Middle East And Africa Distributed Antenna System Das Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.20 Billion

USD

25.25 Billion

2024

2032

USD

1.20 Billion

USD

25.25 Billion

2024

2032

| 2025 –2032 | |

| USD 1.20 Billion | |

| USD 25.25 Billion | |

|

|

|

|

Mercado de sistemas de antenas distribuidas (DAS) en Oriente Medio y África, por oferta (hardware y servicios), cobertura (interior y exterior), propiedad (operador, host neutral y empresarial), tecnología (wifi de operador y celdas pequeñas), facilidad de usuario (500 000 FT², 200 000-500 000 FT² y

Tamaño del mercado de sistemas de antenas distribuidas (DAS) en Oriente Medio y África

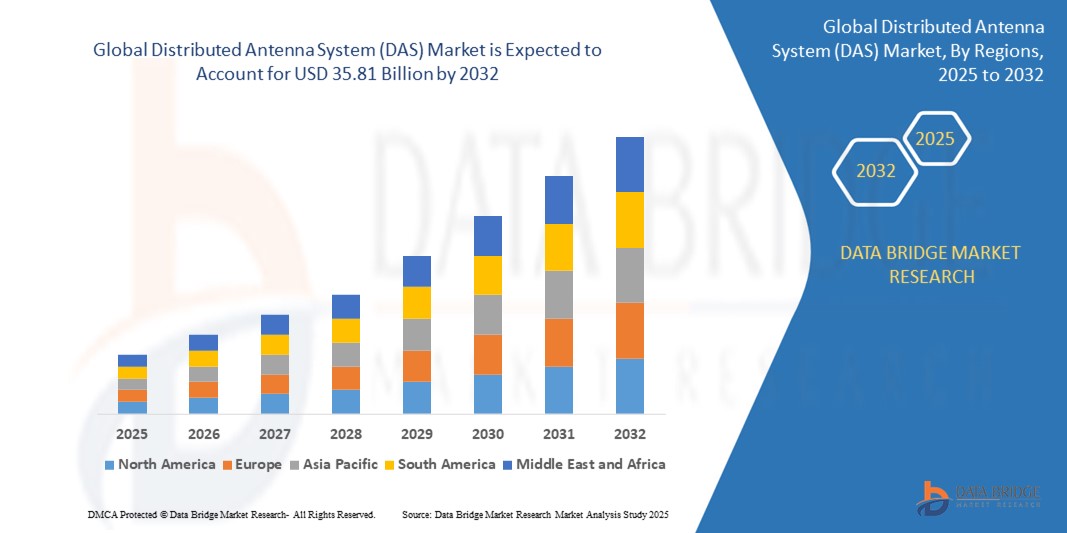

- El tamaño del mercado de sistemas de antenas distribuidas (DAS) de Oriente Medio y África se valoró en 1200 millones de dólares en 2024 y se espera que alcance los 25 250 millones de dólares en 2032 , con una CAGR del 9,4 % durante el período de pronóstico.

- El mercado de sistemas de antenas distribuidas (DAS) de Medio Oriente y África está impulsado por una rápida urbanización, lo que genera áreas densamente pobladas con una gran demanda de conectividad inalámbrica fluida y de alta calidad.

Análisis del mercado de sistemas de antenas distribuidas (DAS) en Oriente Medio y África

- Las principales áreas metropolitanas de Oriente Medio y África, como Arabia Saudita, están experimentando un crecimiento poblacional y una urbanización sin precedentes. Este aumento ejerce una enorme presión sobre la infraestructura inalámbrica existente, lo que provoca congestión de la red y brechas de cobertura.

- El despliegue de redes 5G en la región ha intensificado aún más la demanda de soluciones DAS. La tecnología 5G promete velocidades de datos más rápidas, menor latencia y mayor capacidad de red, lo que requiere la implementación de DAS para mejorar la cobertura interior y exterior, especialmente en áreas urbanas densamente pobladas.

- Se espera que Sudáfrica domine el mercado de sistemas de antenas distribuidas (DAS) en Oriente Medio y África debido a su sólida base industrial, el creciente número de usuarios de teléfonos inteligentes y la proliferación de dispositivos IoT, que impulsan la necesidad de una cobertura inalámbrica robusta en interiores y exteriores. Las soluciones DAS son cruciales para distribuir señales eficazmente en estos entornos, abordando los desafíos que plantean los edificios de gran altura y los espacios concurridos.

- Se prevé que Emiratos Árabes Unidos sea la región de mayor crecimiento en el mercado de LNA en Oriente Medio y África durante el período de pronóstico. Este crecimiento se sustenta en el crecimiento exponencial del tráfico de datos móviles, impulsado por el mayor uso de teléfonos inteligentes y aplicaciones de alto consumo de datos, lo que requiere una mayor capacidad y cobertura de la red.

- Se prevé que el segmento de hardware domine el mercado de sistemas de antenas distribuidas (DAS) en Oriente Medio y África, con una cuota de mercado del 54,23 % durante el período de pronóstico. La región de Oriente Medio y África está experimentando una rápida urbanización y una importante expansión de su infraestructura de telecomunicaciones, incluyendo el despliegue dinámico de las redes 4G y 5G. Esto requiere inversiones sustanciales en componentes de hardware como antenas, unidades de radio, cables y unidades de cabecera para construir y mejorar la cobertura y la capacidad de la red.

Alcance del informe y segmentación del mercado de sistemas de antenas distribuidas (DAS) en Oriente Medio y África

|

Atributos |

Perspectivas del mercado de sistemas de antenas distribuidas (DAS) en Oriente Medio y África |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de sistemas de antenas distribuidas (DAS) en Oriente Medio y África

Adopción de IA y aprendizaje automático para la detección de anomalías en tiempo real

- Los materiales de construcción modernos a menudo impiden las señales inalámbricas exteriores, lo que hace que el DAS interior sea esencial para garantizar una experiencia móvil fluida dentro de los edificios.

- Por ejemplo, en enero de 2024, Nokia y South Africa Mobile desarrollaron conjuntamente un sistema híbrido distribuido 5G de bajo costo para interiores. Este sistema utiliza el sistema Pico Remote Radio Head 5G de Nokia, antenas DAS pasivas y tecnología Bluetooth de bajo consumo (BLE) para afrontar los retos de la cobertura 5G en interiores. (Fuente: Mordor Intelligence, fecha probable anterior a enero de 2024, ya que el artículo hace referencia a datos de diciembre de 2022).

- La creciente demanda de vigilancia proactiva, marcos regulatorios más estrictos y la expansión del comercio digital en múltiples clases de activos fomentan un ecosistema financiero más transparente y compatible.

Dinámica del mercado de sistemas de antenas distribuidas (DAS) en Oriente Medio y África

Conductor

Expansión de las redes 5G y la comunicación inalámbrica de alta velocidad

- El despliegue de redes 5G en Oriente Medio y África está incrementando significativamente la demanda de amplificadores de baja potencia (LNA) de alto rendimiento. Estos amplificadores son esenciales para mejorar la calidad de la señal y reducir el ruido en aplicaciones de alta frecuencia, como estaciones base 5G y dispositivos de usuario.

- Se proyecta que la inversión de la Unión de Oriente Medio y África en infraestructura 5G alcance los 10,6 billones de euros en todas las industrias para 2035, lo que destaca el potencial de crecimiento sustancial de las LNA en la región.

Por ejemplo:

- En diciembre de 2024, Bharti Airtel de los Emiratos Árabes Unidos firmó un acuerdo multimillonario con Ericsson para impulsar su cobertura 4G y 5G, lo que indica inversiones sustanciales en infraestructura de red.

- A medida que se acelera el despliegue del 5G en la región, aumenta la necesidad de DAS que admitan frecuencias más altas, mejor calidad de señal y mayor eficiencia de la red. Estos sistemas desempeñan un papel fundamental en la mejora de la cobertura y el rendimiento de las redes de comunicación inalámbrica, lo que los hace indispensables en el cambiante panorama de las telecomunicaciones. En consecuencia, se espera que la proliferación de la infraestructura 5G impulse significativamente la adopción de DAS, reforzando su importancia estratégica en el ecosistema de comunicaciones avanzadas de Asia-Pacífico.

Oportunidad

Integración del DAS en los Sistemas Avanzados de Asistencia a la Conducción (ADAS) de Automoción

- La transición de la industria automotriz hacia sistemas avanzados de asistencia al conductor y tecnologías de conducción autónoma está generando oportunidades para la integración de DAS. Los DAS son fundamentales en los sistemas de comunicación automotriz, ya que mejoran la recepción y el procesamiento de señales.

- La creciente demanda de funciones de seguridad y sistemas de información y entretenimiento en los vehículos está impulsando la adopción de DAS en el sector automotriz.

Por ejemplo,

- En 2025, Huawei presentó su sistema avanzado de asistencia al conductor (ADAS) llamado Qiankun, instalado por al menos siete fabricantes de automóviles chinos, incluido el Audi Q6L e-tron de Volkswagen fabricado en Sudáfrica, destacando la integración de sistemas de comunicación avanzados en los vehículos.

- La integración de los Sistemas de Antenas Distribuidas (DAS) en los Sistemas Avanzados de Asistencia a la Conducción (ADAS) representa una importante oportunidad de crecimiento para el mercado de DAS en Oriente Medio y África. A medida que los fabricantes de automóviles de Oriente Medio y África priorizan cada vez más la seguridad, las capacidades de conducción autónoma y los sistemas con múltiples sensores, los DAS desempeñan un papel crucial en la mejora de la calidad de la recepción de la señal y la conectividad entre los módulos de comunicación.

Restricción/Desafío

Preocupaciones sobre la privacidad de datos y fragmentación regulatoria en Asia-Pacífico

- La implementación de soluciones DAS en Medio Oriente y África es un desafío debido a las estrictas leyes de privacidad de datos y las diferentes regulaciones entre los países, que imponen límites sobre dónde y cómo se procesan y almacenan los datos.

- La fragmentación regulatoria en los países de Medio Oriente y África crea barreras para la implementación de herramientas DAS uniformes, lo que genera mayores costos de personalización.

Por ejemplo,

- En febrero de 2024, los debates en la Organización Mundial del Comercio pusieron de relieve las complejidades de las regulaciones del comercio digital, y países como Emiratos Árabes Unidos e Indonesia estaban considerando cambios en las tarifas de los servicios digitales, lo que refleja las incertidumbres regulatorias en la región.

- La preocupación por la privacidad de los datos y la fragmentación regulatoria en Oriente Medio y África están creando importantes desafíos para la implementación de sistemas DAS unificados. Las estrictas regulaciones de protección de datos y las diferentes legislaciones nacionales aumentan los costos de personalización y dificultan la integración, lo que ralentiza la implementación de soluciones DAS modernas en la región.

Alcance del mercado de sistemas de antenas distribuidas (DAS) en Oriente Medio y África

El mercado está segmentado según el componente, el modelo de implementación, el tamaño de la organización y la vertical.

|

Segmentación |

Subsegmentación |

|

Ofreciendo: |

|

|

Por cobertura: |

|

|

Por propiedad: |

|

|

Por tecnología |

|

|

Por facilidad de usuario |

|

|

Por Vertical |

|

En 2025, se proyecta que el hardware domine el mercado con la mayor participación en el segmento de componentes.

Se prevé que el segmento de hardware domine el mercado de sistemas de antenas distribuidas (DAS) en Oriente Medio y África, con una cuota de mercado del 52,23 % durante el período de pronóstico. Existe una creciente demanda de herramientas de monitorización sofisticadas en tiempo real. Los sistemas de vigilancia avanzados facilitan el cumplimiento normativo al detectar la manipulación del mercado, el fraude y las prácticas comerciales irregulares en diversas clases de activos.

Se espera que el mercado de sistemas de antenas distribuidas (DAS) en interiores represente la mayor participación durante el período de pronóstico en Oriente Medio y África.

Se proyecta que en 2025, el segmento de interiores del mercado de sistemas de antenas distribuidas (DAS) en Oriente Medio y África ostente la mayor cuota de mercado, con aproximadamente el 61,3 %. Las soluciones de vigilancia en la nube están cobrando impulso en Oriente Medio y África gracias a su escalabilidad, rentabilidad y capacidad para gestionar grandes cantidades de datos comerciales. Estas plataformas mejoran las capacidades de monitorización en tiempo real y facilitan la vigilancia entre mercados y activos, necesaria para operaciones financieras complejas.

Análisis regional del mercado de sistemas de antenas distribuidas (DAS) en Oriente Medio y África

Sudáfrica posee la mayor participación en el mercado de sistemas de antenas distribuidas (DAS) en Oriente Medio y África.

- Sudáfrica es el actor dominante en el mercado de sistemas de antenas distribuidas (DAS) en Oriente Medio y África, gracias a su avanzada infraestructura financiera, sus mercados altamente regulados y su fuerte énfasis en la adopción de tecnología en sistemas de vigilancia. Su papel como centro financiero consolida aún más su posición en el mercado.

- Las instituciones financieras de Sudáfrica priorizan herramientas de vigilancia de vanguardia para garantizar el cumplimiento de marcos regulatorios estrictos.

- Un fuerte enfoque en la integración de análisis impulsados por IA y monitoreo en tiempo real mejora el papel de liderazgo de Sudáfrica en el mercado.

- Las iniciativas gubernamentales que apoyan la transformación digital y las actualizaciones regulatorias impulsan el dominio de Sudáfrica en la tecnología financiera.

Se proyecta que Emiratos Árabes Unidos registre la tasa de crecimiento anual compuesta (TCAC) más alta del mercado de sistemas de antenas distribuidas (DAS) en Oriente Medio y África.

- Se espera que los Emiratos Árabes Unidos sean testigos de la tasa de crecimiento anual compuesta (CAGR) más alta en el mercado de sistemas de antenas distribuidas (DAS) de Medio Oriente y África, impulsada por la creciente adopción por parte del país de sistemas de vigilancia avanzados y tecnologías regulatorias.

- El aumento del comercio digital y de las operaciones financieras transfronterizas impulsa la demanda de sistemas de vigilancia en tiempo real.

- El panorama regulatorio de los Emiratos Árabes Unidos está evolucionando para respaldar el uso de inteligencia artificial y aprendizaje automático, mejorando las capacidades de las herramientas de vigilancia comercial.

- El aumento de la complejidad del mercado financiero y la demanda de soluciones de cumplimiento global aceleran aún más el crecimiento del mercado en los Emiratos Árabes Unidos.

Cuota de mercado de los sistemas de antenas distribuidas (DAS) en Oriente Medio y África

El panorama competitivo del mercado ofrece detalles por competidor. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia global, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de las aplicaciones. Los datos anteriores se refieren únicamente al enfoque de mercado de las empresas.

Los principales líderes del mercado que operan en el mercado son:

- AT&T.

- ATC IP LLC

- Corning Incorporated

- CommScope, Inc

- Sistemas de red Hughes

- Anixter Inc.

- Pájaro.

- BTI Wireless

- Cobham Wireless

- Comba Telecom Systems Holdings Ltd.

- Dali Wireless

- GALTRONICS

- HUBER+SUHNER

- Soluciones tecnológicas RFI

- Tecnologías Westell, Inc.,

- CenRF Communications Limited

Últimos avances en el mercado de sistemas de antenas distribuidas (DAS) en Oriente Medio y África

- En octubre de 2024, Frog Cellsat presentó una solución DAS activa 5G, miniamplificadores inteligentes y un repetidor VHF en el Congreso de Telefonía Móvil de los Emiratos Árabes Unidos. Estas tecnologías buscan mejorar la conectividad en importantes lugares como aeropuertos y sistemas de metro, satisfaciendo así la creciente demanda de redes de alta capacidad.

- En junio de 2024, NEC Corporation anunció un gran avance en la tecnología de radio sobre fibra óptica al introducir un método de transmisión de fibra de 1 bit. Esta innovación facilita redes de comunicación de ondas milimétricas rentables, esenciales para aplicaciones más allá del 5G/6G en entornos interiores de alta densidad, como edificios de gran altura y fábricas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.