Mercado de hogares inteligentes en Oriente Medio y África, por tipo de producto (controles de entretenimiento, control de seguridad y acceso, control de HVAC, electrodomésticos, cocina inteligente, control de iluminación, muebles inteligentes, atención médica domiciliaria , otros), tecnología (inalámbrica, cableada), software y servicio (conductual, proactivo), canal de ventas (directo, indirecto): tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado

Las casas inteligentes son cada vez más preferidas entre la población, ya que incorporan sistemas automatizados avanzados capaces de controlar la temperatura, la multimedia, los sistemas de entretenimiento, la seguridad, los termostatos y el funcionamiento de ventanas y puertas.

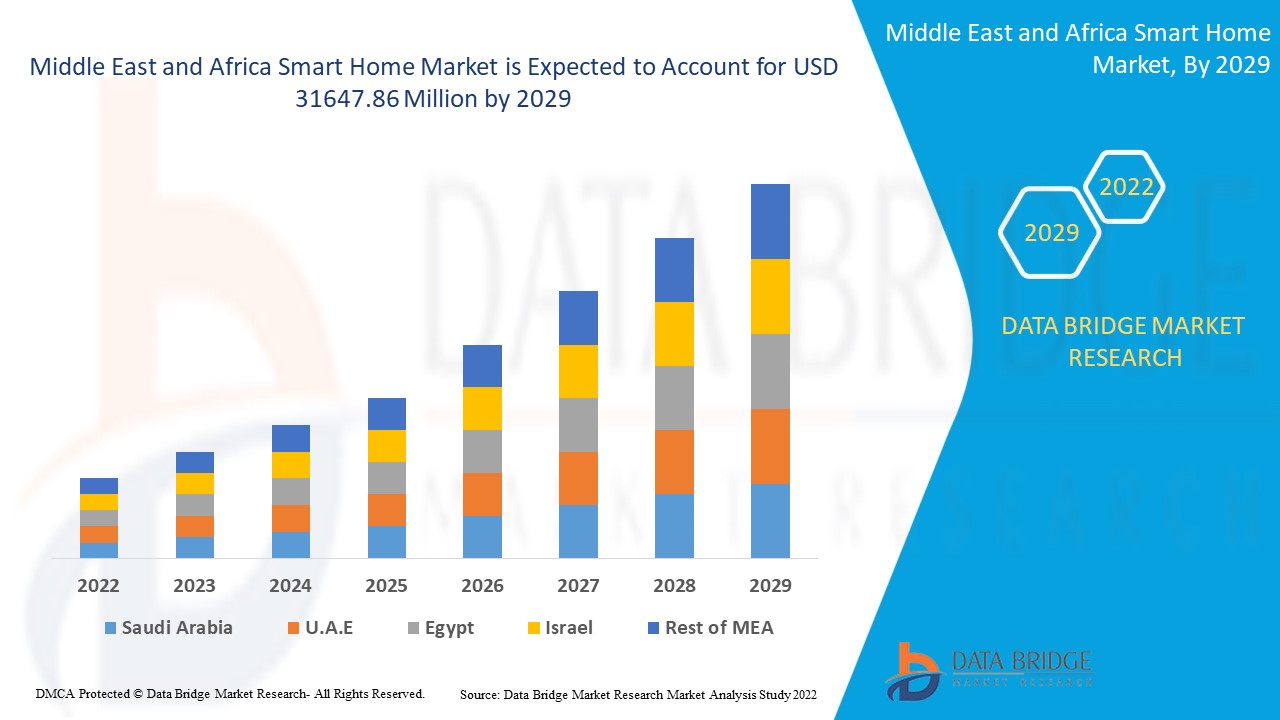

El mercado de hogares inteligentes de Oriente Medio y África se valoró en 6402,09 millones de dólares en 2021 y se espera que alcance los 31647,86 millones de dólares en 2029, registrando una CAGR del 16,80% durante el período de pronóstico de 2022 a 2029. Las redes inalámbricas representan el segmento tecnológico más grande en el mercado respectivo debido al creciente número de dispositivos basados en IoT. El informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis profundo de expertos, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis pestle.

Definición de mercado

Los dispositivos domésticos inteligentes son apropiados para una configuración doméstica en la que los dispositivos pueden manejarse de forma remota mediante un dispositivo móvil u otro dispositivo conectado a la red desde cualquier lugar del mundo conectado a Internet. El consumidor puede controlar servicios como el acceso de seguridad, la temperatura, la iluminación y el entretenimiento doméstico en un hogar inteligente porque todos sus dispositivos están conectados a Internet.

Alcance del informe y segmentación del mercado

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Tipo de producto (controles de entretenimiento, control de seguridad y acceso, control de climatización, electrodomésticos, cocina inteligente, control de iluminación, muebles inteligentes, atención médica domiciliaria, otros), tecnología (inalámbrica, cableada), software y servicio (conductual, proactivo), canal de venta (directo, indirecto) |

|

Países cubiertos |

Arabia Saudita, Emiratos Árabes Unidos, Israel, Egipto, Sudáfrica, Resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA) |

|

Actores del mercado cubiertos |

Honeywell International Inc. (EE. UU.), Siemens (Alemania), Johnson Controls (Irlanda), Axis Communications AB (Suecia), Schneider Electric (Francia), ASSA ABLOY (Suecia), Amazon (EE. UU.), Apple Inc. (EE. UU.), ADT (EE. UU.), ABB (Suiza), Robert Bosch GmbH (Alemania), Sony Corporation (Japón), Samsung (Corea del Sur), Ooma Inc. (EE. UU.), Delta Controls (Canadá), Comcast (EE. UU.), Crestron Electronics Inc. (EE. UU.), SimpliSafe Inc. (EE. UU.), Armorax (EE. UU.), LG Electronics (Corea del Sur), Lutron Electronics Co., Inc (EE. UU.) y Legrand (Francia) |

|

Oportunidades de mercado |

|

Dinámica del mercado de hogares inteligentes en Oriente Medio y África

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores

- Eficiencia energética y bajas emisiones de carbono

La creciente necesidad de soluciones orientadas al ahorro de energía y a bajas emisiones de carbono impulsa el mercado mundial de hogares inteligentes. La eficiencia energética es un aspecto importante del desarrollo económico de un país. Ha habido una creciente demanda de reducir el uso de energía y las emisiones de carbono como resultado del aumento del calentamiento global y las regulaciones regulatorias. Los hogares inteligentes representan un porcentaje significativo del consumo total de energía del mundo. Se proyecta que este factor sea el factor más importante que impulse el crecimiento de este mercado.

- Aumento del número de edificios inteligentes

Además, con la creciente urbanización en las economías en desarrollo, ha habido un aumento de los edificios inteligentes, lo que se estima que impulsará el crecimiento general del mercado. Además, el creciente número de usuarios de Internet, la creciente adopción de dispositivos inteligentes y la creciente preferencia de los clientes por los timbres con video, las tecnologías asistidas por voz (como Alexa y Google Home) y los sistemas de vigilancia también impulsan aún más el crecimiento del mercado.

- Preocupaciones relacionadas con la seguridad

La creciente preocupación por la seguridad y la comodidad del público también amortigua el crecimiento del mercado durante el período previsto. Además, los dispositivos conectados ayudan a los consumidores a controlar y supervisar los electrodomésticos del hogar y los dispositivos de la oficina de forma remota desde sus teléfonos inteligentes o tabletas, lo que actúa como un impulsor del mercado.

Además, la rápida urbanización, el cambio en el estilo de vida, el aumento de las inversiones y el mayor gasto de los consumidores impactan positivamente en el mercado de hogares inteligentes.

Oportunidades

- Penetración e inversión en tecnología

Se estima que la penetración de la tecnología IoT, z-wave, Wi-Fi y Bluetooth, junto con la inversión en dispositivos de seguridad para hogares inteligentes, generarán oportunidades lucrativas para el mercado, lo que expandirá aún más la tasa de crecimiento del mercado de hogares inteligentes en el futuro. Además, el cambio de enfoque en la mejora de la eficiencia energética también ofrecerá numerosas oportunidades de crecimiento dentro del mercado.

Restricciones y desafíos del mercado de hogares inteligentes en Oriente Medio y África

- Alto costo

El alto costo de las instalaciones de hogares inteligentes está actuando como una restricción del mercado. Se espera que el rango de precios obstaculice el crecimiento del mercado.

- Mayores preocupaciones sobre seguridad y privacidad

Además, se proyecta que las preocupaciones sobre la seguridad y la privacidad del consumidor con dispositivos más conectados serán un desafío para el mercado de hogares inteligentes durante el período de pronóstico.

Este informe sobre el mercado de hogares inteligentes proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado por categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de hogares inteligentes, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto de la COVID-19 en el mercado de hogares inteligentes en Oriente Medio y África

El mercado de hogares inteligentes se vio enormemente afectado por el brote de COVID-19. La pandemia ha dañado e interrumpido significativamente los centros de la cadena de suministro en todos los principales sectores verticales del mundo. El confinamiento dañó la producción en todo el mundo y exacerbará la crisis manufacturera existente y la incertidumbre comercial. Estados Unidos ha sido el más afectado en el sector manufacturero, con la capacidad de producción de China cayendo más del 14% y las ventas mundiales de componentes electrónicos cayendo casi un 40%. La industria, que representa aproximadamente el 17% del PIB mundial, es uno de los sectores más afectados durante la epidemia de COVID-19. China está en el epicentro de la pandemia y es el centro de la mayoría de los proveedores de materias primas que suministran materias primas y componentes a una variedad de unidades de fabricación en todo el mundo. Esto ha tenido una influencia directa en las entradas globales de IED y, como resultado, algunas economías de todo el mundo han experimentado caídas significativas. El estancamiento mundial ha sofocado la producción en estas plantas, lo que ha provocado que toda la cadena de suministro se desmorone.

Para combatir la propagación del virus y por razones económicas, las grandes corporaciones industriales han cerrado sus instalaciones y despedido a su personal. Para sobrevivir durante la pandemia, algunos fabricantes han comenzado a cambiar de empresa para poder ofrecer productos cruciales o de alta demanda.

Acontecimientos recientes

- En mayo de 2019, Resideo se asoció con VANWARD para ampliar su cartera de productos en China. El objetivo de la asociación es atraer a los clientes chinos hacia los equipos de calefacción para el hogar que ahorran energía. La asociación ayudará a la empresa a expandir su presencia en China y aumentar su base de clientes.

Alcance del mercado de hogares inteligentes en Oriente Medio y África

El mercado de hogares inteligentes está segmentado en función del tipo de producto, la tecnología, el software, el servicio y el canal de venta. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de producto

- Controles de entretenimiento

- Seguridad y control de acceso

- Control de climatización

- Electrodomésticos

- Cocina inteligente

- Control de iluminación

- Muebles inteligentes

- Atención médica domiciliaria

- Otros

En función del tipo de producto, el mercado de hogares inteligentes se segmenta en controles de entretenimiento, control de seguridad y acceso, control de climatización, electrodomésticos, cocinas inteligentes, control de iluminación, muebles inteligentes, atención médica domiciliaria y otros. Los electrodomésticos tendrán la mayor participación de mercado debido a la disponibilidad en el mercado de soluciones inalámbricas que han permitido que los electrodomésticos inteligentes se conecten con teléfonos inteligentes y tabletas de forma inalámbrica a través de Internet o Bluetooth.

Tecnología

- Inalámbrico

- Cableado

En función de la tecnología, el mercado de hogares inteligentes se segmenta en inalámbrico y cableado.

Software y servicio

- Conductual

- Proactivo

En función del software y del servicio, el mercado de hogares inteligentes se segmenta en conductual y proactivo.

Canal de venta

- Directo

- Indirecto

Sobre la base del canal de ventas, el mercado de hogares inteligentes se segmenta en directo e indirecto.

Análisis y perspectivas regionales del mercado de hogares inteligentes en Oriente Medio y África

Se analiza el mercado de hogares inteligentes y se proporcionan información y tendencias sobre el tamaño del mercado por país, tipo de producto, tecnología, software y servicio y canal de ventas como se mencionó anteriormente.

Los países cubiertos en el informe del mercado de hogares inteligentes son Arabia Saudita, Emiratos Árabes Unidos, Israel, Egipto, Sudáfrica, el resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA)).

Los Emiratos Árabes Unidos representaron la mayor participación de mercado debido al aumento de usuarios de Internet, lo que resultó en una mayor demanda de dispositivos inteligentes que aumentan la demanda de hogares inteligentes.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas abajo y aguas arriba, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Panorama competitivo y mercado de hogares inteligentes en Oriente Medio y África

El panorama competitivo del mercado de hogares inteligentes ofrece detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de hogares inteligentes.

Algunos de los principales actores que operan en el mercado de hogares inteligentes son

- Honeywell International Inc. (Estados Unidos)

- Siemens (Alemania)

- Johnson Controls (Irlanda)

- Axis Communications AB (Suecia)

- Schneider Electric (Francia)

- ASSA ABLOY (Suecia)

- Amazon (Estados Unidos)

- Apple Inc., (Estados Unidos)

- ADT (Estados Unidos)

- ABB (Suiza)

- Robert Bosch GmbH (Alemania)

- Sony Corporation (Japón)

- Samsung (Corea del Sur)

- Ooma Inc., (Estados Unidos)

- Delta Controls (Canadá)

- Comcast (Estados Unidos)

- Crestron Electronics Inc., (Estados Unidos)

- SimpliSafe Inc., (Estados Unidos)

- Armorax (Estados Unidos)

- LG Electronics (Corea del Sur)

- Lutron Electronics Co., Inc. (Estados Unidos)

- Legrand (Francia)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA SMART HOMEMARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING ADOPTION OF INTERNET-ENABLED DEVICES

5.1.2 INCREASE IN USE OF SMARTPHONES FOR CONTROLLING SMART HOME APPLIANCES

5.1.3 GROWING AWARENESS ABOUT NEED OF ENERGY-EFFICIENT SOLUTIONS

5.1.4 INCREASING DISPOSABLE INCOME

5.2 RESTRAINTS

5.2.1 INCREASING CYBER SECURITY CONCERN TOWARDS AUTOMATION

5.2.2 HIGH INITIAL COST OF SMART HOME DEVICES

5.3 OPPORTUNITIES

5.3.1 INCREASING GREEN BUILDINGS BY GOVERNMENTS

5.3.2 INTEGRATION OF POWER LINE COMMUNICATION TECHNOLOGY IN SMART HOMES

5.3.3 LARGE NUMBER OF MANUFACTURERS EXPANDING THEIR SMART HOME PRODUCT PORTFOLIOS

5.3.4 INCREASING POPULARITY OF SMART HOME DEVICES IN DEVELOPING NATIONS

5.4 CHALLENGE

5.4.1 LACK OF AWARENESS AND SKILLED WORKFORCE

6 MIDDLE EAST & AFRICA SMART HOME MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 ENTERTAINMENT CONTROLS

6.2.1 AUDIO, VOLUME, AND MULTIMEDIA ROOM CONTROLS

6.2.2 HOME THEATER SYSTEM CONTROLS

6.2.3 TOUCHSCREENS AND KEYPADS

6.3 SECURITY AND ACCESS CONTROL

6.3.1 VIDEO SURVEILLANCE

6.3.1.1 HARDWARE

6.3.1.1.1 SECURITY CAMERAS

6.3.1.1.2 STORAGE DEVICES

6.3.1.1.3 MONITORS

6.3.1.1.4 ACCESSORIES

6.3.1.2 SOFTWARE/VIDEO ANALYTICS

6.3.1.3 SERVICES

6.3.2 ACCESS CONTROL

6.3.2.1 NON-BIOMETRIC ACCESS CONTROL

6.3.2.1.1 SMART KEYPADS

6.3.2.1.2 VIDEO DOORBELLS

6.3.2.2 BIOMETRIC ACCESS CONTROL

6.3.2.2.1 FINGERPRINT RECOGNITION

6.3.2.2.2 FACIAL RECOGNITION

6.3.2.2.3 IRIS RECOGNITION

6.3.2.2.4 OTHERS

6.4 HVAC CONTROL

6.4.1 SMART THERMOSTATS

6.4.2 SENSORS

6.4.3 ACTUATORS

6.4.4 DAMPERS

6.4.5 CONTROL VALVES

6.4.6 HEATING AND COOLING COILS

6.4.7 PUMPS & FANS

6.4.8 SMART VENTS

6.5 HOME APPLIANCES

6.5.1 SMART WASHERS

6.5.2 SMART DRYERS

6.5.3 SMART WATER HEATERS

6.5.4 SMART VACUUM CLEANERS

6.6 SMART KITCHEN

6.6.1 SMART REFRIGERATORS

6.6.2 SMART DISHWASHERS

6.6.3 SMART COOKERS

6.6.4 SMART OVENS

6.6.5 SMART COOKTOPS

6.6.6 SMART COFFEE MAKERS

6.6.7 SMART KETTLES

6.7 LIGHTING CONTROL

6.7.1 DIMMERS

6.7.2 SWITCHES

6.7.3 RELAYS

6.7.4 DAYLIGHT SENSORS

6.7.5 TIMERS

6.7.6 OCCUPANCY SENSORS

6.7.7 ACCESSORIES AND OTHER PRODUCTS

6.8 SMART FURNITURE

6.8.1 SMART TABLES

6.8.2 SMART STOOLS AND BENCHES

6.8.3 SMART SOFAS

6.8.4 SMART CHAIRS

6.8.5 SMART DESKS

6.9 HOME HEALTHCARE

6.9.1 HEALTH STATUS MONITORS

6.9.2 PHYSICAL ACTIVITY MONITORS

6.1 OTHERS

6.10.1 SMART PLUGS

6.10.2 SMOKE DETECTORS

6.10.3 SMART METERS

7 MIDDLE EAST & AFRICA SMART HOME MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 WIRELESS

7.2.1 WI-FI

7.2.2 BLUETOOTH

7.2.3 ZIGBEE

7.2.4 Z-WAVE

7.2.5 ENOCEAN

7.2.6 OTHERS

7.3 WIRED

8 MIDDLE EAST & AFRICA SMART HOME MARKET, BY SOFTWARE & SERVICE

8.1 OVERVIEW

8.2 BEHAVIORAL

8.3 PROACTIVE

9 MIDDLE EAST & AFRICA SMART HOME MARKET, BY GEOGRAPHY

9.1 MIDDLE EAST AND AFRICA

9.1.1 U.A.E

9.1.2 SAUDI ARABIA

9.1.3 SOUTH AFRICA

9.1.4 ISRAEL

9.1.5 EGYPT

9.1.6 REST OF MIDDLE EAST AND AFRICA

10 MIDDLE EAST & AFRICA SMART HOME MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

11 COMPANY PROFILE

11.1 SAMSUNG

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT DEVELOPMENTS

11.2 ROBERT BOSCH GMBH

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT DEVELOPMENT

11.3 HAIER GROUP

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 COMPANY SHARE ANALYSIS

11.3.4 PRODUCT PORTFOLIO

11.3.5 RECENT DEVELOPMENTS

11.4 SIEMENS

11.4.1 COMPANY SNAPSHOT

11.4.2 REVENUE ANALYSIS

11.4.3 COMPANY SHARE ANALYSIS

11.4.4 PRODUCT & SERVICE PORTFOLIO

11.4.5 RECENT DEVELOPMENTS

11.5 SCHNEIDER ELECTRIC

11.5.1 COMPANY SNAPSHOT

11.5.2 REVENUE ANALYSIS

11.5.3 COMPANY SHARE ANALYSIS

11.5.4 PRODUCT PORTFOLIO

11.5.5 RECENT DEVELOPMENTS

11.6 ABB

11.6.1 COMPANY SNAPSHOT

11.6.2 REVENUE ANALYSIS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT DEVELOPMENTS

11.7 ACUITY BRANDS LIGHTING, INC.

11.7.1 COMPANY SNAPSHOT

11.7.2 REVENUE ANALYSIS

11.7.3 PRODUCT PORTFOLIO

11.7.4 RECENT DEVELOPMENTS

11.8 ADT

11.8.1 COMPANY SNAPSHOT

11.8.2 REVENUE ANALYSIS

11.8.3 PRODUCT PORTFOLIO

11.8.4 RECENT DEVELOPMENTS

11.9 BRINKS HOME SECURITY

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 RECENT DEVELOPMENT

11.1 CARRIER

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT DEVELOPMENTS

11.11 CRESTRON ELECTRONICS, INC.

11.11.1 COMPANY SNAPSHOT

11.11.2 SOLUTION PORTFOLIO

11.11.3 RECENT DEVELOPMENTS

11.12 EMERSON ELECTRIC CO.

11.12.1 COMPANY SNAPSHOT

11.12.2 REVENUE ANALYSIS

11.12.3 PRODUCT PORTFOLIO

11.12.4 RECENT DEVELOPMENTS

11.13 GENERAL ELECTRIC COMPANY (A SUBSIDIARY OF GENERAL ELECTRIC)

11.13.1 COMPANY SNAPSHOT

11.13.2 REVENUE ANALYSIS

11.13.3 PRODUCT PORTFOLIO

11.13.4 RECENT DEVELOPMENTS

11.14 GOOGLE (A SUBSIDIARY OF ALPHABET INC.)

11.14.1 COMPANY SNAPSHOT

11.14.2 REVENUE ANALYSIS

11.14.3 PRODUCT PORTFOLIO

11.14.4 RECENT DEVELOPMENT

11.15 HANWHA TECHWIN AMERICA.

11.15.1 COMPANY SNAPSHOT

11.15.2 PRODUCT PORTFOLIO

11.15.3 RECENT DEVELOPMENTS

11.16 JOHNSON CONTROLS

11.16.1 COMPANY SNAPSHOT

11.16.2 REVENUE ANALYSIS

11.16.3 PRODUCT PORTFOLIO

11.16.4 RECENT DEVELOPMENTS

11.17 KUNA SYSTEMS

11.17.1 COMPANY SNAPSHOT

11.17.2 PRODUCT PORTFOLIO

11.17.3 RECENT DEVELOPMENTS

11.18 LEGRAND

11.18.1 COMPANY SNAPSHOT

11.18.2 REVENUE ANALYSIS

11.18.3 SOLUTION PORTFOLIO

11.18.4 RECENT DEVELOPMENTS

11.19 LEVITON MANUFACTURING CO., INC.

11.19.1 COMPANY SNAPSHOT

11.19.2 PRODUCT PORTFOLIO

11.19.3 RECENT DEVELOPMENTS

11.2 LIFI LABS, INC.

11.20.1 COMPANY SNAPSHOT

11.20.2 PRODUCT PORTFOLIO

11.20.3 RECENT DEVELOPMENT

11.21 LUTRON ELECTRONICS CO., INC.

11.21.1 COMPANY SNAPSHOT

11.21.2 PRODUCT PORTFOLIO

11.21.3 RECENT DEVELOPMENTS

11.22 NICE S.P.A.

11.22.1 COMPANY SNAPSHOT

11.22.2 REVENUE ANALYSIS

11.22.3 SOLUTION PORTFOLIO

11.22.4 RECENT DEVELOPMENTS

11.23 RESIDEO TECHNOLOGIES INC.

11.23.1 COMPANY SNAPSHOT

11.23.2 REVENUE ANALYSIS

11.23.3 PRODUCT PORTFOLIO

11.23.4 RECENT DEVELOPMENTS

11.24 SLEEP NUMBER CORPORATION

11.24.1 COMPANY SNAPSHOT

11.24.2 REVENUE ANALYSIS

11.24.3 PRODUCT PORTFOLIO

11.24.4 RECENT DEVELOPMENT

11.25 SWITCHMATE

11.25.1 COMPANY SNAPSHOT

11.25.2 PRODUCT PORTFOLIO

11.25.3 RECENT DEVELOPMENT

11.26 THE CHAMBERLAIN GROUP INC.

11.26.1 COMPANY SNAPSHOT

11.26.2 PRODUCT PORTFOLIO

11.26.3 RECENT DEVELOPMENT

11.27 VIVINT, INC.

11.27.1 COMPANY SNAPSHOT

11.27.2 PRODUCT PORTFOLIO

11.27.3 RECENT DEVELOPMENTS

12 SWOT & DATA BRIDGE MARKET RESEARCH ANALYSIS

12.1 DATA BRIDGE MARKET RESEARCH ANALYSIS

13 CONCLUSION

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

TABLE 1 MIDDLE EAST & AFRICA SMART HOME MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA ENTERTAINMENT CONTROLS IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA ENTERTAINMENT CONTROLS IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA SECURITY AND ACCESS CONTROL IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA SECURITY AND ACCESS CONTROL IN SMART HOME MARKET, BY TYPE ,2018-2027 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA VIDEO SURVEILLANCE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA HARDWARE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA NON-BIOMETRIC ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA BIOMETRIC ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2020-2027 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA HVAC CONTROL IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA HVAC CONTROL IN SMART HOME MARKET, BY TYPE, 2020-2027 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA HOME APPLIANCES IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA HOME APPLIANCES IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA SMART KITCHEN IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA SMART KITCHEN IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA LIGHTING CONTROL IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA LIGHTING CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA SMART FURNITURE IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA SMART FURNITURE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA HOME HEALTHCARE IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA HOME HEALTHCARE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA OTHERS IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA OTHERS IN SMART HOME MARKET, BY TYPE, 2020-2027 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA SMART HOME MARKET, BY TECHNOLOGY 2018-2027 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA WIRELESS TECHNOLOGY IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA WIRELESS TECHNOLOGY IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA WIRED TECHNOLOGY IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA SMART HOME MARKET, BY SOFTWARE & SERVICE 2018-2027 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA BEHAVIORAL IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA PROACTIVE IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA SMART HOME MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA SMART HOME MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA ENTERTAINMENT CONTROLS IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA SECURITY AND ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA VIDEO SURVEILLANCE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA HARDWARE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA NON-BIOMETRIC ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA BIOMETRIC ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA HVAC CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA HOME APPLIANCES IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA SMART KITCHEN IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA LIGHTING CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA SMART FURNITURE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA HOME HEALTHCARE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA OTHERS IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA SMART HOME MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA WIRELESS TECHNOLOGY IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA SMART HOME MARKET, BY SOFTWARE & SERVICE, 2018-2027 (USD MILLION)

TABLE 51 U.A.E SMART HOME MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 52 U.A.E ENTERTAINMENT CONTROLS IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 53 U.A.E SECURITY AND ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 54 U.A.E VIDEO SURVEILLANCE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 55 U.A.E HARDWARE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 56 U.A.E ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 57 U.A.E NON-BIOMETRIC ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 58 U.A.E BIOMETRIC ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 59 U.A.E HVAC CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 60 U.A.E HOME APPLIANCES IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 61 U.A.E SMART KITCHEN IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 62 U.A.E LIGHTING CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 63 U.A.E SMART FURNITURE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 64 U.A.E HOME HEALTHCARE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 65 U.A.E OTHERS IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 66 U.A.E SMART HOME MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 67 U.A.E WIRELESS TECHNOLOGY IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 68 U.A.E SMART HOME MARKET, BY SOFTWARE & SERVICE, 2018-2027 (USD MILLION)

TABLE 69 SAUDI ARABIA SMART HOME MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 70 SAUDI ARABIA ENTERTAINMENT CONTROLS IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 71 SAUDI ARABIA SECURITY AND ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 72 SAUDI ARABIA VIDEO SURVEILLANCE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 73 SAUDI ARABIA HARDWARE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 74 SAUDI ARABIA ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 75 SAUDI ARABIA NON-BIOMETRIC ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 76 SAUDI ARABIA BIOMETRIC ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 77 SAUDI ARABIA HVAC CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 78 SAUDI ARABIA HOME APPLIANCES IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 79 SAUDI ARABIA SMART KITCHEN IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 80 SAUDI ARABIA LIGHTING CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 81 SAUDI ARABIA SMART FURNITURE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 82 SAUDI ARABIA HOME HEALTHCARE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 83 SAUDI ARABIA OTHERS IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 84 SAUDI ARABIA SMART HOME MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 85 SAUDI ARABIA WIRELESS TECHNOLOGY IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 86 SAUDI ARABIA SMART HOME MARKET, BY SOFTWARE & SERVICE, 2018-2027 (USD MILLION)

TABLE 87 SOUTH AFRICA SMART HOME MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 88 SOUTH AFRICA ENTERTAINMENT CONTROLS IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 89 SOUTH AFRICA SECURITY AND ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 90 SOUTH AFRICA VIDEO SURVEILLANCE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 91 SOUTH AFRICA HARDWARE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 92 SOUTH AFRICA ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 93 SOUTH AFRICA NON-BIOMETRIC ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 94 SOUTH AFRICA BIOMETRIC ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 95 SOUTH AFRICA HVAC CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 96 SOUTH AFRICA HOME APPLIANCES IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 97 SOUTH AFRICA SMART KITCHEN IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 98 SOUTH AFRICA LIGHTING CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 99 SOUTH AFRICA SMART FURNITURE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 100 SOUTH AFRICA HOME HEALTHCARE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 101 SOUTH AFRICA OTHERS IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 102 SOUTH AFRICA SMART HOME MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 103 SOUTH AFRICA WIRELESS TECHNOLOGY IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 104 SOUTH AFRICA SMART HOME MARKET, BY SOFTWARE & SERVICE, 2018-2027 (USD MILLION)

TABLE 105 ISRAEL SMART HOME MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 106 ISRAEL ENTERTAINMENT CONTROLS IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 107 ISRAEL SECURITY AND ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 108 ISRAEL VIDEO SURVEILLANCE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 109 ISRAEL HARDWARE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 110 ISRAEL ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 111 ISRAEL NON-BIOMETRIC ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 112 ISRAEL BIOMETRIC ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 113 ISRAEL HVAC CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 114 ISRAEL HOME APPLIANCES IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 115 ISRAEL SMART KITCHEN IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 116 ISRAEL LIGHTING CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 117 ISRAEL SMART FURNITURE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 118 ISRAEL HOME HEALTHCARE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 119 ISRAEL OTHERS IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 120 ISRAEL SMART HOME MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 121 ISRAEL WIRELESS TECHNOLOGY IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 122 ISRAEL SMART HOME MARKET, BY SOFTWARE & SERVICE, 2018-2027 (USD MILLION)

TABLE 123 EGYPT SMART HOME MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 124 EGYPT ENTERTAINMENT CONTROLS IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 125 EGYPT SECURITY AND ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 126 EGYPT VIDEO SURVEILLANCE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 127 EGYPT HARDWARE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 128 EGYPT ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 129 EGYPT NON-BIOMETRIC ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 130 EGYPT BIOMETRIC ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 131 EGYPT HVAC CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 132 EGYPT HOME APPLIANCES IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 133 EGYPT SMART KITCHEN IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 134 EGYPT LIGHTING CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 135 EGYPT SMART FURNITURE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 136 EGYPT HOME HEALTHCARE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 137 EGYPT OTHERS IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 138 EGYPT SMART HOME MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 139 EGYPT WIRELESS TECHNOLOGY IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 140 EGYPT SMART HOME MARKET, BY SOFTWARE & SERVICE, 2018-2027 (USD MILLION)

TABLE 141 REST OF MIDDLE EAST AND AFRICA SMART HOME MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

Lista de figuras

FIGURE 1 MIDDLE EAST & AFRICA SMART HOME MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA SMART HOME MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA SMART HOME MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA SMART HOME MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA SMART HOME MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA SMART HOME MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA SMART HOME MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA SMART HOME MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA SMART HOME MARKET: SEGMENTATION

FIGURE 10 INCREASING DISPOSABLE INCOME IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA SMART HOME MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 11 ENTERTAINMENT CONTROLS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA SMART HOME MARKET IN 2020 & 2027

FIGURE 12 DRIVERS, RESTRAINS, OPPORTUNITIES & CHALLENGE OF MIDDLE EAST & AFRICA SMART HOME MARKET

FIGURE 13 MIDDLE EAST & AFRICA SMART HOME MARKET: BY PRODUCT TYPE, 2019

FIGURE 14 MIDDLE EAST & AFRICA SMART HOME MARKET: BY TECHNOLOGY, 2019

FIGURE 15 MIDDLE EAST & AFRICA SMART HOME MARKET: BY SOFTWARE & SERVICE, 2019

FIGURE 16 MIDDLE EAST AND AFRICA SMART HOME MARKET: SNAPSHOT (2019)

FIGURE 17 MIDDLE EAST AND AFRICA SMART HOME MARKET: BY COUNTRY (2019)

FIGURE 18 MIDDLE EAST AND AFRICA SMART HOME MARKET: BY COUNTRY (2020 & 2027)

FIGURE 19 MIDDLE EAST AND AFRICA SMART HOME MARKET: BY COUNTRY (2019 & 2027)

FIGURE 20 MIDDLE EAST AND AFRICA SMART HOME MARKET: BY PRODUCT TYPE (2020-2027)

FIGURE 21 MIDDLE EAST & AFRICA SMART HOME MARKET: COMPANY SHARE 2019 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.