Middle East And Africa Smart Medical Devices Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.68 Billion

USD

5.73 Billion

2025

2033

USD

1.68 Billion

USD

5.73 Billion

2025

2033

| 2026 –2033 | |

| USD 1.68 Billion | |

| USD 5.73 Billion | |

|

|

|

|

Segmentación del mercado de dispositivos médicos inteligentes en Oriente Medio y África, por tipo de producto (dispositivos de diagnóstico y monitorización, y dispositivos terapéuticos), tipo (sujeto al cuerpo (parche adhesivo), externo (clip para cinturón) y portátil), tecnología (basada en resorte, accionada por motor, bomba rotatoria, batería expansible, gas presurizado y otros), modalidad (usable y no usable), aplicación (oncología, diabetes, trastornos autoinmunes, enfermedades infecciosas, deportes y fitness, trastornos del sueño y otros), usuario final (hospitales, clínicas, atención domiciliaria, clubes deportivos y otros), canal de distribución (farmacias, canal online y otros): tendencias del sector y pronóstico hasta 2033.

Tamaño del mercado de dispositivos médicos inteligentes en Oriente Medio y África

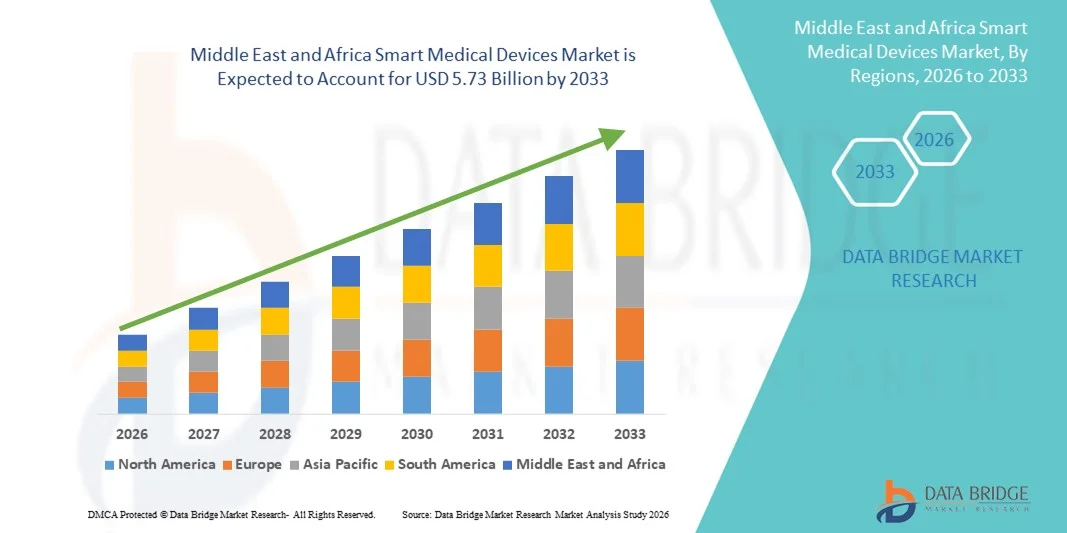

- El tamaño del mercado de dispositivos médicos inteligentes de Medio Oriente y África se valoró en USD 1.68 mil millones en 2025 y se espera que alcance los USD 5.73 mil millones para 2033 , con una CAGR del 16,6% durante el período de pronóstico.

- El crecimiento del mercado se ve impulsado en gran medida por la creciente digitalización de la atención médica, la creciente prevalencia de enfermedades crónicas y la creciente integración de los registros médicos electrónicos (EHR) con dispositivos inteligentes, lo que permite un monitoreo remoto avanzado de los pacientes y mejores resultados clínicos tanto en entornos hospitalarios como domésticos.

- Además, las iniciativas de salud digital impulsadas por los gobiernos, las mejoras de infraestructura y la creciente demanda de soluciones eficientes de monitorización de la salud en tiempo real están consolidando los dispositivos médicos inteligentes como componentes clave de los sistemas de salud modernos. Estos factores convergentes están acelerando su adopción entre consumidores y profesionales sanitarios, impulsando así significativamente el crecimiento del sector.

Análisis del mercado de dispositivos médicos inteligentes en Oriente Medio y África

- Los dispositivos médicos inteligentes, incluidos los dispositivos de diagnóstico y monitoreo, así como los dispositivos terapéuticos, se están convirtiendo en componentes esenciales de los sistemas de atención médica modernos, tanto en hospitales como en entornos de atención domiciliaria, debido a su capacidad para permitir el monitoreo de pacientes en tiempo real, la administración remota y la integración perfecta con registros médicos electrónicos (EHR) y plataformas de telemedicina.

- La creciente demanda de dispositivos médicos inteligentes está impulsada principalmente por la creciente prevalencia de enfermedades crónicas, la creciente adopción de tecnologías portátiles y no portátiles y las iniciativas de salud digital lideradas por los gobiernos en los países de Oriente Medio y África.

- Arabia Saudita dominó el mercado con la mayor participación en los ingresos del 28,4 % en 2025, caracterizada por una infraestructura de atención médica avanzada, la adopción temprana de parches adhesivos y dispositivos portátiles y un fuerte apoyo gubernamental a las soluciones de atención médica inteligente.

- Se espera que Nigeria sea el país de más rápido crecimiento en el mercado de dispositivos médicos inteligentes durante el período de pronóstico debido a la mejora de la infraestructura de atención médica, la creciente conciencia de los dispositivos portátiles para la diabetes y el monitoreo cardiovascular y la expansión de los canales de distribución, incluidas las farmacias y las plataformas en línea.

- El segmento de dispositivos de diagnóstico y monitoreo dominó el mercado con una participación del 55,6% en 2025, impulsado por su eficacia en el manejo de oncología, diabetes y enfermedades infecciosas, facilidad de uso en atención domiciliaria y entornos hospitalarios, e integración perfecta con plataformas de telemedicina.

Alcance del informe y segmentación del mercado de dispositivos médicos inteligentes en Oriente Medio y África

|

Atributos |

Perspectivas clave del mercado de dispositivos médicos inteligentes en Oriente Medio y África |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología de pacientes, análisis de canalización, análisis de precios y marco regulatorio. |

Tendencias del mercado de dispositivos médicos inteligentes en Oriente Medio y África

Atención médica mejorada mediante dispositivos conectados y habilitados con IA

- Una tendencia significativa y en aceleración en el mercado de dispositivos médicos inteligentes de Medio Oriente y África es la integración de inteligencia artificial (IA) y conectividad habilitada para IoT en dispositivos de diagnóstico, monitoreo y terapéuticos, lo que mejora significativamente la atención al paciente, el monitoreo remoto y la toma de decisiones clínicas.

- Por ejemplo, el tensiómetro portátil Omron HeartGuide se conecta con aplicaciones móviles y análisis basados en IA, lo que permite a usuarios y profesionales sanitarios realizar un seguimiento de las tendencias de salud cardiovascular a lo largo del tiempo. De igual forma, los monitores portátiles Biobeat ofrecen monitorización continua del paciente en tiempo real, integrada con IA para alertas predictivas.

- Los dispositivos médicos con IA mejoran la eficiencia al analizar los datos de los pacientes para detectar anomalías, predecir la progresión de la enfermedad y sugerir intervenciones. Por otro lado, los dispositivos conectados permiten generar informes en tiempo real para los profesionales sanitarios. Por ejemplo, algunos monitores de glucosa Health2Sync utilizan IA para ofrecer información personalizada sobre el control de la diabetes y alertar a los profesionales sanitarios si se detectan patrones irregulares de glucosa.

- La integración perfecta de dispositivos médicos inteligentes con sistemas EHR de hospitales y aplicaciones de salud móviles facilita la gestión centralizada de pacientes, lo que permite a los médicos monitorear a varios pacientes simultáneamente y ajustar los planes de tratamiento en tiempo real.

- Esta tendencia hacia dispositivos inteligentes, conectados y centrados en el paciente está transformando las expectativas de la atención médica. Por ello, empresas como Biobeat y Health2Sync están desarrollando dispositivos con IA, análisis predictivo y conectividad en la nube para hospitales y atención domiciliaria.

- La demanda de dispositivos médicos inteligentes que integran IA y conectividad está creciendo rápidamente en hospitales, clínicas y entornos de atención domiciliaria, a medida que los pacientes y los proveedores de atención médica priorizan cada vez más el monitoreo en tiempo real, la atención personalizada y la eficiencia operativa.

- Los dispositivos portátiles son cada vez más preferidos sobre los dispositivos tradicionales debido a su portabilidad, facilidad de uso y capacidades de monitoreo continuo, lo que respalda la participación del paciente a largo plazo y la adherencia a los planes de tratamiento.

- Las soluciones de monitoreo remoto para enfermedades crónicas e infecciosas están ganando terreno en países como Arabia Saudita y Nigeria, reduciendo las visitas al hospital, optimizando los recursos de atención médica y permitiendo intervenciones tempranas.

Dinámica del mercado de dispositivos médicos inteligentes en Oriente Medio y África

Conductor

Aumento de las necesidades de digitalización de la atención sanitaria y gestión de enfermedades crónicas

- La creciente prevalencia de enfermedades crónicas y la creciente adopción de plataformas de atención médica digital en hospitales y entornos de atención domiciliaria son impulsores importantes de la demanda de dispositivos médicos inteligentes.

- Por ejemplo, en abril de 2025, Health2Sync anunció una expansión de su plataforma de gestión de diabetes impulsada por IA en Arabia Saudita y los Emiratos Árabes Unidos, con el objetivo de integrar monitores de glucosa portátiles con aplicaciones de salud móviles para el monitoreo de pacientes en tiempo real.

- A medida que los proveedores de atención médica y los pacientes buscan mejores resultados y una gestión proactiva de las enfermedades crónicas, los dispositivos inteligentes ofrecen monitoreo continuo, alertas predictivas e integración con sistemas EHR, lo que proporciona una alternativa convincente a los modelos de atención tradicionales.

- Además, las iniciativas de salud digital lideradas por el gobierno y las inversiones en infraestructura de atención médica están acelerando la adopción de dispositivos inteligentes, particularmente en los sistemas de atención médica avanzados de Arabia Saudita y los Emiratos Árabes Unidos.

- La conveniencia del monitoreo en tiempo real, la compatibilidad con la telemedicina y la información personalizada sobre la atención médica son factores clave que impulsan la adopción en hospitales, clínicas y atención domiciliaria, mientras que la accesibilidad mejorada y la participación del paciente contribuyen aún más al crecimiento del mercado.

- Las asociaciones entre empresas de dispositivos médicos y plataformas de telemedicina están impulsando el crecimiento al permitir soluciones integradas para hospitales y atención domiciliaria, mejorando la adopción de dispositivos en países de Oriente Medio y África.

- La creciente concientización y los programas de capacitación para profesionales de la salud sobre dispositivos médicos inteligentes están promoviendo su adopción, ya que los médicos reconocen el valor de las herramientas conectadas y habilitadas con IA para mejorar los resultados de los pacientes.

Restricción/Desafío

Preocupaciones sobre la seguridad de los datos y altos costos iniciales

- Las preocupaciones sobre la privacidad de los datos , la ciberseguridad y el cumplimiento de las regulaciones sanitarias plantean desafíos importantes para una adopción más amplia de dispositivos médicos inteligentes en los países de Oriente Medio y África.

- Por ejemplo, los informes de alto perfil sobre violaciones de datos de pacientes en dispositivos habilitados para IoT han hecho que los proveedores de atención médica sean cautelosos a la hora de implementar soluciones de monitoreo conectado, lo que limita su adopción en algunos hospitales y clínicas.

- Abordar estas preocupaciones mediante un cifrado robusto, protocolos de autenticación seguros y el cumplimiento de las normativas regionales es crucial para generar confianza. Empresas como Biobeat y Omron priorizan el almacenamiento seguro en la nube, la anonimización de datos y las actualizaciones de software en sus ofertas para tranquilizar a los usuarios.

- Además, la inversión inicial relativamente alta en dispositivos médicos avanzados con IA o conectados puede ser un obstáculo, especialmente para clínicas pequeñas o proveedores de atención médica sensibles a los precios en países en desarrollo. Si bien los dispositivos de monitoreo básicos se han vuelto más asequibles, los dispositivos premium con análisis de IA, alertas predictivas y conectividad en tiempo real suelen tener un costo más alto.

- Superar estos desafíos mediante una mayor ciberseguridad, el cumplimiento normativo, la educación de los usuarios y soluciones de dispositivos rentables será vital para el crecimiento sostenido en el mercado de dispositivos médicos inteligentes de Medio Oriente y África.

- La experiencia técnica local limitada y la infraestructura de mantenimiento en algunos países africanos pueden obstaculizar la implementación y el funcionamiento a largo plazo de los dispositivos, especialmente de los dispositivos sofisticados habilitados para IA.

- Las variaciones en las regulaciones de atención médica, los aranceles de importación y las políticas de reembolso en los países de Medio Oriente y África pueden crear inconsistencias en la adopción y ralentizar la penetración en el mercado de nuevas tecnologías de dispositivos médicos inteligentes.

Alcance del mercado de dispositivos médicos inteligentes en Oriente Medio y África

El mercado está segmentado según el tipo de producto, tipo de dispositivo, tecnología, modalidad, aplicación, usuario final y canal de distribución.

- Por tipo de producto

Según el tipo de producto, el mercado se segmenta en dispositivos de diagnóstico y monitorización, y dispositivos terapéuticos. El segmento de Dispositivos de Diagnóstico y Monitorización dominó el mercado con la mayor cuota de ingresos, un 55,6%, en 2025, impulsado por la creciente prevalencia de enfermedades crónicas como la diabetes, los trastornos cardiovasculares y la monitorización de infecciones en hospitales y centros de atención domiciliaria. Estos dispositivos permiten la monitorización continua de los pacientes, la recopilación de datos en tiempo real y la integración con los sistemas de Historia Clínica Electrónica (HCE) hospitalarios, lo que proporciona a los médicos información útil. Los monitores portátiles de presión arterial, los monitores continuos de glucosa y los monitores cardíacos con IA están experimentando una alta adopción gracias a su facilidad de uso y fiabilidad clínica. Hospitales y clínicas de Arabia Saudí, Emiratos Árabes Unidos y Catar están priorizando los dispositivos de diagnóstico y monitorización para la atención remota de pacientes y los servicios de telemedicina. Este segmento también se beneficia de las iniciativas gubernamentales de digitalización de la atención sanitaria y del aumento de la inversión en infraestructura sanitaria inteligente. Además, la preferencia de los pacientes por las soluciones de monitorización domiciliaria está impulsando la demanda de dispositivos de diagnóstico portátiles y portátiles.

Se prevé que el segmento de Dispositivos Terapéuticos experimente la tasa de crecimiento más rápida, con una CAGR del 11,5 %, entre 2026 y 2033, impulsada por la creciente adopción en aplicaciones de atención domiciliaria y terapia clínica. Dispositivos terapéuticos como bombas de insulina, sistemas de infusión portátiles y dispositivos de rehabilitación motorizados están cobrando impulso por su capacidad para brindar tratamientos precisos y mejorar la adherencia al tratamiento del paciente. El crecimiento del segmento también se ve respaldado por una mayor concienciación sobre la atención personalizada, los avances en la optimización de terapias basadas en IA y la expansión de la distribución a través de farmacias y canales en línea. Los países africanos, en particular Nigeria y Sudáfrica, están adoptando dispositivos terapéuticos para el tratamiento de enfermedades crónicas y autoinmunes, lo que impulsa un crecimiento regional más rápido. Además, la integración de dispositivos terapéuticos portátiles con aplicaciones móviles y plataformas en la nube está mejorando la interacción del usuario y las capacidades de monitorización.

- Por tipo de dispositivo

Según el tipo de dispositivo, el mercado se segmenta en dispositivos corporales (parche adhesivo), externos (clip para cinturón) y portátiles. El segmento corporal (parche adhesivo) dominó el mercado con una participación del 38,7 % en 2025, gracias a su amplia adopción en aplicaciones de monitorización y terapéuticas portátiles. Estos parches ofrecen un seguimiento continuo de las constantes vitales, los niveles de glucosa o la administración de medicamentos, lo que los hace muy adecuados para el tratamiento de enfermedades crónicas. Los hospitales y los proveedores de atención domiciliaria de Arabia Saudí y los Emiratos Árabes Unidos prefieren los parches adhesivos por su diseño discreto y la alta adherencia del paciente. Este segmento también se beneficia de la integración de la IA y la nube para la monitorización en tiempo real y el análisis predictivo. La facilidad de uso, la portabilidad y la mínima interferencia con las actividades diarias contribuyen aún más al predominio de los dispositivos corporales. Los pacientes prefieren los parches adhesivos a los dispositivos tradicionales por su diseño discreto y su portabilidad a largo plazo.

Se prevé que el segmento de dispositivos portátiles registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 12,3 %, entre 2026 y 2033, impulsada por la portabilidad, la asequibilidad y la idoneidad para el diagnóstico en clínicas, zonas remotas y entornos domésticos. Dispositivos como ecógrafos portátiles, glucómetros portátiles y monitores de punto de atención son cada vez más populares en países africanos con infraestructura hospitalaria limitada. Los dispositivos portátiles ofrecen flexibilidad para los servicios de atención médica móvil y las iniciativas de telemedicina. La creciente adopción de dispositivos de diagnóstico portátiles con IA también mejora la precisión y reduce la necesidad de intervención especializada. La distribución a través de canales en línea y farmacias facilita aún más su rápida penetración en el mercado.

- Por tecnología

En cuanto a la tecnología, el mercado se segmenta en dispositivos basados en resortes, motores, bombas rotativas, baterías expansivas, gases presurizados, entre otros. El segmento de tecnología motorizada dominó con una participación en los ingresos del 33,5 % en 2025, gracias a su aplicación en dispositivos terapéuticos portátiles, bombas de infusión y equipos de rehabilitación. Los dispositivos motorizados permiten un control preciso de la administración del tratamiento y garantizan resultados fiables para el paciente. Los hospitales de Arabia Saudita y los Emiratos Árabes Unidos adoptan dispositivos motorizados para el manejo de enfermedades crónicas, la atención en UCI y la rehabilitación posoperatoria. Estos dispositivos son altamente compatibles con plataformas de monitorización basadas en IA, lo que permite ajustes en tiempo real y una toma de decisiones basada en datos. Las aprobaciones regulatorias, la precisión clínica y la integración con servicios de telemedicina refuerzan aún más su dominio del mercado. El segmento también se beneficia de la creciente preferencia de los pacientes por las soluciones de terapia automatizada.

Se prevé que el segmento de tecnología de baterías en expansión registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 12,1 %, entre 2026 y 2033, impulsada por la demanda de dispositivos portátiles y duraderos, adecuados para la atención domiciliaria y la monitorización remota. Los parches adhesivos portátiles, los monitores portátiles y los dispositivos terapéuticos portátiles aprovechan la creciente tecnología de baterías para garantizar un funcionamiento ininterrumpido. Este crecimiento es especialmente fuerte en países africanos como Nigeria y Sudáfrica, donde la fiabilidad energética y la movilidad son cruciales. Los dispositivos de baterías en expansión también se integran cada vez más con aplicaciones móviles, plataformas en la nube y análisis de IA, lo que mejora la experiencia del usuario y la interacción con el paciente.

- Por modalidad

Según la modalidad, el mercado se segmenta en wearables y no wearables. El segmento wearable dominó con una participación del 57,2% en 2025, impulsado por una fuerte adopción en la monitorización de enfermedades crónicas, el seguimiento de la actividad física y la atención postoperatoria. Los wearables, como parches inteligentes, monitores de glucosa y monitores cardíacos, ofrecen recopilación de datos en tiempo real, integración en la nube y funciones de monitorización remota. Hospitales, clínicas y proveedores de atención domiciliaria en Arabia Saudita, Emiratos Árabes Unidos y Catar implementan ampliamente dispositivos wearables debido a su facilidad de uso, comodidad para el paciente y mejor adherencia al tratamiento. La creciente concienciación sobre la atención médica preventiva y la monitorización de la actividad física también impulsa la demanda. Los wearables permiten planes de atención personalizados, soporte de telemedicina y alertas predictivas, lo que los convierte en la modalidad preferida. La integración con aplicaciones móviles y análisis de IA mejora aún más la toma de decisiones clínicas y la participación del paciente.

Se prevé que el segmento de dispositivos no portátiles registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 10,8 %, entre 2026 y 2033, impulsada por la adopción de dispositivos de diagnóstico y terapéuticos independientes, como ecógrafos portátiles, bombas de infusión estacionarias y monitores de trastornos del sueño de uso doméstico. Los dispositivos no portátiles se utilizan ampliamente en clínicas, hospitales y centros de terapia deportiva para la evaluación, rehabilitación y tratamiento de pacientes. Los países africanos están experimentando una creciente adopción debido a su rentabilidad, fiabilidad clínica y facilidad de implementación en centros sanitarios. La creciente adopción de IA y funcionalidades basadas en la nube mejora la eficacia de los dispositivos no portátiles.

- Por aplicación

Según la aplicación, el mercado se segmenta en oncología, diabetes, trastornos autoinmunes, enfermedades infecciosas, deportes y fitness, trastornos del sueño, entre otros. El segmento de diabetes dominó con una cuota de ingresos del 31,8% en 2025, debido a la creciente prevalencia de la diabetes en los países de Oriente Medio y África. Los monitores continuos de glucosa, las bombas de insulina y los dispositivos terapéuticos con IA se adoptan ampliamente en hospitales, clínicas y entornos de atención domiciliaria. Arabia Saudí y los Emiratos Árabes Unidos son mercados clave debido a la adopción temprana de programas digitales de gestión de la diabetes y una infraestructura sanitaria avanzada. La integración con aplicaciones móviles y plataformas de telemedicina permite la monitorización en tiempo real, alertas predictivas y una mejor adherencia del paciente. El segmento se beneficia de la creciente concienciación, las iniciativas sanitarias del gobierno y la disponibilidad de dispositivos reembolsables. La alta adherencia del paciente y la facilidad de uso hacen de la monitorización de la diabetes un segmento de aplicación dominante.

Se prevé que el segmento de Enfermedades Infecciosas registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 12,5 %, entre 2026 y 2033, impulsada por la creciente demanda de dispositivos de diagnóstico remoto, soluciones de monitorización portátiles y pruebas en el punto de atención. La detección y el seguimiento rápidos de infecciones son cruciales en países africanos con infraestructura hospitalaria limitada. Los dispositivos inteligentes permiten la detección oportuna, las alertas remotas y la integración con los historiales clínicos electrónicos (HCE) hospitalarios para una gestión eficaz de las enfermedades. Los dispositivos de monitorización portátiles y portátiles también facilitan el seguimiento epidemiológico y las intervenciones tempranas, apoyando así las iniciativas de salud pública.

- Por el usuario final

Según el usuario final, el mercado se segmenta en hospitales, clínicas, atención domiciliaria, clubes deportivos y otros. El segmento Hospitales dominó el mercado con una participación del 48,3% en 2025, impulsado por la adopción de dispositivos médicos inteligentes para el manejo de enfermedades crónicas, la monitorización en UCI, la atención postoperatoria y la integración de la telemedicina. Los hospitales de Arabia Saudita y los Emiratos Árabes Unidos utilizan dispositivos portátiles y wearables para monitorizar a múltiples pacientes en tiempo real, mejorando así la eficiencia clínica. La integración con sistemas de Historia Clínica Electrónica (HCE), análisis de IA y alertas predictivas impulsa aún más la demanda hospitalaria. Los hospitales también adoptan dispositivos terapéuticos para la rehabilitación de pacientes y la atención automatizada. El apoyo gubernamental a las iniciativas de hospitales inteligentes y a la infraestructura de salud digital contribuye al predominio de este segmento.

Se prevé que el segmento de Cuidado Domicilio registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 13,1 %, entre 2026 y 2033, impulsada por la creciente adopción de dispositivos portátiles y de monitorización para la diabetes, los trastornos cardiovasculares y el control de infecciones. Pacientes y cuidadores prefieren cada vez más la monitorización domiciliaria para reducir las visitas al hospital y aumentar la comodidad. Países como Nigeria, Sudáfrica y Egipto están experimentando una rápida adopción gracias al crecimiento de las iniciativas de telemedicina, la distribución a través de farmacias y plataformas en línea, y los programas de concienciación para pacientes. La integración de información basada en IA y la conectividad de aplicaciones móviles impulsa el crecimiento del segmento.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en farmacias, canal online y otros. El segmento de farmacias dominó el mercado con una cuota de mercado del 52,6% en 2025, gracias a la fácil accesibilidad a dispositivos médicos inteligentes para la atención domiciliaria y el tratamiento de enfermedades crónicas. Las farmacias de Arabia Saudí, Emiratos Árabes Unidos y Nigeria ofrecen monitores portátiles, herramientas de diagnóstico portátiles y dispositivos terapéuticos, a menudo incluidos en servicios de apoyo al paciente. Este segmento se beneficia de la sólida confianza en las redes de farmacias, el procesamiento de recetas y la orientación in situ. Las farmacias también facilitan la integración con plataformas de telemedicina y salud móvil, lo que mejora la adherencia al tratamiento. Las alianzas de marketing entre fabricantes de dispositivos y cadenas de farmacias refuerzan aún más el dominio de este canal.

Se prevé que el segmento del Canal Online registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 14,2 %, entre 2026 y 2033, impulsada por la creciente adopción del comercio electrónico, las ventas directas de dispositivos wearables y la necesidad de una cómoda entrega a domicilio. Las plataformas online permiten a los pacientes de regiones africanas remotas acceder fácilmente a dispositivos de diagnóstico, monitorización y terapia. La integración con aplicaciones de telesalud, la gestión de dispositivos con IA y los servicios de asistencia virtual impulsan una rápida adopción. Los canales online también son rentables, lo que permite a los fabricantes ampliar su alcance y ofrecer soluciones de monitorización por suscripción.

Análisis regional del mercado de dispositivos médicos inteligentes en Oriente Medio y África

- Arabia Saudita dominó el mercado con la mayor participación en los ingresos del 28,4 % en 2025, caracterizada por una infraestructura de atención médica avanzada, la adopción temprana de parches adhesivos y dispositivos portátiles y un fuerte apoyo gubernamental a las soluciones de atención médica inteligente.

- Los proveedores de atención médica y los pacientes de la región valoran mucho el monitoreo en tiempo real, el análisis habilitado por IA y la integración perfecta de dispositivos con sistemas EHR de hospitales y plataformas de salud móviles, lo que permite mejores resultados para los pacientes, atención preventiva y eficiencia operativa.

- Esta adopción generalizada está respaldada además por una infraestructura de atención médica avanzada, iniciativas de salud digital lideradas por el gobierno, una alta conciencia de los pacientes y una creciente preferencia por el monitoreo remoto de pacientes, lo que establece los dispositivos médicos inteligentes como herramientas esenciales tanto para la atención clínica como domiciliaria en Arabia Saudita, los Emiratos Árabes Unidos y Qatar.

Análisis del mercado de dispositivos médicos inteligentes de Arabia Saudita

El mercado de dispositivos médicos inteligentes de Arabia Saudita capturó la mayor participación en los ingresos, con un 28,4 %, en 2025, impulsado por la rápida adopción de dispositivos conectados de diagnóstico, monitorización y terapia en hospitales, clínicas y centros de atención domiciliaria. Pacientes y profesionales sanitarios priorizan cada vez más la monitorización en tiempo real, el análisis basado en IA y la integración fluida con los sistemas de Historia Clínica Electrónica (HCE) hospitalaria. Las iniciativas gubernamentales que promueven la salud digital, los hospitales inteligentes y las plataformas de telemedicina impulsan aún más el crecimiento del mercado. La demanda de dispositivos portátiles y wearables para el tratamiento de enfermedades crónicas, como la diabetes y las enfermedades cardiovasculares, sigue en aumento. Además, la sólida infraestructura sanitaria y la alta concienciación de los pacientes respaldan su adopción generalizada en entornos residenciales y clínicos.

Análisis del mercado de dispositivos médicos inteligentes en los EAU

Se proyecta que el mercado de dispositivos médicos inteligentes de los EAU se expandirá a una tasa de crecimiento anual compuesta (TCAC) sustancial durante el período de pronóstico, impulsado principalmente por el alto gasto en atención médica y la adopción temprana de tecnologías de salud digital. Hospitales y proveedores de atención domiciliaria están integrando dispositivos de monitorización y terapéuticos con IA para mejorar los resultados de los pacientes y la eficiencia operativa. El énfasis de la región en iniciativas de ciudades inteligentes, la telemedicina y la atención médica preventiva está impulsando su adopción. La creciente urbanización, el aumento de los ingresos disponibles y una población con conocimientos tecnológicos contribuyen aún más a la expansión del mercado. Tanto los hospitales públicos como las clínicas privadas invierten cada vez más en dispositivos conectados para mejorar la gestión de enfermedades crónicas y la atención remota a los pacientes.

Análisis del mercado de dispositivos médicos inteligentes de Qatar

Se prevé que el mercado catarí de dispositivos médicos inteligentes crezca a una tasa de crecimiento anual compuesta (TCAC) notable durante el período de pronóstico, impulsado por la creciente concienciación sobre el manejo de enfermedades crónicas y la creciente adopción de la atención domiciliaria. Los profesionales sanitarios están implementando dispositivos portátiles y wearables con IA para monitorizar a pacientes con diabetes, enfermedades cardiovasculares y otras enfermedades crónicas. El apoyo gubernamental a la infraestructura de salud digital y la integración de la telemedicina sigue impulsando la demanda. Los pacientes prefieren cada vez más las soluciones de monitorización domiciliaria, lo que reduce las visitas al hospital y garantiza la generación de informes de datos en tiempo real. La pequeña población del país y su avanzado sistema sanitario permiten una rápida implementación de dispositivos inteligentes en entornos clínicos y residenciales.

Análisis del mercado de dispositivos médicos inteligentes de Nigeria

Se espera que el mercado nigeriano de dispositivos médicos inteligentes se expanda a una tasa de crecimiento anual compuesta (TCAC) considerable durante el período de pronóstico, impulsado por la creciente popularidad de la telemedicina y las soluciones de monitorización portátil. Hospitales, clínicas y proveedores de atención domiciliaria están adoptando cada vez más dispositivos de diagnóstico y tratamiento basados en IA para el manejo de enfermedades crónicas y afecciones infecciosas. La adopción de dispositivos portátiles para la monitorización remota de pacientes está en aumento debido a la limitada infraestructura hospitalaria en las zonas rurales. Las iniciativas gubernamentales para mejorar el acceso a la atención médica digital, junto con la creciente penetración de los teléfonos inteligentes, impulsan el crecimiento del mercado. Pacientes y cuidadores muestran una mayor aceptación de los dispositivos conectados para el manejo de enfermedades en el hogar.

Cuota de mercado de dispositivos médicos inteligentes en Oriente Medio y África

La industria de dispositivos médicos inteligentes de Oriente Medio y África está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- SmartHealthTec (EAU)

- Al Zahrawi Medical Supplies Est (EAU)

- Medtronic (Irlanda)

- Abbott (EE. UU.)

- GE Healthcare (EE. UU.)

- Siemens Healthineers AG (Alemania)

- Boston Scientific Corporation (EE. UU.)

- F. Hoffmann La Roche Ltd (Suiza)

- Masimo (EE. UU.)

- Dexcom, Inc. (EE. UU.)

- Samsung Electronics Co., Ltd. (Corea del Sur)

- Garmin Ltd. (Suiza)

- Fitbit, Inc. (EE. UU.)

- Omron Healthcare, Inc. (Japón)

- BioTelemetry, Inc. (EE. UU.)

- CardiacSense Ltd (Israel)

- iHealth Labs, Inc. (EE. UU.)

- Polar Electro Oy (Finlandia)

- Bio Beat (Israel)

¿Cuáles son los desarrollos recientes en el mercado de dispositivos médicos inteligentes en Oriente Medio y África?

- En noviembre de 2025, el grupo de atención médica sudafricano Netcare se asoció con Corsano Health para adoptar dispositivos portátiles para el monitoreo continuo de pacientes en todas sus salas de hospital, utilizando dispositivos portátiles inteligentes para rastrear signos vitales como la presión arterial, la frecuencia cardíaca, la saturación de oxígeno, la frecuencia respiratoria y más, lo que marca un cambio hacia el monitoreo predictivo e ininterrumpido dentro del entorno clínico.

- En junio de 2025, Royal Philips presentó sus últimos sistemas de monitoreo de pacientes IntelliVue y TC habilitados con IA en Africa Health ExCon 2025 en El Cairo, apoyando la transformación de la atención médica de Egipto con soluciones diseñadas para mejorar la precisión del diagnóstico y la toma de decisiones clínicas al tiempo que mejora la seguridad del paciente.

- En marzo de 2025, Mediclinic Middle East lanzó “Mediclinic at Home”, un sistema de monitoreo remoto de pacientes para el manejo de enfermedades crónicas que integra sensores portátiles, teléfonos móviles y otros dispositivos conectados para transmitir datos de salud de los pacientes a los médicos, lo que permite el monitoreo en tiempo real de afecciones como diabetes e hipertensión e intervenciones oportunas desde la comodidad de los hogares de los pacientes.

- En enero de 2025, Royal Philips presentó innovaciones impulsadas por IA en diagnóstico, monitoreo de pacientes y tratamiento en Arab Health 2025 en Dubái, presentando sistemas avanzados como la resonancia magnética BlueSeal sin helio con lectura inteligente de IA y soluciones de tomografía computarizada y ultrasonido habilitadas con IA que mejoran la precisión del diagnóstico y los flujos de trabajo clínicos.

- En octubre de 2023, Philips lanzó innovaciones avanzadas en atención médica en Arabia Saudita en la Exposición de Salud Global 2023, incluido el arco en C móvil Zenition 10 para imágenes quirúrgicas mejoradas y una solución de ultrasonido portátil, en línea con los objetivos de la Visión 2030 del país para ampliar el acceso a la tecnología médica moderna.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.