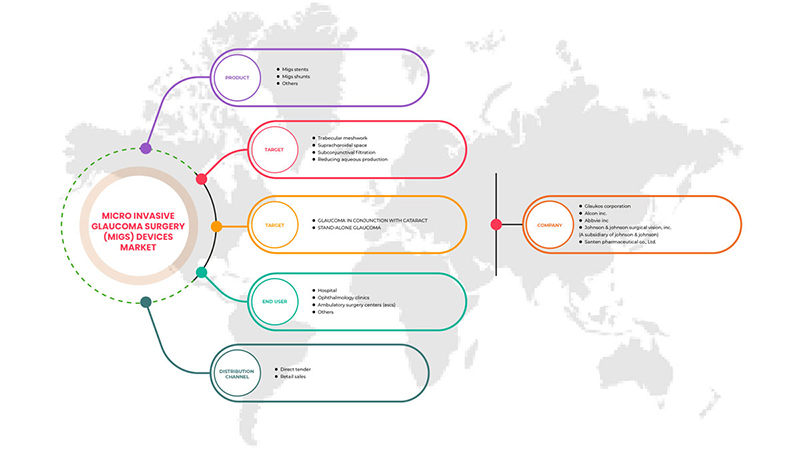

Mercado de dispositivos de cirugía microinvasiva de glaucoma (MIGS) en Oriente Medio y África, por producto (stents MIGS, derivaciones MIGS y otros), objetivo (filtración subconjuntival del espacio supracoroideo de malla trabecular y reducción de la producción acuosa), tipo de cirugía (glaucoma en conjunción con cataratas y glaucoma independiente ), usuario final (departamentos ambulatorios de hospitales (HOPD), clínicas de oftalmología, centros de cirugía ambulatoria (ASCS) y otros), canal de distribución (licitación directa y ventas minoristas): tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado de dispositivos de cirugía microinvasiva para el glaucoma (MIGS) en Oriente Medio y África

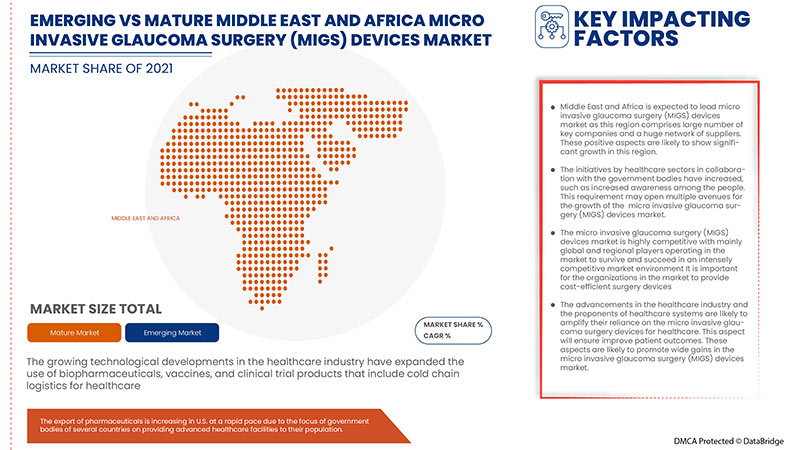

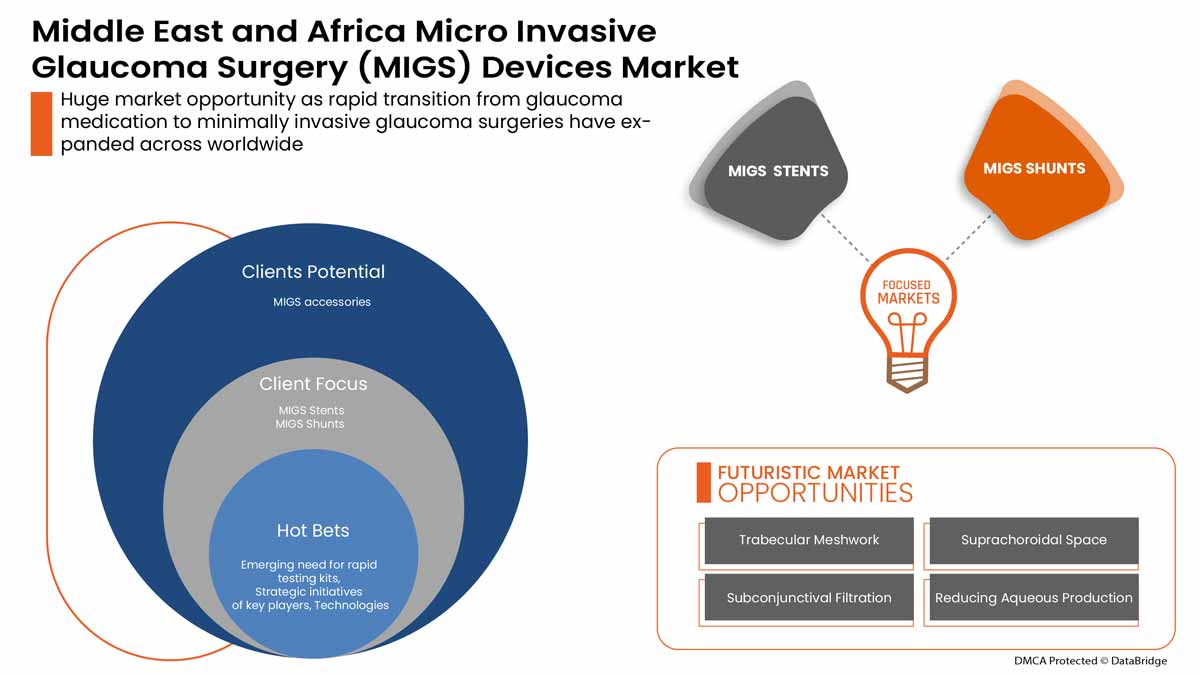

La cirugía microinvasiva para el glaucoma se utiliza para tratar el glaucoma de ángulo abierto. Inicialmente, para tratar el glaucoma de ángulo abierto, se administraban medicamentos que reducían la producción de humor acuoso o aumentaban su drenaje. Para el glaucoma de ángulo abierto de leve a moderado, tradicionalmente se realizaba un tratamiento farmacológico y con láser. Con la llegada de los procedimientos de cirugía microinvasiva para el glaucoma (MIGS), se crearon nuevas opciones para aquellos que no eran aptos para la cirugía convencional. Se espera que el aumento de la población geriátrica y el aumento de las iniciativas gubernamentales para la prevención de la ceguera impulsen el mercado. La rápida transición de la medicación para el glaucoma a las cirugías mínimamente invasivas para el glaucoma podría estar creando oportunidades para el fabricante de dispositivos MIGS. Sin embargo, las deficientes facilidades de reembolso podrían actuar como un obstáculo para el mercado.

El aumento de la demanda de cirugías microinvasivas se debe a la creciente incidencia de enfermedades oculares, la creciente demanda de cirugías microinvasivas y la reducción de los traumatismos quirúrgicos, lo que impulsa la necesidad del mercado en el período de pronóstico. Sin embargo, el alto costo de instalación y la escasez de profesionales capacitados pueden obstaculizar el crecimiento del mercado de cirugía mínimamente invasiva en el período de pronóstico.

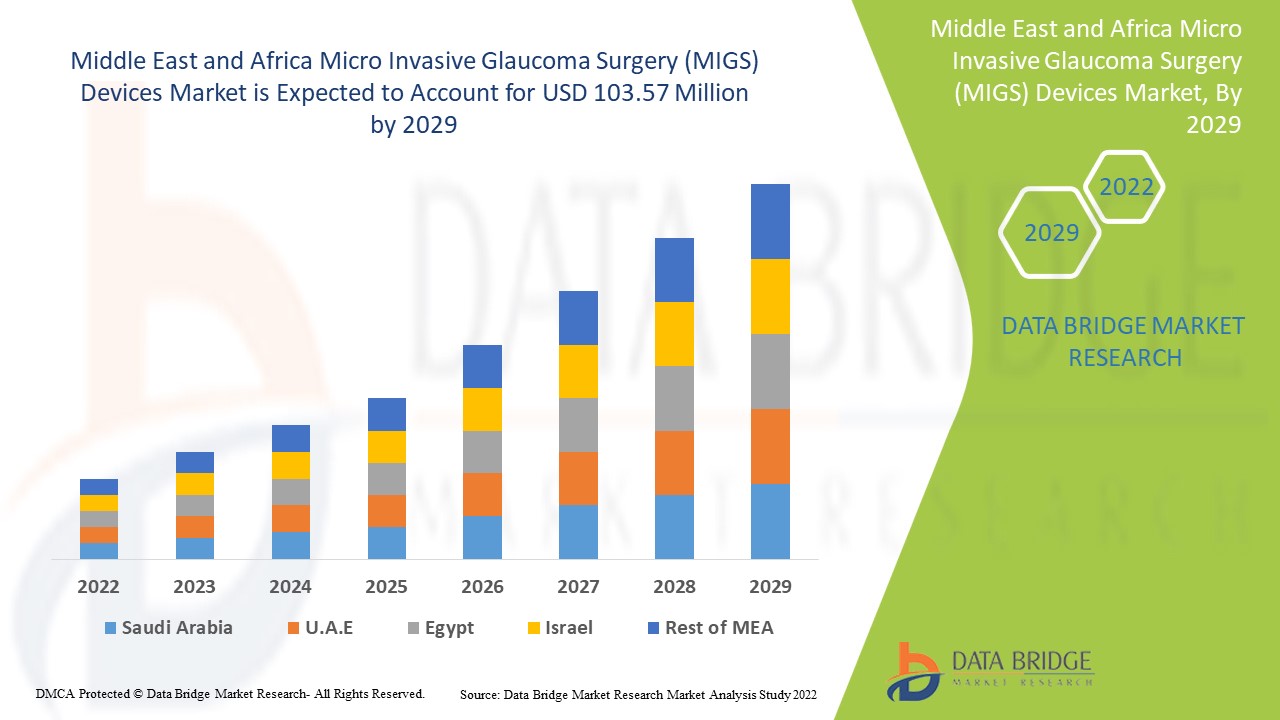

Data Bridge Market Research analiza que se espera que el mercado de dispositivos de cirugía microinvasiva de glaucoma (MIGS) alcance un valor de USD 103,57 millones para 2029, a una CAGR del 25,4% durante el período de pronóstico. Los "stents MIGS" representan el segmento tecnológico más grande en el mercado de dispositivos de cirugía microinvasiva de glaucoma (MIGS) debido a los rápidos desarrollos en las vías tecnológicas para comercializar el uso de dispositivos de cirugía microinvasiva de glaucoma (MIGS). El informe del mercado de dispositivos de cirugía microinvasiva de glaucoma (MIGS) también cubre los avances tecnológicos en profundidad.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por producto (derivación MIGS, stent MIGS y otros), objetivo (malla trabecular, espacio supracoroideo, filtración subconjuntival y reducción de la producción acuosa), cirugía (glaucoma asociado a cataratas, glaucoma independiente), usuario final (hospital, clínicas oftalmológicas, centros de cirugía ambulatoria (ASCS) y otros), canal de distribución (licitación directa y ventas minoristas) |

|

Países cubiertos |

Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Israel, Egipto, Resto de Medio Oriente y África (MEA) en Medio Oriente y África. |

|

Actores del mercado cubiertos |

AbbVie, BVI, Ellex, Glaukos Corporation, Johnson and Johnson, Alcon, Microsurgical Technology, New World Medical, Santen Pharmaceutical, Nova Eye Medical Limited, Belkin Vision y Sight Scientific, entre otros. |

Definición de mercado

MIGS son las siglas de cirugía microinvasiva para el glaucoma, que ayuda a tratar el glaucoma. Se trata de una tecnología de avanzada en el tratamiento del glaucoma leve a moderado. Es una alternativa a los medicamentos que se administraban anteriormente y también evita las complicaciones de la cirugía convencional. Estos procedimientos se utilizan para reducir la presión intraocular del ojo y evitar dañar el nervio óptico. Estos procedimientos son más seguros y tienen un tiempo de recuperación muy rápido en comparación con la cirugía convencional. Los diversos dispositivos MIGS que se implantan son shunts y stents para reducir la PIO.

Dinámica del mercado de dispositivos para cirugía microinvasiva de glaucoma (MIGS)

- Aumento de la población geriátrica

Un problema de salud importante entre las personas mayores es la pérdida de visión. Según la Academia Estadounidense de Médicos de Familia, a los 65 años, una de cada tres personas sufre una enfermedad ocular que reduce la visión. La población de personas mayores está aumentando rápidamente, por lo que esto genera una demanda de tecnologías avanzadas para tratar el glaucoma entre los adultos mayores. Por lo tanto, el aumento de la población geriátrica es un factor impulsor del mercado.

- Aumento de la incidencia del glaucoma en todo el mundo

La causa principal de la ceguera global irreversible es el glaucoma. El glaucoma es un grupo de trastornos oculares que presentan síntomas mínimos o nulos en la etapa inicial, pero que luego provocan daños en los nervios ópticos, lo que puede provocar pérdida de visión o ceguera. La prevalencia del glaucoma ha ido en aumento, lo que genera una demanda de dispositivos MIGS, por lo que se espera que la creciente incidencia del glaucoma actúe como un impulsor del mercado.

- Iniciativas gubernamentales para aumentar la conciencia sobre la prevención de la ceguera

Según la OMS, al menos 2.200 millones de personas padecen deficiencia visual y ceguera, de las cuales al menos 1.000 millones tienen una deficiencia visual que podría haberse evitado. Para prevenirlas, los gobiernos de varios países del mundo han tomado iniciativas. Esto crea una demanda de tratamientos avanzados, como la cirugía microinvasiva del glaucoma, que impulsa el mercado de dispositivos MIGS. Por lo tanto, se espera que actúe como un impulsor del mercado.

- Introducción de productos tecnológicamente avanzados.

El glaucoma es una enfermedad ocular grave que puede provocar pérdida de visión si no se controla. Generalmente no provoca ceguera, ya que se puede controlar con tratamientos modernos y muchas opciones para prevenir daños mayores. Con el aumento de los avances científicos, se ha producido un cambio revolucionario en el tratamiento del glaucoma. Con la llegada de la cirugía microinvasiva para el glaucoma, se ha producido un cambio de paradigma en la medicina, ya que puede ayudar en el tratamiento del glaucoma en una etapa temprana y evitar la dependencia de cirugías de filtración como la trabeculectomía. Esto también supera los riesgos asociados a estas cirugías incisionales. Existen varios avances en el tratamiento del glaucoma con MIGS.

Restricciones/Desafíos que enfrenta el mercado

- Normas estrictas para dispositivos MIGS

Existen al menos 7 regulaciones que cualquier fabricante de dispositivos debe cumplir completamente en los EE. UU., a saber, Registro de establecimiento y listado de dispositivos médicos, Notificación previa a la comercialización 510(k), Aprobación previa a la comercialización (PMA) (solo para dispositivos de clase tres), Exención de dispositivos en investigación (IDE) para estudios clínicos, regulación del Sistema de calidad (QS), Requisitos de etiquetado y Notificación de dispositivos médicos (MDR). Estos dispositivos de mayor riesgo necesitan un proceso regulatorio de solicitud previa a la comercialización más estricto para demostrar evidencia válida de seguridad y eficacia. Los plazos prolongados dan como resultado un acceso demorado, lo que podría restringir el mercado de dispositivos MIGS.

- Alto costo de los procedimientos quirúrgicos

Aunque los tratamientos para el glaucoma tienen resultados modestos y son más seguros que las cirugías de filtración tradicionales, tienen costos muy altos. Además, las personas pueden necesitar cirugías posteriores si la presión intraocular no se reduce de manera efectiva de inmediato. Todas estas consideraciones hacen que estos procedimientos sean altamente costosos e inaccesibles para la mayoría de las personas y, por lo tanto, los altos costos de los procedimientos quirúrgicos pueden ser una limitación en el mercado.

Acontecimientos recientes

- En enero de 2022, Glaukos anunció la inscripción del primer paciente de GLK=301 en el ensayo clínico de fase II para la enfermedad del ojo seco. Tras la aprobación exitosa del organismo regulador, este medicamento ayudará a la empresa a hacer crecer su segmento comercial.

- En enero de 2022, Alcon adquirió Ivantis, desarrollador del novedoso Hydrus Microstent, un dispositivo de cirugía de glaucoma mínimamente invasiva (MIGS). Este dispositivo quirúrgico está diseñado para reducir la presión ocular en pacientes con glaucoma de ángulo abierto. Esta adquisición mejorará la cartera de la empresa en el segmento de cirugía ocular.

Alcance del mercado de dispositivos para cirugía microinvasiva de glaucoma (MIGS)

El mercado de dispositivos para cirugía microinvasiva de glaucoma (MIGS) está segmentado en función del tipo, tipo de producto, tecnología, precio y aplicación. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Producto

- Stents MIGS

- Derivaciones MIGS

- Otros

Sobre la base del producto, el mercado de dispositivos de cirugía de glaucoma microinvasiva (MIGS) está segmentado en derivaciones MIGS, stents MIGS y otros.

Objetivo

- Malla trabecular

- Espacio supracoroideo

- Filtración subconjuntival

- Reducción de la producción acuosa

Sobre la base del objetivo, el mercado de dispositivos de cirugía de glaucoma microinvasiva (MIGS) se segmenta en malla trabecular, espacio supracoroideo, filtración subconjuntival y reducción de la producción acuosa.

Cirugía

- Glaucoma en conjunción con cataratas

- Glaucoma aislado

Sobre la base de la cirugía, el mercado de dispositivos de cirugía microinvasiva de glaucoma (MIGS) está segmentado en glaucoma junto con cataratas y glaucoma independiente.

Usuario final

- Departamentos ambulatorios de hospitales (HOPD)

- Clínicas de oftalmología

- Centros de cirugía ambulatoria (ASCS)

- Otros

Sobre la base del usuario final, el mercado de dispositivos de cirugía de glaucoma microinvasiva (MIGS) está segmentado en departamentos ambulatorios de hospitales (HOPD), clínicas de oftalmología, centros de cirugía ambulatoria (ASCS) y otros.

Canal de distribución

- Licitación directa

- Ventas al por menor

Sobre la base del canal de distribución, el mercado de dispositivos de cirugía de glaucoma microinvasiva (MIGS) está segmentado en licitación directa y ventas minoristas.

Análisis y perspectivas regionales del mercado de dispositivos para cirugía microinvasiva de glaucoma (MIGS)

Se analiza el mercado de dispositivos de cirugía de glaucoma microinvasiva (MIGS) y se proporcionan información y tendencias del tamaño del mercado por país, producto, objetivo, cirugía, usuario final y canal de distribución como se menciona anteriormente.

Los países cubiertos en el informe del mercado de dispositivos de cirugía de glaucoma microinvasiva (MIGS) son Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Israel, Egipto y el resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA).

Sudáfrica domina el mercado de dispositivos de cirugía de glaucoma microinvasiva (MIGS) en Medio Oriente y África debido al aumento de casos de glaucoma y enfermedades oculares, lo que se espera que impulse el crecimiento del mercado.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los dispositivos de cirugía microinvasiva para el glaucoma (MIGS)

El panorama competitivo del mercado de dispositivos para cirugía microinvasiva del glaucoma (MIGS) proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia regional, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento del producto, la amplitud y la variedad del producto, el dominio de la aplicación. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado de dispositivos para cirugía microinvasiva del glaucoma (MIGS).

Algunos de los principales actores que operan en el mercado de dispositivos de cirugía microinvasiva del glaucoma (MIGS) son AbbVie, BVI, Ellex, Glaukos Corporation, Johnson and Johnson, Alcon, Microsurgical Technology, New World Medical, Santen Pharmaceutical, Nova Eye Medical Limited, Belkin Vision y Sight Scientific, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCTS LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INTERNATIONAL STANDARDS

4.2 REGIONAL STANDARDS

4.3 MARKET VIEWPOINT OF KEY OPINION LEADERS

4.4 EXPECTATIONS OF FUTURE MARKET SCENARIOS

4.5 FINDINGS AND REGIONAL TRENDS

4.6 COMPETITIVE GROUPING

5 COUNTRY WISE- NO OF PROCEDURES

5.1 NORTH AMERICA

5.2 EUROPE

5.3 ASIA-PACIFIC

5.4 SOUTH AMERICA

5.5 MIDDLE EAST AND AFRICA

6 REGULATION

6.1 UNITED STATES

6.2 EUROPE

6.3 CHINA

6.4 AUSTRALIA

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN THE GERIATRIC POPULATION

7.1.2 RISE IN INCIDENCE OF GLAUCOMA ACROSS THE WORLD

7.1.3 GOVERNMENT INITIATIVES TO INCREASE AWARENESS ABOUT THE PREVENTION OF BLINDNESS

7.1.4 GROWTH IN POPULARITY OF MINIMALLY INVASIVE SURGERY ACROSS THE GLOBE

7.2 RESTRAINTS

7.2.1 INADEQUATE REIMBURSEMENT SCENARIO

7.2.2 STRINGENT REGULATIONS FOR MIGS DEVICES

7.2.3 HIGH COST OF SURGICAL PROCEDURES

7.3 OPPORTUNITIES

7.3.1 RAPID TRANSITION FROM GLAUCOMA MEDICATION TO MINIMALLY INVASIVE GLAUCOMA SURGERIES

7.3.2 INTRODUCTION OF TECHNOLOGICAL ADVANCED PRODUCT

7.4 CHALLENGES

7.4.1 LACK OF SKILLED PROFESSIONALS WITH ADEQUATE KNOWLEDGE

7.4.2 RISKS ASSOCIATED WITH THE MICRO INVASIVE GLAUCOMA SURGERY

8 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 MIGS STENTS

8.3 MIGS SHUNTS

8.4 OTHERS

9 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY TARGET

9.1 OVERVIEW

9.2 TRABECULAR MESHWORK

9.3 SUPRACHOROIDAL SPACE

9.4 SUBCONJUNCTIVAL FILTRATION

9.5 REDUCING AQUEOUS PRODUCTION

10 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY SURGERY TYPE

10.1 OVERVIEW

10.2 GLAUCOMA IN CONJUNCTION WITH CATARACT

10.3 STAND-ALONE GLAUCOMA

11 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITAL

11.3 OPHTHALMOLOGY CLINICS

11.4 AMBULATORY SURGERY CENTERS (ASCS)

11.5 OTHERS

12 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

13 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 SOUTH AFRICA

13.1.2 SAUDI ARABIA

13.1.3 U.A.E.

13.1.4 ISRAEL

13.1.5 EGYPT

13.1.6 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 GLAUKOS CORPORATION

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.4.1 RECENT DEVELOPMENT

16.2 ALCON INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.4.1 RECENT DEVELOPMENTS

16.3 ABBVIE INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.4.1 RECENT DEVELOPMENT

16.4 JOHNSON & JOHNSON SURGICAL VISION, INC. (A SUBSIDIARY OF JOHNSON & JOHNSON)

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.4.1 RECENT DEVELOPMENT

16.5 SANTEN PHARMACEUTICAL CO., LTD.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.4.1 RECENT DEVELOPMENTS

16.6 BELKIN VISION, ISRAEL

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 BVI

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.2.1 RECENT DEVELOPMENTS

16.8 ELLEX INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.2.1 RECENT DEVELOPMENTS

16.9 IOPTIMA

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 MICROSURGICAL TECHNOLOGY. (A SUBSIDIARY OF HALMA PLC)

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.2.1 RECENT DEVELOPMENT

16.11 NEW WORLD MEDICAL, INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.2.1 RECENT DEVELOPMENTS

16.12 NOVA EYE MEDICAL LIMITED

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.3.1 RECENT DEVELOPMENTS

16.13 SIGHT SCIENCES.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.3.1 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 NUMBER OF PEOPLE (AGED 40-80 YEARS, IN MILLIONS) WITH GLAUCOMA IN 2013 AND PROJECTION OF THE NUMBER OF PEOPLE HAVING GLAUCOMA IN 2020 AND 2040

TABLE 2 NEW OPTIONS FOR GLAUCOMA TREATMENT

TABLE 3 NUMBER OF PHYSICIANS/ THOUSAND POPULATIONS

TABLE 4 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA MIGS STENTS IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA MIGS SHUNTS IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA OTHERS IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY TARGET, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA TRABECULAR MESHWORK IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA SUPRACHOROIDAL SPACE IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA SUBCONJUNCTIVAL FILTRATION IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA REDUCING AQUEOUS PRODUCTION IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA GLAUCOMA IN CONJUNCTION WITH CATARACT IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA STAND-ALONE GLAUCOMA IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA HOSPITAL IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA OPHTHALMOLOGY CLINICS IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA AMBULATORY SURGERY CENTERS (ASCS) IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA OTHERS IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA DIRECT TENDER IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA RETAIL SALES IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY TARGET, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 30 SOUTH AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 31 SOUTH AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY TARGET, 2020-2029 (USD MILLION)

TABLE 32 SOUTH AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 33 SOUTH AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 34 SOUTH AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 35 SAUDI ARABIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 36 SAUDI ARABIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY TARGET, 2020-2029 (USD MILLION)

TABLE 37 SAUDI ARABIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 38 SAUDI ARABIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 39 SAUDI ARABIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 40 U.A.E. MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 41 U.A.E. MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY TARGET, 2020-2029 (USD MILLION)

TABLE 42 U.A.E. MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 43 U.A.E. MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 U.A.E. MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 ISRAEL MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 46 ISRAEL MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY TARGET, 2020-2029 (USD MILLION)

TABLE 47 ISRAEL MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 48 ISRAEL MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 49 ISRAEL MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 50 EGYPT MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 51 EGYPT MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY TARGET, 2020-2029 (USD MILLION)

TABLE 52 EGYPT MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 53 EGYPT MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 EGYPT MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 55 REST OF MIDDLE EAST AND AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: MARKET END USER GRID

FIGURE 9 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: SEGMENTATION

FIGURE 11 INCREASING GERIATRIC POPULATIONAND RISING PREVALENCE OF GLAUCOMA IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PRODUCT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF GLAUCOMA SURGERY (MIGS) DEVICES MARKET

FIGURE 14 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY PRODUCT, 2021

FIGURE 15 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY PRODUCT, 2022-2029 (USD MILLION)

FIGURE 16 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 17 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 18 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY TARGET, 2021

FIGURE 19 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY TARGET, 2022-2029 (USD MILLION)

FIGURE 20 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY TARGET, CAGR (2022-2029)

FIGURE 21 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY TARGET, LIFELINE CURVE

FIGURE 22 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY SURGERY TYPE, 2021

FIGURE 23 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY SURGERY TYPE, 2022-2029 (USD MILLION)

FIGURE 24 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY SURGERY TYPE, CAGR (2022-2029)

FIGURE 25 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY SURGERY TYPE, LIFELINE CURVE

FIGURE 26 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY END USER, 2021

FIGURE 27 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 28 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 29 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 31 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 32 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 33 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 34 MIDDLE EAST AND AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: SNAPSHOT (2021)

FIGURE 35 MIDDLE EAST AND AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY COUNTRY (2021)

FIGURE 36 MIDDLE EAST AND AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 37 MIDDLE EAST AND AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 38 MIDDLE EAST AND AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY PRODUCT (2022-2029)

FIGURE 39 MIDDLE EAST & AFRICA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.