Middle East And Africa Plasma Fractionation Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

929.37 Billion

USD

1,362.67 Billion

2025

2033

USD

929.37 Billion

USD

1,362.67 Billion

2025

2033

| 2026 –2033 | |

| USD 929.37 Billion | |

| USD 1,362.67 Billion | |

|

|

|

|

Segmentación del mercado de fraccionamiento de plasma en Oriente Medio y África, por tipo de producto (inmunoglobulinas, concentrados de factores de coagulación, albúmina, inhibidores de proteasa y otros productos), aplicación (neurología, inmunología, hematología, cuidados intensivos, neumología, hematooncología, reumatología y otros), tecnología de procesamiento (cromatografía de intercambio iónico, cromatografía de afinidad, criopreservación, ultrafiltración y microfiltración), modo (fraccionamiento de plasma moderno y fraccionamiento de plasma tradicional), usuario final (hospitales y clínicas, laboratorios de investigación clínica, instituciones académicas y otros), canal de distribución (licitaciones directas, distribución a terceros y otros) - Tendencias de la industria y pronóstico hasta 2033

Tamaño del mercado de fraccionamiento de plasma en Oriente Medio y África

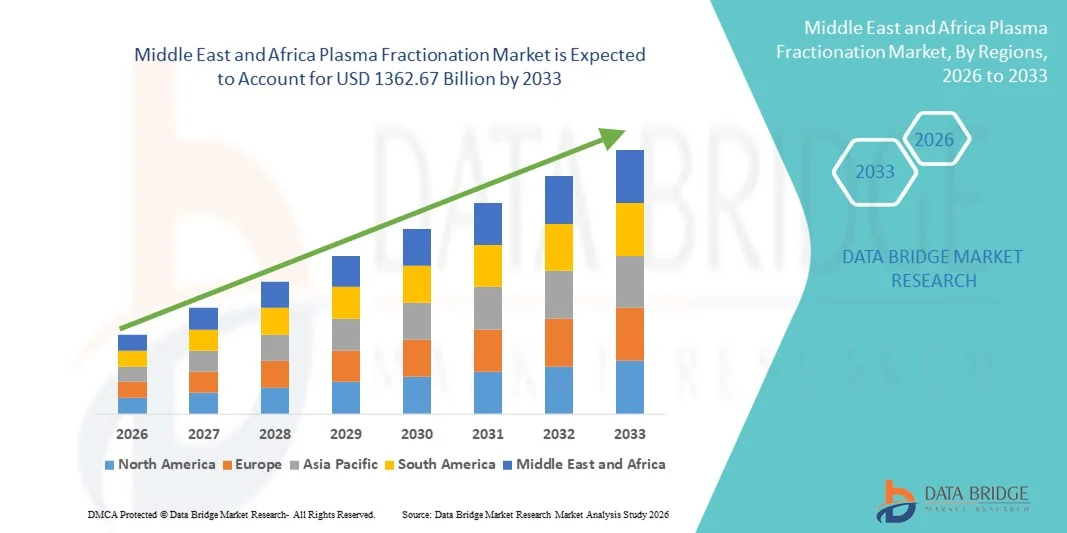

- El tamaño del mercado de fraccionamiento de plasma de Medio Oriente y África se valoró en USD 929,37 mil millones en 2025 y se espera que alcance los USD 1362,67 mil millones para 2033 , con una CAGR del 4,90% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente demanda de terapias derivadas del plasma, los avances en las tecnologías de fraccionamiento del plasma y la expansión de la infraestructura de atención médica en las regiones en desarrollo.

- Además, la creciente prevalencia de enfermedades crónicas y raras, como trastornos de inmunodeficiencia, hemofilia y afecciones neurológicas, está impulsando un mayor consumo de productos derivados del plasma, lo que impulsa significativamente el crecimiento del mercado de fraccionamiento de plasma.

Análisis del mercado de fraccionamiento de plasma en Oriente Medio y África

- El fraccionamiento del plasma es un proceso crítico que se utiliza para separar y purificar proteínas terapéuticas del plasma humano, incluidas inmunoglobulinas, factores de coagulación y albúmina, que son esenciales para el tratamiento de diversas enfermedades crónicas y raras.

- La creciente demanda de terapias derivadas del plasma, junto con los continuos avances tecnológicos en los métodos de fraccionamiento y el aumento de las iniciativas de donación de plasma, está impulsando un crecimiento significativo en el mercado del fraccionamiento de plasma.

- El mercado de fraccionamiento de plasma de Arabia Saudita dominó la región de Oriente Medio con la mayor participación en los ingresos, con un 36,9 % en 2025, gracias a una sólida inversión gubernamental en infraestructura sanitaria y fabricación biofarmacéutica. El país se beneficia de instalaciones consolidadas de recolección y procesamiento de plasma y de un creciente enfoque en iniciativas de autosuficiencia de plasma.

- Se prevé que el mercado de fraccionamiento de plasma de los EAU sea el de mayor crecimiento de la región, registrando una tasa de crecimiento anual compuesta (TCAC) del 21,7 % durante el período de pronóstico. El crecimiento se ve impulsado por el aumento del gasto sanitario y la rápida expansión de la infraestructura sanitaria avanzada. El aumento de las inversiones en redes de recolección de plasma favorece la disponibilidad de materia prima.

- El segmento de fraccionamiento de plasma moderno dominó la mayor participación en ingresos del mercado con un 61,4 % en 2025, impulsado por su eficiencia superior, mayor rendimiento del producto y estándares de seguridad mejorados.

Alcance del informe y segmentación del mercado de fraccionamiento de plasma

|

Atributos |

Perspectivas clave del mercado del fraccionamiento de plasma |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis en profundidad de expertos, epidemiología de pacientes, análisis de la cartera de productos, análisis de precios y marco regulatorio. |

Tendencias del mercado de fraccionamiento de plasma en Oriente Medio y África

Creciente demanda de inmunoglobulinas y terapias derivadas del plasma

- Una tendencia importante y de rápida aceleración en el mercado mundial de fraccionamiento de plasma es la creciente demanda de inmunoglobulinas (IgG) y otras terapias derivadas del plasma, impulsada por la mayor prevalencia de trastornos inmunitarios, enfermedades crónicas y una creciente conciencia de las opciones de tratamiento basadas en plasma en todo el mundo.

- Por ejemplo, en 2023, la escasez mundial de productos de inmunoglobulina y el creciente número de indicaciones clínicas llevaron a los principales fraccionadores de plasma como Grifols, CSL Behring y Takeda a ampliar su capacidad de recolección de plasma y sus instalaciones de fabricación para satisfacer la demanda mundial.

- El fraccionamiento del plasma se utiliza cada vez más para producir terapias vitales, como la inmunoglobulina intravenosa (IVIG), la albúmina, los factores de coagulación y otros derivados del plasma. A medida que los sistemas de salud se expanden y más países adoptan políticas de reembolso para enfermedades raras, se prevé un aumento significativo de la demanda de productos derivados del plasma.

- La creciente demanda también está impulsada por un aumento en las aprobaciones de nuevas indicaciones, un mayor acceso al tratamiento en regiones en desarrollo y una creciente población de pacientes con trastornos autoinmunes, todo lo cual contribuye a la expansión del mercado a largo plazo.

- Esta tendencia está transformando el panorama del fraccionamiento de plasma, obligando a las empresas a realizar grandes inversiones en redes de recolección de plasma, tecnología de fraccionamiento avanzada y cumplimiento normativo para garantizar la continuidad del suministro y la seguridad del producto.

- Como resultado, las principales empresas de plasma están invirtiendo en nuevos centros de plasma y expansiones de fabricación, especialmente en América del Norte y Europa, para respaldar la creciente demanda mundial de terapias derivadas del plasma.

Dinámica del mercado de fraccionamiento de plasma en Oriente Medio y África

Conductor

Creciente necesidad de terapias derivadas del plasma y expansión de indicaciones

- El mercado mundial de fraccionamiento de plasma está siendo impulsado por la creciente demanda de terapias derivadas del plasma, que incluyen IgIV, albúmina y factores de coagulación, utilizados para tratar afecciones como deficiencias inmunitarias, hemofilia y trastornos autoinmunes.

- Por ejemplo, en 2022, importantes empresas como CSL Behring y Grifols anunciaron expansiones en sus operaciones de recolección y fabricación de plasma para satisfacer la creciente demanda de inmunoglobulinas y otras terapias basadas en plasma.

- La creciente prevalencia de enfermedades crónicas e inmunitarias, junto con una mayor concienciación y un mejor diagnóstico, están impulsando la demanda de productos derivados del plasma en todo el mundo.

- Además, la creciente disponibilidad de reembolsos para tratamientos de enfermedades raras en países en desarrollo está impulsando aún más el crecimiento del mercado.

- Con una I+D continua y aprobaciones para nuevas indicaciones, el fraccionamiento de plasma sigue siendo un área crítica de la atención médica, que respalda la creciente necesidad de terapias biológicas a nivel mundial.

Restricción/Desafío

Restricciones en el suministro de plasma y estricto cumplimiento normativo

- El desafío clave para el mercado global de fraccionamiento de plasma es el suministro limitado de plasma, que crea un cuello de botella significativo para la producción de terapias derivadas del plasma, como inmunoglobulinas, albúmina y factores de coagulación.

- Por ejemplo, durante 2021-2022, varias empresas de fraccionamiento de plasma, como Grifols y CSL Behring, informaron de escasez en la recolección de plasma tras las interrupciones causadas por la pandemia de COVID-19. La menor participación de donantes y el cierre temporal de centros de recolección de plasma en Norteamérica y Europa provocaron restricciones de suministro y retrasos en la disponibilidad de inmunoglobulinas en varios países.

- La recolección de plasma depende en gran medida de la participación voluntaria de los donantes, y cualquier interrupción causada por crisis de salud pública, cambios regulatorios o restricciones de elegibilidad de los donantes puede afectar directamente la disponibilidad de plasma y la continuidad de la fabricación.

- Además, los estrictos requisitos regulatorios que rigen la recolección, prueba, almacenamiento y fraccionamiento del plasma varían según la región, lo que aumenta la complejidad operativa y los costos de cumplimiento para los fabricantes.

- El proceso de fraccionamiento de plasma también implica una alta inversión de capital, logística de cadena de frío, pruebas de seguridad avanzadas y ciclos de producción largos, lo que limita la escalabilidad rápida y plantea desafíos para los nuevos participantes del mercado.

- Para superar estas limitaciones se requieren inversiones sostenidas en la expansión de las redes de recolección de plasma, la mejora de los programas de retención de donantes, el aumento de la eficiencia de la fabricación y el mantenimiento de un estricto cumplimiento normativo para garantizar la seguridad del producto y la estabilidad del suministro.

Alcance del mercado de fraccionamiento de plasma en Oriente Medio y África

El mercado está segmentado según el tipo de producto, la aplicación, la tecnología de procesamiento, el modo, el usuario final y el canal de distribución.

- Por tipo de producto

Según el tipo de producto, el mercado de fraccionamiento de plasma se segmenta en inmunoglobulinas, concentrados de factores de coagulación, albúmina, inhibidores de la proteasa y otros productos. El segmento de inmunoglobulinas dominó la mayor cuota de mercado con un 42,6 % en 2025, impulsado por su amplio uso en el tratamiento de trastornos de inmunodeficiencia primaria y secundaria, enfermedades autoinmunes y afecciones neurológicas como la PDIC y el síndrome de Guillain-Barré. La creciente prevalencia mundial de enfermedades inflamatorias crónicas y relacionadas con el sistema inmunitario sigue impulsando la demanda. Las inmunoglobulinas se administran a menudo como terapia a largo plazo o de por vida, lo que garantiza un consumo recurrente. La mayor concienciación y el diagnóstico precoz de los trastornos inmunitarios impulsan aún más el crecimiento del segmento. La favorable cobertura de reembolso en las regiones desarrolladas fortalece la adopción. Los avances tecnológicos que mejoran la pureza y la seguridad del producto también aumentan la preferencia de los médicos. La expansión de las indicaciones y el uso fuera de indicación contribuyen a una mayor utilización. La sólida infraestructura de recolección de plasma en Norteamérica y Europa facilita un suministro constante. El crecimiento de la población geriátrica incrementa aún más la demanda. La alta eficacia clínica y las directrices de tratamiento consolidadas refuerzan el dominio. Los principales fabricantes siguen invirtiendo fuertemente en la expansión de la capacidad de inmunoglobulina. Estos factores, en conjunto, sustentan el liderazgo del segmento.

Se espera que el segmento de concentrados de factores de coagulación experimente la CAGR más rápida del 8,9% entre 2026 y 2033, impulsada por el aumento de la incidencia y la mejora del diagnóstico de la hemofilia A y B a nivel mundial. Las crecientes iniciativas de concienciación y los programas de detección de pacientes están ampliando el grupo de pacientes tratados. Los programas de atención a la hemofilia financiados por el gobierno en las economías emergentes respaldan el acceso. Los avances tecnológicos que mejoran la seguridad viral y los productos híbridos de plasma recombinante aumentan la confianza entre los médicos. La creciente adopción de regímenes de tratamiento profiláctico aumenta el consumo de volumen. La expansión de los centros especializados en el tratamiento de la hemofilia impulsa aún más la demanda. El aumento de las tasas de supervivencia entre los pacientes con hemofilia extiende la duración del tratamiento. Las aprobaciones regulatorias favorables para los nuevos concentrados de factores aceleran la adopción. La sólida actividad de la línea de producción y las inversiones en I+D contribuyen a la innovación. La mejora de la logística de la cadena de frío mejora el alcance de la distribución. El mayor gasto en atención médica en Asia-Pacífico respalda la adopción. Estos factores, en conjunto, impulsan el rápido crecimiento del segmento.

- Por aplicación

Según su aplicación, el mercado del fraccionamiento de plasma se segmenta en neurología, inmunología, hematología, cuidados intensivos, neumología, hematooncología, reumatología y otros. El segmento de inmunología representó la mayor cuota de mercado en ingresos, con un 34,8%, en 2025, impulsado por el uso generalizado de inmunoglobulinas plasmáticas en trastornos autoinmunes e inflamatorios. La creciente prevalencia de afecciones como la inmunodeficiencia primaria, el lupus y la artritis reumatoide impulsa una demanda sostenida. Los requisitos de tratamiento a largo plazo garantizan su uso continuo. La mayor concienciación entre médicos y pacientes mejora las tasas de diagnóstico. La sólida evidencia clínica que respalda la eficacia de las inmunoglobulinas refuerza su adopción. Los marcos de reembolso favorables en los sistemas de salud desarrollados favorecen la accesibilidad. La expansión de las clínicas especializadas en inmunología impulsa el volumen de tratamiento. Los avances tecnológicos que mejoran la seguridad y la tolerabilidad aumentan la confianza de los médicos. El crecimiento de la población de edad avanzada eleva aún más la incidencia de enfermedades. El aumento de los ingresos hospitalarios relacionados con trastornos inmunitarios impulsa la demanda. Las compañías farmacéuticas continúan ampliando sus carteras de plasma centradas en la inmunología. Estos factores fortalecen colectivamente el dominio del segmento.

Se proyecta que el segmento de neurología crezca a la tasa de crecimiento anual compuesta (TCAC) más rápida del 9,4 % entre 2026 y 2033, impulsada por la creciente incidencia de trastornos neurológicos tratados con terapias derivadas del plasma. El aumento en el diagnóstico de PDIC, miastenia gravis y neuropatía motora multifocal respalda el crecimiento. El envejecimiento de la población en los mercados desarrollados y emergentes aumenta la carga de enfermedades neurológicas. La expansión de las aprobaciones clínicas para indicaciones neurológicas impulsa su uso. La mejora en los resultados de los tratamientos fomenta la intervención temprana. La creciente concienciación de los neurólogos y la adopción de directrices respaldan la expansión del mercado. El aumento del gasto sanitario mejora el acceso de los pacientes a terapias avanzadas. El aumento de los departamentos de neurología hospitalarios mejora la capacidad de tratamiento. La investigación clínica en curso fortalece la evidencia terapéutica. La expansión de los centros de infusión especializados respalda la administración. Asia-Pacífico muestra un fuerte crecimiento debido a la mejora del acceso. Estos factores, en conjunto, aceleran el crecimiento del segmento.

- Por tecnología de procesamiento

Según la tecnología de procesamiento, el mercado del fraccionamiento de plasma se segmenta en cromatografía de intercambio iónico, cromatografía de afinidad, criopreservación, ultrafiltración y microfiltración. El segmento de la cromatografía de intercambio iónico dominó el mercado con una participación en los ingresos del 37,9 % en 2025, impulsado por su eficiencia, escalabilidad y rentabilidad en la separación de proteínas plasmáticas a gran escala. Es ampliamente adoptado por las principales instalaciones de fraccionamiento de plasma a nivel mundial. La tecnología ofrece un rendimiento constante y un alto rendimiento, lo que la hace adecuada para la producción comercial. El conocimiento de las normativas respalda su uso continuo. La compatibilidad con múltiples productos derivados del plasma mejora la versatilidad. La menor complejidad operativa en comparación con las técnicas avanzadas refuerza el dominio. Una infraestructura consolidada reduce los costes de cambio. La alta reproducibilidad garantiza la consistencia de los lotes. La sólida experiencia de los fabricantes refuerza aún más su adopción. La optimización continua mejora los resultados de rendimiento. La eficiencia de purificación fiable contribuye a la seguridad del producto. Estas ventajas, en conjunto, sustentan el liderazgo del mercado.

Se espera que el segmento de cromatografía de afinidad experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 10,1 %, entre 2026 y 2033, impulsada por la demanda de productos plasmáticos de alta pureza. Esta tecnología ofrece una especificidad y selectividad superiores en el aislamiento de proteínas. El creciente enfoque en la seguridad de los productos y el cumplimiento normativo respalda su adopción. Los avances en el desarrollo de ligandos mejoran la eficiencia y la rentabilidad. El creciente uso en productos plasmáticos premium y especializados impulsa el crecimiento. El aumento de las inversiones en I+D acelera el perfeccionamiento tecnológico. La adopción por parte de instalaciones de fraccionamiento de última generación impulsa la penetración. La mejora de la escalabilidad aborda limitaciones previas. La fuerte demanda de procesamiento de inmunoglobulinas y factores de coagulación respalda la expansión. Las tasas de recuperación mejoradas mejoran la viabilidad económica. La creciente capacidad de fabricación biofarmacéutica respalda la adopción. Estos factores impulsan un rápido crecimiento.

- Por modo

Según el modelo, el mercado de fraccionamiento de plasma se segmenta en fraccionamiento de plasma moderno y fraccionamiento de plasma tradicional. El segmento de fraccionamiento de plasma moderno dominó la mayor participación en los ingresos del mercado, con un 61,4 % en 2025, gracias a su eficiencia superior, mayor rendimiento del producto y estándares de seguridad mejorados. Las técnicas de fraccionamiento modernas utilizan cromatografía avanzada, automatización y sistemas de procesamiento cerrados, lo que reduce significativamente los riesgos de contaminación. Estos métodos permiten la producción de inmunoglobulinas y factores de coagulación de alta pureza. Los organismos reguladores favorecen cada vez más los procesos modernos debido a su mejor trazabilidad y cumplimiento normativo. Las grandes empresas de fraccionamiento de plasma continúan invirtiendo en la modernización de sus instalaciones para adoptar tecnologías modernas. La mayor escalabilidad respalda la creciente demanda global. Los tiempos de procesamiento más rápidos mejoran la productividad operativa. La reducción del desperdicio de plasma mejora la rentabilidad. La sólida adopción en Norteamérica y Europa refuerza el dominio. La creciente demanda de productos de plasma de primera calidad respalda su uso continuo. La integración con sistemas de monitorización digital mejora el control de procesos. Estos factores, en conjunto, mantienen el liderazgo en el segmento.

Se espera que el segmento tradicional de fraccionamiento de plasma registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 7,2 %, entre 2026 y 2033, impulsada por su continua relevancia en mercados emergentes y sensibles a los costos. Los métodos tradicionales siguen utilizándose ampliamente debido a la menor inversión de capital requerida. Los países en desarrollo recurren a técnicas de fraccionamiento consolidadas para productos básicos derivados del plasma. Los programas de plasma financiados por el gobierno impulsan su adopción continua. Las mejoras incrementales en los procesos mejoran la seguridad y el rendimiento. El aumento en los volúmenes de recolección de plasma incrementa la utilización de la infraestructura existente. El mayor acceso a la atención médica en las economías emergentes impulsa la demanda. Las instalaciones de fabricación del sector público continúan utilizando procesos tradicionales. La creciente demanda de terapias esenciales, como la albúmina, impulsa el crecimiento. Las iniciativas de transferencia de tecnología contribuyen a la optimización de procesos. La expansión de los centros regionales de plasma impulsa su adopción. Estos factores contribuyen al crecimiento constante del segmento.

- Por el usuario final

En función del usuario final, el mercado de fraccionamiento de plasma se segmenta en hospitales y clínicas, laboratorios de investigación clínica, instituciones académicas y otros. Este segmento representó la mayor cuota de mercado en ingresos, con un 48,7%, en 2025, impulsado por la alta afluencia de pacientes y la administración generalizada de terapias derivadas del plasma. Los hospitales sirven como centros de tratamiento primario para inmunodeficiencias, hemofilia y cuidados críticos. La disponibilidad de instalaciones de infusión especializadas impulsa la utilización del producto. El aumento de las tasas de hospitalización relacionadas con enfermedades crónicas y raras impulsa la demanda. Los profesionales sanitarios cualificados permiten una administración eficaz de la terapia. Las políticas de reembolso favorables en los entornos hospitalarios facilitan el acceso. La expansión de los hospitales terciarios y especializados aumenta la capacidad de tratamiento. La creciente adopción de terapias profilácticas impulsa el consumo de volumen. Las sólidas capacidades de diagnóstico facilitan la intervención temprana. Los hospitales desempeñan un papel fundamental en el uso de productos plasmáticos de emergencia. El aumento de las inversiones en infraestructura sanitaria refuerza el dominio. Estos factores, en conjunto, fortalecen el liderazgo del segmento.

Se proyecta que el segmento de laboratorios de investigación clínica crecerá a la tasa de crecimiento anual compuesta (TCAC) más rápida, del 9,6 %, entre 2026 y 2033, impulsada por el aumento de los ensayos clínicos y las actividades de I+D. El creciente desarrollo de nuevas terapias derivadas del plasma impulsa la demanda de reactivos. El creciente enfoque en la investigación de enfermedades raras respalda el uso de laboratorios. La expansión de las líneas de productos biológicos y biosimilares acelera la actividad de ensayos. La financiación pública y privada para la investigación en ciencias de la vida impulsa el crecimiento. Las capacidades analíticas avanzadas aumentan la adopción. La colaboración entre el mundo académico y la industria respalda la expansión. La creciente demanda de estudios de optimización de procesos impulsa el consumo de laboratorios. El aumento de los requisitos regulatorios para la validación clínica respalda el uso. El crecimiento de la investigación traslacional fortalece la demanda. Los mercados emergentes están invirtiendo fuertemente en infraestructura de investigación. Estos factores, en conjunto, impulsan un rápido crecimiento.

- Por canal de distribución

Sobre la base del canal de distribución, el mercado de fraccionamiento de plasma se segmenta en licitaciones directas, distribución de terceros y otros. El segmento de licitaciones directas dominó el mercado con una participación en los ingresos del 55,9% en 2025, impulsado por la adquisición a granel por parte de gobiernos, hospitales y organizaciones de atención médica. Las licitaciones directas garantizan un suministro constante de productos derivados del plasma a precios negociados. Los sistemas de salud pública dependen en gran medida de las compras basadas en licitaciones. Los contratos a largo plazo respaldan flujos de ingresos predecibles para los fabricantes. Los costos intermedios reducidos mejoran la asequibilidad. La fuerte adopción en Europa y las economías emergentes refuerza el dominio. La transparencia y la supervisión regulatoria favorecen los mecanismos de licitación. La compra a gran escala respalda las economías de escala. Los programas nacionales de plasma comúnmente utilizan modelos de adquisición directa. Los sistemas basados en licitaciones mejoran la seguridad del suministro. La creciente demanda de terapias esenciales sostiene el uso. Estos factores mantienen colectivamente el liderazgo del mercado.

Se espera que el segmento de distribución de terceros registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 8,4 %, entre 2026 y 2033, impulsada por la expansión de su alcance a regiones remotas y desatendidas. Los distribuidores brindan apoyo logístico y gestión de la cadena de frío. El creciente número de centros de salud privados depende de los distribuidores para un abastecimiento flexible. El crecimiento de las farmacias especializadas impulsa la expansión de la distribución. Los mercados emergentes se benefician de las redes de distribuidores para mayor accesibilidad. Los fabricantes recurren a los distribuidores para reducir la complejidad operativa. La creciente demanda de terapias ambulatorias y domiciliarias impulsa el crecimiento. La mejora de la infraestructura de la cadena de suministro mejora la eficiencia. Las alianzas estratégicas amplían la cobertura geográfica. Los distribuidores facilitan la entrada más rápida de nuevos productos al mercado. La creciente privatización de la atención médica impulsa la demanda. Estos factores impulsan el crecimiento acelerado del segmento.

Análisis regional del mercado de fraccionamiento de plasma en Oriente Medio y África

- Se proyecta que el mercado de fraccionamiento de plasma de Medio Oriente se expandirá a una CAGR constante y sustancial durante el período de pronóstico, impulsado por la creciente demanda de terapias derivadas del plasma y el creciente enfoque del gobierno en el fortalecimiento de los sistemas de atención médica.

- La región se beneficia de la mejora de la infraestructura de recolección de plasma, la expansión de las capacidades de fraccionamiento y una creciente carga de enfermedades crónicas y raras, como los trastornos de inmunodeficiencia y la hemofilia.

- La creciente demanda de inmunoglobulinas, albúmina y factores de coagulación en hospitales y centros de atención especializada está impulsando la expansión del mercado. Las iniciativas gubernamentales, dirigidas a mejorar la autosuficiencia de plasma y reducir la dependencia de las importaciones, están fortaleciendo las cadenas de suministro regionales.

Análisis del mercado de fraccionamiento de plasma en Arabia Saudita

El mercado de fraccionamiento de plasma de Arabia Saudita dominó la región de Oriente Medio con la mayor participación en los ingresos, un 36,9%, en 2025, gracias a una sólida inversión gubernamental en infraestructura sanitaria y fabricación biofarmacéutica. El país cuenta con instalaciones consolidadas de recolección y procesamiento de plasma y un fuerte enfoque en iniciativas de autosuficiencia plasmática. La creciente adopción de terapias derivadas del plasma en hospitales y clínicas especializadas impulsa la demanda. El elevado gasto sanitario y los programas nacionales de transformación de la atención sanitaria refuerzan aún más el liderazgo del mercado. Las colaboraciones estratégicas con empresas biofarmacéuticas globales mejoran la capacidad de producción nacional. Los marcos regulatorios favorables garantizan los estándares de calidad y seguridad. La creciente prevalencia de trastornos inmunológicos y hematológicos impulsa su utilización. La expansión de tecnologías avanzadas de fraccionamiento favorece la escalabilidad. Estos factores, en conjunto, refuerzan la posición dominante de Arabia Saudita en el mercado de la región.

Perspectivas del mercado de fraccionamiento de plasma en los EAU

Se espera que el mercado de fraccionamiento de plasma en los EAU sea el de mayor crecimiento en Oriente Medio, registrando una tasa de crecimiento anual compuesta (TCAC) proyectada del 21,7 % durante el período de pronóstico. El crecimiento se ve impulsado por el aumento del gasto sanitario y la rápida expansión de la infraestructura sanitaria avanzada. El aumento de las inversiones en redes de recolección de plasma respalda la disponibilidad de materia prima. La creciente demanda de inmunoglobulinas y productos derivados del plasma en hospitales y centros de atención especializada impulsa el crecimiento del mercado. Las sólidas iniciativas gubernamentales para promover la fabricación nacional de productos biológicos aceleran la expansión. La adopción de tecnologías avanzadas de fraccionamiento mejora la eficiencia. El aumento del turismo médico y la presencia de profesionales sanitarios internacionales impulsan su utilización. El creciente conocimiento de las terapias con plasma entre los médicos impulsa aún más su adopción. Estos factores posicionan a los EAU como el mercado de fraccionamiento de plasma de mayor crecimiento en la región.

Cuota de mercado del fraccionamiento de plasma en Oriente Medio y África

La industria del fraccionamiento de plasma está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

• Grifols (España)

• Takeda Pharmaceutical Company (Japón)

• Octapharma (Suiza)

• Kedrion Biopharma (Italia)

• LFB Group (Francia)

• Biotest AG (Alemania)

• China Biologic Products Holdings (China)

• SK Plasma (Corea del Sur)

• ADMA Biologics (EE. UU.)

• GC Pharma (Corea del Sur)

• Sanquin (Países Bajos)

• Bharat Serums and Vaccines (India)

• PlasmaGen BioSciences (India)

• Hualan Biological Engineering (China)

Últimos avances en el mercado de fraccionamiento de plasma en Oriente Medio y África

- En junio de 2023, GC Biopharma recibió la aprobación regulatoria y comenzó la construcción de la primera planta de fraccionamiento de plasma de Indonesia en el polígono industrial Jababeka, lo que marca un paso importante en la expansión de la infraestructura de procesamiento de plasma en el sudeste asiático y la reducción de la dependencia de las importaciones de medicamentos derivados del plasma producidos regionalmente, como inmunoglobulinas y albúmina.

- En septiembre de 2023, Grifols recibió la aprobación de la FDA estadounidense para ampliar la capacidad de purificación y llenado de inmunoglobulinas en sus instalaciones de Clayton, Carolina del Norte, lo que aumentó la producción anual en 16 millones de gramos de su marca líder de inmunoglobulina Gamunex-C, un avance clave que respalda una mayor continuidad del suministro de terapias de IgIV utilizadas en afecciones inmunológicas.

- En abril de 2024, Takeda anunció una inversión de 230 millones de dólares estadounidenses para ampliar su planta de terapias derivadas de plasma en Los Ángeles, con el objetivo de aumentar la capacidad de procesamiento anual en aproximadamente 2 millones de litros de plasma, fortaleciendo la infraestructura para la producción de SCIG/IVIG en el mercado de plasma más grande de un solo país.

- En diciembre de 2023, los medios locales informaron sobre el importante plan de GC Biopharma de abrir una planta de fraccionamiento de plasma de 400.000 litros por año en Indonesia, estableciendo una nueva base de fabricación para productos plasmáticos clave en la región de Asia y el Pacífico y mejorando el acceso a terapias críticas más cerca de las poblaciones de pacientes.

- En marzo de 2025, Grifols completó la adquisición de los 14 centros de recolección de plasma restantes de EE. UU. que anteriormente eran de propiedad conjunta con Immunotek, lo que le otorga el control operativo total de 28 centros a su subsidiaria Biotek America LLC, lo que expandió significativamente la capacidad de recolección de plasma de la compañía en América del Norte.

- En julio de 2025, Grifols anunció una inversión de 160 millones de euros para construir una nueva planta de fraccionamiento de plasma en Lliçà de Vall, Barcelona, destinada a duplicar su capacidad de fraccionamiento europea y fortalecer el suministro de productos derivados del plasma a más de 300.000 pacientes en toda Europa.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.