Middle East And Africa Meat Poultry And Seafood Processing Equipment Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

717.65 Million

USD

982.16 Million

2024

2032

USD

717.65 Million

USD

982.16 Million

2024

2032

| 2025 –2032 | |

| USD 717.65 Million | |

| USD 982.16 Million | |

|

|

|

|

Segmentación del mercado de equipos para el procesamiento de carne, aves y mariscos en Oriente Medio y África, por tipo de equipo (equipos de porcionado, freidora, filtrado, recubrimiento, cocción, ahumado, sacrificio, refrigeración, procesamiento a alta presión, masaje y otros), proceso (reducción de tamaño, aumento de tamaño, homogeneización, mezcla y otros), modo de operación (automático, semiautomático y manual), aplicación (productos frescos procesados, crudos cocidos, precocidos, crudos fermentados, carne seca, curada, congelada y otros), función (corte, mezcla, ablandamiento, relleno, marinado, rebanado, molienda, ahumado, sacrificio y desplumado, deshuesado y desollado, evisceración, destripamiento, fileteado y otros), tipo de productos procesados (carne, aves y mariscos) - Tendencias de la industria y pronóstico hasta 2032.

¿Cuál es el tamaño y la tasa de crecimiento del mercado de equipos para el procesamiento de carne, aves y mariscos en Oriente Medio y África?

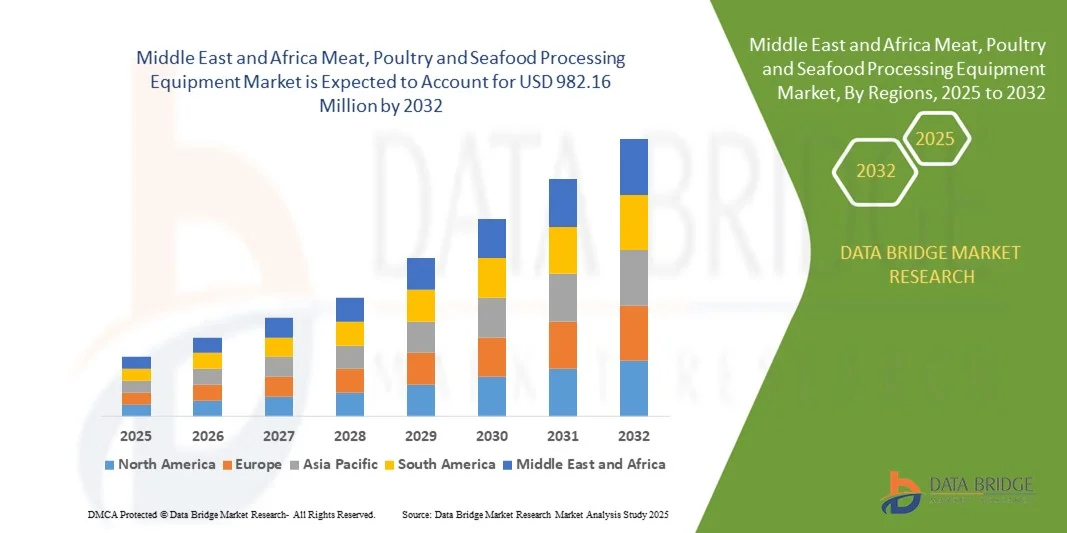

- El tamaño del mercado de equipos para el procesamiento de carne, aves y mariscos en Oriente Medio y África se valoró en 717,65 millones de dólares en 2024 y se espera que alcance los 982,16 millones de dólares en 2032 , con una tasa de crecimiento anual compuesta (TCAC) del 4,00 % durante el período de pronóstico.

- El creciente consumo de carne, aves y mariscos procesados, junto con el aumento de cadenas de comida rápida y restaurantes, impulsa la demanda de carne procesada y otros productos de mejor calidad. Asimismo, los avances tecnológicos en el mercado de equipos, especialmente en los sectores de carne, aves y mariscos, han incrementado el valor de mercado actual.

- Los factores que limitan el crecimiento del mercado son la elevada inversión de capital y la lenta renovación de los equipos debido a su mayor vida útil.

¿Cuáles son las principales conclusiones del mercado de equipos para el procesamiento de carne, aves y mariscos?

- La creciente automatización en la industria de procesamiento de alimentos puede ser la mejor oportunidad para el mercado de equipos de procesamiento de carne, aves y mariscos.

- El elevado coste de las máquinas, la escasa infraestructura en los países en desarrollo y el consumo excesivo de agua durante el procesamiento y la limpieza de tuberías pueden representar una amenaza para el mercado.

- Arabia Saudita dominó el mercado de equipos para el procesamiento de carne, aves y mariscos en Oriente Medio y África en 2025, con una cuota de ingresos del 28,7%, impulsada por la creciente demanda de instalaciones modernas de procesamiento de carne, automatización e infraestructura de cadena de frío.

- Se prevé que el mercado de equipos para el procesamiento de carne, aves y mariscos de los Emiratos Árabes Unidos experimente el mayor crecimiento, con una tasa del 12,1%, impulsado por la rápida urbanización, la creciente demanda de carne y mariscos procesados y las iniciativas gubernamentales que promueven la producción local de alimentos.

- El segmento de equipos de corte y porcionado dominó el mercado en 2025 con una cuota de mercado del 32,8%, impulsado por la creciente demanda de corte de precisión, control de porciones y recorte automatizado en plantas procesadoras de carne y mariscos a gran escala.

Alcance del informe y segmentación del mercado de equipos para el procesamiento de carne, aves y mariscos

|

Atributos |

Información clave del mercado de equipos para el procesamiento de carne, aves y mariscos |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Principales actores del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de datos de valor añadido |

Además de información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y principales actores, los informes de mercado elaborados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de cuota de mercado de marcas, encuestas a consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

¿Cuál es la principal tendencia en el mercado de equipos para el procesamiento de carne, aves y mariscos?

Tecnologías de automatización y procesamiento sostenible

- Una de las principales tendencias que está transformando el mercado de equipos para el procesamiento de carne, aves y mariscos es la rápida adopción de sistemas de automatización y procesamiento sostenibles, diseñados para mejorar la eficiencia, reducir el desperdicio y aumentar la seguridad alimentaria. El creciente énfasis en operaciones energéticamente eficientes y un diseño higiénico está impulsando a los fabricantes hacia innovaciones ecológicas.

- Las empresas están integrando cada vez más la robótica, la inspección basada en IA y los sistemas de monitorización habilitados por IoT para optimizar los procesos de deshuesado, corte y envasado, garantizando la precisión y reduciendo el error humano.

- Además, el uso de tecnologías de ahorro de agua y reducción de residuos está ganando terreno a medida que los procesadores buscan cumplir con las regulaciones de sostenibilidad y reducir los costos operativos.

- Un ejemplo notable es GEA Group Aktiengesellschaft (Alemania), que introdujo su Línea de Procesamiento Sostenible que integra automatización inteligente, refrigeración eficiente y sistemas de recuperación de residuos para optimizar la producción de carne y mariscos.

- Este cambio hacia soluciones inteligentes, ecológicas y de bajo consumo energético está transformando la industria, fomentando las inversiones en equipos de última generación que equilibran la productividad, la seguridad y la sostenibilidad.

¿Cuáles son los principales impulsores del mercado de equipos para el procesamiento de carne, aves y mariscos?

- El creciente consumo mundial de alimentos ricos en proteínas y la mayor demanda de carne y mariscos procesados son factores clave que impulsan el mercado. Los consumidores buscan opciones de alimentos convenientes, seguras e higiénicamente procesados, lo que impulsa la modernización de los equipos.

- Por ejemplo, en 2025, Marel (Islandia) amplió su línea de productos con sistemas automatizados de porcionado y corte que mejoran la precisión del rendimiento y la consistencia del producto en el procesamiento de aves y mariscos.

- El sector también se beneficia de las inversiones gubernamentales en normativas de seguridad alimentaria e infraestructura de exportación, lo que fomenta la demanda de maquinaria de procesamiento avanzada.

- Además, el auge de los productos listos para el consumo y congelados ha acelerado las mejoras en los equipos para optimizar las capacidades de envasado, refrigeración y almacenamiento.

- Innovaciones como los sistemas de clasificación impulsados por IA, las cintas transportadoras higiénicas y las tecnologías de sellado al vacío están mejorando aún más la calidad del producto, prolongando su vida útil e impulsando la expansión del mercado en los segmentos industriales y comerciales.

¿Qué factor está frenando el crecimiento del mercado de equipos para el procesamiento de carne, aves y mariscos?

- Los elevados costes de inversión inicial y mantenimiento siguen siendo importantes obstáculos que limitan la adopción, especialmente entre las pequeñas y medianas empresas procesadoras. Equipos como las deshuesadoras automatizadas y las llenadoras al vacío requieren una inversión inicial considerable.

- Por ejemplo, en 2025, el aumento de los precios del acero inoxidable y de los componentes electrónicos incrementó los costes de fabricación de equipos para actores clave como BAADER (Alemania) y JBT Corporation (EE. UU.), afectando a los márgenes de beneficio.

- Además, los complejos requisitos de limpieza y desinfección pueden prolongar el tiempo de inactividad, lo que afecta la eficiencia de la producción.

- Las normativas medioambientales y energéticas también obligan a las empresas a actualizar continuamente sus sistemas para reducir las emisiones y el consumo de agua.

- A pesar de estas barreras, empresas como GEA Group Aktiengesellschaft y Key Technology (EE. UU.) están abordando estos problemas mediante diseños modulares, energéticamente eficientes y fáciles de limpiar. El equilibrio entre coste, cumplimiento normativo y sostenibilidad sigue siendo vital para garantizar el crecimiento y la competitividad a largo plazo en el mercado.

¿Cómo se segmenta el mercado de equipos para el procesamiento de carne, aves y mariscos?

El mercado de equipos para el procesamiento de carne, aves y mariscos se segmenta según el tipo de equipo, el proceso, el modo de operación, la aplicación, la función y el tipo de producto procesado.

- Por tipo de equipo

Según el tipo de equipo, el mercado se segmenta en equipos de porcionado, fritura, filtrado, recubrimiento, cocción, ahumado, sacrificio, refrigeración, procesamiento por alta presión (HPP), masaje y otros. El segmento de equipos de corte y porcionado dominó el mercado en 2025 con una cuota de mercado del 32,8%, impulsado por la creciente demanda de corte de precisión, control de porciones y recorte automatizado en plantas de procesamiento de carne y mariscos a gran escala. Estos sistemas mejoran la eficiencia, minimizan el desperdicio y mantienen una calidad de producto constante.

Se prevé que el segmento de equipos de procesamiento de alta presión (HPP) registre la tasa de crecimiento anual compuesto (CAGR) más rápida entre 2026 y 2033, impulsada por la creciente adopción de tecnologías de conservación no térmicas para mejorar la vida útil y garantizar productos cárnicos y mariscos libres de patógenos sin comprometer el valor nutricional ni la textura.

- Por proceso

Según el proceso, el mercado de equipos para el procesamiento de carne, aves y mariscos se clasifica en reducción de tamaño, aumento de tamaño, homogeneización, mezcla y otros. El segmento de reducción de tamaño dominó el mercado en 2025 con una cuota de mercado del 39,5%, ya que la molienda, el corte y el picado son etapas iniciales cruciales en el procesamiento de la carne, pues permiten obtener una textura consistente y una uniformidad de producto en salchichas, hamburguesas y productos derivados del mar. La eficiencia de los modernos sistemas de reducción de tamaño contribuye a optimizar la producción y la calidad.

Se prevé que el segmento de mezcla experimente la mayor tasa de crecimiento anual compuesto (TCAC) entre 2026 y 2033, impulsado por la creciente demanda de formulaciones de carne mezclada, marinadas y mariscos procesados. Las mezcladoras de vacío y de paletas avanzadas se están adoptando cada vez más para lograr una distribución uniforme de los ingredientes, una consistencia de sabor y una mayor estabilidad del producto.

- Por modo de operación

Según su modo de operación, el mercado se segmenta en automático, semiautomático y manual. El segmento automático dominó el mercado en 2025 con una cuota del 46,7%, impulsado por la creciente adopción de la automatización para reducir los costes laborales, aumentar la eficiencia de la producción y garantizar el cumplimiento de las normas de higiene. Los sistemas automatizados integran robótica, sensores y software para realizar tareas complejas como el deshuesado y el envasado con precisión.

Se prevé que el segmento de sistemas semiautomáticos registre la mayor tasa de crecimiento anual compuesto (CAGR) entre 2026 y 2033, a medida que las pequeñas y medianas empresas procesadoras buscan equilibrar las ventajas de la automatización con la asequibilidad. Los sistemas semiautomáticos ofrecen flexibilidad, menor complejidad operativa y adaptabilidad a diferentes escalas de producción.

- Mediante solicitud

Según su aplicación, el mercado de equipos para el procesamiento de carne, aves y mariscos se segmenta en productos frescos procesados, crudos cocidos, precocidos, crudos fermentados, carne seca, curada, congelada y otros. El segmento de productos frescos procesados ostentó la mayor cuota de mercado, con un 41,2 % en 2025, debido al alto consumo de productos cárnicos y mariscos mínimamente procesados, como salchichas, nuggets y hamburguesas, que requieren maquinaria avanzada de corte, mezcla y recubrimiento. La demanda se ve impulsada por la preferencia de los consumidores por comidas listas para cocinar con un sabor fresco.

Se prevé que el segmento de congelados experimente el mayor crecimiento anual compuesto (CAGR) entre 2026 y 2033, impulsado por la creciente popularidad de los mariscos congelados y los platos preparados a nivel mundial. Las mejoras en las tecnologías de congelación y la logística de la cadena de frío permiten una mayor vida útil y una mejor conservación de la textura y el sabor.

- Por función

Según su función, el mercado se clasifica en corte, mezcla, ablandamiento, llenado, marinado, rebanado, molienda, ahumado, sacrificio y desplumado, deshuesado y desollado, evisceración, destripamiento, fileteado y otros. El segmento de corte y rebanado dominó el mercado en 2025 con una cuota de mercado del 36,4 %, ya que representa una función esencial en casi todas las operaciones de procesamiento de carne y mariscos. La demanda de sistemas de corte y rebanado de precisión se debe a la necesidad de lograr un grosor uniforme, reducir el desperdicio y mantener la integridad del producto.

Se prevé que el segmento de deshuesado y desollado registre la tasa de crecimiento anual compuesto (CAGR) más rápida entre 2026 y 2033, impulsada por la necesidad de sistemas de alta eficiencia que minimicen la mano de obra, mejoren el rendimiento y optimicen la higiene, especialmente en las líneas de procesamiento de aves y pescado.

- Por tipo de producto procesado

Según el tipo de producto procesado, el mercado se segmenta en carne, aves y mariscos. El segmento de la carne dominó el mercado en 2025 con una cuota de mercado del 44,9%, debido al creciente consumo de productos cárnicos procesados como salchichas, tocino y jamón, especialmente en Norteamérica, Oriente Medio y África. Las líneas de procesamiento de carne requieren sistemas sofisticados de molienda, curado y envasado para garantizar la seguridad y la calidad.

Se prevé que el segmento de productos del mar experimente el mayor crecimiento anual compuesto (CAGR) entre 2026 y 2033, impulsado por la creciente demanda mundial de pescado, camarones y mariscos procesados. El aumento de las exportaciones de productos del mar, junto con los avances tecnológicos en fileteado y congelación, están impulsando la automatización y la expansión de la capacidad en las plantas procesadoras de productos del mar en todo el mundo.

¿Qué región concentra la mayor parte del mercado de equipos para el procesamiento de carne, aves y mariscos?

- Arabia Saudita dominó el mercado de equipos para el procesamiento de carne, aves y mariscos en Oriente Medio y África en 2025, con una cuota de ingresos del 28,7%, impulsada por la creciente demanda de instalaciones modernas de procesamiento de carne, automatización e infraestructura de cadena de frío.

- Las inversiones del país en seguridad alimentaria, producción avícola y cárnica a escala industrial e iniciativas de sustitución de importaciones han acelerado la adopción de equipos de procesamiento de alto rendimiento. Se están integrando cada vez más tecnologías avanzadas de sacrificio, deshuesado y envasado para garantizar el cumplimiento de las normas HACCP e ISO de seguridad alimentaria.

- En general, el enfoque de Arabia Saudita en la modernización, la expansión industrial y el cumplimiento de las normas de seguridad alimentaria la ha posicionado como el país líder en la región de Oriente Medio y África en equipos para el procesamiento de carne, aves y mariscos.

Perspectivas del mercado de equipos para el procesamiento de carne, aves y mariscos en los Emiratos Árabes Unidos

Se prevé que el mercado de equipos para el procesamiento de carne, aves y mariscos en los Emiratos Árabes Unidos experimente el mayor crecimiento, con una tasa del 12,1%, impulsado por la rápida urbanización, la creciente demanda de carne y mariscos procesados y las iniciativas gubernamentales que promueven la producción local de alimentos. Los fabricantes y procesadores de alimentos con sede en los Emiratos Árabes Unidos están invirtiendo fuertemente en sistemas automatizados de porcionado, congelación y envasado para satisfacer la creciente demanda de los sectores de hostelería, comercio minorista y exportación. La integración de sistemas de control inteligentes, refrigeración energéticamente eficiente y líneas de procesamiento higiénicas mejora la productividad y reduce los costos operativos. El enfoque de los Emiratos Árabes Unidos en tecnologías de procesamiento avanzadas, sostenibles y de alta eficiencia los posiciona como un centro de crecimiento clave en el mercado de Oriente Medio y África.

Perspectivas del mercado egipcio de equipos para el procesamiento de carne, aves y mariscos

El mercado egipcio de equipos para el procesamiento de carne, aves y mariscos se encuentra en constante expansión, impulsado por el crecimiento de las industrias procesadoras de aves y mariscos del país y las iniciativas gubernamentales para mejorar la seguridad alimentaria y la autosuficiencia. Los fabricantes egipcios están adoptando cada vez más equipos modernos de sacrificio, despiece y congelación para mejorar la higiene, la productividad y el cumplimiento de las normas internacionales de exportación. Las inversiones en infraestructura de almacenamiento en frío, porcionado automatizado y sistemas de recubrimiento mejoran aún más la eficiencia. Gracias a su ubicación estratégica, su amplio mercado interno y su creciente capacidad industrial, Egipto desempeña un papel fundamental en el desarrollo de la industria regional de equipos para el procesamiento de carne, aves y mariscos.

Perspectivas del mercado de equipos para el procesamiento de carne, aves y mariscos en Sudáfrica

El mercado sudafricano de equipos para el procesamiento de carne, aves y mariscos experimenta un crecimiento sostenido, impulsado por el sólido sector exportador de carne del país y la creciente demanda de alimentos procesados de alta calidad. Los fabricantes sudafricanos están adoptando sistemas automatizados de deshuesado, corte, marinado y envasado para mejorar la productividad, reducir los costos laborales y cumplir con las normas internacionales de seguridad alimentaria. Las iniciativas de sostenibilidad, como la refrigeración energéticamente eficiente y las líneas de procesamiento que ahorran agua, contribuyen aún más a la expansión del mercado. En general, la combinación de la demanda impulsada por las exportaciones, las capacidades industriales y el enfoque en la sostenibilidad de Sudáfrica fortalece su posición como mercado líder en la región de Oriente Medio y África.

Perspectivas del mercado de equipos para el procesamiento de carne, aves y mariscos en Marruecos

El mercado marroquí de equipos para el procesamiento de carne, aves y mariscos está experimentando un crecimiento sostenido, impulsado por el aumento del consumo interno, la expansión de las granjas avícolas y pesqueras y el incremento de las inversiones en modernas instalaciones de procesamiento. Los procesadores marroquíes están adoptando equipos avanzados de congelación, envasado y porcionado para mejorar la calidad, la seguridad y la preparación para la exportación de sus productos. Los incentivos gubernamentales para la modernización de la industria alimentaria y la colaboración con proveedores internacionales están fomentando la transferencia de tecnología y la eficiencia operativa. En consecuencia, Marruecos se está consolidando como un actor clave para el crecimiento y la competitividad del mercado de equipos para el procesamiento de carne, aves y mariscos en Oriente Medio y África.

¿Cuáles son las principales empresas en el mercado de equipos para el procesamiento de carne, aves y mariscos?

La industria de equipos para el procesamiento de carne, aves y mariscos está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Equipamientos Cárnicos, SL (España)

- BRAHER INTERNACIONAL, SA (España)

- RZPO (Polonia)

- Minerva Omega Group srl (Italia)

- Grupo GEA Aktiengesellschaft (Alemania)

- RISCO SpA (Italia)

- PSS SVIDNÍK, como (Eslovaquia)

- Metalbud (Polonia)

- BAADER (Alemania)

- Corporación JBT (EE. UU.)

- Marel (Islandia)

- Tecnología clave (EE. UU.)

- Illinois Tool Works Inc. (EE. UU.)

- La Corporación Middleby (EE. UU.)

- Bettcher Industries, Inc. (EE. UU.)

- BIZERBA (Alemania)

¿Cuáles son los últimos avances en el mercado de equipos para el procesamiento de carne, aves y mariscos en Oriente Medio y África?

- En febrero de 2025, JBT Marel se asoció estratégicamente con Ace Aquatec, designándola como su proveedor preferido de soluciones de aturdimiento de pescado para maquinaria de procesamiento de alimentos. Esta colaboración fortalece la posición de JBT Marel en el procesamiento sostenible de productos del mar y amplía su innovadora cartera de maquinaria.

- En enero de 2025, la empresa estadounidense JBT adquirió la totalidad de Marel, formando la nueva entidad JBT Marel Corporation. Esta fusión crea un líder mundial de gran prestigio en tecnología de procesamiento de alimentos, mejorando la eficiencia y la innovación en diversos sectores alimentarios.

- En noviembre de 2024, Fortifi Food Processing Solutions anunció la adquisición de la propiedad intelectual, las relaciones con los clientes, inventarios seleccionados y activos fijos de JWE-BANSS GmbH (Alemania), un fabricante clave de sistemas de procesamiento de proteínas. Esta adquisición refuerza la experiencia de Fortifi en el procesamiento de carne y consolida su presencia en el mercado de Oriente Medio y África.

- En julio de 2024, Ross Industries lanzó la AMS 400 Membrane Skinner, una solución diseñada para procesadores de carne artesanales y de tamaño mediano, con el fin de mejorar la eficiencia operativa y la calidad del producto final. Este lanzamiento refleja el compromiso de Ross Industries con la satisfacción de las necesidades de automatización en constante evolución de los pequeños y medianos productores de alimentos.

- En marzo de 2024, se lanzó oficialmente Fortifi Food Processing Solutions como una plataforma global unificada de marcas de procesamiento y automatización de alimentos, con presencia en los cinco continentes. Este lanzamiento representa un paso estratégico hacia la oferta de soluciones integradas para las industrias de procesamiento de proteínas, lácteos, frutas y verduras.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.