Middle East And Africa Track And Trace Solutions Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

279.04 Million

USD

1,035.81 Million

2024

2032

USD

279.04 Million

USD

1,035.81 Million

2024

2032

| 2025 –2032 | |

| USD 279.04 Million | |

| USD 1,035.81 Million | |

|

|

|

Mercado de soluciones de seguimiento y rastreo en Oriente Medio y África, por producto (componentes de software, componentes de hardware y plataforma independiente), solución (serialización a nivel de línea y de sitio, trazabilidad a nivel empresarial en la nube, solución de distribución y almacén, red de intercambio de datos de la cadena de suministro y otros), aplicación (serialización, impresión, etiquetado e inspección de empaquetado, agregación, seguimiento, rastreo e informes), tecnología (códigos de barras 2D, identificación por radiofrecuencia (RFID) y códigos de barras lineales/1D), usuario final (empresas farmacéuticas y biofarmacéuticas, bienes de consumo envasados, bienes de lujo, alimentos y bebidas, empresas de dispositivos médicos, organizaciones de fabricación por contrato, reenvasadores, empresas de cosméticos y otros), canal de distribución (ventas directas y distribuidores externos): tendencias de la industria y pronóstico hasta 2032

Análisis del mercado de soluciones de seguimiento y localización en Oriente Medio y África

El seguimiento y rastreo de medicamentos para mejorar la accesibilidad de los productos en la cadena de suministro de medicamentos recetados no es un fenómeno nuevo. En realidad, el concepto de serialización ha sido debatido durante más de 15 años. En 1999, después de un estudio realizado por la Facultad de Medicina de Estados Unidos, el presidente Bill Clinton puso la protección del paciente (incluyendo evitar errores en el punto de dispensación de medicamentos) en la agenda del gobierno federal y procedió a promover la reforma después de su presidencia. En 2003, la Administración de Alimentos y Medicamentos de Estados Unidos (FDA) exigió el código de barras a nivel de unidad, y en el mismo año, la Organización Mundial de la Salud (OMS) publicó un estudio que destacaba el alcance del problema de los medicamentos falsificados, afirmando que el 10% de los medicamentos en todo el mundo eran falsificados. Un cambio importante en la serialización tuvo lugar alrededor de 2005 y la variedad de países comenzó a establecer objetivos para su adopción. Sin embargo, después de tomar varias medidas para proteger la cadena de suministro, el desafío dejó de ser una preocupación después de la crisis financiera de 2008.

A medida que la economía mundial ha ido cambiando, el enfoque se ha ido desplazando gradualmente. Turquía adoptó estándares de serialización en 2010 y las reglas están vigentes para otros mercados como China, Corea del Sur e India. Con la Directiva de Medicamentos Falsificados (FMD) de la UE que entró en vigor en febrero de 2019 y la adopción de la legislación por parte de los EE. UU. como parte de la Ley de Seguridad de la Cadena de Suministro de Medicamentos (DSCSA) en noviembre de 2017, más del 75% de los medicamentos de Medio Oriente y África deben estar protegidos por algún tipo de regulación de seguimiento y rastreo para 2019. El mercado de soluciones de seguimiento y rastreo es de gran importancia en varias industrias, desde la farmacéutica hasta los dispositivos médicos y los alimentos y bebidas, entre otras.

El aumento de la demanda de soluciones de seguimiento y rastreo en los centros de atención médica se debe a las estrictas leyes formuladas para la serialización y el etiquetado, lo que conduce al crecimiento lucrativo de las soluciones de seguimiento y rastreo en el mercado. La amplia cartera de productos con enormes opciones para casi todas las industrias principales, como alimentos y bebidas, cosméticos y dispositivos médicos, entre otras, impulsa aún más el crecimiento de las soluciones de seguimiento y rastreo en el mercado de soluciones de seguimiento y rastreo de Oriente Medio y África.

Tamaño del mercado de soluciones de seguimiento y localización en Oriente Medio y África

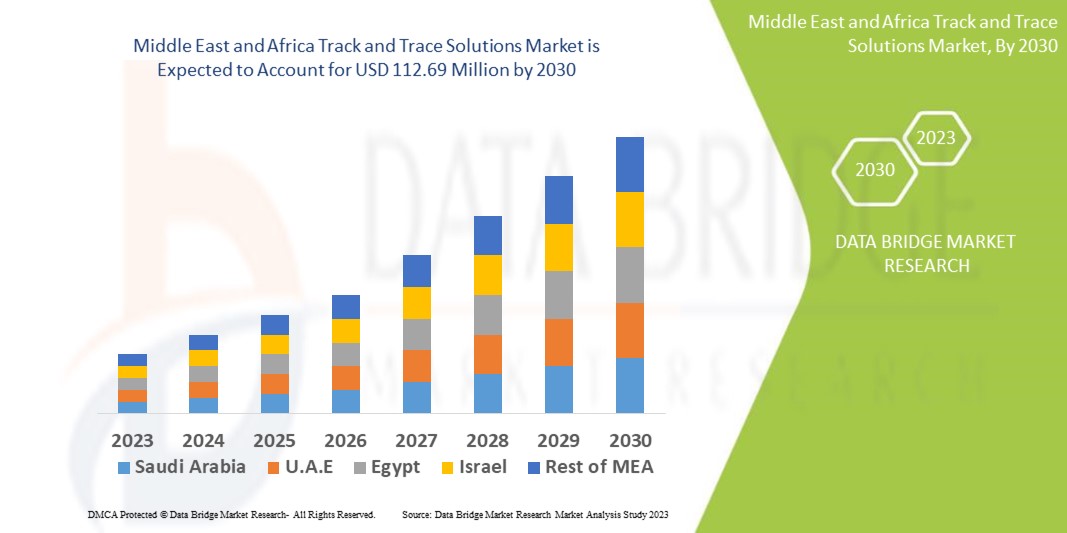

El tamaño del mercado de soluciones de seguimiento y rastreo de Oriente Medio y África se valoró en USD 279,04 millones en 2024 y se proyecta que alcance los USD 1.035,81 millones para 2032, con una CAGR del 19,5% durante el período de pronóstico de 2025 a 2032. Además de la información sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas / consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio.

Tendencias del mercado de soluciones de seguimiento y localización en Oriente Medio y África

“Mayor demanda de transparencia en la cadena de suministro”

La demanda de soluciones de seguimiento y rastreo es particularmente fuerte debido a la necesidad de garantizar la seguridad del paciente, la integridad del producto y el cumplimiento normativo. Las tecnologías de seguimiento y rastreo ayudan a monitorear el movimiento de productos farmacéuticos, dispositivos médicos y vacunas a lo largo de la cadena de suministro, minimizando el riesgo de medicamentos falsificados y asegurando que los productos se almacenen y transporten en condiciones adecuadas. Además, con la creciente necesidad de medicina personalizada y una mayor responsabilidad en la atención médica, estas soluciones permiten a los proveedores de atención médica rastrear los productos desde la producción hasta el uso final, asegurando que lleguen a los pacientes correctos de manera segura y eficiente. Los organismos reguladores, como la FDA, requieren estrictas medidas de trazabilidad, lo que hace que los sistemas de seguimiento y rastreo sean una parte esencial de las operaciones de atención médica.

Alcance del informe y segmentación del mercado de soluciones de seguimiento y localización en Oriente Medio y África

|

Atributos |

Perspectivas del mercado de soluciones de seguimiento y localización en Oriente Medio y África |

|

Segmentos cubiertos |

|

|

Región cubierta |

Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Qatar, Egipto, Kuwait, Bahréin, Omán y el resto de Oriente Medio y África |

|

Actores clave del mercado |

SAP SE (Alemania), Zebra Technologies Corp. (EE. UU.), Videojet Technologies, Inc. (EE. UU.), METTLER TOLEDO (EE. UU.), Tracelink Inc. (EE. UU.), Siemens, Domino Printing Sciences plc (Reino Unido), Laetus GmbH (Alemania), Xyntek Incorporated (EE. UU.), IBM Corporation (EE. UU.), WIPOTEC-OCS GmbH (Alemania), 3Keys (Alemania), ACG (India), NJM Packaging Inc. (EE. UU.), OPTEL GROUP (Canadá), Systech (EE. UU.), Robert Bosch Manufacturing Solutions GmbH (Alemania), ANTARES VISION SpA (Italia), Uhlmann (Alemania), SEA VISION Srl (Italia), Jekson Vision (India), Kevision Systems (India), Arvato Systems, Grant-Soft Ltd. (Turquía), PharmaSecure Inc. (EE. UU.), Axyway (Francia) y SL Controls Ltd. (EE. UU.) |

|

Oportunidades de mercado |

Expansión del comercio en Oriente Medio y África |

|

Conjuntos de información de datos de valor añadido |

Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis de consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Definición del mercado de soluciones de seguimiento y localización en Oriente Medio y África

El método de identificación de la posición actual e histórica (y otra información) de un objeto o propiedad en particular implica el almacenamiento y transporte de varios tipos de artículos, el seguimiento y el rastreo. Esta definición puede ir seguida de la estimación y el registro de la ubicación de automóviles y contenedores, por ejemplo, registrados en una base de datos en tiempo real. Este método deja el desafío de elaborar una descripción coherente de las notas de progreso correspondientes. El seguimiento y rastreo consiste en vincular las máquinas a la TI y compartir datos a toda velocidad. Esto incluye módulos de dispositivos de hardware potentes o sistemas independientes. El objetivo principal de las soluciones de seguimiento y rastreo es reducir la cadena de medicamentos y productos falsificados en todo el mundo y proporcionar un flujo fluido y trazabilidad de las mercancías en todos y cada uno de los puntos.

Dinámica del mercado de soluciones de seguimiento y localización en Oriente Medio y África

Conductores

- Normas y reglamentos estrictos para la implementación de la serialización

La llegada de la serialización obligatoria ha transformado por completo el mercado farmacéutico. Con la entrada en vigor de la Ley de Seguridad de la Cadena de Suministro de Medicamentos (DSCSA) de los Estados Unidos y la Directiva sobre Medicamentos Falsificados (FMD) de la Unión Asia-Pacífico, la cadena de suministro de productos farmacéuticos está vinculada para siempre a los productos y datos serializados. Si analizamos más a fondo, un programa de serialización exitoso implica mucho más que simplemente colocar números de serie en los envases. Las regulaciones varían de un mercado a otro y pueden cambiar a menudo, lo que significa que los profesionales de la regulación deben estar preparados para ajustar los procedimientos, procesos y presentaciones para mantenerse al día. Dado que la ley sobre el etiquetado y la serialización de medicamentos es bastante reciente, está sujeta a una mayor complejidad en Asia-Pacífico y varía con más frecuencia que otras regulaciones. Además, como la cadena de suministro de productos farmacéuticos genuinos se ha vuelto más larga, esto crea una oportunidad para los falsificadores en cada paso de la cadena de suministro. Por lo tanto, se establecen regulaciones y estandarizaciones estrictas para proteger los productos.

- En julio de 2024, según el artículo publicado por la Administración de Alimentos y Medicamentos, la Ley de Seguridad de la Cadena de Suministro de Medicamentos (DSCSA, por sus siglas en inglés) obliga a la identificación y el rastreo electrónicos de medicamentos recetados a nivel de paquete para evitar que medicamentos dañinos ingresen a la cadena de suministro de EE. UU. Esta estricta regulación impulsa la necesidad de soluciones avanzadas de seguimiento y rastreo para garantizar el cumplimiento, proteger a los pacientes y permitir respuestas rápidas a las amenazas, actuando así como un impulsor clave para el mercado de Asia y el Pacífico.

- En febrero de 2022, según el artículo publicado por el Programa de la Cadena de Suministro de Salud de Asia y el Pacífico de USAID, la Administración Estatal de Alimentos y Medicamentos de China ordenó la serialización de 502 medicamentos farmacéuticos de la lista de medicamentos esenciales, lo que garantiza la trazabilidad y la autenticidad. Esta estricta regulación impulsa la demanda de soluciones de seguimiento y rastreo para cumplir con los requisitos de serialización. Como resultado, actúa como un impulsor clave para el mercado de Asia y el Pacífico, impulsando una adopción más amplia de tecnologías de seguimiento avanzadas.

La cuestión de los medicamentos y la adulteración de medicamentos ha sido una preocupación en Asia-Pacífico durante décadas. Impulsados por cadenas de suministro físicas y cibernéticas no seguras en Asia-Pacífico, ventas por Internet y sanciones mínimas, el gobierno y varias compañías farmacéuticas en todo el mundo creen que la implementación de la serialización podría reducir y detener los problemas relacionados con la falsificación. Esto hace que las estrictas regulaciones y estándares para la implementación de la serialización actúen como un impulsor del mercado de soluciones de seguimiento y rastreo en Asia-Pacífico.

- Crecientes preocupaciones por falsificaciones

La creciente preocupación por los productos falsificados se ha convertido en un problema importante, en particular en los sectores farmacéutico y sanitario, donde la presencia de medicamentos falsos puede tener graves consecuencias para la salud y la seguridad de los pacientes. Los medicamentos falsificados no solo comprometen la integridad del sistema sanitario, sino que también aumentan los riesgos de efectos adversos, resistencia a los medicamentos y fracasos del tratamiento. En respuesta a esta creciente amenaza, los reguladores y las partes interesadas de la industria están presionando para que se adopten medidas de trazabilidad y serialización más estrictas. Estas medidas ayudan a garantizar la autenticidad de los productos al permitir que los fabricantes, distribuidores y minoristas rastreen el movimiento de las mercancías a lo largo de toda la cadena de suministro. Cada vez se utilizan más tecnologías como RFID, códigos de barras y blockchain para combatir la falsificación, lo que permite controlar y verificar los productos en cada etapa de la cadena de suministro, desde la fabricación hasta el consumidor final. Con la expansión del comercio mundial y cadenas de suministro más complejas, el riesgo de que entren productos falsificados en los mercados se ha vuelto más pronunciado, lo que impulsa aún más la necesidad de mejorar los sistemas de trazabilidad. Esta mayor conciencia de los riesgos de falsificación actúa como un impulsor clave para el mercado global de soluciones de seguimiento y rastreo, ya que las empresas y los gobiernos buscan sistemas sólidos para autenticar productos, mantener el cumplimiento normativo y proteger a los consumidores de productos falsificados potencialmente dañinos.

Por ejemplo,

- En mayo de 2024, según el artículo publicado por la Administración de Alimentos y Medicamentos, los medicamentos falsificados, que pueden contener ingredientes incorrectos, insuficientes o nocivos, plantean graves riesgos para la salud al comercializarse falsamente como auténticos. Esta creciente preocupación por la seguridad y la eficacia de los productos farmacéuticos está impulsando la adopción de soluciones de seguimiento y rastreo para garantizar la autenticidad del producto. Como resultado, las crecientes preocupaciones por los productos falsificados actúan como un impulsor importante del mercado mundial de soluciones de seguimiento y rastreo.

- En octubre de 2024, según el artículo publicado por Science Direct, los medicamentos falsificados y falsificados, especialmente en viajes internacionales, suponen un grave riesgo para la salud pública. Con el aumento de los casos notificados a nivel mundial, la preocupación por la propagación de medicamentos falsificados ha aumentado significativamente. Esto ha llevado a una mayor necesidad de sistemas de trazabilidad para garantizar la autenticidad del producto. Como resultado, la creciente preocupación por los medicamentos falsificados actúa como un factor clave para el mercado mundial de soluciones de seguimiento y rastreo.

La preocupación por los productos falsificados, especialmente en las industrias farmacéutica y sanitaria, se ha convertido en un problema importante debido al daño potencial que pueden causar los medicamentos falsificados a los pacientes. Los medicamentos falsificados pueden dar lugar a tratamientos ineficaces y a riesgos para la salud, lo que provoca una mayor demanda de soluciones de trazabilidad. Mediante el uso de tecnologías como RFID, códigos de barras y blockchain, las empresas pueden rastrear los productos a lo largo de la cadena de suministro para garantizar su autenticidad. A medida que las cadenas de suministro globales se vuelven más complejas, aumenta el riesgo de que entren productos falsificados en el mercado, lo que impulsa la necesidad de sistemas de seguimiento más sólidos. Esta demanda de soluciones de trazabilidad seguras y fiables actúa como un importante impulsor del mercado mundial de soluciones de seguimiento y localización.

Oportunidades

- Crecimiento en el sector del comercio electrónico

El rápido crecimiento del sector del comercio electrónico presenta una oportunidad sustancial para el mercado de soluciones de seguimiento y rastreo de Asia-Pacífico debido a la creciente complejidad y escala de las operaciones minoristas en línea. A medida que más consumidores optan por las compras en línea, las empresas deben garantizar que sus procesos logísticos y de cadena de suministro sean eficientes y transparentes. Las soluciones de seguimiento y rastreo facilitan el monitoreo en tiempo real de los niveles de inventario, el estado del envío y los procesos de entrega, lo que permite a las empresas proporcionar información precisa a los clientes sobre sus pedidos. Este mayor nivel de transparencia aumenta la confianza del cliente y mejora la experiencia de compra en general, lo que hace que las empresas de comercio electrónico sean más competitivas en un mercado abarrotado.

Por ejemplo,

- En julio de 2024, según un artículo titulado 'Impacto del comercio electrónico en la logística: adaptación a la demanda', publicado en el Marketplace Digest, la implementación de soluciones avanzadas de seguimiento y visibilidad mejora las soluciones de seguimiento y visibilidad, que son fundamentales para satisfacer las demandas del comercio electrónico. La tecnología de seguimiento en tiempo real permite a los transportistas proporcionar estimaciones y actualizaciones de entrega precisas, lo que mejora la transparencia y la confianza del cliente.

- En abril de 2023, según un artículo, 'Identificación de beneficios, desafíos y vías en las industrias de comercio electrónico, publicado en ScienceDirect: Un modelo integrado de toma de decisiones en dos fases', la industria del comercio electrónico ha experimentado un crecimiento significativo durante la última década, ya que se centra en la conveniencia y la accesibilidad, lo que lleva a un aumento de las compras en línea con un mayor número de consumidores que optan por ellas.

Además, con el auge del comercio electrónico, existe un riesgo creciente de problemas como robo, fraude y productos falsificados, lo que requiere sistemas de seguimiento y rastreo robustos que puedan mitigar estos desafíos. La implementación de tecnologías avanzadas como RFID, blockchain y sistemas de seguimiento automatizados permite a las empresas de comercio electrónico mantener la integridad de sus productos desde el almacén hasta la entrega. Estas soluciones también permiten a las empresas cumplir con los requisitos regulatorios y los estándares de la industria relacionados con la responsabilidad y seguridad de los productos. A medida que el comercio electrónico continúa expandiéndose, la demanda de soluciones de seguimiento y rastreo confiables aumentará, lo que creará importantes oportunidades de mercado para los proveedores de dichas tecnologías.

- Expansión del comercio mundial

La expansión del comercio global crea una oportunidad significativa para el mercado global de soluciones de seguimiento y rastreo, impulsada por la creciente complejidad de las cadenas de suministro que cruzan fronteras internacionales. A medida que las empresas dependen cada vez más de las redes globales para obtener materiales y distribuir sus productos, la necesidad de sistemas de seguimiento efectivos se vuelve primordial. Las soluciones de seguimiento y rastreo permiten a las empresas monitorear los envíos en tiempo real, lo que garantiza la transparencia y la eficiencia en todo el proceso logístico. Esta capacidad mejora la eficiencia operativa y ayuda a las organizaciones a cumplir con las regulaciones y estándares internacionales, lo que genera una mayor confianza entre socios y clientes. A medida que el comercio global continúa expandiéndose, es probable que aumente la demanda de tecnologías de seguimiento sofisticadas que puedan manejar varios requisitos regulatorios y brindar visibilidad en múltiples jurisdicciones.

Por ejemplo,

- En mayo de 2024, según un artículo publicado en el Foro Económico Mundial, se espera que el comercio mundial de bienes y servicios crezca un 2,3% este año y un 3,3% en 2025, más del doble del crecimiento del 1% observado en 2023.

Además, el auge del comercio electrónico y la venta minorista en línea ha acelerado aún más la demanda de soluciones de seguimiento y rastreo, ya que los consumidores esperan entregas puntuales y transparencia con respecto a sus pedidos. Con grandes cantidades de bienes transportados por todo el mundo, las empresas necesitan sistemas robustos para rastrear su inventario y envíos con precisión. Esta demanda ha impulsado la innovación en el mercado de seguimiento y rastreo, alentando el desarrollo de tecnologías avanzadas como blockchain, IoT e inteligencia artificial. Estas innovaciones mejoran las capacidades de las soluciones de seguimiento y rastreo y ofrecen la oportunidad de diferenciarse en un mercado abarrotado. A medida que el comercio global continúa creciendo y evolucionando, el mercado de soluciones de seguimiento y rastreo está preparado para capitalizar esta tendencia, proporcionando herramientas esenciales que ayudan a las empresas a navegar por las complejidades de la gestión de la cadena de suministro moderna y al mismo tiempo satisfacer las demandas de los consumidores en cuanto a transparencia y responsabilidad.

Restricciones/Desafíos

- Riesgos asociados a la contaminación de las muestras

Las preocupaciones sobre la seguridad y la privacidad de los datos representan un desafío importante para el mercado de soluciones de seguimiento y rastreo de Asia-Pacífico, ya que estos sistemas a menudo implican la recopilación, el almacenamiento y la transmisión de información confidencial. Esto puede incluir datos personales, detalles de productos e información de la cadena de suministro, que, si no se protegen adecuadamente, plantean riesgos tanto para los consumidores como para las empresas. Las violaciones de la seguridad de los datos pueden provocar pérdidas financieras, daños a la reputación y ramificaciones legales, en particular a la luz de regulaciones cada vez más estrictas como el RGPD en Asia-Pacífico y varias leyes de protección de datos en Asia-Pacífico. A medida que las organizaciones implementan tecnologías de seguimiento y rastreo, deben garantizar medidas de seguridad sólidas, lo que puede aumentar los costos y complicar el proceso de implementación, lo que podría disuadir a las empresas de adoptar estas soluciones.

Por ejemplo,

- En agosto de 2024, según un artículo titulado "Principales desafíos en la implementación de soluciones de seguimiento y rastreo en la gestión de la cadena de suministro", publicado por Shriram Veritech Solutions Pvt. Ltd., con la implementación de soluciones de seguimiento y rastreo, las empresas manejan una gran cantidad de datos confidenciales, incluida información confidencial, detalles de clientes y seguimiento de ubicación en tiempo real. Los sistemas de seguimiento y rastreo son vulnerables a los ciberataques.

Además, la concienciación de los consumidores respecto de la privacidad de los datos está aumentando, lo que lleva a un mayor escrutinio de las empresas que manejan información personal. Las organizaciones están bajo presión para demostrar el cumplimiento de las normas de protección de datos y generar confianza con sus clientes. Si las empresas no pueden garantizar con seguridad a las partes interesadas su capacidad para proteger los datos, corren el riesgo de perder participación de mercado y enfrentar la reacción negativa de los consumidores. Este clima de preocupación puede limitar la voluntad de las empresas de invertir plenamente en soluciones avanzadas de seguimiento y rastreo que pueden requerir un manejo y procesamiento de datos extensos y adoptarlas. En consecuencia, el mercado puede mostrar un crecimiento más lento a medida que las organizaciones naveguen por estas complejidades, buscando equilibrar los beneficios de las capacidades de seguimiento mejoradas con el imperativo de mantener la privacidad y seguridad de los datos.

- Daños en las etiquetas de seguimiento durante la entrega

Los daños en las etiquetas de seguimiento durante la entrega afectan significativamente la eficacia de las soluciones de seguimiento y rastreo en el mercado global. Cuando las etiquetas de seguimiento, como las etiquetas RFID o los códigos de barras, se dañan durante el transporte, se producen imprecisiones en los datos, pérdida de visibilidad del producto y retrasos en el seguimiento. Esto compromete la fiabilidad de las operaciones de la cadena de suministro, especialmente en industrias que dependen del movimiento preciso del producto y del cumplimiento normativo. En el sector farmacéutico, por ejemplo, las etiquetas dañadas interrumpen los procesos críticos de trazabilidad, lo que aumenta el riesgo de productos falsificados e incumplimiento normativo. Estos problemas dan lugar a ineficiencias, mayores costos operativos y una disminución de la confianza del cliente, lo que actúa como una restricción significativa en el mercado global de soluciones de seguimiento y rastreo.

Por ejemplo,

- En agosto de 2024, según el artículo publicado por encstorge.com, las etiquetas RFID son vulnerables a sufrir daños durante la entrega, provocados por factores como el agua, el calor excesivo, los productos químicos o la rotura física del chip o de las líneas de la antena. Comprender estos riesgos es fundamental para optimizar el rendimiento de la RFID en diferentes entornos. Estos daños interrumpen los sistemas de seguimiento y localización, lo que genera imprecisiones e ineficiencias que actúan como una importante limitación para el crecimiento del mercado global.

- En agosto de 2023, según el artículo publicado por Lexicon Tech Solutions, los códigos de barras pueden dañarse durante la entrega debido a la exposición a la humedad, los aceites o las superficies rugosas, lo que genera problemas como manchas o rasgaduras. Este daño hace que el código de barras sea ilegible, lo que interrumpe el proceso de seguimiento. Estos problemas con la integridad del código de barras pueden causar retrasos, imprecisiones e ineficiencias en las cadenas de suministro, lo que actúa como una restricción importante para el mercado global de soluciones de seguimiento y rastreo.

Los daños en las etiquetas de seguimiento durante la entrega dificultan la eficacia de los sistemas de seguimiento y localización en el mercado global. Las etiquetas RFID o los códigos de barras dañados provocan errores de seguimiento, pérdida de visibilidad y retrasos, lo que afecta a la precisión de la cadena de suministro. En sectores como el farmacéutico, esto altera el cumplimiento y la trazabilidad, lo que genera ineficiencias, mayores costos y menor confianza, lo que limita el crecimiento del mercado.

Alcance del mercado de soluciones de seguimiento y localización en Oriente Medio y África

El mercado está segmentado en función del producto, la solución, la aplicación, la tecnología, el usuario final y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Producto

- Componentes de software

- Gerente de Planta

- Controlador de línea

- Administrador de empresas y redes

- Seguimiento de paquetes

- Seguimiento de casos

- Gerente de Almacén y Envíos

- Seguimiento de palets

- Otros

- Componentes de hardware

- Impresión y marcado

- Escáner de código de barras

- Monitoreo y verificación

- Etiquetadora

- Controlador de peso

- Lector RFID

- Otros

- Plataforma independiente

Solución

- Serialización a nivel de línea y de sitio

- Trazabilidad a nivel empresarial en la nube

- Solución de distribución y almacenamiento

- Red de intercambio de datos de la cadena de suministro

- Otros

Solicitud

- Publicación por entregas

- Serialización de cajas de cartón

- Serialización de botellas

- Serialización de dispositivos médicos

- Serialización de viales y ampollas

- Serialización en blíster

- Impresión

- Inspección de etiquetado y embalaje

- Agregación

- Agregación de paquetes

- Agregación de casos

- Agregación de palets

- Seguimiento

- Rastreo

- Informes

Tecnología

- Códigos de barras 2d

- Identificación por radiofrecuencia (RFID)

- Códigos de barras lineales/1d

Usuario final

- Empresas farmacéuticas y biofarmacéuticas

- Bienes de consumo envasados

- Bienes de lujo

- Alimentos y bebidas

- Empresas de dispositivos médicos

- Organizaciones de fabricación por contrato

- Reenvasadores

- Empresas de cosméticos

- Otros

Canal de distribución

- Ventas directas

- Distribuidores de terceros

Análisis regional del mercado de soluciones de seguimiento y localización en Oriente Medio y África

Se analiza el mercado y se proporcionan información sobre el tamaño del mercado y las tendencias por país, producto, solución, aplicación, tecnología, usuario final y canal de distribución como se menciona anteriormente.

Los países cubiertos en el mercado son Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Qatar, Egipto, Kuwait, Bahréin, Omán y el resto de Medio Oriente y África.

Se espera que Sudáfrica domine el mercado debido al avance tecnológico en la región junto con la presencia de importantes actores de soluciones de seguimiento y rastreo en la región.

Se espera que Sudáfrica sea el mercado de seguimiento y rastreo más rápido de Oriente Medio y África debido a la rápida industrialización, el creciente comercio electrónico, los estrictos requisitos regulatorios y la creciente preocupación por los productos falsificados. Además, la expansión de los sectores farmacéutico y de atención médica, junto con los avances tecnológicos, están impulsando la demanda de soluciones eficientes de visibilidad de la cadena de suministro.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas arriba y aguas abajo, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Medio Oriente y África y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales al proporcionar un análisis de pronóstico de los datos del país.

Cuota de mercado de soluciones de seguimiento y localización en Oriente Medio y África

El panorama competitivo del mercado proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Oriente Medio y África, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado.

Los líderes del mercado de soluciones de seguimiento y localización en Oriente Medio y África que operan en el mercado son:

- SAP SE (Alemania)

- Zebra Technologies Corp. (Estados Unidos)

- Videojet Technologies, Inc. (Estados Unidos)

- METTLER TOLEDO (EE.UU.)

- Tracelink Inc. (Estados Unidos)

- Siemens (Alemania)

- Domino Printing Sciences plc (Reino Unido)

- Laetus GmbH (Alemania)

- Xyntek Incorporated (Estados Unidos)

- IBM Corporation (Estados Unidos)

- WIPOTEC-OCS GmbH (Alemania)

- 3Keys (Alemania)

- ACG (India)

- NJM Packaging Inc. (Estados Unidos)

- GRUPO OPTEL (Canadá)

- Systech (India)

- Robert Bosch Manufacturing Solutions GmbH (Alemania)

- ANTARES VISION SpA (Italia)

- Uhlmann (India)

- SEA VISION Srl (Italia)

- Visión de Jekson (India)

- Sistemas Kevision (India)

- Arvato Systems (Alemania)

- Grant-Soft Ltd. (Turquía)

- PharmaSecure Inc. (Estados Unidos)

- Axyway (Francia)

- SL Controls Ltd. (Estados Unidos)

Últimos avances en el mercado de soluciones de seguimiento y localización en Oriente Medio y África

- En mayo de 2024, Videojet lanzó el láser de CO2 3350 de 30 vatios, diseñado para proporcionar un marcado permanente de alta calidad para una variedad de materiales. Esta solución láser avanzada mejora la eficiencia operativa y reduce el tiempo de inactividad gracias a su rendimiento confiable y de alta velocidad. Es especialmente adecuada para industrias que requieren un marcado de precisión, como la de alimentos, bebidas y productos farmacéuticos.

- En mayo de 2019, METTLER TOLEDO inauguró en Barcelona su nuevo centro de pruebas de inspección de productos para procesadores de alimentos y productos farmacéuticos de Oriente Medio y África. Este nuevo centro de pruebas inaugurado por la empresa aumenta su credibilidad en el mercado, lo que se traduce en un aumento de la demanda y de las ventas de su producto en el futuro.

- En febrero de 2020, ACG presentó una innovadora plataforma de marca basada en blockchain. Esta nueva plataforma presentada por la empresa aumentará su demanda en el mercado.

- En noviembre de 2019, ACG presentó la serie NXT, máquinas preparadas para el futuro que brindarán una experiencia de USUARIO inteligente a nuestros clientes. En la serie NXT, las máquinas incluidas son Protab 300 NXT, Protab 700 NXT, BMax NXT, KartonX NXT y Verishield CS18 NXT en PMEC 2019. Estos nuevos productos lanzados por ACG aumentarán la demanda de su producto en el mercado.

- En julio de 2020, Axyway recibió la designación AWS Healthcare Competency y la designación AWS Life Sciences Competency de Amazon Web Services (AWS) por sus soluciones utilizadas en múltiples industrias. Este reconocimiento recibido por la empresa aumentará su credibilidad en el mercado.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCTS LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

5 MIDDLE EAST AND AFRICA TRACK & TRACE SOLUTIONS MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 STRINGENT REGULATIONS & STANDARDS FOR THE IMPLEMENTATION OF SERIALIZATION

6.1.2 RISING COUNTERFEIT CONCERNS

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN TRACK AND TRACE SOLUTIONS

6.1.4 COMPLEXITY IN MIDDLE EAST AND AFRICA SUPPLY CHAIN

6.2 RESTRAINTS

6.2.1 RESISTANCE FROM SMALL BUSINESSES

6.2.2 DAMAGE TO TRACKING TAGS DURING DELIVERY

6.3 OPPORTUNITIES

6.3.1 GROWTH IN THE E-COMMERCE SECTOR

6.3.2 INCREASING FOCUS ON DATA ANALYTICS

6.3.3 EXPANSION IN MIDDLE EAST AND AFRICA TRADE

6.4 CHALLENGES

6.4.1 HIGH IMPLEMENTATION COSTS

6.4.2 DATA SECURITY AND PRIVACY CONCERNS

7 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS

7.1 OVERVIEW

7.2 SOFTWARE COMPONENTS

7.2.1.1 PLANT MANAGER

7.2.1.2 ENTERPRISE & NETWORK MANAGER

7.2.1.3 BUNDLE TRACKING

7.2.1.4 PALLET TRACKING

7.2.1.5 CASE TRACKING

7.2.1.6 WAREHOUSE & SHIPMENT MANAGER

7.2.1.7 LINE CONTROLLER

7.2.1.8 OTHERS

7.3 HARDWARE COMPONENTS

7.3.1.1 PRINTING & MARKING

7.3.1.2 LABELER

7.3.1.3 BARCODE SCANNER

7.3.1.4 RFID READER

7.3.1.5 CHECKWEIGHER

7.3.1.6 MONITORING & VERIFICATION

7.3.1.7 OTHERS

7.4 STANDALONE PLATFORMS

8 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION

8.1 OVERVIEW

8.2 LINE & SITE LEVEL SERIALIZATION

8.3 CLOUD ENTERPRISE-LEVEL TRACEABILITY

8.4 DISTRIBUTION & WAREHOUSE SOLUTION

8.5 SUPPLY CHAIN DATA-SHARING NETWORK

8.6 OTHERS

9 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 2D BARCODES

9.3 RADIOFREQUENCY IDENTIFICATION (RFID)

9.4 LINEAR/1D BARCODESS

10 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 SERIALIZATION

10.3 PRINTING

10.4 LABELING & PACKAGING INSPECTION

10.5 AGGREGATION

10.6 TRACKING

10.7 TRACING

10.8 REPORTING

11 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY END USER

11.1 OVERVIEW

11.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIE

11.3 CONSUMER PACKAGED GOODS

11.4 LUXURY GOODS

11.5 FOOD & BEVERAGE

11.6 MEDICAL DEVICE COMPANIES

11.7 CONTRACT MANUFACTURING ORGANIZATIONS

11.8 REPACKAGERS

11.9 COSMETICS COMPANIES

11.1 OTHERS

12 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT SALES

12.3 THIRD PARTY DISTRIBUTORS

13 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET

13.1 MIDDLE EAST AND AFRICA

13.1.1 SOUTH AFRICA

13.1.2 SAUDI ARABIA

13.1.3 U.A.E.

13.1.4 ISRAEL

13.1.5 EGYPT

13.1.6 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 SAP SE

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 ZEBRA TECHNOLOGIES CORP.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 TRACELINK INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 VIDEOJET TECHNOLOGIES, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 METTLER TOLEDO

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ACG

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 AXYWAY

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 ANTARES VISION S.P.A.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 ARVATO SYSTEMS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 DOMINO PRINTING SCIENCES PLC

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GRANT-SOFT LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 IBM CORPORATION

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 JEKSON VISION

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 3KEYS

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 KEVISION SYSTEMS

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 LAETUS GMBH

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 NJM PACKAGING INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 OPTEL GROUP

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 PHARMADECURE INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 ROBERT BOSCH MANUFACTURING SOLUTIONS GMBH

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SEA VISION S.R.L.

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENT

16.22 SIEMENS

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENT

16.23 SL CONTROLS LTD

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 SYSTECH

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 UHLMANN

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 WIPOTEC-OCS GMBH

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 XYNTEK INCORPORATED

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 2 MIDDLE EAST AND AFRICA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA STANDALONE PLATFORMS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA LINE & SITE LEVEL SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA CLOUD ENTERPRISE-LEVEL TRACEABILITY IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA DISTRIBUTION & WAREHOUSE SOLUTION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA SUPPLY CHAIN DATA-SHARING NETWORK IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA OTHERS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA 2D BARCODES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032(USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA RADIOFREQUENCY IDENTIFICATION (RFID) IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA LINEAR/1D BARCODES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA PRINTING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA LABELING & PACKAGING INSPECTION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA TRACKING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA TRACING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA REPORTING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIE IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA CONSUMER PACKAGED GOODS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA LUXURY GOODS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA FOOD & BEVERAGE IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA MEDICAL DEVICE COMPANIES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA CONTRACT MANUFACTURING ORGANIZATIONS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA REPACKAGERS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA COSMETICS COMPANIES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA OTHERS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA DIRECT SALES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032(USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA THIRD-PARTY DISTRIBUTORS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 51 SOUTH AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 52 SOUTH AFRICA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 53 SOUTH AFRICA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 54 SOUTH AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 55 SOUTH AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 56 SOUTH AFRICA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 57 SOUTH AFRICA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 SOUTH AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 59 SOUTH AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 60 SOUTH AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 61 SAUDI ARABIA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 62 SAUDI ARABIA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 63 SAUDI ARABIA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 64 SAUDI ARABIA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 65 SAUDI ARABIA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 66 SAUDI ARABIA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 67 SAUDI ARABIA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 68 SAUDI ARABIA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 69 SAUDI ARABIA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 70 SAUDI ARABIA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 71 U.A.E. TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 72 U.A.E. SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 73 U.A.E. HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 74 U.A.E. TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 75 U.A.E. TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 76 U.A.E. SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 77 U.A.E. AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 78 U.A.E. TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 79 U.A.E. TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 80 U.A.E. TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 81 ISRAEL TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 82 ISRAEL SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 83 ISRAEL HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 84 ISRAEL TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 85 ISRAEL TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 86 ISRAEL SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 87 ISRAEL AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 88 ISRAEL TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 89 ISRAEL TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 90 ISRAEL TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 91 EGYPT TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 92 EGYPT SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 93 EGYPT HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 94 EGYPT TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 95 EGYPT TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 96 EGYPT SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 97 EGYPT AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 98 EGYPT TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 99 EGYPT TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 100 EGYPT TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 101 REST OF MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

Lista de figuras

FIGURE 1 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: SEGMENTATION

FIGURE 11 STRINGENT REGULATIONS & STANDARDS FOR THE IMPLEMENTATION OF SERIALIZATION IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 12 SOFTWARE COMPONENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET IN 2025 & 2032

FIGURE 13 DROC ANALYSIS

FIGURE 14 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY PRODUCTS, 2024

FIGURE 15 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY PRODUCTS, 2025-2032 (USD THOUSAND)

FIGURE 16 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY PRODUCTS, CAGR (2025-2032)

FIGURE 17 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY PRODUCTS, LIFELINE CURVE

FIGURE 18 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY SOLUTION, 2024

FIGURE 19 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY SOLUTION, 2025-2032 (USD THOUSAND)

FIGURE 20 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY SOLUTION, CAGR (2025-2032)

FIGURE 21 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY SOLUTION, LIFELINE CURVE

FIGURE 22 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY TECHNOLOGY, 2024

FIGURE 23 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY TECHNOLOGY, 2025-2032 (USD THOUSAND)

FIGURE 24 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY TECHNOLOGY, CAGR (2025-2032)

FIGURE 25 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 26 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY APPLICATION, 2024

FIGURE 27 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY APPLICATION, 2025-2032 (USD THOUSAND)

FIGURE 28 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 29 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY END USER, 2024

FIGURE 31 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 32 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY END USER, CAGR (2025-2032)

FIGURE 33 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 35 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 36 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 37 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET SNAPSHOT

FIGURE 39 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: COMPANY SHARE 2024 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.