Mercado de sistemas de clasificación de paquetes en Oriente Medio y África, por tipo (sistemas de clasificación de paquetes lineales y sistemas de clasificación de paquetes en bucle), oferta (hardware, software y servicios), tamaño de bandeja (pequeña, mediana y grande), capacidad de manejo de paquetes (menos de 20 000 paquetes/hora, de 20 000 a 30 000 paquetes/hora y más de 30 000 paquetes/hora), usuario final (logística, comercio electrónico, suministro farmacéutico y médico, alimentos y bebidas y otros), país (EAU, Arabia Saudita, Israel, Egipto, Sudáfrica y resto de Oriente Medio y África), tendencias del mercado y pronóstico hasta 2029

Análisis y perspectivas del mercado: mercado de sistemas de clasificación de paquetes en Oriente Medio y África

Análisis y perspectivas del mercado: mercado de sistemas de clasificación de paquetes en Oriente Medio y África

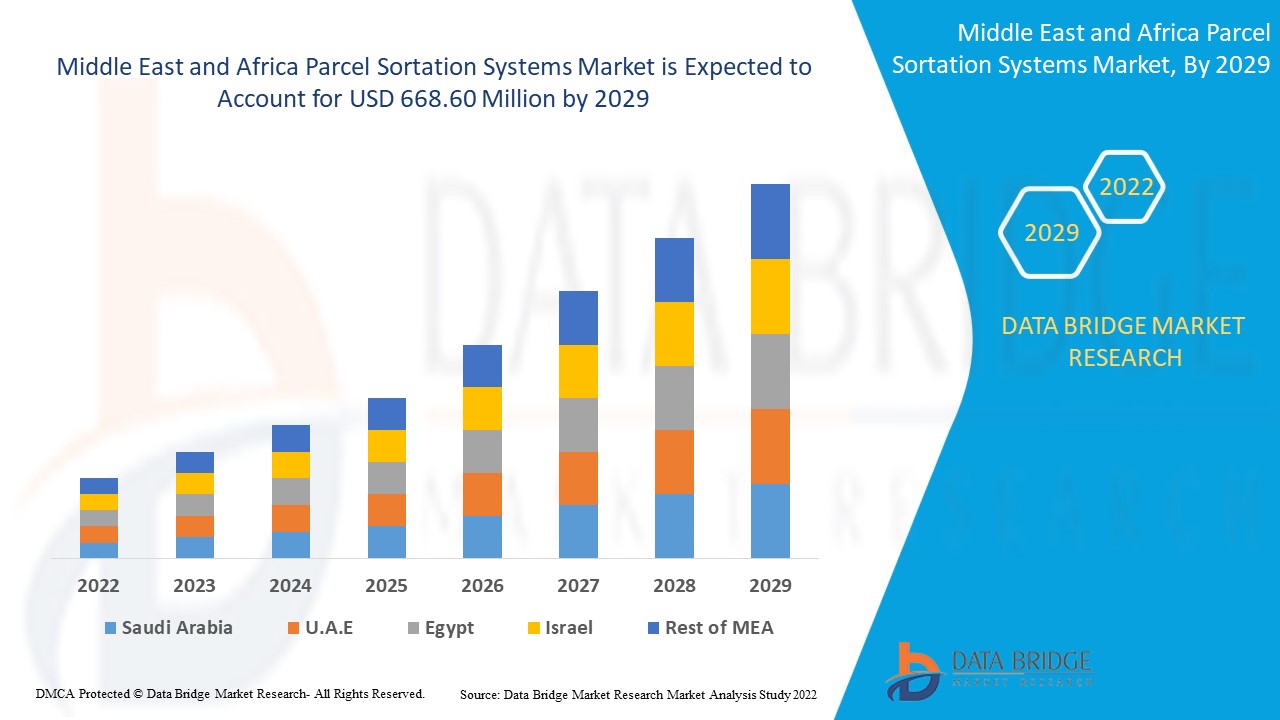

Se espera que el mercado de sistemas de clasificación de paquetes de Oriente Medio y África gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 12,4% en el período de pronóstico de 2022 a 2029 y se espera que alcance los 668,60 millones para 2029.

La clasificación de paquetes es el proceso de identificar artículos en un sistema transportador y desviarlos a destinos específicos utilizando varios dispositivos controlados por software específico de la tarea . También pueden leer las etiquetas aplicables o incluso aplicar otras nuevas. Estas operaciones son increíblemente importantes para garantizar que los paquetes lleguen a su destino final, pero organizar las entregas es la tarea que proporciona el beneficio más directo para ese fin. La clasificación de paquetes coloca los contenedores en las áreas de entrega correctas para que se dirijan a su destino final. La clasificación puede tener un gran impacto en la eficiencia de la automatización de su cumplimiento. Los paquetes vienen en una variedad de formas y tamaños y deben organizarse en consecuencia. Los sistemas transportadores y otros procesos mecánicos pueden ayudar a agilizar la automatización de su cumplimiento y mantener las cosas en movimiento. En un centro de distribución, la clasificación de paquetes se puede aplicar en diferentes pasos del proceso de cumplimiento de pedidos, como recepción, selección, embalaje y envío. La selección de sistemas de clasificación se decide considerando las siguientes características, como la fragilidad del material a manipular, la geometría del producto, los materiales , la consideración de la tasa, la función de clasificación, el espacio disponible, entre otros.

Existe una creciente inversión en infraestructura logística en la planificación urbana, que actúa como un factor importante para el crecimiento del mercado. Los avances en tecnologías como la IA y los robots para las operaciones de clasificación han impulsado el crecimiento del mercado. Sin embargo, la incorporación de tecnologías de automatización reguladas por el gobierno puede actuar como una restricción significativa para el desarrollo del mercado. La región de Medio Oriente y África ha sido testigo de la creciente adopción de sistemas de clasificación automatizados en los aeropuertos para manejar el creciente tráfico, lo que abre oportunidades en el mercado. Las altas expectativas de los clientes con respecto a los plazos de entrega pueden actuar como un desafío importante para el crecimiento del mercado.

Este informe de mercado de sistemas de clasificación de paquetes proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen de analistas ; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de sistemas de clasificación de paquetes en Oriente Medio y África

Alcance y tamaño del mercado de sistemas de clasificación de paquetes en Oriente Medio y África

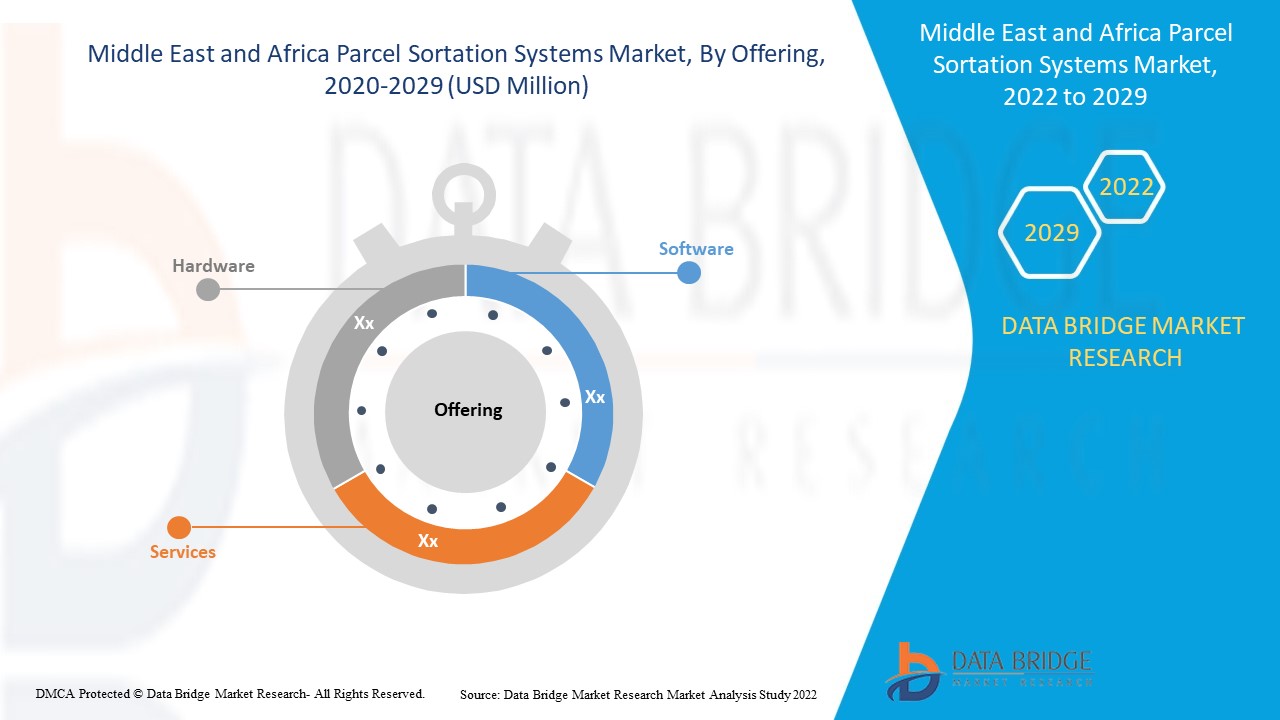

El mercado de sistemas de clasificación de paquetes de Medio Oriente y África está segmentado en cinco segmentos notables según el tipo, la oferta, el tamaño de la bandeja, la capacidad de manejo de paquetes y el usuario final.

- Según el tipo, el mercado de sistemas de clasificación de paquetes de Asia-Pacífico se segmenta en sistemas de clasificación de paquetes lineales y sistemas de clasificación de paquetes en bucle. En 2022, se espera que el segmento de sistemas de clasificación de paquetes lineales domine el mercado, ya que ofrece varios beneficios, incluido un mayor rendimiento, y requiere menos espacio en comparación. Los centros logísticos pequeños y medianos están adoptando cada vez más este sistema en la región para manejar los mayores volúmenes de paquetes.

- En función de la oferta, el mercado global de sistemas de clasificación de paquetes se segmenta en hardware, software y servicios. En 2022, se espera que el segmento de hardware domine el mercado, ya que los sistemas de clasificación basados en hardware aumentan la eficiencia de la clasificación. Además, la implementación de hardware puede acelerar las aplicaciones de clasificación y hace un uso extensivo de comparaciones de datos simultáneos e intercambios en cada ciclo de reloj.

- En función del tamaño de las bandejas, el mercado mundial de sistemas de clasificación de paquetes se segmenta en pequeño, mediano y grande. En 2022, se espera que el segmento mediano domine el mercado, ya que la cantidad de paquetes de tamaño mediano está aumentando en los centros logísticos debido al aumento del comercio electrónico, que requiere bandejas de tamaño mediano e impulsa la adopción de bandejas de tamaño mediano en el mercado de sistemas de clasificación de paquetes.

- Sobre la base de la capacidad de manejo de paquetes, el mercado global de sistemas de clasificación de paquetes está segmentado en menos de 20 000 paquetes/hora, de 20 000 a 30 000 paquetes/hora y más de 30 000 paquetes/hora. En 2022, se espera que menos de 20 000 paquetes/hora dominen el mercado a medida que aumenta la adopción de sistemas de clasificación entre las pequeñas y medianas empresas, que tienen un menor volumen de paquetes para manejar y tienen un poder adquisitivo limitado.

- En función de los usuarios finales, el mercado global de sistemas de clasificación de paquetes se segmenta en logística, comercio electrónico, productos farmacéuticos, suministros médicos, alimentos y bebidas, entre otros. En 2022, se espera que el comercio electrónico domine el mercado, ya que la industria del comercio electrónico está creciendo exponencialmente en los últimos años, lo que también aumenta la cantidad de paquetes que se deben clasificar y entregar a los clientes en todo el mundo.

Análisis a nivel de país del mercado de sistemas de clasificación de paquetes en Oriente Medio y África

Se analiza el mercado de sistemas de clasificación de paquetes de Oriente Medio y África, y se proporciona información sobre el tamaño del mercado por país, tipo, oferta, tamaño de la bandeja, capacidad de manejo de paquetes y usuario final.

Los países cubiertos en el informe de mercado de sistemas de clasificación de paquetes de Medio Oriente y África son los Emiratos Árabes Unidos, Arabia Saudita, Israel, Egipto, Sudáfrica y el resto de Medio Oriente y África.

Israel está dominando el mercado en la región de Medio Oriente y África debido a la creciente adopción de la automatización en el sector logístico y las incorporaciones tecnológicas como IoT para el monitoreo de procesos y la recopilación de datos para obtener información comercial sobre los sistemas de clasificación para la eficiencia de la cadena de suministro.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia significativa o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Demanda creciente de sistemas de clasificación de paquetes

El mercado de sistemas de clasificación de paquetes de Oriente Medio y África también le proporciona un análisis detallado del mercado para cada país, el crecimiento de la industria con ventas, ventas de componentes, el impacto del desarrollo tecnológico en los sistemas de clasificación de paquetes y los cambios en los escenarios regulatorios con su apoyo al mercado de sistemas de clasificación de paquetes. Los datos están disponibles para el período histórico de 2012 a 2020.

Análisis del panorama competitivo y de la cuota de mercado de los sistemas de clasificación de paquetes en Oriente Medio y África

El panorama competitivo del mercado de sistemas de clasificación de paquetes de Oriente Medio y África proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión del producto, el dominio de la aplicación, la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas relacionado con el mercado de sistemas de clasificación de paquetes de Oriente Medio y África.

Los principales actores incluidos en el informe son Siemens Logistics GmbH (una subsidiaria de Siemens AG), BEUMER GROUP, FIVES, Dematic, Murata Machinery, Ltd., Interroll Group, BOWE SYSTEC GMBH y Honeywell International Inc., entre otros actores nacionales. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Las empresas de todo el mundo también están iniciando muchos desarrollos de productos, lo que también está acelerando el crecimiento del mercado de sistemas de clasificación de paquetes en Oriente Medio y África.

Por ejemplo,

- En septiembre de 2019, BOWE SYSTEC GMBH anunció el lanzamiento del clasificador Double Split-Tray en la feria Parcel+Post Expo de Ámsterdam. El nuevo sistema fue diseñado para clasificar artículos ligeros de hasta 5 kilogramos. Era capaz de clasificar productos como ropa, libros, productos farmacéuticos, bolsas de plástico, multimedia, artículos planos o joyas. Con esto, la empresa pudo ofrecer clasificadores capaces de manejar paquetes de diferentes formas y tamaños, lo que mejoró la cartera de productos de la empresa en el mercado de sistemas de clasificación de paquetes.

- En junio de 2021, Interroll Group anunció el lanzamiento del clasificador de banda transversal vertical MX 018V. El nuevo producto es económico, eficiente energéticamente, fácil de mantener y facilitó a los integradores de sistemas y a sus clientes finales la entrada en el mundo de las soluciones de clasificación de banda transversal automatizadas. Permitió a los proveedores de servicios de mensajería y paquetería, proveedores de comercio electrónico y proveedores de servicios logísticos obtener la capacidad de manipular una gran variedad de mercancías de manera que ahorre espacio, sea cuidadosa y eficiente energéticamente a través de una única infraestructura técnica con un mayor número de puntos finales. Esto mejoró la cartera de productos de la empresa.

Las asociaciones, las empresas conjuntas y otras estrategias mejoran la participación de mercado de la empresa con una mayor cobertura y presencia. También brindan a las organizaciones la ventaja de mejorar su oferta de sistemas de clasificación de paquetes mediante una gama más amplia de tamaños.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 END USER COVERAGE GRID

2.9 MULTIVARIATE MODELING

2.1 TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TRENDS

4.1.1 INTERNET BUYING CONTINUES TO GROW EXPONENTIALLY

4.1.2 SAME DAY DELIVERY TREND

4.1.3 FREE SHIPPING IS A COMMON INCENTIVE TO SELL PRODUCT

4.1.4 LARGE ITEMS BROUGHT ONLINE

4.1.5 INCREASE IN DEMAND FOR HOME DELIVERY ITEMS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 CONTINUOUS DEVELOPMENT IN THE MIDDLE EAST & AFRICA E-COMMERCE INDUSTRY

5.1.2 MINIMIZING MANUAL INTERVENTION AND REDUCING LABOR COSTS

5.1.3 DEVELOPMENTS IN TECHNOLOGIES SUCH AS AI AND ROBOTS FOR SORTING OPERATIONS

5.1.4 INCREASING NEED TO REDUCE THE LAST MILE DELIVERY COSTS

5.1.5 LOGISTICS INFRASTRUCTURE DEVELOPMENTS WITH URBAN PLANNING

5.2 RESTRAINTS

5.2.1 HIGH INITIAL INVESTMENTS

5.2.2 GOVERNMENT REGULATIONS IMPOSED ON AUTOMATION TECHNOLOGIES

5.3 OPPORTUNITIES

5.3.1 WIDESPREAD ADOPTION OF IOT TECHNOLOGY

5.3.2 INTEGRATION OF AUTOMATIC PARCEL SINGULATOR IN SORTATION SYSTEM

5.3.3 INCREASING ADOPTION OF AUTOMATED SORTATION SYSTEMS AT AIRPORTS TO HANDLE THE INCREASING TRAFFIC

5.3.4 HIGH INVESTMENTS IN SUPPLY CHAIN AUTOMATION

5.4 CHALLENGES

5.4.1 HIGH VARIETY IN PARCEL SIZES AND VOLUME

5.4.2 SHORTAGE OF SKILLED PROFESSIONAL AND TECHNICAL EXPERTISE

5.4.3 HIGH CUSTOMER EXPECTATIONS ABOUT DELIVERY TIMELINES

5.4.4 COMPLEXITIES IN AUTOMATION INTEGRITY

5.4.5 PROPER UTILIZATION OF SPACE

6 IMPACT ON COVID-19 ON THE MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 IMPACT ON PRICE

6.7 CONCLUSION

7 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY TYPE

7.1 OVERVIEW

7.2 LINEAR PARCEL SORTATION SYSTEMS

7.2.1 SHOE SORTER

7.2.2 PUSHER SORTERS

7.2.3 POP-UP/NARROW BELT SORTERS

7.2.4 ARB SORTERS

7.2.5 PADDLE SORTERS

7.2.6 LINEAR/VERTICAL BELT SORTERS

7.2.7 SMALL PARCEL SORTERS

7.3 LOOP PARCEL SORTATION SYSTEMS

7.3.1 CROSS-BELT SORTERS (HORIZONTAL)

7.3.2 TILT TRAY SORTERS

7.3.3 FLAT SORTERS/BOMB BAY SORTERS

8 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY OFFERING

8.1 OVERVIEW

8.2 HARDWARE

8.2.1 ELECTRICAL AND MECHANICAL COMPONENTS

8.2.2 SENSOR

8.2.2.1 PROXIMITY SENSOR

8.2.2.2 OPTICAL SENSOR

8.2.2.3 DISPLACEMENT SENSOR

8.2.2.4 PRESSURE SENSOR

8.2.2.5 ANALOG FLOW SENSOR

8.2.3 DIVERTERS

8.2.4 CAMERAS

8.2.5 PROCESSORS

8.2.6 DISPLAYS

8.3 SOFTWARE

8.4 SERVICES

9 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY TRAY SIZE

9.1 OVERVIEW

9.2 MEDIUM

9.3 SMALL

9.4 LARGE

10 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY PARCEL HANDLING CAPACITY

10.1 OVERVIEW

10.2 LESS THAN 20000/HR

10.3 20000 TO 30000 PARCELS/HR

10.4 MORE THAN 30000 PARCEL/HR

11 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY END USER

11.1 OVERVIEW

11.2 E COMMERCE

11.2.1 AIRPORTS

11.2.2 INTERNATIONAL AIRPORTS

11.3 LOGISTICS

11.3.1 STORAGE AND WAREHOUSING

11.3.2 COURIER

11.3.3 POSTAL SERVICES

11.3.4 FREIGHT FORWARDING

11.4 PHARMACEUTICALS AND MEDICAL SUPPLY

11.4.1 DISTRIBUTORS

11.4.2 DRUG MANUFACTURERS

11.4.3 ACTIVE PHARMACEUTICAL INGREDIENT SUPPLIERS

11.5 FOOD & BEVERAGES

11.5.1 PROCESSED FOOD

11.5.2 PROCESSED CULINARY INGREDIENTS

11.5.3 UNPROCESSED OR MINIMALLY PROCESSED FOOD

11.6 OTHERS

12 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY REGION

12.1 MIDDLE EAST & AFRICA

12.1.1 ISRAEL

12.1.2 U.A.E

12.1.3 SAUDI ARABIA

12.1.4 EGYPT

12.1.5 SOUTH AFRICA

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 DAIFUKU CO., LTD.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 DEMATIC

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 VANDERLANDE INDUSTRIES B.V.

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 PITNEY BOWES INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 SIEMENS LOGISTICS GMBH (A SUBSIDIARY OF SIEMENS AG)

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 BASTIAN SOLUTIONS, LLC

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 BEUMER GROUP

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 BOWE SYSTEC GMBH

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 EQUINOX

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 FIVES

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 GBI INTRALOGISTICS, INC

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 HONEYWELL INTERNATIONAL INC

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 INTERROLL GROUP

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 INTRALOX

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 INVATA INTRALOGISTICS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 MHS MIDDLE EAST & AFRICA

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 MURATA MACHINERY, LTD.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 OKURA YUSOKI CO., LTD.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 SOLYSTIC SAS

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 VIASTORE

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA LINEAR PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA LINEAR PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA LOOP PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA LOOP PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA HARDWARE IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA HARDWARE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA SENSOR IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA SOFTWARE IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA SERVICES IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY TRAY SIZE, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA MEDIUM IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA SMALL IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA LARGE IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY PARCEL HANDLING CAPACITY, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA LESS THAN 20000 PARCELS/HR IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA 20000 TO 30000 PARCELS/HR IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA MORE THAN 30000 PARCEL/HR IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA E-COMMERCE IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA E-COMMERCE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA LOGISTICS IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA LOGISTICS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA PHARMACEUTICALS AND MEDICAL SUPPLY IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA PHARMACEUTICALS AND MEDICAL SUPPLY IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA OTHERS IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA LINEAR PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA LOOP PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA HARDWARE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA SENSORS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY TRAY SIZE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY PARCEL HANDLING CAPACITY, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA E-COMMERCE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA LOGISTICS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA PHARMACEUTICALS AND MEDICAL SUPPLY IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 ISRAEL PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 ISRAEL LINEAR PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 ISRAEL LOOP PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 ISRAEL PARCEL SORTATION SYSTEMS MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 48 ISRAEL HARDWARE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 ISRAEL SENSORS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 ISRAEL PARCEL SORTATION SYSTEMS MARKET, BY TRAY SIZE, 2020-2029 (USD MILLION)

TABLE 51 ISRAEL PARCEL SORTATION SYSTEMS MARKET, BY PARCEL HANDLING CAPACITY, 2020-2029 (USD MILLION)

TABLE 52 ISRAEL PARCEL SORTATION SYSTEMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 53 ISRAEL E-COMMERCE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 ISRAEL LOGISTICS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 ISRAEL PHARMACEUTICALS AND MEDICAL SUPPLY IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 ISRAEL FOOD & BEVERAGES IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.A.E PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.A.E LINEAR PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.A.E LOOP PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.A.E PARCEL SORTATION SYSTEMS MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 61 U.A.E HARDWARE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.A.E SENSORS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.A.E PARCEL SORTATION SYSTEMS MARKET, BY TRAY SIZE, 2020-2029 (USD MILLION)

TABLE 64 U.A.E PARCEL SORTATION SYSTEMS MARKET, BY PARCEL HANDLING CAPACITY, 2020-2029 (USD MILLION)

TABLE 65 U.A.E PARCEL SORTATION SYSTEMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 U.A.E E-COMMERCE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.A.E LOGISTICS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.A.E PHARMACEUTICALS AND MEDICAL SUPPLY IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.A.E FOOD & BEVERAGES IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 SAUDI ARABIA PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SAUDI ARABIA LINEAR PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 SAUDI ARABIA LOOP PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 SAUDI ARABIA PARCEL SORTATION SYSTEMS MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 74 SAUDI ARABIA HARDWARE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 SAUDI ARABIA SENSORS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 SAUDI ARABIA PARCEL SORTATION SYSTEMS MARKET, BY TRAY SIZE, 2020-2029 (USD MILLION)

TABLE 77 SAUDI ARABIA PARCEL SORTATION SYSTEMS MARKET, BY PARCEL HANDLING CAPACITY, 2020-2029 (USD MILLION)

TABLE 78 SAUDI ARABIA PARCEL SORTATION SYSTEMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 79 SAUDI ARABIA E-COMMERCE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 SAUDI ARABIA LOGISTICS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 SAUDI ARABIA PHARMACEUTICALS AND MEDICAL SUPPLY IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 SAUDI ARABIA FOOD & BEVERAGES IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 EGYPT PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 EGYPT LINEAR PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 EGYPT LOOP PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 EGYPT PARCEL SORTATION SYSTEMS MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 87 EGYPT HARDWARE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 EGYPT SENSORS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 EGYPT PARCEL SORTATION SYSTEMS MARKET, BY TRAY SIZE, 2020-2029 (USD MILLION)

TABLE 90 EGYPT PARCEL SORTATION SYSTEMS MARKET, BY PARCEL HANDLING CAPACITY, 2020-2029 (USD MILLION)

TABLE 91 EGYPT PARCEL SORTATION SYSTEMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 EGYPT E-COMMERCE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 EGYPT LOGISTICS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 EGYPT PHARMACEUTICALS AND MEDICAL SUPPLY IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 EGYPT FOOD & BEVERAGES IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 SOUTH AFRICA PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 SOUTH AFRICA LINEAR PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 SOUTH AFRICA LOOP PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 SOUTH AFRICA PARCEL SORTATION SYSTEMS MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 100 SOUTH AFRICA HARDWARE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 SOUTH AFRICA SENSORS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 SOUTH AFRICA PARCEL SORTATION SYSTEMS MARKET, BY TRAY SIZE, 2020-2029 (USD MILLION)

TABLE 103 SOUTH AFRICA PARCEL SORTATION SYSTEMS MARKET, BY PARCEL HANDLING CAPACITY, 2020-2029 (USD MILLION)

TABLE 104 SOUTH AFRICA PARCEL SORTATION SYSTEMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 105 SOUTH AFRICA E-COMMERCE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 SOUTH AFRICA LOGISTICS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 SOUTH AFRICA PHARMACEUTICALS AND MEDICAL SUPPLY IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 SOUTH AFRICA FOOD & BEVERAGES IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 REST OF MIDDLE EAST AND AFRICA PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: SEGMENTATION

FIGURE 11 CONTINUOUS DEVELOPMENT IN MIDDLE EAST & AFRICA E-COMMERCE INDUSTRY IS THE MAJOR FACTOR BOOSTING THE GROWTH OF MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 LINEAR PARCEL SORTATION SYSTEMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGER SHARE OF THE MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 WORLDWIDE RETAIL E-COMMERCE SALES, FROM 2014 TO 2023

FIGURE 15 SHARE OF CONSUMERS CHOOSING DIFFERENT DELIVERY OPTIONS, PERCENT OF X2C VOLUME

FIGURE 16 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGE OF MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET

FIGURE 17 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2021

FIGURE 18 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY OFFERING, 2021

FIGURE 19 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY TRAY SIZE, 2021

FIGURE 20 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY PARCEL HANDLING CAPACITY, 2021

FIGURE 21 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY END USER, 2021

FIGURE 22 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: SNAPSHOT (2021)

FIGURE 23 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: BY COUNTRY (2021)

FIGURE 24 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: BY TYPE (2022-2029)

FIGURE 27 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.