Middle East And Africa Surgical Power Tools Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

73.97 Million

USD

96.65 Million

2025

2033

USD

73.97 Million

USD

96.65 Million

2025

2033

| 2026 –2033 | |

| USD 73.97 Million | |

| USD 96.65 Million | |

|

|

|

|

Mercado de herramientas eléctricas quirúrgicas en Oriente Medio y África, por producto (pieza de mano, desechables y accesorios), tecnología (herramientas eléctricas operadas a batería, herramientas eléctricas neumáticas y otras), tipo de dispositivo (herramientas eléctricas para huesos grandes, herramientas eléctricas para huesos pequeños, herramientas eléctricas para huesos medianos y otras), aplicación (cirugía ortopédica, cirugía otorrinolaringológica, cirugía neurológica, cirugía dental, cirugía cardiotorácica, otras), usuario final (hospitales, centros quirúrgicos ambulatorios (ASC), clínicas y otros), canal de distribución (licitaciones directas y distribución de terceros), país (Arabia Saudita, Sudáfrica, Emiratos Árabes Unidos, Israel, Egipto y el resto de Oriente Medio y África), tendencias de la industria y pronóstico hasta 2028.

Análisis y perspectivas del mercado: mercado de herramientas eléctricas quirúrgicas en Oriente Medio y África

Análisis y perspectivas del mercado: mercado de herramientas eléctricas quirúrgicas en Oriente Medio y África

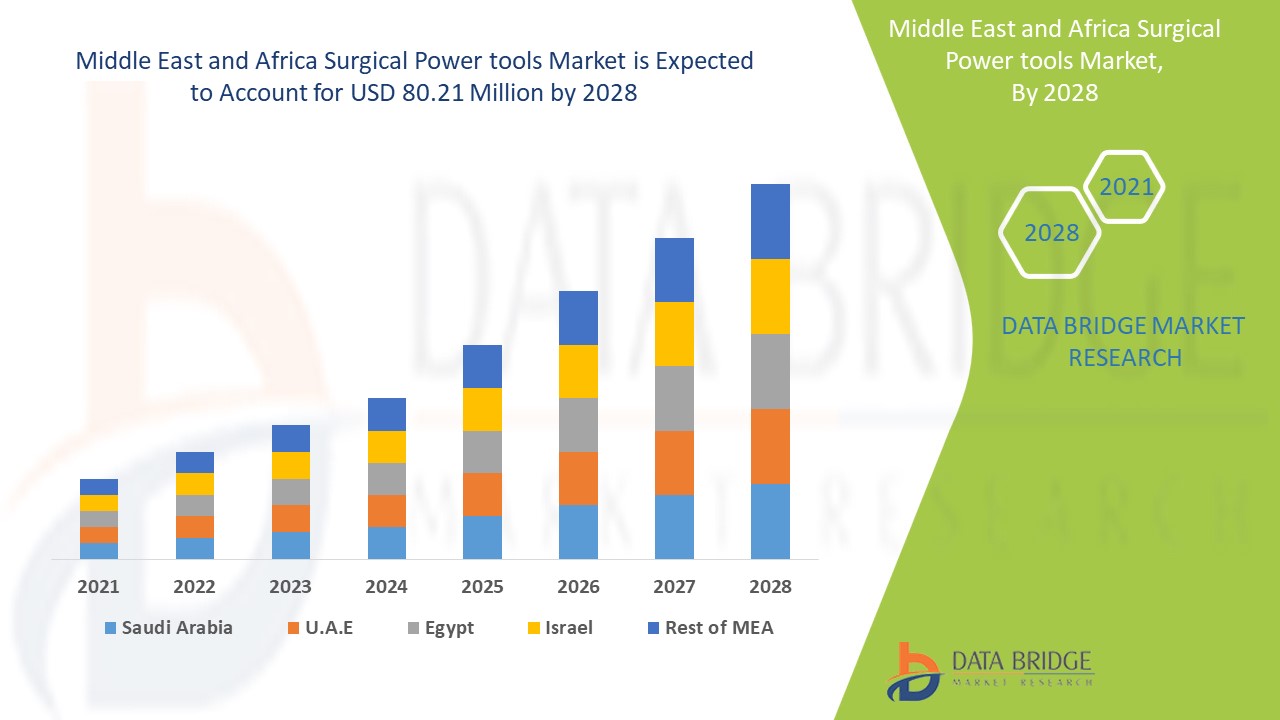

Se espera que el mercado de herramientas eléctricas quirúrgicas de Oriente Medio y África gane crecimiento de mercado en el período de pronóstico de 2021 a 2028. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 3,4% en el período de pronóstico de 2021 a 2028 y se espera que alcance los USD 80,21 millones para 2028 desde USD 62,59 millones en 2020. La creciente demanda de herramientas eléctricas quirúrgicas y el aumento de las cirugías ortopédicas son los principales impulsores que impulsaron la demanda del mercado en el período de pronóstico.

El aumento de los trastornos neurológicos y ortopédicos es el principal factor que ha impulsado la demanda de herramientas eléctricas quirúrgicas que se utilizan para realizar cirugías en huesos o fragmentos de huesos, entre otros tipos. Estas herramientas eléctricas ayudan a escariar, serrar, perforar, atornillar y otros procedimientos. Incluye una pieza de mano, desechables y accesorios. Las piezas de mano que se utilizan para cirugías son generalmente de dos tipos: piezas de mano eléctricas y piezas de mano impulsadas por aire; sin embargo, con una rápida investigación y desarrollo, también se han descubierto piezas de mano eléctricas de alto par. Los principales procedimientos quirúrgicos en los que se pueden emplear estas herramientas incluyen cirugía ortopédica, cirugía otorrinolaringológica, cirugía neurológica, cirugía dental y cirugía cardiotorácica. El descubrimiento de estas herramientas eléctricas ha revolucionado los procedimientos quirúrgicos al hacer que el procedimiento general sea eficiente e impecable.

Las herramientas eléctricas quirúrgicas desempeñan un papel importante durante las cirugías. Las herramientas eléctricas quirúrgicas son los equipos e instrumentos que se utilizan durante las diversas cirugías y ofrecen varias ventajas, entre ellas la optimización de la potencia, la suavidad de la aplicación y la compatibilidad con una amplia gama de accesorios, lo que mejora su uso entre los cirujanos. Además, la introducción de herramientas eléctricas quirúrgicas ha atraído a los cirujanos y, por lo general, prefieren estos instrumentos eléctricos por su alta velocidad, lo que mejora la tasa de flexibilidad de las cirugías.

El informe de mercado de herramientas eléctricas quirúrgicas proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen analítico; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de herramientas eléctricas quirúrgicas

Alcance y tamaño del mercado de herramientas eléctricas quirúrgicas

El mercado de herramientas eléctricas quirúrgicas se clasifica en seis segmentos notables que se basan en el producto, la tecnología, el tipo de dispositivo, la aplicación, el usuario final y el canal de distribución. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- En función del producto, el mercado de herramientas eléctricas quirúrgicas se segmenta en piezas de mano, desechables y accesorios. En 2021, se espera que el segmento de piezas de mano domine el mercado debido a su función de optimización automática de la potencia, su aplicación quirúrgica suave y su alta tasa de compatibilidad con una amplia gama de accesorios y desechables. Las piezas de mano se utilizan para diversos procedimientos quirúrgicos que van desde la perforación hasta el escariado, lo que impulsa el crecimiento del mercado.

- En función de la tecnología, el mercado de herramientas eléctricas quirúrgicas se segmenta en herramientas eléctricas operadas eléctricamente, herramientas eléctricas impulsadas por batería , herramientas eléctricas neumáticas, entre otras. En 2021, se espera que el segmento de herramientas eléctricas operadas eléctricamente domine el mercado, ya que este instrumento ofrece un par constante incluso con alta resistencia y mayor carga. Además, se han reducido las precauciones de seguridad mejoradas asociadas con las lesiones accidentales mediante la introducción de herramientas eléctricas operadas eléctricamente, lo que acelera el crecimiento del mercado. Las herramientas eléctricas operadas eléctricamente no producen ninguna sensación vibratoria, lo que aumenta su demanda en el mercado.

- Según el tipo de dispositivo, el mercado de herramientas eléctricas quirúrgicas se segmenta en herramientas eléctricas para huesos grandes , herramientas eléctricas para huesos pequeños, herramientas eléctricas para huesos medianos, entre otras. En 2021, se espera que el segmento de herramientas eléctricas para huesos grandes domine el mercado debido al aumento de la prevalencia de osteoartritis, osteoporosis y fracturas de cadera, entre otras lesiones en huesos grandes. Además, el creciente número de artroplastias de rodilla, entre otras, está proporcionando al mercado un crecimiento lucrativo.

- En función de la aplicación, el mercado de herramientas eléctricas quirúrgicas se segmenta en cirugía ortopédica, cirugía otorrinolaringológica, cirugía neurológica, cirugía dental, cirugía cardiotorácica, entre otras. En 2021, se espera que el segmento de cirugía ortopédica domine el mercado debido al aumento de varios tipos de accidentes de tránsito y la alta adopción de procedimientos quirúrgicos mínimamente invasivos.

- En función del usuario final, el mercado de herramientas eléctricas quirúrgicas se segmenta en hospitales , centros quirúrgicos ambulatorios (ASC), clínicas y otros. En 2021, se espera que el segmento de hospitales domine el mercado debido al aumento en el número de cirugías y la demanda de dispositivos que puedan reducir el tiempo total de cirugía y la presión de los altos costos.

- Sobre la base del canal de distribución, el mercado de herramientas eléctricas quirúrgicas se segmenta en licitaciones directas y distribución de terceros. En 2021, se espera que el segmento de licitaciones directas ingrese al mercado debido al bajo costo de adquisición de dispositivos y la gran dependencia de los hospitales, entre otros usuarios finales, de las licitaciones directas.

Análisis a nivel de país del mercado de herramientas eléctricas quirúrgicas

Se analiza el mercado de herramientas eléctricas quirúrgicas y se proporciona información sobre el tamaño del mercado sobre la base de seis segmentos notables que son por producto, tecnología, tipo de dispositivo, aplicación, usuario final y canal de distribución como se mencionó anteriormente.

Los países cubiertos en el informe del mercado de herramientas eléctricas quirúrgicas son Arabia Saudita, Sudáfrica, Emiratos Árabes Unidos, Israel, Egipto y el resto de Medio Oriente y África.

Se espera que Oriente Medio y África crezcan a una CAGR del 3,4 % en el período de pronóstico debido a las innovaciones en atención médica y al creciente enfoque en herramientas eléctricas quirúrgicas y a los avances tecnológicos en herramientas eléctricas quirúrgicas multifuncionales.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Las iniciativas estratégicas de los actores del mercado están creando nuevas oportunidades en el mercado de herramientas eléctricas quirúrgicas

El mercado de herramientas eléctricas quirúrgicas también le proporciona un análisis detallado del mercado de cada país: el crecimiento de las herramientas eléctricas quirúrgicas, el impacto de los avances en las herramientas eléctricas quirúrgicas y los cambios en los escenarios regulatorios con su apoyo al mercado de herramientas eléctricas quirúrgicas. Los datos están disponibles para el período histórico de 2010 a 2019.

Análisis del panorama competitivo y de la cuota de mercado de las herramientas eléctricas quirúrgicas

El panorama competitivo del mercado de herramientas eléctricas quirúrgicas proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y amplitud de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa relacionado con el mercado de herramientas eléctricas quirúrgicas.

Las principales empresas que suministran herramientas eléctricas quirúrgicas son Medtronic, Stryker, Zimmer Biomet, DePuy Synthes (The Orthopaedic Company of Johnson & Johnson Services, Inc.), 3M, CONMED Corporation, entre otras. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Muchos lanzamientos de productos y acuerdos también son iniciados por empresas de todo el mundo que también están acelerando el mercado de herramientas eléctricas quirúrgicas.

Por ejemplo,

- En diciembre de 2020, Zimmer Biomet anunció que había completado la adquisición de A&E Medical Corporation. Este acuerdo tuvo un impacto insignificante en las ganancias netas de la empresa en 2020.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.