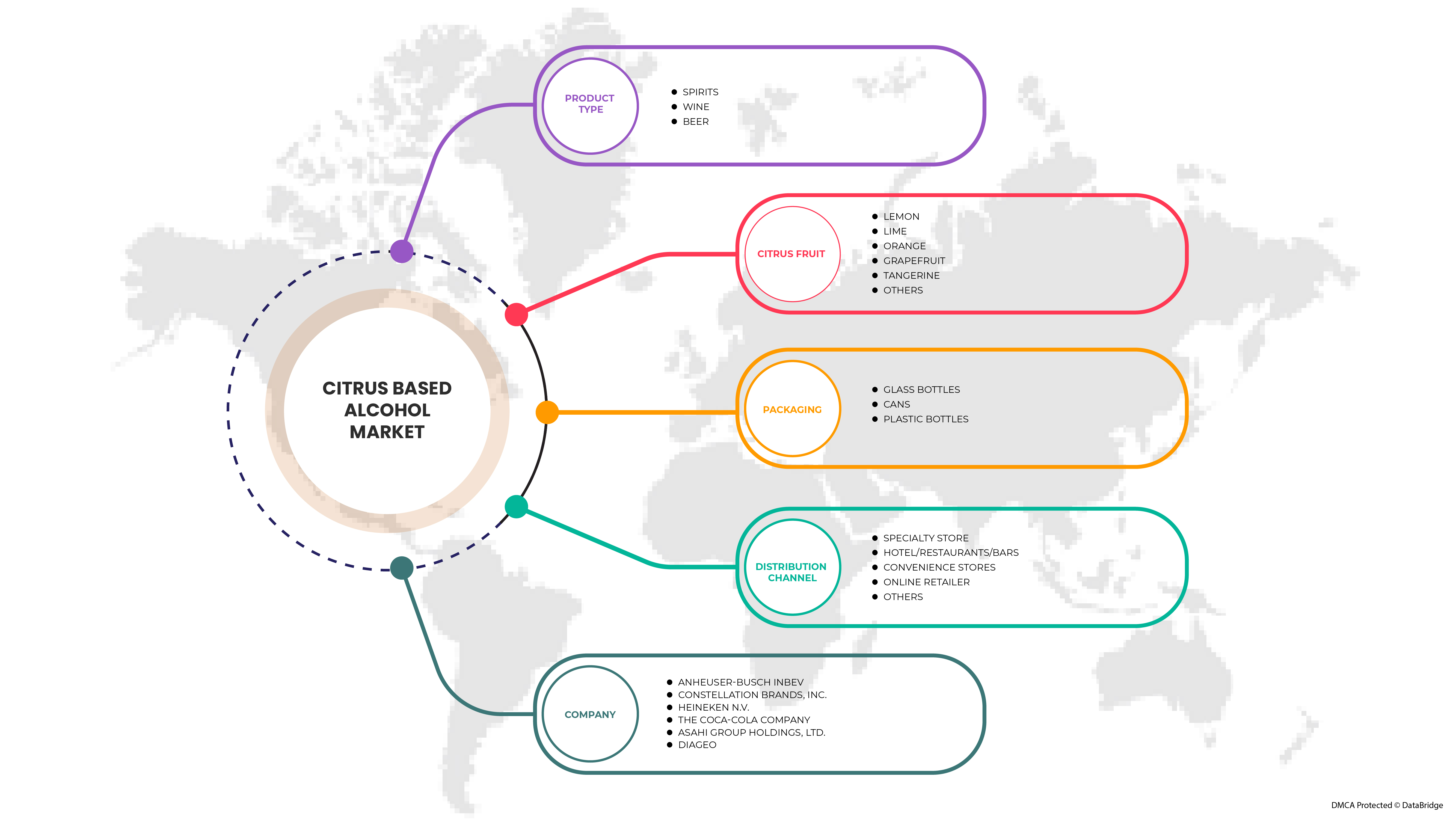

Mercado de alcohol a base de cítricos en Oriente Medio y África por tipo de producto (bebidas espirituosas, vino y cerveza), frutas cítricas ( limón , lima, naranja, pomelo, mandarina y otras), embalaje ( botellas de vidrio , latas y botellas de plástico), canal de distribución (tiendas especializadas, hoteles/restaurantes/bares, tiendas de conveniencia, minoristas en línea y otros), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de alcohol a base de cítricos en Oriente Medio y África

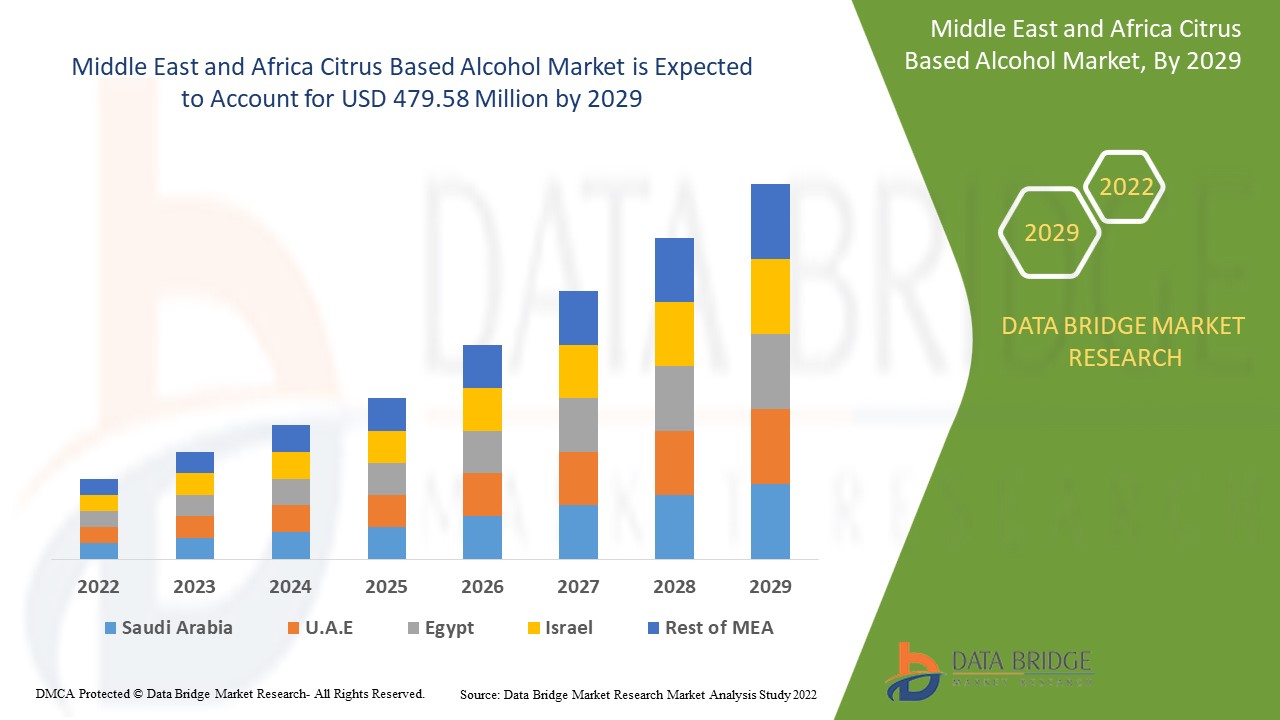

Se espera que el mercado de alcohol a base de cítricos gane un crecimiento significativo en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 3,7% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 479,58 millones para 2029. El principal factor que impulsa el crecimiento del mercado de alcohol a base de cítricos es la tendencia creciente de las bebidas espirituosas artesanales y la adopción de ingredientes rentables.

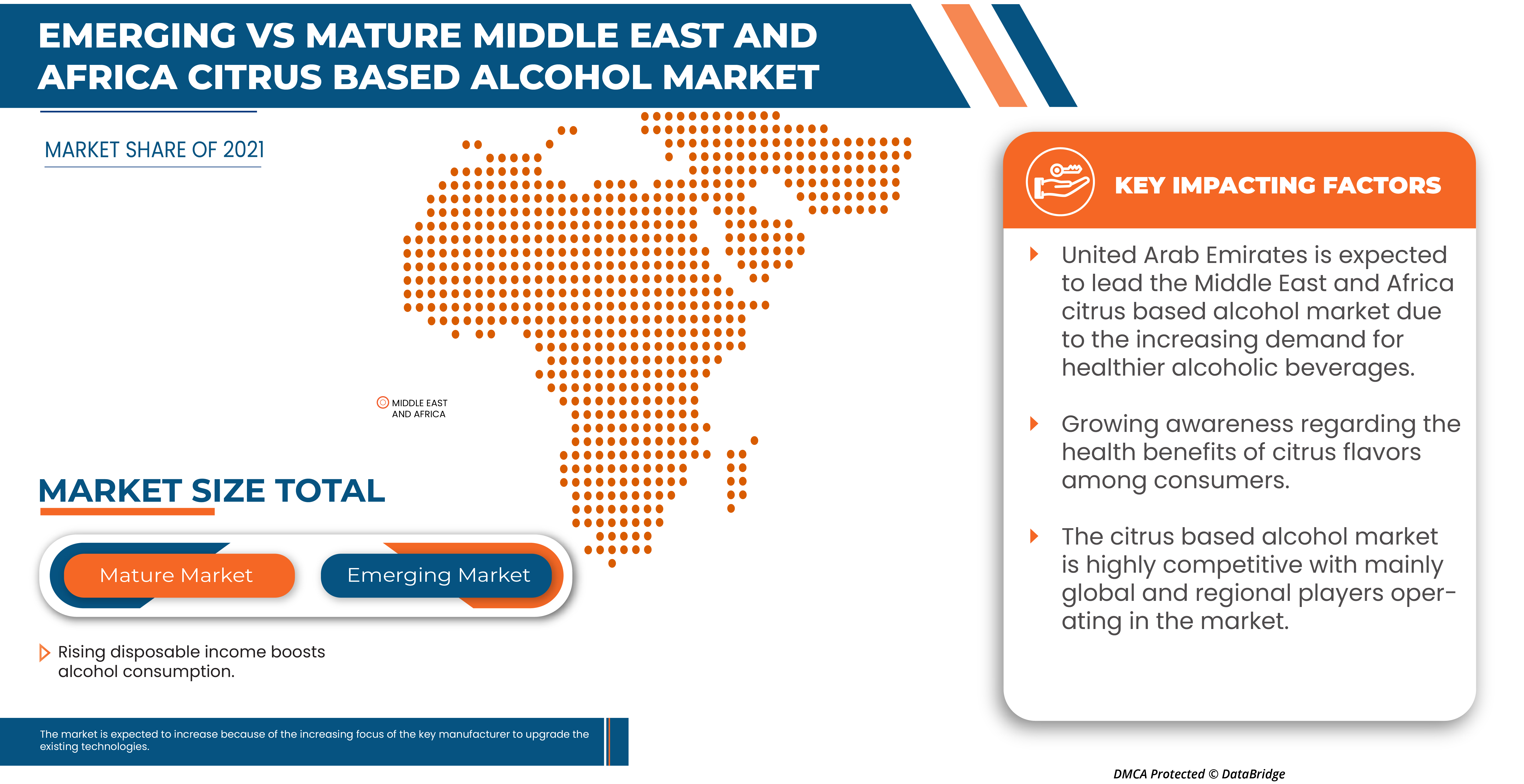

La creciente demanda y popularidad de las bebidas espirituosas artesanales y la adopción de ingredientes rentables es un factor importante para el mercado de bebidas alcohólicas a base de cítricos en Oriente Medio y África. El aumento de los ingresos disponibles impulsa el consumo de alcohol, y se espera que la creciente conciencia sobre los beneficios para la salud de los sabores cítricos entre los consumidores impulse el crecimiento del mercado de bebidas alcohólicas a base de cítricos en Oriente Medio y África.

El informe de mercado de alcohol a base de cítricos proporciona detalles de la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por tipo de producto (licores, vino y cerveza), frutas cítricas ( limón , lima, naranja, pomelo, mandarina y otros), embalaje ( botellas de vidrio , latas y botellas de plástico), canal de distribución (tiendas especializadas, hoteles/restaurantes/bares, tiendas de conveniencia, minoristas en línea y otros). |

|

Países cubiertos |

Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Kuwait y resto de Medio Oriente y África. |

|

Actores del mercado cubiertos |

Anheuser-Busch InBev, Constellation Brands, Inc., Heineken NV, The Coca-Cola Company, ASAHI GROUP HOLDINGS, LTD., Anheuser-Busch Companies, LLC., The Boston Beer Company, Diageo, Beam Suntory, Inc., Radico Khaitan Ltd., EDRINGTON, SUNTORY HOLDINGS LIMITED, Accolade Wines Limited., WILLIAM GRANT & SONS, Cervecerías Carlsberg A/S, Licores artesanales Halewood, Pernod Ricard, UNITED BREWERIES LTD., Brown-Forman, Destilerías KALS Private Limited, Bacardi Limited |

Definición de mercado

Los alcoholes a base de cítricos se producen principalmente a partir de frutas cítricas como el limón, la lima, el pomelo y la naranja. Debido a su sabor y fuerte acidez, los cítricos se han convertido en una parte integral de las bebidas alcohólicas, incluida la cerveza y los licores como el vino, el ron y la ginebra, y se utilizan para proporcionar equilibrio en los cócteles. Asimismo, el alcohol cítrico se utiliza como base y aditivo de sabor en la producción de alcohol. Las bebidas alcohólicas a base de cítricos heredan el perfil nutricional de las frutas cítricas de las que se producen, como el limón, la lima, la naranja, el pomelo, la mandarina y otras. Las frutas cítricas son ricas en vitamina C, que es un poderoso antioxidante que protege las células del daño de los radicales libres y juega un papel importante en la prevención de enfermedades como la diabetes, el cáncer y las enfermedades neurológicas.

Los licores artesanales se desarrollan principalmente mediante la infusión de sabores de frutas. La innovación que surge de los licores artesanales no tiene paralelo en la industria de las bebidas. Los consumidores consideran que los productos artesanales son más creativos, ágiles y especializados, con tanta variedad y arte. Este crecimiento creciente de los licores artesanales ayuda al crecimiento del alcohol a base de cítricos al incorporar cítricos en sus productos de destilería. Además de los cítricos, el licor se infunde con varias especias, como canela, vainilla, jengibre, pimienta y otras, para mejorar el sabor y el aroma. Esta adopción de los ingredientes y los cítricos es más saludable y más rentable para la producción de licores.

Dinámica del mercado de alcoholes a base de cítricos

Conductores

- Tendencia creciente de bebidas espirituosas artesanales y la adopción de ingredientes rentables

A medida que la industria de las bebidas continúa expandiéndose y desarrollándose, no se puede ignorar el auge de los licores artesanales, entre ellos las cervezas y las sidras artesanales. Desde el ron hasta la ginebra, hay una gran variedad de licores artesanales, tanto en línea como en las tiendas, y todos ellos encarnan algo diferente. Tanto es así que muchos prefieren los licores artesanales a las marcas comerciales más tradicionales, lo que probablemente también se deba a la tendencia de los consumidores a comprar localmente en destilerías y cervecerías más pequeñas. La rápida demanda de licores artesanales de primera calidad debido al cambio de actitudes culturales de la población joven y adinerada es un importante contribuyente al crecimiento del mercado de licores artesanales en todo el mundo. Los consumidores de licores artesanales prefieren productos elaborados con sabores naturales u orgánicos, mientras que los destiladores a pequeña escala se diferencian con etiquetas limpias, ingredientes auténticos seleccionados a mano, como agua de manantial y granos no transgénicos y combinaciones de sabores únicas. El ron artesanal más popular es el ron especiado, infusionado con varias especias, como canela, jengibre, vainilla, nuez moscada y pimienta. Esta adopción de ingredientes es más saludable y rentable para la producción de bebidas espirituosas artesanales.

- El aumento de la renta disponible impulsa el consumo de alcohol

Pero hoy en día el alcohol se ha vuelto más asequible en la mayoría de los países, debido al aumento de los ingresos disponibles de la gente. El cambio en los ingresos reales fue mayor que el cambio en el precio relativo del alcohol. Esto demuestra que el crecimiento de los ingresos reales fue el principal impulsor de la asequibilidad. El crecimiento del alcohol es grande para el sector de edad entre 18 y 80 años. Especialmente entre los jóvenes. El aumento del empleo y el aumento de los ingresos disponibles junto con las tasas de desempleo decrecientes están impulsando la demanda de alcohol. En el mundo moderno, en todas partes la gente necesita alcohol para disfrutar de sus días y noches de vacaciones, fiestas y también tiempo libre. El aumento de los sectores de TI y la gente tratando de ser más sociable entre colegas. Esta socialización necesita principalmente alcohol. Para facilitar esto, el alcohol no solo está disponible en licorerías o tiendas, los hoteles de alta gama y los restaurantes están ansiosos por incorporar bebidas espirituosas artesanales a su cartera.

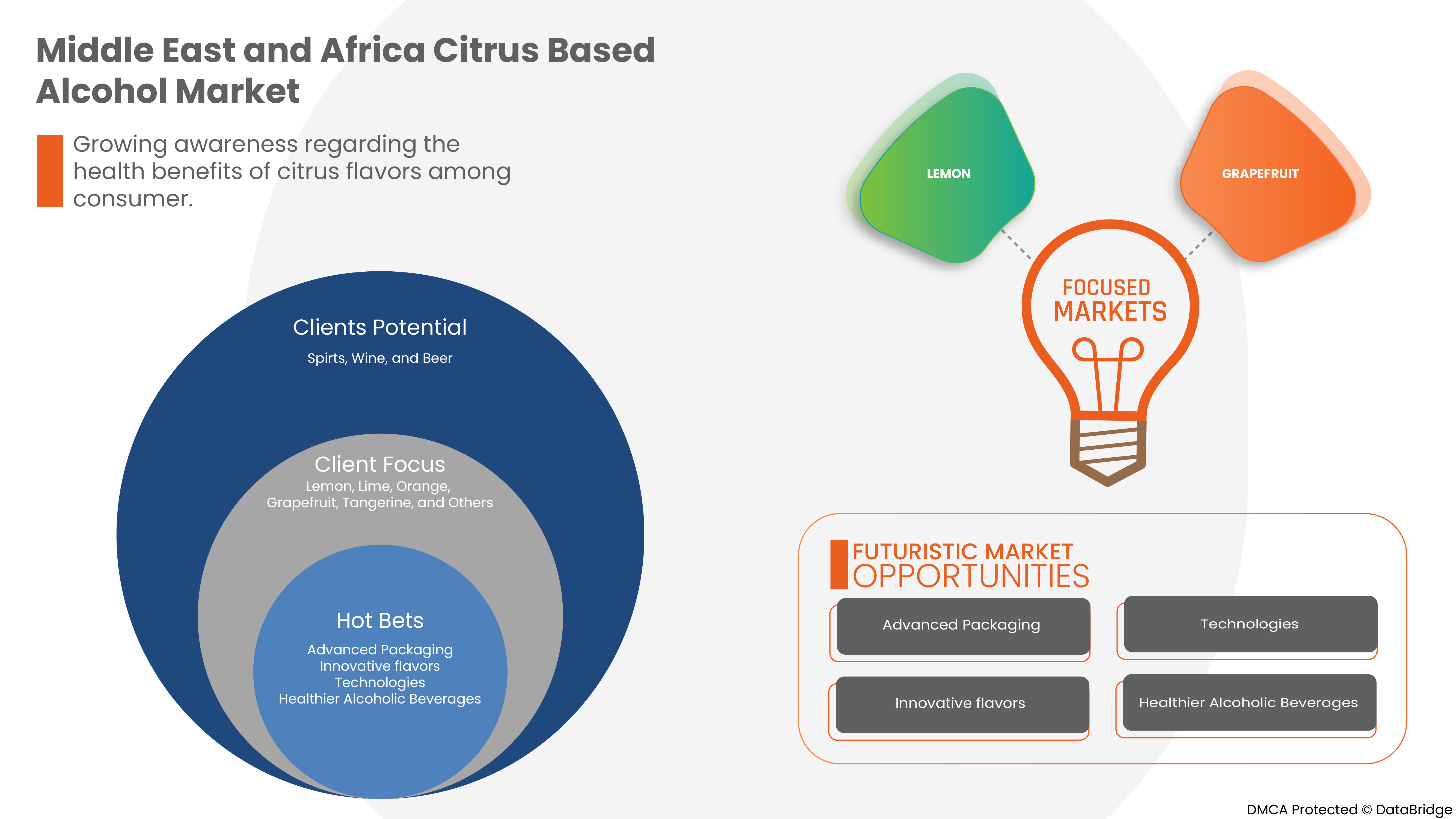

- Creciente conciencia sobre los beneficios para la salud de los sabores cítricos entre los consumidores

Las bebidas alcohólicas con sabor a cítricos son cada vez más populares entre la mayoría de las personas en todo el mundo debido a sus múltiples beneficios para la salud y su capacidad para mejorar el sabor. Las frutas cítricas, como los limones y las naranjas, tienen un alto contenido de vitamina C, un poderoso antioxidante que protege las células del daño de los radicales libres. La producción de huesos, la curación del tejido conectivo y la salud de las encías requieren principalmente vitamina C, que se obtiene de las bebidas con sabor a cítricos. La vitamina C que se encuentra en los cítricos también ayuda a prevenir las arrugas, la piel seca por el envejecimiento y el daño solar. Además, también cataliza la producción de colágeno, que es vital para la salud de la piel.

Oportunidades

- Creciente demanda de sabores innovadores de bebidas alcohólicas

Existen muchas formas de mejorar una bebida alcohólica pura utilizando sabores de frutas. Los aceites cítricos se utilizan ampliamente para aromatizar bebidas. Esta fruta pertenece a la familia Rutaceae y consta de alrededor de 140 tribus y 1300 especies, como: limón verde, pomelo, naranjas, limón amarillo, mandarinas, pomelo, bergamota y cidra. Los aceites cítricos se almacenan en hojas, cáscaras y jugo. Los terpenos, sesquiterpenos, aldehídos, alcoholes, ésteres y esteroles se encuentran entre los muchos químicos que se encuentran en estos excelentes aceites esenciales. También se conocen como mezclas de hidrocarburos, químicos que contienen oxígeno y compuestos residuales no volátiles. Los sabores cítricos son populares en las bebidas, particularmente en la cerveza de trigo. Uno de los productos de la fermentación de la cerveza de trigo son los ésteres que le dan el sabor y el aroma de la fruta a la cerveza en sí, por lo que encaja perfectamente con los sabores cítricos y casi oculta el sabor y el aroma proporcionados por el lúpulo. Los cócteles de cerveza más populares se mezclan con frutas cítricas como limón, jugo de naranja o aromatizantes.

- Mayor enfoque del fabricante clave para actualizar las tecnologías existentes

El mercado de bebidas alcohólicas está en una rápida transición con el creciente consumo de bebidas alcohólicas a base de cítricos. La técnica de producción de bebidas alcohólicas fermentadas con cítricos, como el vino cítrico y el brandy cítrico, pertenece al campo del procesamiento profundo de cítricos, utiliza frutas cítricas como materia prima y adopta los siguientes pasos: prensado del jugo, centrifugado, reposo y clarificación, regulación de la relación azúcar-ácido y baja temperatura. Fermentación primaria, posfermentación, filtrado y envejecimiento, mezcla, congelación y filtrado, pasteurización instantánea a temperatura ultraalta y llenado térmico para obtener el vino fermentado con cítricos; y luego hacer que el vino fermentado con cítricos de tipo seco se someta a los procesos de destilación, preparación, filtrado, envejecimiento, mezcla, congelación y filtrado para obtener el brandy cítrico inventado. Dicho brandy cítrico es claro y transparente, posee fragancia cítrica y color natural, y tiene un sabor rico y pleno en el paladar. Y también, existen otras tecnologías existentes para la fabricación de bebidas alcohólicas a base de cítricos.

Restricciones/Desafíos

- Volatilidad de precios en frutas cítricas

Los precios de las frutas cítricas o de las materias primas juegan un papel importante en el mercado de alcohol a base de cítricos debido al uso de los aromas de frutas cítricas en el alcohol, se producen y venden bebidas considerablemente más saludables y sabrosas en el mercado. El aumento del consumo de alcohol en todo el mundo también aumenta el consumo de bebidas alcohólicas a base de cítricos, debido a su mezcla de frutas cítricas con sabor natural. La materia prima principal básica para la producción de alcohol a base de cítricos son las frutas cítricas. Las frutas cítricas incluyen naranjas, limones, limas y pomelos. A pesar de que estas frutas cítricas están ampliamente disponibles en el mercado, la tasa de inflación de varios países, las condiciones climáticas, las leyes y aranceles de importación y exportación, la volatilidad de los precios de los productos derivados del petróleo utilizados para el transporte y otros factores tienen un impacto significativo y causan las fluctuaciones de precios.

- Normas estrictas destinadas a limitar el consumo de alcohol

Las principales políticas estrictas que se han aplicado para reducir el consumo de alcohol incluyen el uso de impuestos por parte de varios países para fijar los precios del alcohol, como el impuesto unitario, el impuesto específico (volumétrico) y otros impuestos especiales sobre el consumo de alcohol. Además de estos impuestos, algunos gobiernos se han interesado cada vez más en el precio mínimo unitario (MUP, por sus siglas en inglés). El MUP es una herramienta de política que establece un precio mínimo obligatorio por unidad de alcohol o bebida estándar, dirigido a las bebidas alcohólicas baratas. Varios países, incluido Canadá, han aplicado el MUP. La disponibilidad de alcohol puede restringirse para afectar la ingesta, lo que limita la oportunidad de que las personas compren y consuman alcohol. Por ejemplo, en Tamil Nadu, India, el horario de funcionamiento de las tiendas de alcohol es de 12:00 p. m. a 10:00 p. m.

- Creciente preocupación por los efectos nocivos de los sabores artificiales en la salud

Los sabores artificiales no tienen ningún valor nutricional. No aportan beneficios para la salud a través de vitaminas y minerales esenciales. Tienen efectos nocivos para la salud humana. Los principales efectos del consumo elevado de bebidas alcohólicas saborizadas son el riesgo elevado de cáncer y otros como hipertensión arterial, enfermedades cardíacas, accidentes cerebrovasculares, enfermedades hepáticas, debilitamiento del sistema inmunológico y otros.

- Una alta prevalencia del trastorno por consumo de alcohol (TCA)

Las causas del trastorno por consumo de alcohol parecen ser una combinación de factores genéticos, acontecimientos ocurridos en la primera infancia e intentos de aliviar el dolor emocional. Las personas tienen más probabilidades de desarrollar un trastorno por consumo de alcohol si consumen alcohol con frecuencia, en grandes cantidades o comienzan a beber a una edad temprana, han sufrido algún trauma, como abuso físico o sexual, tienen antecedentes familiares de trastorno por consumo de alcohol, tienen problemas de salud mental, como duelo, ansiedad, depresión, trastornos alimentarios y trastorno de estrés postraumático, o se han sometido a una cirugía de bypass gástrico por problemas de peso.

- Disponibilidad de sustitutos de los cítricos

Existen muchas alternativas al jugo de cítricos fresco para equilibrar nuestros cócteles, y vienen en forma de ácidos naturales. El que probablemente conozca es el ácido cítrico. Sin embargo, existen varios otros: ácido málico (presente en manzanas, albaricoques, melocotones), ácido tartárico (uvas, plátanos) y ácido láctico (productos lácteos), por nombrar algunos. Además, los vinagres, las melazas y el agraz pueden proporcionar diferentes tipos de acidez y acidez que los cítricos y los ácidos en polvo. El uso de un porcentaje increíblemente pequeño de ácido permite estabilizar los jarabes y jugos, que tienen una degradación natural del sabor, y aumentar enormemente su vida útil.

Desarrollo reciente

- En octubre de 2021, según Craft Spirits, SunDaze, los cócteles cítricos enlatados listos para beber, anunció su lanzamiento en el sur de California en las tiendas PinkDot y Total Wine del condado de Los Ángeles y en todo el país (donde sea legal) a través de envíos directos al consumidor en línea. Este lanzamiento intensificará las operaciones de la empresa en el mercado de Medio Oriente y África.

- En julio de 2022, según Spirits Business, la destilería Shakespeare, con sede en el Reino Unido, lanzó un vodka cítrico como parte de su gama de edición limitada Distillery Special. Este vodka cítrico tiene fuertes sabores de naranjas y limones frescos que se pelan a mano en la destilería.

Alcance del mercado de alcohol a base de cítricos

El mercado de alcohol a base de cítricos se clasifica en función del tipo de producto, la fruta cítrica, el envase y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas a fin de identificar las principales aplicaciones del mercado.

Tipo de producto

- Espíritu

- Vino

- Cerveza

Según el tipo de producto, el mercado de alcohol a base de cítricos se clasifica en tres segmentos, a saber, cerveza, vino y bebidas espirituosas.

Fruta cítrica

- Limón

- Cal

- Naranja

- Pomelo

- Mandarina

- Otros

Sobre la base de los cítricos, el mercado de alcohol a base de cítricos se clasifica en seis segmentos, a saber, limón, lima, naranja, pomelo, mandarina y otros.

Embalaje

- Botellas de vidrio

- Latas

- Botellas de plástico

Según el tipo de embalaje, el mercado de alcohol a base de cítricos se clasifica en tres segmentos, a saber, botellas de vidrio, latas y botellas de plástico.

Canal de distribución

- Tiendas especializadas

- Hotel/Restaurantes/Bares

- Tiendas de conveniencia

- Minorista en línea

- Otros

Sobre la base del canal de distribución, el mercado de alcohol a base de cítricos se clasifica en cinco segmentos, a saber, tiendas especializadas, hoteles/restaurantes/bares, tiendas de conveniencia, minoristas en línea y otros.

Análisis y perspectivas regionales del mercado de alcohol a base de cítricos

El mercado de alcohol a base de cítricos está segmentado según el tipo de producto, la fruta cítrica, el embalaje y el canal de distribución.

Los países del mercado de alcohol a base de cítricos son Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Kuwait y el resto de Medio Oriente y África.

Los Emiratos Árabes Unidos dominan el mercado de alcohol a base de cítricos de Medio Oriente y África en términos de participación de mercado e ingresos de mercado debido a la creciente tendencia de las bebidas espirituosas artesanales y la adopción de ingredientes rentables.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos del análisis de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Oriente Medio y África y los desafíos que enfrentan debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles internos y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los alcoholes a base de cítricos

El panorama competitivo del mercado de alcohol a base de cítricos proporciona detalles por competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de supervivencia de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de alcohol a base de cítricos.

Algunos de los principales actores del mercado que operan en el mercado son Anheuser-Busch InBev, Constellation Brands, Inc., Heineken NV, The Coca-Cola Company, ASAHI GROUP HOLDINGS, LTD., Anheuser-Bush Companies, LLC., The BOSTON BEER COMPANY, Diageo, Beam Suntory, Inc., Radico Khaitan Ltd., EDRINGTON, SUNTORY HOLDINGS LIMITED., Accolade Wines Limited., WILLIAM GRANT & SONS, Carlsberg Breweries A/S, Halewood Artisanal Spirits, Pernod Ricard, UNITED BREWERIES LTD., Brown-Forman, KALS Distilleries Private Limited, Bacardi Limited y entre otros.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con tamaños de muestra grandes. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes del mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen cuadrículas de posicionamiento de proveedores, análisis de la línea de tiempo del mercado, descripción general y guía del mercado, cuadrículas de posicionamiento de la empresa, análisis de la participación de mercado de la empresa, estándares de medición, MEA vs. Regional y análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING PURCHASING DECISION OF END USERS

4.2 GROWTH STRATEGIES OF THE KEY MARKET PLAYERS

4.3 IMPACT OF THE ECONOMY ON MARKET

4.3.1 IMPACT ON PRICE

4.3.2 IMPACT ON SUPPLY CHAIN

4.3.3 IMPACT ON SHIPMENT

4.3.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.5 TECHNOLOGICAL ADVANCEMENT

4.6 FOB & B2B PRICES – MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET

4.7 B2B PRICES – MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET

4.8 VALUE CHAIN ANALYSIS:

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 RAW MATERIAL PROCUREMENT

4.9.2 MANUFACTURING AND PACKING

4.9.3 MARKETING AND DISTRIBUTION

4.9.4 END USERS

5 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING TREND OF CRAFT SPIRITS AND THE ADOPTION OF COST-EFFECTIVE INGREDIENTS

6.1.2 RISING DISPOSABLE INCOME BOOSTS ALCOHOL CONSUMPTION

6.1.3 GROWING AWARENESS REGARDING THE HEALTH BENEFITS OF CITRUS FLAVORS AMONG CONSUMERS

6.2 RESTRAINTS

6.2.1 PRICE VOLATILITY IN CITRUS FRUITS

6.2.2 STRICT RULES AIMED AT LIMITING ALCOHOL CONSUMPTION

6.2.3 GROWING CONCERNS ABOUT THE HARMFUL EFFECTS OF ARTIFICIAL FLAVORS ON HEALTH

6.3 OPPORTUNITIES

6.3.1 SOARING DEMAND FOR INNOVATIVE ALCOHOL FLAVORS

6.3.2 INCREASING FOCUS OF THE KEY MANUFACTURER TO UPGRADE THE EXISTING TECHNOLOGIES

6.4 CHALLENGES

6.4.1 A HIGH PREVALENCE OF ALCOHOL USE DISORDER (AUD)

6.4.2 AVAILABILITY OF SUBSTITUTES FOR CITRUS

7 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 SPIRITS

7.2.1 DISTILLED SPIRITS

7.2.1.1 VODKA

7.2.1.2 WHISKEY

7.2.1.3 RUM

7.2.1.3.1 LIGHT RUM

7.2.1.3.2 GOLD RUM

7.2.1.3.3 DARK RUM

7.2.1.3.4 OVER-PROOF RUM

7.2.1.3.5 SPICED RUM

7.2.1.3.6 CACHACA

7.2.1.3.7 FLAVORED RUM

7.2.1.4 TEQUILA

7.2.1.4.1 BLANCO

7.2.1.4.2 REPOSADO

7.2.1.4.3 ANEJO

7.2.1.4.4 EXTRA-ANEJO

7.2.1.5 BRANDY

7.2.1.5.1 COGNAC

7.2.1.5.2 ARMAGNAC

7.2.1.5.3 SPANISH BRANDY

7.2.1.5.4 AMERICAN BRANDY

7.2.1.5.5 GRAPPA

7.2.1.5.6 EAU-DE-VIE

7.2.1.5.7 FLAVORED BRANDY

7.2.1.6 GIN

7.2.1.6.1 LONDON DRY GIN

7.2.1.6.2 PLYMOUTH GIN

7.2.1.6.3 OLD TOM GIN

7.2.1.6.4 GENEVER

7.2.1.6.5 NEW AMERICAN

7.2.2 NON-DISTILLED SPIRITS

7.3 WINE

7.3.1 RED WINE

7.3.1.1 CABERNET SAUVIGNON

7.3.1.2 PINOT NOIR

7.3.1.3 ZINFANDEL

7.3.1.4 SYRAH

7.3.2 WHITE WINE

7.3.2.1 CHARDONNAY

7.3.2.2 RIESLING

7.3.2.3 PINOT GRIS

7.3.2.4 SAUVIGNON BLANC

7.3.3 ROSE WINE

7.3.4 SPARKLING WINE

7.3.5 DESSERT WINE

7.4 BEER

7.4.1 ALE

7.4.1.1 BROWN ALE

7.4.1.2 PALE ALE

7.4.1.3 INDIA PALE ALE

7.4.1.4 SOUR ALE

7.4.2 LAGER

7.4.3 PORTER

7.4.4 STOUT

7.4.5 WHEAT

7.4.6 PILSNER

8 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT

8.1 OVERVIEW

8.2 LEMON

8.3 LIME

8.4 ORANGE

8.5 GRAPEFRUIT

8.6 TANGERINE

8.7 OTHERS

9 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY PACKAGING

9.1 OVERVIEW

9.2 GLASS BOTTLES

9.3 CANS

9.4 PLASTIC BOTTLES

10 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 SPECIALTY STORES

10.3 HOTEL/RESTAURANTS/BARS

10.4 CONVENIENCE STORES

10.5 ONLINE RETAILERS

10.6 OTHERS

11 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY REGION

11.1 MIDDLE EAST & AFRICA

11.1.1 UNITED ARAB EMIRATES

11.1.2 SOUTH AFRICA

11.1.3 SAUDI ARABIA

11.1.4 KUWAIT

11.1.5 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12.2 MERGERS & ACQUISITIONS

12.3 EXPANSIONS

12.4 NEW PRODUCT DEVELOPMENTS

12.5 AGREEMENTS

12.6 PARTNERSHIPS

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 ANHEUSER-BUSCH INBEV

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 CONSTELLATION BRANDS, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 HEINEKEN N.V.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 THE COCA-COLA COMPANY

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 ASHAHI GROUP HOLDINGS, LTD

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ANHEUSER-BUSCH COMPANIES, LLC.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 THE BOSTON BEER COMPANY

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 DIAGEO

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 BEAM SUNTORY INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 ACCOLADE WINES LIMITED.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 BACARDI LIMITED

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 BROWN-FORMAN

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 CARLSBERG BREWERIES A/S

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 EDRINGTON

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENT

14.15 HALEWOOD ARTISANAL SPIRITS

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 KALS DISTILLERIES PRIVATE LIMITED.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 PERNOD RICARD

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 RADICO KHAITAN LTD.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 SUNTORY HOLDINGS LIMITED

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 UNITED BREWERIES LTD.

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENT

14.21 WILLIAM GRANT & SONS

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 3 MIDDLE EAST & AFRICA SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (MILLION LITRES)

TABLE 5 MIDDLE EAST & AFRICA SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA WINE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA WINE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (MILLION LITRES)

TABLE 13 MIDDLE EAST & AFRICA WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA BEER IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA BEER IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (MILLION LITRES)

TABLE 18 MIDDLE EAST & AFRICA BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA LEMON IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA LIME IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA ORANGE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA GRAPEFRUIT IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA TANGERINE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA OTHERS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA GLASS BOTTLES IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA CANS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA PLASTIC BOTTLES IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA SPECIALTY STORES RANGE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA HOTEL/RESTAURANTS/BARS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA CONVENIENCE STORES IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA ONLINE RETAILERS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA OTHERS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY COUNTRY, 2020-2029 (MILLION LITRES)

TABLE 39 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 41 MIDDLE EAST & AFRICA SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 55 UNITED ARAB EMIRATES CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 56 UNITED ARAB EMIRATES CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 57 UNITED ARAB EMIRATES SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 58 UNITED ARAB EMIRATES DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 59 UNITED ARAB EMIRATES RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 60 UNITED ARAB EMIRATES TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 61 UNITED ARAB EMIRATES BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 62 UNITED ARAB EMIRATES GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 63 UNITED ARAB EMIRATES WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 64 UNITED ARAB EMIRATES RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 65 UNITED ARAB EMIRATES WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 66 UNITED ARAB EMIRATES BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 67 UNITED ARAB EMIRATES ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 UNITED ARAB EMIRATES CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 69 UNITED ARAB EMIRATES CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 70 UNITED ARAB EMIRATES CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 SOUTH AFRICA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 SOUTH AFRICA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 73 SOUTH AFRICA SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 74 SOUTH AFRICA DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 75 SOUTH AFRICA RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 76 SOUTH AFRICA TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 77 SOUTH AFRICA BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 78 SOUTH AFRICA GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 79 SOUTH AFRICA WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 80 SOUTH AFRICA RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 81 SOUTH AFRICA WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 82 SOUTH AFRICA BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 83 SOUTH AFRICA ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 SOUTH AFRICA CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 85 SOUTH AFRICA CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 86 SOUTH AFRICA CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 87 SAUDI ARABIA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 88 SAUDI ARABIA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 89 SAUDI ARABIA SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 90 SAUDI ARABIA DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 91 SAUDI ARABIA RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 92 SAUDI ARABIA TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 93 SAUDI ARABIA BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 94 SAUDI ARABIA GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 95 SAUDI ARABIA WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 96 SAUDI ARABIA RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 97 SAUDI ARABIA WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 98 SAUDI ARABIA BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 99 SAUDI ARABIA ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 SAUDI ARABIA CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 101 SAUDI ARABIA CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 102 SAUDI ARABIA CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 103 KUWAIT CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 KUWAIT CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 105 KUWAIT SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 106 KUWAIT DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 107 KUWAIT RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 108 KUWAIT TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 109 KUWAIT BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 110 KUWAIT GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 111 KUWAIT WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 112 KUWAIT RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 113 KUWAIT WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 114 KUWAIT BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 115 KUWAIT ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 KUWAIT CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 117 KUWAIT CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 118 KUWAIT CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 119 REST OF MIDDLE EAST AND AFRICA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 120 REST OF MIDDLE EAST AND AFRICA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

Lista de figuras

FIGURE 1 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET

FIGURE 2 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: SEGMENTATION

FIGURE 13 GROWING TREND OF CRAFT SPIRITS AND THE ADOPTION OF COST-EFFECTIVE INGREDIENTS IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET IN THE FORECAST PERIOD

FIGURE 14 SPIRITS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET IN 2022 & 2029

FIGURE 15 SUPPLY CHAIN ANALYSIS – MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET

FIGURE 17 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: BY PRODUCT TYPE, 2021

FIGURE 18 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: BY CITRUS FRUIT, 2021

FIGURE 19 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: BY PACKAGING, 2021

FIGURE 20 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 21 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: SNAPSHOT (2021)

FIGURE 22 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: BY COUNTRY (2021)

FIGURE 23 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.