Mercado de células solares orgánicas (OPV) de Oriente Medio y África, por tipo (heterounión de membrana bicapa, tipo Schottky y otros), material (polímero y moléculas pequeñas), aplicación (BIPV y arquitectura, electrónica de consumo, dispositivos portátiles , automoción, militar y dispositivos, y otros), tamaño físico (más de 140 x 100 mm cuadrados y menos de 140 x 100 mm cuadrados), usuario final (comercial, industrial, residencial y otros), tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de células solares orgánicas (OPV) en Oriente Medio y África

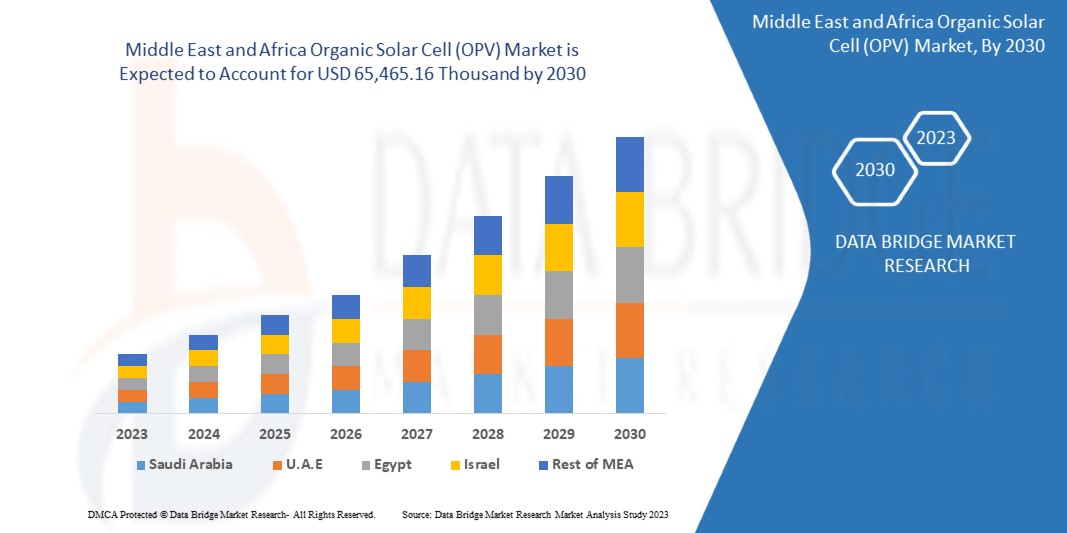

Se espera que el mercado de células solares orgánicas (OPV) de Oriente Medio y África crezca significativamente en el período de pronóstico de 2023 a 2030. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 10,1% en el período de pronóstico de 2023 a 2030 y se espera que alcance los USD 65.465,16 mil para 2030. El principal factor que impulsa el crecimiento del mercado de células solares orgánicas (OPV) es la creciente popularidad de los productos de células solares orgánicas (OPV) entre las células solares orgánicas y la creciente conciencia sobre las propiedades de los productos de células solares orgánicas (OPV).

Las células solares orgánicas (OSC), que se clasifican como células solares de tercera generación que utilizan material polimérico orgánico como capa absorbente de luz, son una de las tecnologías fotovoltaicas (PV) más nuevas. Las células solares fotovoltaicas orgánicas (OPV) buscan ofrecer una solución fotovoltaica (PV) de baja producción de energía y abundante en la Tierra.

El informe de mercado de células solares orgánicas (OPV) de Oriente Medio y África proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un informe de analista. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2020 - 2015) |

|

Unidades cuantitativas |

Ingresos en miles de USD |

|

Segmentos cubiertos |

Por tipo (membrana de heterojunción bicapa, tipo Schottky y otros), material (polímero y moléculas pequeñas), aplicación (BIPV y arquitectura, electrónica de consumo, dispositivos portátiles, automoción, militar y dispositivos, y otros), tamaño físico (más de 140 x 100 mm cuadrados y menos de 140 x 100 mm cuadrados), usuario final (comercial, industrial, residencial y otros) |

|

Países cubiertos |

Sudáfrica, Egipto, Arabia Saudita, Emiratos Árabes Unidos, Israel y el resto de Medio Oriente y África. |

|

Actores del mercado cubiertos |

Eni SpA, TOSHIBA CORPORATION, ARMOR, Tokyo Chemicals Industry Co. Ltd, Merck KGaA, Alfa Aesar, Thermo Fisher Scientific, Heliatek, Solarmer Energy Inc., SUNEW, Epishine, Lumtec, Borun New Material Technology Co., Ltd, Novaled GmbH, Ningbo Polycrown Solar Tech Co, Ltd, SHIFENG TECHNOLOGY CO., LTD., Solaris Chem Inc, MORESCO Corporation, NanoFlex Power Corporation y Flask, entre otras. |

Definición de mercado

Las células solares orgánicas o fotovoltaicas orgánicas son dispositivos fotovoltaicos multicapa fabricados con compuestos orgánicos que convierten la energía solar en electricidad. Una célula solar orgánica se fabrica utilizando material a base de carbono y electrónica orgánica en lugar de silicio como semiconductor. Las células orgánicas también pueden denominarse células solares de plástico o células solares de polímero; en comparación con las células solares de silicio cristalino, las células solares orgánicas están hechas de compuestos que se pueden disolver en tinta e imprimir sobre plásticos. Esto le da a las células solares orgánicas el atributo de flexibilidad, ligereza y fácil incorporación en lugares o estructuras, entre otros.

La tecnología de células solares orgánicas todavía está en desarrollo. La eficiencia de conversión de energía de las células solares orgánicas no es comparable con la eficiencia lograda por las células solares de silicio inorgánico. Pero las OPV presentan una amplia gama de aplicaciones potenciales y puede que no pase mucho tiempo antes de que se conviertan en la tecnología de uso común. Las OPV son fáciles de fabricar en comparación con las células solares inorgánicas y baratas de producir, y físicamente versátiles. El principio de funcionamiento de las células solares orgánicas es igual al de las células solares de silicio monocristalino y policristalino. Generan electricidad a través del efecto fotovoltaico en tres simples pasos, como:

- Los electrones se desprenden del material polimérico semiconductor cuando se absorbe la luz.

- El flujo de electrones sueltos constituye una corriente eléctrica.

- La corriente se captura y se transfiere a los cables.

La versatilidad de las OPV se puede atribuir a la diversidad de materiales orgánicos diseñados y sintetizados para el absorbedor, el aceptor y las interfaces. Las células solares orgánicas encuentran aplicaciones en la industria automotriz, paneles para techos, sistemas fotovoltaicos integrados en edificios (BIPV), electrónica de consumo y otros.

Dinámica del mercado de células solares orgánicas (OPV) en Oriente Medio y África

En esta sección se aborda la comprensión de los factores impulsores, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Aumentar la concienciación sobre el uso de energía renovable para la generación de energía

El continuo crecimiento de la población y el creciente florecimiento del sector industrial, junto con el crecimiento del desarrollo de la infraestructura, están provocando un aumento significativo de la demanda de electricidad en Oriente Medio y África. Los países están invirtiendo fuertemente en recursos de generación de energía mediante la instalación de nuevas plantas de energía para satisfacer la demanda energética para un desarrollo sin trabas. Esto ha provocado un aumento de la contaminación y los riesgos ambientales. A medida que el enfoque se desplaza hacia la conservación del clima, aumenta la adopción de fuentes de energía renovables para la generación de energía y el aprovechamiento de la energía solar para la electricidad es una de las tecnologías líderes en Oriente Medio y África.

- Aumento de la demanda de productos fotovoltaicos integrados en edificios (BIPV)

La energía fotovoltaica integrada en edificios (BIPV) se refiere a los materiales que se utilizan en la construcción para reemplazar los materiales de construcción convencionales en techos, tragaluces y fachadas, entre otros. Con BIPV, los edificios tienen una capa exterior de la estructura que también genera electricidad para uso en el sitio o para exportarla a la red. Las aplicaciones de BIPV se utilizan a menudo en edificios comerciales e industriales. El uso de OPV tiene ventajas significativas sobre las células solares de silicio, ya que dan como resultado una reducción de costos. Son livianos, flexibles y visiblemente transparentes. Esto ha dado como resultado un crecimiento en la adopción de energía fotovoltaica orgánica como material en aplicaciones BIPV.

Los paneles fotovoltaicos orgánicos son flexibles y de láminas delgadas, y pueden integrarse en los laterales de los edificios, reemplazando las ventanas de vidrio convencionales; esto ofrece una gran superficie disponible para la absorción de energía solar. Los tragaluces OPC se integran utilizando células solares orgánicas ultradelgadas, que permiten que la luz del día penetre al mismo tiempo que generan electricidad.

Oportunidades

- Aplicaciones cada vez más numerosas en proyectos de bricolaje y gadgets

En los últimos años se han llevado a cabo numerosas investigaciones para desarrollar células solares orgánicas con el fin de aumentar la eficiencia y hacerlas más flexibles y delgadas. Los resultados obtenidos son encomiables. Los investigadores han logrado una eficiencia de conversión de energía (PCE) superior al 10 %. Los avances recientes han permitido mejorar la flexibilidad, la estabilidad mecánica a la flexión y la buena adaptabilidad. Esto ha dado lugar a aplicaciones de células solares orgánicas en aplicaciones como la generación de energía en dispositivos electrónicos portátiles y en pequeños proyectos.

Existe una creciente demanda en el mercado de dispositivos electrónicos portátiles y ponibles, como relojes inteligentes o sensores biométricos, que empleen recursos de generación de energía livianos, flexibles y eficientes. Esto ha abierto oportunidades interesantes para las células solares orgánicas como recursos de suministro de energía de próxima generación debido a sus propiedades deseables. Como resultado, se están llevando a cabo muchas actividades de investigación para seguir desarrollando células solares orgánicas para aumentar su PCE y flexibilidad en Oriente Medio y África.

- Aumentar la atención del gobierno al cambio climático

El calentamiento de Oriente Medio y África, impulsado por las emisiones de gases de efecto invernadero inducidas por el hombre y los cambios en los patrones climáticos debido a la constante alteración de los ecosistemas, está dando lugar a cambios climáticos acelerados en todas las regiones de Oriente Medio y África. Este cambio no se está desacelerando y tiene un impacto inmenso en el bienestar humano y la pobreza en todo el mundo. Según el Banco Mundial, el cambio climático puede empujar a 132 millones de personas a la pobreza. Hay un movimiento en todo el mundo y los principales gobiernos se están dando cuenta y actuando para adoptar y combatir medidas para evitar más daños al ecosistema mundial.

Restricciones/Desafíos

- Mayor costo de instalación de los sistemas OPV

Se ha puesto mucho énfasis en acelerar la adopción de sistemas eléctricos solares, como los sistemas fotovoltaicos orgánicos, para desarrollar sistemas fotovoltaicos integrados en edificios. Pero a pesar de estos esfuerzos, la incorporación del diseño BIPV (fotovoltaica integrada en edificios) en el diseño de los edificios es menor en comparación con los edificios con sistemas de células solares orgánicas montados en bastidores. Esto se suma al aumento del costo de la integración del diseño previo a la implementación, lo que demuestra ser un factor restrictivo significativo para el mercado.

Si bien se fomenta la adopción de energías renovables y, por lo tanto, está aumentando debido a la creciente atención prestada al cambio climático, se observa que los adoptantes de la energía solar están sesgados en la mayoría de las regiones del mundo. Esta asimetría se atribuye a los ingresos de la población.

- Tasas de baja eficiencia de las células solares orgánicas

La eficiencia de conversión de energía en una célula solar se refiere a la fracción de energía luminosa que la célula es capaz de convertir en electricidad. Existe una oportunidad creciente para la adopción de células solares orgánicas, ya que proporcionan flexibilidad y pueden adaptarse a cualquier superficie, como el techo de un automóvil o el exterior de dispositivos electrónicos portátiles. El principal desafío que ha impedido la comercialización de la tecnología es la eficiencia de conversión de energía relativamente baja en comparación con la eficiencia proporcionada por las células solares de silicio inorgánico.

Desarrollo reciente

- En enero de 2023, Novaled GmbH anunció que había ganado el premio "Corporate Health Excellence Award" en 2022. Esto ayudará a que la empresa sea mejor reconocida entre los competidores.

Alcance del mercado de células solares orgánicas (OPV) en Oriente Medio y África

El mercado de células solares orgánicas (OPV) de Oriente Medio y África se clasifica en función del tipo, el material, la aplicación, el tamaño físico y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

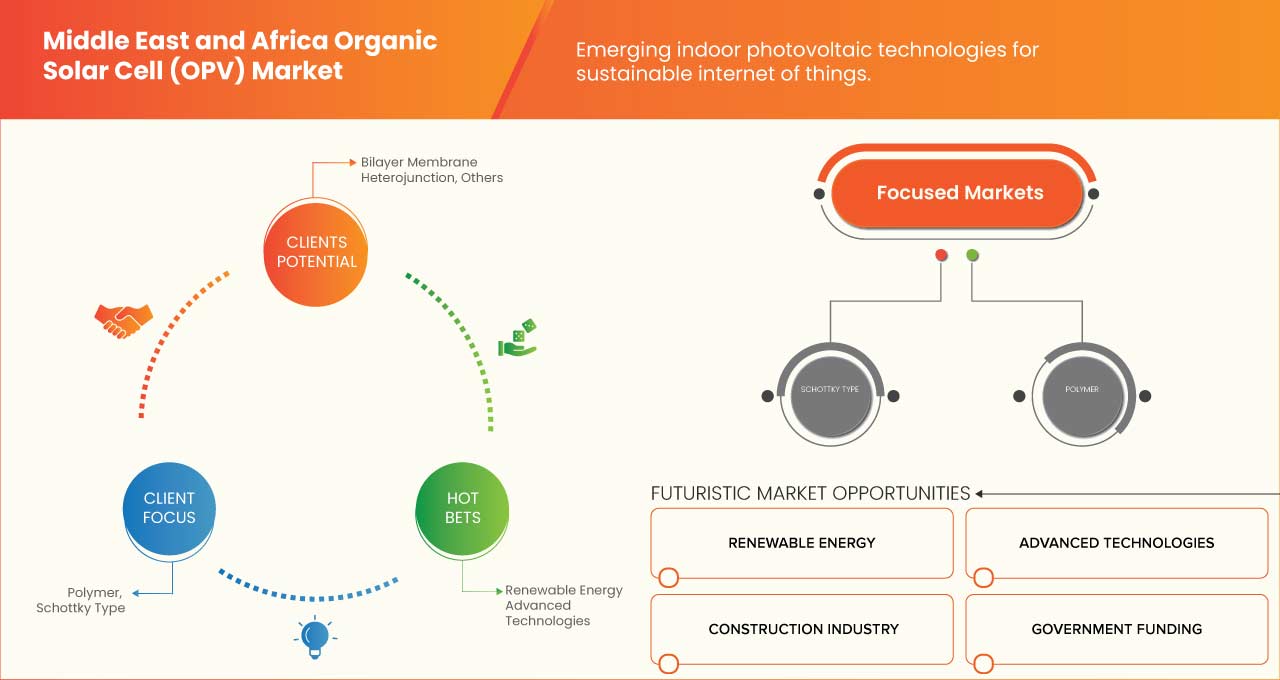

Tipo

- Heterounión de membrana bicapa

- Tipo Schottky

- Otros

Según el tipo, el mercado de células solares orgánicas (OPV) de Oriente Medio y África se clasifica en tres segmentos: heterounión de membrana bicapa, tipo Schottky y otros.

Material

- Polímero

- Moléculas pequeñas

Sobre la base del material, el mercado de células solares orgánicas (OPV) de Medio Oriente y África se clasifica en dos segmentos: polímeros y moléculas pequeñas.

Solicitud

- BIPV y arquitectura

- Electrónica de consumo

- Dispositivos portátiles

- Automotor

- Militar y dispositivos

- Otros

Sobre la base de la aplicación, el mercado de células solares orgánicas (OPV) de Oriente Medio y África se clasifica en seis segmentos: BIPV y arquitectura, electrónica de consumo, dispositivos portátiles, automotriz, militar y dispositivos, y otros.

Tamaño físico

- Más de 140*100 mm cuadrados

- Menos de 140*100 mm cuadrados

Sobre la base del tamaño físico, el mercado de células solares orgánicas (OPV) de Medio Oriente y África se clasifica en dos segmentos: más de 140*100 MM cuadrados y menos de 140*100 MM cuadrados.

Usuario final

- Comercial

- Industrial

- Residencial

- Otros

Sobre la base del usuario final, el mercado de células solares orgánicas (OPV) de Oriente Medio y África se clasifica en cuatro segmentos: comercial, industrial, residencial y otros.

Análisis y perspectivas regionales del mercado de células solares orgánicas (OPV) en Oriente Medio y África

El mercado de células solares orgánicas (OPV) de Oriente Medio y África está segmentado según el tipo, el material, la aplicación, el tamaño físico y el usuario final.

Los países del mercado de células solares orgánicas (OPV) en Oriente Medio y África son Sudáfrica, Egipto, Arabia Saudita, Emiratos Árabes Unidos, Israel y el resto de Oriente Medio y África. Los Emiratos Árabes Unidos dominan el mercado de células solares orgánicas (OPV) en Oriente Medio y África en términos de participación de mercado e ingresos de mercado debido a la creciente popularidad de las células solares orgánicas (OPV) entre los sectores comercial y residencial en esta región.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. El análisis de los puntos de datos de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Oriente Medio y África y los desafíos que enfrentan debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de células solares orgánicas (OPV) en Oriente Medio y África

El panorama competitivo del mercado de células solares orgánicas (OPV) de Oriente Medio y África proporciona detalles por competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones, la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas relacionado con el mercado de células solares orgánicas (OPV) de Oriente Medio y África.

Algunos de los participantes destacados que operan en el mercado de células solares orgánicas (OPV) de Oriente Medio y África son Eni SpA, TOSHIBA CORPORATION, ARMOR, Tokyo Chemicals Industry Co. Ltd, Merck KGaA, Alfa Aesar, Thermo Fisher Scientific, Heliatek, Solarmer Energy Inc., SUNEW, Epishine, Lumtec, Borun New Material Technology Co., Ltd, Novaled GmbH, Ningbo Polycrown Solar Tech Co, Ltd, SHIFENG TECHNOLOGY CO., LTD., Solaris Chem Inc., MORESCO Corporation, NanoFlex Power Corporation y Flask, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING AWARENESS TOWARDS THE USE OF RENEWABLE ENERGY FOR POWER GENERATION

5.1.2 SURGE IN DEMAND FOR BUILDING INTEGRATED PHOTOVOLTAIC PRODUCTS (BIPV)

5.1.3 GOVERNMENT INITIATIVES AND TAX BENEFITS FOR THE APPLICATION OF ALTERNATE ENERGY RESOURCE

5.1.4 ADVANTAGES OF OPVS OVER SILICON SOLAR CELLS AND SIMPLICITY IN THE MANUFACTURING PROCESS

5.1.5 INCREASING SOLAR ADOPTION IN RESIDENTIAL AREAS

5.2 RESTRAINTS

5.2.1 HIGHER SETUP COST OF OPV SYSTEMS

5.2.2 CUSTOM TARIFFS OVER SOLAR PANELS AND SOLAR CELLS BY MULTIPLE GOVERNMENTS

5.3 OPPORTUNITIES

5.3.1 INCREASING APPLICATIONS IN DIY PROJECTS AND GADGETS

5.3.2 INCREASING GOVERNMENT FOCUS ON CLIMATE CHANGE

5.3.3 INCREASING FOCUS ON THE DEVELOPMENT OF TANDEM ORGANIC CELLS

5.3.4 EMERGING INDOOR PHOTOVOLTAIC TECHNOLOGIES FOR SUSTAINABLE INTERNET OF THINGS

5.4 CHALLENGES

5.4.1 LOW-EFFICIENCY RATES OF ORGANIC SOLAR CELLS

5.4.2 STABILITY PROBLEMS IN ORGANIC SOLAR CELL

6 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE

6.1 OVERVIEW

6.2 BILAYER MEMBRANE HETEROJUNCTION

6.3 SCHOTTKY TYPE

6.4 OTHERS

7 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL

7.1 OVERVIEW

7.2 POLYMER

7.3 SMALL MOLECULES

8 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 BIPV & ARCHITECTURE

8.3 CONSUMER ELECTRONICS

8.4 WEARABLE DEVICES

8.5 AUTOMOTIVE

8.6 MILITARY & DEVICE

8.7 OTHERS

9 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE

9.1 OVERVIEW

9.2 MORE THAN 140*100 MM SQUARE

9.3 LESS THAN 140*100 MM SQUARE

10 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER

10.1 OVERVIEW

10.2 COMMERCIAL

10.2.1 COMMERCIAL, BY COMMERCIAL TYPE

10.2.1.1 PUBLIC INSTITUTIONS

10.2.1.2 GOVERNMENT AGENCIES

10.2.1.3 RESEARCH INSTITUTIONS

10.2.1.4 OTHERS

10.2.2 COMMERCIAL, BY TYPE

10.2.2.1 BILAYER MEMBRANE HETEROJUNCTION

10.2.2.2 SCHOTTKY TYPE

10.2.2.3 OTHERS

10.3 INDUSTRIAL

10.3.1 INDUSTRIAL, BY TYPE

10.3.1.1 BILAYER MEMBRANE HETEROJUNCTION

10.3.1.2 SCHOTTKY TYPE

10.3.1.3 OTHERS

10.4 RESIDENTIAL

10.4.1 RESIDENTIAL, BY TYPE

10.4.1.1 BILAYER MEMBRANE HETEROJUNCTION

10.4.1.2 SCHOTTKY TYPE

10.4.1.3 OTHERS

10.5 OTHERS

11 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 U.A.E

11.1.2 SAUDI ARABIA

11.1.3 SOUTH AFRICA

11.1.4 ISRAEL

11.1.5 EGYPT

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12.2 BUSINESS ACQUISITION & EXPANSION

12.3 COLLABORATION & PARTNERSHIP

12.4 ACQUISITION

12.5 AGREEMENT & CERTIFICATION

12.6 RECOGNITION & PRODUCT LAUNCH

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 ENI SPA (2022)

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 TOSHIBA CORPORATION (2022)

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 ARMOR

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 TOKYO CHEMICAL INDUSTRY CO., LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 MERCK KGAA (2022)

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ALFA AESAR, THERMO FISHER SCIENTIFIC.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 BORUN NEW MATERIAL TECHNOLOGY CO., LTD.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 EPISHINE

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 FLASK

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 HELIATEK

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 LUMTEC

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 MORESCO CORPORATION (2022)

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 NANOFLEX POWER CORPORATION (2022)

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 NINGBO POLYCROWN SOLAR TECH CO, LTD

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 NOVALED GMBH

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 SHIFENG TECHNOLOGY CO., LTD.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 SOLARIS CHEM INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 SOLARMER ORGANIC OPTOELECTRONICS TECHNOLOGY (BEIJING) CO., LTD.

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 SUNEW

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA ON PHOTOSENSITIVE SEMICONDUCTOR DEVICES, INCL. PHOTOVOLTAIC CELLS, WHETHER OR NOT ASSEMBLED IN ...; HS CODE – 854140 (USD THOUSAND)

TABLE 2 EXPORT DATA OF PHOTOSENSITIVE SEMICONDUCTOR DEVICES, INCL. PHOTOVOLTAIC CELLS, WHETHER OR NOT ASSEMBLED IN ...; HS CODE – 854140 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA BILAYER MEMBRANE HETEROJUNCTION IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION , 2021-2030 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA SCHOTTKY TYPE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA OTHERS IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA POLYMER IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA SMALL MOLECULES IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA BIPV & ARCHITECTURE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA WEARABLE DEVICES IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA AUTOMOTIVE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA MILITARY & DEVICE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA OTHERS IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE , 2021-2030 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA MORE THAN 140*100 MM SQUARE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA LESS THAN 140*100 MM SQUARE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA OTHERS IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2021-2030 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 U.A.E ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 U.A.E ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 41 U.A.E ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 42 U.A.E ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2021-2030 (USD THOUSAND)

TABLE 43 U.A.E ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 44 U.A.E COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 U.A.E COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 U.A.E INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 U.A.E RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 SAUDI ARABIA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 SAUDI ARABIA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 50 SAUDI ARABIA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 51 SAUDI ARABIA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2021-2030 (USD THOUSAND)

TABLE 52 SAUDI ARABIA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 53 SAUDI ARABIA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 SAUDI ARABIA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 SAUDI ARABIA INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 SAUDI ARABIA RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 SOUTH AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 SOUTH AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 59 SOUTH AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 60 SOUTH AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2021-2030 (USD THOUSAND)

TABLE 61 SOUTH AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 62 SOUTH AFRICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 SOUTH AFRICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 SOUTH AFRICA INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 SOUTH AFRICA RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 ISRAEL ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 ISRAEL ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 68 ISRAEL ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 69 ISRAEL ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2021-2030 (USD THOUSAND)

TABLE 70 ISRAEL ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 71 ISRAEL COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 ISRAEL COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 ISRAEL INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 ISRAEL RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 EGYPT ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 EGYPT ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 77 EGYPT ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 78 EGYPT ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2021-2030 (USD THOUSAND)

TABLE 79 EGYPT ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 80 EGYPT COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 EGYPT COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 EGYPT INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 EGYPT RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 REST OF MIDDLE EAST AND AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Lista de figuras

FIGURE 1 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL MARKET

FIGURE 2 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: SEGMENTATION

FIGURE 14 INCREASING AWARENESS TOWARDS THE USE OF RENEWABLE ENERGY FOR POWER GENERATION IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET IN THE FORECAST PERIOD

FIGURE 15 2 WHEEL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET IN 2023 & 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET

FIGURE 17 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2022

FIGURE 18 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2022

FIGURE 19 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2022

FIGURE 20 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2022

FIGURE 21 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2022

FIGURE 22 MIDDLE EAST AND AFRICA ORGANIC SOLAR CELL (OPV) MARKET: BY SNAPSHOT (2022)

FIGURE 23 MIDDLE EAST AND AFRICA ORGANIC SOLAR CELL (OPV) MARKET: BY COUNTRY (2022)

FIGURE 24 MIDDLE EAST AND AFRICA SOLAR CELL (OPV) MARKET: BY COUNTRY (2023 & 2030)

FIGURE 25 MIDDLE EAST AND AFRICA ORGANIC SOLAR CELL (OPV) MARKET: BY COUNTRY (2022 & 2030)

FIGURE 26 MIDDLE EAST AND AFRICA ORGANIC SOLAR CELL (OPV) MARKET: BY TYPE (2023-2030)

FIGURE 27 MIDDLE EAST & AFRICA HEAVY METALS TESTING MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.