Middle East And Africa Gaskets And Seals Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

5.92 Billion

USD

8.75 Billion

2025

2033

USD

5.92 Billion

USD

8.75 Billion

2025

2033

| 2026 –2033 | |

| USD 5.92 Billion | |

| USD 8.75 Billion | |

|

|

|

|

Segmentación del mercado de juntas y sellos en Oriente Medio y África, por tipo (juntas y sellos), aplicación (intercambiadores de calor, recipientes a presión, tapas de registro, bocas de acceso, bonetes de válvulas, bridas de tuberías, etc.), canal de distribución (fabricantes de equipos originales y posventa), industria (industria papelera y de pulpa, petróleo y gas, eléctrica, automotriz, aeroespacial, fabricación industrial, naval y ferroviaria, etc.): tendencias y pronóstico de la industria hasta 2033.

Tamaño del mercado de juntas y sellos en Oriente Medio y África

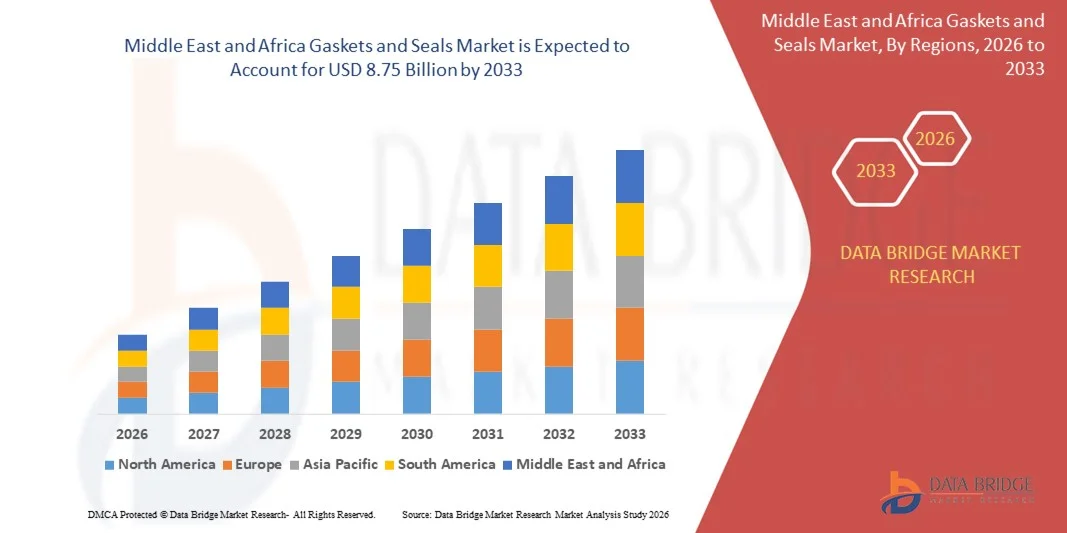

- El tamaño del mercado de juntas y sellos de Medio Oriente y África se valoró en USD 5,92 mil millones en 2025 y se espera que alcance los USD 8,75 mil millones para 2033 , con una CAGR del 5,00% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente demanda de las industrias automotriz, aeroespacial, de petróleo y gas y manufacturera de una mayor eficiencia de sellado y prevención de fugas.

- El creciente énfasis en la confiabilidad del equipo, la seguridad operativa y la reducción de costos de mantenimiento está impulsando aún más la adopción

Análisis del mercado de juntas y sellos en Oriente Medio y África

- El mercado está experimentando un crecimiento constante impulsado por la creciente necesidad de soluciones de sellado de alto rendimiento que puedan soportar presiones extremas, temperaturas y entornos corrosivos.

- Los avances en tecnologías de materiales como elastómeros, compuestos y sellos reforzados con metal están mejorando la durabilidad y el rendimiento.

- Los Emiratos Árabes Unidos dominaron el mercado de juntas y sellos de Medio Oriente y África en 2025, respaldados por una inversión significativa en infraestructura de petróleo y gas, expansión petroquímica y desarrollo industrial a gran escala.

- Se espera que Arabia Saudita sea testigo de la mayor tasa de crecimiento anual compuesta (CAGR) en el mercado de juntas y sellos de Medio Oriente y África debido a las crecientes iniciativas de diversificación industrial, la creciente adopción de soluciones de sellado avanzadas en proyectos de energía y petroquímicos y la continua inversión liderada por el gobierno en desarrollos de infraestructura a gran escala.

- El segmento de sellos obtuvo la mayor participación en ingresos del mercado en 2025, impulsado por su amplio uso en equipos rotativos como bombas, compresores y motores en las industrias manufacturera y automotriz. Su capacidad para proporcionar un control confiable de fugas en sistemas de alta presión y alta temperatura los hace esenciales en las operaciones industriales.

Alcance del informe y segmentación del mercado de juntas y sellos en Oriente Medio y África

|

Atributos |

Información clave del mercado de juntas y sellos de Oriente Medio y África |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de juntas y sellos en Oriente Medio y África

El auge de la integración avanzada de materiales en juntas y sellos

- La creciente adopción de materiales avanzados, como elastómeros de alto rendimiento, compuestos de PTFE y soluciones de sellado reforzadas con metal, está transformando el panorama de las juntas y sellos al mejorar la durabilidad, la resistencia química y la estabilidad térmica en aplicaciones industriales. Estos materiales ofrecen un rendimiento superior en entornos operativos hostiles donde los componentes de sellado tradicionales fallan. Su amplia integración contribuye a una mayor confiabilidad y eficiencia en sistemas de maquinaria crítica.

- La demanda de componentes de sellado que resistan temperaturas extremas, fluidos agresivos y entornos de alta presión está acelerando la innovación en la ciencia de los materiales, especialmente en industrias como la del petróleo y el gas, la química y la automoción, donde la fiabilidad operativa es fundamental. Los fabricantes se centran en crear formulaciones que ofrezcan mayor resiliencia y reduzcan el riesgo de fugas. Esta tendencia impulsa la adopción de tecnologías de sellado avanzadas tanto en nuevas instalaciones como en actividades de mantenimiento.

- La transición hacia maquinaria ligera y energéticamente eficiente está impulsando el uso de materiales de ingeniería con propiedades mecánicas mejoradas, lo que permite una mayor vida útil y menores requisitos de mantenimiento. Estos materiales contribuyen a reducir el peso del equipo, manteniendo al mismo tiempo una sólida integridad de sellado. Su adopción está ayudando a las industrias a lograr ahorros de energía, una mayor productividad operativa y un mayor rendimiento del sistema.

- Por ejemplo, en 2023, varios fabricantes de equipos originales (OEM) de automóviles integraron sellos avanzados de fluorocarbono y silicona para mejorar la eficiencia del motor y reducir las fugas, lo que resultó en un mejor rendimiento y una reducción de las reclamaciones de garantía. Estos materiales permitieron una mayor resistencia a los ciclos térmicos y a la exposición química. La integración de estas soluciones está estableciendo nuevos estándares para los sistemas de sellado automotriz de próxima generación.

- Si bien las innovaciones en materiales mejoran el rendimiento y amplían el alcance de las aplicaciones, su adopción depende de la rentabilidad, las pruebas de compatibilidad y la escalabilidad de la fabricación. Las empresas deben invertir en rigurosos procesos de validación para garantizar su idoneidad en diversas condiciones operativas. Los fabricantes deben priorizar la producción localizada, las formulaciones a medida y los procesos rentables para satisfacer la creciente demanda de forma eficiente.

Dinámica del mercado de juntas y sellos en Oriente Medio y África

Impulsor

Aumento de la automatización industrial y la demanda de fiabilidad de los activos

- El auge de la automatización industrial está impulsando a los fabricantes de todos los sectores a priorizar soluciones de sellado de alta calidad que garanticen operaciones ininterrumpidas y eviten fallos en los equipos. Los sistemas automatizados dependen en gran medida de componentes que minimizan las fugas, mantienen la integridad de la presión y admiten ciclos operativos largos. Esta tendencia está aumentando la necesidad de juntas y sellos duraderos y de ingeniería de precisión en entornos industriales de rápido crecimiento

- Las industrias son cada vez más conscientes de los altos riesgos financieros asociados con el tiempo de inactividad de los equipos, incluyendo la pérdida de productividad, los riesgos de seguridad y las costosas reparaciones. Esta concienciación ha llevado a la adopción sistemática de juntas y sellos de alta calidad en maquinaria crítica donde la fiabilidad es fundamental. Como resultado, las estrategias de mantenimiento preventivo se están fortaleciendo, lo que impulsa aún más la demanda de componentes de sellado de alto rendimiento.

- Las iniciativas gubernamentales y las normas de seguridad industrial están fortaleciendo la infraestructura para el mantenimiento preventivo y la certificación de equipos, lo que acelera la necesidad de componentes de sellado confiables. Los marcos de cumplimiento exigen que las industrias implementen soluciones de sellado capaces de soportar estrictos estándares operativos. Esto está incrementando la inversión en tecnologías de sellado avanzadas en las operaciones de fabricación, procesamiento e industria pesada.

- Por ejemplo, varias instalaciones industriales modernizaron sus sistemas de sellado en aplicaciones de alta presión para mejorar la seguridad operativa y reducir las interrupciones por mantenimiento. Estas mejoras ayudaron a reducir las paradas imprevistas y las fallas de los equipos. Esta medida refleja una transición más amplia hacia soluciones de sellado optimizadas para el rendimiento y adaptadas a las necesidades industriales modernas.

- Si bien la automatización y el enfoque regulatorio impulsan su adopción, se requieren mejoras continuas en el diseño, la validación del rendimiento y la integración con maquinaria en constante evolución para sostener el crecimiento del mercado a largo plazo. Los fabricantes deben innovar para afrontar la creciente complejidad de los sistemas automatizados. Esto incluye la creación de sellos que ofrezcan mayor durabilidad, mayor vida útil y compatibilidad con arquitecturas de sistemas avanzadas.

Restricción/Desafío

Precios fluctuantes de las materias primas y altos costos de producción

- El alto costo de las materias primas clave, como el caucho sintético, los fluoropolímeros y los metales especializados, crea desafíos de precios para los fabricantes, en particular para los proveedores pequeños y medianos. La volatilidad en los precios del petróleo crudo impacta directamente la disponibilidad de elastómeros, lo que afecta la planificación de materiales y la estabilidad de costos. Estas fluctuaciones a menudo obligan a los productores a ajustar las estructuras de precios, lo que impacta la competitividad del mercado

- Muchas industrias enfrentan limitaciones para adoptar soluciones de sellado avanzadas debido a los altos costos de producción y la necesidad de tecnologías de fabricación de precisión. La necesidad de maquinaria especializada y mano de obra cualificada eleva aún más los gastos de producción. Esto restringe su adopción en sectores sensibles a los costos, donde las alternativas tradicionales de bajo costo siguen predominando a pesar de las limitaciones de rendimiento.

- Las interrupciones en la cadena de suministro y la disponibilidad irregular de materias primas dificultan la producción y la entrega puntuales, lo que a menudo lleva a la dependencia de alternativas de menor calidad con menor rendimiento. Los retrasos en el transporte, las limitaciones de abastecimiento global y la escasez de materiales contribuyen a prolongar los plazos de entrega. Estos problemas, en última instancia, afectan a los usuarios finales, quienes dependen de un rendimiento de sellado constante para la continuidad operativa.

- Por ejemplo, varios fabricantes informaron retrasos en la producción debido a la escasez de elastómeros de alta calidad, lo que afectó los plazos de suministro para aplicaciones automotrices y de maquinaria. Esta escasez afectó los plazos de los fabricantes de equipos originales (OEM) y la disponibilidad de repuestos, creando cuellos de botella en las cadenas de suministro. Estos incidentes resaltan la importancia de contar con estrategias de abastecimiento sólidas y una adquisición diversificada de materiales.

- Si bien los avances tecnológicos están mejorando la eficiencia de la fabricación, abordar las barreras de costos y asegurar cadenas de suministro estables sigue siendo crucial. Los fabricantes deben invertir en marcos de producción optimizados en costos e ingeniería avanzada de materiales. El abastecimiento local, los materiales reciclables y los modelos de fabricación escalables desempeñarán un papel fundamental para superar los desafíos de suministro y costos a largo plazo.

Mercado de juntas y sellos en Oriente Medio y África

El mercado está segmentado según el tipo, la aplicación, el canal de distribución y la industria.

- Por tipo

El mercado de juntas y sellos en Oriente Medio y África se segmenta por tipo. El segmento de sellos obtuvo la mayor cuota de mercado en 2025, gracias a su amplio uso en equipos rotativos como bombas, compresores y motores en las industrias manufacturera y automotriz. Su capacidad para proporcionar un control fiable de fugas en sistemas de alta presión y alta temperatura los convierte en esenciales en las operaciones industriales.

Se prevé que el segmento de juntas experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente demanda de sistemas de tuberías, intercambiadores de calor y equipos de proceso. El creciente enfoque en la eficiencia de los equipos, la reducción del mantenimiento y la mejora del rendimiento del sellado está acelerando aún más la adopción de materiales de juntas avanzados en diversos entornos industriales.

- Por aplicación

Según la aplicación, el mercado de juntas y sellos de Oriente Medio y África se segmenta en intercambiadores de calor, recipientes a presión, tapas de registro, pozos de acceso, bonetes de válvulas, bridas de tuberías y otros. El segmento de bridas de tuberías tuvo la mayor participación en los ingresos del mercado en 2025 debido a su amplio despliegue en infraestructuras de petróleo y gas, petroquímicas y de tratamiento de agua. Su papel fundamental para garantizar conexiones seguras y a prueba de fugas en las tuberías impulsa una demanda constante

Se prevé que el segmento de intercambiadores de calor experimente su mayor crecimiento entre 2026 y 2033, impulsado por la expansión industrial, el crecimiento del procesamiento químico y las crecientes exigencias de eficiencia energética. El aumento de las inversiones en sistemas de climatización (HVAC), centrales eléctricas e instalaciones de fabricación contribuye a la adopción acelerada de soluciones de sellado en los conjuntos de intercambiadores de calor.

- Por canal de distribución

Según el canal de distribución, el mercado de juntas y sellos de Oriente Medio y África se segmenta en fabricantes de equipos originales (OEM) y mercado de repuestos. El segmento OEM tuvo la mayor participación en los ingresos del mercado en 2025 debido a la creciente producción de maquinaria industrial, componentes automotrices y equipo pesado en la región. Los fabricantes integran cada vez más componentes de sellado de alta calidad durante el ensamblaje inicial para mejorar la confiabilidad y la vida útil del equipo

Se prevé que el segmento de posventa experimente su mayor crecimiento entre 2026 y 2033, impulsado por el aumento de las actividades de mantenimiento, la renovación de maquinaria y la sustitución de componentes de sellado desgastados. El creciente énfasis en el mantenimiento preventivo y la rentabilidad operativa en todos los sectores impulsa aún más la demanda de posventa.

- Por industria

Por industria, el mercado de juntas y sellos de Oriente Medio y África se segmenta en las industrias papelera y de pulpa, petrolera y gasística, eléctrica, automotriz, aeroespacial, de fabricación industrial, marítima y ferroviaria, entre otras. El segmento automotriz obtuvo la mayor participación en los ingresos del mercado en 2025 gracias a la sólida base de producción de vehículos de la región y al uso generalizado de soluciones de sellado en motores, transmisiones, sistemas de frenos y unidades de gestión térmica.

Se prevé que el segmento de fabricación industrial experimente el mayor crecimiento entre 2026 y 2033, impulsado por la rápida industrialización, la expansión de las instalaciones de producción y la creciente adopción de maquinaria automatizada. Las industrias invierten cada vez más en componentes de sellado duraderos para mejorar la seguridad, minimizar el tiempo de inactividad y lograr una mayor eficiencia operativa en entornos de fabricación complejos.

Análisis regional del mercado de juntas y sellos en Oriente Medio y África

- Los Emiratos Árabes Unidos dominaron el mercado de juntas y sellos de Medio Oriente y África en 2025, respaldados por una inversión significativa en infraestructura de petróleo y gas, expansión petroquímica y desarrollo industrial a gran escala.

- El énfasis del país en los equipos de alto rendimiento, el estricto cumplimiento de las normas de seguridad y la confiabilidad operativa mejorada está impulsando una fuerte demanda de componentes de sellado avanzados.

- Las mejoras continuas en las instalaciones de energía, fabricación y procesamiento refuerzan aún más la posición de los EAU como mercado líder en la región.

Análisis del mercado de juntas y sellos de Arabia Saudita

Se prevé que Arabia Saudita sea el país con mayor crecimiento en el mercado de juntas y sellos de Oriente Medio y África entre 2026 y 2033, impulsado por la creciente diversificación industrial, la creciente adopción de maquinaria moderna y las sólidas iniciativas gubernamentales que apoyan la fabricación a gran escala. El creciente enfoque del país en la eficiencia del mantenimiento, la mejora del rendimiento de los activos y la mayor seguridad operativa está acelerando la necesidad de soluciones de sellado de alta calidad, lo que posiciona a Arabia Saudita como el mercado de mayor crecimiento de la región.

Cuota de mercado de juntas y sellos en Oriente Medio y África

La industria de juntas y sellos de Medio Oriente y África está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

• Klinger Oriente Medio (EAU)

• Delta Gaskets (EAU)

• Sealmech Trading LLC (EAU)

• Afron Seals (Sudáfrica)

• Dual Valves Africa (Sudáfrica)

• Blue Seal Africa (Sudáfrica)

• Sondel Gaskets (Sudáfrica)

• Rubseal Gaskets (Sudáfrica)

• Sunflex Oriente Medio (EAU)

• Al Zerwa Trading (EAU)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.