Middle East And Africa Leak Detection Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.15 Billion

USD

2.17 Billion

2025

2033

USD

1.15 Billion

USD

2.17 Billion

2025

2033

| 2026 –2033 | |

| USD 1.15 Billion | |

| USD 2.17 Billion | |

|

|

|

|

Mercado de detección de fugas en Oriente Medio y África, por tipo (Upstream, Midstream y Downstream), tipo de producto (detectores de gas portátiles, detectores basados en UAV, detectores de aeronaves tripuladas y detectores basados en vehículos), tecnología (acústica/ultrasonido, fibra óptica, métodos de desviación de presión-flujo, modelo transitorio extendido en tiempo real (E-RTTM), termografía, equilibrio de masa/volumen, detección de vapor, absorción láser y lidar, detección de fugas hidráulicas, válvulas de presión negativa y otros), usuario final (petróleo y gas, planta química, plantas de tratamiento de agua, planta de energía térmica, minería y lodos y otros), país (Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Israel, Egipto, resto de Oriente Medio y África) Tendencias de la industria y pronóstico hasta 2028

Análisis y perspectivas del mercado : mercado de detección de fugas en Oriente Medio y África

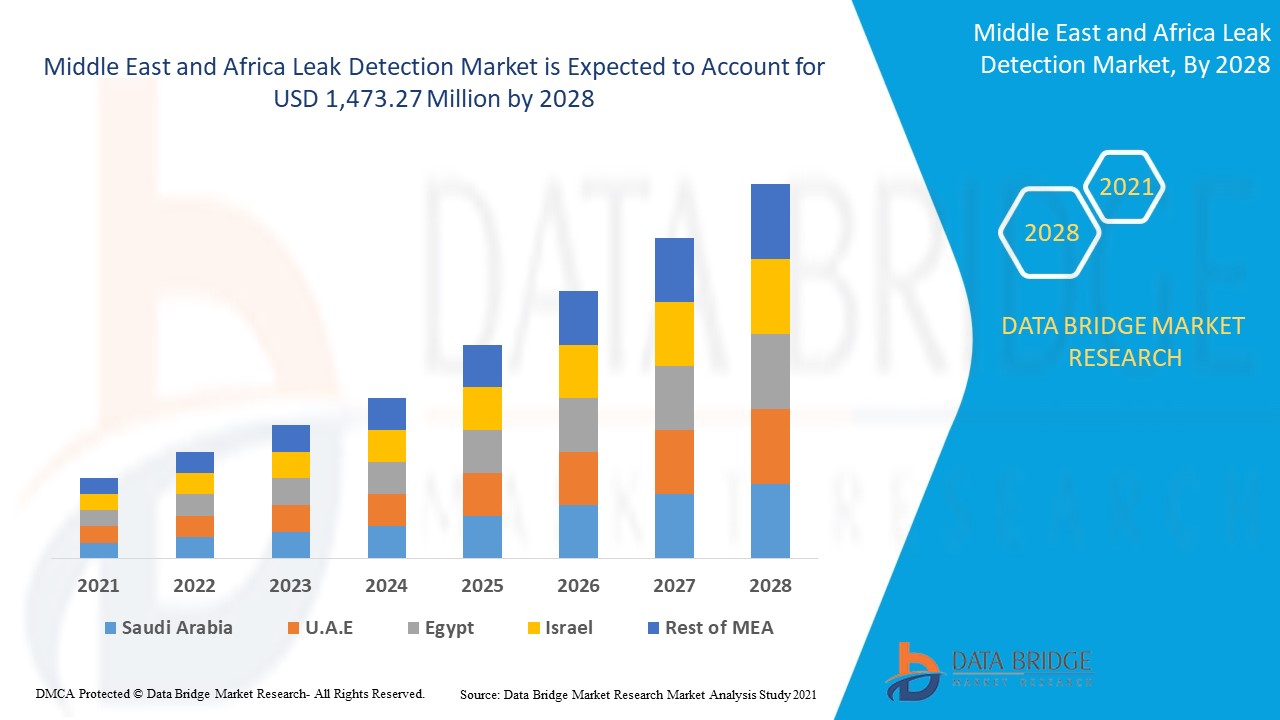

Se espera que el mercado de detección de fugas gane crecimiento de mercado en el período de pronóstico de 2021 a 2028. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 8,2% en el período de pronóstico de 2021 a 2028 y se espera que alcance los USD 1.473,27 millones para 2028. El crecimiento creciente de la infraestructura de oleoductos y gasoductos y plantas de almacenamiento está actuando como un factor de crecimiento importante para el mercado global de detección de fugas.

El término fuga o escape significa una grieta, orificio o porosidad no intencional en una pared envolvente o junta de las tuberías, baterías, productos sellados, cámaras o contenedores de almacenamiento que deben contener/transferir diferentes fluidos y gases. Estas grietas o orificios permiten el escape de fluidos y gases de un medio cerrado.

El elevado número de incidentes con fugas en tuberías actúa como un factor importante para el crecimiento del mercado de detección de fugas. Las complicaciones técnicas con los detectores de fugas actúan como una importante limitación para el mercado de detección de fugas. El aumento de la producción de petróleo y gas a nivel mundial está actuando como una importante ventana de oportunidad para el mercado de detección de fugas. El desafío asociado con las tuberías de gran diámetro para una detección de fugas efectiva está actuando como un desafío importante para el crecimiento del mercado de detección de fugas.

Este informe de mercado de detección de fugas proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen analítico; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de detección de fugas en Oriente Medio y África

El mercado de detección de fugas está segmentado en función del tipo, el tipo de producto, la tecnología y el usuario final. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- Según el tipo, el mercado de detección de fugas se segmenta en upstream, midstream y downstream. En 2021, el segmento midstream ha sido considerado el que tiene la mayor participación de mercado, ya que se ocupa básicamente del transporte de petróleo crudo y gas natural a través de varios modos de transporte, como los oleoductos.

- Según el tipo de producto, el mercado de detección de fugas se segmenta en detectores de gas portátiles, detectores basados en vehículos aéreos no tripulados, detectores de aeronaves tripuladas y detectores basados en vehículos. En 2021, el segmento de detectores basados en vehículos ha sido el que ha acaparado la mayor cuota de mercado, ya que se pueden montar fácilmente en un vehículo y utilizar para supervisar las tuberías a través del vehículo en movimiento.

- En función de la tecnología, el mercado de detección de fugas se segmenta en acústica/ultrasonido, fibra óptica , métodos de desviación de presión-flujo, modelo transitorio extendido en tiempo real (E-RTTM), termografía, equilibrio masa/volumen, detección de vapor, absorción láser y lidar, detección de fugas hidráulicas, ondas de presión negativa y otros. En 2021, el segmento acústico/ultrasonido ha sido considerado la mayor participación de mercado, ya que ofrece una detección más rápida de fugas y es una solución de bajo costo; además, proporciona una detección temprana y la pérdida se puede prevenir en una etapa temprana.

- En función del usuario final, el mercado de detección de fugas se segmenta en petróleo y gas, plantas químicas, plantas de tratamiento de agua, centrales térmicas, minería y lodos, entre otros. En 2021, el segmento de petróleo y gas ha sido considerado la mayor participación de mercado, ya que esta industria es un importante usuario del sistema de detección de fugas para evitar fugas de petróleo crudo y gas y emisiones de metano.

Análisis a nivel de país del mercado de detección de fugas en Oriente Medio y África

Se analiza el mercado de detección de fugas y se proporciona información sobre el tamaño del mercado por país, tipo, tipo de producto, tecnología y usuario final como se menciona anteriormente. Los países cubiertos en el informe del mercado de detección de fugas de Medio Oriente y África son Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Israel, Egipto, resto de Medio Oriente y África.

Arabia Saudita representa el segundo mercado más grande debido a la alta producción de petróleo crudo para el segmento intermedio en el mercado de detección de fugas de Oriente Medio y África. La sección de países del informe de mercado de detección de fugas también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, actos regulatorios y análisis de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Los lanzamientos de nuevos productos por parte de los fabricantes están creando nuevas oportunidades para los actores del mercado de detección de fugas

El mercado de detección de fugas también le ofrece un análisis detallado del mercado para cada país, el crecimiento de la base instalada de diferentes tipos de productos, el impacto de la tecnología mediante curvas de vida útil y cambios en los escenarios regulatorios y su impacto en el mercado de detección de fugas. Los datos están disponibles para el año histórico 2011 a 2019.

Análisis del panorama competitivo y de la cuota de mercado de detección de fugas

El panorama competitivo del mercado de detección de fugas proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de ensayos clínicos, el análisis de la marca, las aprobaciones de productos, las patentes, la amplitud y la extensión del producto, el dominio de la aplicación y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de detección de fugas.

Algunos de los principales actores que operan en el mercado de detección de fugas son FLIR SYSTEMS, Inc., ABB, Honeywell International Inc., Siemens Energy, Pentair, ClampOn AS, Schneider Electric, Atmos International, Xylem, Emerson Electric Co., KROHNE Messtechnik GmbH, PERMA-PIPE International Holdings, Inc., TTK - Leak Detection System, MSA, HIMA, AVEVA Group plc, Yokogawa Electric Corporation, INFICON, Fotech Group Ltd., Hawk Measurement Systems y OptaSense Ltd., entre otros. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Numerosos lanzamientos de productos y acuerdos son también iniciados por empresas de todo el mundo, lo que también está acelerando el mercado de detección de fugas.

Por ejemplo,

- En noviembre, Siemens Energy se asoció con ProFlex Technologies, con sede en Houston, para brindar servicios de detección de fugas espontáneas a operadores de tuberías. En virtud de este acuerdo, Siemens Energy tendrá acceso exclusivo a la tecnología avanzada de detección de fugas digital Pipe-Safe de ProFlex Technologies. Con esta asociación, la empresa ha ampliado su cartera de productos.

Las asociaciones, las empresas conjuntas y otras estrategias mejoran la participación de mercado de la empresa con una mayor cobertura y presencia. También brindan a la organización el beneficio de mejorar su oferta para el mercado de detección de fugas mediante una gama de productos ampliada.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.