Middle East And Africa Commercial Jar Blender Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

17.41 Million

USD

21.89 Million

2025

2033

USD

17.41 Million

USD

21.89 Million

2025

2033

| 2026 –2033 | |

| USD 17.41 Million | |

| USD 21.89 Million | |

|

|

|

|

Segmentación del mercado de licuadoras comerciales de jarra en Oriente Medio y África, por tipo de producto (jarra de plástico, jarra de metal, jarra de vidrio y otros), tipo (licuadoras de uso intensivo, licuadoras de uso intermedio y licuadoras de uso ligero), aplicación (alimentos y bebidas), tipo de control (control electrónico, control de palanca y otros), modo de funcionamiento (automático y manual), usuario final (establecimientos de procesamiento de alimentos, establecimientos de servicio de alimentos y otros), canal de distribución (tanto en tiendas físicas como fuera de ellas): tendencias del sector y pronóstico hasta 2033.

¿Cuál es el tamaño y la tasa de crecimiento del mercado de licuadoras comerciales en Oriente Medio y África?

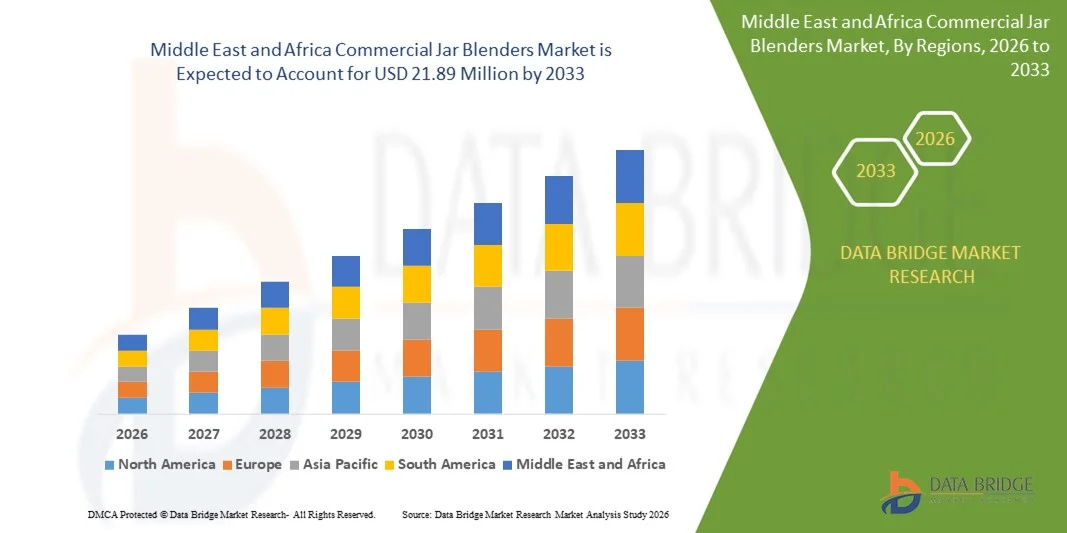

- El tamaño del mercado de licuadoras comerciales de Oriente Medio y África se valoró en 17,41 millones de dólares en 2025 y se espera que alcance los 21,89 millones de dólares en 2033 , con una CAGR del 2,9 % durante el período de pronóstico.

- Los factores que impulsan el crecimiento del mercado son la creciente demanda de licuadoras de jarra comerciales con recintos acústicos, la creciente preferencia por el consumo de bebidas a base de frutas, la creciente adopción de las últimas tecnologías en licuadoras de jarra y el creciente número de distribuidores y tiendas de electrónica.

¿Cuáles son las principales conclusiones del mercado de licuadoras de jarra comerciales?

- Debido a la facilidad y seguridad que ofrece a los usuarios, las batidoras de inmersión han ganado una popularidad significativa entre las poblaciones trabajadoras y no trabajadoras.

- La aparición de las batidoras de mano coincide con un movimiento en la elección de los consumidores hacia productos naturales, lo que se espera que impulse las ventas de batidoras en un futuro no muy lejano.

- Los Emiratos Árabes Unidos dominaron el mercado de licuadoras comerciales de Medio Oriente y África con una participación estimada en los ingresos del 28,3 % en 2025, impulsado por el rápido crecimiento de los cafés, restaurantes y cadenas de servicios de alimentos.

- En Sudáfrica, se espera que el mercado registre la CAGR más rápida del 7,1 % entre 2026 y 2033, impulsada por la creciente cultura de los cafés, el crecimiento de las cadenas de batidos y jugos y la expansión de los servicios de hostelería y catering.

- El segmento de frascos de plástico dominó el mercado con una participación estimada del 39,2 % en 2025, impulsado por la asequibilidad, el diseño liviano, la resistencia al impacto y la facilidad de limpieza, lo que lo hace ideal para la preparación de bebidas comerciales y servicios de alimentos de gran volumen.

Alcance del informe y segmentación del mercado de licuadoras de vaso comerciales

|

Atributos |

Licuadoras de vaso comerciales: Perspectivas clave del mercado |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

¿Cuál es la tendencia clave en el mercado de licuadoras de jarra comerciales?

Aumento de la demanda de licuadoras comerciales de alto rendimiento, de bajo consumo y multifunción

- El mercado de licuadoras de jarra comerciales está siendo testigo de una fuerte adopción de licuadoras de alta potencia, duraderas y versátiles diseñadas para cocinas profesionales, cafés, bares de batidos y operaciones de servicio de alimentos.

- Los fabricantes están ampliando sus carteras con licuadoras para aplicaciones específicas, que incluyen motores de alto torque, controles de velocidad variable, configuraciones preprogramadas y tecnologías de reducción de ruido diseñadas para uso comercial.

- La creciente demanda de eficiencia, consistencia y multifuncionalidad está impulsando su adopción en restaurantes, bares de jugos, hoteles y empresas de catering.

- Por ejemplo, empresas como Vitamix, Blendtec, Hamilton Beach, Waring y NutriBullet están invirtiendo en diseños de jarras robustas, sensores inteligentes e interfaces programables para mejorar el rendimiento de la mezcla.

- El creciente enfoque en la preparación a pedido, las texturas personalizables y la fácil limpieza está acelerando la demanda de licuadoras comerciales de alta calidad.

- A medida que los operadores de servicios de alimentos valoran cada vez más la durabilidad, la velocidad y la versatilidad, las licuadoras de jarra comerciales seguirán siendo fundamentales para las operaciones profesionales culinarias y de bebidas.

¿Cuáles son los impulsores clave del mercado de licuadoras de jarra comerciales?

- Creciente demanda de licuadoras de alta eficiencia, versátiles y duraderas en restaurantes, cafés, bares de jugos y servicios de catering a nivel mundial.

- Por ejemplo, durante 2024-2025, los principales actores como Vitamix, Blendtec, Hamilton Beach, Waring y NutriBullet actualizaron sus líneas de productos con mayor potencia de motor, jarras de mayor capacidad y programas de licuado inteligentes.

- La creciente adopción de batidos, jugos y tendencias alimentarias centradas en la salud en los EE. UU., Europa, Medio Oriente y África está impulsando el consumo de licuadoras comerciales.

- Los avances en la eficiencia del motor, la reducción de ruido, la durabilidad del material del recipiente y los controles de interfaz digital mejoran el rendimiento, la velocidad y la confiabilidad.

- La creciente demanda de una textura de producto consistente, funcionalidad de usos múltiples y una preparación rápida respalda el crecimiento del mercado a largo plazo.

- Con el respaldo de un número cada vez mayor de cafés, restaurantes saludables y cocinas comerciales, se espera que el mercado de licuadoras de jarra comerciales sea testigo de un fuerte crecimiento global.

¿Qué factor está obstaculizando el crecimiento del mercado de licuadoras de vaso comerciales?

- Los altos costos iniciales de las licuadoras comerciales de primera calidad, los frascos robustos y los controles electrónicos avanzados limitan su adopción entre las pequeñas empresas.

- Por ejemplo, durante 2024-2025, las fluctuaciones en los precios de los componentes, los costos de los motores y los aranceles de importación afectaron los precios de los productos de varias marcas globales.

- La intensa competencia de las licuadoras de nivel básico de bajo costo y los modelos personales para uso doméstico crea presión sobre los precios y reduce la diferenciación.

- La limitada conciencia entre los pequeños restaurantes y las empresas que funcionan desde el hogar respecto de los beneficios de las licuadoras de calidad profesional ralentiza la penetración en el mercado.

- Los requisitos de mantenimiento, las piezas de repuesto y el consumo de energía pueden plantear desafíos operativos para algunos usuarios.

- Para abordar estos problemas, las empresas se están centrando en motores energéticamente eficientes, materiales de jarra duraderos, componentes modulares, soporte posventa y funciones inteligentes de valor agregado para expandir la adopción global de licuadoras de jarra comerciales.

¿Cómo está segmentado el mercado de licuadoras de jarra comerciales?

El mercado está segmentado según el tipo de producto, tipo, aplicación, tipo de control, modo de operación, usuario final y canal de distribución .

- Por tipo de producto

Según el tipo de producto, el mercado de licuadoras de vaso comerciales se segmenta en vasos de plástico, de metal, de vidrio y otros. El segmento de vasos de plástico dominó el mercado con una participación estimada del 39,2 % en 2025, gracias a su asequibilidad, diseño ligero, resistencia a impactos y facilidad de limpieza, lo que lo hace ideal para la preparación de bebidas comerciales y servicios de alimentación de alto volumen. Los vasos de plástico son ampliamente utilizados en cafeterías, bares de jugos y cadenas de comida rápida debido a su durabilidad, bajo costo y compatibilidad con operaciones de licuado a alta velocidad.

Se espera que el segmento de frascos de vidrio crezca a la tasa de crecimiento anual compuesta (TCAC) más alta entre 2026 y 2033, impulsado por la creciente demanda de licuadoras de primera calidad, sin químicos y estéticamente atractivas. Los frascos de vidrio ofrecen una resistencia superior al calor, transparencia y un licuado sin olores, lo que los convierte en la opción preferida de negocios y establecimientos que se preocupan por la salud y que buscan equipos de calidad profesional para preparar batidos, sopas y salsas.

- Por tipo

Según el tipo de licuadora, el mercado se segmenta en licuadoras de alto rendimiento, licuadoras de rendimiento medio y licuadoras de bajo rendimiento. El segmento de alto rendimiento dominó el mercado con una participación del 41,8 % en 2025, impulsado por la demanda en cocinas comerciales de alto volumen, bares de batidos y procesadoras de alimentos, donde el funcionamiento continuo, los motores potentes y la larga durabilidad son fundamentales. Las licuadoras de alto rendimiento garantizan una textura, velocidad y fiabilidad constantes para chefs profesionales y operadores que manipulan ingredientes densos.

Se prevé que el segmento de servicio mediano crezca a la tasa de crecimiento anual compuesta (TCAC) más alta entre 2026 y 2033, impulsado por su adopción en cafeterías, bares de jugos y restaurantes boutique de tamaño pequeño a mediano. Los modelos de servicio mediano logran un equilibrio entre asequibilidad, potencia y versatilidad, respondiendo a la creciente demanda en centros urbanos y pequeñas empresas de servicios de alimentación que buscan un rendimiento confiable sin especificaciones industriales.

- Por aplicación

En cuanto a su aplicación, el mercado de licuadoras de vaso comerciales se segmenta principalmente en Alimentos y Bebidas. Este segmento dominó el mercado con una participación estimada del 88,5 % en 2025, impulsado por su amplio uso en cafeterías, bares de jugos, restaurantes y servicios de catering. Las licuadoras son esenciales para la preparación de batidos, sopas, salsas, mantequillas de frutos secos y otras bebidas, garantizando consistencia, rapidez e higiene. La creciente popularidad de las bebidas saludables, los batidos de proteínas y la preparación de bebidas a pedido continúa impulsando su adopción.

Se proyecta que el segmento mantendrá un sólido crecimiento, impulsado por la creciente demanda de alimentos y bebidas frescos, personalizados y visualmente atractivos. Las recetas especializadas, la alta velocidad de mezclado y la versatilidad de los ingredientes consolidan a las licuadoras comerciales como herramientas indispensables en la industria global de servicios de alimentación y hostelería.

- Por tipo de control

Según el tipo de control, el mercado se segmenta en control electrónico, control de palanca y otros. El segmento de control electrónico dominó el mercado con una participación del 53,4 % en 2025, gracias a su precisa regulación de la velocidad, ciclos de licuado preprogramados e interfaces digitales intuitivas. Los controles electrónicos permiten a los operadores comerciales obtener resultados consistentes, reducir los errores humanos e integrar flujos de trabajo automatizados en cocinas con mucha actividad.

Se prevé que el segmento de control de palanca experimente el mayor crecimiento anual compuesto (CAGR) entre 2026 y 2033, gracias a su simplicidad, bajo mantenimiento y fiabilidad en pequeñas cafeterías y establecimientos de comida rápida. Las licuadoras con control de palanca son rentables, duraderas y las preferidas por establecimientos que requieren un funcionamiento sencillo sin componentes electrónicos complejos.

- Por modo de operación

Según el modo de funcionamiento, el mercado se segmenta en licuadoras automáticas y manuales. El segmento automático dominó el mercado con una participación del 61,1 % en 2025, gracias a sus ajustes programables, la licuación con temporizador y el control de velocidad optimizado que reduce el esfuerzo del operador en entornos de alto volumen. Las licuadoras automáticas mejoran la eficiencia, la consistencia y la seguridad, especialmente en cadenas de restauración y cocinas comerciales.

Se espera que el segmento Manual crezca a la CAGR más rápida entre 2026 y 2033, respaldado por la demanda en pequeños restaurantes, negocios desde el hogar y cocinas experimentales donde se prefiere el control práctico sobre la velocidad de mezcla, la duración y la textura.

- Por el usuario final

Según el usuario final, el mercado se segmenta en establecimientos de procesamiento de alimentos, establecimientos de servicio de alimentos y otros. El segmento de establecimientos de servicio de alimentos dominó el mercado con una participación del 48,7 % en 2025, impulsado por la alta adopción en cafeterías, restaurantes, hoteles y empresas de catering que requieren una licuadora confiable y de alta velocidad para diversos platos del menú. Las licuadoras son esenciales para una calidad constante, eficiencia operativa y una preparación rápida de bebidas y salsas.

Se proyecta que el segmento de establecimientos de procesamiento de alimentos crecerá a la CAGR más rápida entre 2026 y 2033, respaldado por el aumento del uso de licuadoras en cocinas industriales, producción de alimentos envasados y fabricación de bebidas listas para beber, donde los grandes volúmenes, la consistencia y la durabilidad son fundamentales.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en canales con y sin tienda. El segmento con tienda dominó el mercado con una participación del 51,3 % en 2025, impulsado por minoristas de electrodomésticos, tiendas de artículos de cocina y tiendas de equipos especializados que ofrecen acceso directo, soporte de instalación y servicio posventa.

Se prevé que el segmento de comercios sin presencia física crezca a la tasa de crecimiento anual compuesta (TCAC) más alta entre 2026 y 2033, impulsado por mercados en línea, plataformas de comercio electrónico y canales de venta directa a empresas. La comodidad, los precios competitivos, la información detallada de los productos y la entrega a domicilio impulsan su adopción entre pequeñas empresas, cafeterías y startups a nivel mundial.

¿Qué región posee la mayor participación en el mercado de licuadoras de vaso comerciales?

- Los Emiratos Árabes Unidos dominaron el mercado de licuadoras comerciales de Medio Oriente y África con una participación estimada en los ingresos del 28,3 % en 2025, impulsado por el rápido crecimiento de los cafés, restaurantes y cadenas de servicios de alimentos.

- La creciente preferencia de los consumidores por bebidas saludables, batidos y bebidas a pedido, combinada con el aumento de las inversiones en cocinas comerciales modernas e importaciones de electrodomésticos de primera calidad, respalda una adopción generalizada.

- Las redes de distribución avanzadas, la penetración del comercio electrónico y una sólida infraestructura hotelera refuerzan aún más el liderazgo de los EAU en el mercado regional.

Análisis del mercado de licuadoras de vaso comerciales en Sudáfrica

En Sudáfrica, se espera que el mercado registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 7,1 %, entre 2026 y 2033, impulsada por la creciente cultura de las cafeterías, el crecimiento de las cadenas de smoothies y jugos, y la expansión de los servicios de hostelería y catering. Las licuadoras con múltiples velocidades, jarras de alta capacidad y funcionamiento automatizado están ganando popularidad. La creciente adopción del comercio electrónico, la distribución minorista moderna y la creciente concienciación sobre las tendencias en salud y nutrición aceleran aún más la penetración de las licuadoras comerciales en todo el país.

Análisis del mercado de licuadoras comerciales de vaso en Egipto

En Egipto, se observa un crecimiento sostenido gracias al aumento de las inversiones en servicios de alimentación urbanos, restaurantes de comida rápida y servicios de catering. La demanda de licuadoras comerciales fiables, duraderas y eficientes con controles electrónicos y jarras de gran capacidad está aumentando en bares de jugos y pequeñas unidades de producción de alimentos. La expansión del comercio minorista organizado, los canales de importación de electrodomésticos y los programas gubernamentales de apoyo impulsan la adopción en el mercado.

¿Cuáles son las principales empresas del mercado de licuadoras de jarra comerciales?

La industria de las licuadoras de vaso comerciales está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Newell Brands Inc. (EE. UU.)

- Whirlpool Corp. (EE. UU.)

- Vita-Mix Corp (EE. UU.)

- Spectrum Brands, Inc. (EE. UU.)

- Blendtec Inc. (EE. UU.)

- Marcas de Hamilton Beach (EE. UU.)

- Zhongshan CRANDDI Electrical Appliance Co., Ltd (China)

- Ceado Srl (Italia)

- Foshan Canmax Electric Appliances Co. (China)

- Waring (Estados Unidos)

- Sammic SL (España)

- NutriBullet, LLC (EE. UU.)

- ELECTRODOMÉSTICOS HANS (India)

- Bianco di puro GmbH & Co. KG (Alemania)

¿Cuáles son los desarrollos recientes en el mercado global de licuadoras de jarra comerciales?

- En febrero de 2025, la Unión Europea aprobó una normativa actualizada sobre equipos de procesamiento de alimentos, incluidas las batidoras de vaso comerciales, que exige normas de seguridad e higiene más estrictas (Comunicado de prensa de la Comisión Europea). Este cambio normativo impulsó a los fabricantes a modernizar sus productos, lo que generó oportunidades para la innovación y mejoró el cumplimiento normativo en el mercado de batidoras comerciales.

- En mayo de 2024, Hamilton Beach Brands Holding Corporation completó la adquisición de Silverson Machines, un destacado fabricante de equipos de mezcla industrial, incluyendo mezcladoras de jarra comerciales (presentación ante la SEC). Esta adquisición permitió a Hamilton Beach diversificar sus fuentes de ingresos, ampliar su cartera de productos y fortalecer su presencia en los mercados industrial y comercial.

- En marzo de 2024, Waring Commercial y Blendtec formaron una alianza estratégica para compartir la marca y distribuir determinados modelos de Blendtec bajo el nombre de Waring (Bloomberg). Esta colaboración aprovechó las fortalezas de ambas compañías, amplió su alcance de mercado y mejoró su oferta combinada de productos para clientes comerciales.

- En enero de 2024, Bosch Appliance Corporation lanzó su nueva licuadora de vaso de calidad comercial, la PowerMaster Pro, con un motor de 3 caballos de fuerza y una capacidad de 12 litros (Reuters). Este lanzamiento amplió la gama de licuadoras comerciales de Bosch, atendiendo a grandes empresas y aplicaciones industriales, y consolidó su posición en el mercado de licuadoras profesionales.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.