Middle East and Africa Hummus Market, By Type (Classic Hummus, Red Pepper Hummus, Roasted Garlic Hummus, Black Olive Hummus, Lentil Hummus, Edamame Hummus, White Bean Hummus, and Others), Raw Material (Chickpeas, Beans, Green Peas, Red Lentil, Eggplant, and Others), Packaging (Tubs / Cups, Pouch, Bottled, Jars, and Others), Origin (Conventional and Organic), Emulsion Type (Permanent, Semi Permanent, and Temporary), Fat Content (Regular, Low Fat, and Fat Free), Packaging Material (Polymers, Metal, Glass, and Others), Application (Paste & Spreads, Sauces & Dips, Desserts, Confectionery, and Others), Distribution Channel (B2C and B2B), End User (Household / Retail, Commercials and Industrial) Industry Trends and Forecast to 2030.

Middle East and Africa Hummus Market Analysis and Insights

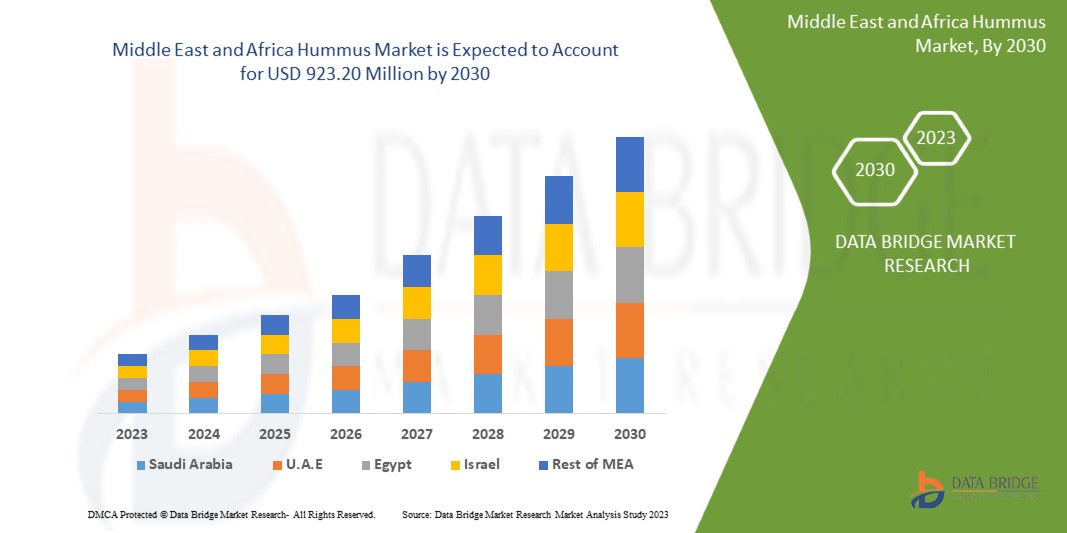

Middle East & Africa hummus market is expected to gain significant growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 7.1% in the forecast period of 2023 to 2030 and is expected to reach USD 923.20 million by 2030. The major factor driving the growth of the Middle East and Africa hummus market is rising consumer spending towards packaged food items.

Hummus is known for being a clean, healthful dish. Hummus comes in a variety of flavors in the United States and other Western countries. Hummus can be found in basic versions with simply chickpeas and perhaps a vegetable or two for flavour, or in "multi-layer" type hummuses with extra components like olive oil and spices.

Middle East and Africa hummus market report provides details of market share, new developments, and the impact of domestic and localized market players, analysis opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Tipo (hummus clásico, hummus de pimiento rojo, hummus de ajo asado, hummus de aceitunas negras, hummus de lentejas, hummus de edamame, hummus de frijoles blancos y otros), materia prima (garbanzos, frijoles, guisantes verdes, lentejas rojas, berenjenas y otros), empaque (tarros/vasos, bolsas , botellas, frascos y otros), origen (convencional y orgánico), tipo de emulsión (permanente, semipermanente y temporal), contenido de grasa (regular, bajo en grasa y sin grasa), material de empaque (polímeros, metal, vidrio y otros), aplicación (pastas y cremas para untar, salsas y aderezos, postres, confitería y otros), canal de distribución (B2C y B2B), usuario final (hogar/venta minorista, (comercial e industrial) |

|

Región cubierta |

Arabia Saudita, Emiratos Árabes Unidos, Omán, Kuwait, Qatar, Sudáfrica, Resto de Oriente Medio y África |

|

Actores del mercado cubiertos |

SAVENCIA SA (Francia), Kasih Food (Jordania) y Elma Farms (EE.UU.) |

Definición de mercado

El plato mediterráneo y de Oriente Medio más conocido es el hummus. Se elabora principalmente a partir de puré de garbanzos, junto con limón, pasta de tahini, aceite de oliva y especias como ajo asado, pimientos rojos asados y cebolla. El perejil, los tomates o pepinos picados y los piñones también se incluyen a veces en la producción de hummus. El hummus se compone principalmente de garbanzos que son una buena fuente de proteínas, almidón resistente, ácidos grasos poliinsaturados, fibra dietética y varios minerales y vitaminas como tiamina, riboflavina, fósforo, ácido fólico, niacina, calcio y potasio. El alto contenido de proteínas del hummus lo convierte en una opción ideal para las personas veganas que lo utilizan como salsa o para untar junto con panes y patatas fritas. El hummus también tiene un índice glucémico bajo, por lo tanto, no aumenta el nivel de azúcar en sangre en comparación con otros alimentos ricos en carbohidratos.

Dinámica del mercado del hummus en Oriente Medio y África

Conductores

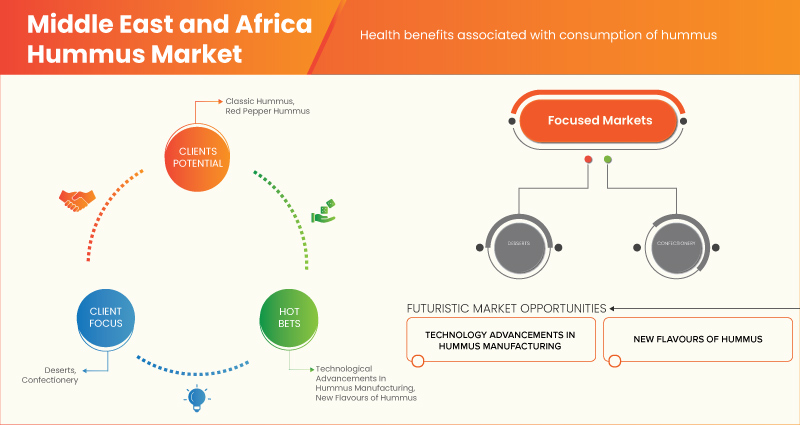

- AUMENTO DEL NÚMERO DE LANZAMIENTOS DE NUEVOS PRODUCTOS CON VARIAS COMBINACIONES DE SABORES

El hummus es una famosa salsa mediterránea y, como dip, tiene un alto contenido de vitaminas, minerales, fibra y proteínas. Los ingredientes del hummus, como los garbanzos, el tahini y el aceite de oliva, son superalimentos muy conocidos. Debido a su alto valor nutricional y sus beneficios, la popularidad del hummus está aumentando en todo el mundo. También ha aumentado el gasto de los consumidores en productos envasados de hummus. Los veganos también están optando por el hummus como opción de aperitivo, ya que es una buena fuente de proteínas de origen vegetal.

El hummus se utiliza principalmente como salsa para verduras junto con apio, zanahorias, pimientos morrones, rodajas de pepino, guisantes o brócoli. También se utiliza como salsa o para untar con pan de pita, chips de pretzel, galletas saladas, panecillos y relleno de sándwiches. Además, la tendencia de consumir opciones listas para comer también es una fuerza impulsora de las ventas de hummus en el mercado de Oriente Medio y África. Para atraer a nuevos consumidores, los fabricantes están tratando de lanzar diferentes sabores. Los sabores tradicionales son demasiado famosos, pero para atraer a nuevos clientes, los fabricantes están desarrollando nuevos tipos de hummus con sabores. Además, para llegar a los nuevos mercados, los productores están desarrollando hummus con sabores regionales.

- BENEFICIOS PARA LA SALUD ASOCIADOS AL CONSUMO DE HUMMUS

El hummus es un plato tradicional de Oriente Medio que se elabora a partir de garbanzos cocidos en puré. Con frecuencia incluye condimentos adicionales, como tahini, jugo de limón, sal y aceite de oliva. El hummus ha sido un alimento básico en las regiones del Mediterráneo, Oriente Medio y el norte de África. El hummus se compone principalmente de garbanzos, que son una buena fuente de proteínas, almidón resistente, ácidos grasos poliinsaturados, fibra dietética y varios minerales y vitaminas como tiamina, riboflavina, fósforo, ácido fólico, niacina, calcio y potasio. Junto con los garbanzos, el tahini también es uno de los ingredientes para elaborar el hummus. Es una pasta hecha de sésamo tostado y molido que se compone de lignanos antioxidantes, ácidos grasos insaturados, tocoferoles y minerales que consisten en fósforo y calcio.

Oportunidades

- LA CRECIENTE POPULARIDAD DE LOS ALIMENTOS MEDITERRÁNEOS EN LOS MERCADOS EMERGENTES

En los últimos años, la comida mediterránea se ha vuelto popular en todo el mundo. La comida mediterránea está llena de alimentos de origen vegetal que consisten en aceite de oliva, cereales integrales, frijoles y otras legumbres, verduras, especias, nueces y hierbas. Varios estudios de investigación han demostrado que la dieta mediterránea tiene potencial para reducir el riesgo de enfermedades cardiovasculares y otras enfermedades crónicas. La dieta mediterránea también es recomendada por profesionales de la salud debido a la cantidad limitada de grasas trans y grasas saturadas, ácidos grasos omega-3, menor sodio, menos carbohidratos refinados y alta cantidad de fibra dietética. Alimentos como el pan de pita, hummus, ensalada fattoush y baklava son algunos de los famosos alimentos de base mediterránea famosos en todo el mundo.

El hummus también tiene beneficios para la salud, ya que se compone de varios ingredientes saludables como garbanzos, aceite de oliva, jugo de limón y tahini. Es una buena fuente de proteínas para la población que sigue una dieta vegana. El hummus también es conveniente para envasarlo en recipientes pequeños y es una opción de refrigerio saludable. En regiones económicas en ascenso como Asia y África, también ha habido un mercado creciente de alimentos mediterráneos que ofrece una amplia gama de oportunidades para el crecimiento del mercado de hummus en Medio Oriente y África.

- AVANCES TECNOLÓGICOS EN LA FABRICACIÓN DE HUMMUS

El hummus ha ganado popularidad en todo el mundo. Los beneficios para la salud y el aumento de la población vegana han impulsado la demanda de hummus. En los últimos años, ha habido cada vez más avances tecnológicos en la fabricación de hummus. El aumento de los avances tecnológicos ha aumentado aún más la calidad y la cantidad del hummus producido. La producción de hummus, que comienza pelando los garbanzos, tostándolos, moliéndolos, mezclándolos y envasándolos en paquetes, se realiza automáticamente en máquinas sin ninguna intervención humana.

Además, la conservación del hummus es una de las áreas más investigadas en lo que respecta a los avances tecnológicos. El procesamiento a alta presión es uno de los métodos más investigados para conservar y esterilizar el hummus mediante presión sin utilizar conservantes. Además, se han producido avances en la tecnología de envasado. Los fabricantes también están cambiando hacia aplicaciones de envasado sostenibles, reciclables, ecológicas y flexibles para el almacenamiento del hummus.

Restricciones/Desafíos

- FLUCTUACIÓN DE LOS PRECIOS DE LAS MATERIAS PRIMAS

El hummus es una pasta para untar o salsa preparada con garbanzos machacados, jugo de limón, frijoles, ajo, tahini, aceite de oliva y sal. Se pueden agregar otros ingredientes, como piñones o pimiento rojo, para que la comida tenga más sabor. El hummus es un alimento popular en la cocina de Oriente Medio, Mediterráneo, Oriente Medio y África, y Oriente Medio y África. Es un ingrediente básico en la mayoría de las dietas veganas y vegetarianas. La gente elige alimentos preparados en tiendas y supermercados. Sin embargo, los compradores han visto recientemente un aumento en el precio del hummus.

La creciente demanda de hummus, junto con la escasez de garbanzos, ha provocado un aumento de los costos. Los garbanzos necesitan mucha agua para crecer. Se ha proyectado que la sequía ha reducido la producción mundial de legumbres en un 40% aproximadamente. El costo de los garbanzos está influenciado por dos factores principales: el conflicto de Rusia contra Ucrania y el clima. Según la Confederación de Legumbres de Oriente Medio y África, se prevé que el suministro mundial de esta legumbre disminuya aproximadamente un 20% en 2022. El clima y los conflictos han perjudicado el suministro de este frijol rico en proteínas, lo que ha aumentado los costos de los alimentos y ha causado problemas a los productores de alimentos.

- AUMENTO DE LA ADULTERACIÓN EN PRODUCTOS DE HUMMUS

Se considera que un alimento está adulterado cuando incluye un componente "venenoso o perjudicial" que puede poner en peligro la salud. La adulteración puede ocurrir de forma intencionada o no, pero causa grandes dificultades tanto a los consumidores como a los productores. Se han dado algunos casos de adulteración de productos de hummus, que han dado lugar a retiradas de productos por parte de los consumidores finales, como tiendas minoristas o supermercados, así como a advertencias a los consumidores para que no utilicen los productos adulterados. Esto crea una impresión negativa entre los consumidores y, como resultado, los fabricantes pierden clientes e ingresos.

Acontecimientos recientes

- En junio de 2021, el principal productor y cofabricante de hummus del país, CEDAR'S MEDITERRANEAN FOODS, INC., aumentó su distribución para incluir Amazon Fresh. Con más de 8000 establecimientos en todo el país, incluidos Whole Foods Market, Sprouts, Kroger y Publix, Cedar's es una marca líder de alimentos mediterráneos en el canal de productos naturales y orgánicos. Esto ayudará a la empresa a expandir su negocio y llegar a un mayor número de clientes.

- En noviembre de 2019, Hannah Foods lanzó un nuevo producto llamado hummus de coliflor y pimiento rojo asado, que ha sido un gran éxito en la región sudeste de Costco. Se complacen en anunciar que el hummus de coliflor y pimiento rojo asado estará disponible en todas las sucursales de Costco en la región sudeste a partir de enero. Esto permite a la corporación atraer a más clientes que prefieren alimentos listos para comer, lo que aumenta la producción y los ingresos.

- En septiembre de 2019, Boar's Head Brand lanzó su nuevo hummus de postre de pastel de calabaza FallSpice Selection. El hummus se prepara con azúcar orgánico, calabaza real, garbanzos, vainas de vainilla y agradables especias otoñales como canela y nuez moscada. El lanzamiento del producto ayudará a atraer a los clientes que deseen probar diferentes sabores de hummus.

Mercado del hummus en Oriente Medio y África

El mercado de hummus de Oriente Medio y África se clasifica en función del tipo, la materia prima, el envase, el origen, el tipo de emulsión, el contenido de grasa, el material de envasado, la aplicación, el canal de distribución y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Hummus clásico

- Hummus de pimiento rojo

- Hummus de ajo asado

- Hummus de aceitunas negras

- Hummus de lentejas

- Hummus de edamame

- Hummus de frijoles blancos

- Otros

Según el tipo, el mercado de hummus de Medio Oriente y África está segmentado en hummus clásico, hummus de pimiento rojo, hummus de ajo asado, hummus de aceitunas negras, hummus de lentejas, hummus de edamame, hummus de frijoles blancos y otros.

Materia prima

- Garbanzos

- Frijoles

- Guisantes

- Lenteja roja

- Berenjena

- Otros

Según la materia prima, el mercado de hummus de Oriente Medio y África está segmentado en garbanzos, frijoles, guisantes, lentejas rojas, berenjenas y otros.

Embalaje

- Tinas / Tazas

- Bolsa

- Embotellado

- Paso

- Otros

Según el empaque, el mercado de hummus de Medio Oriente y África está segmentado en recipientes/vasos, bolsas, botellas, frascos y otros.

Origen

- Convencional

- Orgánico

Según el origen, el mercado de hummus de Oriente Medio y África está segmentado en convencional y orgánico.

Tipo de emulsión

- Permanente

- Semipermanente

- Temporario

Según el tipo de emulsión, el mercado de hummus de Oriente Medio y África está segmentado en permanente, semipermanente y temporal.

Contenido de grasa

- Regular

- Bajo en grasa

- Sin grasa

Según el contenido de grasa, el mercado de hummus de Medio Oriente y África está segmentado en regular, bajo en grasa y sin grasa.

Material de embalaje

- Polímeros

- Metal

- Vaso

- Otros

Según el material de envasado, el mercado de hummus de Medio Oriente y África está segmentado en polímeros, metal, vidrio y otros.

Solicitud

- Pastas y untables

- Salsas y aderezos

- Postres

- Confitería

- Otros

Según la aplicación, el mercado de hummus de Medio Oriente y África está segmentado en pastas y untables, salsas y aderezos, postres, confitería y otros.

Canal de distribución

- De empresa a consumidor

- B2B

Según el canal de distribución, el mercado de hummus de Oriente Medio y África está segmentado en B2C y B2B.

Usuario final

- Hogar/venta al por menor

- Comerciales

- Industrial

Según el usuario final, el mercado de hummus de Oriente Medio y África está segmentado en hogares/venta minorista, comerciales e industriales.

Análisis y perspectivas regionales del mercado del hummus en Oriente Medio y África

El mercado de hummus de Oriente Medio y África está segmentado según el tipo, la materia prima, el embalaje, el origen, el tipo de emulsión, el contenido de grasa, el material de embalaje, la aplicación, el canal de distribución y el usuario final.

Los países que componen el mercado del hummus en Oriente Medio y África son Arabia Saudita, Emiratos Árabes Unidos, Omán, Kuwait, Qatar, Sudáfrica y el resto de Oriente Medio y África. Arabia Saudita domina el mercado del hummus en Oriente Medio y África en términos de participación de mercado e ingresos de mercado debido al aumento del gasto de los consumidores en alimentos envasados.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos del análisis de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de nuevas marcas y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles internos y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado del hummus en Oriente Medio y África

El panorama competitivo del mercado del hummus en Oriente Medio y África proporciona detalles por competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión del producto, el dominio de la aplicación, la curva de vida útil del producto. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas relacionado con el mercado del hummus en Oriente Medio y África.

Algunos de los participantes destacados que operan en el mercado de hummus de Medio Oriente y África son SAVENCIA SA (Francia), Kasih Food (Jordania) y Elma Farms (EE. UU.).

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA HUMMUS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TREATMENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND ANALYSIS

4.2 COMPARATIVE ANALYSIS WITH THE PARENT MARKET

4.2.1 OVERVIEW

4.2.1.1 SALSA

4.2.1.2 MAYONNAISE

4.2.1.3 FRUIT PRESERVES

4.2.1.4 GUACAMOLE

4.3 CONSUMER BUYING BEHAVIOR

4.3.1 OVERVIEW

4.3.1.1 COMPLEX BUYING BEHAVIOR

4.3.1.2 DISSONANCE-REDUCING BUYING BEHAVIOR

4.3.1.3 HABITUAL BUYING BEHAVIOR

4.3.1.4 VARIETY SEEKING BEHAVIOR

4.3.2 CONCLUSION

4.4 PATENT ANALYSIS OF THE MIDDLE EAST & AFRICA HUMMUS MARKET

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 OVERVIEW

4.5.2 LOGISTIC COST SCENARIO

4.5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.6 UPCOMING TECHNOLOGY AND TRENDS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN THE NUMBER OF NEW PRODUCT LAUNCHES WITH VARIOUS FLAVORS COMBINATION

6.1.2 HEALTH BENEFITS ASSOCIATED WITH THE CONSUMPTION OF HUMMUS

6.1.3 THE INCREASING PREVALENCE OF VEGANISM BOOSTS HUMMUS DEMAND

6.1.4 RISING CONSUMER SPENDING TOWARD PACKAGED FOOD ITEMS

6.2 RESTRAINTS

6.2.1 FLUCTUATION IN RAW MATERIAL PRICES

6.2.2 AVAILABILITY OF OTHER TYPES OF DIPS

6.3 OPPORTUNITIES

6.3.1 RISING POPULARITY OF MEDITERRANEAN FOOD IN EMERGING MARKETS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN HUMMUS MANUFACTURING

6.4 CHALLENGES

6.4.1 SIDE EFFECTS ASSOCIATED WITH THE CONSUMPTION OF HUMMUS

6.4.2 INCREASING ADULTERATION IN HUMMUS PRODUCTS

7 MIDDLE EAST & AFRICA HUMMUS MARKET, BY REGION

7.1 MIDDLE EAST & AFRICA

7.1.1 SAUDI ARABIA

7.1.2 U.A.E

7.1.3 OMAN

7.1.4 KUWAIT

7.1.5 QATAR

7.1.6 SOUTH AFRICA

7.1.7 REST OF MIDDLE EAST AND AFRICA

8 MIDDLE EAST & AFRICA HUMMUS MARKET, COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

9 SWOT ANALYSIS

10 COMPANY PROFILES

10.1 LANCASTER COLONY CORPORATION

10.1.1 COMPANY SNAPSHOT

10.1.2 REVENUE ANALYSIS

10.1.3 COMPANY SHARE ANALYSIS

10.1.4 PRODUCT PORTFOLIO

10.1.5 RECENT DEVELOPMENTS

10.2 SABRA DIPPING CO., LLC

10.2.1 COMPANY SNAPSHOT

10.2.2 COMPANY SHARE ANALYSIS

10.2.3 PRODUCT PORTFOLIO

10.2.4 RECENT DEVELOPMENT

10.3 BAKKAVOR GROUP PLC

10.3.1 COMPANY SNAPSHOT

10.3.2 REVENUE ANALYSIS

10.3.3 COMPANY SHARE ANALYSIS

10.3.4 PRODUCT PORTFOLIO

10.3.5 RECENT DEVELOPMENTS

10.4 BOAR'S HEAD BRAND

10.4.1 COMPANY SNAPSHOT

10.4.2 COMPANY SHARE ANALYSIS

10.4.3 PRODUCT PORTFOLIO

10.4.4 RECENT DEVELOPMENT

10.5 TRIBE MEDITERRANEAN FOODS, INC.

10.5.1 COMPANY SNAPSHOT

10.5.2 COMPANY SHARE ANALYSIS

10.5.3 PRODUCT PORTFOLIO

10.5.4 RECENT DEVELOPMENT

10.6 ABRAHAM'S NATURAL FOODS

10.6.1 COMPANY SNAPSHOT

10.6.2 PRODUCT PORTFOLIO

10.6.3 RECENT DEVELOPMENT

10.7 CEDAR'S MEDITERRANEAN FOODS, INC.

10.7.1 COMPANY SNAPSHOT

10.7.2 PRODUCT PORTFOLIO

10.7.3 RECENT DEVELOPMENTS

10.8 ELMA FARMS

10.8.1 COMPANY SNAPSHOT

10.8.2 PRODUCT PORTFOLIO

10.8.3 RECENT DEVELOPMENT

10.9 ESTI FOODS

10.9.1 COMPANY SNAPSHOT

10.9.2 PRODUCT PORTFOLIO

10.9.3 RECENT DEVELOPMENTS

10.1 HAIG'S DELICACIES

10.10.1 COMPANY SNAPSHOT

10.10.2 PRODUCT PORTFOLIO

10.10.3 RECENT DEVELOPMENTS

10.11 HALIBURTON INTERNATIONAL FOODS, INC.

10.11.1 COMPANY SNAPSHOT

10.11.2 PRODUCT PORTFOLIO

10.11.3 RECENT DEVELOPMENTS

10.12 HANNAH FOODS

10.12.1 COMPANY SNAPSHOT

10.12.2 PRODUCT PORTFOLIO

10.12.3 RECENT DEVELOPMENTS

10.13 ITHACA HUMMUS

10.13.1 COMPANY SNAPSHOT

10.13.2 PRODUCT PORTFOLIO

10.13.3 RECENT DEVELOPMENT

10.14 KASIH FOOD

10.14.1 COMPANY SNAPSHOT

10.14.2 PRODUCT PORTFOLIO

10.14.3 RECENT DEVELOPMENT

10.15 LANTANA FOODS

10.15.1 COMPANY SNAPSHOT

10.15.2 PRODUCT PORTFOLIO

10.15.3 RECENT DEVELOPMENTS

10.16 LILLY'S FOODS

10.16.1 COMPANY SNAPSHOT

10.16.2 PRODUCT PORTFOLIO

10.16.3 RECENT DEVELOPMENTS

10.17 PELOPAC INC.

10.17.1 COMPANY SNAPSHOT

10.17.2 PRODUCT PORTFOLIO

10.17.3 RECENT DEVELOPMENTS

10.18 ROOTS HUMMUS

10.18.1 COMPANY SNAPSHOT

10.18.2 PRODUCT PORTFOLIO

10.18.3 RECENT DEVELOPMENT

10.19 SAVENCIA SA

10.19.1 COMPANY SNAPSHOT

10.19.2 COMPANY SHARE ANALYSIS

10.19.3 PRODUCT PORTFOLIO

10.19.4 RECENT DEVELOPMENT

10.2 SEVAN AB

10.20.1 COMPANY SNAPSHOT

10.20.2 PRODUCT PORTFOLIO

10.20.3 RECENT DEVELOPMENTS

11 QUESTIONNAIRE

12 RELATED REPORTS

Lista de Tablas

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 MIDDLE EAST & AFRICA HUMMUS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 SAUDI ARABIA HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 SAUDI ARABIA HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 24 SAUDI ARABIA HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 25 SAUDI ARABIA HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 26 SAUDI ARABIA HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 27 SAUDI ARABIA HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 28 SAUDI ARABIA HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 29 SAUDI ARABIA HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 30 SAUDI ARABIA PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 SAUDI ARABIA SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 SAUDI ARABIA DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 SAUDI ARABIA CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 SAUDI ARABIA OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 SAUDI ARABIA HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 36 SAUDI ARABIA B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 SAUDI ARABIA B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 SAUDI ARABIA HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 39 SAUDI ARABIA COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 SAUDI ARABIA INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 41 U.A.E HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 U.A.E HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 43 U.A.E HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 44 U.A.E HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 45 U.A.E HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 46 U.A.E HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 47 U.A.E HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 48 U.A.E HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 49 U.A.E PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 U.A.E SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 U.A.E DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 U.A.E CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 U.A.E OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 U.A.E HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 55 U.A.E B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 U.A.E B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 U.A.E HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 58 U.A.E COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 U.A.E INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 OMAN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 OMAN HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 62 OMAN HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 63 OMAN HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 64 OMAN HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 65 OMAN HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 66 OMAN HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 67 OMAN HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 68 OMAN PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 OMAN SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 OMAN DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 OMAN CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 72 OMAN OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 OMAN HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 74 OMAN B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 OMAN B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 OMAN HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 77 OMAN COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 OMAN INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 KUWAIT HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 KUWAIT HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 81 KUWAIT HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 82 KUWAIT HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 83 KUWAIT HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 84 KUWAIT HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 85 KUWAIT HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 86 KUWAIT HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 87 KUWAIT PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 88 KUWAIT SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 KUWAIT DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 KUWAIT CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 91 KUWAIT OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 92 KUWAIT HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 93 KUWAIT B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 KUWAIT B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 KUWAIT HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 96 KUWAIT COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 KUWAIT INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 QATAR HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 QATAR HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 100 QATAR HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 101 QATAR HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 102 QATAR HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 103 QATAR HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 104 QATAR HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 105 QATAR HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 106 QATAR PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 QATAR SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 QATAR DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 QATAR CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 QATAR OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 111 QATAR HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 112 QATAR B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 113 QATAR B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 QATAR HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 115 QATAR COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 116 QATAR INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 117 SOUTH AFRICA HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 SOUTH AFRICA HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 119 SOUTH AFRICA HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 120 SOUTH AFRICA HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 121 SOUTH AFRICA HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 122 SOUTH AFRICA HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 123 SOUTH AFRICA HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 124 SOUTH AFRICA HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 125 SOUTH AFRICA PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 126 SOUTH AFRICA SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 127 SOUTH AFRICA DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 SOUTH AFRICA CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 SOUTH AFRICA OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 SOUTH AFRICA HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 131 SOUTH AFRICA B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 132 SOUTH AFRICA B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 SOUTH AFRICA HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 134 SOUTH AFRICA COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 135 SOUTH AFRICA INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 REST OF MIDDLE EAST AND AFRICA HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 MIDDLE EAST & AFRICA HUMMUS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA HUMMUS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA HUMMUS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA HUMMUS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA HUMMUS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA HUMMUS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA HUMMUS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA HUMMUS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA HUMMUS MARKET VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA HUMMUS MARKET: SEGMENTATION

FIGURE 11 RISE IN THE NUMBER OF NEW PRODUCT LAINCHES WITH VARIOUS FLAVOURS COMBINATION IS DRIVING THE GROWTH OF THE MIDDLE EAST & AFRICA HUMMUS MARKET IN THE FORECAST PERIOD

FIGURE 12 THE CLASSIC HUMMUS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA HUMMUS MARKET IN 2023 & 2030

FIGURE 13 MIDDLE EAST & AFRICA HUMMUS MARKET: TYPES OF CONSUMER BUYING BEHAVIOUR

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA HUMMUS MARKET

FIGURE 15 MIDDLE EAST & AFRICA HUMMUS MARKET: SNAPSHOT (2022)

FIGURE 16 MIDDLE EAST & AFRICA HUMMUS MARKET: BY COUNTRY (2022)

FIGURE 17 MIDDLE EAST & AFRICA HUMMUS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 18 MIDDLE EAST & AFRICA HUMMUS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 19 MIDDLE EAST & AFRICA HUMMUS MARKET: BY TYPE (2023-2030)

FIGURE 20 MIDDLE EAST & AFRICA HUMMUS MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.