Mercado de peptizantes de caucho en Oriente Medio y África, por producto (disulfuro de dibenzamido difenilo (DBD), pentaclorotiofenol, pentaclorotiofenato de zinc, aril mercaptanos, mercaptobenzotiazol y otros), aplicación ( caucho natural y caucho sintético), uso final (neumáticos y no neumáticos): tendencias de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de peptizadores de caucho en Oriente Medio y África

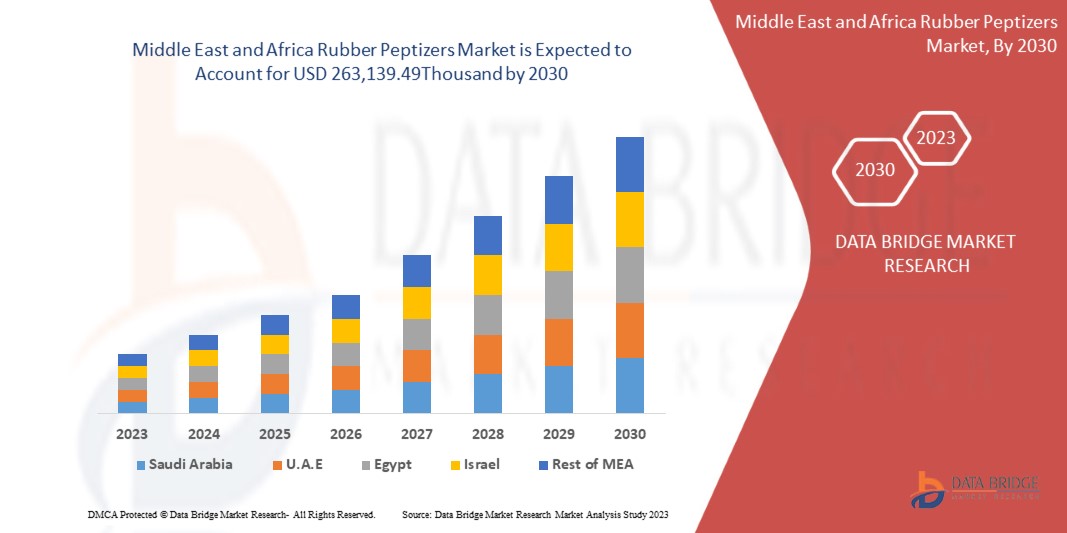

Se espera que el mercado de peptizadores de caucho de Oriente Medio y África gane un crecimiento significativo en el período de pronóstico de 2023 a 2030. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 4,2% en el período de pronóstico de 2023 a 2030 y se espera que alcance los USD 263.139,49 mil para 2030. El principal factor que impulsa el crecimiento del mercado de peptizadores de caucho de Oriente Medio y África es la mayor demanda de uso en el sector de la construcción.

El informe de mercado de peptizadores de caucho de Oriente Medio y África proporciona detalles de la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen analítico; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2020 - 2015) |

|

Unidades cuantitativas |

Ingresos en miles de USD |

|

Segmentos cubiertos |

Subproducto (disulfuro de dibenzamido difenilo (DBD), pentaclorotiofenol, pentaclorotiofenato de zinc, arilmercaptanos, mercaptobenzotiazol y otros), aplicación (caucho natural y caucho sintético), uso final (neumáticos y otros) |

|

Países cubiertos |

Sudáfrica, Egipto, Arabia Saudita, Emiratos Árabes Unidos, Israel y el resto de Oriente Medio y África |

|

Actores del mercado cubiertos |

Struktol Company of America, LLC, LANXESS, Shandong Stair Chemical & Technology Co., Ltd., Zhengzhou Double Vigour Chemical Product Co., Ltd., Taizhou Huangyan Donghai Chemical Co., Ltd., Acmechem, HENAN CONNECT RUBBER CHEMICAL LIMITED y Kettlitz-Chemie GmbH & Co. KG |

Definición de mercado

Los peptizadores actúan como catalizadores de oxidación o como aceptores de radicales, que esencialmente eliminan los radicales libres formados durante la mezcla inicial del elastómero. Esto evita la recombinación de polímeros, lo que permite una caída consiguiente del peso molecular del polímero y, por lo tanto, reduce la viscosidad del compuesto. Este ablandamiento del polímero permite entonces la incorporación de la gama de materiales de composición incluidos en la formulación. Algunos ejemplos de peptizadores son el pentaclorotiofenol, la fenilhidrazina, ciertos difenilsulfuros y el xilil mercaptano. Cada peptizador tiene una carga óptima en un compuesto para lograr la máxima eficiencia. Los peptizadores se utilizan en la masticación del caucho natural para optimizar su procesamiento. Reducen el peso molecular de los polímeros al romper las cadenas de moléculas. Se espera que el aumento del uso de peptizadores de caucho en diversas aplicaciones, como el caucho natural y el caucho sintético, para la industria de los neumáticos y otras industrias del caucho, aumente la demanda en todo el mundo.

Dinámica del mercado de peptizadores de caucho en Oriente Medio y África

Conductores

- AUMENTO DEL USO DE PEPTIZADORES DE CAUCHO EN LA FABRICACIÓN DE PRODUCTOS DE CAUCHO

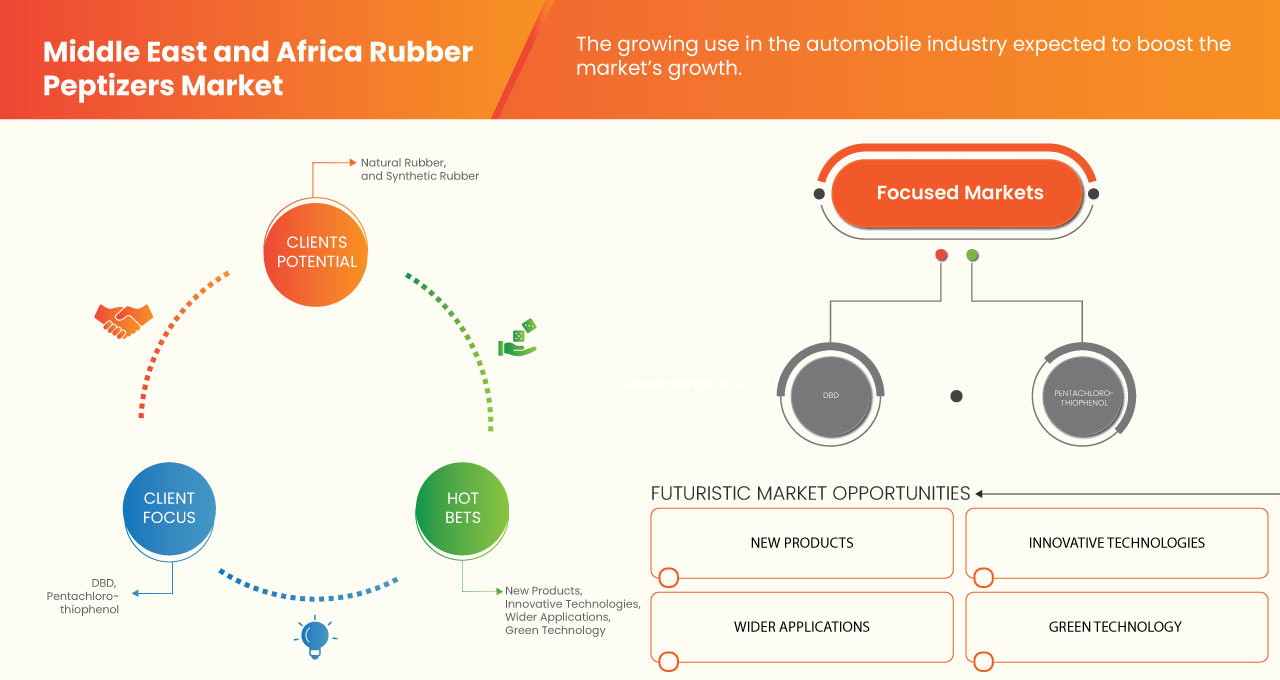

Se espera que el creciente uso de caucho natural en las industrias automotriz, química , médica y otras promueva el alcance de los peptizantes a nivel de Medio Oriente y África. En comparación con el caucho natural, el caucho sintético ofrece más resistencia a la abrasión. Debido a esta ventaja, el caucho sintético se utiliza cada vez más en juntas y sellos de caucho. Los peptizantes de caucho se utilizan en la masticación de caucho natural para optimizar su procesamiento. Este aditivo de caucho garantiza la calidad en la fabricación de productos de caucho donde hay poco o ningún rechazo. Requiere productos químicos especiales para lograr una buena dispersión de rellenos y una plasticidad perfecta. El caucho natural sin tratamiento es extremadamente resistente. En este caso, los peptizantes se utilizan en la masticación de caucho natural para optimizar el procesamiento. El uso de peptizantes, que es un aditivo de caucho, acelera la masticación en un amplio rango de temperaturas.

- ADOPTADO POR VARIAS INDUSTRIAS DEBIDO A SU VISCOSIDAD SIGNIFICATIVA

Los peptizadores actúan como catalizadores de oxidación o como aceptores de radicales, que eliminan esencialmente los radicales libres formados durante la mezcla inicial del elastómero. Esto evita la recombinación de polímeros, lo que permite una caída consiguiente del peso molecular del polímero y, por lo tanto, la reducción de la viscosidad del compuesto. Los peptizadores se utilizan en la masticación del caucho natural para optimizar su procesamiento. Reducen el peso molecular de los polímeros al romper las cadenas de moléculas. A diferencia de la masticación mecánica del caucho, los peptizadores químicos acortan el tiempo de masticación y reducen el consumo de energía, con el resultado de que mejora la productividad en la preparación de compuestos.

- AUMENTO DE LAS APLICACIONES EN LA INDUSTRIA AUTOMOTRIZ

El rápido crecimiento del sector automovilístico ha generado un aumento de la demanda de aditivos para caucho en la producción de neumáticos, ya que los distintos productos de caucho mejoran la resistencia de los neumáticos a la luz solar, el ozono, el calor y el estrés mecánico. Los aditivos para caucho se utilizan para mejorar la resistencia y el rendimiento del caucho. La demanda de aditivos para caucho para aplicaciones distintas de los neumáticos impulsa el crecimiento del mercado.

Oportunidades

- ADOPCIÓN DE TECNOLOGÍA VERDE EN LA FABRICACIÓN DE CAUCHO

La adopción de tecnología verde en la fabricación de caucho ha abierto muchos caminos para los peptizadores de caucho, también como para el procesamiento de caucho natural, los peptizadores son uno de los principales compuestos. La reducción del peso molecular y las propiedades del caucho natural, como la viscosidad, la resistencia a la tracción y la resistencia a la compresión, también disminuyeron. La masticación se realiza solo para el caucho natural. La masticación se puede realizar químicamente (usando peptizadores). La masticación química del caucho natural da como resultado una sesión de cadena, un peso molecular más bajo, una distribución de peso molecular límite y un mayor número de extremos de cadena libres. Los peptizadores son productos químicos que se utilizan para la masticación química. Hay dos tipos de peptizadores. Esos son peptizadores físicos y químicos. Los peptizadores físicos son lubricantes que reducen la viscosidad interna y no reducen el peso molecular. Los peptizadores químicos son catalizadores de oxidación o aceptores de radicales.

- AUMENTO DEL USO DE PEPTIZADORES DE CAUCHO EN EL SECTOR DE LA CONSTRUCCIÓN

El sector de la construcción es uno de los mercados más importantes para los aditivos químicos del caucho. Se utiliza una amplia variedad de aditivos químicos para el caucho en la producción de múltiples componentes e ingredientes para el sector de la construcción, como baldosas de caucho, juntas, sellos y tuberías, entre otros. El sector de la construcción muestra un crecimiento sobresaliente a nivel mundial con un aumento de las inversiones y las actividades de construcción. La preparación de compuestos es la ciencia de los materiales que modifica un caucho o un elastómero, o una mezcla de polímeros y otros materiales para optimizar las propiedades con el fin de cumplir con una aplicación de servicio determinada o un conjunto de parámetros de rendimiento. La preparación de compuestos es una ciencia multidisciplinaria compleja que requiere conocimientos de física de materiales, química orgánica y de polímeros, química inorgánica y cinética de reacciones químicas.

Restricciones/Desafíos

- EMISIÓN DE GASES Y CONTAMINANTES PELIGROSOS

Los riesgos que las industrias generan en nuestro medio ambiente se manifiestan principalmente en forma de contaminación del aire, del agua y del ruido. Existen numerosas industrias que producen distintos productos sintéticos y no sintéticos, entre las que las industrias del caucho desempeñan el papel de columna vertebral. La industria de fabricación del caucho no solo produce artículos de caucho como producto principal, sino que también produce una enorme cantidad de contaminación del aire, del ruido y del agua como subproductos. En el aire de las unidades y las instalaciones hay una gran cantidad de materia orgánica volátil y otras partículas. Además, durante los procesos de fabricación se utilizan diferentes productos químicos que se vierten como efluentes al medio ambiente. Por ello, el estudio se llevó a cabo para evaluar la calidad del aire y del ruido en el lugar de trabajo y las características de las aguas residuales, de modo que se puedan tomar las medidas necesarias para proteger a los trabajadores de la exposición ocupacional.

- IMPOSICIÓN DE REGULACIONES GUBERNAMENTALES ESTRICTAS

Los aditivos químicos para el caucho están asociados con efectos adversos para la salud humana, lo que ha sido un desafío en el mercado. Esto podría obstaculizar el crecimiento del mercado durante el período de pronóstico. Varios organismos reguladores, como el Registro, Evaluación, Autorización y Restricción de Sustancias Químicas (REACH) y la Agencia de Protección Ambiental (EPA), controlan estrictamente el uso de aditivos químicos en la preparación del caucho. Es probable que las estrictas regulaciones sobre el uso de productos químicos para el caucho obstaculicen la demanda de productos químicos para el caucho en el mercado. Dado que la mayoría de ellos se vierten en cuerpos de agua, los productos químicos de procesamiento utilizados para el caucho son dañinos para la atmósfera y la vida marina.

Alcance del mercado de peptizadores de caucho en Oriente Medio y África

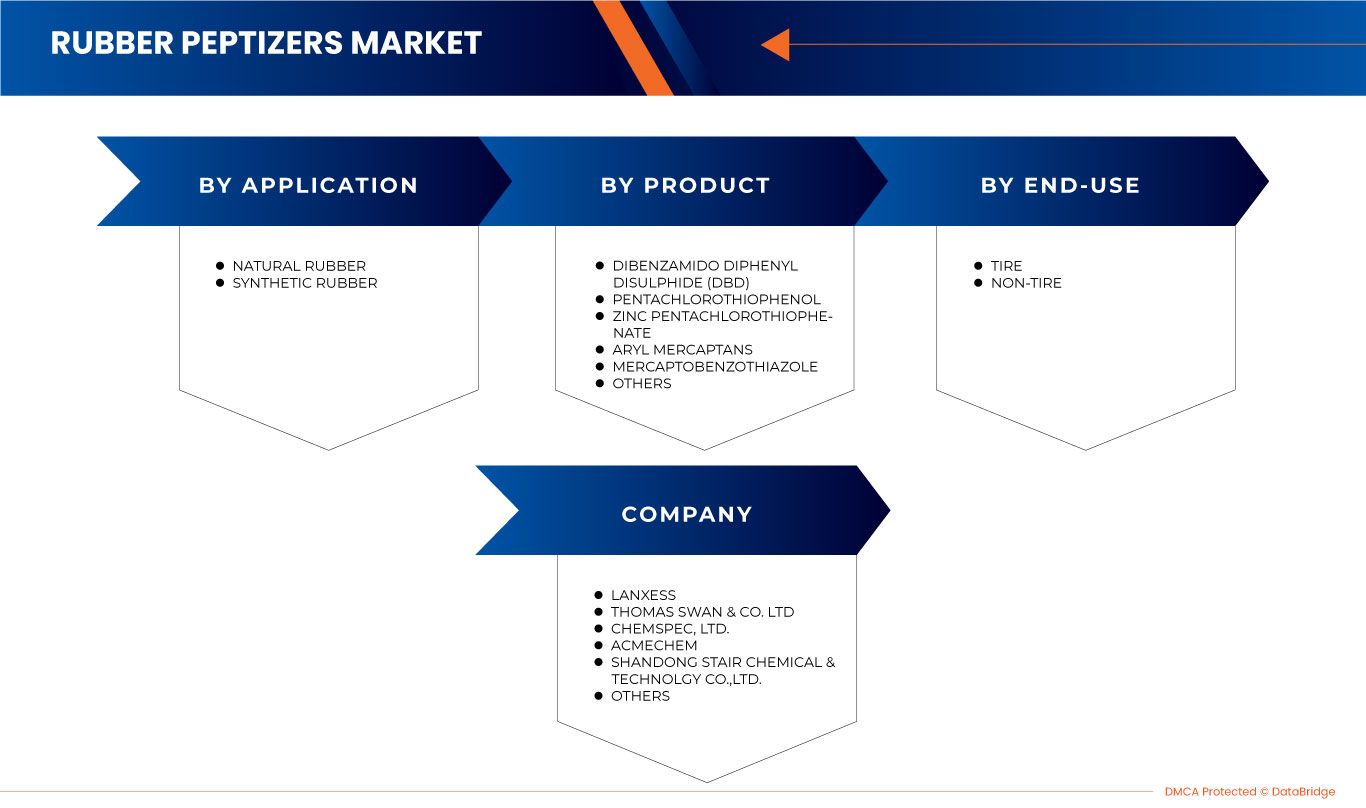

El mercado de peptizadores de caucho de Oriente Medio y África se clasifica en función del producto, la aplicación y el uso final. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Producto

- Disulfuro de dibenzamido difenilo (DBD)

- Pentaclorotiofenol

- Pentaclorotiofenato de zinc

- Mercaptanos arílicos

- Mercaptobenzotiazol

- Otros

Según el producto, el mercado de peptizantes de caucho de Oriente Medio y África se clasifica en disulfuro de dibenzamido difenilo (DBD), pentaclorotiofenol, pentaclorotiofenato de zinc, arilmercaptanos, mercaptobenzotiazol y otros.

Solicitud

- Caucho natural

- Caucho sintético

Según la aplicación, el mercado de peptizadores de caucho de Oriente Medio y África se clasifica en caucho natural y caucho sintético.

Uso final

- Neumático

- Sin neumáticos

Según el uso final, el mercado de peptizadores de caucho de Oriente Medio y África se clasifica en neumáticos y no neumáticos.

Análisis y perspectivas regionales del mercado de peptizadores de caucho en Oriente Medio y África

El mercado de peptizadores de caucho de Oriente Medio y África está segmentado según el producto, la aplicación y el uso final.

Los países del mercado de peptizadores de caucho de Medio Oriente y África son Sudáfrica, Egipto, Arabia Saudita, Emiratos Árabes Unidos, Israel y el resto de Medio Oriente y África.

Arabia Saudita domina el mercado de peptizadores de caucho de Medio Oriente y África en términos de participación de mercado e ingresos de mercado debido a la adopción de tecnología verde en la fabricación de caucho.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. El análisis de los puntos de datos de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Oriente Medio y África y los desafíos que enfrentan debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los peptizadores de caucho en Oriente Medio y África

El panorama competitivo del mercado de peptizadores de caucho de Oriente Medio y África proporciona detalles por competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones, la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado de peptizadores de caucho de Oriente Medio y África.

Algunos de los participantes destacados que operan en el mercado de peptizadores de caucho de Medio Oriente y África son Struktol Company of America, LLC, LANXESS, Shandong Stair Chemical & Technology Co., Ltd., Zhengzhou Double Vigour Chemical Product Co., ltd., Taizhou Huangyan Donghai Chemical Co., Ltd., Acmechem, HENAN CONNECT RUBBER CHEMICAL LIMITED y Kettlitz-Chemie GmbH & Co. KG.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT'S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 RAW MATERIAL PROCUREMENT

4.4.2 MANUFACTURING AND PACKING

4.4.3 MARKETING AND DISTRIBUTION

4.4.4 END USERS

4.5 PRICE INDEX

4.6 PRODUCTION AND CONSUMPTION ANALYSIS

4.7 PRODUCTION CAPACITY OVERVIEW

4.8 RAW MATERIAL PRODUCTION COVERAGE

4.9 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.1 VENDOR SELECTION CRITERIA

4.11 REGULATION COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING THE USE OF RUBBER PEPTIZERS IN THE MANUFACTURING OF RUBBER PRODUCTS

5.1.2 ADOPTED BY THE VARIOUS INDUSTRIES BECAUSE OF SIGNIFICANT VISCOSITY

5.1.3 INCREASED APPLICATIONS IN THE AUTOMOBILE INDUSTRY

5.2 RESTRAINTS

5.2.1 EMISSION OF HAZARDOUS GASSES AND POLLUTANTS

5.2.2 IMPOSITION OF STRINGENT GOVERNMENT REGULATIONS

5.3 OPPORTUNITIES

5.3.1 ADOPTION OF GREEN TECHNOLOGY IN RUBBER MANUFACTURING

5.3.2 INCREASING USE OF RUBBER PEPTIZERS IN THE CONSTRUCTION SECTOR

5.4 CHALLENGES

5.4.1 DISRUPTIONS IN THE SUPPLY CHAIN

5.4.2 FLUCTUATING PRICE OF RAW MATERIALS.

6 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 DIBENZAMIDO DIPHENYL DISULPHIDE (DBD)

6.3 PENTACHLOROTHIOPHENOL

6.4 MERCAPTOBENZOTHIAZOLE

6.5 ARYL MERCAPTANS

6.6 ZINC PENTACHLOROTHIOPHENATE

6.7 OTHERS

7 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 NATURAL RUBBER

7.3 SYNTHETIC RUBBER

7.3.1 SYNTHETIC RUBBER, BY CATEGORY

7.3.1.1 STYRENE-BUTADIENE RUBBER (SBR)

7.3.1.2 ACRYLONITRILE-BUTADIENE RUBBER (NBR)

7.3.1.3 POLYBUTADIENE RUBBER (BR)

7.3.1.4 BUTYL RUBBER (IIR)

7.3.1.5 OTHERS

8 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY END-USE

8.1 OVERVIEW

8.2 NON-TIRE

8.3 TIRE

9 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY REGION

9.1 MIDDLE EAST & AFRICA

9.1.1 SAUDI ARABIA

9.1.2 UNITED ARAB EMIRATES

9.1.3 EGYPT

9.1.4 SOUTH AFRICA

9.1.5 ISRAEL

9.1.6 REST OF MIDDLE EAST & AFRICA

10 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

10.2 CERTIFICATION

10.3 ACHIEVEMENT

10.4 LAUNCH

10.5 EVENT

10.6 INVESTMENT

10.7 COMMITMENT

10.8 ACQUISITION

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 LANXESS

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 THOMAS SWAN & CO. LTD

12.2.1 COMPANY SNAPSHOT

12.2.2 COMPANY SHARE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENTS

12.3 CHEMSPEC LTD.

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 ACMECHEM

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 SHANDONG STAIR CHEMICAL & TECHNOLOGY CO., LTD.

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENTS

12.6 AKROCHEM CORPORATION

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 DONGEUN CO., LTD

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 HENAN CONNECT RUBBER CHEMICAL LIMITED

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 KETTLITZ-CHEMIE GMBH & CO. KG

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 KING INDUSTRIES, INC.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 STRUKTOL COMPANY OF AMERICA, LLC

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 TAIZHOU HUANGYAN DONGHAI CHEMICAL CO., LTD.

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

12.13 ZHENGZHOU DOUBLE VIGOUR CHEMICAL PRODUCT CO., LTD.

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Lista de Tablas

TABLE 1 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (PRICE/KG)

TABLE 2 REGULATORY FRAMEWORK

TABLE 3 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 5 MIDDLE EAST & AFRICA DIBENZAMIDO DIPHENYL DISULPHIDE (DBD) IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA PENTACHLOROTHIOPHENOL IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA MERCAPTOBENZOTHIAZOLE IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA ARYL MERCAPTANS IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA ZINC PENTACHLOROTHIOPHENATE IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA OTHERS IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA NATURAL RUBBER IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA NON-TIRE IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA TIRE IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 20 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 22 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 25 SAUDI ARABIA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 26 SAUDI ARABIA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 27 SAUDI ARABIA RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 28 SAUDI ARABIA SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 29 SAUDI ARABIA RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 30 UNITED ARAB EMIRATES RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 31 UNITED ARAB EMIRATES RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 32 UNITED ARAB EMIRATES RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 33 UNITED ARAB EMIRATES SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 34 UNITED ARAB EMIRATES RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 35 EGYPT RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 36 EGYPT RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 37 EGYPT RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 38 EGYPT SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 39 EGYPT RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 40 SOUTH AFRICA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 41 SOUTH AFRICA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 42 SOUTH AFRICA RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 43 SOUTH AFRICA SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 44 SOUTH AFRICA RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 45 ISRAEL RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 46 ISRAEL RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 47 ISRAEL RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 48 ISRAEL SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 49 ISRAEL RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 50 REST OF MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 51 REST OF MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

Lista de figuras

FIGURE 1 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET

FIGURE 2 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: SEGMENTATION

FIGURE 14 INCREASED APPLICATIONS IN THE AUTOMOBILE INDUSTRY ARE EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET IN THE FORECAST PERIOD

FIGURE 15 DIBENZAMIDO DIPHENYL DISULPHIDE (DBD) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET IN 2023 & 2030

FIGURE 16 SUPPLY CHAIN ANALYSIS – MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET

FIGURE 17 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: PRODUCTION AND CONSUMPTION ANALYSIS, 2021-2023 (TONS)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET

FIGURE 19 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: BY PRODUCT, 2022

FIGURE 20 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: BY APPLICATION, 2022

FIGURE 21 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: BY END-USE, 2022

FIGURE 22 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: SNAPSHOT (2022)

FIGURE 23 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: BY COUNTRY (2022)

FIGURE 24 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 25 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 26 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: BY PRODUCT (2023-2030)

FIGURE 27 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.