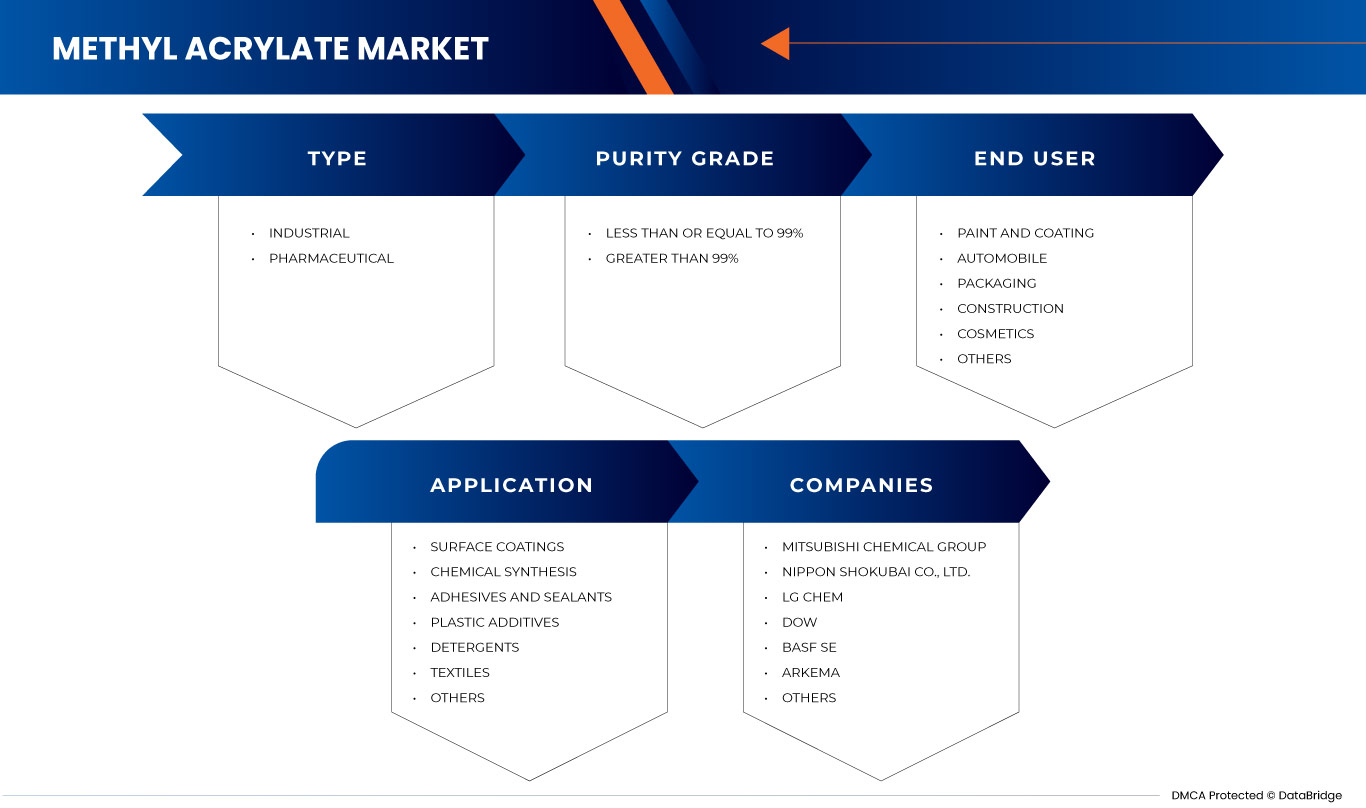

Mercado de acrilato de metilo en Oriente Medio y África, por tipo (industrial y farmacéutico), grado de pureza (menor o igual al 99% y mayor al 99%), aplicación (recubrimientos de superficie, síntesis química, adhesivos y selladores, aditivos plásticos , detergentes, textiles y otros), usuario final (pintura y revestimiento, automóvil, embalaje, construcción, cosméticos y otros), tendencias de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de acrilato de metilo en Oriente Medio y África

El acrilato de metilo se utiliza como intermediario químico en la producción de otros productos químicos, como el ácido acrílico y la acrilamida. También se utiliza como disolvente para diversas resinas, aceites y ceras.

Sin embargo, el acrilato de metilo es una sustancia química peligrosa y debe manipularse con cuidado. Es inflamable y puede formar peróxidos explosivos en contacto con el aire. También puede causar irritación en la piel y los ojos y es tóxico si se ingiere o se inhala.

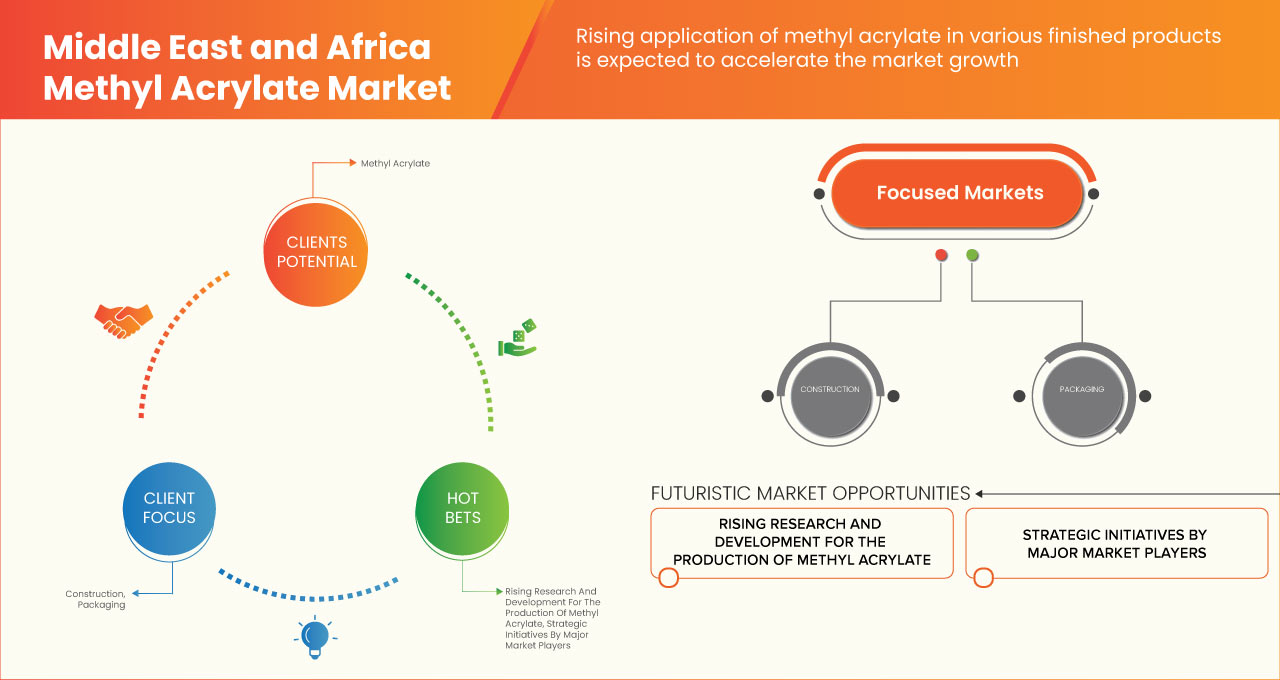

El mercado del acrilato de metilo está impulsado principalmente por la demanda de sus usos finales, en particular en las industrias de recubrimientos y adhesivos. Factores como la disponibilidad de materias primas, las políticas regulatorias y los avances tecnológicos también influyen en la demanda de acrilato de metilo.

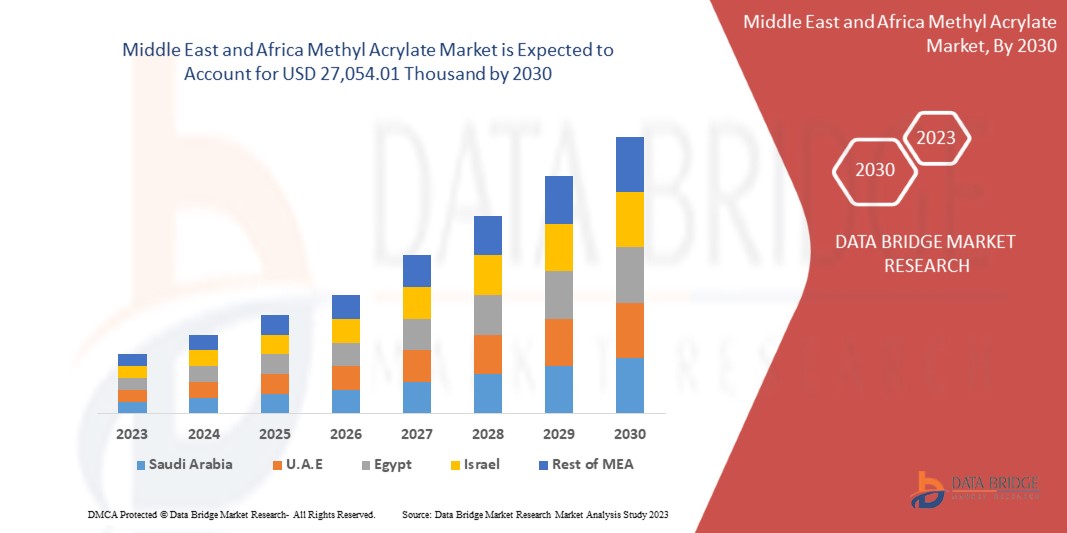

Data Bridge Market Research analiza que se espera que el mercado de acrilato de metilo en Oriente Medio y África alcance un valor de 27.054,01 mil dólares en 2030, con una tasa compuesta anual del 3,7 % durante el período de pronóstico. El segmento de tipos representa el segmento más grande del mercado debido al creciente uso de acrilato de metilo en diversas aplicaciones industriales.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Año histórico |

2021 (Personalizable para 2020 - 2015) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en toneladas y precios en USD |

|

Segmentos cubiertos |

Por tipo (industrial y farmacéutica), grado de pureza (menor o igual al 99 % y mayor al 99 %), aplicación (recubrimientos de superficies, síntesis química, adhesivos y selladores, aditivos plásticos, detergentes, textiles y otros), usuario final (pinturas y recubrimientos, automóviles, embalajes, construcción, cosméticos y otros) |

|

Países cubiertos |

Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Egipto, Israel y el resto de Oriente Medio y África. |

|

Actores del mercado cubiertos |

Mitsubishi Chemical Group, NIPPON SHOKUBAI CO., LTD., LG Chem, Dow, BASF SE, Arkema, DuPont, EVONIK, Merck KGaA, Solventis, Shanghai Huayi Acrylic Acid Co., Ltd., SIBUR INTERNATIONAL, Nouryon, Jurong Group Su y SHANGDONG KAITAI PETROCHEMICAL Co., LTD., entre otros. |

Definición de mercado

El acrilato de metilo es un compuesto orgánico con la fórmula química CH2=CHCOOCH3. Es un éster de ácido acrílico y metanol y también se lo conoce como propionato de metilo. El acrilato de metilo es un líquido incoloro con un fuerte olor acre que es altamente inflamable. Es soluble en la mayoría de los solventes orgánicos, incluida el agua.

El acrilato de metilo se utiliza principalmente como componente básico en la producción de diversos productos químicos, como polímeros, revestimientos, adhesivos y textiles. Se utiliza en la producción de poli(acrilato de metilo) y poli(metacrilato de metilo), que se utilizan ampliamente en la producción de pinturas, adhesivos y revestimientos. También se utiliza como reticulante para diversos polímeros.

El acrilato de metilo es un monómero reactivo que se utiliza a menudo en la preparación de copolímeros. A menudo se copolimeriza con otros monómeros, como el acrilato de etilo, el acrilato de butilo o el estireno, para mejorar las propiedades del polímero resultante, como la resistencia y la adhesión.

Dinámica del mercado de acrilato de metilo en Oriente Medio y África

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

CONDUCTORES

- Demanda creciente de productos a base de acrilato de metilo

El acrilato de metilo estabilizado es un líquido volátil incoloro con un olor penetrante. Sus vapores pueden irritar los ojos y el sistema respiratorio. Es muy tóxico si se inhala, se ingiere o entra en contacto con la piel. Es menos denso que el agua (0,957 g/cm3) y poco soluble en agua, por lo que flota en el agua. Sus vapores son más pesados que el aire. Es una materia prima en aplicaciones que incluyen fibras acrílicas, tratamientos de fibras, resinas de moldeo, adhesivos, pinturas, revestimientos y emulsiones.

El acrilato de metilo se utiliza en diversas industrias, como revestimientos, adhesivos, textiles y plásticos. Se espera que el crecimiento de estas industrias aumente la demanda de acrilato de metilo.

Por lo tanto, el aumento de la demanda de productos basados en acrilato de metilo está actuando como motor del crecimiento del mercado.

- Avance tecnológico en el proceso de fabricación de acrilato de metilo

El acrilato de metilo se utiliza a menudo en la producción de polímeros y resinas, especialmente fibras acrílicas, revestimientos y adhesivos. También se utiliza como materia prima en la síntesis de diversos productos químicos, incluidos productos químicos agrícolas, medicamentos y perfumes.

El método tradicional para fabricar acrilato de metilo implica la reacción del ácido acrílico con metanol en presencia de un catalizador. La reacción es exotérmica y normalmente requiere enfriamiento para controlar la temperatura.

Por tanto, el avance tecnológico en el proceso de fabricación de acrilato de metilo está actuando como motor del crecimiento del mercado.

RESTRICCIÓN

- El costo fluctuante de las materias primas utilizadas en la producción de acrilato de metilo

El acrilato de metilo se obtiene principalmente de productos petroquímicos y cualquier fluctuación en el precio del petróleo crudo puede afectar significativamente los costos de producción del acrilato de metilo.

Una de las materias primas más importantes para la producción de acrilato de metilo es el propileno, que se obtiene a partir del petróleo crudo o del gas natural. Por ello, las fluctuaciones en los precios de estos productos pueden afectar significativamente el precio del propileno y, por lo tanto, el coste total de producción del acrilato de metilo.

El petróleo crudo es la principal materia prima utilizada en la producción de muchos productos químicos, entre ellos el propileno, que se utiliza en la producción de acrilato de metilo. Por lo tanto, las fluctuaciones en el precio del petróleo crudo pueden afectar significativamente los costos de producción del acrilato de metilo.

OPORTUNIDAD

-

Demanda creciente de productos sostenibles y ecológicos

Las tendencias emergentes en la producción de productos de acrilato de metilo sostenibles y respetuosos con el medio ambiente están aumentando la demanda de acrilato de metilo en el mercado.

El uso cada vez mayor de productos de acrilato de metilo sostenibles y respetuosos con el medio ambiente refleja una mayor conciencia de la importancia de la sostenibilidad medioambiental en la producción química. Al adoptar prácticas más sostenibles y desarrollar productos ecológicos, la industria se esfuerza por minimizar su impacto medioambiental y responder a las necesidades cambiantes de los clientes.

La creciente preocupación por el medio ambiente aumenta la demanda de productos sostenibles y respetuosos con el medio ambiente. El acrilato de metilo es una alternativa sostenible a los productos petroquímicos tradicionales y puede ofrecer oportunidades de crecimiento en este ámbito.

Por tanto, la creciente demanda de productos sostenibles y ecológicos actúa como una oportunidad para el crecimiento del mercado.

DESAFÍO

- Normas gubernamentales estrictas sobre el uso de acrilato de metilo

Las normas gubernamentales sobre el uso del acrilato de metilo varían según el país y la región. Sin embargo, algunas jurisdicciones han impuesto normas estrictas debido a las preocupaciones sobre los posibles efectos del compuesto sobre la salud y el medio ambiente.

Según el reglamento REACH, las empresas que producen o importan más de una tonelada de acrilato de metilo al año deben registrarlo en la Agencia Europea de Sustancias y Mezclas Químicas (ECHA). El proceso de registro implica proporcionar información sobre las propiedades y usos de la sustancia, así como el peligro potencial que puede presentar para la salud humana o el medio ambiente.

En general, la normativa REACH para el acrilato de metilo tiene como objetivo garantizar que su producción, importación y uso sean seguros y no supongan un riesgo para la salud humana o el medio ambiente. Las empresas que utilicen o produzcan acrilato de metilo en la UE deben cumplir estas normativas para evitar posibles sanciones legales y económicas.

Por lo tanto, las estrictas regulaciones gubernamentales respecto al uso de acrilato de metilo actúan como un desafío para el crecimiento del mercado.

Desarrollo reciente

- En junio de 2020, Merck KGaA recibió la aprobación para BAVENCIO, una terapia de células NK dirigidas a PD-L1 para el tratamiento del carcinoma urotelial localmente avanzado o metastásico. Esta aprobación ayudó a la empresa a mejorar su cartera de productos para el tratamiento del cáncer.

Alcance del mercado de acrilato de metilo en Oriente Medio y África

El mercado de acrilato de metilo de Oriente Medio y África se divide en cuatro segmentos importantes: tipo, grado de pureza, aplicación y usuario final. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

Por tipo

- Industrial

- Farmacéutico

Según el tipo, el mercado se segmenta en industrial y farmacéutico.

Por grado de pureza

- Menor o igual al 99%

- Mayor al 99%

Sobre la base del grado de pureza, el mercado se segmenta en menor o igual al 99% y mayor al 99%.

Por aplicación

- Recubrimientos de superficie

- Adhesivos y selladores

- Textiles

- Aditivos para plásticos

- Síntesis química

- Detergentes

- Otros

Según la aplicación, el mercado está segmentado en recubrimientos de superficies, síntesis química, adhesivos y selladores, aditivos plásticos, detergentes, textiles y otros.

Por el usuario final

- Pintura y revestimiento

- Automóvil

- Embalaje

- Construcción

- Productos cosméticos

- Otros

Según el usuario final, el mercado está segmentado en pinturas y recubrimientos, automóviles, embalajes, construcción, cosméticos y otros.

Análisis y perspectivas regionales del mercado de acrilato de metilo en Oriente Medio y África

El mercado de acrilato de metilo de Oriente Medio y África está segmentado en cuatro segmentos notables según el tipo, el grado de pureza, la aplicación y el usuario final.

Los países cubiertos en este informe de mercado son Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Egipto, Israel y el resto de Medio Oriente y África.

Arabia Saudita está dominando el mercado debido al aumento del avance tecnológico en productos basados en acrilato de metilo.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Medio Oriente y África y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, y el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Panorama competitivo y análisis de la cuota de mercado del acrilato de metilo en Oriente Medio y África

El panorama competitivo del mercado de acrilato de metilo en Oriente Medio y África proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en I+D, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las aprobaciones de productos, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa en el mercado.

Algunos de los principales actores del mercado que operan en el mercado de acrilato de metilo en Medio Oriente y África son Mitsubishi Chemical Group, NIPPON SHOKUBAI CO., LTD., LG Chem, Dow, BASF SE, Arkema, DuPont, EVONIK, Merck KGaA, Solventis, Shanghai Huayi Acrylic Acid Co., Ltd., SIBUR INTERNATIONAL, Nouryon, Jurong Group Su y SHANGDONG KAITAI PETROCHEMICAL Co., LTD., entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 RAW MATERIAL COVERAGE

4.2 PRODUCTION CONSUMPTION ANALYSIS

4.3 TRADE SCENARIO

4.3.1 OVERVIEW

4.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.5 PORTER’S FIVE FORCES

4.6 VENDOR SELECTION CRITERIA

4.7 PESTEL ANALYSIS

4.8 REGULATION COVERAGE

4.9 EXCLUSIVE LIST OF POTENTIAL BUYERS

4.1 EXCLUSIVE PRODUCTS LIST MADE FROM METHYL ACRYLATE WITH ESTIMATED %

5 CLIMATE CHANGE SCENARIO

5.1 ENVIRONMENTAL CONCERNS

5.2 INDUSTRY RESPONSE

5.3 GOVERNMENT’S ROLE

5.4 ANALYST RECOMMENDATION

6 PRICE INDEX

7 SUPPLY CHAIN ANALYSIS

8 PRODUCTION CAPACITY OVERVIEW

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 INCREASING DEMAND FOR METHYL ACRYLATE-BASED PRODUCTS

9.1.2 TECHNOLOGICAL ADVANCEMENT IN THE MANUFACTURING PROCESS OF METHYL ACRYLATE

9.1.3 GROWING AWARENESS REGARDING PROPERTIES OF METHYL ACRYLATE

9.2 RESTRAINTS

9.2.1 FLUCTUATING COST OF RAW MATERIALS USED IN METHYL ACRYLATE PRODUCTION

9.2.2 AVAILABILITY OF SUBSTITUTES FOR METHYL ACRYLATE

9.3 OPPORTUNITIES

9.3.1 INCREASING DEMAND FOR SUSTAINABLE AND ECOFRIENDLY PRODUCTS

9.3.2 DEVELOPMENT OF NEW APPLICATIONS USING METHYL ACRYLATE

9.4 CHALLENGES

9.4.1 STRINGENT GOVERNMENT REGULATIONS REGARDING THE USE OF METHYL ACRYLATE

9.4.2 HEALTH AND SAFETY CONCERNS ASSOCIATED WITH THE USE OF METHYL ACRYLATE

10 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, BY TYPE

10.1 OVERVIEW

10.2 INDUSTRIAL

10.3 PHARMACEUTICAL

11 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, BY PURITY GRADE

11.1 OVERVIEW

11.2 GREATER THAN 99%

11.3 LESS THAN OR EQUAL TO 99%

12 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 SURFACE COATINGS

12.3 ADHESIVES AND SEALANTS

12.4 TEXTILES

12.5 PLASTIC ADDITIVES

12.6 CHEMICAL SYNTHESIS

12.7 DETERGENTS

12.8 OTHERS

13 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, BY END USER

13.1 OVERVIEW

13.2 PAINT AND COATING

13.2.1 GREATER THAN 99%

13.2.2 LESS THAN OR EQUAL TO 99%

13.3 AUTOMOBILE

13.3.1 GREATER THAN 99%

13.3.2 LESS THAN OR EQUAL TO 99%

13.4 PACKAGING

13.4.1 GREATER THAN 99%

13.4.2 LESS THAN OR EQUAL TO 99%

13.5 CONSTRUCTION

13.5.1 GREATER THAN 99%

13.5.2 LESS THAN OR EQUAL TO 99%

13.6 COSMETICS

13.6.1 GREATER THAN 99%

13.6.2 LESS THAN OR EQUAL TO 99%

13.7 OTHERS

14 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, BY GEOGRAPHY

14.1 MIDDLE EAST AND AFRICA

14.1.1 SAUDI ARABIA

14.1.2 UNITED ARAB EMIRATES

14.1.3 SOUTH AFRICA

14.1.4 EGYPT

14.1.5 ISRAEL

14.1.6 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 MITSUBISHI CHEMICAL GROUP

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 BASF SE

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 LG CHEM

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 NIPPON SHOKUBAI CO., LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 ARKEMA

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 DOW

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 DUPONT

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 EVONIK

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 JURONG GROUP SU

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 MERCK KGAA

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 NOURYON

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 SHANGDONG KAITAI PETROCHEMICAL CO., LTD

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 SHANGHAI HUAYI ACRYLIC ACID CO. LTD.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 SIBUR INTERNATIONAL

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 SOLVENTIS

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 LIST OF TRADERS

TABLE 2 POTENTIAL BUYERS OF METHYL ACRYLATE

TABLE 3 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, ESTIMATED SHARE BY APPLICATION, 2022

TABLE 4 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, BY TYPE, 2021 AND 2022 (ASP IN TONS)

TABLE 5 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD TONS)

TABLE 7 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (ASP IN TONS)

TABLE 8 MIDDLE EAST & AFRICA INDUSTRIAL IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA PHARMACEUTICAL IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA GREATER THAN 99% IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA LESS THAN OR EQUAL TO 99% IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA SURFACE COATINGS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA ADHESIVES AND SEALANTS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA TEXTILES IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA PLASTIC ADDITIVES IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA CHEMICAL SYNTHESIS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA DETERGENTS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA OTHERS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA PAINT AND COATING IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA PAINT AND COATING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA AUTOMOBILE IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA AUTOMOBILE IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA PACKAGING IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA PACKAGING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA CONSTRUCTION IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA CONSTRUCTION IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA COSMETICS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA COSMETICS IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA OTHERS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET, BY COUNTRY, 2021-2030 (USD TONS)

TABLE 35 MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD TONS)

TABLE 37 MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA PAINT AND COATING IN METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA AUTOMOBILE IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA PACKAGING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA CONSTRUCTION IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA COSMETICS IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 45 SAUDI ARABIA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 SAUDI ARABIA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD TONS)

TABLE 47 SAUDI ARABIA METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 48 SAUDI ARABIA METHYL ACRYLATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 49 SAUDI ARABIA METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 50 SAUDI ARABIA PAINT AND COATING IN METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 51 SAUDI ARABIA AUTOMOBILE IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 52 SAUDI ARABIA PACKAGING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 53 SAUDI ARABIA CONSTRUCTION IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 54 SAUDI ARABIA COSMETICS IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 55 UNITED ARAB EMIRATES METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 UNITED ARAB EMIRATES METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD TONS)

TABLE 57 UNITED ARAB EMIRATES METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 58 UNITED ARAB EMIRATES METHYL ACRYLATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 59 UNITED ARAB EMIRATES METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 60 UNITED ARAB EMIRATES PAINT AND COATING IN METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 61 UNITED ARAB EMIRATES AUTOMOBILE IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 62 UNITED ARAB EMIRATES PACKAGING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 63 UNITED ARAB EMIRATES CONSTRUCTION IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 64 UNITED ARAB EMIRATES COSMETICS IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 65 SOUTH AFRICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 SOUTH AFRICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD TONS)

TABLE 67 SOUTH AFRICA METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 68 SOUTH AFRICA METHYL ACRYLATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 69 SOUTH AFRICA METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 70 SOUTH AFRICA PAINT AND COATING IN METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 71 SOUTH AFRICA AUTOMOBILE IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 72 SOUTH AFRICA PACKAGING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 73 SOUTH AFRICA CONSTRUCTION IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 74 SOUTH AFRICA COSMETICS IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 75 EGYPT METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 EGYPT METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD TONS)

TABLE 77 EGYPT METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 78 EGYPT METHYL ACRYLATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 79 EGYPT METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 80 EGYPT PAINT AND COATING IN METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 81 EGYPT AUTOMOBILE IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 82 EGYPT PACKAGING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 83 EGYPT CONSTRUCTION IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 84 EGYPT COSMETICS IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 85 ISRAEL METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 ISRAEL METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD TONS)

TABLE 87 ISRAEL METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 88 ISRAEL METHYL ACRYLATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 89 ISRAEL METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 90 ISRAEL PAINT AND COATING IN METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 91 ISRAEL AUTOMOBILE IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 92 ISRAEL PACKAGING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 93 ISRAEL CONSTRUCTION IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 94 ISRAEL COSMETICS IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 95 REST OF MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Lista de figuras

FIGURE 1 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET

FIGURE 2 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: MARKET END – USE COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: SEGMENTATION

FIGURE 14 INCREASING DEMAND FOR METHYL ACRYLATE-BASED PRODUCTS IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET IN THE FORECAST PERIOD

FIGURE 15 INDUSTRIAL TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET IN 2023 AND 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET

FIGURE 17 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY TYPE, 2022

FIGURE 18 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY TYPE, 2023-2030 (USD THOUSAND)

FIGURE 19 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 20 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY TYPE, LIFELINE CURVE

FIGURE 21 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY PURITY GRADE, 2022

FIGURE 22 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY PURITY GRADE, 2023-2030 (USD THOUSAND)

FIGURE 23 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY PURITY GRADE, CAGR (2023-2030)

FIGURE 24 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY PURITY GRADE, LIFELINE CURVE

FIGURE 25 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY APPLICATION, 2022

FIGURE 26 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY APPLICATION, 2023-2030 (USD THOUSAND)

FIGURE 27 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 28 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 29 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY END USER, 2022

FIGURE 30 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY END USER, 2023-2030 (USD THOUSAND)

FIGURE 31 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY END USER, CAGR (2023-2030)

FIGURE 32 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY END USER, LIFELINE CURVE

FIGURE 33 MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET: SNAPSHOT (2022)

FIGURE 34 MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET: BY COUNTRY (2022)

FIGURE 35 MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 36 MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 37 MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET: TYPE (2023-2030)

FIGURE 38 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.