Middle East And Africa Bioherbicides Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

87.14 Million

USD

126.12 Million

2024

2032

USD

87.14 Million

USD

126.12 Million

2024

2032

| 2025 –2032 | |

| USD 87.14 Million | |

| USD 126.12 Million | |

|

|

|

|

Segmentación del mercado de bioherbicidas en Oriente Medio y África por tipo (microbiano, bioquímico y otros), modo de acción (bioherbicidas selectivos y no selectivos), presentación (líquida y seca), aplicación (pulverización foliar, tratamiento de semillas, tratamiento del suelo, poscosecha, quimigación y otros), tipo de cultivo (cereales y granos, frutas y verduras, oleaginosas y legumbres, césped y ornamentales, y otros cultivos), canal de distribución (directo e indirecto): tendencias del sector y pronóstico hasta 2032.

Tamaño del mercado de bioherbicidas en Oriente Medio y África

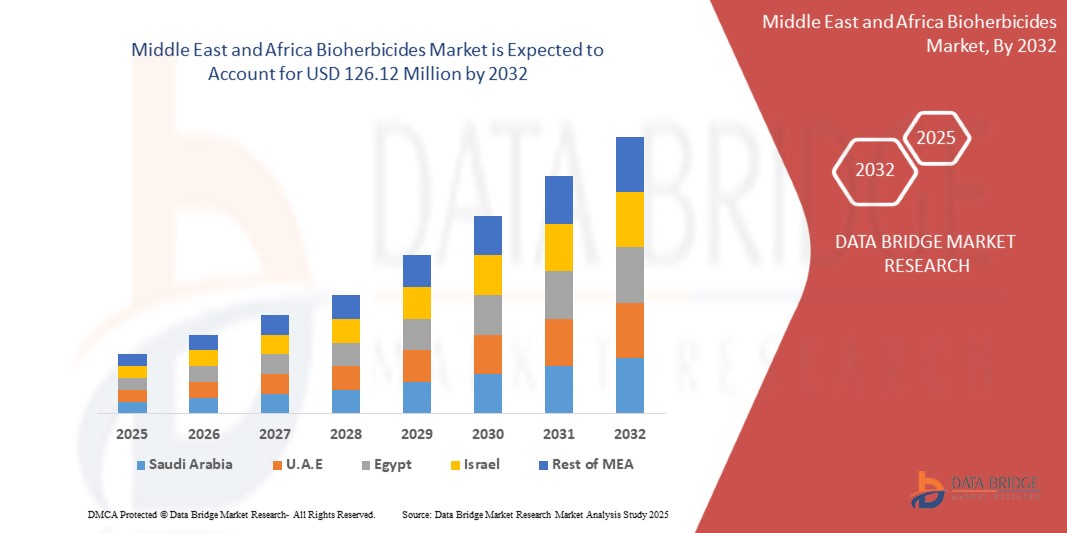

- El tamaño del mercado de bioherbicidas de Oriente Medio y África se valoró en 87,14 millones de dólares en 2024 y se espera que alcance los 126,12 millones de dólares en 2032 , con una CAGR del 4,73 % durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a la creciente adopción de prácticas agrícolas sostenibles y ecológicas, junto con una mayor concienciación sobre el impacto ambiental de los herbicidas sintéticos. Los agricultores y las empresas agroindustriales están optando cada vez más por soluciones biológicas para controlar las malezas y reducir los residuos químicos en los cultivos y el suelo.

- Además, el creciente apoyo regulatorio para los productos de protección de cultivos de base biológica y los avances en formulaciones microbianas y bioquímicas están acelerando el desarrollo y la adopción de bioherbicidas, impulsando así significativamente el crecimiento de la industria.

Análisis del mercado de bioherbicidas en Oriente Medio y África

- Los bioherbicidas son agentes biológicos derivados de organismos naturales o sus metabolitos, utilizados para controlar o suprimir el crecimiento de malezas en campos agrícolas. Ofrecen alternativas específicas y ecológicas a los herbicidas químicos convencionales y pueden aplicarse en diversas presentaciones, incluyendo tratamientos líquidos, secos y de semillas, en múltiples tipos de cultivos.

- La creciente demanda de bioherbicidas se debe principalmente a la necesidad de soluciones sostenibles para el manejo de malezas, la creciente prevalencia de malezas resistentes a los herbicidas y la creciente preocupación por reducir el uso de productos químicos en la agricultura. Los avances en la tecnología de formulación, la facilidad de integración en las prácticas agrícolas modernas y la creciente concienciación de los agricultores sobre la salud a largo plazo del suelo y los cultivos impulsan aún más la expansión del mercado.

- Arabia Saudita dominó el mercado de bioherbicidas en Oriente Medio y África en 2024, debido a la creciente adopción de prácticas agrícolas sostenibles y la necesidad de gestionar las malezas resistentes a los herbicidas en cultivos básicos y de alto valor.

- Se espera que los Emiratos Árabes Unidos sean la región de más rápido crecimiento en el mercado de bioherbicidas de Medio Oriente y África durante el período de pronóstico debido a la adopción de técnicas agrícolas sostenibles, cultivo en invernadero y producción de cultivos de alto valor.

- El segmento líquido dominó el mercado con una cuota de mercado del 57,6 % en 2024, gracias a su facilidad de aplicación, rápida absorción y distribución uniforme en las zonas objetivo. Los antivirales líquidos son especialmente adecuados para la pulverización foliar y el tratamiento de semillas, lo que permite una administración eficiente de los compuestos activos. Su flexibilidad de formulación y su compatibilidad con sistemas de aplicación automatizados los hacen muy atractivos para su uso comercial. Además, las formulaciones líquidas permiten una dosificación precisa y una respuesta rápida a las amenazas virales emergentes, lo que mejora su eficacia en la protección de cultivos a gran escala. Su adaptabilidad a diferentes tipos de cultivos y condiciones ambientales refuerza aún más su adopción en el mercado.

Alcance del informe y segmentación del mercado de bioherbicidas en Oriente Medio y África

|

Atributos |

Perspectivas clave del mercado de bioherbicidas en Oriente Medio y África |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de bioherbicidas en Oriente Medio y África

Creciente demanda de agricultura orgánica y sostenible

- La transición acelerada hacia prácticas agrícolas orgánicas y sostenibles está impulsando la demanda de bioherbicidas, ya que ofrecen alternativas ecológicas a las soluciones químicas sintéticas para el control de malezas. Los agricultores y productores buscan cada vez más insumos naturales que minimicen el daño ambiental y mantengan la productividad.

- Por ejemplo, Marrone Bio Innovations ha desarrollado productos bioherbicidas que controlan las malezas mediante microbios naturales y compuestos vegetales. Su portafolio demuestra cómo las soluciones sostenibles pueden abordar eficazmente los desafíos de las malezas, a la vez que impulsan el crecimiento del mercado impulsado por los productos orgánicos.

- El aumento de la preferencia de los consumidores por productos alimenticios sin químicos está impulsando a los agricultores a adoptar insumos que cumplen con las certificaciones de sostenibilidad. Los bioherbicidas, al no dejar residuos y ser biodegradables, refuerzan el cumplimiento de las normas de agricultura orgánica y la demanda de prácticas agrícolas más seguras impulsada por los consumidores.

- Además, la concienciación sobre la salud del suelo y la biodiversidad ha influido en las estrategias agrícolas. Los bioherbicidas contribuyen a estos objetivos al reducir la acumulación de sustancias químicas, potenciar la actividad microbiana y contribuir a la sostenibilidad a largo plazo de las tierras de cultivo, en comparación con los herbicidas sintéticos.

- El creciente sector de la agricultura orgánica ofrece condiciones favorables para los bioherbicidas. A medida que aumentan los desafíos de la seguridad alimentaria, la gestión sostenible de malezas mediante controles de base biológica se está convirtiendo en una prioridad clave para el ecosistema agrícola.

- En conjunto, la tendencia hacia la agricultura orgánica y sostenible refuerza el papel fundamental de los bioherbicidas. Su capacidad para satisfacer las expectativas de los consumidores, mejorar la calidad del suelo y alinearse con los objetivos regulatorios y ambientales los posiciona como un componente vital de la agricultura del futuro.

Dinámica del mercado de bioherbicidas en Oriente Medio y África

Conductor

Apoyo regulatorio e iniciativas gubernamentales

- Los marcos regulatorios globales y las políticas gubernamentales desempeñan un papel crucial en impulsar la adopción de bioherbicidas. Las políticas centradas en reducir la dependencia de los herbicidas químicos están impulsando la transición hacia alternativas sostenibles en la agricultura convencional.

- Por ejemplo, la Unión Europea ha introducido regulaciones más estrictas sobre pesticidas sintéticos, lo que genera oportunidades para la adopción de bioherbicidas. Empresas como BioWorks están aprovechando estos cambios de política al ampliar la producción de soluciones de origen biológico que cumplen con los requisitos regulatorios para una agricultura más segura.

- Los programas de investigación y subsidios gubernamentales promueven aún más su adopción. Muchos países invierten en el desarrollo de biopesticidas y ofrecen incentivos a los agricultores para que integren insumos de origen biológico en sistemas integrados de gestión de malezas.

- Además, el énfasis en el logro de los Objetivos de Desarrollo Sostenible (ODS) de las Naciones Unidas ha incrementado el apoyo a los insumos agrícolas respetuosos con el medio ambiente. Los bioherbicidas se alinean estrechamente con la acción climática y los objetivos de productividad agrícola sostenible.

- En conjunto, el respaldo regulatorio, los incentivos políticos y la financiación institucional están creando una base sólida para la adopción generalizada de bioherbicidas en el mercado. Se espera que estos marcos de apoyo refuercen la demanda y fomenten la innovación en el sector.

Restricción/Desafío

Conocimiento limitado de los agricultores sobre los beneficios de los bioherbicidas

- Un desafío importante en el mercado de bioherbicidas en Oriente Medio y África es la escasa concienciación de los agricultores sobre su eficacia en comparación con los productos químicos convencionales. Muchos agricultores se muestran reticentes debido a la preocupación por el rendimiento, los procesos de aplicación y la limitada disponibilidad del producto en los mercados locales.

- Por ejemplo, las encuestas en economías emergentes muestran que las empresas agroindustriales como BASF Biologicals enfrentan dificultades para persuadir a los agricultores a adoptar bioherbicidas en lugar de herbicidas tradicionales debido a los riesgos percibidos en la confiabilidad del rendimiento y la eficacia del control.

- La ausencia de servicios de extensión sólidos y programas de educación agrícola a menudo dificulta la difusión de conocimientos sobre bioherbicidas. La falta de directrices y demostraciones claras contribuye aún más a las bajas tasas de adopción, especialmente entre los pequeños y medianos agricultores.

- Además, el mayor costo y la limitada disponibilidad comercial en comparación con los herbicidas sintéticos restringen el acceso en mercados sensibles a los precios. Los agricultores con presupuestos reducidos tienden a continuar con los productos químicos convencionales que ofrecen resultados rápidos y conocidos.

- Superar estos desafíos requiere una amplia educación de los agricultores, proyectos de demostración y campañas de concienciación respaldadas por el gobierno. Abordar estas deficiencias será esencial para aumentar la confianza, expandir la adopción y aprovechar al máximo el potencial de los bioherbicidas en la agricultura sostenible.

Alcance del mercado de bioherbicidas en Oriente Medio y África

El mercado está segmentado según el tipo, modo de acción, forma, aplicación, tipo de cultivo y canal de distribución.

• Por tipo

Según el tipo, el mercado de antivirales se segmenta en microbianos, bioquímicos y otros. El segmento microbiano dominó la mayor cuota de mercado en 2024, gracias a su probada eficacia en el control de patógenos virales y su compatibilidad con aplicaciones agrícolas y sanitarias. Los antivirales microbianos son populares por su naturaleza ecológica y su mínimo impacto en organismos no objetivo, lo que los convierte en la opción preferida para el manejo sostenible de enfermedades. La sólida investigación y desarrollo de formulaciones microbianas ha mejorado aún más su estabilidad, eficacia y facilidad de aplicación. Su capacidad para integrarse con los protocolos existentes de protección de cultivos y atención sanitaria también impulsa su adopción.

Se prevé que el segmento bioquímico experimente el mayor crecimiento entre 2025 y 2032, impulsado por los avances en compuestos antivirales moleculares y la mayor demanda de soluciones de precisión. Los antivirales bioquímicos son altamente eficaces para interrumpir la replicación viral, ofreciendo una especificidad que reduce los daños colaterales a los organismos benéficos. El aumento de la inversión en biotecnología y la creciente concienciación sobre las alternativas sin químicos en los sectores agrícola y sanitario impulsan aún más la expansión del mercado.

• Por modo de acción

Según su mecanismo de acción, el mercado de antivirales se segmenta en bioherbicidas selectivos y no selectivos. El segmento de bioherbicidas selectivos dominó la mayor cuota de mercado en 2024, ya que ataca patógenos virales específicos sin afectar a otros organismos, reduciendo así los daños no deseados a los cultivos o las comunidades microbianas. Esta especificidad permite resultados más seguros y predecibles tanto en aplicaciones agrícolas como sanitarias. El apoyo regulatorio a las soluciones selectivas y su creciente adopción en las prácticas de agricultura de precisión también contribuyen a su liderazgo en el mercado.

Se prevé que el segmento de bioherbicidas no selectivos registre la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por la creciente necesidad de soluciones antivirales de amplio espectro en regiones propensas a múltiples cepas virales y brotes frecuentes de enfermedades. Estos antivirales proporcionan un control rápido e integral, atacando eficazmente a una amplia gama de patógenos y reduciendo el riesgo de pérdidas de cultivos. Su capacidad para ofrecer una protección consistente en diversas condiciones ambientales los hace especialmente adecuados para la protección de cultivos a gran escala y la gestión de emergencias de brotes. Esta creciente adopción también se ve respaldada por los avances en las tecnologías de formulación que mejoran la estabilidad, la eficacia y la facilidad de aplicación.

• Por formulario

En cuanto a su presentación, el mercado de antivirales se segmenta en líquido y seco. El segmento líquido dominó la mayor cuota de mercado con un 57,6% en 2024, gracias a su facilidad de aplicación, rápida absorción y distribución uniforme en las zonas objetivo. Los antivirales líquidos son especialmente adecuados para la pulverización foliar y el tratamiento de semillas, lo que permite una administración eficiente de los compuestos activos. Su flexibilidad de formulación y compatibilidad con sistemas de aplicación automatizados los hacen muy atractivos para su uso comercial. Además, las formulaciones líquidas permiten una dosificación precisa y una respuesta rápida a las amenazas virales emergentes, lo que mejora su eficacia en la protección de cultivos a gran escala. Su adaptabilidad a diferentes tipos de cultivos y condiciones ambientales refuerza aún más su adopción en el mercado.

Se proyecta que el segmento de productos secos experimentará el mayor crecimiento entre 2025 y 2032, impulsado por ventajas como una mayor vida útil, facilidad de almacenamiento y un transporte rentable. Los antivirales secos pueden reconstituirse según sea necesario, lo que reduce el desperdicio y promueve prácticas de aplicación sostenibles. Su estabilidad en diversas condiciones ambientales los hace adecuados para regiones con infraestructura limitada de cadena de frío. Su fácil manejo y dosificación precisa aumentan aún más su atractivo entre agricultores y operadores agrícolas. Además, se espera que la creciente demanda en regiones remotas o con recursos limitados, donde las formulaciones líquidas pueden ser menos prácticas, acelere la adopción de productos antivirales secos. La creciente conciencia sobre prácticas sostenibles y eficientes de protección de cultivos también contribuye a la expansión del mercado.

• Por aplicación

Según su aplicación, el mercado de antivirales se segmenta en pulverización foliar, tratamiento de semillas, tratamiento de suelos, poscosecha, quimigación, entre otros. El segmento de pulverización foliar dominó la mayor cuota de mercado en 2024 gracias a su aplicación directa en los cultivos, lo que proporciona un control viral inmediato y reduce la propagación de infecciones. Las pulverizaciones foliares permiten una dosificación precisa y una cobertura uniforme, lo que mejora la eficiencia del tratamiento y minimiza el impacto ambiental. Su compatibilidad con sistemas de pulverización automatizados y técnicas de agricultura de precisión refuerza aún más su adopción en la agricultura comercial. Además, las pulverizaciones foliares son versátiles para diferentes tipos de cultivos y condiciones climáticas, lo que las convierte en la opción preferida para operaciones agrícolas a gran escala y de alto valor. La creciente conciencia sobre el manejo oportuno y eficaz de enfermedades también está impulsando la demanda del mercado.

Se prevé que el segmento de tratamiento de semillas experimente el mayor crecimiento entre 2025 y 2032, impulsado por su papel en la protección temprana contra patógenos virales, mejorando la resiliencia y el rendimiento de los cultivos. Los tratamientos de semillas están cobrando impulso gracias a su eficiencia, la menor necesidad de insumos químicos y su compatibilidad con las prácticas agrícolas modernas, lo que favorece las estrategias de prevención de enfermedades. Su capacidad para brindar protección específica en la etapa crítica de germinación reduce el riesgo de fracaso de los cultivos y mejora la productividad general. Además, se espera que los avances en las tecnologías de recubrimiento de semillas y la creciente adopción de prácticas agrícolas sostenibles aceleren aún más el crecimiento de este segmento. La creciente demanda de las regiones que se centran en la producción de cultivos de alta calidad y libres de enfermedades también está impulsando su adopción.

• Por tipo de cultivo

Según el tipo de cultivo, el mercado de antivirales se segmenta en cereales y granos, frutas y hortalizas, oleaginosas y legumbres, césped y ornamentales, y otros cultivos. El segmento de frutas y hortalizas dominó la mayor cuota de mercado en 2024, impulsado por la alta susceptibilidad de estos cultivos a las infecciones virales y la creciente demanda de productos seguros y de alta calidad. La preferencia de los consumidores por soluciones sin químicos impulsa aún más la adopción de tratamientos antivirales en estos cultivos. Las técnicas avanzadas de aplicación y las prácticas de agricultura de precisión también mejoran la eficacia de los antivirales en este segmento.

Se proyecta que el segmento de cereales y granos experimentará la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por la creciente demanda de cultivos básicos y el aumento de los brotes de patógenos virales que afectan la seguridad alimentaria mundial. Las soluciones antivirales para cereales y granos ayudan a prevenir pérdidas de rendimiento, mejorar la resiliencia de los cultivos y garantizar la estabilidad del suministro de alimentos, lo que impulsa una mayor adopción. La creciente concienciación de los agricultores sobre el impacto económico de las infecciones virales, sumada a la integración de antivirales en las prácticas agrícolas modernas, está impulsando aún más la adopción de estas soluciones.

• Por canal de distribución

Según el canal de distribución, el mercado de antivirales se segmenta en directo e indirecto. El segmento de distribución directa obtuvo la mayor cuota de mercado en 2024, gracias a las sólidas relaciones entre fabricantes y grandes consumidores, como cooperativas agrícolas, explotaciones agrícolas comerciales e instituciones sanitarias. Los canales directos permiten un mejor control de precios, entregas puntuales y soluciones personalizadas adaptadas a las necesidades del consumidor final. El sólido soporte técnico del fabricante y los servicios posventa refuerzan aún más su dominio.

Se prevé que el segmento de distribución indirecta experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente red de distribuidores, minoristas y plataformas en línea. Los canales indirectos mejoran la accesibilidad de los productos para los pequeños agricultores y los operadores agrícolas regionales, lo que mejora la penetración en el mercado y fomenta su adopción generalizada. Este crecimiento se ve impulsado aún más por el auge del comercio electrónico y los mercados digitales, que permiten a los fabricantes llegar a regiones remotas y desatendidas. Además, las alianzas con distribuidores locales y proveedores de servicios de tecnología agrícola facilitan la educación y la concienciación sobre los beneficios de los bioherbicidas, acelerando su adopción en diversas geografías.

Análisis regional del mercado de bioherbicidas en Oriente Medio y África

- Arabia Saudita dominó el mercado de bioherbicidas en Medio Oriente y África con la mayor participación en los ingresos en 2024, impulsada por la creciente adopción de prácticas agrícolas sostenibles y la necesidad de gestionar las malezas resistentes a los herbicidas en cultivos básicos y de alto valor.

- El enfoque del país en modernizar la agricultura a través de iniciativas gubernamentales e inversión en investigación para la protección ecológica de cultivos ha acelerado la adopción de soluciones bioherbicidas.

- El creciente énfasis en mejorar el rendimiento de los cultivos, garantizar la seguridad alimentaria y reducir el uso de productos químicos fortalece aún más el liderazgo de Arabia Saudita. Las colaboraciones estratégicas con proveedores globales de bioherbicidas y la expansión de las redes de distribución locales refuerzan el dominio del mercado del país.

Perspectiva del mercado de bioherbicidas en los Emiratos Árabes Unidos, Oriente Medio y África

Se proyecta que los EAU registrarán la tasa de crecimiento anual compuesta (TCAC) más rápida del mercado de Oriente Medio y África entre 2025 y 2032, impulsada por la adopción de técnicas agrícolas sostenibles, el cultivo en invernaderos y la producción de cultivos de alto valor. La creciente concienciación sobre las regulaciones ambientales y la demanda de soluciones de protección de cultivos sin químicos están impulsando el crecimiento del mercado. La apertura del país a las colaboraciones tecnológicas, las iniciativas gubernamentales que promueven la innovación agrícola y la inversión en sistemas de agricultura de precisión están impulsando la expansión del mercado. La creciente demanda de soluciones eficaces para el manejo de malezas en la agricultura en ambiente controlado acelera aún más la adopción de bioherbicidas en los EAU.

Perspectiva del mercado de bioherbicidas de Sudáfrica, Oriente Medio y África

Se prevé que Sudáfrica experimente un crecimiento sostenido entre 2025 y 2032, impulsado por la expansión de su sector agrícola comercial y el creciente cultivo de cereales, granos y hortalizas. La creciente concienciación sobre las prácticas sostenibles de control de malezas y la creciente adopción de soluciones biológicas para la protección de cultivos están impulsando la penetración en el mercado. El enfoque del país en la modernización agrícola, junto con la colaboración con proveedores internacionales de bioherbicidas, está mejorando la accesibilidad y la eficacia de estas soluciones. Los esfuerzos de los distribuidores locales por ofrecer productos bioherbicidas rentables y fiables están impulsando aún más el crecimiento sostenido del mercado sudafricano.

Cuota de mercado de bioherbicidas en Oriente Medio y África

La industria de los bioherbicidas está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- BASF (Alemania)

- Corporación FMC (EE. UU.)

- Coromandel International Limited (India)

- Certis USA LLC (EE. UU.)

- Emery Oleochemicals (Malasia)

- BioHerbicidas Australia (Australia)

- Herbanatur (España)

- Andermatt Biocontrol Suisse (Suiza)

- Syngenta AG (Suiza)

- Bayer CropScience AG (Alemania)

- Novozymes A/S (Dinamarca)

- Marrone Bio Innovations Inc. (EE. UU.)

- Ciencias de la vida de Verdesian (EE. UU.)

- Deer Creek Holdings (EE. UU.)

- EcoPesticides International, Inc. (EE. UU.)

Últimos avances en el mercado de bioherbicidas en Oriente Medio y África

- En julio de 2025, Seipasa, empresa española especializada en biopesticidas, anunció sus esfuerzos para registrar un nuevo bioherbicida con un novedoso mecanismo de acción. Este desarrollo busca ofrecer una alternativa a los herbicidas sintéticos existentes, respondiendo a la creciente demanda de soluciones sostenibles para la protección de cultivos. Se espera que la introducción de este innovador producto mejore la cartera de productos de Seipasa y contribuya al avance de las prácticas agrícolas respetuosas con el medio ambiente.

- En diciembre de 2022, Seipasa inauguró una nueva base industrial de 4.000 m² para apoyar el desarrollo y registro de sus productos bioherbicidas. Estas instalaciones buscan facilitar el crecimiento de la empresa y mejorar su capacidad para satisfacer la creciente demanda de soluciones biopesticidas.

- En mayo de 2023, BASF presentó dos nuevos herbicidas, Facet y Duvelon, para ayudar a los productores indios de arroz y té a controlar las malezas problemáticas. Facet ataca la maleza graminosa Echinochloa spp. en los cultivos de arroz, mientras que Duvelon, potenciado por Kixor Active, combate las malezas de hoja ancha en las plantaciones de té. Este lanzamiento amplía la oferta de BASF, abordando los principales desafíos que enfrentan los productores de arroz y té en la India, y refuerza el compromiso de la compañía con las prácticas agrícolas sostenibles.

- En octubre de 2024, FMC Corporation anunció el lanzamiento del herbicida Ambriva en Chandigarh, India, para ayudar a los agricultores de trigo a combatir la maleza resistente Phalaris minor. Con Isoflex active, un novedoso herbicida del grupo 13, Ambriva ofrece un control eficaz en postemergencia temprana y una protección residual duradera. El herbicida ha sido rigurosamente probado y ofrece una nueva y potente solución para los agricultores de Punjab, Haryana, Uttar Pradesh y Rajastán, abordando los importantes desafíos que plantea esta maleza destructiva.

- En diciembre de 2022, FMC Corporation y Micropep Technologies anunciaron su colaboración para desarrollar soluciones biológicas para el control de malezas resistentes a herbicidas. Esta alianza combina la experiencia agrícola de FMC con la tecnología de micropéptidos de Micropep para acelerar el desarrollo de soluciones bioherbicidas innovadoras, con el objetivo de mejorar el rendimiento de los cultivos y promover prácticas agrícolas sostenibles.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.