se han vuelto cada vez más esenciales.

En general, la pandemia de COVID-19 ha acelerado la adopción de soluciones de tesorería digital, lo que ha dado lugar a un crecimiento significativo del mercado de software de tesorería en Oriente Medio y África. Se espera que la demanda de soluciones basadas en la nube, previsión de efectivo y gestión de liquidez, y capacidades avanzadas de automatización e integración continúe en el mundo pospandémico a medida que las organizaciones buscan mejorar su agilidad, resiliencia y eficiencia.

Acontecimientos recientes

- En marzo de 2022, ZenTreasury y su socio local MCA proporcionaron a Redington Gulf un software de contabilidad de arrendamientos para la NIIF-16. Ahora, los clientes no necesitan importar datos de muchas fuentes y almacenarlos en varias plataformas. Todo se hace con un solo software.

- En septiembre de 2022, TIS y Delega colaboraron para ofrecer a los clientes una gestión automatizada de derechos de firma de múltiples bancos de última generación. Los clientes de TIS y Delega pueden aprovechar la gestión electrónica de cuentas bancarias NextGen gracias al acuerdo (eBAM)

Alcance del mercado de software de tesorería en Oriente Medio y África

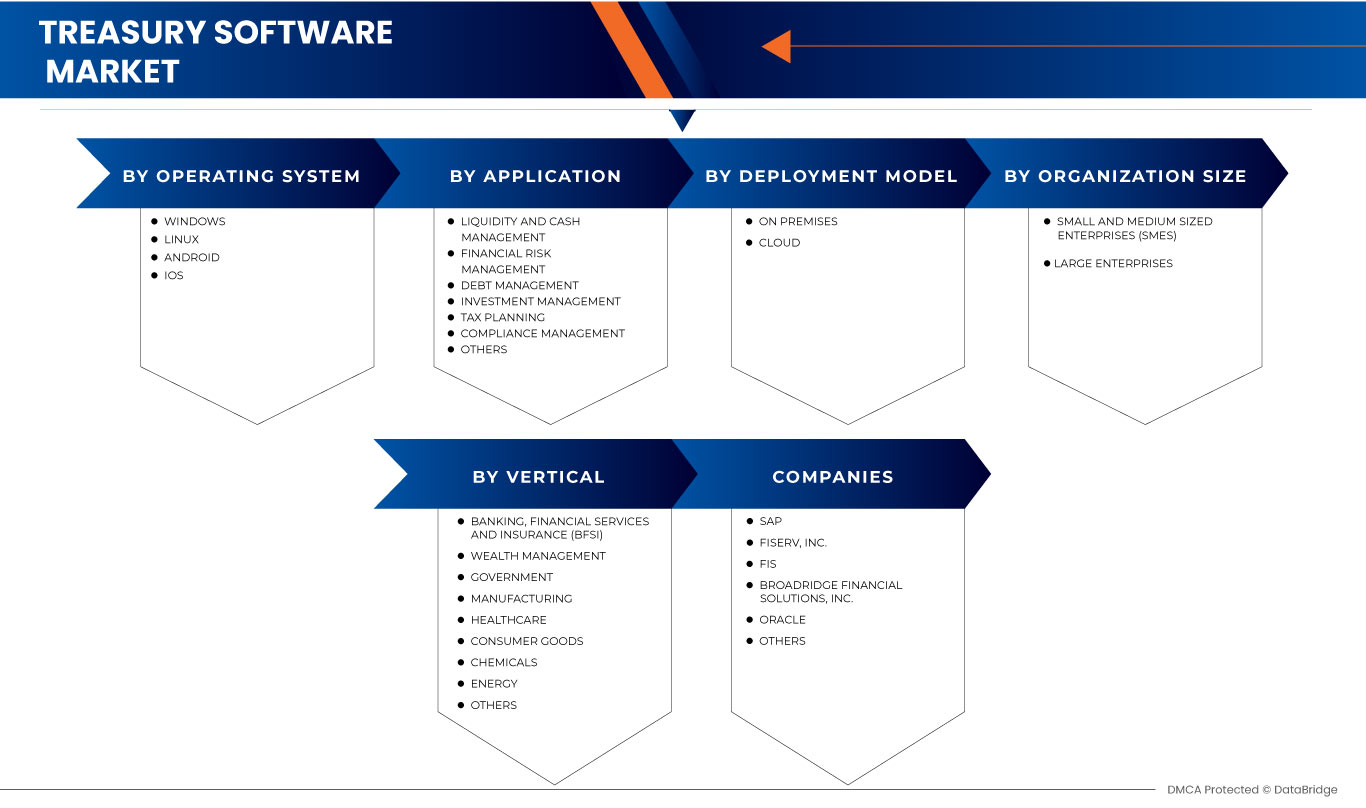

El mercado de software de tesorería de Oriente Medio y África está segmentado en función del sistema operativo, la aplicación, el modelo de implementación, el tamaño de la organización y la vertical. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

MERCADO DE SOFTWARE DE TESORERÍA DE ORIENTE MEDIO Y ÁFRICA, POR SISTEMA OPERATIVO

- IMPERMEABLE

- VENTANAS

- iOS

- ANDROIDE

- Linux

Sobre la base del sistema operativo, el mercado de software de tesorería de Medio Oriente y África está segmentado en Windows, Linux, MAC, Android e iOS.

MERCADO DE SOFTWARE DE TESORERÍA DE ORIENTE MEDIO Y ÁFRICA, POR APLICACIÓN

- GESTIÓN DE LIQUIDEZ Y EFECTIVO

- GESTIÓN DE RIESGOS FINANCIEROS

- GESTIÓN DE DEUDA

- GESTIÓN DE INVERSIONES

- PLANIFICACIÓN FISCAL

- GESTIÓN DEL CUMPLIMIENTO

- OTROS

Sobre la base de la aplicación, el mercado de software de tesorería de Medio Oriente y África se segmenta en gestión de liquidez y efectivo, gestión de inversiones, gestión de deuda, gestión de riesgo financiero, gestión de cumplimiento, planificación fiscal y otros.

MERCADO DE SOFTWARE DE TESORERÍA EN ORIENTE MEDIO Y ÁFRICA, POR MODELO DE IMPLEMENTACIÓN

- EN LAS INSTALACIONES

- NUBE

Sobre la base del modo de implementación, el mercado de software de tesorería de Medio Oriente y África está segmentado en nube y local.

MERCADO DE SOFTWARE DE TESORERÍA EN ORIENTE MEDIO Y ÁFRICA, POR TAMAÑO DE ORGANIZACIÓN

- PEQUEÑAS Y MEDIANAS EMPRESAS (PYMES)

- GRANDES EMPRESAS

Sobre la base del tamaño de la organización, el mercado de software de tesorería de Medio Oriente y África está segmentado en grandes empresas y pequeñas y medianas empresas.

MERCADO DE SOFTWARE DE TESORERÍA DE ORIENTE MEDIO Y ÁFRICA, POR VERTICAL

- BANCA, SERVICIOS FINANCIEROS Y SEGUROS (BFSI)

- GESTIÓN PATRIMONIAL

- GOBIERNO

- FABRICACIÓN

- CUIDADO DE LA SALUD

- BIENES DE CONSUMO

- PRODUCTOS QUÍMICOS

- ENERGÍA

- OTROS

Sobre la base vertical, el mercado de software de tesorería de Medio Oriente y África está segmentado en banca, servicios financieros y seguros (BFSI), gobierno, manufactura, atención médica, bienes de consumo, productos químicos, energía y otros.

Análisis y perspectivas regionales del mercado de software de tesorería de Oriente Medio y África

Se analiza el mercado de software de tesorería de Medio Oriente y África y se proporcionan información y tendencias del tamaño del mercado por país, sistema operativo, aplicación, modelo de implementación, tamaño de la organización y vertical como se menciona anteriormente.

Algunos de los países incluidos en el informe sobre el mercado de software de tesorería de Oriente Medio y África son Sudáfrica, Egipto, Emiratos Árabes Unidos, Arabia Saudita, Israel y el resto de Oriente Medio y África. Se espera que los Emiratos Árabes Unidos dominen el mercado, ya que el país ha demostrado un fuerte compromiso con el desarrollo y la implementación de software de gestión de tesorería.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas arriba y aguas abajo, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Oriente Medio y África y sus desafíos afrontados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado del software de tesorería en Oriente Medio y África

El panorama competitivo del mercado de software de tesorería de Oriente Medio y África proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Oriente Medio y África, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la extensión de los productos, el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de software de tesorería de Oriente Medio y África.

Algunos de los principales actores que operan en el mercado de software de tesorería de Medio Oriente y África son Finastra, ZenTreasury Ltd, Emphasys Software, SS&C Technologies, Inc., CAPIX, Adenza, Coupa Software Inc., DataLog Finance, FIS, Access Systems (UK) Limited, Treasury Software Corp., MUREX SAS, EdgeVerve Systems Limited (una subsidiaria de propiedad absoluta de Infosys), Financial Sciences Corp., Broadridge Financial Solutions, Inc., CashAnalytics, Oracle, Fiserv, Inc, ION, SAP, Solomon Software, ABM CLOUD, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 OPERATING SYSTEM TIMELINE CURVE

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 KEY PRIMARY INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING ADOPTION OF SMART ELECTRONIC PAYMENT MANAGEMENT TOOLS

5.1.2 GROWING DEMAND FOR ADVANCED TREASURY MANAGEMENT SYSTEM FOR ENHANCING CUSTOMER EXPERIENCE

5.1.3 HEAVING ADOPTION OF ARTIFICIAL INTELLIGENCE IN TREASURY MANAGEMENT

5.1.4 ADOPTION OF CLOUD BASED SOLUTION IN TREASURY MANAGEMENT

5.2 RESTRAINTS

5.2.1 INCREASING CYBER THREATS AND DATA BREACHES

5.2.2 HIGH COST ASSOCIATED WITH TREASURY MANAGEMENT SYSTEMS

5.2.3 CONTINUOUS CHANGES IN REGULATORY FRAMEWORK IN TREASURER MANAGEMENT

5.3 OPPORTUNITIES

5.3.1 PENETRATION OF ADVANCED ANALYTICS SOLUTIONS IN THE BANKING SECTOR

5.3.2 ADOPTION OF AUTOMATED SOLUTIONS TO REDUCE COMPLEXITY

5.3.3 RISE IN STRATEGIC PARTNERSHIP & COLLABORATION AMONG THE ORGANIZATION

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS AMONG CONSUMERS REGARDING THE BENEFITS OF TREASURY SOFTWARE

5.4.2 FACTORS LIKE COMPLEXITIES, INADEQUATE INFRASTRUCTURE, AND FX VOLATILITY HAMPERS TMS EFFICIENCY

6 IMPACT OF COVID-19 ON THE MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET

7 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM

7.1 OVERVIEW

7.2 WINDOWS

7.3 LINUX

7.4 MAC

7.5 ANDROID

7.6 IOS

8 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 LIQUIDITY AND CASH MANAGEMENT

8.3 INVESTMENT MANAGEMENT

8.4 DEBT MANAGEMENT

8.5 FINANCIAL RISK MANAGEMENT

8.6 COMPLIANCE MANAGEMENT

8.7 TAX PLANNING MANAGEMENT

8.8 OTHERS

9 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

10 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL

10.1 OVERVIEW

10.2 CLOUD

10.2.1 PUBLIC

10.2.2 HYBRID

10.2.3 PRIVATE

10.3 ON-PREMISES

11 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

11.2.1 WEALTH MANAGEMENT

11.2.2 BANKING

11.2.3 CAPITAL MARKET

11.2.4 OTHERS

11.3 GOVERNMENT

11.4 MANUFACTURING

11.5 HEALTHCARE

11.6 CONSUMER GOODS

11.7 CHEMICALS

11.8 ENERGY

11.9 OTHERS

12 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET , BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 U.A.E.

12.1.2 SAUDI ARABIA

12.1.3 SOUTH AFRICA

12.1.4 ISRAEL

12.1.5 EGYPT

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILING

15.1 SAP

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 APPLICATION PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 FISERV, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 FIS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 SOLUTION PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 BROADRIDGE FINANCIAL SOLUTIONS, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 SOLUTION PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 ORACLE

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ABM CLOUD

15.6.1 COMPANY SNAPSHOT

15.6.2 SERVICE PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 ACCESS SYSTEMS (UK) LIMITED

15.7.1 COMPANY SNAPSHOT

15.7.2 SOLUTION PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 ADENZA

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 CAPIX

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 CASHANALYTICS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 COUPA SOFTWARE INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 DATALOG FINANCE

15.12.1 COMPANY SNAPSHOT

15.12.2 SOLUTION PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 EDGEVERVE SYSTEMS LIMITED (A WHOLLY OWNED SUBSIDIARY OF INFOSYS)

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 EMPHASYS SOFTWARE

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 ERNST & YOUNG

15.15.1 COMPANY SNAPSHOT

15.15.2 SERVICE PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 FINASTRA

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 FINANCIAL SCIENCES CORP.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 ION

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 MUREX S.A.S

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 NOMENTIA

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 SOLOMON SOFTWARE

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 SS&C TECHNOLOGIES, INC.

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENTS

15.23 TREASURY INTELLIGENCE SOLUTIONS

15.23.1 COMPANY SNAPSHOT

15.23.2 SERVICE PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.24 TREASURY SOFTWARE CORP

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENTS

15.25 ZENTREASURY LTD

15.25.1 COMPANY SNAPSHOT

15.25.2 SOLUTION PORTFOLIO

15.25.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA WINDOWS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA LINUX IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA MAC IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA ANDROID IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA IOS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET, APPLICATION, 2021-2030 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA LIQUIDITY AND CASH MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA INVESTMENT MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA DEBT MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA FINANCIAL RISK MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA COMPLIANCE MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA TAX PLANNING MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA OTHERS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA LARGE ENTERPRISES IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA SMALL AND MEDIUM SIZED ENTERPRISES (SMES) IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA CLOUD IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA ON-PREMISES IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA GOVERNMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA MANUFACTURING IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA HEALTHCARE IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA CONSUMER GOODS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA CHEMICALS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA ENERGY IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA OTHERS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA TREASURY SOFTWARE MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.A.E. TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 41 U.A.E. TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 42 U.A.E. TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 43 U.A.E. CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 U.A.E. TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 45 U.A.E. TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 46 U.A.E. BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 SAUDI ARABIA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 48 SAUDI ARABIA TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 49 SAUDI ARABIA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 50 SAUDI ARABIA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 SAUDI ARABIA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 52 SAUDI ARABIA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 53 SAUDI ARABIA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 SOUTH AFRICA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 55 SOUTH AFRICA TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 56 SOUTH AFRICA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 57 SOUTH AFRICA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 SOUTH AFRICA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 59 SOUTH AFRICA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 60 SOUTH AFRICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 ISRAEL TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 62 ISRAEL TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 63 ISRAEL TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 64 ISRAEL CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 ISRAEL TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 66 ISRAEL TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 67 ISRAEL BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 EGYPT TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 69 EGYPT TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 70 EGYPT TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 71 EGYPT CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 72 EGYPT TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 73 EGYPT TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 74 EGYPT BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 REST OF MIDDLE EAST AND AFRICA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET: MIDDLE EAST & AFRICA VS REGIONAL ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET: SEGMENTATION

FIGURE 11 SURGING UTILITY IN THE MILITARY AND DEFENSE SECTOR IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET IN THE FORECAST PERIOD

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET

FIGURE 14 MOBILE PAYMENTS SHARE (%) BY COUNTRY

FIGURE 15 FACTORS AFFECTING THE TMS AND CUSTOMER EXPERIENCE

FIGURE 16 THREE WAYS ARTIFICIAL INTELLIGENCE IS TRANSFORMING TREASURY

FIGURE 17 CYBER-ATTACKS INCIDENTS ACROSS INDUSTRIES FROM 2016 TO 2021

FIGURE 18 CYBER-ATTACKS INCIDENTS BY COUNTRY AND REGION IN 2020

FIGURE 19 TREASURY DEPARTMENT CURRENTLY USING

FIGURE 20 ANALYTICS ADOPTION BY SECTOR, FROM THE YEAR 2019 TO 2021 AT INDIAN FIRMS

FIGURE 21 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET: BY OPERATING SYSTEM, 2022

FIGURE 22 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET: BY APPLICATION, 2022

FIGURE 23 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET: BY ORGANIZATION SIZE, 2022

FIGURE 24 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET: BY DEPLOYMENT MODEL, 2022

FIGURE 25 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET: BY VERTICAL, 2022

FIGURE 26 MIDDLE EAST AND AFRICA TREASURY SOFTWARE MARKET : SNAPSHOT (2022)

FIGURE 27 MIDDLE EAST AND AFRICA TREASURY SOFTWARE MARKET: BY COUNTRY (2022)

FIGURE 28 MIDDLE EAST AND AFRICA TREASURY SOFTWARE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 MIDDLE EAST AND AFRICA TREASURY SOFTWARE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 MIDDLE EAST AND AFRICA TREASURY SOFTWARE MARKET: BY OPERATING SYSTEM (2023 & 2030)

FIGURE 31 MIDDLE EAST & AFRICA TREASURY SOFTWARE MARKET: COMPANY SHARE 2022(%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.