Middle East And Africa Nut Oil Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

7.13 Billion

USD

13.69 Billion

2025

2033

USD

7.13 Billion

USD

13.69 Billion

2025

2033

| 2026 –2033 | |

| USD 7.13 Billion | |

| USD 13.69 Billion | |

|

|

|

|

Segmentación del mercado de aceites de frutos secos en Oriente Medio y África, por tipo de producto (aceite de avellana, aceite de almendras, aceite de argán, aceite de macadamia, aceite de marula, aceite de mongongo, aceite de nuez pecana, aceite de pistacho, aceite de piñón, aceite de nuez y otros), uso final (procesamiento de alimentos, cosméticos y cuidado personal, aromaterapia, pinturas y barnices, hogar y otros), naturaleza (orgánico y convencional), canal de distribución (B2B y B2C), tipo de envase (frascos, botellas, bolsas y otros): tendencias de la industria y pronóstico hasta 2033.

¿Cuál es el tamaño y la tasa de crecimiento del mercado de aceite de nueces en Oriente Medio y África?

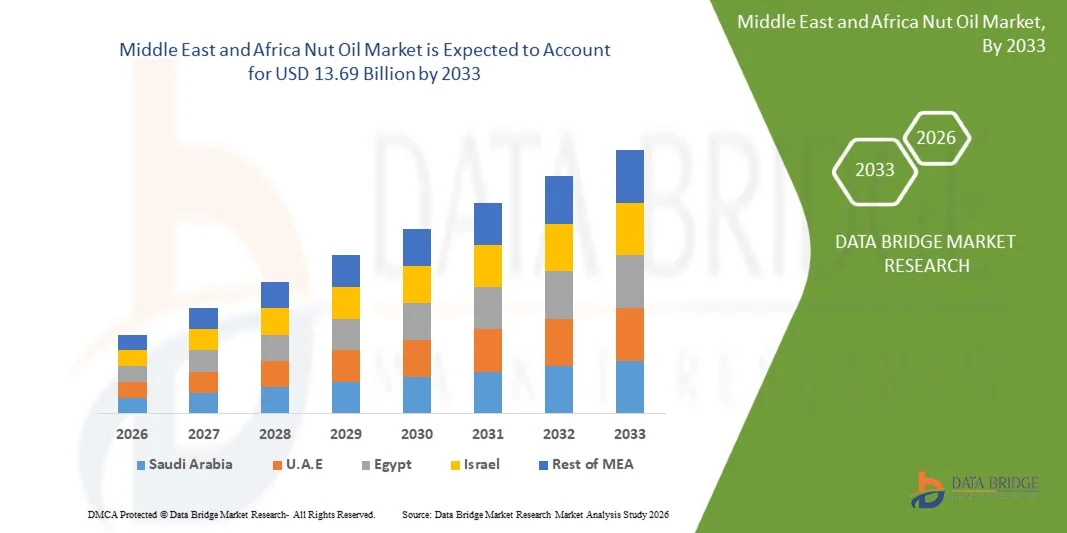

- El tamaño del mercado de aceite de nueces de Medio Oriente y África se valoró en USD 7,13 mil millones en 2025 y se espera que alcance los USD 13,69 mil millones para 2033 , con una CAGR del 8,5% durante el período de pronóstico.

- El aumento de la conciencia de la salud entre los consumidores con respecto a la cocina saludable es un factor vital que aumenta el crecimiento del mercado, también aumenta el uso de subproductos de aceite de maní en la fabricación de alimentos, aumenta la conciencia sobre los diversos beneficios para la salud de los aceites de nueces, como el control de peso y la mejora de la salud del corazón y los huesos y aumenta la presencia de una alta concentración de vitaminas y antioxidantes, el aceite de nuez se usa como limpiador, tónico para la piel, humectante y gel de baño son los principales factores, entre otros, que impulsan el mercado de aceite de nueces de Medio Oriente y África.

¿Cuáles son las principales conclusiones del mercado de aceite de frutos secos?

- El aumento de la población vegana, el aumento de las actividades de investigación y desarrollo y el aumento de la modernización de los nuevos productos ofrecidos en el mercado crearán nuevas oportunidades para el mercado de aceite de nueces de Oriente Medio y África.

- Sin embargo, el aumento en el problema relacionado con el almacenamiento de materias primas es el principal factor entre otros que actúa como restricción y desafiará aún más el mercado de aceite de nueces de Medio Oriente y África en el período de pronóstico.

- Arabia Saudita dominó el mercado de aceite de nueces de Medio Oriente y África con una participación de ingresos del 32,4% en 2025, impulsada por un fuerte consumo de aceites de almendras, argán y nueces en alimentos, cosméticos y cuidado personal.

- Se proyecta que India experimentará la CAGR más rápida del 8,4 % entre 2026 y 2033, impulsada por el creciente consumo de aceites de almendras, argán y macadamia en aplicaciones culinarias, de cuidado personal y de aromaterapia.

- El segmento de aceite de almendras dominó el mercado con una participación en los ingresos del 29,4% en 2025, debido a su alto valor nutricional, versatilidad en aplicaciones culinarias y popularidad en productos cosméticos y para el cuidado de la piel.

Alcance del informe y segmentación del mercado de aceites de frutos secos

|

Atributos |

Información clave del mercado del aceite de frutos secos |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

¿Cuál es la tendencia clave en el mercado de aceite de nueces?

Creciente demanda de productos de aceite de frutos secos sostenibles y de primera calidad

- El mercado de aceites de frutos secos está experimentando una tendencia clave: la creciente adopción de aceites sostenibles, de alta calidad y ricos en nutrientes derivados de frutos secos como almendras, nueces y macadamia. Esta tendencia se debe a la creciente concienciación de los consumidores sobre la salud, el bienestar y los productos de etiqueta limpia, especialmente en Norteamérica y Europa.

- Por ejemplo, empresas como Wilmar International, ADM y Cargill están ampliando su oferta de aceites de frutos secos orgánicos y prensados en frío para satisfacer la creciente demanda de opciones dietéticas saludables para el corazón y basadas en plantas.

- La creciente preferencia por los aceites funcionales enriquecidos con antioxidantes, ácidos grasos omega y vitaminas está acelerando su adopción en el mercado.

- Los fabricantes están integrando técnicas de extracción avanzadas, como prensado en frío, procesamiento sin solventes y sistemas de alta presión, para mejorar el rendimiento, la calidad y la vida útil.

- El aumento de la I+D en la retención del sabor, la estabilidad de los nutrientes y los envases ecológicos está impulsando la innovación de productos.

- A medida que los consumidores continúan priorizando el bienestar, la sostenibilidad y los aceites comestibles de alta calidad, se espera que los aceites de frutos secos premium sigan siendo un foco central en el panorama mundial de los aceites comestibles.

¿Cuáles son los impulsores clave del mercado del aceite de nueces?

- El creciente énfasis de los consumidores en la salud cardíaca, la inmunidad y las dietas basadas en plantas es un importante impulsor de la expansión del mercado.

- Por ejemplo, en 2025, Wilmar International y Cargill lanzaron aceites de nueces premium prensados en frío y fortificados dirigidos a consumidores preocupados por la salud en todo el mundo.

- La creciente conciencia sobre los aceites de etiqueta limpia, no transgénicos y orgánicos está impulsando su adopción en América del Norte, Europa, Medio Oriente y África.

- Los avances tecnológicos en la extracción de aceite, la filtración y la conservación de nutrientes están mejorando la calidad del producto y el atractivo para el consumidor.

- La creciente integración de prácticas de abastecimiento sostenible, sistemas de trazabilidad y envases ecológicos está fortaleciendo el crecimiento del mercado.

- Con una inversión continua en I+D, desarrollo de productos funcionales y educación del consumidor, se espera que el mercado de aceites de frutos secos mantenga un sólido impulso de crecimiento en los próximos años.

¿Qué factor está frenando el crecimiento del mercado del aceite de frutos secos?

- Los altos costos de producción asociados con el abastecimiento de nueces de primera calidad, la extracción mediante prensado en frío y las pruebas de calidad limitan la asequibilidad, en particular en mercados sensibles a los precios.

- Por ejemplo, durante 2024-2025, las fluctuaciones en los precios de las materias primas de los frutos secos, los costos de la energía y los componentes de embalaje afectaron los volúmenes de producción y los precios de los principales actores.

- El cumplimiento normativo en materia de seguridad alimentaria, etiquetado y certificaciones orgánicas aumenta la complejidad operativa y los costos.

- La limitada conciencia de los consumidores en los mercados emergentes respecto de los aceites de frutos secos funcionales y de primera calidad restringe su adopción masiva.

- La competencia de los aceites comestibles tradicionales, los aceites mezclados y las alternativas de bajo costo crea presión sobre los precios y afecta la penetración en el mercado.

- Para abordar estos desafíos, las empresas se están centrando en el abastecimiento sostenible, métodos de extracción rentables, líneas de productos fortificados y programas de educación del consumidor para ofrecer aceites de nueces de primera calidad, nutritivos y de alta calidad.

¿Cómo está segmentado el mercado del aceite de frutos secos?

El mercado está segmentado según el tipo de producto, el uso final, la naturaleza, el canal de distribución y el tipo de embalaje .

• Por tipo de producto

Según el tipo de producto, el mercado de aceites de frutos secos se segmenta en aceite de avellana, aceite de almendras, aceite de argán, aceite de macadamia, aceite de marula, aceite de mongongo, aceite de nuez pecana, aceite de pistacho, aceite de piñón, aceite de nuez y otros. El segmento de aceite de almendras dominó el mercado con una participación en los ingresos del 29,4 % en 2025, gracias a su alto valor nutricional, su versatilidad en aplicaciones culinarias y su popularidad en productos cosméticos y de cuidado de la piel.

Se proyecta que el aceite de macadamia crecerá a la CAGR más rápida entre 2026 y 2033, impulsado por la creciente demanda de aceites especiales en la cocina gourmet, el cuidado de la piel de primera calidad y las formulaciones cosméticas antienvejecimiento.

• Por uso final

Según el uso final, el mercado se segmenta en Procesamiento de Alimentos, Cosméticos y Cuidado Personal, Aromaterapia, Pinturas y Barnices, Hogar y Otros. El segmento de Procesamiento de Alimentos dominó con una participación en los ingresos del 34,6 % en 2025, impulsado por la creciente preferencia de los consumidores por aceites de cocina saludables ricos en grasas insaturadas y ácidos grasos omega.

Se proyecta que los cosméticos y el cuidado personal crecerán a la CAGR más rápida entre 2026 y 2033, respaldados por el aumento de los productos de belleza naturales y de origen vegetal que incorporan aceites de nueces para la hidratación de la piel y beneficios antienvejecimiento.

• Por naturaleza

Según la naturaleza, el mercado de aceites de frutos secos se segmenta en orgánico y convencional. El segmento convencional dominó con un 61.2 % de participación en los ingresos en 2025, ya que está ampliamente disponible, es rentable y se utiliza en las industrias alimentaria y cosmética

Se proyecta que los aceites de frutos secos orgánicos crecerán a la CAGR más rápida entre 2026 y 2033, impulsados por la creciente conciencia de los consumidores sobre los aceites libres de químicos y de origen sostenible y la demanda de productos de etiqueta limpia.

• Por canal de distribución

Según el canal de distribución, el mercado se segmenta en B2B y B2C. El segmento B2B dominó con una participación de ingresos del 53,5 % en 2025, impulsado por las compras a gran escala por parte de fabricantes de alimentos, marcas de cosméticos y empresas nutracéuticas que buscan la adquisición masiva de aceites de frutos secos.

Se proyecta que el segmento B2C crecerá a la CAGR más rápida entre 2026 y 2033, respaldado por la expansión de las plataformas de comercio electrónico, las ventas directas al consumidor y las entregas basadas en suscripción de aceites de nueces especiales y orgánicos.

• Por tipo de embalaje

Según el tipo de envase, el mercado de aceites de frutos secos se segmenta en frascos, botellas, bolsas y otros. El segmento de botellas dominó con una participación de ingresos del 47,8 % en 2025, gracias a su facilidad de almacenamiento, su amplia aceptación por parte del consumidor y su idoneidad tanto para aplicaciones minoristas como industriales.

Se proyecta que las bolsas crecerán a la CAGR más rápida entre 2026 y 2033, impulsadas por soluciones de envasado livianas, ecológicas y convenientes que satisfacen a los consumidores modernos y las iniciativas de productos sustentables.

¿Qué región posee la mayor participación en el mercado de aceite de frutos secos?

- Arabia Saudita dominó el mercado de aceite de nueces de Medio Oriente y África con una participación de ingresos del 32,4% en 2025, impulsada por un fuerte consumo de aceites de almendras, argán y nueces en alimentos, cosméticos y cuidado personal.

- La creciente conciencia sobre la salud, la preferencia por los aceites vegetales y orgánicos, y las inversiones en modernas instalaciones de extracción y envasado fortalecen el liderazgo en el mercado. La urbanización, el aumento de la renta disponible y la demanda de aceites funcionales y de etiqueta limpia aceleran aún más su adopción.

Análisis del mercado de aceite de nueces de los EAU

Se proyecta que los Emiratos Árabes Unidos experimentarán la tasa de crecimiento anual compuesta (TCAC) más rápida, del 7,9 %, entre 2026 y 2033, impulsada por aceites de frutos secos premium como la macadamia, el argán y el pistacho en cosmética, alimentación y aromaterapia. La expansión de los canales minoristas, la creciente adopción del comercio electrónico y la creciente concienciación sobre la salud impulsan el crecimiento del mercado. Las inversiones en tecnología de prensado en frío, envases sostenibles y aceites importados de alta calidad mejoran la penetración en el mercado y satisfacen la creciente demanda de aceites de frutos secos naturales y funcionales.

Análisis del mercado de aceite de nueces de Sudáfrica

Sudáfrica contribuye de forma constante al crecimiento regional, impulsada por la creciente demanda de aceites de nuez, marula y almendra en productos alimenticios y de cuidado personal. Los consumidores prefieren cada vez más los aceites orgánicos y funcionales, lo que anima a los fabricantes a invertir en fórmulas de valor añadido, envases de alta calidad y abastecimiento sostenible. El crecimiento de la población urbana y el aumento de las conductas saludables impulsan aún más su adopción. Se espera que las alianzas estratégicas y las oportunidades de exportación de aceites de frutos secos de alta calidad fortalezcan la posición del país en el mercado de Oriente Medio y África.

Análisis del mercado del aceite de nueces en Egipto

Egipto se perfila como un mercado clave, impulsado por los sectores culinario, cosmético y nutracéutico. La creciente concienciación sobre los aceites saludables y el aumento de las importaciones de aceites de almendra, macadamia y pistacho impulsan el consumo. La expansión del comercio minorista, las tiendas especializadas y la penetración del comercio electrónico facilitan el acceso a aceites premium y funcionales. Los consumidores se inclinan por los aceites orgánicos, vegetales y prensados en frío, lo que impulsa la demanda de productos de alta calidad. Se espera que las inversiones en infraestructura de procesamiento impulsen el crecimiento sostenible del mercado en la región.

Análisis del mercado del aceite de nueces de Marruecos

Marruecos contribuye significativamente, especialmente en el caso de los aceites de argán y almendras, utilizados en cosmética y gastronomía. Las inversiones en cultivos sostenibles, la extracción moderna de aceite y la producción orientada a la exportación aumentan la capacidad del mercado. La creciente urbanización, el aumento de la renta disponible y la preferencia por los aceites vegetales, orgánicos y funcionales impulsan su adopción. El apoyo gubernamental a la producción local y al comercio internacional contribuye a ampliar el alcance del mercado. El posicionamiento de primera calidad de los aceites de argán y almendras en los mercados globales fortalece el papel de Marruecos en la industria de aceites de frutos secos de Oriente Medio y África.

¿Cuáles son las principales empresas del mercado de aceite de nueces?

La industria del aceite de nueces está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Caloy Company, LP (EE. UU.)

- Wilmar International Ltd (Singapur)

- Fairtrade International (Alemania)

- ADM (Archer Daniels Midland) (EE. UU.)

- Bunge Limited (Suiza)

- FUJI OIL CO., LTD. (Japón)

- Gustav Heess Oleochemische Erzeugnisse GmbH (Alemania)

- Natural Oils International Inc (EE. UU.)

- Cargill, Incorporated (EE. UU.)

- CHS Inc. (EE. UU.)

- Mazola (EE. UU.)

- Biofinest (EE. UU.)

- Natural Sourcing, LLC (EE. UU.)

- Liberty Vegetable Oil Company (EE. UU.)

¿Cuáles son los desarrollos recientes en el mercado de aceite de nueces de Medio Oriente y África?

- En octubre de 2024, Texas A&M Agri Life Research, una de las agencias de investigación y desarrollo tecnológico más grandes de Texas, anunció el desarrollo de una variedad de maní con alto contenido de aceite para mejorar la producción de maní con alto contenido de aceite, lo que marca un paso significativo en la innovación de cultivos.

- En septiembre de 2024, Fassoum Peanut Oil, una empresa de petróleo y derivados con sede en Nigeria, se unió al Programa LaunchUp de la empresa FasterCapital con sede en Dubái para apoyar a las nuevas empresas, mejorar las operaciones y fortalecer su presencia global, contribuyendo así al crecimiento de la industria del aceite de maní.

- En mayo de 2023, Singireddy Niranjan Reddy, Ministro de Agricultura de Telangana, lanzó el aceite de maní de la marca Vijaya con la participación del Presidente de la Reserva Federal del Petróleo y otros dignatarios, promoviendo el aceite de maní de alta calidad producido localmente.

- En abril de 2022, Gemini Edibles and Fats India Ltd. (GEF India) presentó un frasco de cinco litros de aceite de maní bajo su marca Freedom, que ofrece un sabor a nuez preferido para hacer encurtidos en toda la India, lo que refuerza la elección de los consumidores por los aceites de cocina tradicionales.

- En marzo de 2020, Dhara, una popular marca india de aceite de cocina, lanzó la campaña "Milled in India" para alentar a los consumidores a elegir aceites filtrados autóctonos como el aceite de maní Kachi Ghani y el aceite de mostaza, destacando la importancia de los aceites producidos localmente.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.