Mercado de envases de poliestireno en Oriente Medio y África, por tipo (cuencos, tinas, cajas, vasos, bolsas, sobres, botellas, envoltorios y películas, platos y otros), aplicación (frutas, verduras, pescado, productos del mar, productos cárnicos, productos lácteos, panadería y confitería, aperitivos y alimentos cocinados), usuario final (alimentos y bebidas, productos farmacéuticos y cuidado personal y del hogar): tendencias de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de envases de poliestireno en Oriente Medio y África

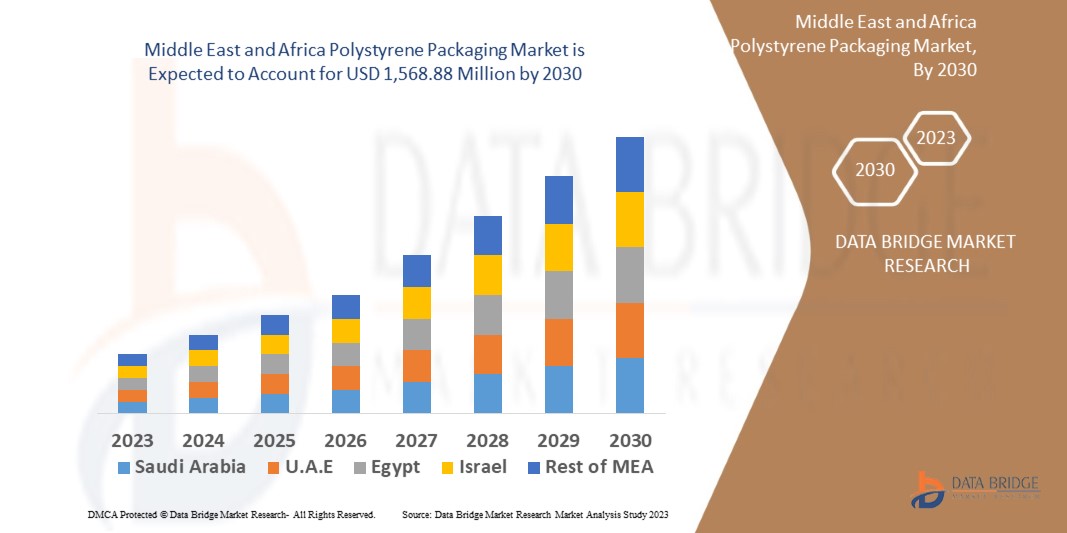

Se espera que el mercado de envases de poliestireno de Oriente Medio y África crezca significativamente entre 2023 y 2030. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 4,6% entre 2023 y 2030 y se espera que alcance los 1.568,88 millones de dólares en 2030. El principal factor que impulsa el crecimiento del mercado de envases de poliestireno es el uso cada vez mayor del envase en la industria médica y farmacéutica, y se espera que el creciente número de puntos de venta de alimentos impulse el crecimiento del mercado de envases de poliestireno de Oriente Medio y África.

El informe de mercado de envases de poliestireno de Oriente Medio y África proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Póngase en contacto con nosotros para obtener un informe de analista para comprender el análisis y el escenario del mercado. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por tipo (cuencos, tarrinas, cajas, vasos, bolsas, sobres, botellas, envoltorios y películas, platos y otros), aplicación (frutas, verduras, pescado, productos del mar, productos cárnicos, productos lácteos, panadería y confitería, aperitivos y alimentos cocinados), usuario final (alimentos y bebidas, productos farmacéuticos y cuidado personal y del hogar) |

|

Países cubiertos |

Egipto, Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Israel y el resto de Oriente Medio y África |

|

Actores del mercado cubiertos |

Alpek SAB de CV, Ohishi Sangyo Co., Ltd., Sonoco Products Company, KANEKA CORPORATION, MONOTEZ, SUNPOR, Versalis SpA (una subsidiaria de Eni SpA), NEFAB GROUP, Heubach Corporation y Synthos, entre otras. |

Definición de mercado

El poliestireno es un polímero versátil que se utiliza para producir una amplia gama de productos de consumo. Se utiliza mucho como material de embalaje debido a sus propiedades de plástico sólido y duro. Ofrece transparencia al producto completo. El plástico a menudo se combina con aditivos y otros polímeros para que sea ideal para su aplicación en diferentes industrias, como la farmacéutica, la del hogar, la del cuidado personal y otras.

Dinámica del mercado de envases de poliestireno en Oriente Medio y África

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

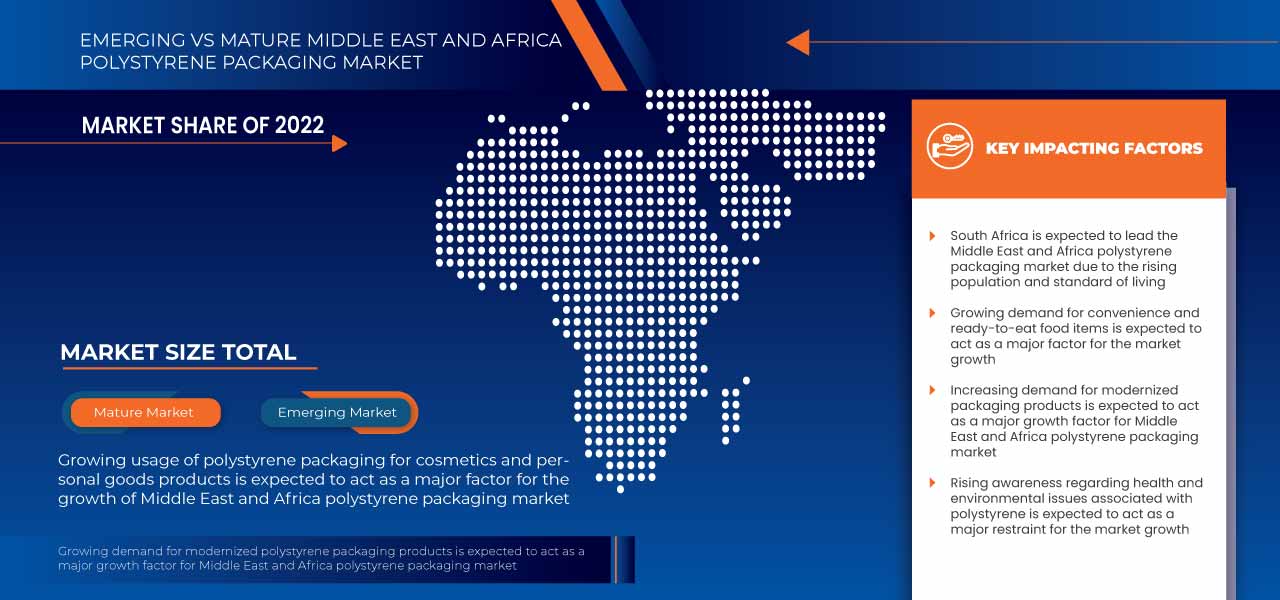

- Aumento del uso de envases de poliestireno en cosméticos y otros productos personales debido a su mayor durabilidad

La demanda de productos cosméticos y de artículos personales ha aumentado a lo largo de los años debido al aumento de los ingresos disponibles, el deseo de lucir bella y mantener la higiene personal. Sin embargo, el contenido de dichos productos es perecedero y tiene una vida útil definida. La exposición al aire, al calor, a la luz y al frío puede empeorar la calidad y la estabilidad de los ingredientes de los productos cosméticos y de artículos personales. Para superar estos desafíos, los envases de poliestireno ofrecen una gran solución. Esto no solo ayuda a mantener los productos en el estado físico deseado, sino que también puede resultar útil para facilitar su transporte.

- Aumentar su uso en envases de la industria médica y farmacéutica

El acceso mejorado a los servicios de atención sanitaria, el uso creciente de seguros médicos, la creciente conciencia pública sobre la atención sanitaria, la demografía favorable, el aumento de la investigación y el desarrollo y el aumento de los ingresos disponibles han aumentado el mercado de la industria médica y farmacéutica. Los productos farmacéuticos son sensibles a la contaminación y deben suministrarse a los consumidores con gran seguridad. Para abordar esta preocupación, los envases de poliestireno ofrecen ser uno de los materiales más utilizados por las empresas farmacéuticas.

- Aumento del número de establecimientos de venta de alimentos

La creciente urbanización, la introducción de cadenas alimentarias de Oriente Medio y África, el aumento de los ingresos, la demografía, la llegada del comercio electrónico a la industria alimentaria y los cambios en los hábitos alimentarios son fuerzas que impulsan el mercado de la industria alimentaria. Las ciudades metropolitanas dominan el mercado de los restaurantes de comida, ya que los consumidores tienen altos ingresos disponibles y una mayor capacidad de gasto. También están expuestos a diversas cocinas y productos relacionados con los alimentos envasados. La llegada del comercio electrónico a la industria de alimentos y bebidas también impulsa el creciente número de puntos de venta de alimentos.

Oportunidades

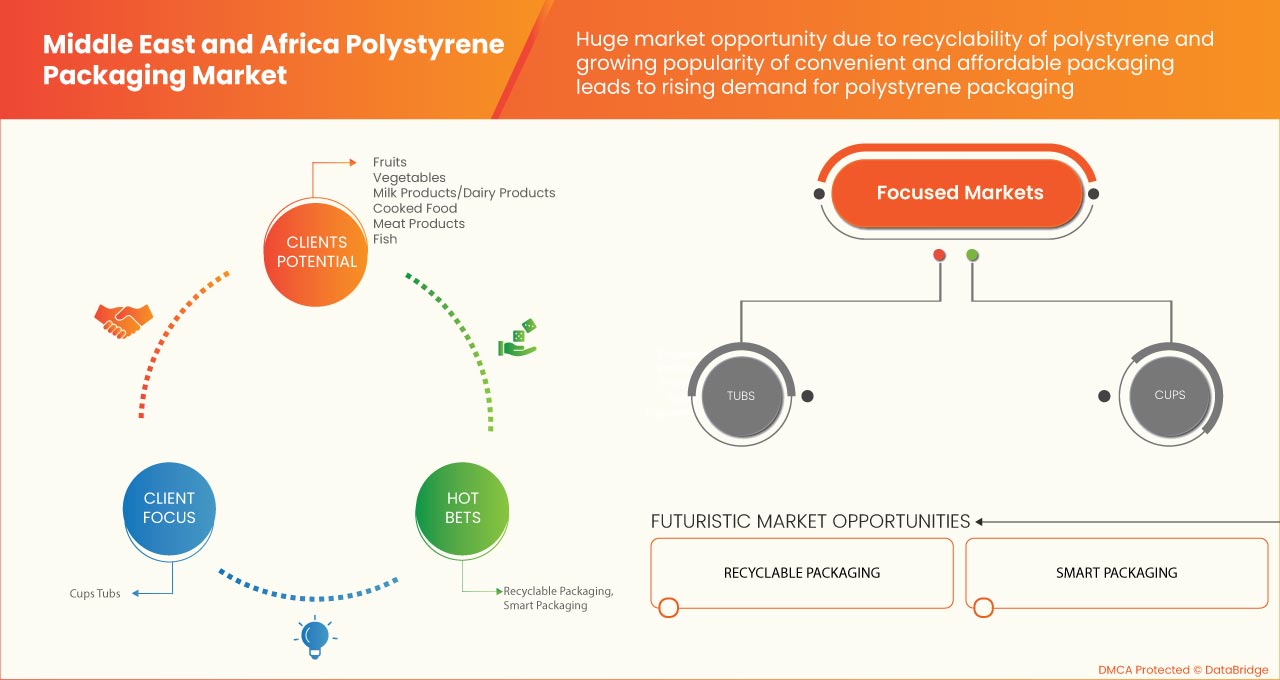

- Capacidad de reciclar materiales de poliestireno.

El poliestireno es un polímero flexible que se emplea en diversos artículos, como embalajes, transporte, bienes de consumo, etc. Sin embargo, se producen daños ambientales porque no se degrada cuando estos artículos se desechan. Como resultado, se hace mayor hincapié en el reciclaje y la reutilización de materiales de poliestireno. Después de su uso, una cantidad significativa de PS expandido se libera en supermercados, grandes almacenes, mercados mayoristas, tiendas y restaurantes, empresas que venden equipos eléctricos e industrias donde se fabrican máquinas. Los materiales a base de poliestireno que deben reciclarse se lavan para eliminar el polvo o las partículas extrañas y luego se trituran.

- Aumentar la inclinación del consumidor hacia envases convenientes y asequibles.

El elemento central del plan de marketing es el embalaje, ya que aumenta el valor del producto en el lineal y facilita su manipulación. Además, es fundamental considerar cómo hacer que el embalaje sea más atractivo, al tiempo que se protege el producto contenido en el mismo de los efectos medioambientales y se mantiene la frescura del producto. Según la conveniencia del consumidor, el embalaje implica colocar los artículos en paquetes atractivos. Para aumentar la demanda del producto entre los consumidores, se utiliza un embalaje apropiado y atractivo como estrategia promocional.

Restricciones

- Disponibilidad de una amplia gama de sustitutos

El poliestireno es uno de los plásticos más flexibles debido a su ligereza, facilidad de procesamiento y mínimo costo. Se ha convertido en el envase de comida para llevar preferido por muchos restaurantes e industrias debido a sus ventajosas características de rendimiento, que incluyen tolerancia y retención del calor. Sin embargo, estos materiales afectan negativamente a la salud humana y al medio ambiente, lo que obliga a los consumidores a buscar otras alternativas sostenibles. Las demandas de los consumidores, la conciencia sobre la sostenibilidad y las regulaciones son las restricciones que provocan la disminución del mercado de envases de poliestireno en Oriente Medio y África.

En los últimos tiempos, otros materiales ligeros, económicos y ecológicos han sustituido a los envases de poliestireno. El papel revestido con ácido poliláctico se ha utilizado como recipiente o vaso para envasar alimentos fríos o calientes. Los vasos comestibles fabricados a partir de productos de cereales naturales tienen una gran demanda para envasar y servir bebidas frías y calientes en la industria de la restauración.

- Problemas de salud y medioambientales asociados al poliestireno

El poliestireno ha contaminado y afectado negativamente al medio ambiente y a nuestra salud debido a su uso extensivo. Se necesitan casi 500 años para descomponerse de forma natural si se desecha, por lo que permanece en el medio ambiente durante mucho tiempo. Estos materiales a base de poliestireno se acumulan en los vertederos y en los cuerpos de agua, degradando aún más la calidad del suelo y del agua. Los pequeños fragmentos de poliestireno podrían ser consumidos por los animales presentes en la tierra y provocar asfixia u obstrucción intestinal. Después de desintegrarse en el océano, el poliestireno puede ser consumido por los peces, que pueden ser consumidos por las especies marinas que se encuentran más arriba en la cadena alimentaria, lo que concentraría la contaminación.

Desafíos

- Normas estrictas sobre el uso de poliestireno

Los envases de poliestireno tienen una amplia gama de aplicaciones en el envasado de alimentos, como cubiertos y platos desechables, vasos de un solo uso para bebidas frías o calientes, bandejas para carne y huevos, y recipientes para productos farmacéuticos y de cuidado personal. Sin embargo, debido a su uso diverso, los materiales de poliestireno a menudo se acumulan y se agregan a los desechos. El poliestireno, debido a su naturaleza liviana, se rompe en pequeños fragmentos y no es fácilmente biodegradable, lo que hace que sea persistente en el medio ambiente y susceptible a la contaminación por microplásticos. El estireno también es un carcinógeno potencial a partir del cual se fabrica el poliestireno. La exposición frecuente al poliestireno puede causar efectos adversos para la salud.

- Volatilidad en los precios de las materias primas

El poliestireno, un polímero de hidrocarburo aromático artificial, está hecho a partir del monómero de estireno. Al combinar etileno y benceno , se crea el estireno . El estireno se compone de un 26 % de etileno y un 74 % de benceno. Junto con el benceno y el etileno, un catalizador como el tricloruro de aluminio, el óxido de magnesio y el óxido de hierro son las otras materias primas involucradas en la producción de poliestireno. Es razonable anticipar que, dado que el benceno y el etileno son productos del procesamiento del petróleo y el gas natural, sus precios seguirán el precio del petróleo crudo. Además, las instalaciones necesarias para producir dicho poliestireno requieren un alto capital y una amplia infraestructura.

Desarrollo reciente

- En mayo de 2022, Alpek, SAB de CV recibió todas las aprobaciones necesarias de las autoridades regulatorias y concretó la adquisición de OCTAL Holding SAOC. La compañía adquirió el 100% de las acciones de OCTAL por USD 620 millones sin deuda.

Alcance del mercado de envases de poliestireno en Oriente Medio y África

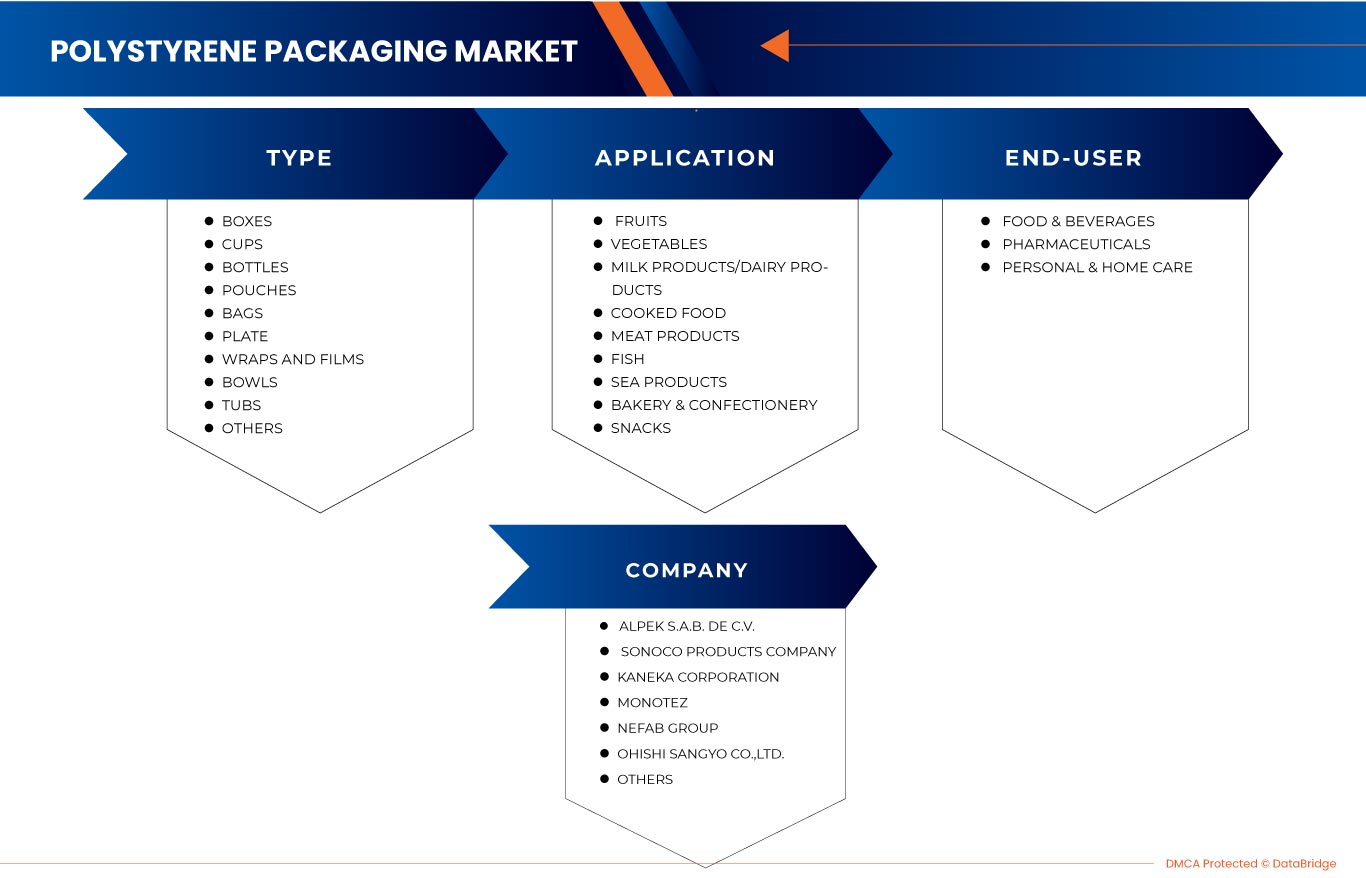

El mercado de envases de poliestireno de Oriente Medio y África se clasifica en función del tipo, la aplicación y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Bochas

- Tinas

- Cajas

- tazas

- Bolsas

- Bolsas

- Botellas

- Envolturas y películas

- Lámina

- Otros

Según el tipo, el mercado de envases de poliestireno de Oriente Medio y África se clasifica en diez segmentos: cuencos, recipientes, cajas, vasos, bolsas, bolsitas, botellas, envoltorios y películas, platos y otros.

Solicitud

- Frutas

- Verdura

- Pez

- Productos del mar

- Productos cárnicos

- Productos lácteos/Productos lácteos

- Panadería y Confitería

- Bocadillos

- Comida cocinada

Según el producto, el mercado de envases de poliestireno de Oriente Medio y África se clasifica en nueve segmentos: frutas, verduras, pescado, productos del mar, productos cárnicos, productos lácteos, panadería y confitería, snacks y alimentos cocinados.

Usuario final

- Alimentos y bebidas

- Productos farmacéuticos

- Cuidado personal y del hogar

Según los usuarios finales, el mercado de envases de poliestireno de Oriente Medio y África se clasifica en tres segmentos: alimentos y bebidas, productos farmacéuticos y cuidado personal y del hogar.

Análisis y perspectivas regionales del mercado de envases de poliestireno en Oriente Medio y África

El mercado de envases de poliestireno de Oriente Medio y África está segmentado según el tipo, la aplicación y los usuarios finales.

Los países del mercado de envases de poliestireno de Oriente Medio y África son Egipto, Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Israel y el resto de Oriente Medio y África.

Sudáfrica domina el mercado de envases de poliestireno en Oriente Medio y África debido a la creciente demanda de envases de poliestireno en la región.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. El análisis de la cadena de valor de los puntos de datos aguas abajo y aguas arriba, las tendencias tecnológicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas de Oriente Medio y África y los desafíos que enfrentan debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles internos y las rutas comerciales al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los envases de poliestireno en Oriente Medio y África

El panorama competitivo del mercado de envases de poliestireno en Oriente Medio y África proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la profundidad de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores solo están relacionados con las empresas que se centran en el mercado de envases de poliestireno en Oriente Medio y África.

Algunos participantes destacados que operan en el mercado de envases de poliestireno en Oriente Medio y África son Alpek SAB de CV, Ohishi Sangyo Co., Ltd., Sonoco Products Company, KANEKA CORPORATION, MONOTEZ, SUNPOR, Versalis SpA (una subsidiaria de Eni SpA), NEFAB GROUP, Heubach Corporation y Synthos, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT'S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 PRICE TREND ANALYSIS

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.7 VENDOR SELECTION CRITERIA

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 RAW MATERIAL ANALYSIS

4.1 REGULATION COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN THE USE OF POLYSTYRENE PACKAGING IN COSMETICS AND OTHER PERSONAL GOODS DUE TO ENHANCED DURABILITY

5.1.2 INCREASE IN THE USE IN PACKAGING OF MEDICAL AND PHARMACEUTICAL INDUSTRY

5.1.3 RISE IN THE NUMBER OF FOOD OUTLETS

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF A WIDE RANGE OF SUBSTITUTES

5.2.2 HEALTH AND ENVIRONMENTAL ISSUES ASSOCIATED WITH POLYSTYRENE

5.2.3 UNABLE TO TOLERATE HIGH MECHANICAL, CHEMICAL, AND THERMAL STRESS

5.3 OPPORTUNITIES

5.3.1 ABILITY TO RECYCLE POLYSTYRENE MATERIALS

5.3.2 INCREASING CONSUMER'S INCLINATION TOWARD CONVENIENT AND AFFORDABLE PACKAGING

5.4 CHALLENGES

5.4.1 STRINGENT REGULATIONS REGARDING THE USE OF POLYSTYRENE

5.4.2 VOLATILITY IN RAW MATERIAL PRICES

6 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET, BY TYPE

6.1 OVERVIEW

6.2 BOXES

6.3 CUPS

6.4 BOTTLES

6.5 POUCHES

6.6 BAGS

6.7 PLATE

6.8 WRAPS AND FILMS

6.9 BOWLS

6.1 TUBS

6.11 OTHERS

7 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 FRUITS

7.3 VEGETABLES

7.4 MILK PRODUCTS/DAIRY PRODUCTS

7.5 COOKED FOOD

7.6 MEAT PRODUCTS

7.7 FISH

7.8 SEA PRODUCTS

7.9 BAKERY & CONFECTIONERY

7.1 SNACKS

8 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET, BY END-USER

8.1 OVERVIEW

8.2 FOOD & BEVERAGES

8.2.1 BOXES

8.2.2 CUPS

8.2.3 BOTTLES

8.2.4 POUCHES

8.2.5 BAGS

8.2.6 PLATE

8.2.7 WRAPS AND FILMS

8.2.8 BOWLS

8.2.9 TUBS

8.2.10 OTHERS

8.2.10.1 FRUITS

8.2.10.2 VEGETABLES

8.2.10.3 MILK PRODUCTS/DAIRY PRODUCTS

8.2.10.4 COOKED FOOD

8.2.10.5 MEAT PRODUCTS

8.2.10.6 FISH

8.2.10.7 SEA PRODUCTS

8.2.10.8 BAKERY & CONFECTIONERY

8.2.10.9 SNACKS

8.3 PHARMACEUTICALS

8.3.1 BOXES

8.3.2 CUPS

8.3.3 BOTTLES

8.3.4 POUCHES

8.3.5 BAGS

8.3.6 PLATE

8.3.7 WRAPS AND FILMS

8.3.8 BOWLS

8.3.9 TUBS

8.3.10 OTHERS

8.4 PERSONAL & HOME CARE

8.4.1 BOXES

8.4.2 CUPS

8.4.3 BOTTLES

8.4.4 POUCHES

8.4.5 BAGS

8.4.6 PLATE

8.4.7 WRAPS AND FILMS

8.4.8 BOWLS

8.4.9 TUBS

8.4.10 OTHERS

9 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET, BY REGION

9.1 MIDDLE EAST AND AFRICA

9.1.1 SOUTH AFRICA

9.1.2 EGYPT

9.1.3 SAUDI ARABIA

9.1.4 UNITED ARAB EMIRATES

9.1.5 ISRAEL

9.1.6 REST OF MIDDLE EAST AND AFRICA

10 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

10.2 EXPANSIONS

10.3 ACQUISITIONS

10.4 AWARDS

10.5 AGREEMENT

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 ALPEK S.A.B. DE C.V.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 SONOCO PRODUCTS COMPANY

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 KANEKA CORPORATION

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 MONOTEZ

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 NEFAB GROUP

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENTS

12.6 HEUBACH CORPORATION

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 OHISHI SANGYO CO, LTD.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 SUNPOR

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 SYNTHOS

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 VERSALIS S.P.A. (A SUBSIDIARY OF ENI S.P.A)

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF PLATES, SHEETS, FILM, FOIL, AND STRIPS OF PLASTICS, REINFORCED, LAMINATED, SUPPORTED, OR SIMILARLY COMBINED WITH OTHER MATERIALS, OR OF CELLULAR PLASTIC, UNWORKED OR MERELY SURFACE-WORKED OR MERELY CUT INTO SQUARES OR RECTANGLES (EXCLUDING SELF-ADHESIVE PRODUCTS, FLOOR, WALL AND CEILING COVERINGS; HS CODE – 3912 (USD THOUSAND)

TABLE 2 EXPORT DATA OF PLATES, SHEETS, FILM, FOIL, AND STRIPS OF PLASTICS, REINFORCED, LAMINATED, SUPPORTED, OR SIMILARLY COMBINED WITH OTHER MATERIALS, OR OF CELLULAR PLASTIC, UNWORKED OR MERELY SURFACE-WORKED OR MERELY CUT INTO SQUARES OR RECTANGLES (EXCLUDING SELF-ADHESIVE PRODUCTS, FLOOR, WALL AND CEILING COVERINGS; HS CODE – 3912 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 6 MIDDLE EAST & AFRICA BOXES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA BOXES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 8 MIDDLE EAST & AFRICA CUPS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA CUPS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 10 MIDDLE EAST & AFRICA BOTTLES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA BOTTLES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 12 MIDDLE EAST & AFRICA POUCHES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA POUCHES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 14 MIDDLE EAST & AFRICA BAGS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA BAGS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 16 MIDDLE EAST & AFRICA PLATE IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA PLATE IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 18 MIDDLE EAST & AFRICA WRAPS AND FILMS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA WRAPS AND FILMS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 20 MIDDLE EAST & AFRICA BOWLS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA BOWLS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 22 MIDDLE EAST & AFRICA TUBS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA TUBS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 24 MIDDLE EAST & AFRICA OTHERS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA OTHERS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 26 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (MILLION UNITS)

TABLE 28 MIDDLE EAST & AFRICA FRUITS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA FRUITS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 30 MIDDLE EAST & AFRICA VEGETABLES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA VEGETABLES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 32 MIDDLE EAST & AFRICA MILK PRODUCTS/DAIRY PRODUCTS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA MILK PRODUCTS/DAIRY PRODUCTS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 34 MIDDLE EAST & AFRICA COOKED FOOD IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA COOKED FOOD IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 36 MIDDLE EAST & AFRICA MEAT PRODUCTS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA MEAT PRODUCTS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 38 MIDDLE EAST & AFRICA FISH IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA FISH IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 40 MIDDLE EAST & AFRICA SEA PRODUCTS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA SEA PRODUCTS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 42 MIDDLE EAST & AFRICA BAKERY & CONFECTIONERY IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA BAKERY & CONFECTIONERY IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 44 MIDDLE EAST & AFRICA SNACKS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA SNACKS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 46 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (MILLION UNITS)

TABLE 48 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 50 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 54 MIDDLE EAST & AFRICA PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA PERSONAL & HOME CAREIN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 57 MIDDLE EAST & AFRICA PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA POLYSTYRENE PACKAGING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 59 MIDDLE EAST AND AFRICA POLYSTYRENE PACKAGING MARKET, BY COUNTRY, 2021-2030 (MILLION UNITS)

TABLE 60 MIDDLE EAST AND AFRICA POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 62 MIDDLE EAST AND AFRICA POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 63 MIDDLE EAST AND AFRICA POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (MILLION UNITS)

TABLE 64 MIDDLE EAST AND AFRICA POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 65 MIDDLE EAST AND AFRICA POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (MILLION UNITS)

TABLE 66 MIDDLE EAST AND AFRICA FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 MIDDLE EAST AND AFRICA FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 68 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 MIDDLE EAST AND AFRICA PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 SOUTH AFRICA POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 SOUTH AFRICA POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 72 SOUTH AFRICA POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 73 SOUTH AFRICA POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (MILLION UNITS)

TABLE 74 SOUTH AFRICA POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 75 SOUTH AFRICA POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (MILLION UNITS)

TABLE 76 SOUTH AFRICA FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 77 SOUTH AFRICA FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 78 SOUTH AFRICA PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 SOUTH AFRICA PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 EGYPT POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 EGYPT POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 82 EGYPT POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 83 EGYPT POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (MILLION UNITS)

TABLE 84 EGYPT POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 85 EGYPT POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (MILLION UNITS)

TABLE 86 EGYPT FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 87 EGYPT FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 88 EGYPT PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 EGYPT PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 SAUDI ARABIA POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 91 SAUDI ARABIA POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 92 SAUDI ARABIA POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 93 SAUDI ARABIA POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (MILLION UNITS)

TABLE 94 SAUDI ARABIA POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 95 SAUDI ARABIA POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (MILLION UNITS)

TABLE 96 SAUDI ARABIA FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 SAUDI ARABIA FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 98 SAUDI ARABIA PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 SAUDI ARABIA PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 UNITED ARAB EMIRATES POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 UNITED ARAB EMIRATES POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 102 UNITED ARAB EMIRATES POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 103 UNITED ARAB EMIRATES POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (MILLION UNITS)

TABLE 104 UNITED ARAB EMIRATES POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 105 UNITED ARAB EMIRATES POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (MILLION UNITS)

TABLE 106 UNITED ARAB EMIRATES FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 UNITED ARAB EMIRATES FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 108 UNITED ARAB EMIRATES PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 UNITED ARAB EMIRATES PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 ISRAEL POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 111 ISRAEL POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 112 ISRAEL POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 113 ISRAEL POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (MILLION UNITS)

TABLE 114 ISRAEL POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 115 ISRAEL POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (MILLION UNITS)

TABLE 116 ISRAEL FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 117 ISRAEL FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 118 ISRAEL PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 119 ISRAEL PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 120 REST OF MIDDLE EAST AND AFRICA POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 121 REST OF MIDDLE EAST AND AFRICA POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

Lista de figuras

FIGURE 1 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET

FIGURE 2 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET: SEGMENTATION

FIGURE 14 RISING USE OF POLYSTYRENE PACKAGING IN COSMETICS AND OTHER PERSONAL GOODS DUE TO ENHANCED DURABILITY IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET IN THE FORECAST PERIOD

FIGURE 15 BOXES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET IN 2022 & 2029

FIGURE 16 PRICE ANALYSIS FOR POLYSTYRENE PACKAGING PRODUCTS (USD/UNIT)

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET

FIGURE 18 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET: BY TYPE, 2022

FIGURE 19 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET: BY APPLICATION, 2022

FIGURE 20 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET: BY END-USER, 2022

FIGURE 21 MIDDLE EAST AND AFRICA POLYSTYRENE PACKAGING MARKET: SNAPSHOT (2022)

FIGURE 22 MIDDLE EAST AND AFRICA POLYSTYRENE PACKAGING MARKET: BY COUNTRY (2022)

FIGURE 23 MIDDLE EAST AND AFRICA POLYSTYRENE PACKAGING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 MIDDLE EAST AND AFRICA POLYSTYRENE PACKAGING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 MIDDLE EAST AND AFRICA POLYSTYRENE PACKAGING MARKET: BY TYPE (2023 - 2030)

FIGURE 26 MIDDLE EAST & AFRICA POLYSTYRENE PACKAGING MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.