Middle East And Africa Molecular Diagnostics Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.16 Billion

USD

1.86 Billion

2025

2033

USD

1.16 Billion

USD

1.86 Billion

2025

2033

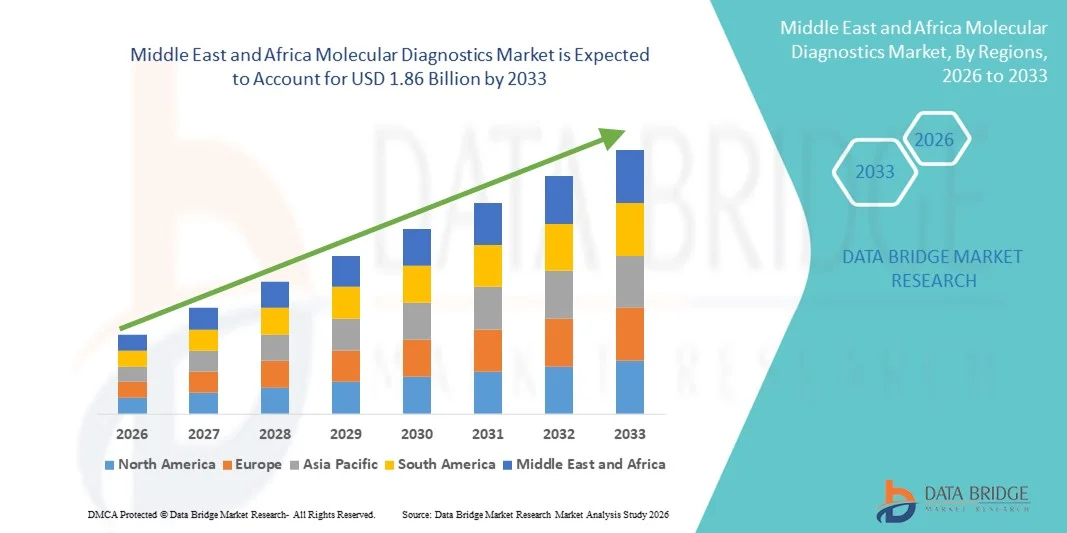

| 2026 –2033 | |

| USD 1.16 Billion | |

| USD 1.86 Billion | |

|

|

|

|

Segmentación del mercado de diagnóstico molecular en Oriente Medio y África, por productos (reactivos y kits, instrumentos, servicios y software), tecnología (espectrometría de masas [MS], electroforesis capilar, secuenciación de nueva generación [NGS], chips y microarrays, métodos basados en la reacción en cadena de la polimerasa [PCR], citogenética, hibridación in situ [ISH o FISH], imágenes moleculares y otros), aplicación (oncología, farmacogenómica, microbiología, pruebas prenatales, tipificación de tejidos, análisis de sangre, enfermedades cardiovasculares, enfermedades neurológicas, enfermedades infecciosas y otras), usuario final (hospitales, laboratorios clínicos y académicos): tendencias de la industria y pronóstico hasta 2033.

Tamaño del mercado de diagnóstico molecular en Oriente Medio y África

- El tamaño del mercado de diagnóstico molecular de Medio Oriente y África se valoró en USD 1.16 mil millones en 2025 y se espera que alcance los USD 1.86 mil millones para 2033 , con una CAGR del 6,1% durante el período de pronóstico.

- El crecimiento del mercado está impulsado principalmente por la creciente prevalencia de enfermedades infecciosas, trastornos genéticos y afecciones crónicas, combinado con avances en tecnologías de pruebas moleculares como PCR, secuenciación de próxima generación y métodos de amplificación isotérmica en hospitales, laboratorios de diagnóstico y entornos de punto de atención.

- Además, el aumento de la inversión en atención médica, la creciente concienciación sobre la detección temprana de enfermedades y las iniciativas gubernamentales para mejorar la infraestructura de laboratorio están posicionando el diagnóstico molecular como una herramienta crucial para el diagnóstico oportuno y preciso de los pacientes. Estos factores están acelerando su adopción, impulsando significativamente la trayectoria de crecimiento del mercado en la región MEA.

Análisis del mercado de diagnóstico molecular en Oriente Medio y África

- Los diagnósticos moleculares, que abarcan tecnologías avanzadas para detectar biomarcadores de ADN, ARN y proteínas, son cada vez más críticos en hospitales, laboratorios clínicos y centros de investigación académica en los países de MEA debido a su alta precisión, resultados rápidos y papel en la medicina personalizada.

- La creciente demanda de diagnósticos moleculares está impulsada principalmente por la creciente prevalencia de enfermedades infecciosas, cáncer y trastornos genéticos, junto con la creciente adopción de tecnologías como métodos basados en PCR, secuenciación de próxima generación (NGS) y plataformas de microarrays, que permiten un diagnóstico más rápido y preciso.

- Los Emiratos Árabes Unidos (EAU) dominaron el mercado de diagnóstico molecular de MEA con la mayor participación en los ingresos del 22,4 % en 2025, respaldado por iniciativas gubernamentales para fortalecer la infraestructura de atención médica, expandir las capacidades de pruebas moleculares y mejorar la vigilancia de enfermedades, junto con importantes inversiones en instrumentos y reactivos de diagnóstico de última generación.

- Se espera que Sudáfrica sea el país de más rápido crecimiento en el mercado de diagnóstico molecular de MEA durante el período de pronóstico debido al aumento del gasto en atención médica, el mejor acceso a las instalaciones de laboratorio y la creciente conciencia de la detección temprana de enfermedades y la medicina de precisión.

- El segmento de reactivos y kits dominó el mercado de diagnóstico molecular con una participación de mercado del 48,3 % en 2025, impulsado por la creciente demanda de consumibles de alta calidad, soluciones rentables para PCR, NGS y pruebas de enfermedades infecciosas, y programas de salud pública en curso que requieren kits de diagnóstico estandarizados.

Alcance del informe y segmentación del mercado de diagnóstico molecular en Oriente Medio y África

|

Atributos |

Perspectivas clave del mercado de diagnóstico molecular en Oriente Medio y África |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología de pacientes, análisis de canalización, análisis de precios y marco regulatorio. |

Tendencias del mercado de diagnóstico molecular en Oriente Medio y África

Avances en pruebas rápidas y en el punto de atención

- Una tendencia notable y en aceleración en el mercado de diagnóstico molecular de MEA es la creciente adopción de plataformas de pruebas rápidas y en el punto de atención (POC), lo que permite tomar decisiones de diagnóstico y tratamiento más rápidas, particularmente en áreas remotas o desatendidas.

- Por ejemplo, el sistema GeneXpert de Cepheid se ha implementado cada vez más en Sudáfrica y Nigeria para proporcionar pruebas rápidas de tuberculosis y COVID-19 en ubicaciones descentralizadas, lo que reduce los tiempos de respuesta de días a horas.

- La integración de diagnósticos moleculares POC con informes digitales y plataformas de salud móviles está permitiendo la vigilancia de enfermedades en tiempo real y el seguimiento epidemiológico en hospitales y clínicas, mejorando la gestión de los pacientes.

- Los avances tecnológicos, como la microfluídica y las soluciones de laboratorio en un chip, están mejorando la sensibilidad y especificidad de las pruebas al tiempo que minimizan el volumen de la muestra y la complejidad operativa.

- Esta tendencia hacia soluciones de pruebas moleculares más portátiles, precisas y conectadas está cambiando las expectativas de la prestación de servicios de salud, impulsando a empresas como Roche Diagnostics y Abbott a desarrollar instrumentos compactos y de alto rendimiento adecuados para entornos de atención médica de MEA.

- La demanda de diagnósticos moleculares rápidos, fáciles de usar y descentralizados está aumentando rápidamente tanto en los programas de salud pública como en los laboratorios clínicos privados, impulsada por la necesidad de detección y monitoreo oportunos de enfermedades.

- La colaboración entre las empresas de diagnóstico y los gobiernos locales para implementar unidades de prueba móviles y comunitarias está impulsando aún más la adopción en zonas rurales y de difícil acceso, aumentando el acceso a los diagnósticos moleculares en toda la región.

Dinámica del mercado de diagnóstico molecular en Oriente Medio y África

Conductor

Aumento de la prevalencia de enfermedades infecciosas y afecciones crónicas

- La creciente incidencia de enfermedades infecciosas como el VIH, la tuberculosis, la hepatitis y la COVID-19, junto con el aumento de casos de cáncer y trastornos genéticos, es un impulsor importante de la adopción de diagnósticos moleculares en los centros de atención médica de MEA.

- Por ejemplo, en 2025, Arabia Saudita amplió los programas nacionales de detección de tuberculosis integrando pruebas moleculares basadas en PCR en laboratorios clínicos para mejorar la detección temprana y los resultados del tratamiento.

- Los diagnósticos moleculares proporcionan una detección rápida, precisa y sensible, lo que permite una toma de decisiones clínicas oportuna, mejores resultados para los pacientes y un manejo eficiente de la enfermedad.

- Las crecientes inversiones en infraestructura de laboratorio avanzada, apoyadas por iniciativas de atención médica gubernamentales en países como los Emiratos Árabes Unidos y Egipto, están facilitando la adopción de sofisticadas plataformas de pruebas moleculares.

- La creciente conciencia entre los médicos y los pacientes sobre los beneficios del diagnóstico temprano y la medicina personalizada está acelerando aún más la adopción de tecnologías de diagnóstico molecular tanto en entornos hospitalarios como de laboratorios privados.

- La expansión de los programas de salud pública, el aumento del gasto en atención médica y la creciente adopción de plataformas de diagnóstico avanzadas impulsan colectivamente el crecimiento del mercado en toda la región MEA.

- Los proveedores de atención médica privados en MEA se asocian cada vez más con empresas de diagnóstico globales para implementar tecnologías moleculares de vanguardia, creando nuevas oportunidades de mercado e impulsando la adopción general.

- La aparición de pruebas moleculares para enfermedades no transmisibles, como trastornos cardiovasculares y neurológicos, está ampliando las aplicaciones y contribuyendo al crecimiento del mercado más allá del diagnóstico de enfermedades infecciosas.

Restricción/Desafío

Alto costo de los instrumentos y escasez de mano de obra calificada

- El costo relativamente alto de los instrumentos de diagnóstico molecular, los consumibles y el mantenimiento, en comparación con los métodos de diagnóstico tradicionales, plantea un desafío de adopción significativo en los mercados de MEA sensibles a los precios.

- Por ejemplo, los altos costos de las plataformas NGS y los reactivos asociados en Egipto y Nigeria limitan la accesibilidad en clínicas más pequeñas y entornos de atención médica rurales, lo que ralentiza la penetración generalizada.

- La escasez de personal de laboratorio capacitado y de experiencia técnica para operar plataformas complejas de diagnóstico molecular restringe aún más el crecimiento del mercado, en particular en los países del África subsahariana.

- Los desafíos en torno a las aprobaciones regulatorias, el control de calidad y la estandarización de las pruebas moleculares en varios países de MEA agregan complejidad a las estrategias de lanzamiento de productos e ingreso al mercado.

- Para abordar estos desafíos se requieren inversiones en capacitación de la fuerza laboral, soluciones de pruebas rentables y marcos regulatorios sólidos para facilitar la adopción de diagnósticos confiables.

- Si bien los precios de algunos kits de pruebas moleculares simplificadas y de POC están disminuyendo gradualmente, el precio de las tecnologías avanzadas y la experiencia local limitada siguen restringiendo la adopción rápida y uniforme en toda la región.

- Las cadenas de suministro inconsistentes de reactivos y kits en ciertos países de MEA causan demoras y limitan la disponibilidad de pruebas, lo que crea obstáculos operativos para laboratorios y hospitales.

- La limitada conciencia entre las clínicas más pequeñas y los proveedores de atención médica rurales sobre los diagnósticos moleculares avanzados reduce el potencial de adopción, lo que destaca la necesidad de programas de educación y divulgación.

Alcance del mercado de diagnóstico molecular en Oriente Medio y África

El mercado está segmentado en función de los productos, la tecnología, la aplicación y el usuario final.

- Por productos

En cuanto a los productos, el mercado de diagnóstico molecular en Oriente Medio y África (MEA) se segmenta en reactivos y kits, instrumentos, y servicios y software. El segmento de reactivos y kits dominó el mercado con la mayor participación en los ingresos, un 48,3%, en 2025, impulsado por la creciente demanda de consumibles para pruebas basadas en PCR, NGS, paneles de enfermedades infecciosas y diagnósticos oncológicos. Los laboratorios de los Emiratos Árabes Unidos, Arabia Saudita y Sudáfrica priorizan reactivos de alta calidad para garantizar resultados fiables y precisos, especialmente para aplicaciones de alto rendimiento. Esta demanda también se ve impulsada por los programas de salud pública financiados por el gobierno, dirigidos a las pruebas de tuberculosis, VIH y COVID-19, que dependen en gran medida de kits estandarizados. Además, los reactivos y kits son relativamente más fáciles de implementar en centros descentralizados y de punto de atención, lo que los convierte en la columna vertebral de las operaciones de diagnóstico molecular en Oriente Medio y África.

Se prevé que el segmento de Instrumentos registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 10,2 %, entre 2026 y 2033, impulsada por la adopción de plataformas avanzadas como sistemas de PCR automatizados, secuenciadores NGS y analizadores de microarrays. Países como Arabia Saudita y Emiratos Árabes Unidos están invirtiendo en instrumentos de alto rendimiento para fortalecer las capacidades de hospitales y laboratorios clínicos. Este crecimiento también se ve respaldado por la creciente demanda de tecnologías de diagnóstico rápido en oncología y el manejo de enfermedades infecciosas, junto con la creciente adopción de iniciativas de medicina de precisión en hospitales públicos y privados. El crecimiento del segmento de Instrumentos se ve impulsado aún más por las colaboraciones entre empresas globales de diagnóstico y proveedores de atención médica locales para implementar infraestructuras de laboratorio modernas.

- Por tecnología

En función de la tecnología, el mercado está segmentado en espectrometría de masas (MS), electroforesis capilar, secuenciación de nueva generación (NGS), chips y microarrays, métodos basados en la reacción en cadena de la polimerasa (PCR), citogenética, hibridación in situ (ISH o FISH), imágenes moleculares y otros. El segmento de métodos basados en PCR dominó el mercado con una participación en los ingresos del 50,6% en 2025, debido a su amplia aplicación en la detección de enfermedades infecciosas, oncología y pruebas prenatales. La PCR sigue siendo el estándar de oro para la detección rápida, sensible y específica de patógenos y marcadores genéticos. Los hospitales y laboratorios clínicos de los Emiratos Árabes Unidos, Egipto y Nigeria dependen en gran medida de las plataformas de PCR para la detección de tuberculosis, COVID-19 y hepatitis. El dominio del segmento también se ve reforzado por la disponibilidad de kits rentables, la creciente conciencia sobre el diagnóstico temprano y los programas de vigilancia de enfermedades liderados por el gobierno.

Se prevé que el segmento de secuenciación de nueva generación (NGS) experimente la tasa de crecimiento más rápida, con una tasa de crecimiento anual compuesta (TCAC) del 11,5 % entre 2026 y 2033, impulsada por la creciente adopción en oncología, farmacogenómica y pruebas de enfermedades raras. La tecnología NGS permite la elaboración de perfiles genómicos integrales, lo que orienta las decisiones terapéuticas personalizadas y las aplicaciones de investigación. Los países del CCG, en particular Arabia Saudí y los Emiratos Árabes Unidos, están expandiendo activamente la infraestructura de NGS en hospitales y centros académicos. El creciente enfoque en la medicina de precisión y las inversiones en plataformas de secuenciación de alto rendimiento están acelerando aún más el crecimiento de este segmento.

- Por aplicación

Según la aplicación, el mercado se segmenta en oncología, farmacogenómica, microbiología, pruebas prenatales, tipificación de tejidos, análisis de sangre, enfermedades cardiovasculares, enfermedades neurológicas, enfermedades infecciosas, entre otras. El segmento de enfermedades infecciosas dominó el mercado con una participación en los ingresos del 46,5 % en 2025, impulsado por la alta prevalencia de tuberculosis, VIH, hepatitis y COVID-19 en los países de Oriente Medio y África. Los gobiernos de Sudáfrica, Nigeria y Egipto han implementado programas de cribado a gran escala mediante diagnóstico molecular, lo que ha incrementado el consumo de reactivos y servicios de análisis. Las pruebas de enfermedades infecciosas también se benefician de la implementación en el punto de atención en clínicas y laboratorios móviles, lo que mejora la accesibilidad en zonas remotas. Este segmento sigue siendo un foco clave para las iniciativas de salud pública, lo que garantiza una demanda sostenida y el liderazgo del mercado.

Se prevé que el segmento de Oncología experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 12,1 %, entre 2026 y 2033, impulsada por la creciente prevalencia del cáncer, la mayor concienciación sobre el diagnóstico precoz y la adopción de pruebas moleculares para terapias dirigidas. Las tecnologías de NGS, PCR y microarrays se utilizan cada vez más para la elaboración de perfiles tumorales, la detección de mutaciones y el seguimiento de la respuesta al tratamiento. Los Emiratos Árabes Unidos y Arabia Saudí están invirtiendo en diagnóstico molecular centrado en la oncología en hospitales de atención terciaria y centros de investigación académica. La expansión de las iniciativas de medicina personalizada y el aumento de la inversión en la sanidad privada son factores clave para el rápido crecimiento de este segmento.

- Por el usuario final

Según el usuario final, el mercado se segmenta en hospitales, laboratorios clínicos y el sector académico. El segmento Hospitalario dominó el mercado con una participación en los ingresos del 51,2 % en 2025, gracias al alto volumen de pacientes, la adopción a gran escala de diagnósticos moleculares para enfermedades infecciosas, oncología y pruebas prenatales, y las inversiones en infraestructura de laboratorio avanzada. Los principales hospitales de los Emiratos Árabes Unidos, Arabia Saudita y Sudáfrica están integrando cada vez más las pruebas moleculares en los diagnósticos rutinarios para agilizar los resultados y mejorar la atención al paciente. Los hospitales también prefieren soluciones integrales que incluyan instrumentos, reactivos y software, lo que genera una demanda integral para los proveedores.

Se prevé que el segmento de Laboratorios Clínicos experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 10,8 %, entre 2026 y 2033, impulsada por el auge de las cadenas privadas de diagnóstico, los laboratorios especializados y las instalaciones de pruebas en el punto de atención en centros urbanos. Países como Nigeria, Egipto y Sudáfrica están experimentando un aumento en el número de laboratorios privados que ofrecen pruebas moleculares de alto rendimiento para enfermedades infecciosas, oncología y farmacogenómica. La creciente colaboración entre empresas internacionales de diagnóstico y laboratorios locales, junto con la externalización de servicios de pruebas moleculares, está acelerando la adopción y el crecimiento del mercado en este segmento.

Análisis regional del mercado de diagnóstico molecular en Oriente Medio y África

- Los Emiratos Árabes Unidos (EAU) dominaron el mercado de diagnóstico molecular de MEA con la mayor participación en los ingresos del 22,4 % en 2025, respaldado por iniciativas gubernamentales para fortalecer la infraestructura de atención médica, expandir las capacidades de pruebas moleculares y mejorar la vigilancia de enfermedades, junto con importantes inversiones en instrumentos y reactivos de diagnóstico de última generación.

- Los proveedores de atención médica y los laboratorios en los Emiratos Árabes Unidos priorizan la adopción de PCR, NGS y plataformas de pruebas moleculares en el punto de atención debido a la alta prevalencia de enfermedades infecciosas, la creciente demanda de diagnósticos oncológicos y la necesidad de resultados rápidos y precisos tanto para pruebas de rutina como especializadas.

- Esta sólida posición en el mercado se ve respaldada además por el alto gasto sanitario del país, su población tecnológicamente avanzada y el creciente enfoque en la medicina de precisión, lo que establece el diagnóstico molecular como una herramienta fundamental para la gestión de pacientes y los programas de salud pública tanto en el sector privado como en el público.

Perspectiva del mercado de diagnóstico molecular de los EAU

El mercado de diagnóstico molecular de los EAU captó la mayor participación en los ingresos, con un 22,4%, en 2025, impulsado por importantes inversiones en infraestructura sanitaria, laboratorios avanzados e iniciativas gubernamentales para ampliar la capacidad de análisis molecular. Los hospitales y laboratorios clínicos de los EAU están adoptando cada vez más plataformas de PCR, NGS y de punto de atención para enfermedades infecciosas, oncología y análisis prenatales. El creciente enfoque en la medicina de precisión, sumado al elevado gasto sanitario y a una población tecnológicamente avanzada, está acelerando la adopción del diagnóstico molecular en los sectores público y privado. Además, la colaboración entre empresas internacionales de diagnóstico y hospitales locales está mejorando la accesibilidad y la implementación de soluciones diagnósticas de vanguardia.

Análisis del mercado de diagnóstico molecular en Arabia Saudita

El mercado de diagnóstico molecular de Arabia Saudita ocupó la segunda mayor cuota de ingresos, con un 20,8%, en 2025, gracias a programas nacionales de detección temprana de enfermedades y la adopción de plataformas de pruebas moleculares de alto rendimiento. Los hospitales y laboratorios de diagnóstico del país están implementando cada vez más tecnologías de PCR, NGS y microarrays para aplicaciones en oncología, enfermedades infecciosas y farmacogenómica. El aumento de las inversiones en infraestructura sanitaria, junto con las iniciativas gubernamentales para fortalecer las redes de laboratorios, está impulsando el crecimiento del mercado. Además, la creciente concienciación sobre el diagnóstico temprano y la medicina personalizada está estimulando la demanda en los segmentos hospitalario y de laboratorios privados.

Perspectivas del mercado de diagnóstico molecular en Sudáfrica

El mercado sudafricano de diagnóstico molecular se perfila como el de mayor crecimiento en Oriente Medio y África, con una tasa de crecimiento anual compuesta (TCAC) proyectada del 9,3 %, impulsado por la creciente concienciación sobre la detección temprana de enfermedades y la expansión de la infraestructura de los laboratorios clínicos. El país está experimentando un creciente despliegue de plataformas de diagnóstico molecular descentralizadas y en el punto de atención, en particular para enfermedades infecciosas como el VIH y la tuberculosis. Las iniciativas gubernamentales que apoyan los programas de vigilancia de enfermedades, junto con el crecimiento de las cadenas privadas de diagnóstico, están facilitando la expansión del mercado. Además, la adopción de instrumentos de alto rendimiento en hospitales de atención terciaria y centros de investigación está aumentando la capacidad y la eficiencia general de las pruebas.

Análisis del mercado de diagnóstico molecular en Egipto

El mercado egipcio de diagnóstico molecular representó el 12,7 % del mercado de Oriente Medio y África en 2025, impulsado por iniciativas gubernamentales para mejorar la detección de enfermedades infecciosas y el diagnóstico de laboratorio. Hospitales y laboratorios clínicos están invirtiendo en tecnologías de PCR y NGS para satisfacer la creciente demanda de pruebas rápidas, precisas y fiables. La expansión de los servicios de salud privados, la mayor concienciación sobre la detección temprana y las colaboraciones con empresas internacionales de diagnóstico contribuyen al crecimiento del mercado. Además, la creciente prevalencia de enfermedades infecciosas y casos de oncología está impulsando la adopción del diagnóstico molecular en las regiones urbanas y semiurbanas.

Cuota de mercado del diagnóstico molecular en Oriente Medio y África

La industria de diagnóstico molecular de Oriente Medio y África está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Abbott (EE. UU.)

- BIOMÉRIEUX (Francia)

- Thermo Fisher Scientific Inc. (EE. UU.)

- Bio-Rad Laboratories, Inc. (EE. UU.)

- Meridian Bioscience, Inc. (EE. UU.)

- Illumina, Inc. (EE. UU.)

- Siemens Healthineers AG (Alemania)

- Hologic, Inc. (EE. UU.)

- Agilent Technologies, Inc. (EE. UU.)

- BD (EE. UU.)

- DiaSorin SpA (Italia)

- Quidel Corporation (EE. UU.)

- SD Biosensor, Inc. (Corea del Sur)

- Mindray Medical International (China)

- Astragene (EAU)

- Euroimmun Medizinische Labordiagnostika AG (Alemania)

- F. Hoffmann-La Roche Ltd. (Suiza)

- QIAGEN (Países Bajos)

- Danaher (Estados Unidos)

¿Cuáles son los desarrollos recientes en el mercado de diagnóstico molecular de Oriente Medio y África?

- En marzo de 2025, Illumina y Africa CDC renovaron su asociación para integrar la genómica y la bioinformática de patógenos en la vigilancia rutinaria de la salud pública en África, impulsando las capacidades de respuesta rápida a enfermedades infecciosas y reforzando la infraestructura de diagnóstico molecular en todo el continente.

- En diciembre de 2024, Abbott se asoció con ISN para transformar las pruebas de atención médica privada en Nigeria, lanzando una iniciativa estratégica para implementar 50 máquinas de diagnóstico m-PIMA™ en centros de atención médica privados para mejorar el acceso a los diagnósticos moleculares y en el punto de atención, haciendo que las pruebas avanzadas sean más asequibles y sostenibles para los laboratorios de todo el país.

- En diciembre de 2024, la Iniciativa Presidencial para Desbloquear las Cadenas de Valor de la Atención Médica (PVAC) firmó un memorando de entendimiento con Abbott Rapid Diagnostics para localizar la producción de pruebas de diagnóstico rápido en Nigeria, con el objetivo de aumentar los kits de diagnóstico molecular producidos localmente y reducir la dependencia de las importaciones, una medida que se espera mejore la disponibilidad y asequibilidad de las pruebas rápidas en África Occidental.

- En septiembre de 2024, Roche lanzó la prueba cobas Respiratory flex, el primer ensayo de diagnóstico molecular que utiliza su tecnología patentada TAGS (generación de señal activada por temperatura) que permite la detección simultánea basada en PCR de hasta 12 patógenos respiratorios a partir de una sola muestra, mejorando la capacidad de pruebas de alto rendimiento en los laboratorios de diagnóstico.

- En abril de 2024, los CDC de África iniciaron dos proyectos emblemáticos de vigilancia genómica y diagnóstico molecular: la Plataforma Integrada de Vigilancia Genómica e Intercambio de Datos (IGS) y la Vigilancia Genómica Integrada para la Detección de Brotes (DETECT), para fortalecer la detección de múltiples patógenos, la vigilancia genómica de la resistencia a los antimicrobianos (RAM) y el intercambio rápido de datos entre los estados miembros de la Unión Africana.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.