Middle East And Africa Powder Sulfur Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

59,979.20 Thousand

USD

75,274.83 Thousand

2022

2030

USD

59,979.20 Thousand

USD

75,274.83 Thousand

2022

2030

| 2023 –2030 | |

| USD 59,979.20 Thousand | |

| USD 75,274.83 Thousand | |

|

|

|

Mercado de azufre en polvo de Oriente Medio y África, por grado (grado agrícola, grado de caucho, grado industrial, grado farmacéutico, grado alimenticio y otros), producto (azufre en polvo sin relleno de aceite y azufre en polvo con relleno de aceite), finura (malla 200, malla 300, malla 325, malla 400, malla 500 y otros): tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de azufre en polvo en Oriente Medio y África

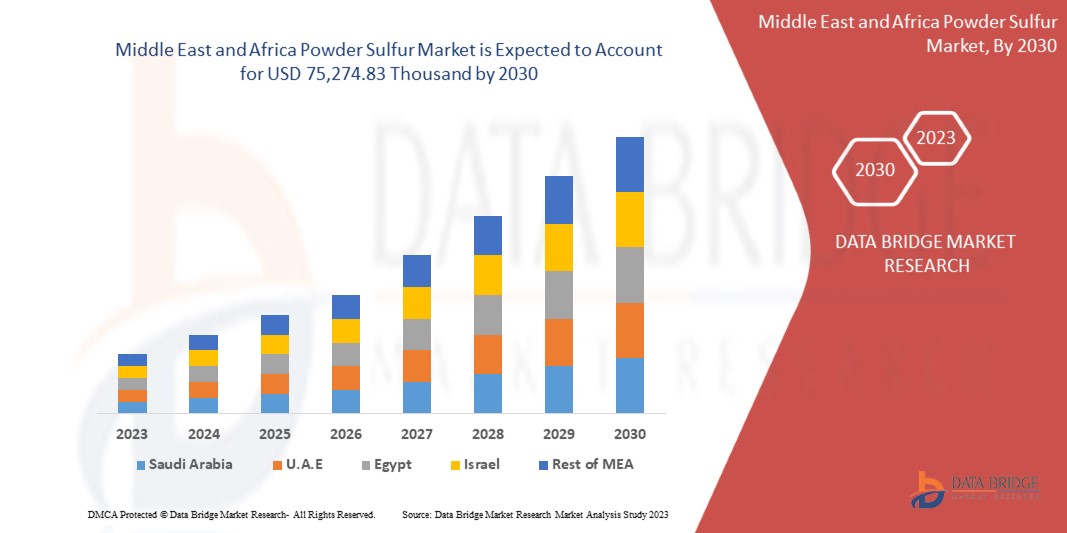

Data Bridge Market Research analiza que se espera que el mercado de azufre en polvo de Medio Oriente y África alcance los USD 75,274.83 mil para 2030 desde USD 59,979.20 mil en 2022, creciendo con una CAGR sustancial del 2.9% en el período de pronóstico de 2023 a 2030.

Una perspectiva positiva hacia la industria agrícola y la creciente aceptación como ingrediente dermatológico en el sector farmacéutico son algunos de los factores impulsores que se espera que impulsen el crecimiento del mercado. Sin embargo, se espera que los problemas peligrosos asociados con la naturaleza química del azufre en polvo y la disponibilidad de sustitutos en algunos de los segmentos de aplicación limiten el crecimiento del mercado. Se espera que el aumento del gasto en I+D en los segmentos de vehículos eléctricos y energía renovable brinde oportunidades para el crecimiento del mercado. Sin embargo, se espera que la implementación de normas y regulaciones destinadas a prevenir el uso de almacenamiento de productos químicos desafíe el crecimiento del mercado.

El informe de mercado de azufre en polvo de Oriente Medio y África proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un informe de analista. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Año histórico |

2021 (Personalizable para 2015 - 2020) |

|

Unidades cuantitativas |

Ingresos en miles de USD |

|

Segmentos cubiertos |

Grado (grado agrícola, grado de caucho, grado industrial, grado farmacéutico, grado alimenticio y otros), producto (azufre en polvo sin relleno de aceite y azufre en polvo con relleno de aceite), finura (malla 200, malla 300, malla 325, malla 400, malla 500 y otros) |

|

Países cubiertos |

Marruecos, Sudáfrica, Arabia Saudita, Egipto, Israel y el resto de Oriente Medio y África |

|

Actores del mercado cubiertos |

Grupo Azoty, Kaycee Chem Industries, MK CHEMICAL INDUSTRIES, Jordan Sulphur, Golden Chemicals, Sulphur., JK Industries, Solar Chemferts Pvt Ltd, American Elements, JAINSON CHEMICALS y Jaishil Sulphur & Chemical Industries, entre otras. |

Definición de mercado

El azufre en polvo es una forma finamente molida de azufre elemental, que se utiliza habitualmente en diversas industrias y aplicaciones. Se caracteriza por su consistencia en polvo, compuesta normalmente por pequeñas partículas con un alto grado de pureza. Sirve como ingrediente clave en la producción de fertilizantes, pesticidas y fungicidas, así como en la fabricación de productos químicos y farmacéuticos. Su naturaleza versátil permite su uso como aditivo en procesos industriales, como la vulcanización del caucho y las aplicaciones metalúrgicas. Desempeña un papel vital en diversos sectores debido a sus propiedades químicas únicas y a su amplia utilidad industrial.

Dinámica del mercado de azufre en polvo en Oriente Medio y África

Conductores

- Perspectivas positivas para la industria agrícola

El azufre se destaca en la agricultura por múltiples usos como la protección de cultivos como producto fitosanitario, propiedades fungicidas y acaricidas, y el potencial que ofrece como agronutriente por su potencial como fertilizante y bioestimulante natural. Esto debido a que el azufre incentiva a las plantas a producir por sí mismas aminoácidos esenciales como cisteína, cistina y metionina, fortaleciendo sus defensas naturales contra los hongos.

El azufre en polvo beneficiará a todas las plantas si los niveles de azufre en el suelo son bajos, ya que el azufre es necesario para el crecimiento de las plantas. Algunas verduras, como la cebolla, el ajo y la mostaza, necesitan azufre para tener más sabor. Como resultado, el sector agrícola se beneficiará significativamente, lo que se espera que impulse el crecimiento del mercado porque es el ingrediente más eficaz para un crecimiento excepcional de los cultivos.

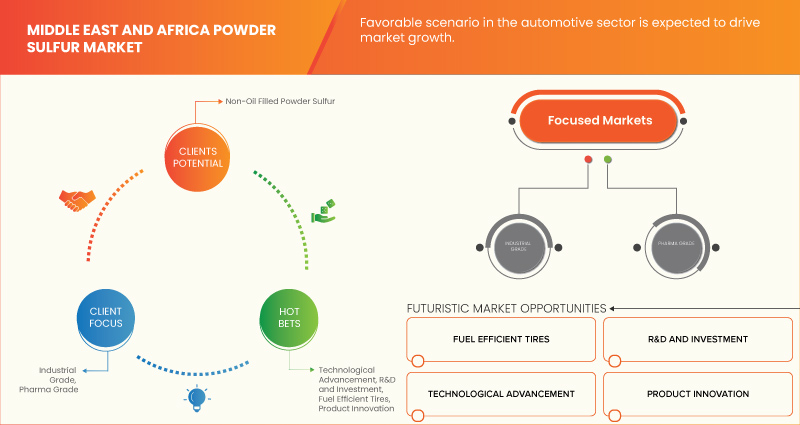

- Escenario favorable en el sector automotor

La industria de los neumáticos es uno de los componentes más importantes del mercado automovilístico. Los neumáticos y las cámaras, que son componentes esenciales de los vehículos automotores, son fundamentales para la economía de un país. Los neumáticos se utilizan en vehículos de pasajeros, vehículos comerciales, camiones grandes, camiones ligeros y otros tipos de vehículos.

Como resultado, las ventas, la demanda y la producción de neumáticos están aumentando en todo el mundo. Por consiguiente, existe una creciente demanda de neumáticos eficaces. Para aumentar la elasticidad, la resistencia y la durabilidad, se añade azufre tanto al caucho natural como al sintético. Las moléculas de azufre y caucho crean enlaces cruzados que le dan al caucho sus características distintivas. Estos factores lo convierten en una materia prima necesaria en la producción de neumáticos. Por lo tanto, el polvo de azufre se utiliza mucho en la fabricación de neumáticos. Además, los neumáticos tienen el potencial de ser un importante impulsor del crecimiento del mercado debido a su creciente demanda, producción y ventas.

Oportunidad

- Perspectivas de apoyo hacia el procesamiento químico en todo el mundo

El azufre en polvo se utiliza para producir sustancias químicas como el ácido sulfúrico, los sulfitos y el dióxido de azufre. La fabricación de papel, la filtración de agua y el procesamiento de metales son solo algunos de los usos industriales de estos compuestos. La producción de explosivos como el TNT (trinitrotolueno) y el fueloil que contiene nitrato de amonio también lo utilizan como componente. Proporciona a la mezcla explosiva la cantidad esencial de azufre que necesita y, al mismo tiempo, ayuda a mantener la reacción estable. El azufre en polvo se utiliza a veces en la purificación del agua para eliminar contaminantes y evitar el crecimiento de bacterias y algas en los sistemas de agua, así como como agente blanqueador en la fabricación de papel, lana y seda. Además, se utiliza en la producción de varios tipos de jabón y detergentes.

El uso de productos químicos procesados a partir de azufre en polvo se ha utilizado en muchas industrias, como el tratamiento de agua, los fuegos artificiales y la construcción, entre otras. Además, se espera que los diferentes usos de los productos químicos en diversas industrias presenten perspectivas para la industria.

Restricciones/Desafíos

- Amenaza creíble de sustitutos en algunos segmentos de aplicación

El azufre en polvo desempeña diversas funciones en la producción de distintos productos en distintos segmentos, como el automotriz, el agrícola, el farmacéutico y otros. Su función en múltiples segmentos puede tener efectos tanto positivos como negativos en el mercado en general, ya que cada segmento de aplicación puede tener varios sustitutos que pueden anular de manera efectiva el uso del azufre en polvo.

De los ejemplos anteriores se desprende que ya existen muchos compuestos químicos sustitutos que pueden utilizarse como sustitutos del azufre en polvo. Por lo tanto, se espera que la disponibilidad de estos sustitutos limite el crecimiento del mercado.

- Implementación de normas y reglamentos destinados a prevenir el uso de sustancias químicas

La creciente preocupación por el uso de productos químicos peligrosos en el proceso de fabricación ha dado lugar a la aplicación de normas y reglamentos estrictos en el sector del azufre en polvo. Estas directrices y leyes abarcan el uso de los productos químicos que intervienen en la producción del propio azufre, así como el uso del azufre en la producción de otros productos. Por tanto, se espera que la aplicación de normas estrictas limite el crecimiento del mercado.

La restricción de utilizar determinados materiales, productos químicos y procesos de producción hace que las empresas inviertan más en nuevos métodos y materiales de I+D, esquemas de producción, tecnología y equipos para cumplir con los requisitos de la normativa, lo que a su vez tendrá un impacto en el coste y la disponibilidad del producto, lo que en última instancia afectará al mercado. Por otro lado, el verdadero propósito de estas normas y reglamentos es hacer hincapié en la sostenibilidad y la innovación, y en la colaboración entre diversas empresas para lograr la viabilidad a largo plazo y entregar productos inocuos al cliente. Por tanto, los fabricantes deberían tomar estas normas como un reto y tomar las medidas necesarias para superarlas y destacarse entre los demás fabricantes.

Alcance del mercado de azufre en polvo en Oriente Medio y África

El mercado de azufre en polvo de Oriente Medio y África se divide en tres segmentos importantes según el grado, el producto y la finura. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Calificación

- Grado agrícola

- Grado de caucho

- Grado industrial

- Grado farmacéutico

- Grado alimenticio

- Otros

Sobre la base del grado, el mercado de Medio Oriente y África está segmentado en grado agrícola, grado de caucho, grado industrial, grado farmacéutico, grado alimenticio y otros.

Producto

- Azufre en polvo relleno de aceite

- Azufre en polvo sin relleno de aceite

Sobre la base del producto, el mercado de Medio Oriente y África está segmentado en azufre en polvo relleno de aceite y azufre en polvo no relleno de aceite.

Finura

- Malla 200

- Malla 300

- Malla 325

- Malla 400

- Malla 500

- Otros

Sobre la base de la finura, el mercado de Medio Oriente y África está segmentado en malla 200, malla 300, malla 325, malla 400, malla 500 y otros.

Análisis y perspectivas regionales del mercado de azufre en polvo en Oriente Medio y África

El mercado de azufre en polvo de Medio Oriente y África está segmentado en tres segmentos notables según el grado, el producto y la finura.

Los países cubiertos en este informe de mercado son Marruecos, Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Egipto, Israel y el resto de Medio Oriente y África.

Se espera que Marruecos domine el mercado debido al creciente uso de azufre en polvo en el sector agrícola de la región.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. El análisis de los puntos de datos de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para cada país. Además, se consideran la presencia y disponibilidad de marcas regionales y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado del azufre en polvo en Oriente Medio y África

El panorama competitivo del mercado de azufre en polvo de Oriente Medio y África proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de supervivencia de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado.

Algunos de los principales actores del mercado que operan en el mercado de azufre en polvo de Medio Oriente y África son Grupa Azoty, Kaycee Chem Industries, MK CHEMICAL INDUSTRIES, Jordan Sulphur, Golden Chemicals, Sulphur., JK Industries, Solar Chemferts Pvt Ltd, American Elements, JAINSON CHEMICALS y Jaishil Sulphur & Chemical Industries, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION (RIVALRY)

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 IMPORT-EXPORT SCENARIO

4.5 PRICE ANALYSIS

4.6 PRODUCTION CONSUMPTION ANALYSIS

4.7 PRODUCTION CAPACITY OVERVIEW

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTICS COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.1 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 POSITIVE OUTLOOK TOWARDS AGRICULTURE INDUSTRY

6.1.2 FAVORABLE SCENARIO IN THE AUTOMOTIVE SECTOR

6.1.3 GAINING ACCEPTANCE AS A DERMATOLOGICAL INGREDIENT IN PHARMA SECTOR

6.2 RESTRAINTS

6.2.1 CREDIBLE THREAT OF SUBSTITUTES IN SOME OF THE APPLICATION SEGMENTS

6.2.2 HAZARDOUS ISSUES ASSOCIATED WITH THE CHEMICAL NATURE OF POWDERED SULFUR

6.3 OPPORTUNITIES

6.3.1 SUPPORTIVE OUTLOOK TOWARD CHEMICAL PROCESSING AROUND THE GLOBE

6.3.2 RISING R&D SPENDING IN EV AND RENEWABLE ENERGY SEGMENTS

6.4 CHALLENGES

6.4.1 IMPLEMENTATION OF RULES AND REGULATIONS AIMED AT PREVENTING THE USAGE OF CHEMICAL USAGE

6.4.2 FLUCTUATING DEMAND-SUPPLY DYNAMICS OF SULFUR

7 MIDDLE EAST & AFRICA POWDER SULFUR MARKET, BY REGION

7.1 MIDDLE EAST AND AFRICA

7.1.1 MOROCCO

7.1.2 SAUDI ARABIA

7.1.3 EGYPT

7.1.4 SOUTH AFRICA

7.1.5 ISRAEL

7.1.6 REST OF MIDDLE EAST AND AFRICA

8 MIDDLE EAST & AFRICA POWDER SULFUR MARKET: COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

9 COMPANY PROFILES

9.1 GRUPA AZOTY

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 SWOT ANALYSIS

9.1.4 COMPANY SHARE ANALYSIS

9.1.5 PRODUCT PORTFOLIO

9.1.6 RECENT DEVELOPMENTS

9.2 JAISHIL SULPHUR & CHEMICAL INDUSTRIES

9.2.1 COMPANY SNAPSHOT

9.2.2 SWOT

9.2.3 COMPANY SHARE ANALYSIS

9.2.4 PRODUCT PORTFOLIO

9.2.5 RECENT DEVELOPMENTS

9.3 JAINSON CHEMICALS

9.3.1 COMPANY SNAPSHOT

9.3.2 SWOT

9.3.3 COMPANY SHARE ANALYSIS

9.3.4 PRODUCT PORTFOLIO

9.3.5 RECENT DEVELOPMENTS

9.4 AMERICAN ELEMENTS

9.4.1 COMPANY SNAPSHOT

9.4.2 SWOT ANALYSIS

9.4.3 COMPANY SHARE ANALYSIS

9.4.4 PRODUCT PORTFOLIO

9.4.5 RECENT DEVELOPMENTS

9.5 SOLAR CHEMFERTS PVT LTD

9.5.1 COMPANY SNAPSHOT

9.5.2 SWOT ANALYSIS

9.5.3 COMPANY SHARE ANALYSIS

9.5.4 PRODUCT PORTFOLIO

9.5.5 RECENT DEVELOPMENTS

9.6 GOLDEN CHEMICALS

9.6.1 COMPANY SNAPSHOT

9.6.2 SWOT

9.6.3 PRODUCT PORTFOLIO

9.6.4 RECENT DEVELOPMENTS

9.7 J K INDUSTRIES

9.7.1 COMPANY SNAPSHOT

9.7.2 SWOT

9.7.3 PRODUCT PORTFOLIO

9.7.4 RECENT DEVELOPMENTS

9.8 JORDAN SULPHUR

9.8.1 COMPANY SNAPSHOT

9.8.2 SWOT ANALYSIS

9.8.3 PRODUCT PORTFOLIO

9.8.4 RECENT DEVELOPMENT

9.9 KAYCEE CHEM INDUSTRIES

9.9.1 COMPANY SNAPSHOT

9.9.2 SWOT

9.9.3 PRODUCT PORTFOLIO

9.9.4 RECENT DEVELOPMENTS

9.1 M. K. CHEMICAL INDUSTRIES

9.10.1 COMPANY SNAPSHOT

9.10.2 SWOT

9.10.3 PRODUCT PORTFOLIO

9.10.4 RECENT DEVELOPMENTS

9.11 SULPHUR.

9.11.1 COMPANY SNAPSHOT

9.11.2 SWOT ANALYSIS

9.11.3 PRODUCT PORTFOLIO

9.11.4 RECENT DEVELOPMENTS

10 QUESTIONNAIRE

11 RELATED REPORTS

Lista de Tablas

TABLE 1 REGULATORY COVERAGE

TABLE 2 MIDDLE EAST AND AFRICA POWDER SULFUR MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA POWDER SULFUR MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 4 MIDDLE EAST AND AFRICA POWDER SULFUR MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA POWDER SULFUR MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 6 MIDDLE EAST AND AFRICA AGRICULTURAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA RUBBER GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA RUBBER GRADE IN POWDER SULFUR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA INDUSTRIAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA PHARMA GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA FOOD GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA OTHERS IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 15 MIDDLE EAST AND AFRICA POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (TONS)

TABLE 17 MOROCCO POWDER SULFUR MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 18 MOROCCO POWDER SULFUR MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 19 MOROCCO AGRICULTURAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 20 MOROCCO RUBBER GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 21 MOROCCO RUBBER GRADE IN POWDER SULFUR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 MOROCCO INDUSTRIAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 23 MOROCCO PHARMA GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 24 MOROCCO FOOD GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 25 MOROCCO OTHERS IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 26 MOROCCO POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 27 MOROCCO POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 28 MOROCCO POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (USD THOUSAND)

TABLE 29 MOROCCO POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (TONS)

TABLE 30 SAUDI ARABIA POWDER SULFUR MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 31 SAUDI ARABIA POWDER SULFUR MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 32 SAUDI ARABIA AGRICULTURAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 33 SAUDI ARABIA RUBBER GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 34 SAUDI ARABIA RUBBER GRADE IN POWDER SULFUR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 SAUDI ARABIA INDUSTRIAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 36 SAUDI ARABIA PHARMA GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 37 SAUDI ARABIA FOOD GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 38 SAUDI ARABIA OTHERS IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 39 SAUDI ARABIA POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 40 SAUDI ARABIA POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 41 SAUDI ARABIA POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (USD THOUSAND)

TABLE 42 SAUDI ARABIA POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (TONS)

TABLE 43 EGYPT POWDER SULFUR MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 44 EGYPT POWDER SULFUR MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 45 EGYPT AGRICULTURAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 46 EGYPT RUBBER GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 47 EGYPT RUBBER GRADE IN POWDER SULFUR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 EGYPT INDUSTRIAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 49 EGYPT PHARMA GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 50 EGYPT FOOD GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 51 EGYPT OTHERS IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 52 EGYPT POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 53 EGYPT POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 54 EGYPT POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (USD THOUSAND)

TABLE 55 EGYPT POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (TONS)

TABLE 56 SOUTH AFRICA POWDER SULFUR MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 57 SOUTH AFRICA POWDER SULFUR MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 58 SOUTH AFRICA AGRICULTURAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 59 SOUTH AFRICA RUBBER GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 60 SOUTH AFRICA RUBBER GRADE IN POWDER SULFUR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 SOUTH AFRICA INDUSTRIAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 62 SOUTH AFRICA PHARMA GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 63 SOUTH AFRICA FOOD GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 64 SOUTH AFRICA OTHERS IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 65 SOUTH AFRICA POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 66 SOUTH AFRICA POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 67 SOUTH AFRICA POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (USD THOUSAND)

TABLE 68 SOUTH AFRICA POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (TONS)

TABLE 69 ISRAEL POWDER SULFUR MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 70 ISRAEL POWDER SULFUR MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 71 ISRAEL AGRICULTURAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 72 ISRAEL RUBBER GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 73 ISRAEL RUBBER GRADE IN POWDER SULFUR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 ISRAEL INDUSTRIAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 75 ISRAEL PHARMA GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 76 ISRAEL FOOD GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 77 ISRAEL OTHERS IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 78 ISRAEL POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 79 ISRAEL POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 80 ISRAEL POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (USD THOUSAND)

TABLE 81 ISRAEL POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (TONS)

TABLE 82 REST OF MIDDLE EAST AND AFRICA POWDER SULFUR MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 83 REST OF MIDDLE EAST AND AFRICA POWDER SULFUR MARKET, BY GRADE, 2021-2030 (TONS)

Lista de figuras

FIGURE 1 MIDDLE EAST & AFRICA POWDER SULFUR MARKET

FIGURE 2 MIDDLE EAST & AFRICA POWDER SULFUR MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA POWDER SULFUR MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA POWDER SULFUR MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA POWDER SULFUR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA POWDER SULFUR MARKET: THE PRODUCT LIFELINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA POWDER SULFUR MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA POWDER SULFUR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA POWDER SULFUR MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA POWDER SULFUR MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 MIDDLE EAST & AFRICA POWDER SULFUR MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 MIDDLE EAST & AFRICA POWDER SULFUR MARKET: SEGMENTATION

FIGURE 13 A POSITIVE OUTLOOK TOWARDS THE BUILDING AND CONSTRUCTION SECTOR IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA POWDER SULFUR MARKET IN THE FORECAST PERIOD

FIGURE 14 THE AGRICULTURAL GRADE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA POWDER SULFUR MARKET IN 2023 AND 2030

FIGURE 15 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 16 PRICE ANALYSIS FOR MIDDLE EAST & AFRICA POWDER SULFUR MARKET (USD/TON)

FIGURE 17 VENDOR SELECTION CRITERIA

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA SULFUR POWDER MARKET

FIGURE 19 MIDDLE EAST AND AFRICA POWDER SULFUR MARKET: SNAPSHOT (2022)

FIGURE 20 MIDDLE EAST AND AFRICA POWDER SULFUR MARKET: BY COUNTRY (2022)

FIGURE 21 MIDDLE EAST AND AFRICA POWDER SULFUR MARKET: BY COUNTRY (2023 & 2030)

FIGURE 22 MIDDLE EAST AND AFRICA POWDER SULFUR MARKET: BY COUNTRY (2022 & 2030)

FIGURE 23 MIDDLE EAST AND AFRICA POWDER SULFUR MARKET: BY GRADE (2023 - 2030)

FIGURE 24 MIDDLE EAST & AFRICA POWDER SULFUR MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.