Middle East And Africa Hydrochloric Acid Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

51.51 Million

USD

72.69 Million

2025

2033

USD

51.51 Million

USD

72.69 Million

2025

2033

| 2026 –2033 | |

| USD 51.51 Million | |

| USD 72.69 Million | |

|

|

|

|

Segmentación del mercado de ácido clorhídrico en Oriente Medio y África: tipo (ácido clorhídrico sintético y subproducto), presentación (base acuosa, acuosa y solución), aplicación (decapado de acero, acidificación de pozos petrolíferos, procesamiento de minerales, procesamiento de alimentos, saneamiento de piscinas, cloruro de calcio, etc.), canal de distribución (comercio electrónico, B2B, tiendas especializadas, etc.), usuario final (alimentos y bebidas, productos farmacéuticos, textiles, petróleo y gas, siderurgia, química, etc.): tendencias y pronóstico del sector hasta 2033.

Tamaño del mercado de ácido clorhídrico en Oriente Medio y África

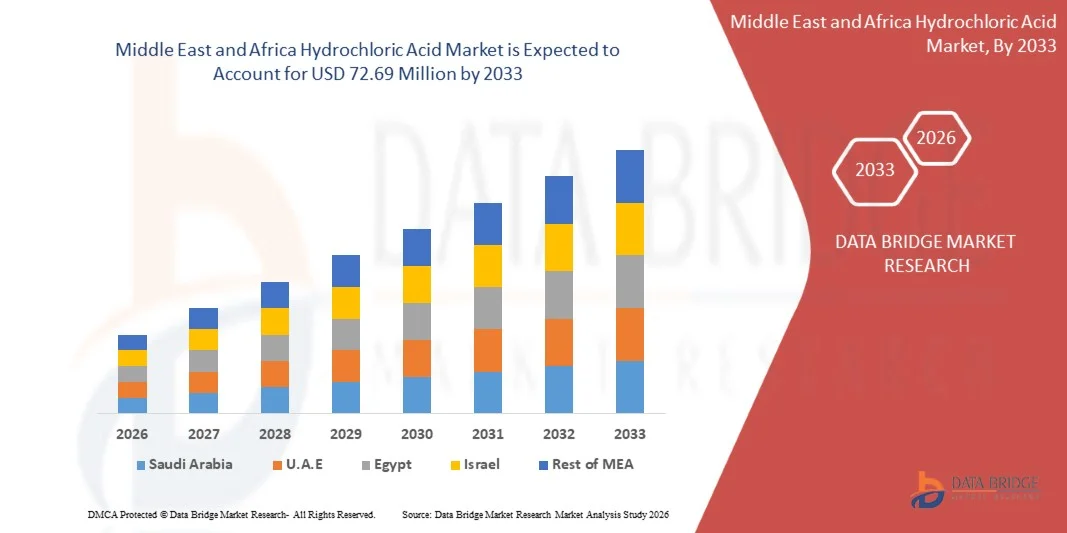

- El tamaño del mercado de ácido clorhídrico de Oriente Medio y África se valoró en 51,51 millones de USD en 2025 y se espera que alcance los 72,69 millones de USD en 2033 , con una CAGR del 4,4 % durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida al creciente uso de ácido clorhídrico en procesos industriales clave, como el decapado de acero, la acidificación de pozos petrolíferos, el procesamiento de alimentos y la síntesis química, impulsado por el aumento de la producción manufacturera y la creciente demanda de la industria pesada. La creciente demanda de HCl de alta pureza en la fabricación de productos farmacéuticos y electrónicos está impulsando aún más los volúmenes de producción y fortaleciendo las perspectivas de consumo.

- Además, la creciente adopción del ácido clorhídrico como subproducto de las plantas cloroalcalinas y los sistemas de recuperación orientados a la sostenibilidad están mejorando la disponibilidad de suministro para los sectores de uso final. Estos factores convergentes están acelerando el uso industrial del HCl y apoyando un crecimiento estable de la demanda en áreas de aplicación consolidadas y emergentes.

Análisis del mercado del ácido clorhídrico en Oriente Medio y África

- El ácido clorhídrico, una sustancia química inorgánica clave utilizada para el tratamiento de metales, el control del pH, el procesamiento químico y la recuperación de recursos, sigue siendo un insumo fundamental para industrias como la siderúrgica, la del petróleo y el gas, la alimentaria y la farmacéutica. Su versatilidad y su papel esencial en los flujos de trabajo industriales a gran escala refuerzan su importancia en las operaciones globales de fabricación y de la cadena de valor.

- La creciente demanda de ácido clorhídrico se debe principalmente al desarrollo de infraestructura, el aumento de las actividades de exploración de petróleo crudo que requieren acidificación y el creciente consumo de alimentos procesados y productos químicos especializados. Estos factores impulsores del mercado están fortaleciendo las tendencias de utilización a largo plazo y contribuyendo al crecimiento constante de la producción de HCl sintético y derivado.

- Los Emiratos Árabes Unidos dominaron el mercado de ácido clorhídrico en Oriente Medio y África en 2025, debido a su base de fabricación de productos químicos en expansión, sus sólidas operaciones de refinería y el aumento del consumo en los sectores de tratamiento de agua, procesamiento de alimentos y limpieza de metales.

- Se espera que Arabia Saudita sea el país de más rápido crecimiento en el mercado de ácido clorhídrico de Medio Oriente y África durante el período de pronóstico debido a la expansión de los sectores petroquímico, de petróleo y gas y de fabricación, junto con inversiones a gran escala bajo Visión 2030.

- El segmento del ácido clorhídrico sintético dominó el mercado con una cuota de mercado del 74,5 % en 2025, gracias a su pureza constante, su proceso de producción controlado y su idoneidad para industrias que requieren una composición química precisa. Los fabricantes prefieren las variantes sintéticas para aplicaciones como la farmacéutica, el procesamiento de alimentos y el tratamiento de aguas, donde la fiabilidad de la calidad repercute directamente en la producción operativa. La disponibilidad de instalaciones de producción a gran escala y rentables refuerza su presencia tanto en economías desarrolladas como en desarrollo. Las industrias que utilizan HCl sintético se benefician de niveles de concentración uniformes que reducen la variabilidad del proceso y mejoran la calidad del producto final. El segmento también avanza gracias a mejores tecnologías de manipulación y al aumento de la inversión en clústeres de fabricación de productos químicos a nivel mundial, lo que eleva su cuota de mercado.

Alcance del informe y segmentación del mercado de ácido clorhídrico en Oriente Medio y África

|

Atributos |

Ácido clorhídrico: información clave del mercado |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado del ácido clorhídrico en Oriente Medio y África

Creciente adopción de sistemas de producción de ácido clorhídrico basados en la recuperación

- Una tendencia importante en el mercado del ácido clorhídrico en Oriente Medio y África es la creciente transición hacia tecnologías de producción basadas en la recuperación que permiten la reutilización eficiente del gas de cloruro de hidrógeno procedente de las operaciones industriales. Este cambio se debe a la necesidad de reducir los residuos químicos, disminuir los costes de producción y cumplir con las normativas ambientales que promueven prácticas industriales sostenibles.

- Por ejemplo, Covestro AG y BASF SE han implementado sistemas de recuperación de cloruro de hidrógeno integrados en las unidades de fabricación de policarbonato e isocianato. Estos sistemas de circuito cerrado capturan y convierten el gas de cloruro de hidrógeno en ácido clorhídrico reutilizable, lo que mejora la eficiencia de los recursos y reduce las emisiones en las instalaciones de producción química.

- La adopción de sistemas de recuperación se está expandiendo en las industrias cloroalcalinas y petroquímicas, ya que estos procesos generan grandes volúmenes de cloruro de hidrógeno como subproducto. Al convertir este gas en ácido clorhídrico comercializable, las empresas mejoran la sostenibilidad operativa, optimizando sus estructuras de costos y la eficiencia de su cadena de suministro.

- La creciente innovación tecnológica en las unidades de recuperación de ácido, como los separadores de membrana y los módulos de recuperación térmica, está mejorando aún más la eficiencia del proceso. Estos avances permiten obtener resultados de mayor pureza y minimizar el consumo de energía, lo que respalda la viabilidad económica a largo plazo de los sistemas sostenibles de producción de ácido.

- Además, el creciente énfasis en la fabricación química circular está fomentando la integración del ácido clorhídrico recuperado en las cadenas de valor de la metalurgia, el procesamiento de alimentos y el tratamiento de aguas. Esta integración se alinea con los esfuerzos globales para reducir la huella de carbono y mejorar el uso de los recursos industriales.

- La tendencia generalizada hacia la producción de ácido clorhídrico basado en la recuperación refleja un mayor compromiso de la industria con la sostenibilidad y la resiliencia operativa. A medida que las empresas continúan invirtiendo en sistemas de circuito cerrado y marcos de producción sostenibles, se espera que estas tecnologías redefinan los parámetros competitivos en la fabricación de ácido y la eficiencia de la recuperación de recursos.

Dinámica del mercado del ácido clorhídrico en Oriente Medio y África

Conductor

“Aumento de la demanda de aplicaciones de decapado de acero y acidificación de pozos petrolíferos”

- La creciente demanda de las industrias de decapado de acero y acidificación de pozos petrolíferos es un factor clave para el mercado de ácido clorhídrico en Oriente Medio y África. En la producción de acero, el ácido clorhídrico desempeña un papel fundamental en la eliminación de impurezas y películas de óxido de las superficies metálicas antes del galvanizado o recubrimiento, garantizando una calidad superior del producto y resistencia a la corrosión.

- Por ejemplo, ArcelorMittal y Tata Steel han integrado plantas de regeneración de ácido clorhídrico en sus plantas de fabricación para garantizar un suministro constante para las operaciones de decapado. De igual manera, empresas de servicios petrolíferos como Halliburton y Schlumberger dependen en gran medida del ácido clorhídrico para tratamientos de acidificación que mejoran la permeabilidad en yacimientos de carbonato.

- La expansión de los proyectos de exploración de petróleo y gas, sumada al crecimiento de las operaciones de refinación downstream, está impulsando un mayor consumo de ácido clorhídrico. La eficacia de este compuesto para disolver incrustaciones minerales y limpiar las superficies de los pozos lo hace indispensable para mantener la eficiencia de la producción en los procesos de perforación y estimulación.

- En la fabricación de acero, la modernización de las unidades de procesamiento y el desarrollo de líneas de decapado avanzadas impulsan aún más la demanda a largo plazo. El uso de ácido clorhídrico en operaciones de decapado continuo permite superficies metálicas más limpias, mayor productividad y menor impacto ambiental en comparación con los métodos tradicionales de ácido sulfúrico.

- El continuo aumento de proyectos de construcción, automoción e infraestructura industrial en todo el mundo garantiza una demanda constante de acero de alta calidad, lo que impulsa la demanda de ácido clorhídrico. Su uso combinado en los sectores energético, metalúrgico y manufacturero posiciona a este compuesto como un químico industrial esencial que impulsa la actividad económica mundial.

Restricción/Desafío

“Volatilidad en el suministro de cloro y materias primas”

- La volatilidad en el suministro y los precios del cloro, una materia prima clave en la producción de ácido clorhídrico, plantea un desafío importante para los fabricantes. Dado que la disponibilidad de cloro está estrechamente vinculada a las operaciones de la industria cloroalcalina, las fluctuaciones en la producción o la demanda posterior de sosa cáustica pueden influir directamente en las tasas de producción de ácido clorhídrico y la estabilidad de los precios

- Por ejemplo, durante períodos de escasez de cloro, importantes productores como Olin Corporation y Westlake Chemical han reportado restricciones de producción y un aumento en los costos de adquisición de derivados, incluido el ácido clorhídrico. Estos desequilibrios en el suministro pueden interrumpir los compromisos contractuales y reducir la rentabilidad de las industrias dependientes.

- La naturaleza cíclica de la producción de cloro, sumada a las limitaciones logísticas y de almacenamiento, suele generar dinámicas desequilibradas entre la oferta y la demanda. Dado que el ácido clorhídrico es difícil de transportar a largas distancias debido a problemas de seguridad, los déficits de producción regional pueden provocar aumentos repentinos de precios y una disponibilidad limitada.

- Además, las fluctuaciones económicas mundiales y las interrupciones por mantenimiento en las instalaciones de cloro-álcali pueden agravar aún más la escasez de materias primas. Las variaciones en los precios de la energía y los costos de producción también afectan la economía de la fabricación de cloro, lo que a su vez influye en las tendencias de precios del ácido clorhídrico en las distintas regiones industriales.

- Garantizar el abastecimiento constante de materias primas y desarrollar modelos de producción eficientes basados en la recuperación será esencial para contrarrestar la volatilidad del mercado. Se espera que las colaboraciones estratégicas, la integración regresiva y la adopción de sistemas circulares de producción química contribuyan a estabilizar las cadenas de suministro y a mantener una producción fiable de ácido clorhídrico a largo plazo.

Alcance del mercado del ácido clorhídrico en Oriente Medio y África

El mercado está segmentado según el tipo, la forma, la aplicación, el canal de distribución y el usuario final.

• Por tipo

Según el tipo, el mercado se segmenta en ácido clorhídrico sintético y ácido clorhídrico subproducto. El segmento de ácido clorhídrico sintético dominó el mercado con la mayor participación del 74.5 % en 2025 debido a su pureza constante, proceso de producción controlado e idoneidad para industrias que requieren una composición química precisa. Los fabricantes prefieren variantes sintéticas para aplicaciones como productos farmacéuticos, procesamiento de alimentos y tratamiento de agua, donde la fiabilidad de la calidad impacta directamente en el rendimiento operativo. La disponibilidad de instalaciones de producción a gran escala y rentables fortalece su presencia tanto en economías desarrolladas como en desarrollo. Las industrias que utilizan HCl sintético se benefician de niveles de concentración uniformes que reducen la variabilidad del proceso y mejoran la calidad del producto final. El segmento también avanza gracias a mejores tecnologías de manipulación y al aumento de las inversiones en clústeres de fabricación de productos químicos a nivel mundial, lo que eleva su participación de mercado

Se proyecta que el segmento de subproductos de ácido clorhídrico experimentará el mayor crecimiento entre 2026 y 2033, impulsado por su creciente disponibilidad en plantas integradas de acero y químicas. Este tipo cobra impulso a medida que las industrias buscan alternativas rentables, derivadas del creciente enfoque en la eficiencia de los recursos y la fabricación circular. Su adopción se consolida a medida que las plantas de acero modernizan sus operaciones y generan mayores volúmenes de subproducto HCl, apto para el consumo posterior. Muchos sectores de uso final aceptan variantes de subproductos para aplicaciones como el procesamiento de metales y la estimulación de pozos petrolíferos, donde no es necesaria una pureza ultraalta. Las consideraciones ambientales y la reducción de los costos de producción aceleran aún más su trayectoria de crecimiento en los mercados globales.

• Por formulario

Según su presentación, el mercado se segmenta en ácido clorhídrico (A base de agua), ácido acuoso (A acuoso) y solución. El segmento de ácido clorhídrico (A base de agua) dominó el mercado de ácido clorhídrico en Oriente Medio y África en 2025 debido a su amplia aplicabilidad en síntesis química, tratamiento de metales y procesamiento industrial. El HCl (A base de agua) se prefiere por sus niveles de concentración equilibrados, su fácil manejo y su compatibilidad con grandes sistemas industriales. Las industrias de consumo final prefieren esta presentación, ya que permite velocidades de reacción estables y reduce los riesgos asociados a las formas ácidas altamente concentradas. Este segmento se beneficia de la expansión de las operaciones de fabricación en los sectores del acero y el petróleo y el gas, donde las variantes a base de agua se utilizan ampliamente. Sus ventajas en cuanto a rentabilidad y seguridad garantizan una demanda continua entre los compradores de productos químicos a granel y especializados.

Se prevé que el segmento de HCl acuoso y en solución experimente el mayor crecimiento entre 2026 y 2033 debido a su creciente adopción en laboratorios, aplicaciones industriales controladas y síntesis química de precisión. Estas presentaciones ofrecen niveles de concentración personalizables que cumplen con los estrictos requisitos operativos de las industrias farmacéutica, alimentaria y electrónica. El crecimiento se ve impulsado aún más por la creciente automatización de los sistemas de dosificación, que utilizan formatos de solución estandarizados para evitar la variabilidad. El segmento se beneficia de la expansión de aplicaciones en áreas donde se prioriza la consistencia del comportamiento químico y la seguridad en la manipulación. Esta flexibilidad en la formulación facilita su rápida expansión en las industrias emergentes de uso final.

• Por aplicación

Según la aplicación, el mercado se segmenta en decapado de acero, acidificación de pozos petrolíferos, procesamiento de minerales, procesamiento de alimentos, saneamiento de piscinas, cloruro de calcio y otros. La aplicación de decapado de acero dominó el mercado en 2025 debido al papel indispensable del ácido en la eliminación de incrustaciones, óxido e impurezas durante el procesamiento del acero. El ácido clorhídrico proporciona una eficiencia de decapado superior en comparación con los ácidos alternativos, ofreciendo velocidades de reacción más rápidas y una preparación de superficies más limpia para los procesos posteriores. La expansión de la producción mundial de acero, particularmente en Asia-Pacífico, refuerza aún más su dominio. Los fabricantes de acero prefieren el HCl por su reciclabilidad a través de sistemas de regeneración ácida, lo que reduce el impacto ambiental y los costos operativos. El segmento mantiene una posición sólida debido a la continua modernización de las líneas de decapado y la demanda de las industrias automotriz, de la construcción y pesada

Se proyecta que la acidificación de pozos petrolíferos registrará el mayor crecimiento entre 2026 y 2033, impulsada por el aumento de las actividades de perforación en reservas convencionales y no convencionales. El ácido clorhídrico es el preferido por su capacidad para disolver carbonatos, mejorar la permeabilidad de los yacimientos y optimizar los caudales de hidrocarburos. La expansión de los proyectos de exploración de esquisto y recuperación mejorada de petróleo incrementa la demanda de soluciones de acidificación de alto rendimiento. El enfoque de la industria en maximizar la productividad de los pozos y reducir el tiempo de inactividad fomenta una mayor adopción de formulaciones basadas en HCl. La creciente inversión en servicios petrolíferos y técnicas avanzadas de estimulación impulsa a este segmento a la vanguardia del crecimiento futuro.

• Por canal de distribución

Según el canal de distribución, el mercado se segmenta en comercio electrónico, B2B, tiendas especializadas y otros. El canal de distribución B2B dominó el mercado de ácido clorhídrico en Oriente Medio y África en 2025 debido a los patrones de compra a granel de los consumidores industriales en los sectores del acero, la química y el petróleo y el gas. Las empresas prefieren los contratos de suministro directo para garantizar una disponibilidad ininterrumpida, precios estables y grados de concentración personalizados. Los fabricantes y distribuidores de productos químicos fortalecen este canal con redes logísticas consolidadas y acuerdos de servicio a largo plazo. Los grandes usuarios se benefician de sistemas integrados de almacenamiento, transporte y seguridad que agilizan las entregas de grandes volúmenes. Este canal sigue siendo dominante a medida que la dependencia industrial de un suministro controlado y oportuno continúa aumentando a nivel mundial.

Se prevé que el segmento del comercio electrónico experimente el mayor crecimiento entre 2026 y 2033 debido a la creciente digitalización de los procesos de adquisición y la expansión de los mercados químicos en línea. Las pequeñas y medianas industrias recurren cada vez más a las plataformas en línea para obtener precios transparentes, comparar productos y procesar pedidos con agilidad. Las plataformas de comercio electrónico facilitan el acceso a fichas de datos de seguridad, certificaciones y especificaciones técnicas, lo que facilita la toma de decisiones informada. La transición hacia la compra descentralizada y la demanda de envases más pequeños también impulsan el crecimiento. La creciente participación de los proveedores de productos químicos en la distribución en línea acelera la expansión del segmento.

• Por el usuario final

Según el usuario final, el mercado se segmenta en alimentos y bebidas, productos farmacéuticos, textiles, petróleo y gas, siderurgia, industria química y otros. La industria siderúrgica dominó el mercado en 2025 debido al consumo a gran escala de ácido clorhídrico para procesos de decapado, decapado y optimización de la producción. Las acerías dependen del HCl para lograr superficies limpias, reducir impurezas y permitir operaciones eficientes de laminado y acabado. El crecimiento continuo de los sectores de la construcción, la automoción y las infraestructuras mantiene altos niveles de producción de acero. Las tecnologías de regeneración ácida fomentan aún más su adopción al reducir los residuos y mejorar la rentabilidad. El segmento se beneficia de las continuas expansiones de capacidad en las principales regiones productoras de acero, lo que garantiza un dominio sostenido.

Se proyecta que el segmento de petróleo y gas crecerá a su ritmo más rápido entre 2026 y 2033, impulsado por la creciente demanda de estimulación ácida, limpieza de pozos y operaciones de recuperación mejorada. El ácido clorhídrico desempeña un papel crucial en la mejora del rendimiento de los yacimientos, especialmente en formaciones carbonatadas, donde la acidificación es esencial. El crecimiento de la extracción de esquisto y la perforación de pozos profundos impulsa la demanda de mezclas ácidas a medida. El sector adopta soluciones químicas más avanzadas para maximizar el rendimiento y la eficiencia operativa. El aumento de la inversión global en proyectos de exploración y producción garantiza una rápida expansión de este segmento de usuarios finales.

Análisis regional del mercado de ácido clorhídrico en Oriente Medio y África

- Los Emiratos Árabes Unidos dominaron el mercado de ácido clorhídrico en Oriente Medio y África con la mayor participación en los ingresos en 2025, impulsados por su base de fabricación de productos químicos en expansión, sólidas operaciones de refinería y un consumo creciente en los sectores de tratamiento de agua, procesamiento de alimentos y limpieza de metales.

- La avanzada infraestructura industrial del país y la expansión de las instalaciones petroquímicas y cloroalcalinas, impulsada por el gobierno, están fortaleciendo la producción nacional de ácido clorhídrico. Las alianzas estratégicas entre productores químicos globales y clústeres industriales locales están mejorando la fiabilidad del suministro, la eficiencia de los procesos y la calidad de los productos.

- El aumento de las inversiones en diversificación industrial, proyectos de infraestructura a gran escala e iniciativas de tratamiento de aguas residuales refuerza el liderazgo de los EAU en el mercado regional. El compromiso del país con el fortalecimiento de las cadenas de valor químicas posteriores continúa respaldando su posición dominante.

Análisis del mercado del ácido clorhídrico en Arabia Saudita, Oriente Medio y África

Se proyecta que Arabia Saudita registrará la tasa de crecimiento anual compuesta (TCAC) más rápida del mercado de ácido clorhídrico en Oriente Medio y África durante el período 2026-2033, impulsada por la expansión de los sectores petroquímico, de petróleo y gas, y manufacturero, junto con las inversiones a gran escala en el marco de la Visión 2030. El país está incrementando el uso de ácido clorhídrico en la perforación, la recuperación mejorada de petróleo, el procesamiento de acero y la producción química para impulsar la expansión industrial. La creciente colaboración entre productores locales y empresas químicas internacionales está acelerando la adopción de tecnología, mejorando las capacidades de producción y ampliando las redes de distribución. Las iniciativas respaldadas por el gobierno que promueven la autosuficiencia industrial, el crecimiento del procesamiento de minerales y la infraestructura de tratamiento de agua están creando sólidas perspectivas de demanda. El enfoque estratégico de Arabia Saudita en la modernización industrial y el desarrollo sostenible continúa impulsando el crecimiento constante de su mercado.

Perspectiva del mercado del ácido clorhídrico en Sudáfrica, Oriente Medio y África

Se proyecta que Sudáfrica experimentará un sólido crecimiento durante el período 2026-2033, impulsado por el fortalecimiento de sus industrias minera, metalúrgica y de procesamiento químico. Los consolidados sectores de extracción y refinación de minerales del país están incrementando la necesidad de ácido clorhídrico para el procesamiento de minerales y el tratamiento de metales. Los avances en las tecnologías de producción de cloro-álcali y el aumento de las inversiones del sector público en infraestructura de tratamiento de agua están mejorando el suministro interno. Las colaboraciones entre fabricantes de productos químicos, empresas mineras y organizaciones centradas en la sostenibilidad están promoviendo la innovación y ampliando la visibilidad en el mercado. El énfasis de Sudáfrica en la eficiencia de los recursos, la modernización industrial y el desarrollo de la economía circular la consolida como el mercado de mayor crecimiento de la región.

Cuota de mercado del ácido clorhídrico en Oriente Medio y África

La industria del ácido clorhídrico está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Corporación Olin (EE. UU.)

- Corporación Occidental Petroleum (EE. UU.)

- Shin-Etsu Chemical Co., Ltd. (Japón)

- BASF SE (Alemania)

- UNID (Corea del Sur)

- Detrex Corporation – Italmatch Chemicals SpA (EE. UU./Italia)

- Tronox Holdings plc (EE. UU.)

- IXOM (Australia)

- Nouryon (Países Bajos)

- ERCO Worldwide – Superior Plus (Canadá)

- SEQUENS (Francia)

- Formosa Plastics Corporation (Taiwán)

- Grupo Tessenderlo (Bélgica)

- Westlake Chemical Corporation (EE. UU.)

- Productos químicos Aditya Birla (India)

- AGC Chemicals Americas (EE. UU./Japón)

- TOAGOSEI CO., LTD (Japón)

Últimos avances en el mercado del ácido clorhídrico en Oriente Medio y África

- En noviembre de 2025, la EPA de EE. UU. introdujo regulaciones más estrictas sobre emisiones atmosféricas para las cámaras de combustión de residuos peligrosos, lo que impone controles más estrictos a las instalaciones que recuperan ácido clorhídrico de los flujos de residuos. Las normas actualizadas aumentan la necesidad de tecnologías avanzadas de control de emisiones, lo que incrementa los costos operativos y de cumplimiento normativo de las unidades de recuperación de HCl. Se espera que este avance influya en la rentabilidad de la producción de ácido clorhídrico como subproducto, lo que podría ralentizar la ampliación de la capacidad basada en la recuperación e impulsar a los productores a reevaluar sus estrategias de inversión a largo plazo en sistemas de conversión de residuos en productos químicos.

- En julio de 2025, Olin Corporation amplió su capacidad de producción de ácido clorhídrico en su planta de fabricación de Luisiana para atender la creciente demanda de las industrias de procesamiento de acero, síntesis química y tratamiento de aguas. Esta expansión mejora la capacidad de Olin para satisfacer las necesidades de suministro regionales e internacionales, reduce la dependencia de los volúmenes importados y estabiliza la disponibilidad en todos los segmentos de uso final. Al fortalecer la fiabilidad de la producción, Olin también mejora su ventaja competitiva dentro de la cadena de valor del cloro-álcali, impulsando el equilibrio del mercado en un contexto de aumento del consumo.

- En enero de 2025, Jones-Hamilton Co. completó la adquisición de Nexchlor LLC, ampliando significativamente su capacidad de producción de ácido clorhídrico y su presencia geográfica. La integración fortalece la posición de la compañía en el mercado global, mejorando la seguridad del suministro y permitiendo una cobertura de servicio más amplia en más de 20 países. Con el nombramiento de Jon Cupps como gerente de división para el negocio de HCl, la compañía busca optimizar las operaciones y mejorar la alineación estratégica. El director ejecutivo, Tim Poure, destacó cómo la experiencia combinada mejorará las relaciones con los clientes y el rendimiento del suministro a largo plazo.

- En agosto de 2024, Westlake Corporation celebró una audiencia pública para debatir su propuesta de instalar dos hornos de ácido clorhídrico alimentados con residuos peligrosos, diseñados para recuperar HCl de flujos de residuos industriales. El proyecto destaca la creciente atención de la industria a la eficiencia de los recursos y a las vías de producción sostenibles. Si bien los asistentes de la comunidad expresaron su preocupación por los impactos ambientales y de seguridad, los expertos en regulación enfatizaron el estricto cumplimiento de los requisitos de eliminación de contaminantes de la Ley de Conservación y Recuperación de Recursos. El avance del proyecto podría mejorar el suministro regional y apoyar modelos de producción circulares, aunque el escrutinio regulatorio y la opinión de la comunidad podrían influir en el cronograma final de implementación.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.