Mercado de detección y diagnóstico de genes CRISPR en Oriente Medio y África, por clase (Clase 1: proteínas efectoras múltiples y Clase 2: proteína de unión a ARNcr única), productos y servicios (productos y servicios), aplicación (diagnóstico biomédico, ingeniería genómica, descubrimiento de fármacos, aplicaciones agrícolas y otros), flujo de trabajo (preparación de muestras, preamplificación, ARNcr, enzimas Cas y detección), usuario final (hospitales, centros de diagnóstico, empresas de biotecnología, institutos académicos y de investigación y otros), canal de distribución (licitación directa, ventas minoristas) Tendencias de la industria y pronóstico hasta 2029.

Definición y perspectivas del mercado

CRISPR es una herramienta de edición genómica que consiste en repeticiones palindrómicas cortas agrupadas y regularmente intercaladas. Permite a los investigadores alterar secuencias de ADN y modificar la función de los genes con facilidad. Tiene muchas aplicaciones potenciales, como la corrección de defectos genéticos y el tratamiento y la prevención de la propagación de enfermedades. Los diagnósticos basados en CRISPR se han utilizado para muchas aplicaciones biomédicas, como la detección de biomarcadores basados en ácidos nucleicos de enfermedades infecciosas y no infecciosas y la detección de enfermedades genéticas. Los kits de ensayo en CRISPR están compuestos por dos componentes: una proteína llamada Cas9 y un ARN guía, una cadena de moléculas de ácido nucleico con un código genético determinado.

Este sistema CRISPR-Cas9 ha sido modificado para su uso en células de mamíferos. Podemos inactivar genes específicos introduciendo una secuencia guía (sgRNA) específica para nuestro gen de interés introduciendo mutaciones de cambio de marco mediante unión de extremos no homólogos (NHEJ) o generar mutaciones de inserción.

Los sistemas CRISPR-Cas 9 han ampliado el alcance de los diagnósticos y servicios en terapias génicas y celulares. Las compañías farmacéuticas invierten mucho en I+D para desarrollar nuevos productos, y se ha producido un aumento de agentes de terapia génica y celular en las primeras etapas de desarrollo. La inversión de los actores del mercado permitiría producir tratamientos seguros y eficaces para pacientes con necesidades graves.

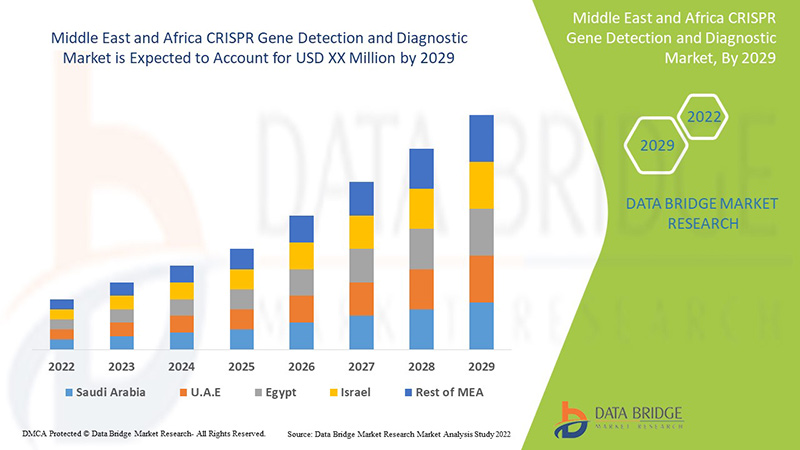

La detección y el diagnóstico de genes mediante CRISPR en Oriente Medio y África es de apoyo y tiene como objetivo reducir la gravedad de los síntomas. Data Bridge Market Research analiza que el mercado de detección y diagnóstico de genes mediante CRISPR crecerá a una tasa compuesta anual del 8,8 % durante el período de pronóstico de 2022 a 2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por clase (Clase 1: proteínas efectoras múltiples y Clase 2: proteína de unión a ARNcr simple), Productos y servicios (Productos y servicios), Aplicación (Diagnóstico biomédico, Ingeniería genómica, Descubrimiento de fármacos, Aplicaciones agrícolas y otras), Flujo de trabajo (Preparación de muestras, Preamplificación, ARNcr, Enzimas Cas y detección), Usuario final (Hospitales, Centros de diagnóstico, Empresas de biotecnología, Institutos académicos y de investigación y otros), Canal de distribución (Licitación directa, Ventas minoristas) |

|

Países cubiertos |

Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Egipto, Israel y el resto de Oriente Medio y África |

|

Actores del mercado cubiertos |

GenScript, Takara Bio Inc., Agilent Technologies, Inc., Merck KGaA, Integrated DNA Technologies, Inc. (una subsidiaria de Danaher) y Thermo Fisher Scientific Inc., entre otros. |

Dinámica del mercado de detección y diagnóstico de genes mediante CRISPR en Oriente Medio y África

Conductores

- Aumento de la prevalencia e incidencia de enfermedades crónicas

Las enfermedades crónicas son afecciones de salud comunes, y uno de cada tres adultos padece alguna de ellas. Las enfermedades crónicas han afectado la salud y la calidad de vida de muchos ciudadanos.

CRISPR es la abreviatura de repeticiones palindrómicas cortas agrupadas y regularmente interespaciadas. En los últimos años, CRISPR se ha convertido en una herramienta de gran utilidad para la edición genética, que se utiliza para alterar las secuencias específicas de ADN en una célula. CRISPR tiene un uso importante en la investigación y el tratamiento de la enfermedad de Huntington, la distrofia muscular, el cáncer y el colesterol alto.

Por ejemplo,

- En 2021, los datos de NORD - National Organization for Rare Disorders, Inc. indicaron la incidencia diagnosticada de distrofia muscular de Duchenne (DMD). La distrofia muscular de Duchenne (DMD) es una enfermedad genética frecuente que afecta a 1 de cada 3500 nacimientos de varones en todo el mundo.

- Aumento de la inversión en investigación y desarrollo

Las tecnologías de edición genética, como el sistema CRISPR-Cas 9, han ampliado el alcance de los diagnósticos y servicios en terapias génicas y celulares. Las compañías farmacéuticas invierten mucho en I+D para desarrollar nuevos productos, y se ha producido un aumento de agentes de terapia génica y celular en las primeras etapas de desarrollo. La inversión de los actores del mercado permitiría alcanzar el objetivo de producir tratamientos seguros y eficaces para pacientes con necesidades graves.

Por ejemplo,

- En febrero de 2022, Synthego había recaudado 200 millones de dólares como inversión para investigación y desarrollo con el fin de impulsar el desarrollo de medicamentos basados en CRISPR desde la fase inicial de investigación hasta la fase clínica. Synthego utilizará el monto de inversión de la financiación de la Serie E para acelerar la creación de diagnósticos y servicios CRISPR.

Disponibilidad de financiación para el diagnóstico genético CRISPR

El Instituto Nacional de Salud (NIH) financia el diagnóstico y la investigación de genes mediante CRISPR. El sector privado también financia la detección e investigación de genes mediante CRISPR, pero esa inversión generalmente ocurre más tarde, durante la fase de prueba y desarrollo, y luego durante la investigación básica inicial. Como la edición genómica es un campo tan nuevo, un organismo gubernamental imparcial debe supervisarlos; la FDA es cautelosa y minuciosa, pero lucha sin descanso por obtener fondos, lo que hace una inversión a largo plazo que alinea el pago con los posibles beneficiarios futuros., mejorará aún más el crecimiento del mercado de detección y diagnóstico de genes mediante CRISPR.

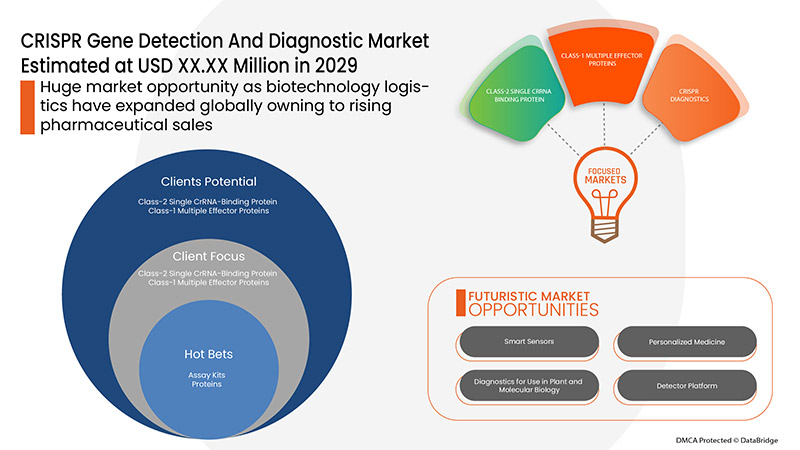

Además, el avance en el diagnóstico genético CRISPR, las crecientes iniciativas de organizaciones públicas y privadas para difundir la conciencia y el aumento de la financiación gubernamental son los factores que expandirán el mercado de detección genética CRISPR. Otros factores, como el aumento de la demanda de terapias efectivas y la creciente conciencia sobre el diagnóstico oportuno, tendrán un impacto positivo en la tasa de crecimiento del mercado de detección y diagnóstico genético CRISPR. Además, los altos ingresos disponibles, el creciente número de enfermedades crónicas y el cambio en el estilo de vida darán como resultado la expansión del mercado de detección y diagnóstico genético CRISPR.

Oportunidades

- El aumento del gasto sanitario

Además, el aumento de las actividades de investigación y desarrollo y el aumento de las inversiones por parte del gobierno y de organizaciones privadas impulsarán nuevas oportunidades para la tasa de crecimiento del mercado.

- Iniciativa estratégica de los actores del mercado

La demanda de detección y diagnóstico de genes mediante CRISPR ha aumentado en los EE. UU. y, debido al tratamiento oportuno de enfermedades crónicas, estos factores favorables aumentan la necesidad de medicamentos y, para satisfacer la demanda del mercado, los actores menores y mayores del mercado están utilizando diversas estrategias.

Los principales actores también están tratando de diseñar estrategias específicas, como lanzamientos de productos, adquisiciones, aprobaciones, expansiones y asociaciones, para garantizar el buen funcionamiento del negocio, evitar riesgos y aumentar el crecimiento a largo plazo de las ventas del mercado.

Por ejemplo,

- En mayo de 2021, Horizon Discovery Ltd. amplió su cartera de modulación genética con el primer ARN guía sintético único y el represor dcas9 pendiente de patente para la interferencia CRISPR en Waltham. La expansión de la cartera había aumentado las ventas y los ingresos de la cartera de ARN guía sintético en la región de EE. UU. y el Reino Unido y había aumentado la colaboración con los actores del mercado.

Además, el lanzamiento de terapias efectivas y ensayos clínicos continuos brindarán oportunidades beneficiosas para el mercado de detección y diagnóstico de genes CRISPR en el período de pronóstico de 2022 a 2029. Además, la gran necesidad insatisfecha de tecnología actual y los avances en el campo de la atención médica aumentarán la tasa de crecimiento del mercado de detección y diagnóstico de genes CRISPR en el futuro.

Restricciones/Desafíos

Sin embargo, el alto costo de los diagnósticos CRISPR y los riesgos que se enfrentan al utilizarlos impedirán la tasa de crecimiento del mercado de detección y diagnóstico de genes CRISPR. Además, los riesgos que se corren al utilizar los dispositivos de resonancia magnética obstaculizarán el crecimiento del mercado de detección y diagnóstico de genes CRISPR. La falta de conocimientos especializados y regulaciones supondrán un desafío adicional para el mercado en el período de pronóstico mencionado anteriormente.

- Aumento del coste de los diagnósticos basados en CRISPR

El enorme potencial de las terapias basadas en CRISPR tiene un coste. Las terapias de edición genómica máxima requieren una mayor cantidad de tiempo para su desarrollo y producción, y de ahí el aumento de los costes. Además, los kits de ensayo y los medicamentos relacionados con la detección y el diagnóstico de genes mediante CRISPR son aplicables a un gran sector de la población. Estos costes recaen sobre los pacientes, por lo que se espera que los elevados costes actuales muestren una tendencia descendente en el futuro.

Por ejemplo,

- En julio de 2021, según Integrated DNA Technologies, Inc., el primer ensayo de diagnóstico basado en CRISPR disponible comercialmente para el SARS-CoV-2 que incluye LAMP de transcripción inversa (RT-LAMP) como preamplificación está actualmente disponible a USD 30,15 por reacción.

El informe de mercado de detección y diagnóstico de genes CRISPR proporciona detalles de nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de detección y diagnóstico de genes CRISPR, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Análisis de la epidemiología de los pacientes

Según un estudio de Globocan, en 2020, el cáncer de mama tuvo una alta incidencia de casos, alrededor del 11,7%, seguido del cáncer de pulmón con un 11,40%, el cáncer colorrectal con un 10,00% y el cáncer de cuello uterino y esófago con un menor número de casos incidentes.

El mercado de detección y diagnóstico de genes CRISPR también le proporciona un análisis detallado del mercado para el análisis de pacientes, el pronóstico y las curas. La prevalencia, la incidencia, la mortalidad y las tasas de adherencia son algunas de las variables de datos que están disponibles en el informe. Se analizan los análisis de impacto directo o indirecto de la epidemiología en el crecimiento del mercado para crear un modelo estadístico multivariado de cohorte más sólido para pronosticar el mercado en el período de crecimiento.

Impacto de la COVID-19 en el mercado de detección y diagnóstico de genes mediante CRISPR

El COVID-19 ha afectado negativamente al mercado. Los confinamientos y el aislamiento durante las pandemias complican el diagnóstico, la gestión y el tratamiento. La falta de acceso a los centros sanitarios para la administración rutinaria y de medicamentos afectará aún más al mercado. El aislamiento social aumenta el estrés, la desesperación y el apoyo social, todo lo cual puede provocar una reducción de la adherencia a la medicación anticonvulsiva durante la pandemia.

Desarrollo reciente

- En agosto de 2020, SHERLOCK BIOSCIENCES anunció una colaboración con Dartmouth-Hitchcock Health para llevar a cabo el ensayo clínico del kit de diagnóstico SHERLOCK para el SARS-CoV-2. El kit recibió la aprobación de emergencia de la Autorización de uso de emergencia (EUA) de la Administración de Alimentos y Medicamentos de los Estados Unidos (FDA).

Alcance del mercado de detección y diagnóstico de genes mediante CRISPR en Oriente Medio y África

El mercado de detección y diagnóstico de genes mediante CRISPR está segmentado en base a seis segmentos: clase, productos y servicios, aplicación, flujo de trabajo, usuario final y canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducidos en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Clase

- Clase 1: Proteínas efectoras múltiples

- Clase 2: proteína de unión a ARNcr simple

Sobre la base de la clase, el mercado de detección y diagnóstico de genes CRISPR se segmenta en clase 1: proteínas efectoras múltiples y clase 2: proteína de unión de ARNr único.

Productos y servicios

- Productos

- Servicios

Sobre la base de productos y servicios, el mercado de detección y diagnóstico de genes CRISPR se segmenta en productos y servicios.

Solicitud

- Diagnóstico biomédico

- Ingeniería Genómica

- Descubrimiento de fármacos

- Aplicaciones agrícolas

- Otros

Sobre la base de la aplicación, el mercado de detección y diagnóstico de genes CRISPR se segmenta en diagnóstico biomédico, ingeniería genómica, descubrimiento de fármacos, aplicaciones agrícolas y otros.

Flujo de trabajo

- Preparación de la muestra

- Preamplificación

- ARNcr

- Enzimas Cas

- Detección

Sobre la base del flujo de trabajo, el mercado de detección y diagnóstico de genes CRISPR se segmenta en preparación de muestras, preamplificación, CrRNA, enzimas Cas y detección.

Usuario final

- Hospitales

- Centros de diagnóstico

- Empresas de biotecnología

- Institutos académicos y de investigación

- Otros

Sobre la base del usuario final, el mercado de detección y diagnóstico de genes CRISPR está segmentado en hospitales, centros de diagnóstico, empresas de biotecnología, institutos académicos y de investigación y otros.

Canal de distribución

- Licitaciones directas

- Ventas al por menor

Sobre la base del canal de distribución, el mercado de detección y diagnóstico de genes CRISPR se segmenta en licitaciones directas y ventas minoristas.

Análisis y perspectivas regionales del mercado de detección y diagnóstico de genes mediante CRISPR

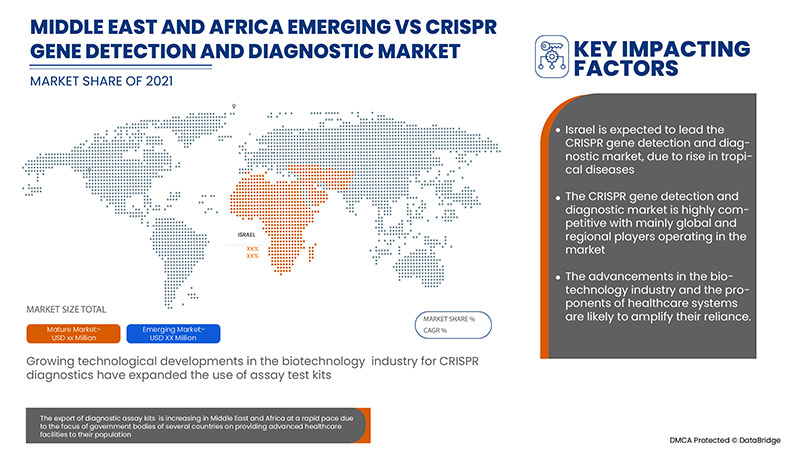

The Middle East and Africa CRISPR gene detection and diagnostic market is analysed and market size insights and trends are provided by regions, class, products & services, application, workflow, end user, and distribution channel as referenced above.

The countries covered in the CRISPR gene detection and diagnostic market report are South Africa, Saudi Arabia, UAE, Egypt, Israel and Rest of Middle East and Africa.

Israel dominates the CRISPR gene detection and diagnostic market due to the strategic initiatives by market players.

The country section of the report also provides individual market impacting factors and changes in regulations in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and CRISPR Gene Detection and Diagnostic Market Share Analysis

The Middle East and Africa CRISPR gene detection and diagnostic market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, the Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the CRISPR gene detection and diagnostic market.

Some of the major players operating in the CRISPR gene detection and diagnostic market are GenScript, Takara Bio Inc., Agilent Technologies, Inc., Merck KGaA, Integrated DNA Technologies, Inc. (A subsidiary of Danaher) and Thermo Fisher Scientific Inc. among others.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 CLASS SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 INTELLECTUAL PROPERTY LANDSCAPE (PATENT LANDSCAPE)

6 EPIDEMIOLOGY

7 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: REGULATORY SCENARIO

8 PIPELINE ANALYSIS FOR MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, OF CRISPR DIAGNOSTICS

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 RISE IN PREVALENCE AND INCIDENCE OF CHRONIC DISEASES

9.1.2 RISE IN INVESTMENT IN RESEARCH AND DEVELOPMENT

9.1.3 AVAILABILITY OF FUNDING FOR CRISPR GENE DIAGNOSTICS

9.1.4 RISE IN GMP-CERTIFICATION APPROVALS FOR CRISPR GENE DIAGNOSTIC

9.1.5 RISE IN CLINICAL TRIALS FOR CRISPR BASED DIAGNOSTICS

9.2 RESTRAINTS

9.2.1 RISE IN COST OF CRISPR BASED DIAGNOSTICS

9.2.2 RISKS FACED WHILE USING CRISPR DIAGNOSIS

9.2.3 ETHICAL CONCERNS RELATED TO CRISPR GENE DETECTION AND DIAGNOSTIC RESEARCH

9.2.4 AVAILABILITY OF ALTERNATIVES

9.3 OPPORTUNITIES

9.3.1 STRATEGIC INITIATIVE BY MARKET PLAYERS

9.3.2 RISE IN HEALTHCARE EXPENDITURE

9.3.3 EMERGENCE OF TECHNOLOGICAL ADVANCEMENTS IN CRISPR BASED DIAGNOSTICS

9.4 CHALLENGES

9.4.1 LACK OF SKILLED PROFESSIONALS REQUIRED FOR CRISPR DIAGNOSTICS

9.4.2 STRINGENT REGULATIONS

10 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS

10.1 OVERVIEW

10.2 CLASS-2 SINGLE CRRNA-BINDING PROTEIN

10.2.1 BIOMEDICAL DIAGNOSTICS

10.2.2 AGRICULTURAL APPLICATIONS

10.2.3 GENOME ENGINEERING

10.2.4 DRUG DISCOVERY

10.2.5 OTHERS

10.3 CLASS-1 MULTIPLE EFFECTOR PROTEINS

11 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES

11.1 OVERVIEW

11.2 PRODUCTS

11.2.1 ASSAY KITS

11.2.1.1 SGRNA KIT

11.2.1.2 GENOMIC DETECTION KIT

11.2.1.3 OTHERS

11.2.2 PROTEINS

11.2.2.1 CAS9

11.2.2.2 CPF1

11.2.2.3 OTHERS

11.2.3 PLASMID AND VECTOR

11.2.4 LIBRARY

11.2.5 CONTROL KITS

11.2.6 DELIVERY SYSTEM PRODUCTS

11.2.7 DESIGN TOOLS

11.2.8 GENOMIC RNA

11.2.9 HDR BLOCKERS

11.2.9.1 AZIDOTHYMIDINE

11.2.9.2 TRIFLUOROTHYMIDINE

11.2.9.3 OTHERS

11.2.9.4 OTHERS

11.3 SERVICES

11.3.1 G-RNA DESIGN

11.3.2 CELL LINE ENGINEERING

11.3.3 MICROBIAL GENE EDITING

11.3.4 DNA SYNTHESIS

11.3.5 OTHERS

12 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 BIOMEDICAL DIAGNOSTICS

12.2.1 CANCER

12.2.2 BLOOD DISORDERS

12.2.3 HEREDITARY DISORDERS

12.2.4 MUSCULAR DYSTROPHY

12.2.5 AIDS

12.2.6 NEURODEGENERATIVE CONDITION

12.2.7 OTHERS

12.3 AGRICULTURAL APPLICATIONS

12.4 GENOME ENGINEERING

12.4.1 CELL LINE ENGINEERING

12.4.2 HUMAN STEM CELLS

12.5 DRUG DISCOVERY

12.6 OTHERS

13 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW

13.1 OVERVIEW

13.2 CRRNA

13.3 CAS ENZYME

13.4 PRE-AMPLIFICATION

13.4.1 PCR

13.4.2 LAMP

13.4.3 RPA

13.5 SAMPLE PREPARATION

13.6 SENSING

13.6.1 FLUORESCENT PROBES

13.6.2 COLORIMETRIC

14 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER

14.1 OVERVIEW

14.2 BIOTECHNOLOGY COMPANIES

14.3 ACADEMIC AND RESEARCH INSTITUTES

14.4 DIAGNOSTIC CENTERS

14.5 HOSPITALS

14.6 OTHERS

15 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 DIRECT TENDER

15.3 RETAIL SALES

16 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION

16.1 MIDDLE EAST AND AFRICA

16.1.1 ISRAEL

16.1.2 SOUTH AFRICA

16.1.3 U.A.E

16.1.4 EGYPT

16.1.5 SAUDI ARABIA

16.1.6 REST OF MIDDLE EAST AND AFRICA

17 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 THERMO FISHER SCIENTIFIC INC.

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 MERCK KGA

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 AGILENT TECHNILOGIES, INC

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENT

19.4 INTEGRATED DNA TECHNOLOGIES, INC. (A SUBSIDIARY OF DANAHER)

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 GENSCRIPT

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENT

19.6 10 X GENOMICS

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENTS

19.7 APPLIED STEM CELL

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENT

19.8 ADDGENE

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENT

19.9 BIOVISION INC.

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENT

19.1 CELLECTA, INC

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENTS

19.11 CAS TAG BIOSCIENCES

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 RECENT DEVELOPMENT

19.12 GENECOPOEIA, INC.

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENT

19.13 HORIZON DISCOVERY LTD

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENTS

19.14 HERA BIOLABS

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 NEW ENGLAND BIOLABS

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENTS

19.16 ORIGENE TECHNOLOGIES, INC.

19.16.1 COMPANY SNAPSHOT

19.16.2 PRODUCT PORTFOLIO

19.16.3 RECENT DEVELOPMENT

19.17 SYNTHEGO

19.17.1 COMPANY SNAPSHOT

19.17.2 PRODUCT PORTFOLIO

19.17.3 RECENT DEVELOPMENTS

19.18 TAKARA BIO INC.

19.18.1 COMPANY SNAPSHOT

19.18.2 REVENUE ANALYSIS

19.18.3 PRODUCT PORTFOLIO

19.18.4 RECENT DEVELOPMENT

19.19 TOOLGEN, INC.

19.19.1 COMPANY SNAPSHOT

19.19.2 PRODUCT PORTFOLIO

19.19.3 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

Lista de Tablas

TABLE 1 PIPELINE ANALYSIS FOR MIDDLE EAST & AFRICA CRISPR GENE THERAPEUTICS

TABLE 2 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA CLASS-1 MULTIPLE EFFECTOR PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA ASSAY KITS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA HDR BLOCKERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA AGRICULTURAL APPLICATIONS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA DRUG DISCOVERYIN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA OTHERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA CRRNA IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA CAS ENZYME IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA PRE-AMPLIFICATION IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA PRE-AMPLIFICATION IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA SAMPLE PREPARATION IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA SENSING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA SENSING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA BIOTECHNOLOGY COMPANIES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA ACADEMIC AND RESEARCH INSTITUTES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA DIAGNOSTIC CENTERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA HOSPITALS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA OTHERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA DIRECT TENDER IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA RETAIL SALES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA ASSAY KITS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA HDR BLOCKERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA PRE-AMPLIFICATION IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA SENSING IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 56 ISRAEL CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS, 2020-2029 (USD MILLION)

TABLE 57 ISRAEL CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 ISRAEL CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 59 ISRAEL PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 ISRAEL ASSAY KITS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 61 ISRAEL HDR BLOCKERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 ISRAEL PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 63 ISRAEL SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 ISRAEL CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 ISRAEL GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 ISRAEL BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 ISRAEL CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 68 ISRAEL PRE-AMPLIFICATION IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 69 ISRAEL SENSING IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 70 ISRAEL CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 71 ISRAEL CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 72 SOUTH AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS, 2020-2029 (USD MILLION)

TABLE 73 SOUTH AFRICA CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 SOUTH AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 75 SOUTH AFRICA PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 SOUTH AFRICA ASSAY KITS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 77 SOUTH AFRICA HDR BLOCKERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 SOUTH AFRICA PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 79 SOUTH AFRICA SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 SOUTH AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 SOUTH AFRICA GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 SOUTH AFRICA BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 SOUTH AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 84 SOUTH AFRICA PRE-AMPLIFICATION IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 85 SOUTH AFRICA SENSING IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 86 SOUTH AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 87 SOUTH AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 U.A.E CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS, 2020-2029 (USD MILLION)

TABLE 89 U.A.E CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 U.A.E CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 91 U.A.E PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 U.A.E ASSAY KITS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 U.A.E HDR BLOCKERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 U.A.E PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 U.A.E SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 U.A.E CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 U.A.E GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 U.A.E BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 U.A.E CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 100 U.A.E PRE-AMPLIFICATION IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 101 U.A.E SENSING IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 102 U.A.E CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 103 U.A.E CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 104 EGYPT CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS, 2020-2029 (USD MILLION)

TABLE 105 EGYPT CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 EGYPT CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 107 EGYPT PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 EGYPT ASSAY KITS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 109 EGYPT HDR BLOCKERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 110 EGYPT PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 111 EGYPT SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 EGYPT CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 EGYPT GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 114 EGYPT BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 EGYPT CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 116 EGYPT PRE-AMPLIFICATION IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 117 EGYPT SENSING IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 118 EGYPT CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 119 EGYPT CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 120 SAUDI ARABIA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS, 2020-2029 (USD MILLION)

TABLE 121 SAUDI ARABIA CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 SAUDI ARABIA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 123 SAUDI ARABIA PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 SAUDI ARABIA ASSAY KITS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 SAUDI ARABIA HDR BLOCKERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 SAUDI ARABIA PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 127 SAUDI ARABIA SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 SAUDI ARABIA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 129 SAUDI ARABIA GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 SAUDI ARABIA BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 SAUDI ARABIA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 132 SAUDI ARABIA PRE-AMPLIFICATION IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 133 SAUDI ARABIA SENSING IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 134 SAUDI ARABIA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 135 SAUDI ARABIA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 136 REST OF MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: DBMR POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: END USER COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASED INCIDENCE OF CHRONIC DISEASES, RISE IN TECHNOLOGICAL ADVANCEMENTS IN CRISPR DIAGNOSTICS, AND GOVERNMENT FUNDING FOR THE DEVELOPMENT OF CRISPR DETECTION KITS ARE EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET FROM 2022 TO 2029

FIGURE 13 CLASS SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET FROM 2022 & 2029

FIGURE 14 MIDDLE EAST & AFRICA CRISPR GENE PATENT SCENARIO, BY APPLICATION

FIGURE 15 CRISPR PATENT LANDSCAPE AND NUMBER OF APPLICATIONS OF NEW PATENT FAMILIES FILED WORLDWIDE, 2001 TO 2019

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET

FIGURE 17 INCIDENCE OF VARIOUS TYPES OF CANCER IN 2020

FIGURE 18 PREVALENCE OF HUNTINGTON’S DISEASE IN 2019

FIGURE 19 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY CLASS, 2021

FIGURE 20 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY CLASS, 2022-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY CLASS, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY CLASS, LIFELINE CURVE

FIGURE 23 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY PRODUCTS AND SERVICES, 2021

FIGURE 24 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY PRODUCTS AND SERVICES, 2022-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY PRODUCTS AND SERVICES, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY PRODUCTS AND SERVICES, LIFELINE CURVE

FIGURE 27 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY APPLICATION, 2021

FIGURE 28 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 29 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 31 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY WORKFLOW, 2021

FIGURE 32 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY WORKFLOW, 2022-2029 (USD MILLION)

FIGURE 33 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY WORKFLOW, CAGR (2022-2029)

FIGURE 34 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY WORKFLOW, LIFELINE CURVE

FIGURE 35 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY END USER, 2021

FIGURE 36 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 37 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY END USER, CAGR (2022-2029)

FIGURE 38 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY END USER, LIFELINE CURVE

FIGURE 39 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 40 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 41 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 42 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 43 MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: SNAPSHOT (2021)

FIGURE 44 MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY COUNTRY (2021)

FIGURE 45 MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY COUNTRY (2022 & 2029)

FIGURE 46 MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY COUNTRY (2021 & 2029)

FIGURE 47 MIDDLE EAST AND AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY CLASS (2022-2029)

FIGURE 48 MIDDLE EAST & AFRICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.