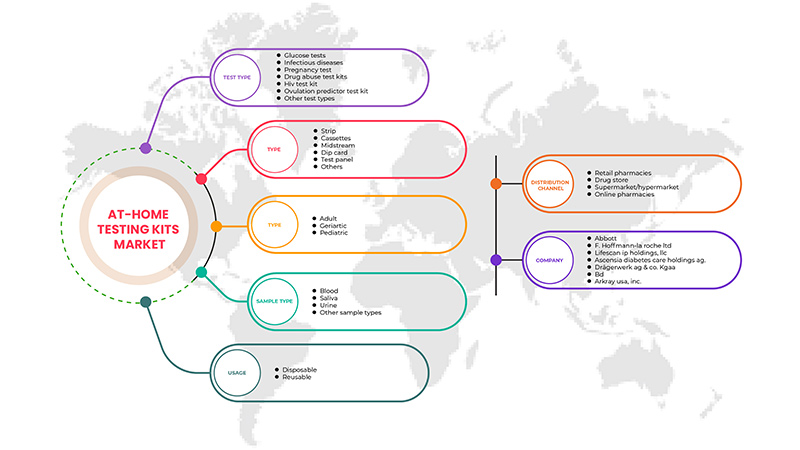

Mercado de kits de prueba para el hogar en Oriente Medio y África, por tipo de prueba (prueba de embarazo, kit de prueba de VIH , diabetes, enfermedades infecciosas, pruebas de glucosa, kit de prueba de predicción de ovulación, kit de prueba de abuso de drogas y otros), tipo (casete, tira, midstream, panel de prueba, tarjeta de inmersión y otros), edad (pediátrica, adulta y geriátrica), tipo de muestra (orina, sangre, saliva y otros tipos de muestra), uso (desechable y reutilizable), canales de distribución (farmacias minoristas, droguerías, supermercados/hipermercados y farmacias en línea): tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de kits de prueba para el hogar en Oriente Medio y África

Se espera que el mercado de kits de prueba para el hogar en Oriente Medio y África crezca, ya que antes la gente solía visitar los hospitales con frecuencia, incluso para problemas básicos, pero debido a la creciente conciencia sobre varios productos, este comportamiento ha cambiado y ha cambiado la tendencia. Los kits de prueba para el hogar o para el autodiagnóstico están fácilmente disponibles en las farmacias y se ha vuelto extremadamente fácil adquirirlos. Varias empresas médicas se están aventurando en este espacio, ya que fabrican rápidamente kits de prueba para el autodiagnóstico.

Esta amplia disponibilidad también se puede atribuir a las empresas de farmacias online que han empezado a lanzar productos médicos, que facilitan la disponibilidad con solo pulsar un botón. Además, estos kits de autodiagnóstico están disponibles sin receta médica, lo que puede impulsar fácilmente el mercado de los kits de prueba para el hogar. Los kits de prueba para el hogar permiten a los usuarios finales recolectar su muestra en casa y luego realizar las pruebas en casa o enviar esa muestra al laboratorio para su análisis. Los kits de prueba para el hogar sin duda han facilitado el proceso de confirmación de la preocupación de la persona, ya sea una prueba de embarazo casera o de VIH, o cualquier otra prueba de enfermedades infecciosas.

Estos kits de prueba para el hogar son fáciles de usar y también asequibles. Sin embargo, siempre existe una duda sobre la precisión de los resultados que se ha convertido en una limitación para el mercado de kits de prueba para el hogar en Oriente Medio y África. Un resultado falso positivo de una prueba puede causar ansiedad y estrés a la persona, incluso si no la tiene. Es muy molesto y perturbador para la persona recibir resultados falsos positivos o negativos. Hoy en día, muchas empresas producen kits de prueba de diagnóstico rápido para COVID-19, que se pueden realizar en casa. Pero hay varios problemas relacionados con la precisión debido a los cuales se ha suspendido la distribución de esos kits de prueba para el hogar a partir de la verificación de su confiabilidad.

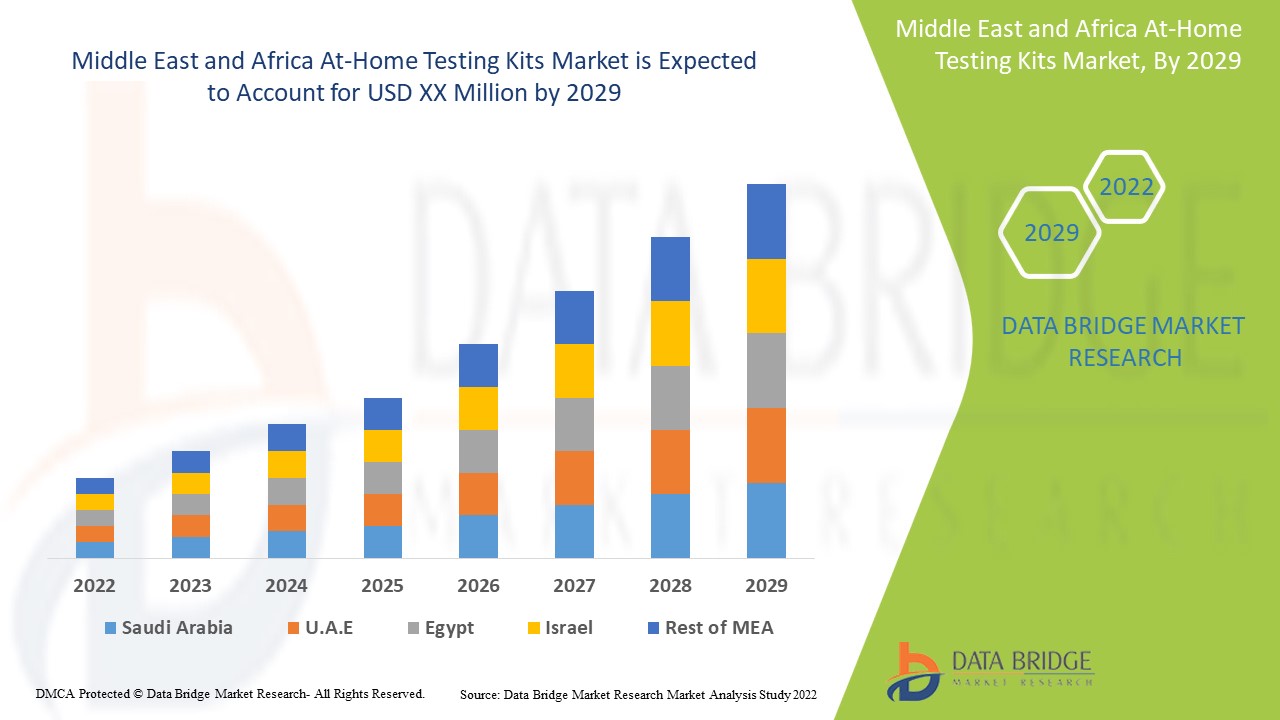

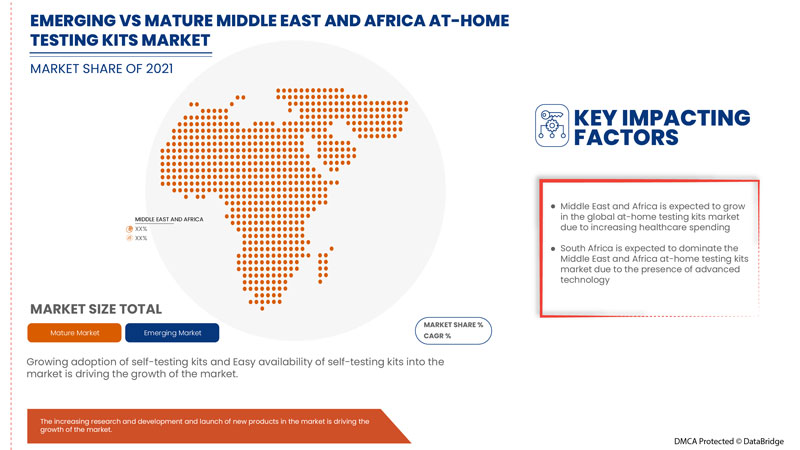

Data Bridge Market Research analiza que el mercado de kits de prueba para el hogar en Oriente Medio y África crecerá a una CAGR del 4,5 % durante el período de pronóstico de 2022 a 2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019-2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por tipo de prueba (prueba de embarazo, kit de prueba de VIH, diabetes, enfermedades infecciosas, pruebas de glucosa, kit de prueba de predicción de ovulación, kit de prueba de abuso de drogas y otros), tipo (casete, tira, prueba de flujo medio, panel de prueba, tarjeta de inmersión y otros), edad (pediátrica, adulta y geriátrica), tipo de muestra (orina, sangre, saliva y otros tipos de muestras), uso (desechable y reutilizable), canales de distribución (farmacias minoristas, droguerías, supermercados/hipermercados y farmacias en línea) |

|

Países cubiertos |

Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Israel, Egipto y el resto de Oriente Medio y África |

|

Actores del mercado cubiertos |

Abbott, Siemens Healthcare GmbH, F. Hoffmann-La Roche Ltd, BD, Drägerwerk AG & Co. KGaA, LifeScan IP Holdings, LLC, Ascensia Diabetes Care Holdings AG, Nectar Lifesciences Ltd. (Rapikit), ACON Laboratories, Inc., Quidel Corporation, ARKRAY USA, Inc., BTNX INC., Atomo Diagnostics, Eurofins Scientific, Piramal Enterprises Ltd., Bionime Corporation, Nova Biomedical, Cardinal Health, OraSure Technologies, Biolytical Laboratories Inc., Everlywell, Inc., SA Scientific Ltd., Clearblue (una subsidiaria de Swiss Precision Diagnostics GmbH), Biosynex, PRIMA Lab SA, MP BIOMEDICALS, Sterilab Services, Chembio Diagnostics, Inc., BioSure, Selfdiagnostics OU, entre otros. |

Definición del mercado de kits de prueba para el hogar en Oriente Medio y África

Los kits de prueba para el hogar son instrumentos de prueba que ayudan a las personas a realizar pruebas en casa y les dan resultados rápidos en un minuto. También incluyen equipos de monitoreo de salud para verificar y controlar continuamente la salud del paciente diabético. Las pruebas para el hogar son muy convenientes para realizar con comodidad en el hogar y están disponibles a un precio muy asequible. Las pruebas de auto-prueba suelen ser las versiones avanzadas de los kits de prueba rápida en el punto de atención que fueron diseñados originalmente para profesionales de la salud y pueden ser realizados por una persona común. Sus procesos, empaques e instrucciones se han simplificado para guiar a la persona a través de los pasos para realizar una prueba. Hay varios kits de prueba para el hogar disponibles, incluidas pruebas de VIH, prueba de embarazo, diabetes, prueba de ovulación y enfermedades infecciosas como malaria, COVID-19 y otras. Para realizar estas pruebas rápidas en el hogar, se puede tomar sangre, orina y fluido oral como muestra.

Dinámica del mercado de kits de prueba para el hogar en Oriente Medio y África

Conductores

- Creciente adopción de kits de autodiagnóstico

Antes, la gente solía acudir a menudo a los hospitales, incluso para problemas básicos. Sin embargo, a medida que ha aumentado la conciencia sobre varios productos, este comportamiento ha cambiado y se ha convertido en una tendencia. Hoy en día, la gente prefiere hacerse las pruebas básicas con kits de prueba en casa antes de visitar a un médico.

Esto se ha vuelto aún más evidente debido a esta pandemia, ya que las personas están adoptando más kits de prueba de autoayuda debido a varias restricciones vigentes. Ha resultado ser una bendición disfrazada tanto para los hospitales como para los pacientes, ya que los hospitales ya están sobrecargados y pueden concentrarse completamente en los pacientes con COVID-19, y los pacientes pueden ahorrar grandes costos de visitas al médico y honorarios por medicamentos. Se ha vuelto muy conveniente para los consumidores, ya que pueden saber rápidamente los resultados de sus pruebas con solo un clic.

- Fácil disponibilidad de kits de autodiagnóstico en farmacias

Los kits de autodiagnóstico o para realizar en casa están disponibles en las farmacias y se han vuelto muy fáciles de conseguir. Varias empresas médicas se están aventurando en este espacio, ya que fabrican rápidamente kits de autodiagnóstico.

Esta amplia disponibilidad también se puede atribuir a las empresas emergentes de farmacias en línea, que facilitan la disponibilidad con solo hacer clic en un botón. Además, estos kits de autodiagnóstico están disponibles sin receta médica.

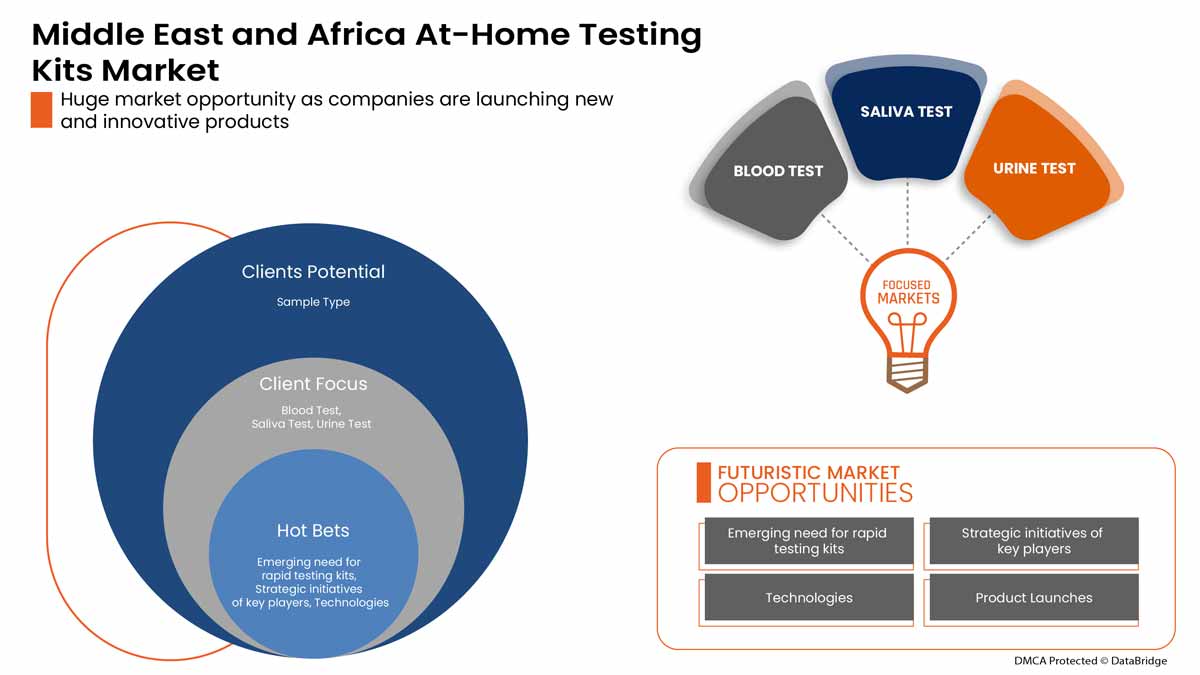

Oportunidad

- Advenimiento de tecnologías avanzadas

Las últimas tecnologías son fundamentales para que los productos médicos sean muy avanzados y fiables. En diferentes dispositivos médicos, la inteligencia artificial (IA) y el aprendizaje automático (ML) son aspectos importantes del sector de la atención sanitaria, ya que tienen la capacidad de mejorar la seguridad de los pacientes y los procesos administrativos mediante la automatización del trabajo y un rendimiento más rápido.

Es seguro que, por defecto, los instrumentos de diagnóstico basados en IA seguirán desarrollándose. La IA solo ha dado pasos modestos hacia una oportunidad enorme y multidimensional en el sector de la atención sanitaria.

Restricción/Desafío

- Inexactitud de los resultados de los kits de autodiagnóstico

Los kits de prueba para el hogar permiten a los usuarios finales recolectar su muestra en casa y realizar las pruebas en casa o enviar esa muestra al laboratorio para su análisis. Los kits de prueba para el hogar sin duda han facilitado el proceso de confirmar la preocupación de la persona, ya sea una prueba de embarazo casera, una prueba de VIH o cualquier otra prueba de enfermedades infecciosas.

Estos kits de prueba para el hogar son fáciles de usar y también asequibles. Sin embargo, siempre existe la duda sobre la precisión de los resultados. El seguimiento de la COVID-19 en el hogar puede ser más cómodo que ir a un hospital o al consultorio médico. También ayudará a reducir el riesgo de propagación o contagio del coronavirus cuando se realice la prueba.

Sin embargo, un resultado falso positivo en una prueba puede causar ansiedad y estrés a la persona, incluso si no la tiene. Es muy molesto y perturbador para la persona recibir resultados falsos positivos o negativos. Hoy en día, muchas empresas producen kits de prueba de diagnóstico rápido para COVID-19 que se pueden realizar en casa, pero existen varios problemas relacionados con la precisión debido a los cuales se ha suspendido la distribución de esos kits de prueba para el hogar para verificar su confiabilidad.

Impacto posterior al COVID-19 en el mercado de kits de prueba para el hogar en Oriente Medio y África

El COVID-19 ha tenido un gran impacto en el mercado de kits de prueba para el hogar en Oriente Medio y África. El mercado de kits de prueba para el hogar se está expandiendo como consecuencia de la creciente popularidad de los kits de prueba de autoayuda y de bricolaje (DIY) debido a su conveniencia y resultados rápidos. Los consumidores están preocupados por la confiabilidad de los kits de prueba rápida para el hogar, lo que podría impedir la expansión del mercado de kits de prueba para el hogar. Las empresas necesitan urgentemente kits de prueba rápida para COVID-19 para reducir las muertes de pacientes y aumentar las tasas de recuperación de los pacientes y también aumentar la tasa del mercado de kits de prueba para el hogar para pacientes diabéticos y pacientes con problemas cardíacos. Esto está creando una importante oportunidad de mercado para los kits de prueba para el hogar.

Desarrollo reciente

- En diciembre de 2021, Siemens Healthineers anunció que su prueba de autodiagnóstico rápido de COVID-19 CLINITEST puede detectar la variante ómicron del SARS-CoV-2. Se trata de un gran logro para la empresa, ya que ha podido detectar una variante tan peligrosa a través de su prueba, lo que ha ayudado a la empresa a aumentar sus ingresos en el mercado y a hacer crecer su presencia.

Alcance del mercado de kits de prueba para el hogar en Oriente Medio y África

El mercado de kits de prueba para el hogar en Oriente Medio y África se clasifica en seis segmentos notables según el tipo de prueba, el tipo, la edad, el tipo de muestra, el uso y los canales de distribución. El crecimiento entre estos segmentos lo ayudará a analizar los segmentos de crecimiento del mercado en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de prueba

- Prueba de embarazo

- Kit de prueba del VIH

- Diabetes

- Enfermedades infecciosas

- Pruebas de glucosa

- Kit de prueba de predicción de la ovulación

- Kit de prueba de abuso de drogas

- Otros

Según el tipo de prueba, el mercado de kits de prueba para el hogar en Medio Oriente y África está segmentado en prueba de embarazo, kit de prueba de VIH, diabetes, enfermedades infecciosas, pruebas de glucosa, kit de prueba de predicción de ovulación, kit de prueba de abuso de drogas y otros.

Tipo

- Casete

- Banda

- Centro de la corriente

- Panel de prueba

- Tarjeta de inmersión

- Otros

Según el tipo, el mercado de kits de prueba para el hogar en Oriente Medio y África está segmentado en casete, tira, prueba intermedia, panel de prueba, tarjeta de inmersión y otros.

Edad

- Pediátrico

- Adulto

- Geriátrico

Según la edad, el mercado de kits de prueba para el hogar en Oriente Medio y África está segmentado en pediátrico, adulto y geriátrico.

Tipo de muestra

- Orina

- Sangre

- Saliva

- Otros

Según el tipo de muestra, el mercado de kits de prueba para el hogar en Oriente Medio y África está segmentado en orina, sangre, saliva y otros.

Uso

- Desechable

- Reutilizable

Según el uso, el mercado de kits de prueba para el hogar en Oriente Medio y África está segmentado en desechables y reutilizables.

Canales de distribución

- Farmacias minoristas

- Farmacia

- Supermercado/Hipermercado

- Farmacias en línea

Según los canales de distribución, el mercado de kits de prueba para el hogar en Medio Oriente y África está segmentado en farmacias minoristas, droguerías, supermercados/hipermercados y farmacias en línea.

Análisis y perspectivas regionales del mercado de kits de prueba para el hogar en Oriente Medio y África

Se analiza el mercado de kits de prueba para el hogar en Oriente Medio y África y se proporcionan información y tendencias sobre el tamaño del mercado según el tipo de prueba, el tipo, la edad, el tipo de muestra, el uso y los canales de distribución.

Las regiones cubiertas en el informe del mercado de kits de prueba para el hogar en Medio Oriente y África son Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Israel, Egipto y el resto de Medio Oriente y África.

Sudáfrica domina el mercado de kits de prueba para el hogar en Oriente Medio y África en términos de participación de mercado e ingresos de mercado y seguirá aumentando su dominio durante el período de pronóstico. Esto se debe al alto gasto en atención médica del país y a la creciente conciencia sobre el mercado de kits de prueba para el hogar en Oriente Medio y África.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los kits de prueba para el hogar en Oriente Medio y África

El panorama competitivo del mercado de kits de prueba para el hogar en Oriente Medio y África proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Oriente Medio y África, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de ensayos clínicos, el análisis de la marca, las aprobaciones de productos, las patentes, la amplitud y la extensión del producto, el dominio de la aplicación, la curva de supervivencia de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de kits de prueba para el hogar en Oriente Medio y África.

Algunos de los principales actores que operan en el mercado de kits de prueba para el hogar en Medio Oriente y África son Abbott, ACON Laboratories, Inc., Rapikit, BD, Cardinal Health, B. Braun Melsungen AG, Piramal Enterprises Ltd., Siemens Healthcare GmbH, Quidel Corporation, Bionime Corporation, SA Scientific, ARKRAY USA, Inc., Nova Biomedical, AdvaCare Pharma, AccuBioTech Co., Ltd., Atlas Medical UK, TaiDoc Technology Corporation, Drägerwerk AG & Co. KGaA, F. Hoffmann-La Roche Ltd, Sensing Self, PTE. Ltd, Atomo Diagnostics, RUNBIO BIOTECH CO.,LTD., Mylan NV (una subsidiaria de Viatris, Inc.), MP BIOMEDICALS, VedaLab, Shanghai Chemtron Biotech Co.Ltd. y Ascensia Diabetes Care Holdings AG, entre otros actores nacionales.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET, BY TEST TYPE

2.8 MARKET POSITION COVERAGE GRID

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 DISTRIBUTOR CHANNEL ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

5 MIDDLE EAST & AFRICA AT- HOME TESTING KITS MARKET: REGULATIONS

5.1 REGULATION IN U.S

5.2 GUIDELINES FOR SELF-TESTING KITS

5.3 REGULATION IN EUROPE

5.4 GUIDELINES FOR TESTING KITS

5.5 REGULATION IN INDONESIA:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING ADOPTION OF SELF-TESTING KITS

6.1.2 EASY AVAILABILITY OF SELF-TESTING KITS AT PHARMACIES

6.1.3 INCREASE IN AWARENESS ABOUT THE IMPORTANCE OF HIV DIAGNOSIS

6.1.4 EASE OF USE AND LOW COSTS OF RAPID SELF-TEST KITS

6.2 RESTRAINTS

6.2.1 INACCURACY OF RESULTS BY SELF-TESTING KITS

6.2.2 STRINGENT GOVERNMENT REGULATIONS FOR MANUFACTURING AND DISTRIBUTION OF TESTING KITS

6.3 OPPORTUNITIES

6.3.1 ADVENT OF ADVANCED TECHNOLOGIES

6.3.2 EMERGING NEED FOR RAPID TESTING KITS FOR COVID-19 PANDEMIC

6.3.3 STRATEGIC INITIATIVES OF KEY PLAYERS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION IN THE MEDICAL TECHNOLOGY INDUSTRY

6.4.2 REDUCTION IN RESEARCH & DEVELOPMENT BUDGETS

7 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET, BY TEST TYPE

7.1 OVERVIEW

7.2 GLUCOSE TESTS

7.3 INFECTIOUS DISEASES

7.4 PREGNANCY TEST

7.5 DRUG ABUSE TEST KITS

7.6 HIV TEST KIT

7.7 OVULATION PREDICTOR TEST KIT

7.8 OTHERS TEST TYPES

8 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET, BY TYPE

8.1 OVERVIEW

8.2 CASSETTES

8.2.1 RETAIL PHARMACIES

8.2.2 ONLINE PHARMACIES

8.2.3 DRUG STORE

8.2.4 SUPERMARKET/HYPERMARKET

8.3 STRIP

8.3.1 RETAIL PHARMACIES

8.3.2 ONLINE PHARMACIES

8.3.3 DRUG STORE

8.3.4 SUPERMARKET/HYPERMARKET

8.4 MIDSTREAM

8.4.1 RETAIL PHARMACIES

8.4.2 ONLINE PHARMACIES

8.4.3 DRUG STORE

8.4.4 SUPERMARKET/HYPERMARKET

8.5 DIP CARD

8.5.1 RETAIL PHARMACIES

8.5.2 ONLINE PHARMACIES

8.5.3 DRUG STORE

8.5.4 SUPERMARKET/HYPERMARKET

8.6 TEST PANEL

8.6.1 RETAIL PHARMACIES

8.6.2 ONLINE PHARMACIES

8.6.3 DRUG STORE

8.6.4 SUPERMARKET/HYPERMARKET

8.7 OTHERS

9 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET, BY AGE

9.1 OVERVIEW

9.2 ADULT

9.3 GERIATRIC

9.4 PEDIATRIC

10 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET, BY SAMPLE TYPE

10.1 OVERVIEW

10.2 BLOOD

10.3 URINE

10.4 SALIVA

10.5 OTHER SAMPLE TYPES

11 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET, BY USAGE

11.1 OVERVIEW

11.2 DISPOSABLE

11.3 REUSABLE

12 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS

12.1 OVERVIEW

12.2 RETAIL PHARMACIES

12.3 ONLINE PHARMACIES

12.4 DRUG STORE

12.5 SUPERMARKET/HYPERMARKET

13 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET, BY REGION

13.1 MIDDLE EAST & AFRICA

13.1.1 SOUTH AFRICA

13.1.2 SAUDI ARABIA

13.1.3 U.A.E

13.1.4 ISRAEL

13.1.5 EGYPT

13.1.6 REST OF MIDDLE EAST & AFRICA

14 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 ABBOTT

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUS ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 SIEMENS HEALTHCARE GMBH

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUS ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 F. HOFFMANN- LA ROCHE LTD

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 BD

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 DRÄGERWERK AG & CO. KGAA

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 LIFESCAN IP HOLDINGS, LLC

16.6.1 COMPANY SNAPSHOT

16.6.2 COMPANY SHARE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 ASCENSIA DIABETES CARE HOLDINGS AG.

16.7.1 COMPANY SNAPSHOT

16.7.2 COMPANY SHARE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 NECTAR LIFESCIENCES LTD. (RAPIKIT)

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 ACON LABORATORIES, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 QUIDEL CORPORATION.

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 ARKRAY USA, INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 BTNX INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 ATOMO DIAGNOSTICS

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 EUROFINS SCIENTIFIC

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENTS

16.15 PIRAMAL ENTERPRISES LTD.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 BIONIME CORPORATION

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 NOVA BIOMEDICAL

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 CARDINAL HEALTH.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 ORASURE TECHNOLOGIES

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 BIOLYTICAL LABORATORIES INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 EVERLYWELL, INC.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 SA SCIENTIFIC LTD.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 CLEARBLUE (A SUBSIDIARY OF SWISS PRECISION DIAGNOSTICS GMBH)

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 BIOSYNEX

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 PRIMA LAB SA

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 MP BIOMEDICALS.

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENTS

16.27 STERILAB SERVICES

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENTS

16.28 CHEMBIO DIAGNOSTICS, INC.

16.28.1 COMPANY SNAPSHOT

16.28.2 REVENUE ANALYSIS

16.28.3 PRODUCT PORTFOLIO

16.28.4 RECENT DEVELOPMENTS

16.29 BIOSURE

16.29.1 COMPANY SNAPSHOT

16.29.2 PRODUCT PORTFOLIO

16.29.3 RECENT DEVELOPMENTS

16.3 SELFDIAGNOSTICS OU

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA GLUCOSE TESTS IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA INFECTIOUS DISEASES IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA PREGNANCY TEST IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA DRUG ABUSE TEST KITS IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA HIV TEST KIT IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA OVULATION PREDICTOR TEST KIT IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA OTHERS TEST TYPES IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA CASSETTES IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA CASSETTES IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA STRIP IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA STRIP IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA DIP CARD IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA DIP CARD IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA TEST PANEL IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA TEST PANEL IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA OTHERS IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA ADULT IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA GERIATRIC IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA PEDIATRIC IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET, BY SAMPLE TYPE, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA BLOOD IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA URINE IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA SALIVA IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA OTHER SAMPLE TYPES IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA DISPOSABLE IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA REUSABLE IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA RETAIL PHARMACIES IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA ONLINE PHARMACIES IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA DRUG STORE IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA SUPERMARKET/HYPERMARKET IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA AT-HOME TESTING KITS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA STRIPS IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA CASSETTES IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA DIP CARD IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA TEST PANEL IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA AT-HOME TESTING KITS MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA AT-HOME TESTING KITS MARKET, BY SAMPLE TYPE, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA AT-HOME TESTING KITS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 50 SOUTH AFRICA AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 51 SOUTH AFRICA AT-HOME TESTING KITS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 SOUTH AFRICA STRIPS IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 53 SOUTH AFRICA CASSETTES IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 54 SOUTH AFRICA MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 55 SOUTH AFRICA DIP CARD IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 56 SOUTH AFRICA TEST PANEL IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 57 SOUTH AFRICA AT-HOME TESTING KITS MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 58 SOUTH AFRICA AT-HOME TESTING KITS MARKET, BY SAMPLE TYPE, 2020-2029 (USD MILLION)

TABLE 59 SOUTH AFRICA AT-HOME TESTING KITS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 60 SOUTH AFRICA AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 61 SAUDI ARABIA AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 62 SAUDI ARABIA AT-HOME TESTING KITS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 SAUDI ARABIA STRIPS IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 64 SAUDI ARABIA CASSETTES IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 65 SAUDI ARABIA MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 66 SAUDI ARABIA DIP CARD IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 67 SAUDI ARABIA TEST PANEL IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 68 SAUDI ARABIA AT-HOME TESTING KITS MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 69 SAUDI ARABIA AT-HOME TESTING KITS MARKET, BY SAMPLE TYPE, 2020-2029 (USD MILLION)

TABLE 70 SAUDI ARABIA AT-HOME TESTING KITS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 71 SAUDI ARABIA AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 72 U.A.E AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.A.E AT-HOME TESTING KITS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 U.A.E STRIPS IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 75 U.A.E CASSETTES IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 76 U.A.E MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 77 U.A.E DIP CARD IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 78 U.A.E TEST PANEL IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 79 U.A.E AT-HOME TESTING KITS MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 80 U.A.E AT-HOME TESTING KITS MARKET, BY SAMPLE TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.A.E AT-HOME TESTING KITS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 82 U.A.E AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 83 ISRAEL AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 84 ISRAEL AT-HOME TESTING KITS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 ISRAEL STRIPS IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 86 ISRAEL CASSETTES IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 87 ISRAEL MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 88 ISRAEL DIP CARD IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 89 ISRAEL TEST PANEL IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 90 ISRAEL AT-HOME TESTING KITS MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 91 ISRAEL AT-HOME TESTING KITS MARKET, BY SAMPLE TYPE, 2020-2029 (USD MILLION)

TABLE 92 ISRAEL AT-HOME TESTING KITS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 93 ISRAEL AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 94 EGYPT AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 95 EGYPT AT-HOME TESTING KITS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 EGYPT STRIPS IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 97 EGYPT CASSETTES IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 98 EGYPT MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 99 EGYPT DIP CARD IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 100 EGYPT TEST PANEL IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 101 EGYPT AT-HOME TESTING KITS MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 102 EGYPT AT-HOME TESTING KITS MARKET, BY SAMPLE TYPE, 2020-2029 (USD MILLION)

TABLE 103 EGYPT AT-HOME TESTING KITS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 104 EGYPT AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 105 REST OF MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: MARKET POSITION COVERAGE GRID

FIGURE 7 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: DISTRIBUTOR CHANNEL ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: SEGMENTATION

FIGURE 11 GROWING ADOPTION OF SELF-TESTING KITS IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 GLUCOSE TEST IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET, BY TEST TYPE IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST GROWING REGION IN THE MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET

FIGURE 15 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY TEST TYPE, 2021

FIGURE 16 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY TEST TYPE, 2022-2029 (USD MILLION)

FIGURE 17 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY TEST TYPE, CAGR (2022-2029)

FIGURE 18 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY TEST TYPE, LIFELINE CURVE

FIGURE 19 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY TYPE, 2021

FIGURE 20 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 23 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY AGE, 2021

FIGURE 24 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY AGE, 2022-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY AGE, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY AGE, LIFELINE CURVE

FIGURE 27 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY SAMPLE TYPE, 2021

FIGURE 28 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY SAMPLE TYPE, 2022-2029 (EURO MILLION)

FIGURE 29 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY SAMPLE TYPE, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY SAMPLE TYPE, LIFELINE CURVE

FIGURE 31 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY USAGE, 2021

FIGURE 32 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY USAGE, 2022-2029 (EURO MILLION)

FIGURE 33 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY USAGE, CAGR (2022-2029)

FIGURE 34 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY USAGE, LIFELINE CURVE

FIGURE 35 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 36 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 37 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 38 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 39 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: SNAPSHOT (2021)

FIGURE 40 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY COUNTRY (2021)

FIGURE 41 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: BY TEST TYPE (2022-2029)

FIGURE 44 MIDDLE EAST & AFRICA AT-HOME TESTING KITS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.