Mercado de tarjetas de sonda de Oriente Medio y África, por tipo de sonda (tarjeta de sonda avanzada y tarjeta de sonda estándar), tipo de tecnología de fabricación ( MEMS , vertical, voladizo, epoxi, cuchilla , otros), tamaño de oblea (más de 12 pulgadas y menos de 12 pulgadas), tamaño de cabezal (más de 40 mm x 40 mm y menos de 40 mm x 40 mm), prueba (prueba de CC, prueba funcional y prueba de CA), material (tungsteno, laminado revestido de cobre (CCL), aluminio , otros), aplicación (WLCSP, SIP, chip invertido de señal mixta, analógico), tamaño del haz (más de 1,5 mil, menos de 1,5 mil), uso final (fundición, paramétrico, dispositivo lógico y de memoria, DRAM, sensor de imagen CMOS (CIS), Flash, otros), país (Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Israel, Egipto y resto de Oriente Medio y África) Tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado : mercado de tarjetas de prueba en Oriente Medio y África

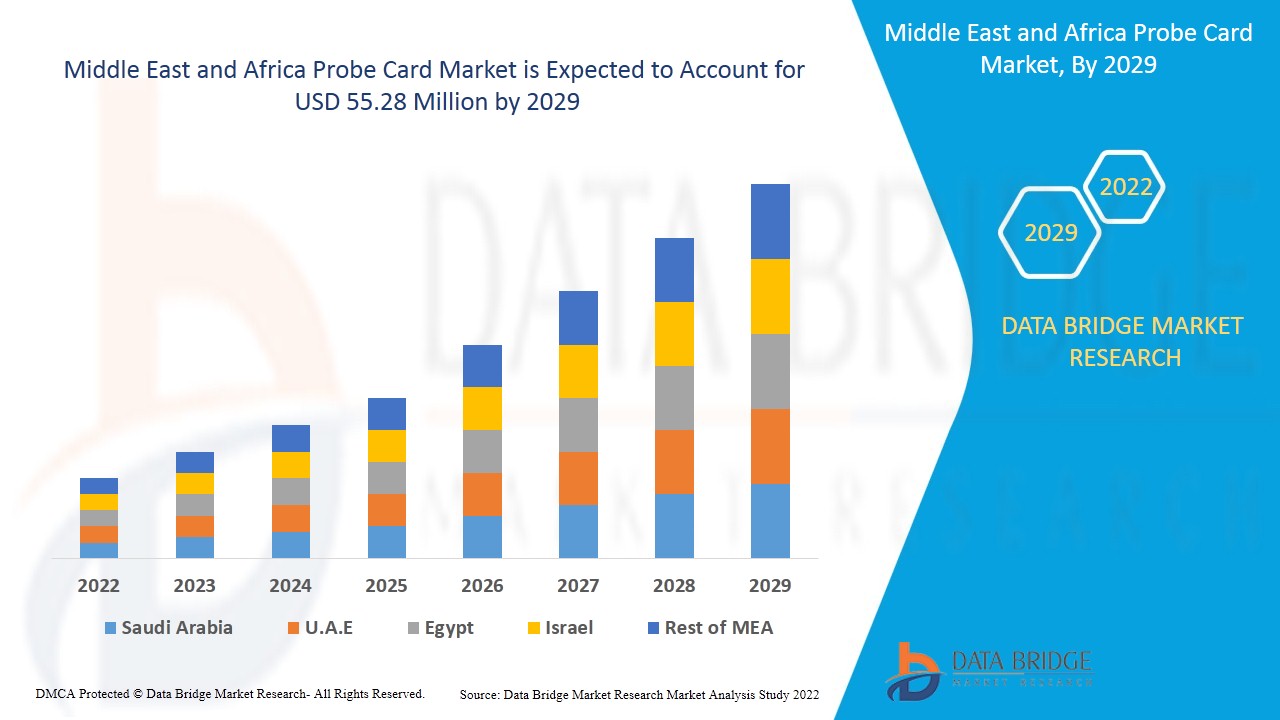

Se espera que el mercado de tarjetas de prueba de Oriente Medio y África gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 9,6% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 55,28 millones para 2029. Se espera que el uso creciente de circuitos integrados en dispositivos electrónicos impulse el mercado de tarjetas de prueba de Oriente Medio y África.

Una tarjeta de prueba es una interfaz que se utiliza para realizar una prueba de oblea para una oblea de semiconductores. Este proceso se utiliza para verificar la calidad de los circuitos integrados o la indexación semántica latente en el primer proceso de fabricación de semiconductores. Generalmente, la tarjeta de prueba está conectada eléctricamente a un probador y acoplada mecánicamente a un probador. La función principal de una tarjeta de prueba es proporcionar una ruta eléctrica entre el sistema de prueba y los circuitos en la oblea, donde se pueden probar los circuitos. Las partes principales incluidas en las tarjetas de prueba se denominan placas de circuito impreso (PCB) y algunas formas de elementos de contacto. Se consideran muchos elementos en una tarjeta de prueba, algunos son muy comunes de usar y otros tienen usos muy especiales.

El aumento de la demanda de pruebas electrónicas en la industria de semiconductores puede actuar como un factor impulsor del mercado de tarjetas de prueba de Oriente Medio y África. Se espera que la falta de conocimiento entre los consumidores sobre los beneficios de la solución de tarjetas de prueba suponga un desafío para el crecimiento del mercado. Sin embargo, se espera que el aumento de las asociaciones y colaboraciones estratégicas entre las organizaciones brinde oportunidades para el mercado de tarjetas de prueba de Oriente Medio y África. El alto costo asociado con la solución de tarjetas de prueba puede resultar restrictivo para el mercado.

El informe de mercado de tarjetas de prueba de Oriente Medio y África proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado de tarjetas de prueba de Oriente Medio y África, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de tarjetas de prueba en Oriente Medio y África

El mercado de tarjetas de sonda de Oriente Medio y África está segmentado en función del tipo de sonda, el tipo de tecnología de fabricación, el tamaño de la oblea, el tamaño del cabezal, la prueba, el material, la aplicación, el tamaño del haz y el uso final. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- En función del tipo de sonda, el mercado de tarjetas de sonda de Oriente Medio y África se segmenta en tarjetas de sonda avanzadas y tarjetas de sonda estándar. En 2022, se prevé que las tarjetas de sonda avanzadas dominen el mercado porque ofrecen la última tecnología con sondas de alta densidad y compatibilidad con procesos de fabricación de semiconductores de menor tamaño.

- En función del tipo de tecnología de fabricación, el mercado de tarjetas de sondeo de Oriente Medio y África se segmenta en MEMS, verticales, en voladizo, epoxi, de cuchillas y otros. En 2022, se prevé que el segmento MEMS domine el mercado porque es compatible con los procesos de fabricación de alta densidad y proporciona una alta eficiencia de sondeo.

- En función del tamaño de las obleas , el mercado de tarjetas de prueba de Oriente Medio y África se segmenta en más de 12 pulgadas y menos de 12 pulgadas. En 2022, se prevé que el segmento de más de 12 pulgadas domine el mercado porque ofrece una mayor eficiencia de fabricación.

- En función del tamaño de la cabeza, el mercado de tarjetas de sonda de Oriente Medio y África se segmenta en más de 40 mm x 40 mm y menos de 40 mm x 40 mm. En 2022, se prevé que el segmento de más de 40 mm x 40 mm domine el mercado porque cubre un área mayor y esto proporciona una mayor velocidad de prueba.

- En función de las pruebas, el mercado de tarjetas de prueba de Oriente Medio y África se segmenta en pruebas de CC, pruebas funcionales y pruebas de CA. En 2022, se prevé que el segmento de pruebas de CC domine el mercado porque las pruebas de corriente continua ayudan a identificar irregularidades básicas del circuito en la etapa inicial y evitan el desperdicio.

- En función del material, el mercado de tarjetas de prueba de Oriente Medio y África se segmenta en tungsteno, laminado revestido de cobre (CCL), aluminio y otros. En 2022, se prevé que el segmento de tungsteno domine el mercado debido a su alto punto de fusión, coeficiente de expansión térmica y estabilidad de forma extremadamente alta incluso en un entorno de temperatura súper alta requerido en la aguja de prueba.

- En función de la aplicación, el mercado de tarjetas de prueba de Oriente Medio y África se segmenta en WLCSP, SIP, chip invertido de señal mixta y analógico. En 2022, se prevé que el segmento WLCSP domine el mercado porque contiene diferentes variedades de semiconductores para diferentes aplicaciones en diferentes tamaños de semiconductores.

- En función del tamaño del haz, el mercado de tarjetas de sonda de Oriente Medio y África se segmenta en más de 1,5 mil y menos de 1,5 mil. En 2022, se prevé que el segmento de más de 1,5 mil domine el mercado porque contiene un tamaño de característica mínimo para continuar el proceso de fabricación de semiconductores y es más fácil de mantener y reemplazar.

- En función del uso final, el mercado de tarjetas de prueba de Oriente Medio y África se segmenta en dispositivos de fundición, paramétricos, lógicos y de memoria, DRAM, sensor de imagen CMOS (CIS), flash y otros. En 2022, se prevé que el segmento de fundición domine el mercado con el aumento de la demanda en el sector automotriz de la región.

Análisis a nivel de país del mercado de tarjetas de prueba en Oriente Medio y África

El mercado de tarjetas de sonda de Medio Oriente y África está segmentado según el tipo de sonda, el tipo de tecnología de fabricación, el tamaño de la oblea, el tamaño del cabezal, la prueba, el material, la aplicación, el tamaño del haz y el uso final.

Los países incluidos en el informe sobre el mercado de tarjetas de prueba de Oriente Medio y África son Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Israel, Egipto y el resto de Oriente Medio y África. Se espera que los Emiratos Árabes Unidos dominen el mercado de tarjetas de prueba de Oriente Medio y África debido a la demanda de productos electrónicos en el sector automotriz y al desarrollo de infraestructura.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de las marcas de Medio Oriente y África y sus desafíos enfrentados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

El aumento de la demanda de pruebas electrónicas en la industria de semiconductores está impulsando el crecimiento del mercado de tarjetas de prueba en Oriente Medio y África

El mercado de tarjetas de prueba de Oriente Medio y África también le proporciona un análisis de mercado detallado del crecimiento de cada país en un mercado en particular. Además, proporciona información detallada sobre la estrategia de los actores del mercado y su presencia geográfica. Los datos están disponibles para el período histórico de 2011 a 2020.

Análisis del panorama competitivo y de la cuota de mercado de las tarjetas de prueba en Oriente Medio y África

El panorama competitivo del mercado de tarjetas de prueba de Oriente Medio y África proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa relacionado con el mercado de tarjetas de prueba de Oriente Medio y África.

Algunas de las principales empresas que operan en el mercado de tarjetas de prueba en Oriente Medio y África son FEINMETALL GmbH, Wentworth Labs y otras empresas nacionales. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Numerosos contratos y acuerdos son iniciados también por empresas de todo el mundo, lo que acelera el mercado de tarjetas de prueba en Oriente Medio y África.

Por ejemplo,

- En abril de 2021, FEINMETALL GmbH presentó una nueva tarjeta de sonda para obleas con una sonda de contacto por resorte como elemento de contacto. La empresa lanzó el producto debido a sus características únicas para contactar chips y sondas con resorte independiente y con un estilo de punta especial. El producto tuvo una gran demanda en el mercado. El mercado se enriqueció con nuevas sondas de características según la demanda de los usuarios.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA PROBE CARD MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PROBE TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 THE MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN

4.1.1 MANUFACTURERS

4.1.2 CONSUMPTION

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING USE OF INTEGRATED CIRCUITS IN ELECTRONIC DEVICES

5.1.2 SURGE IN DEMAND FOR ELECTRONIC TESTING IN THE SEMICONDUCTOR INDUSTRY

5.1.3 GROWING INVESTMENT IN MINIATURIZATION OF ELECTRONIC COMPONENT

5.1.4 RISING DEMAND FOR SEMICONDUCTORS PROBE CARDS IN AUTOMOBILE INDUSTRY

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH PROBE CARD SOLUTION

5.2.2 IMPACT OF METAL PRICES ON OVERALL COMPONENT PRODUCTION COST

5.3 OPPORTUNITIES

5.3.1 RISE IN STRATEGIC PARTNERSHIP AND COLLABORATION

5.3.2 RISING ADOPTION OF PROBE CARDS SOLUTION IN AUTOMOTIVE INDUSTRY

5.3.3 INCREASING USE OF SEMICONDUCTORS IN MILITARY AND DEFENSE SECTOR

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS AMONG CONSUMERS REGARDING BENEFITS OF PROBE CARD SOLUTION

5.4.2 DISRUPTION IN SUPPLY OF PROBE CARD

5.4.3 TECHNOLOGICAL ACCELERATION CREATES A CHALLENGING ENVIRONMENT FOR PROBE CARD SOLUTION

6 IMPACT ANALYSIS OF COVID-19 ON MIDDLE EAST & AFRICA PROBE CARD MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 STRATEGIC DECISIONS BY MANUFACTURERS AFTER COVID-19

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND AND SUPPLY CHAIN

6.5 CONCLUSION

7 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY PROBE TYPE

7.1 OVERVIEW

7.2 ADVANCED PROBE CARD

7.2.1 MEMS SP

7.2.2 VERTICAL PROBE

7.2.3 U-PROBE

7.2.4 SP-PROBE

7.2.5 OTHERS

7.3 STANDARD PROBE CARD

8 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE

8.1 OVERVIEW

8.2 MEMS

8.3 VERTICAL

8.4 CANTILEVER

8.5 EPOXY

8.6 BLADE

8.7 OTHERS

9 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY WAFER SIZE

9.1 OVERVIEW

9.2 MORE THAN 12 INCHES

9.3 LESS THAN 12 INCHES

10 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY HEAD SIZE

10.1 OVERVIEW

10.2 MORE THAN 40MM X 40MM

10.3 LESS THAN 40MM X 40MM

11 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY TEST

11.1 OVERVIEW

11.2 DC TEST

11.3 FUNCTIONAL TEST

11.4 AC TEST

12 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY MATERIAL

12.1 OVERVIEW

12.2 TUNGSTEN

12.3 COPPER CLAD LAMINATED (CCL)

12.4 ALUMINUM

12.5 OTHERS

13 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 WLCSP

13.3 SIP

13.4 MIXED SIGNAL FLIP CHIP

13.5 ANALOG

14 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY BEAM SIZE

14.1 OVERVIEW

14.2 MORE THAN 1.5 MIL

14.3 LESS THAN 1.5 MIL

15 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY END-USE

15.1 OVERVIEW

15.2 FOUNDRY

15.2.1 ADVANCED PROBE CARD

15.2.2 STANDARD PROBE CARD

15.3 PARAMETRIC

15.3.1 ADVANCED PROBE CARD

15.3.2 STANDARD PROBE CARD

15.4 LOGIC AND MEMORY DEVICE

15.4.1 ADVANCED PROBE CARD

15.4.2 STANDARD PROBE CARD

15.5 DRAM

15.5.1 ADVANCED PROBE CARD

15.5.2 STANDARD PROBE CARD

15.6 CMOS IMAGE SENSOR (CIS)

15.6.1 ADVANCED PROBE CARD

15.6.2 STANDARD PROBE CARD

15.7 FLASH

15.7.1 ADVANCED PROBE CARD

15.7.2 STANDARD PROBE CARD

15.8 OTHERS

16 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY REGION

16.1 MIDDLE EAST & AFRICA

16.1.1 U.A.E.

16.1.2 SAUDI ARABIA

16.1.3 ISRAEL

16.1.4 SOUTH AFRICA

16.1.5 EGYPT

16.1.6 REST OF MIDDLE EAST & AFRICA

17 MIDDLE EAST & AFRICA PROBE CARD MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 FORMFACTOR

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 TECHNOPROBE S.P.A.

19.2.1 COMPANY SNAPSHOT

19.2.2 COMPANY SHARE ANALYSIS

19.2.3 PRODUCT PORTFOLIO

19.2.4 RECENT DEVELOPMENT

19.3 MICRONICS JAPAN CO., LTD.

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENT

19.4 MPI CORPORATION

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIUS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 CHUNGHWA PRECISION TEST TECH.CO. LTD

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENT

19.6 FEINMETALL GMBH

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT DEVELOPMENTS

19.7 HTT HIGH TECH TRADE GMBH

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENTS

19.8 KOREA INSTRUMENT CO., LTD

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENT

19.9 JAPAN ELECTRONIC MATERIALS CORPORATION

19.9.1 COMPANY SNAPSHOT

19.9.2 REVENUE ANALYSIS

19.9.3 PRODUCT PORTFOLIO

19.9.4 RECENT DEVELOPMENT

19.1 MICROFRIEND

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 ONTO INNOVATION

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENTS

19.12 SV PROBE

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENT

19.13 STAR TECHNOLOGIES INC.

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENTS

19.14 RIKA DENSHI CO., LTD.

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 TSE CO,. LTD.

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 PRODUCT PORTFOLIO

19.15.4 RECENT DEVELOPMENT

19.16 TRANSLARITY

19.16.1 COMPANY SNAPSHOT

19.16.2 PRODUCT PORTFOLIO

19.16.3 RECENT DEVELOPMENT

19.17 DYNAMIC-TEST

19.17.1 COMPANY SNAPSHOT

19.17.2 PRODUCT PORTFOLIO

19.17.3 RECENT DEVELOPMENTS

19.18 WILL TECHNOLOGY

19.18.1 COMPANY SNAPSHOT

19.18.2 PRODUCT PORTFOLIO

19.18.3 RECENT DEVELOPMENTS

19.19 WENTWORTH LABS

19.19.1 COMPANY SNAPSHOT

19.19.2 PRODUCT PORTFOLIO

19.19.3 RECENT DEVELOPMENTS

19.2 WINWAY TECH. CO., LTD.

19.20.1 COMPANY SNAPSHOT

19.20.2 PRODUCT PORTFOLIO

19.20.3 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

Lista de Tablas

TABLE 1 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA ADVANCED PROBE CARD IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA ADVANCED PROBE CARD IN PROBE CARD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA STANDARD PROBE CARD IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA MEMS IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA VERTICAL IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA CANTILEVER IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA EPOXY IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA BLADE IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA OTHERS IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY WAFER SIZE, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA MORE THAN 12 INCHES IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA LESS THAN 12 INCHES IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY HEAD SIZE, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA MORE THAN 40MM X 40MM IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA LESS THAN 40MM X 40MM IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY TEST, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA DC TEST IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA FUNCTIONAL TEST IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 21 MIDDLE EAST & AFRICA AC TEST IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 22 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA TUNGSTEN IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA COPPER CLAD LAMINATED (CCL) IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 25 MIDDLE EAST & AFRICA ALUMINUM IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 26 MIDDLE EAST & AFRICA OTHERS IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 27 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA WLCSP IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA SIP IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 30 MIDDLE EAST & AFRICA MIXED SIGNAL FLIP CHIP IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 31 MIDDLE EAST & AFRICA ANALOG IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 32 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY BEAM SIZE, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA MORE THAN 1.5 MIL IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA LESS THAN 1.5 MIL IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA FOUNDRY IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA FOUNDRY IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA PARAMETRIC IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 39 MIDDLE EAST & AFRICA PARAMETRIC IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 41 MIDDLE EAST & AFRICA LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA DRAM IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 43 MIDDLE EAST & AFRICA DRAM IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 45 MIDDLE EAST & AFRICA CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA FLASH IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 47 MIDDLE EAST & AFRICA FLASH IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA OTHERS IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 49 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA ADVANCED PROBE CARD IN PROBE CARD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY WAFER SIZE, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY HEAD SIZE, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY TEST, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY BEAM SIZE, 2020-2029 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA PROBE CARD MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA FOUNDRY IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 61 MIDDLE EAST & AFRICA PARAMETRIC IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 63 MIDDLE EAST & AFRICA DRAM IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA FLASH IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.A.E PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.A.E ADVANCED PROBE CARD IN PROBE CARD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.A.E PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.A.E PROBE CARD MARKET, BY WAFER SIZE, 2020-2029 (USD MILLION)

TABLE 70 U.A.E PROBE CARD MARKET, BY HEAD SIZE, 2020-2029 (USD MILLION)

TABLE 71 U.A.E PROBE CARD MARKET, BY TEST, 2020-2029 (USD MILLION)

TABLE 72 U.A.E PROBE CARD MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 73 U.A.E PROBE CARD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 U.A.E PROBE CARD MARKET, BY BEAM SIZE, 2020-2029 (USD MILLION)

TABLE 75 U.A.E PROBE CARD MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 76 U.A.E FOUNDRY IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 77 U.A.E PARAMETRIC IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 78 U.A.E LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 79 U.A.E DRAM IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 80 U.A.E CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.A.E FLASH IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 82 SAUDI ARABIA PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 83 SAUDI ARABIA ADVANCED PROBE CARD IN PROBE CARD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 SAUDI ARABIA PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE, 2020-2029 (USD MILLION)

TABLE 85 SAUDI ARABIA PROBE CARD MARKET, BY WAFER SIZE, 2020-2029 (USD MILLION)

TABLE 86 SAUDI ARABIA PROBE CARD MARKET, BY HEAD SIZE, 2020-2029 (USD MILLION)

TABLE 87 SAUDI ARABIA PROBE CARD MARKET, BY TEST, 2020-2029 (USD MILLION)

TABLE 88 SAUDI ARABIA PROBE CARD MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 89 SAUDI ARABIA PROBE CARD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 SAUDI ARABIA PROBE CARD MARKET, BY BEAM SIZE, 2020-2029 (USD MILLION)

TABLE 91 SAUDI ARABIA PROBE CARD MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 92 SAUDI ARABIA FOUNDRY IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 93 SAUDI ARABIA PARAMETRIC IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 94 SAUDI ARABIA LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 95 SAUDI ARABIA DRAM IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 96 SAUDI ARABIA CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 97 SAUDI ARABIA FLASH IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 98 ISRAEL PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 99 ISRAEL ADVANCED PROBE CARD IN PROBE CARD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 ISRAEL PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE, 2020-2029 (USD MILLION)

TABLE 101 ISRAEL PROBE CARD MARKET, BY WAFER SIZE, 2020-2029 (USD MILLION)

TABLE 102 ISRAEL PROBE CARD MARKET, BY HEAD SIZE, 2020-2029 (USD MILLION)

TABLE 103 ISRAEL PROBE CARD MARKET, BY TEST, 2020-2029 (USD MILLION)

TABLE 104 ISRAEL PROBE CARD MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 105 ISRAEL PROBE CARD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 ISRAEL PROBE CARD MARKET, BY BEAM SIZE, 2020-2029 (USD MILLION)

TABLE 107 ISRAEL PROBE CARD MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 108 ISRAEL FOUNDRY IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 109 ISRAEL PARAMETRIC IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 110 ISRAEL LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 111 ISRAEL DRAM IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 112 ISRAEL CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 113 ISRAEL FLASH IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 114 SOUTH AFRICA PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 115 SOUTH AFRICA ADVANCED PROBE CARD IN PROBE CARD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 SOUTH AFRICA PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE, 2020-2029 (USD MILLION)

TABLE 117 SOUTH AFRICA PROBE CARD MARKET, BY WAFER SIZE, 2020-2029 (USD MILLION)

TABLE 118 SOUTH AFRICA PROBE CARD MARKET, BY HEAD SIZE, 2020-2029 (USD MILLION)

TABLE 119 SOUTH AFRICA PROBE CARD MARKET, BY TEST, 2020-2029 (USD MILLION)

TABLE 120 SOUTH AFRICA PROBE CARD MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 121 SOUTH AFRICA PROBE CARD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 SOUTH AFRICA PROBE CARD MARKET, BY BEAM SIZE, 2020-2029 (USD MILLION)

TABLE 123 SOUTH AFRICA PROBE CARD MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 124 SOUTH AFRICA FOUNDRY IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 125 SOUTH AFRICA PARAMETRIC IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 126 SOUTH AFRICA LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 127 SOUTH AFRICA DRAM IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 128 SOUTH AFRICA CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 129 SOUTH AFRICA FLASH IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 130 EGYPT PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 131 EGYPT ADVANCED PROBE CARD IN PROBE CARD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 EGYPT PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE, 2020-2029 (USD MILLION)

TABLE 133 EGYPT PROBE CARD MARKET, BY WAFER SIZE, 2020-2029 (USD MILLION)

TABLE 134 EGYPT PROBE CARD MARKET, BY HEAD SIZE, 2020-2029 (USD MILLION)

TABLE 135 EGYPT PROBE CARD MARKET, BY TEST, 2020-2029 (USD MILLION)

TABLE 136 EGYPT PROBE CARD MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 137 EGYPT PROBE CARD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 138 EGYPT PROBE CARD MARKET, BY BEAM SIZE, 2020-2029 (USD MILLION)

TABLE 139 EGYPT PROBE CARD MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 140 EGYPT FOUNDRY IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 141 EGYPT PARAMETRIC IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 142 EGYPT LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 143 EGYPT DRAM IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 144 EGYPT CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 145 EGYPT FLASH IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 146 REST OF MIDDLE EAST & AFRICA PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 MIDDLE EAST & AFRICA PROBE CARD MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PROBE CARD MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PROBE CARD MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PROBE CARD MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PROBE CARD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PROBE CARD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA PROBE CARD MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA PROBE CARD MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA PROBE CARD MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA PROBE CARD MARKET: MARKET CHALLENGE MATRIX

FIGURE 11 MIDDLE EAST & AFRICA PROBE CARD MARKET: SEGMENTATION

FIGURE 12 INCREASING USE OF INTEGRATED CIRCUITS IN ELECTRONIC DEVICES IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA PROBE CARD MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 THE ADVANCED PROBE TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA PROBE CARD MARKET IN 2022 & 2029

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE MIDDLE EAST & AFRICA PROBE CARD MARKET IN THE FORECAST PERIOD

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR MIDDLE EAST & AFRICA PROBE CARD MARKET

FIGURE 16 MIDDLE EAST & AFRICA PROBE CARD MARKET: BY PROBE TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA PROBE CARD MARKET: BY MANUFACTURING TECHNOLOGY TYPE, 2021

FIGURE 18 MIDDLE EAST & AFRICA PROBE CARD MARKET: BY WAFER SIZE, 2021

FIGURE 19 MIDDLE EAST & AFRICA PROBE CARD MARKET: BY HEAD SIZE, 2021

FIGURE 20 MIDDLE EAST & AFRICA PROBE CARD MARKET: BY TEST, 2021

FIGURE 21 MIDDLE EAST & AFRICA PROBE CARD MARKET: BY MATERIAL, 2021

FIGURE 22 MIDDLE EAST & AFRICA PROBE CARD MARKET: BY APPLICATION, 2021

FIGURE 23 MIDDLE EAST & AFRICA PROBE CARD MARKET: BY BEAM SIZE, 2021

FIGURE 24 MIDDLE EAST & AFRICA PROBE CARD MARKET: BY END-USE, 2021

FIGURE 25 MIDDLE EAST & AFRICA PROBE CARD MARKET: SNAPSHOT (2021)

FIGURE 26 MIDDLE EAST & AFRICA PROBE CARD MARKET: BY COUNTRY (2021)

FIGURE 27 MIDDLE EAST & AFRICA PROBE CARD MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 MIDDLE EAST & AFRICA PROBE CARD MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 MIDDLE EAST & AFRICA PROBE CARD MARKET: BY PROBE TYPE (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA PROBE CARD MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.