Middle East And Africa Needle Biopsy Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

29.33 Million

USD

39.22 Million

2025

2033

USD

29.33 Million

USD

39.22 Million

2025

2033

| 2026 –2033 | |

| USD 29.33 Million | |

| USD 39.22 Million | |

|

|

|

|

Segmentación del mercado global de biopsias con aguja en Oriente Medio y África, por tipo de aguja (agujas de biopsia de trepanación, aguja esternal Klima, aguja de aspiración con aguja Salah, aguja de Jamshidi y otras), ergonomía (agujas afiladas, romas, de Quincke, de Chiba, de Franseen y otras), procedimiento (biopsia por aspiración con aguja fina, biopsia con aguja gruesa, biopsia asistida por vacío y biopsia guiada por imagen), lugar de muestreo (músculos, huesos y otros órganos), utilidad (desechables y reutilizables), aplicación (tumor, infección, inflamación y otras), usuario final (hospitales, centros de diagnóstico, laboratorios de biopsia, centros de cirugía ambulatoria, organizaciones académicas y de investigación, y otros), canal de distribución (licitación directa y ventas minoristas): tendencias del sector y pronóstico hasta 2033.

Tamaño del mercado de biopsia con aguja en Oriente Medio y África

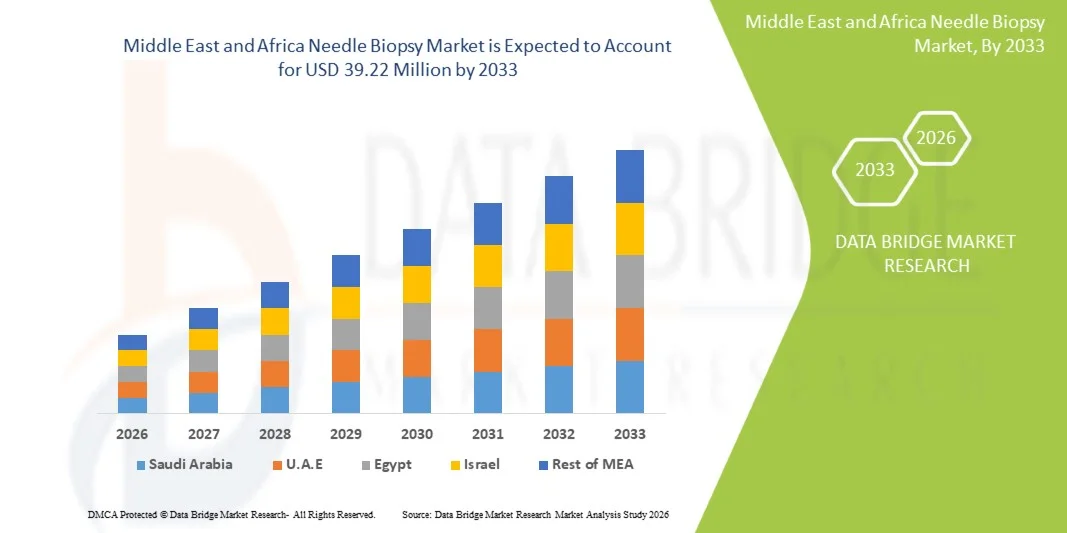

- El tamaño del mercado de biopsia con aguja en Oriente Medio y África se valoró en 29,33 millones de dólares en 2025 y se espera que alcance los 39,22 millones de dólares en 2033 , con una CAGR del 3,70 % durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente adopción de procedimientos de diagnóstico mínimamente invasivos, la creciente incidencia del cáncer y la creciente inversión en infraestructura de diagnóstico en toda la región.

- Además, la creciente demanda de agujas de biopsia desechables y procedimientos guiados por imágenes que ofrecen precisión y comodidad al paciente está consolidando la biopsia por punción como el método de diagnóstico preferido en hospitales y centros de diagnóstico. Estos factores convergentes están acelerando la adopción de soluciones de biopsia por punción, impulsando así significativamente el crecimiento de la industria.

Análisis del mercado de biopsias con aguja en Oriente Medio y África

- La biopsia con aguja, que ofrece una toma de muestras de tejido mínimamente invasiva con fines diagnósticos, es cada vez más vital en los entornos de atención médica modernos en hospitales y centros de diagnóstico debido a su precisión, la reducción de las molestias para el paciente y la compatibilidad con las tecnologías guiadas por imágenes.

- La creciente demanda de procedimientos de biopsia con aguja se ve impulsada principalmente por la creciente incidencia del cáncer y otras enfermedades crónicas, la creciente conciencia sobre el diagnóstico temprano y la creciente adopción de técnicas de diagnóstico mínimamente invasivas.

- Arabia Saudita dominó el mercado de biopsia con aguja de MEA en 2025 con una participación del 28,5%, caracterizada por una creciente inversión en infraestructura de atención médica, una mayor concienciación de los pacientes y una fuerte presencia de proveedores clave de equipos de diagnóstico.

- Se espera que Kenia sea el país de más rápido crecimiento en el mercado de biopsia con aguja de MEA durante el período de pronóstico debido a la mejora del acceso a la atención médica, las iniciativas gubernamentales para mejorar las capacidades de diagnóstico y la creciente demanda de programas de detección del cáncer.

- El segmento de biopsia con aguja gruesa dominó el mercado de biopsia con aguja de MEA con una participación de mercado del 52,6 % en 2025, impulsado por su precisión, eficiencia e idoneidad establecidas para varios tipos de tejidos en diagnósticos tanto oncológicos como no oncológicos.

Alcance del informe y segmentación del mercado de biopsia con aguja en Oriente Medio y África

|

Atributos |

Información clave del mercado de biopsia con aguja en Oriente Medio y África |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología de pacientes, análisis de canalización, análisis de precios y marco regulatorio. |

Tendencias del mercado de biopsias con aguja en Oriente Medio y África

Avances en sistemas de biopsia robótica y guiada por imágenes

- Una tendencia significativa y en aceleración en el mercado de biopsia con aguja de MEA es la creciente adopción de sistemas de biopsia guiados por imágenes y asistidos por robot, que mejoran la precisión del procedimiento, reducen la incomodidad del paciente y optimizan los resultados del diagnóstico.

- Por ejemplo, el sistema de biopsia robótica UltraCore integra imágenes en tiempo real con guía automatizada de la aguja, lo que permite a los médicos de hospitales y centros de diagnóstico obtener muestras de tejido precisas con mínima invasión.

- La integración con modalidades de imágenes avanzadas, como ultrasonido, tomografía computarizada y resonancia magnética, permite que los sistemas de biopsia con aguja apunten a lesiones pequeñas o difíciles de alcanzar, lo que mejora la precisión del diagnóstico y reduce los procedimientos repetidos.

- El uso continuo de tecnologías robóticas y guiadas por imágenes facilita tiempos de procedimiento más cortos y un mejor rendimiento del paciente, lo que permite a los proveedores de atención médica mejorar la eficiencia operativa en hospitales públicos y privados.

- Esta tendencia hacia procedimientos de biopsia más precisos, mínimamente invasivos y automatizados está transformando radicalmente las expectativas clínicas para el diagnóstico del cáncer y las enfermedades crónicas. Por ello, empresas como Merit Medical y Argon Medical Devices están desarrollando soluciones de biopsia asistida por robot con retroalimentación de imágenes en tiempo real.

- La demanda de sistemas de biopsia con aguja que ofrecen mayor precisión, integración con modalidades de imágenes y guía automatizada está creciendo rápidamente tanto en hospitales urbanos como en centros de diagnóstico especializados, a medida que los proveedores de atención médica priorizan la seguridad del paciente y la precisión del diagnóstico.

Dinámica del mercado de biopsias con aguja en Oriente Medio y África

Conductor

“Aumento de la demanda debido al aumento de la incidencia del cáncer y la concienciación sobre el diagnóstico”

- La creciente prevalencia del cáncer y otras enfermedades crónicas en Oriente Medio y África, junto con la creciente conciencia sobre el diagnóstico temprano, es un factor importante para la adopción de la biopsia con aguja.

- Por ejemplo, en marzo de 2025, GE Healthcare introdujo un sistema de biopsia de alta precisión para el diagnóstico de cáncer de mama y próstata en Arabia Saudita, con el objetivo de mejorar la detección temprana y la precisión del muestreo de tejido.

- A medida que los hospitales y centros de diagnóstico amplían sus programas de detección de enfermedades crónicas y oncológicas, la biopsia con aguja proporciona una alternativa mínimamente invasiva a las biopsias quirúrgicas, ofreciendo un menor riesgo para el paciente y una recuperación más rápida.

- Además, las iniciativas gubernamentales que promueven programas de detección del cáncer y las inversiones en infraestructura de atención médica están apoyando tasas más altas de adopción de procedimientos de biopsia avanzados.

- La conveniencia de los sistemas de biopsia con aguja fina, guiada por imágenes y con núcleo, junto con la creciente disponibilidad de dispositivos automatizados y fáciles de usar, está impulsando su adopción en centros de salud públicos y privados.

- Las crecientes colaboraciones entre los fabricantes globales de equipos de biopsia y los distribuidores locales están facilitando una mejor accesibilidad al mercado y una adopción más rápida de soluciones de biopsia innovadoras.

- La creciente preferencia de los pacientes por procedimientos mínimamente invasivos en lugar de biopsias quirúrgicas está impulsando la demanda de tecnologías avanzadas de biopsia con aguja en los hospitales y centros de diagnóstico de MEA.

Restricción/Desafío

“Altos costos de equipo y mano de obra calificada limitada”

- Preocupa que el costo relativamente alto de los sistemas avanzados de biopsia con aguja, incluidos los dispositivos robóticos y guiados por imágenes, plantee un desafío importante para su adopción generalizada, en particular en los países de Oriente Medio y África con ingresos bajos y medios.

- Por ejemplo, los hospitales de Kenia y Nigeria pueden enfrentar restricciones presupuestarias a la hora de adquirir equipos de biopsia de alta gama, lo que limita el acceso a procedimientos de diagnóstico mínimamente invasivos.

- Además, la disponibilidad limitada de radiólogos y médicos capacitados en la operación de sistemas avanzados de biopsia restringe su implementación en muchas regiones, lo que afecta la penetración en el mercado.

- Abordar estos desafíos mediante ofertas de sistemas rentables, modelos de arrendamiento y programas de capacitación clínica es crucial para expandir la presencia en el mercado.

- Si bien algunas agujas de biopsia desechables y manuales ofrecen alternativas asequibles, los sistemas avanzados siguen siendo una opción premium, lo que potencialmente retrasa su adopción entre los centros de atención médica más pequeños.

- Superar estas barreras a través de la transferencia de tecnología, iniciativas de capacitación y apoyo gubernamental a los programas de diagnóstico será vital para el crecimiento sostenido del mercado de biopsia con aguja de MEA.

- Los desafíos regulatorios y los largos procesos de aprobación para nuevos dispositivos de biopsia en ciertos países de MEA pueden retrasar el lanzamiento del producto y desacelerar el crecimiento del mercado.

- La infraestructura de atención médica inconsistente y el acceso limitado a equipos de diagnóstico por imágenes avanzados en las zonas rurales restringen el despliegue generalizado de sistemas sofisticados de biopsia con aguja.

Alcance del mercado de biopsia con aguja en Oriente Medio y África

El mercado está segmentado según el tipo de aguja, la ergonomía, el procedimiento, el sitio de muestra, la utilidad, la aplicación, el usuario final y el canal de distribución.

- Por tipo de aguja

Según el tipo de aguja, el mercado de biopsia con aguja de MEA se segmenta en agujas de biopsia de trépano, aguja esternal Klima, aguja de aspiración con aguja Salah, aguja Jamshidi y otras. El segmento de agujas de biopsia de trépano dominó el mercado en 2025, debido a su uso generalizado en el muestreo de médula ósea y su alta precisión para diagnósticos hematológicos y oncológicos. Los hospitales y centros de diagnóstico prefieren las agujas de trépano debido a su fiabilidad en la obtención de muestras de tejido central, complicaciones mínimas y compatibilidad con dispositivos de biopsia automatizados. Además, su diseño estandarizado permite una fácil utilización por parte de los médicos de diferentes departamentos hospitalarios. El dominio del segmento está respaldado por el creciente volumen de pacientes de hematología y oncología en países como Arabia Saudita, Emiratos Árabes Unidos y Egipto. Las agujas de trépano también son las preferidas por su durabilidad y la calidad constante de la muestra, lo que las convierte en una opción confiable para procedimientos repetidos

Se espera que el segmento de agujas Jamshidi experimente el mayor crecimiento durante el período de pronóstico, impulsado por la creciente adopción en el diagnóstico de enfermedades crónicas y procedimientos hematológicos. Las agujas Jamshidi ofrecen mayor comodidad al paciente y una toma de muestras de tejido eficiente, lo que impulsa su uso en hospitales privados y centros de diagnóstico especializados. La creciente concienciación de los profesionales clínicos sobre los procedimientos mínimamente invasivos y la seguridad del paciente contribuye aún más al rápido crecimiento de este segmento. Se espera que el creciente uso de las agujas Jamshidi en procedimientos avanzados guiados por imagen acelere su adopción en Oriente Medio y África.

- Por ergonomía

En función de la ergonomía, el mercado se segmenta en agujas afiladas, romas, Quincke, Chiba, Franseen y otras. El segmento Sharp dominó el mercado debido a su precisión y eficiencia en la obtención de muestras de tejido limpio en múltiples sitios de muestreo. Las agujas afiladas son ampliamente preferidas en hospitales y centros de diagnóstico debido a su capacidad para reducir el tiempo de procedimiento, disminuir la incomodidad del paciente y mejorar la precisión diagnóstica. El segmento se beneficia de una fuerte preferencia de los médicos, especialmente por las biopsias guiadas por imágenes, y de la innovación continua en los recubrimientos de las agujas y el diseño de las puntas. Las agujas afiladas son particularmente dominantes en las biopsias de huesos y músculos, donde la precisión es fundamental. Los hospitales de los países del CCG continúan adoptando las agujas afiladas como práctica estándar en los departamentos de oncología

Se espera que el segmento Franseen experimente el mayor crecimiento durante el período de pronóstico, gracias a su exclusivo diseño de punta multifacética, que permite obtener muestras de tejido más grandes con un traumatismo mínimo. El creciente uso de las agujas Franseen en el diagnóstico de tumores, especialmente en centros oncológicos de Arabia Saudita y Emiratos Árabes Unidos, está impulsando su adopción. Su compatibilidad con procedimientos de biopsia guiada por imágenes y por núcleo impulsa aún más la expansión del mercado. La creciente concienciación de los profesionales clínicos sobre un mejor rendimiento tisular y mejores resultados histopatológicos está impulsando un rápido crecimiento de las agujas Franseen.

- Por procedimiento

Según el procedimiento, el mercado se segmenta en biopsia por aspiración con aguja fina (BAAF), biopsia con aguja gruesa (BAG), biopsia asistida por vacío (BAV) y biopsia guiada por imágenes. El segmento de la biopsia con aguja gruesa dominó el mercado en 2025 con una cuota de mercado del 52,6 % debido a su mayor precisión diagnóstica en comparación con la BAAF, lo que la convierte en la opción preferida para los procedimientos de biopsia de tumores y órganos. Los hospitales y centros oncológicos de Arabia Saudita, Emiratos Árabes Unidos y Egipto utilizan ampliamente la BAG para el diagnóstico de cáncer de mama, hígado y próstata. Los médicos valoran la BAG por su capacidad de obtener suficiente tejido para histopatología y pruebas moleculares. La biopsia con aguja gruesa proporciona resultados fiables con menos procedimientos repetidos, lo que contribuye a la eficiencia en los centros sanitarios. También es ampliamente compatible con las modalidades guiadas por imágenes, lo que respalda su dominio en los hospitales de Oriente Medio y África

Se espera que el segmento de biopsia guiada por imágenes experimente el mayor crecimiento durante el período de pronóstico, impulsado por la creciente adopción de procedimientos guiados por ultrasonido, tomografía computarizada y resonancia magnética en los hospitales de Oriente Medio y África. La creciente incidencia del cáncer y la necesidad de un muestreo preciso en lesiones pequeñas o profundas son factores clave que contribuyen al rápido crecimiento del segmento. Las innovaciones tecnológicas en la guía de imágenes en tiempo real y la asistencia robótica aceleran aún más su adopción. Los hospitales urbanos y los centros de diagnóstico privados invierten cada vez más en sistemas guiados por imágenes para reducir la duración de los procedimientos y mejorar la precisión.

- Por sitio de muestreo

Según el sitio de muestreo, el mercado se segmenta en músculos, huesos y otros órganos. El segmento de huesos dominó el mercado en 2025, principalmente debido a la alta demanda de biopsias de médula ósea en diagnósticos de oncología y hematología. Las biopsias óseas son procedimientos estándar para la leucemia, el linfoma y el mieloma múltiple, que se diagnostican cada vez más en los países de Oriente Medio y África. Los hospitales favorecen este segmento por sus protocolos de procedimiento bien establecidos y la familiaridad de los médicos. El dominio del segmento de huesos también se ve reforzado por la disponibilidad de agujas especializadas diseñadas para el muestreo de tejido óseo. Arabia Saudita, Emiratos Árabes Unidos y Egipto lideran la adopción de procedimientos de biopsia ósea debido a su avanzada infraestructura sanitaria. La alta precisión clínica y las bajas tasas de complicaciones de las biopsias óseas contribuyen a su uso generalizado

Se espera que el segmento de Otros Órganos experimente el mayor crecimiento durante el período de pronóstico, impulsado por la creciente prevalencia de cánceres de hígado, mama, riñón y próstata en Oriente Medio y África. La demanda de biopsias mínimamente invasivas específicas de órganos en hospitales y centros de diagnóstico está aumentando, impulsada por la necesidad de un diagnóstico histopatológico preciso y una planificación del tratamiento dirigida. La mejora de la guía por imágenes y la asistencia robótica están haciendo que las biopsias de otros órganos sean más seguras y precisas. La creciente preferencia de los pacientes por los procedimientos ambulatorios también contribuye al crecimiento del segmento. La adopción es mayor en los hospitales urbanos con departamentos de oncología avanzados.

- Por utilidad

En función de la utilidad, el mercado se segmenta en desechables y reutilizables. El segmento desechable dominó el mercado en 2025, respaldado por una mayor concienciación sobre el control de infecciones y estrictos estándares de higiene hospitalaria. Las agujas desechables minimizan la contaminación cruzada, reducen los requisitos de esterilización y brindan comodidad a los centros de diagnóstico de alto volumen. La adopción es particularmente fuerte en Arabia Saudita, Emiratos Árabes Unidos y Egipto, donde los hospitales siguen estrictos protocolos de prevención de infecciones. La facilidad de eliminación y la comodidad de un solo uso también reducen el tiempo de preparación de los procedimientos. Las agujas desechables son las preferidas en oncología y diagnóstico de enfermedades infecciosas de alto riesgo. El creciente estímulo regulatorio para los dispositivos de un solo uso refuerza su dominio

Se espera que el segmento de agujas reutilizables experimente el mayor crecimiento durante el período de pronóstico, impulsado por hospitales y clínicas con enfoque en los costos en países como Kenia y Nigeria. Las agujas reutilizables se prefieren en ciertos procedimientos para optimizar los presupuestos de adquisición, y las innovaciones en tecnologías de esterilización y recubrimiento mejoran su seguridad y usabilidad. Los hospitales que buscan la rentabilidad a largo plazo invierten cada vez más en sistemas de agujas reutilizables. Los programas de capacitación sobre procedimientos seguros de reutilización están impulsando su adopción. Este crecimiento se ve impulsado aún más por las mejoras en la durabilidad y precisión de las agujas.

- Por aplicación

Según la aplicación, el mercado se segmenta en tumores, infecciones, inflamación y otros. El segmento de tumores dominó el mercado en 2025, debido a la creciente prevalencia del cáncer en Oriente Medio y África y la necesidad de un diagnóstico histopatológico preciso. Los hospitales y centros oncológicos dependen de la biopsia con aguja para evaluaciones de tumores de mama, hígado, próstata y otros, lo que contribuye al dominio del segmento. Los crecientes programas de detección del cáncer en Arabia Saudita, Emiratos Árabes Unidos y Egipto están impulsando los volúmenes de biopsias tumorales. El diagnóstico de tumores a menudo requiere alta precisión y muestreo de tejido central, lo que favorece las biopsias con aguja. La familiaridad de los médicos y la preferencia de los pacientes por los procedimientos mínimamente invasivos refuerzan el dominio

Se espera que el segmento de infecciones experimente el mayor crecimiento durante el período de pronóstico, debido al aumento de las pruebas diagnósticas para abscesos, infecciones óseas y enfermedades inflamatorias crónicas. La creciente concienciación sobre los procedimientos mínimamente invasivos en el diagnóstico de enfermedades infecciosas y su mayor adopción en los centros de diagnóstico son factores clave de crecimiento. Los hospitales realizan cada vez más biopsias con aguja para la localización de infecciones en lugar de procedimientos quirúrgicos abiertos. Este segmento se beneficia de la creciente inversión en centros de salud rurales. La adopción de procedimientos guiados por imagen para el diagnóstico de infecciones también impulsa el crecimiento.

- Por usuario final

En función del usuario final, el mercado se segmenta en hospitales, centros de diagnóstico, laboratorios de biopsia, centros de cirugía ambulatoria, organizaciones académicas y de investigación, y otros. El segmento de hospitales dominó el mercado en 2025, debido a su alto rendimiento de pacientes, infraestructura avanzada y uso frecuente de biopsia con aguja para oncología, enfermedades crónicas y diagnósticos de rutina. Los hospitales de Arabia Saudita, Emiratos Árabes Unidos y Egipto son líderes en la adopción debido a las crecientes inversiones en atención médica y programas de detección del cáncer. El dominio de los hospitales se ve reforzado por su capacidad para ofrecer procedimientos de biopsia guiados por imágenes y asistidos por robot. Los hospitales a menudo compran sistemas de biopsia de alto valor a través de licitación directa, lo que respalda una demanda constante. Los médicos cualificados y los laboratorios de patología establecidos en los hospitales también respaldan el liderazgo del segmento

Se espera que el segmento de Centros de Diagnóstico experimente el mayor crecimiento durante el período de pronóstico, impulsado por el creciente número de centros de diagnóstico especializados que ofrecen servicios de biopsia mínimamente invasiva en las zonas urbanas de Oriente Medio y África. Esta adopción se ve respaldada por la creciente preferencia de los pacientes por procedimientos ambulatorios convenientes y resultados rápidos de las pruebas. Los centros de diagnóstico están ampliando su cartera de servicios para incluir biopsias guiadas por imagen y biopsias con aguja gruesa. La creciente inversión privada en atención médica está impulsando la proliferación de centros. Las actualizaciones tecnológicas y las alianzas con proveedores globales aceleran la adopción.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en licitación directa y ventas minoristas. El segmento de licitación directa dominó el mercado en 2025, debido a los contratos de adquisición gubernamentales y de grandes hospitales para sistemas de biopsia de alto valor, incluidos dispositivos guiados por imágenes y asistidos por robot. Las licitaciones directas garantizan la entrega oportuna, la capacitación y el soporte posventa. Los hospitales de Arabia Saudita, Emiratos Árabes Unidos y Egipto dependen de la adquisición mediante licitación para implementaciones a gran escala. Los contratos de servicio a largo plazo y los acuerdos de mantenimiento de equipos refuerzan el dominio de las licitaciones directas. Las aprobaciones regulatorias y las asociaciones gubernamentales también favorecen la adquisición directa

Se espera que el segmento de Ventas Minoristas experimente el mayor crecimiento durante el período de pronóstico, impulsado por la creciente demanda de hospitales privados, clínicas y centros de diagnóstico más pequeños que buscan la adquisición a menor escala de agujas desechables y kits de biopsia. La creciente presencia de distribuidores locales y canales de comercio electrónico en los países de Oriente Medio y África (MEA) respalda este crecimiento. Las ventas minoristas ofrecen opciones de compra flexibles y rápidas para centros pequeños. Las cadenas privadas de diagnóstico y los centros ambulatorios emergentes impulsan la demanda minorista. La comodidad, la rápida disponibilidad y la variedad de productos impulsan la adopción minorista.

Análisis regional del mercado de biopsia con aguja en Oriente Medio y África

- Arabia Saudita dominó el mercado de biopsia con aguja de MEA en 2025 con una participación del 28,5%, caracterizada por una creciente inversión en infraestructura de atención médica, una mayor concienciación de los pacientes y una fuerte presencia de proveedores clave de equipos de diagnóstico.

- Los hospitales y centros de diagnóstico del país valoran altamente la precisión, eficiencia y seguridad que ofrecen los procedimientos de biopsia con aguja para el diagnóstico de tumores, infecciones y enfermedades crónicas.

- Esta adopción generalizada está respaldada además por instalaciones de atención médica avanzadas, profesionales médicos capacitados y fuertes iniciativas gubernamentales para la detección y el diagnóstico temprano del cáncer, lo que establece la biopsia con aguja como una solución de diagnóstico preferida para las instituciones de atención médica públicas y privadas.

Análisis del mercado de biopsias con aguja en Arabia Saudita

El mercado de biopsias con aguja de Arabia Saudita capturó la mayor participación en los ingresos, con un 28,5 %, en 2025, impulsado por la creciente prevalencia del cáncer, las crecientes inversiones en infraestructura sanitaria y la mayor adopción de procedimientos de diagnóstico mínimamente invasivos. Los hospitales y centros de diagnóstico priorizan la toma precisa y eficiente de muestras de tejido para el diagnóstico de oncología, infecciones y enfermedades crónicas. El creciente número de centros oncológicos especializados, sumado a las iniciativas gubernamentales para la detección temprana y el cribado del cáncer, está impulsando significativamente el crecimiento del mercado. Además, la creciente integración de sistemas de biopsia guiados por imagen y asistidos por robot está mejorando la precisión y la seguridad de los procedimientos. La fuerte preferencia de los médicos y la concienciación de los pacientes están impulsando una mayor adopción en centros sanitarios públicos y privados. El mercado también se ve respaldado por la colaboración entre proveedores globales y hospitales locales para tecnologías avanzadas de biopsia.

Análisis del mercado de biopsias con aguja en los EAU

Se espera que el mercado de biopsias con aguja en los EAU crezca a una tasa de crecimiento anual compuesta (TCAC) sustancial durante el período de pronóstico, impulsado principalmente por el alto gasto en atención médica, el aumento de la incidencia de cáncer y la modernización de los hospitales con tecnologías de diagnóstico avanzadas. Los centros de diagnóstico y hospitales están invirtiendo en sistemas de biopsia de aguja fina, guiada por imagen y de núcleo para mejorar la precisión y los resultados de los pacientes. La creciente concienciación de los pacientes sobre los procedimientos mínimamente invasivos y una recuperación más rápida está impulsando la demanda. Además, el enfoque del gobierno de los EAU en la innovación sanitaria y el turismo médico está impulsando la expansión del mercado. Los hospitales urbanos y las cadenas privadas de diagnóstico están adoptando agujas de biopsia desechables y asistidas por robot para mejorar la eficiencia. La región también se beneficia de una amplia disponibilidad de profesionales clínicos cualificados en procedimientos avanzados de biopsia.

Análisis del mercado de biopsias con aguja en Egipto

Se prevé que el mercado egipcio de biopsias con aguja crezca a una tasa de crecimiento anual compuesta (TCAC) notable durante el período de pronóstico, impulsado por el aumento de la prevalencia del cáncer, el aumento de la inversión en infraestructura hospitalaria y la creciente demanda de diagnósticos mínimamente invasivos. Los hospitales y centros de diagnóstico especializados utilizan cada vez más procedimientos de biopsia guiada por imágenes y núcleo para tumores y muestreos específicos de órganos. La preferencia de los pacientes por procedimientos menos invasivos con una recuperación más rápida impulsa su adopción. La expansión de centros de oncología y diagnóstico en grandes ciudades como El Cairo y Alejandría está impulsando aún más el crecimiento del mercado. La colaboración entre distribuidores locales y fabricantes globales de equipos de biopsia está mejorando la accesibilidad al mercado. Los crecientes programas de concienciación para la detección temprana del cáncer y los trastornos hematológicos también contribuyen al crecimiento.

Análisis del mercado de biopsias con aguja en Kenia

Se espera que el mercado de biopsias con aguja en Kenia se expanda a una tasa de crecimiento anual compuesta (TCAC) considerable durante el período de pronóstico, impulsado por el mayor acceso a tecnologías de diagnóstico modernas y la creciente incidencia del cáncer y las enfermedades crónicas. Los hospitales y centros de diagnóstico en zonas urbanas están adoptando sistemas de biopsia con aguja gruesa y desechable para mejorar la eficiencia diagnóstica. Las iniciativas gubernamentales que promueven la detección y el diagnóstico temprano del cáncer están impulsando el crecimiento del mercado. La infraestructura limitada en las zonas rurales se está abordando gradualmente mediante unidades de diagnóstico móviles y procedimientos de biopsia con asistencia telemédica. La adopción de programas de capacitación para profesionales clínicos en procedimientos guiados por imagen está aumentando. El mercado se beneficia de la colaboración entre fabricantes internacionales de dispositivos de biopsia y profesionales sanitarios locales.

Cuota de mercado de biopsia con aguja en Oriente Medio y África

La industria de biopsia con aguja en Oriente Medio y África está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- BD (EE. UU.)

- Argon Medical Devices (EE. UU.)

- Cook (EE. UU.)

- Boston Scientific Corporation (EE. UU.)

- Hologic, Inc. (EE. UU.)

- Medtronic (Irlanda)

- B. Braun SE (Alemania)

- Siemens Healthineers AG (Alemania)

- Olympus Corporation (Japón)

- Merit Medical Systems, Inc. (EE. UU.)

- Stryker (EE. UU.)

- Leica Biosystems Nussloch GmbH (Alemania)

- PAJUNK (Alemania)

- INRAD, Inc. (EE. UU.)

- FUJIFILM Holdings Corporation (Japón)

- GE Healthcare (EE. UU.)

- Koninklijke Philips NV (Países Bajos)

- Scion Medical Technologies, LLC (EE. UU.)

- Laboratorio TSK (Japón)

- Devicor Medical Products, Inc. (EE. UU.)

¿Cuáles son los desarrollos recientes en el mercado de biopsia con aguja en Oriente Medio y África?

- En octubre de 2025, Olympus anunció el lanzamiento de SecureFlex, un dispositivo de biopsia con aguja fina de un solo uso en la región EMEA. Este dispositivo está diseñado para usarse junto con endoscopios de ultrasonido y se describe en el canal de comunicados de prensa de la compañía en MEA, indicando su disponibilidad en los mercados de Oriente Medio y África.

- En septiembre de 2025, Olympus también lanzó el broncoscopio de ultrasonido endobronquial (EBUS) BF-UCP190F, una herramienta utilizada en la punción-aspiración transbronquial con aguja (PTBA) guiada por ultrasonido endobronquial en la región EMEA, incluyendo Oriente Medio y África. Está directamente relacionado con los procedimientos de biopsia con aguja (muestreo broncoscópico), lo que aumenta la capacidad de diagnóstico por biopsia en MEA.

- En junio de 2024, una revista del sector sanitario de Oriente Medio y África publicó que, en Egipto, Alameda Healthcare Group firmó una alianza estratégica de siete años con Siemens Healthineers para revolucionar los servicios de diagnóstico por imagen e intervención en toda la región. Esta colaboración impulsa la expansión de la capacidad de diagnóstico mínimamente invasivo en Oriente Medio y África.

- En abril de 2024, el Instituto Sueco de Economía de la Salud (IHE) publicó un informe en abril de 2024 que destaca brechas críticas en la capacidad de diagnóstico del cáncer de mama en nueve países de MEA, incluido el acceso limitado a la biopsia con aguja gruesa y retrasos en el diagnóstico.

- En abril de 2021, el Hospital Americano de Dubái realizó su primera biopsia pulmonar guiada por fluoroscopia por TC utilizando un escáner de TC de baja dosis de radiación recientemente adquirido, empleando una técnica de aguja coaxial para mejorar la seguridad y reducir la invasividad.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.