Middle East And Africa Refractories Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.99 Billion

USD

2.60 Billion

2025

2033

USD

1.99 Billion

USD

2.60 Billion

2025

2033

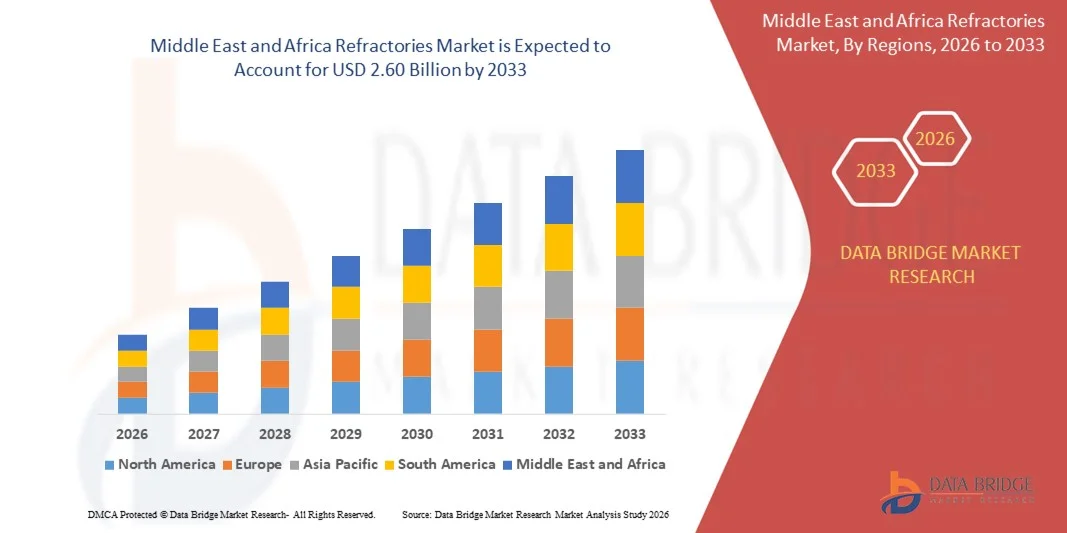

| 2026 –2033 | |

| USD 1.99 Billion | |

| USD 2.60 Billion | |

|

|

|

|

Segmentación del mercado de refractarios en Oriente Medio y África por alcalinidad (refractarios ácidos y neutros, y carbono), tipo de forma (ladrillos, monolíticos y otros), tipo de producto (arcilloso y no arcilloso), temperatura de fusión (refractario normal [1580-1780 °C], refractario alto [1780-2000 °C] y superrefractario [2000 °C]), aplicación (hierro y acero, cemento y cal, energía y productos químicos, vidrio, metales no ferrosos y otros), tecnología (isostáticos y compuertas deslizantes): tendencias y pronóstico de la industria hasta 2033.

¿Cuál es el tamaño y la tasa de crecimiento del mercado de refractarios en Oriente Medio y África?

- El tamaño del mercado de refractarios de Medio Oriente y África se valoró en USD 1.99 mil millones en 2025 y se espera que alcance los USD 2.60 mil millones para 2033 , con una CAGR del 3,60% durante el período de pronóstico.

- Los refractarios están disponibles en todas las formas y tamaños. Los ladrillos son uno de los tipos tradicionales de refractarios y representaban la mayor parte de la producción refractaria en el pasado, pero ahora los refractarios monolíticos se utilizan ampliamente debido a su bajo costo, durabilidad y fácil instalación. El mercado de refractarios tiene una amplia aplicabilidad en industrias como la siderúrgica, el cemento, la cerámica, los metales no ferrosos y otras.

¿Cuáles son las principales conclusiones del mercado de refractarios?

- La creciente prevalencia de la industria de minerales no metálicos, la creciente infraestructura en los países emergentes y la demanda de refractarios de la industria del hierro y el acero son los factores que impulsarán el mercado de refractarios.

- Algunas empresas están ampliando su capacidad de producción en diferentes regiones para expandir el mercado de estos productos. Sin embargo, la corrosividad de los metales ferrosos en condiciones ambientales está frenando el crecimiento del mercado.

- Arabia Saudita dominó el mercado de refractarios con una participación estimada en los ingresos del 36,9 % en 2025, impulsada por la fuerte demanda de la producción de acero, la fabricación de cemento, el procesamiento de vidrio y las industrias de uso intensivo de energía en toda la región.

- Se proyecta que los EAU registren la tasa de crecimiento anual compuesta (TCAC) más rápida, del 7,36 %, entre 2026 y 2033, impulsada por el rápido desarrollo industrial, el creciente procesamiento de aluminio y acero, y las inversiones en energía, construcción y manufactura avanzada. La creciente adopción de refractarios monolíticos de alto rendimiento impulsa la expansión acelerada del mercado.

- El segmento de refractarios ácidos y neutros dominó el mercado con una participación estimada del 58,6 % en 2025, impulsado por su amplio uso en las industrias del acero, el vidrio, el cemento y los metales no ferrosos.

Alcance del informe y segmentación del mercado de refractarios

|

Atributos |

Perspectivas clave del mercado de refractarios |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

¿Cuál es la tendencia clave en el mercado de refractarios?

Cambio creciente hacia soluciones refractarias de alto rendimiento, energéticamente eficientes y específicas para cada aplicación

- El mercado de refractarios está experimentando un fuerte cambio hacia materiales refractarios de alta pureza, baja impureza y específicos para cada aplicación, para satisfacer los crecientes requisitos de rendimiento y durabilidad en entornos industriales de temperaturas extremas.

- Los fabricantes están desarrollando cada vez más refractarios energéticamente eficientes, livianos y con una vida útil más larga, incluidas soluciones refractarias con bajo contenido de carbono, basadas en alúmina, basadas en magnesia y sin óxido.

- El creciente énfasis en la eficiencia térmica, la reducción del tiempo de inactividad y la prolongación de la vida útil del horno está impulsando su adopción en las industrias del acero, el cemento, el vidrio y los metales no ferrosos.

- Por ejemplo, empresas como RHI Magnesita, Vesuvius, Imerys, Morgan Advanced Materials y Saint-Gobain están invirtiendo en formulaciones refractarias avanzadas, refractarios monolíticos y soluciones de revestimiento optimizadas digitalmente.

- La creciente demanda de refractarios diseñados a medida y adaptados a hornos, estufas y reactores específicos está acelerando la innovación.

- A medida que los procesos industriales se vuelven más intensivos en energía y se centran en la sostenibilidad, los refractarios siguen siendo fundamentales para la eficiencia operativa y la protección de los activos.

¿Cuáles son los impulsores clave del mercado de refractarios?

- Creciente demanda de materiales de revestimiento resistentes a altas temperaturas por parte de las industrias del acero, el cemento, el vidrio, la petroquímica y la generación de energía.

- Por ejemplo, durante 2024-2025, actores líderes como RHI Magnesita, Vesuvius y Saint-Gobain ampliaron sus capacidades de producción e introdujeron soluciones refractarias bajas en carbono para apoyar la descarbonización industrial.

- El crecimiento del desarrollo de infraestructura, la urbanización y la fabricación industrial en Asia-Pacífico, Oriente Medio y América Latina está impulsando el consumo refractario.

- Los avances en materias primas refractarias, sistemas de unión y tecnologías monolíticas han mejorado la resistencia al choque térmico y la vida útil.

- La creciente demanda de reemplazo debido al desgaste, la corrosión y las condiciones operativas extremas respalda la demanda recurrente del mercado.

- Respaldado por la expansión industrial y la modernización de hornos y estufas, se espera que el mercado de refractarios experimente un crecimiento estable a largo plazo.

¿Qué factor está obstaculizando el crecimiento del mercado de refractarios?

- La volatilidad de los precios de las materias primas, en particular la magnesia, la bauxita y la alúmina, aumenta los costos de producción y afecta los márgenes de ganancia.

- Por ejemplo, durante 2024-2025, las fluctuaciones de los precios de la energía, las restricciones mineras y las interrupciones logísticas afectaron las cadenas de suministro refractarias a nivel mundial.

- Las estrictas regulaciones ambientales y las normas sobre emisiones de carbono aumentan los costos de cumplimiento para los fabricantes

- La escasez de mano de obra calificada y la alta complejidad de la instalación pueden aumentar los costos operativos para los usuarios finales.

- La competencia de los fabricantes regionales de bajo costo, especialmente en los mercados emergentes, crea presión sobre los precios

- Para abordar estos desafíos, las empresas se están centrando en el abastecimiento sostenible, el reciclaje de materiales refractarios, el monitoreo digital y las soluciones refractarias de valor agregado para mejorar la competitividad.

¿Cómo está segmentado el mercado de refractarios?

El mercado está segmentado en función de la alcalinidad, el tipo de producto, el tipo de forma, la temperatura de fusión, la aplicación y la tecnología .

- Por alcalinidad

En función de su alcalinidad, el mercado de refractarios se segmenta en refractarios ácidos y neutros y refractarios de carbono. El segmento de refractarios ácidos y neutros dominó el mercado con una participación estimada del 58,6 % en 2025, impulsado por su amplio uso en las industrias del acero, el vidrio, el cemento y los metales no ferrosos. Estos refractarios, que incluyen materiales a base de sílice, alúmina y arcilla refractaria, ofrecen una gran estabilidad térmica, resistencia a la corrosión y compatibilidad con una amplia gama de escorias industriales. Su rentabilidad y versatilidad los convierten en la opción preferida para hornos, estufas y reactores que operan en condiciones neutras o ácidas.

Se prevé que el segmento de refractarios de carbono crezca a su tasa de crecimiento anual compuesta (TCAC) más alta entre 2026 y 2033, impulsado por la creciente demanda en altos hornos, hornos de arco eléctrico y aplicaciones de fabricación de acero a alta temperatura. La superior resistencia al choque térmico, la baja humectabilidad y la mayor vida útil están acelerando la adopción de refractarios a base de carbono en procesos metalúrgicos avanzados.

- Por tipo de formulario

Según su forma, el mercado de refractarios se segmenta en ladrillos, monolíticos y otros. El segmento de ladrillos dominó el mercado con una participación del 54,2 % en 2025, gracias a sus formas estandarizadas, alta resistencia mecánica y su uso prolongado en hornos industriales. Los ladrillos refractarios se utilizan ampliamente en cucharas de acero, hornos de cemento, hornos de vidrio y centrales eléctricas gracias a su durabilidad y facilidad de reemplazo durante los ciclos de mantenimiento.

Se proyecta que el segmento monolítico crecerá a la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2026 y 2033, impulsado por la creciente preferencia por los refractarios, las mezclas gunitadas y las masas de apisonamiento. Los refractarios monolíticos ofrecen una instalación más rápida, menor tiempo de inactividad, revestimientos sin juntas mejorados y una mayor eficiencia térmica. La creciente adopción en operaciones continuas y hornos con geometrías complejas está acelerando la transición hacia soluciones monolíticas en múltiples industrias.

- Por tipo de producto

Según el tipo de producto, el mercado de refractarios se segmenta en refractarios arcillosos y no arcillosos. El segmento no arcilloso dominó el mercado con una participación estimada del 61,7 % en 2025, impulsado por la creciente demanda de materiales de alto rendimiento como alúmina, magnesia, zirconio y refractarios a base de carbono. Estos materiales ofrecen una resistencia superior a altas temperaturas, corrosión química y estrés mecánico, lo que los hace esenciales para la siderurgia moderna y aplicaciones industriales de alta gama.

Se prevé que el segmento de refractarios de arcilla crezca a la tasa de crecimiento anual compuesta (TCAC) más alta entre 2026 y 2033, impulsado por las ventajas de costo, la fácil disponibilidad y el creciente uso en hornos industriales de pequeña y mediana escala. Los refractarios de arcilla refractaria siguen encontrando aplicaciones en hornos tradicionales, calderas y revestimientos de respaldo, especialmente en economías emergentes con bases de fabricación en expansión.

- Por temperatura de fusión

Según la temperatura de fusión, el mercado se segmenta en refractarios normales (1580-1780 °C), altamente refractarios (1780-2000 °C) y superrefractarios (>2000 °C). El segmento altamente refractario dominó el mercado con una participación del 46,9 % en 2025, impulsado por su amplio uso en hornos de acero, hornos de cemento y unidades de fundición de vidrio que requieren una resistencia sostenida a altas temperaturas. Estos refractarios ofrecen un equilibrio entre rendimiento y coste, lo que los hace adecuados para la mayoría de las operaciones industriales pesadas.

Se proyecta que el segmento de materiales superrefractarios crecerá a la tasa de crecimiento anual compuesta (TCAC) más alta entre 2026 y 2033, impulsado por la creciente demanda de procesos metalúrgicos avanzados, la producción de materiales aeroespaciales y la fabricación de productos químicos de alta pureza. El creciente enfoque en aplicaciones de temperaturas extremas y tecnologías de hornos de última generación está impulsando la adopción de materiales refractarios de ultraalta temperatura.

- Por aplicación

Según su aplicación, el mercado de refractarios se segmenta en hierro y acero, cemento y cal, energía y productos químicos, vidrio, metales no ferrosos y otros. El segmento de hierro y acero dominó el mercado con una participación estimada del 38,4 % en 2025, gracias al amplio uso de refractarios en altos hornos, hornos básicos de oxígeno, hornos de arco eléctrico y cucharas de colada. La producción continua de acero y la frecuente sustitución de revestimientos garantizan una demanda sostenida.

Se prevé que el segmento de Energía y Productos Químicos experimente su mayor crecimiento anual compuesto (TCAC) entre 2026 y 2033, impulsado por la expansión de plantas petroquímicas, refinerías, plantas de valorización energética de residuos y unidades de producción de hidrógeno. La alta resistencia a los ciclos térmicos y a los ataques químicos está acelerando la adopción de refractarios en entornos de procesamiento con alto consumo energético.

- Por tecnología

En cuanto a la tecnología, el mercado de refractarios se segmenta en isostáticos y de compuertas deslizantes. El segmento isostático dominó el mercado con una participación del 55,1 % en 2025, gracias a su capacidad para producir componentes refractarios de alta densidad, uniformidad y alta resistencia. El prensado isostático garantiza una integridad superior del material, lo que lo hace ideal para revestimientos críticos de hornos y aplicaciones de alta tensión.

Se proyecta que el segmento de compuertas deslizantes experimente su mayor crecimiento anual compuesto (CAGR) entre 2026 y 2033, impulsado por la creciente demanda de un control preciso del flujo de metal fundido en las operaciones de fabricación de acero y colada continua. La mejora de la seguridad, la eficiencia y la automatización de procesos están acelerando la adopción de sistemas refractarios avanzados de compuertas deslizantes en las instalaciones metalúrgicas modernas.

¿Qué región posee la mayor participación en el mercado de refractarios?

- Arabia Saudita dominó el mercado de refractarios con una participación estimada en los ingresos del 36,9 % en 2025, impulsada por la fuerte demanda de la producción de acero, la fabricación de cemento, el procesamiento de vidrio y las industrias de uso intensivo de energía en toda la región.

- Los principales fabricantes de refractarios en Arabia Saudita están invirtiendo en materiales avanzados, soluciones refractarias de alta pureza e instalaciones de producción localizadas, fortaleciendo las cadenas de suministro regionales y reduciendo la dependencia de las importaciones.

- Los programas de diversificación industrial liderados por el gobierno, las inversiones en infraestructura y la expansión del sector energético en las principales economías de MEA continúan consolidando la posición dominante del país en el mercado mundial de refractarios.

Perspectiva del mercado de refractarios de los EAU

Se proyecta que los EAU registren la tasa de crecimiento anual compuesta (TCAC) más rápida, del 7,36 %, entre 2026 y 2033, impulsada por el rápido desarrollo industrial, el creciente procesamiento de aluminio y acero, y las inversiones en energía, construcción y manufactura avanzada. La creciente adopción de refractarios monolíticos de alto rendimiento impulsa la expansión acelerada del mercado.

Perspectiva del mercado de refractarios de Sudáfrica

Sudáfrica contribuye significativamente debido a la fuerte demanda de las industrias minera, siderúrgica, cementera y de metales no ferrosos. La infraestructura metalúrgica consolidada y los proyectos de modernización de hornos en curso respaldan un consumo constante de refractarios.

¿Cuáles son las principales empresas en el mercado de refractarios?

La industria de refractarios está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Cerámicas y refractarios de alto rendimiento de Saint-Gobain (PCR) (Francia)

- Morgan Advanced Materials (Reino Unido)

- Vesubio (Reino Unido)

- Imerys (Francia)

- RHI Magnesita GmbH (Austria)

- Grupo de Refractarios Puyang Co., Ltd (China)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.