Middle East And Africa Passive Fire Protection Coating Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

143,277.58 Thousand

USD

184,292.51 Thousand

2023

2031

USD

143,277.58 Thousand

USD

184,292.51 Thousand

2023

2031

| 2024 –2031 | |

| USD 143,277.58 Thousand | |

| USD 184,292.51 Thousand | |

|

|

|

|

Mercado de recubrimientos de protección pasiva contra incendios en Oriente Medio, por tipo de producto (material cementicio y recubrimiento intumescente), tecnología (recubrimiento de protección a base de agua y recubrimiento de protección a base de solvente), uso final (construcción y edificación, petróleo y gas, automotriz, aeroespacial y defensa, electricidad y electrónica, textiles, muebles y otros): tendencias de la industria y pronóstico hasta 2031.

Análisis y perspectivas del mercado de recubrimientos de protección pasiva contra incendios en Oriente Medio

El informe de mercado de recubrimientos pasivos de protección contra incendios de Oriente Medio proporciona detalles de la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un informe de analistas; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

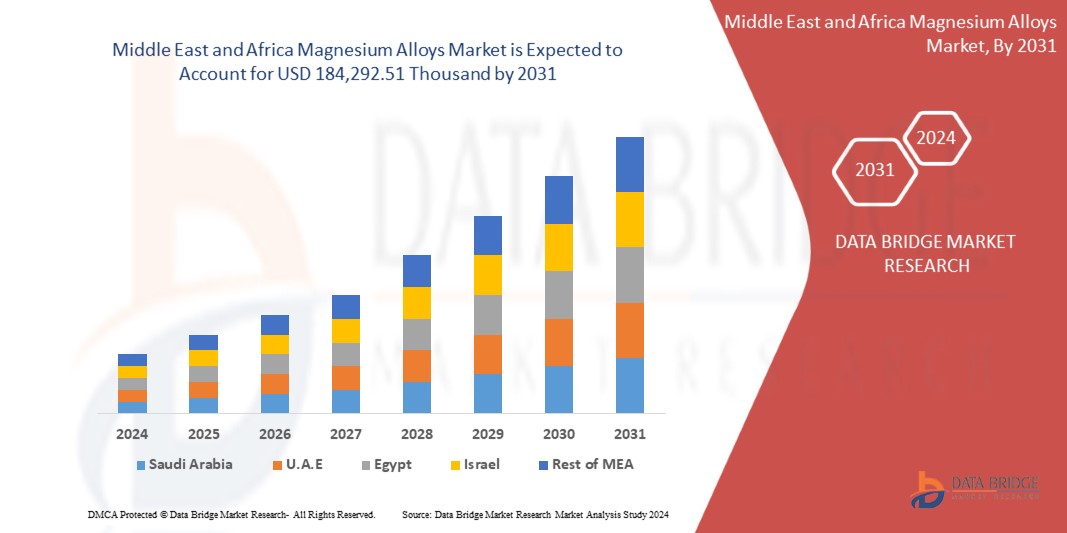

Data Bridge Market Research analiza que se espera que el mercado de recubrimientos de protección pasiva contra incendios en Oriente Medio alcance los USD 184.292,51 mil para 2031 desde USD 143.277,58 mil en 2023, creciendo con una CAGR sustancial del 3,4% en el período de pronóstico de 2024 a 2031.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2024 a 2031 |

|

Año base |

2023 |

|

Años históricos |

2022 (Personalizable para 2016 - 2021) |

|

Unidades cuantitativas |

Ingresos en miles de USD y volumen en toneladas |

|

Segmentos cubiertos |

Tipo de producto (material cementicio y revestimiento intumescente), tecnología (revestimiento protector a base de agua y revestimiento protector a base de solvente), uso final (construcción y edificación, petróleo y gas, automoción, aeroespacial y defensa, electricidad y electrónica, textiles , muebles y otros) |

|

Países cubiertos |

Arabia Saudita, Emiratos Árabes Unidos, Kuwait, Israel, Omán, Bahréin, Líbano, Egipto, Resto de Oriente Medio |

|

Actores del mercado cubiertos |

3M, svt Group of Companies, Hempel A/S, The Sherwin-Williams Company, Hilti, Carboline, Akzo Nobel NV, PPG Industries, Inc., Kansai Paint Co., Ltd., Etex Group, Isolatek International, GCP Applied Technologies Inc. (una subsidiaria de Saint-Gobain), Jotun, Sika AG, Arabian vermiculite industries, CHARCOAT PASSIVE FIRE PROTECTION y Lanexis Enterprises (P) Ltd., entre otras. |

Definición de mercado

Los recubrimientos de protección contra incendios se componen de diversos rellenos y retardantes de llama. Se utilizan para evitar que las llamas del fuego se propaguen rápidamente por la superficie y para limitar la cantidad de tiempo que están expuestas al calor extremo. También reducen la creación de gases que resultan de la combustión de materiales. La protección pasiva contra incendios (PFP) son componentes de un edificio o estructura que ralentizan o impiden el fuego o el humo sin la activación del sistema y, por lo general, sin movimiento. Los ejemplos de sistemas pasivos incluyen pisos, cielorrasos y techos, puertas cortafuegos, ventanas y conjuntos de paredes, recubrimientos resistentes al fuego y otros conjuntos de control de incendios y humo. Los sistemas de protección pasiva contra incendios pueden incluir componentes activos como compuertas cortafuegos.

Dinámica del mercado de recubrimientos de protección pasiva contra incendios en Oriente Medio

Conductores

- El uso creciente de recubrimientos de protección pasiva contra incendios en diversas industrias

Los sistemas de protección pasiva contra incendios se componen de herramientas y otras soluciones de ingeniería que reducen la ocurrencia de incendios o retrasan su propagación en una instalación durante un período determinado. Reducen la magnitud de los daños y el riesgo de muertes, y dan a las personas más tiempo para desalojar el establecimiento y tiempo suficiente para que los servicios de emergencia respondan y actúen. La protección pasiva contra incendios se utiliza comúnmente en edificios de gran altura, casas, hoteles, hospitales, instalaciones industriales, escuelas, almacenes, ferrocarriles, estacionamientos, puentes, supermercados e hidrocarburos en tierra y en alta mar. Los recubrimientos de protección pasiva contra incendios son cada vez más importantes en la industria del petróleo y el gas. Aplicados a las instalaciones industriales de petróleo y gas, los recubrimientos se expanden para formar una capa aislante de carbón vegetal cuando se exponen a altas temperaturas. Esto permite que el acero mantenga su capacidad de carga hasta cuatro horas más durante un incendio, lo que da a las personas un tiempo valioso para escapar del edificio y para que los bomberos apaguen el fuego.

- Demanda creciente de recubrimientos de protección contra incendios a base de agua

Los sectores de la construcción y la infraestructura en Oriente Medio están en auge, lo que genera una demanda sustancial de revestimientos de protección contra incendios. Los revestimientos a base de agua ofrecen soluciones rentables debido a su menor contenido de compuestos orgánicos volátiles (COV) y su facilidad de aplicación, lo que los hace económicamente viables para proyectos de gran escala.

Los recubrimientos a base de agua tienen un atractivo cada vez mayor debido a sus ventajas económicas. Si bien los recubrimientos a base de agua pueden tener un costo inicial mayor que los recubrimientos a base de solventes, brindan beneficios de costo a largo plazo debido a su durabilidad, facilidad de mantenimiento y menores efectos ambientales. En los sectores en desarrollo de la construcción y la infraestructura de Medio Oriente, donde los proyectos a gran escala son típicos, la relación costo-beneficio de los recubrimientos a base de agua atrae a los desarrolladores y gerentes de proyectos.

Oportunidades

- Avance tecnológico en las actividades de exploración de petróleo y gas

Los avances tecnológicos en imágenes sísmicas, estudios geofísicos y técnicas de teledetección han permitido una exploración de petróleo y gas más precisa y eficiente. Esto ha llevado a un aumento de las actividades de exploración en Oriente Medio, lo que ha creado una mayor demanda de recubrimientos de protección pasiva contra incendios para salvaguardar la infraestructura crítica en el sector del petróleo y el gas. La exploración de petróleo y gas a menudo se lleva a cabo en entornos hostiles, incluidas plataformas de perforación en alta mar y ubicaciones remotas en tierra. Los recubrimientos de protección pasiva contra incendios avanzados son esenciales para mitigar el riesgo de incendios en estas condiciones difíciles, lo que garantiza la seguridad e integridad de las estructuras.

La exploración de petróleo y gas suele realizarse en entornos hostiles, incluidas plataformas de perforación en alta mar y lugares remotos en tierra. Los recubrimientos de protección pasiva contra incendios avanzados son esenciales para mitigar el riesgo de incendios en estas condiciones difíciles, garantizando la seguridad e integridad de las estructuras. La incorporación de materiales y tecnologías avanzadas en los recubrimientos de protección pasiva contra incendios mejora su durabilidad y longevidad. A medida que se expanden las actividades de exploración, existe la necesidad de recubrimientos que puedan soportar el duro clima de Medio Oriente y brindar protección a largo plazo contra los riesgos de incendio.

Restricciones/Desafíos

- Instalación incorrecta de revestimiento de protección pasiva contra incendios

Una instalación inadecuada socava la eficacia de los recubrimientos de protección pasiva contra incendios, reduciendo su capacidad para contener y prevenir la propagación de incendios. En industrias de alto riesgo como el petróleo y el gas, la petroquímica y la infraestructura, donde las estrictas normas de seguridad contra incendios son vitales, cualquier error en la instalación puede tener efectos desastrosos, incluyendo la pérdida de vidas, daños a la propiedad y riesgos ambientales. Estos incidentes socavan la confianza en los recubrimientos de protección pasiva contra incendios y desalientan a los clientes potenciales a invertir en estas tecnologías, lo que limita el crecimiento del mercado.

Además, una instalación incorrecta puede dar lugar a un incumplimiento de los requisitos normativos y de las normas de construcción, lo que expone a los promotores, contratistas y propietarios de edificios a responsabilidades legales y sanciones. Los gobiernos de Oriente Medio aplican leyes de seguridad contra incendios estrictas que exigen la instalación adecuada de revestimientos de protección pasiva contra incendios en zonas específicas. El incumplimiento de estas normas pone en peligro no solo la seguridad, sino también las operaciones corporativas y los plazos de los proyectos, lo que disuade a las partes interesadas de invertir en revestimientos de protección pasiva contra incendios.

- Competencia de soluciones alternativas de protección contra incendios

La disponibilidad de alternativas más económicas en el mercado es un reto para el crecimiento del mercado y, en última instancia, reduce el consumo de revestimientos de protección contra incendios. Los revestimientos de protección contra incendios son comparativamente más costosos que otros productos extintores de incendios (revestimientos de protección activa contra incendios), ya que estos revestimientos se aplican o se pulverizan, lo que requiere recursos humanos y tiempo, lo que hace que los revestimientos sean más costosos. Estos sistemas implican el uso de medidas activas, como rociadores, sistemas de nebulización de agua o sistemas de extinción basados en gas, para detectar y extinguir rápidamente los incendios. Están diseñados para combatir y extinguir activamente los incendios en sus primeras etapas. A diferencia de las soluciones pasivas, como los revestimientos, los sistemas de extinción activa proporcionan una intervención inmediata y directa. Los materiales de construcción con propiedades inherentes resistentes al fuego son otra alternativa. Estos materiales, como las placas de yeso resistentes al fuego, la madera tratada con retardantes de fuego o el hormigón con aditivos resistentes al fuego, se integran en la estructura del edificio. Ofrecen un enfoque pasivo al resistir inherentemente la propagación del fuego sin la necesidad de revestimientos adicionales.

Desarrollo reciente

- En febrero de 2024, AkzoNobel concluyó una importante ampliación de capacidad en su planta de recubrimientos en polvo en Como, Italia. Se espera que esta ampliación, que supone una inversión de 21 millones de dólares, mejore la capacidad de la empresa para satisfacer la creciente demanda de sus productos en Europa, Oriente Medio y África (EMEA). La finalización de cuatro nuevas líneas de fabricación, en concreto dos de imprimaciones para automoción y dos de recubrimientos arquitectónicos, marca un hito importante en el proyecto. Además, la incorporación de nuevas líneas de equipos de unión garantiza aún más que los productos fabricados no solo cumplan, sino que superen los estándares de la industria, lo que refuerza el compromiso de AkzoNobel de ofrecer recubrimientos de alta calidad a sus clientes en la región EMEA.

- En diciembre de 2023, Hempel A/S anunció el lanzamiento de HEET Dynamic, un nuevo e innovador software de recubrimientos especialmente diseñado para que los ingenieros estructurales y los evaluadores puedan realizar estimaciones de recubrimientos intumescentes en secciones de acero de forma más rápida, sencilla y precisa. Esto ayudará a los ingenieros a investigar las estructuras de acero y otras superficies en las que se aplican recubrimientos intumescentes resistentes al fuego con mayor precisión, lo que lo convierte en una herramienta muy necesaria. Esto mejorará los ingresos de la empresa a largo plazo.

Alcance del mercado de recubrimientos de protección pasiva contra incendios en Oriente Medio

El mercado de recubrimientos pasivos contra incendios de Oriente Medio se clasifica en función del tipo de producto, la tecnología y el uso final. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de producto

- Recubrimiento intumescente

- Material cementicio

Según el tipo de producto, el mercado está segmentado en revestimiento intumescente y material cementante.

Tecnología

- Recubrimiento protector a base de disolvente

- Recubrimiento protector a base de agua

Sobre la base de la tecnología, el mercado está segmentado en recubrimiento protector a base de solvente y recubrimiento protector a base de agua.

Uso final

- Construcción y edificación

- Petróleo y gas

- Automotor

- Aeroespacial y defensa

- Electricidad y electrónica

- Textil

- Muebles

- Otros

Sobre la base del uso final, el mercado está segmentado en construcción y edificación, petróleo y gas, automotriz, aeroespacial y defensa, electricidad y electrónica, textiles, muebles y otros.

Mercado de recubrimientos de protección pasiva contra incendios en Oriente Medio: análisis y perspectivas regionales

El mercado de recubrimientos de protección pasiva contra incendios de Oriente Medio está segmentado según el tipo de producto, la tecnología y el uso final.

Los países cubiertos en el mercado de recubrimientos de protección pasiva contra incendios de Medio Oriente son Arabia Saudita, Emiratos Árabes Unidos, Kuwait, Israel, Omán, Bahréin, Líbano, Egipto y el resto de Medio Oriente.

Se espera que Arabia Saudita domine el mercado debido a su floreciente sector de la construcción, sus estrictas normas de seguridad contra incendios y sus cuantiosas inversiones en proyectos de infraestructura. Los proyectos de desarrollo a gran escala del país, como complejos comerciales, instalaciones industriales y edificios residenciales, impulsan una importante demanda de soluciones de protección contra incendios.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. El análisis de los puntos de datos de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Oriente Medio y África y los desafíos que enfrentan debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Mercado de recubrimientos de protección pasiva contra incendios en Oriente Medio: panorama competitivo y análisis de participación

El panorama competitivo del mercado de recubrimientos de protección pasiva contra incendios de Oriente Medio proporciona detalles por competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la profundidad de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa en el mercado.

Algunos de los principales actores que operan en el mercado de recubrimientos de protección pasiva contra incendios en Oriente Medio son 3M, svt Group of Companies, Hempel A/S, The Sherwin-Williams Company, Hilti, Carboline, Akzo Nobel NV, PPG Industries, Inc., Kansai Paint Co., Ltd., Etex Group, Isolatek International, GCP Applied Technologies Inc. (una subsidiaria de Saint-Gobain), Jotun, Sika AG, Arabian vermiculite industries, CHARCOAT PASSIVE FIRE PROTECTION y Lanexis Enterprises (P) Ltd., entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 CURRENCY AND PRICING

2.4 GEOGRAPHIC SCOPE

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 DBMR MARKET SWOT MODEL

2.7 TYPE LIFE LINE CURVE

2.8 MULTIVARIATE MODELING

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 MARKET END-USE COVERAGE GRID

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 DBMR VENDOR SHARE ANALYSIS

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 IMPORT EXPORT SCENARIO

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.3.1 ESTIMATED PRODUCTION CONSUMPTION ANALYSIS

4.4 VENDOR SELECTION CRITERIA

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 RAW MATERIAL PROCUREMENT

4.5.2 MANUFACTURING AND PACKING

4.5.3 MARKETING AND DISTRIBUTION

4.5.4 END USERS

4.6 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.7 RAW MATERIAL COVERAGE

4.7.1 RAW MATERIAL PRODUCTION COVERAGE

4.7.2 AMMONIUM POLYPHOSPHATE (APP)

4.7.3 CHLORINATED PARAFFIN 70% (SOLID CP)

4.7.4 EXPANDABLE GRAPHITE

4.7.5 MELAMINE

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING USE OF PASSIVE FIRE PROTECTION COATINGS IN VARIOUS INDUSTRIES

6.1.2 INCREASING DEMAND FOR WATER BASED FIRE PROTECTION COATINGS

6.1.3 GOVERNMENT REGULATIONS FAVORING THE FIRE PROTECTION COATINGS

6.2 RESTRAINTS

6.2.1 IMPROPER INSTALLATION OF PASSIVE FIRE PROTECTION COATING

6.2.2 USE OF HARMFUL CHEMICALS IN MANUFACTURING

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL ADVANCEMENT IN OIL AND GAS EXPLORATION ACTIVITIES

6.3.2 INCREASE IN RESEARCH AND DEVELOPMENT OF NEW PRODUCTS

6.4 CHALLENGES

6.4.1 COMPETITION FROM ALTERNATIVE FIRE PROTECTION SOLUTIONS

6.4.2 FAILURE IN DIAGNOSING FIREPROOFING

7 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 INTUMESCENT COATING

7.3 CEMENTITIOUS MATERIAL

8 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 SOLVENT-BASED PROTECTION COATING

8.3 WATER-BASED PROTECTION COATING

9 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE

9.1 OVERVIEW

9.2 BUILDING AND CONSTRUCTION

9.3 OIL & GAS

9.4 FURNITURE

9.5 AUTOMOTIVE

9.6 AEROSPACE & DEFENSE

9.7 ELECTRICAL AND ELECTRONICS

9.8 TEXTILE

9.9 OTHERS

10 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY COUNTRY

10.1 SAUDI ARABIA

10.2 UNITED ARAB EMIRATES

10.3 KUWAIT

10.4 ISRAEL

10.5 OMAN

10.6 BAHRAIN

10.7 LEBANON

10.8 EGYPT

10.9 REST OF MIDDLE EAST

11 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET-: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: INTERNATIONAL VS MIDDLE EAST REGION

11.2 EXPANSION

11.3 COLLABORATION

11.4 CERTIFICATION

11.5 CERTIFICATION

11.6 ALLIANCE

11.7 PRODUCT LAUNCH

11.8 COMMITMENT

11.9 ACQUISITION

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 GCP APPLIED TECHNOLOGIES INC.

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT DEVELOPMENT

13.2 ETEX GROUP

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 RECENT DEVELOPMENT

13.3 PPG INDUSTRIES, INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 THE SHERWIN-WILLIAMS COMPANY

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 3M

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENT

13.6 AKZO NOBEL N.V.

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENTS

13.7 ARABIAN VERMICULITE INDUSTRIES

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 CARBOLINE

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 CHAROAT PASSIVE FIRE PROTECTION

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 HEMPEL A/S

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 HILTI

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENT

13.12 ISOLATEK INTERNATIONAL

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 JOTUN

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 KANSAI PAINT CO., LTD.

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 LANEXIS ENTERPRISES (P) LTD.

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 SIKA AG

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 SVT GROUP OF COMPANIES

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 3 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 4 MIDDLE EAST INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 5 MIDDLE EAST CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 6 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 7 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 8 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 9 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (TONS)

TABLE 10 MIDDLE EAST BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 11 MIDDLE EAST BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 12 MIDDLE EAST OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 13 MIDDLE EAST OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 14 MIDDLE EAST FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 15 MIDDLE EAST AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 16 MIDDLE EAST AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 17 MIDDLE EAST ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 18 MIDDLE EAST TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 19 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 20 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY COUNTRY, 2022-2031 (TONS)

TABLE 21 SAUDI ARABIA PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 22 SAUDI ARABIA PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 23 SAUDI ARABIA INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 24 SAUDI ARABIA CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 25 SAUDI ARABIA PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 26 SAUDI ARABIA PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 27 SAUDI ARABIA PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 28 SAUDI ARABIA PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (TONS)

TABLE 29 SAUDI ARABIA BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 30 SAUDI ARABIA BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 31 SAUDI ARABIA OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 32 SAUDI ARABIA OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 33 SAUDI ARABIA FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 34 SAUDI ARABIA AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 35 SAUDI ARABIA AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 36 SAUDI ARABIA ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 37 SAUDI ARABIA TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 38 UNITED ARAB EMIRATES PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 39 UNITED ARAB EMIRATES PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 40 UNITED ARAB EMIRATES INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 41 UNITED ARAB EMIRATES CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 42 UNITED ARAB EMIRATES PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 43 UNITED ARAB EMIRATES PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 44 UNITED ARAB EMIRATES PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 45 UNITED ARAB EMIRATES PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (TONS)

TABLE 46 UNITED ARAB EMIRATES BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 47 UNITED ARAB EMIRATES BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 48 UNITED ARAB EMIRATES OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 49 UNITED ARAB EMIRATES OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 50 UNITED ARAB EMIRATES FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 51 UNITED ARAB EMIRATES AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 52 UNITED ARAB EMIRATES AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 53 UNITED ARAB EMIRATES ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 54 UNITED ARAB EMIRATES TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 55 KUWAIT PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 56 KUWAIT PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 57 KUWAIT INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 58 KUWAIT CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 59 KUWAIT PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 60 KUWAIT PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 61 KUWAIT PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 62 KUWAIT PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (TONS)

TABLE 63 KUWAIT BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 64 KUWAIT BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 65 KUWAIT OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 66 KUWAIT OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 67 KUWAIT FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 68 KUWAIT AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 69 KUWAIT AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 70 KUWAIT ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 71 KUWAIT TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 72 ISRAEL PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 73 ISRAEL PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 74 ISRAEL INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 75 ISRAEL CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 76 ISRAEL PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 77 ISRAEL PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 78 ISRAEL PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 79 ISRAEL PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD TONS)

TABLE 80 ISRAEL BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 81 ISRAEL BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 82 ISRAEL OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 83 ISRAEL OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 84 ISRAEL FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 85 ISRAEL AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 86 ISRAEL AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 87 ISRAEL ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 88 ISRAEL TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 89 OMAN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 90 OMAN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 91 OMAN INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 92 OMAN CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 93 OMAN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 94 OMAN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 95 OMAN PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 96 OMAN PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (TONS)

TABLE 97 OMAN BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 98 OMAN BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 99 OMAN OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 100 OMAN OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 101 OMAN FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 102 OMAN AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 103 OMAN AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 104 OMAN ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 105 OMAN TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 106 BAHRAIN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 107 BAHRAIN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 108 BAHRAIN INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 109 BAHRAIN CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 110 BAHRAIN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 111 BAHRAIN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 112 BAHRAIN PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 113 BAHRAIN PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (TONS)

TABLE 114 BAHRAIN BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 115 BAHRAIN BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 116 BAHRAIN OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 117 BAHRAIN OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 118 BAHRAIN FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 119 BAHRAIN AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 120 BAHRAIN AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 121 BAHRAIN ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 122 BAHRAIN TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 123 LEBANON PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 124 LEBANON PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 125 LEBANON INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 126 LEBANON CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 127 LEBANON PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 128 LEBANON PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 129 LEBANON PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 130 LEBANON PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (TONS)

TABLE 131 LEBANON BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 132 LEBANON BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 133 LEBANON OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 134 LEBANON OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 135 LEBANON FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 136 LEBANON AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 137 LEBANON AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 138 LEBANON ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 139 LEBANON TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 140 EGYPT PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 141 EGYPT PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 142 EGYPT INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 143 EGYPT CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 144 EGYPT PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 145 EGYPT PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 146 EGYPT PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 147 EGYPT PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (TONS)

TABLE 148 EGYPT BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 149 EGYPT BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 150 EGYPT OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 151 EGYPT OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 152 EGYPT FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 153 EGYPT AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 154 EGYPT AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 155 EGYPT ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 156 EGYPT TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 157 REST OF MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 158 REST OF MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

Lista de figuras

FIGURE 1 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET : SEGMENTATION

FIGURE 2 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: DATA VALIDATION MODEL

FIGURE 3 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: MARKET END-USE COVERAGE GRID

FIGURE 11 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: DBMR VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: SEGMENTATION

FIGURE 14 INCREASING DEMAND FOR WATER BASED FIRE PROTECTION COATINGS IS DRIVING THE GROWTH OF THE MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET IN THE FORECAST PERIOD 2024 TO 2031

FIGURE 15 INTEUMESCENT COATING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET IN THE FORECAST PERIOD 2024 TO 2031

FIGURE 16 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 17 VENDOR SELECTION CRITERIA

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET

FIGURE 19 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: BY PRODUCT TYPE, 2023

FIGURE 20 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: BY TECHNOLOGY, 2023

FIGURE 21 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: BY END-USE, 2023

FIGURE 22 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: SNAPSHOT (2023)

FIGURE 23 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: COMPANY SHARE 2023 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.