Middle East And Africa Aroma Chemicals Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

66.66 Billion

USD

144.53 Billion

2025

2033

USD

66.66 Billion

USD

144.53 Billion

2025

2033

| 2026 –2033 | |

| USD 66.66 Billion | |

| USD 144.53 Billion | |

|

|

|

|

Segmentación del mercado de productos químicos aromáticos en Oriente Medio y África, por tipo de producto químico (terpenos, bencenoides, almizcles, ésteres, cetonas y otros), aroma (floral, amaderado, cítrico, afrutado, herbáceo, tropical y otros), color (incoloro, blanco, amarillento y otros), origen (natural y sintético), forma (líquida y seca), aplicación (artículos de tocador, fragancias finas/perfumes, cuidado personal, bebidas, alimentos y otros), tipo de producto (vainilla vainas de Madagascar, Tixosil 38 x, vainillina, carvacrol, propilenglicol USP, dipropilenglicol, éter metílico de dipropilenglicol, dihidromircenol, cis-3-hexenol, aldehído c-18, linalol, lismeral, aldehído cinámico, citronelol, galaxolida, iso E Super, geraniol, aldehído hexilcinámico, aldehído C-14, acetato de isobornilo, alcohol feniletílico, anetol, eugenol, furaneol, cetona de frambuesa, gamma-decalactona, Timbersilk, delta-dodecalactona, óxido de difenilo, eucaliptol, anisaldehído, cetalox, hediona // MDJ, alfa ionona, Yara Yara, ionona beta, acetato de linalilo, acetato de isoamilo, butirato de etilo, Triol 91 Kosher, etil vainillina, canfor, citral, terpinoleonas, bromelia, jasmacicleno / acetato de verdilo, aldehído c-12 MNA, acetato de verdox // OTBC, gamma-octalactona, triacetina, acetato de bencilo, citronelal, alcohol bencílico, heliotropina, gamma metil ionona, terpineoles, bourgeonal, dinascona, bacdanol, timol, cumarina, Dihidrocumarina, salicilato de amilo, salicilato de hexilo, salicilato de metilo, propionato de verdilo, undecavertol, nitrilo de citronelol, antranilato de metilo, acetato de terpinilo, metil ciclopentenolona, acetato de PTBC, etilciclopentenolona, ácido butírico, aldehídos c-12 (MOA, MNA, etc.), aldehídos c-11, rosalina, óxido de rosa 90:10, maltol, etil maltol, triplal, caproato de etilo, hexanoatos y heptanoatos de etilo y metilo, mentol, natural, sintético, hierbabuena 60% y 80%, nerol, exaltolida, acetato de estrialilo, tetrahidrolinalol, tetrahidromircenol, glicolato de alil amilo, borneol cristalizado, isoborneol, tonalid, violiff, tibutirina, Javanol y otros) y canal de distribución (indirecto y directo): tendencias de la industria y pronóstico hasta 2033

¿Cuál es el tamaño y la tasa de crecimiento del mercado de productos químicos aromáticos en Oriente Medio y África?

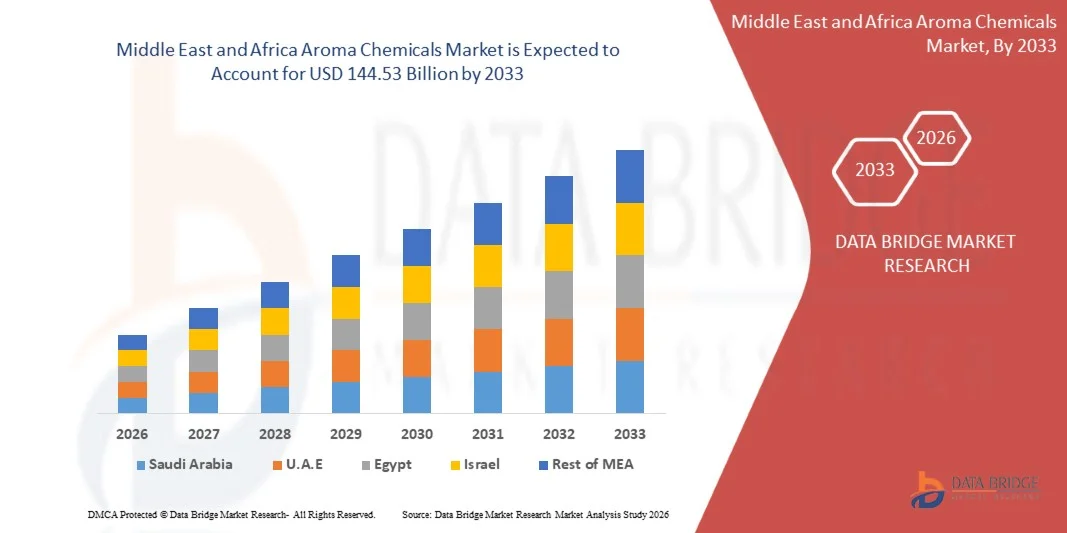

- El tamaño del mercado de productos químicos aromáticos de Oriente Medio y África se valoró en 66.660 millones de dólares en 2025 y se espera que alcance los 144.530 millones de dólares en 2033 , con una CAGR del 7,0 % durante el período de pronóstico.

- El aumento de las actividades de construcción e infraestructura, incluidos proyectos comerciales, residenciales e industriales, está impulsando la demanda de productos químicos aromáticos para proteger las estructuras de la entrada de agua, la humedad y la degradación ambiental, lo que apoya el crecimiento del mercado.

- El alto costo inicial de las membranas premium y su instalación, junto con la necesidad de mano de obra calificada y maquinaria especializada, aumenta el gasto general del proyecto, lo que puede limitar su adopción en proyectos de pequeña escala o sensibles a los costos.

¿Cuáles son las principales conclusiones del mercado de productos químicos aromáticos?

- Los avances en las tecnologías de impermeabilización, como las membranas autoadhesivas, las soluciones de aplicación líquida y las láminas sintéticas de alto rendimiento, están mejorando la durabilidad y la facilidad de instalación, lo que presenta importantes oportunidades de crecimiento para los actores del mercado.

- Desafíos como problemas de fugas, instalación inadecuada y requisitos de mantenimiento continúan afectando la rentabilidad y el rendimiento, lo que plantea obstáculos clave para la adopción generalizada de productos químicos aromáticos en Medio Oriente y África.

- Arabia Saudita dominó el mercado de productos químicos aromáticos de Medio Oriente y África con una participación de ingresos del 34,5 % en 2025, respaldada por la creciente adopción de productos químicos aromáticos de alta calidad en las industrias de fragancias, cuidado personal, alimentos y bebidas.

- Se proyecta que los Emiratos Árabes Unidos registren la CAGR más rápida del 9,8 % entre 2026 y 2033, impulsada por la adopción de productos químicos aromáticos naturales, sostenibles e innovadores en los sectores de perfumería, cuidado personal y alimentos y bebidas.

- El segmento de terpenos dominó el mercado con una participación de ingresos del 54% en 2025, impulsado por la alta demanda en fragancias finas, cuidado personal y aplicaciones alimentarias debido a su versatilidad y perfil de aroma natural.

Alcance del informe y segmentación del mercado de productos químicos aromáticos

|

Atributos |

Información clave del mercado de productos químicos aromáticos |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

¿Cuál es la tendencia clave en el mercado de productos químicos aromáticos?

Creciente demanda de productos químicos aromáticos sostenibles y de alto rendimiento

- El mercado de productos químicos aromáticos de Oriente Medio y África está experimentando una tendencia clave hacia la creciente adopción de ingredientes aromáticos ecológicos, de etiqueta limpia y multifuncionales. Esta tendencia se ve impulsada por la creciente concienciación de los consumidores sobre la salud, el bienestar y la sostenibilidad, especialmente en aplicaciones de alimentación, bebidas, cosméticos y cuidado personal.

- Por ejemplo, empresas como Firmenich y Givaudan están desarrollando productos químicos aromáticos biodegradables derivados de plantas con mayor estabilidad y perfiles sensoriales superiores para cumplir con los estrictos estándares regulatorios y las expectativas de los consumidores.

- La creciente demanda de productos químicos aromáticos naturales, hipoalergénicos y de etiqueta limpia está acelerando su adopción en las industrias de alimentos, bebidas y cuidado personal de Medio Oriente y África.

- Los fabricantes están integrando tecnologías de extracción avanzadas, microencapsulación y procesamiento sin solventes para mejorar el rendimiento, la vida útil y la seguridad.

- El aumento de la I+D en nuevos compuestos de sabor, el abastecimiento sostenible y las tecnologías de enmascaramiento de olores está fomentando la innovación.

- A medida que los consumidores continúan priorizando el bienestar, la sostenibilidad y las experiencias sensoriales de alta calidad, se espera que los productos químicos aromáticos naturales y de primera calidad sigan siendo fundamentales para el desarrollo de productos.

¿Cuáles son los impulsores clave del mercado de productos químicos aromáticos?

- El creciente énfasis en ingredientes de etiqueta limpia, naturales y sostenibles es un importante impulsor de la expansión del mercado.

- Por ejemplo, en 2025, DSM y Symrise lanzaron productos químicos aromáticos de origen vegetal y sin alérgenos para alimentos, bebidas y cuidado personal, dirigidos a consumidores preocupados por la salud.

- La creciente demanda de sabores y fragancias premium y funcionales en alimentos, bebidas y cosméticos envasados está impulsando su adopción.

- Los avances tecnológicos en extracción, purificación y encapsulación permiten a los fabricantes producir ingredientes aromáticos más estables y potentes.

- El creciente enfoque regulatorio en la seguridad, el etiquetado y el abastecimiento sostenible está respaldando el crecimiento del mercado.

- Con una inversión continua en I+D, abastecimiento sostenible e innovación impulsada por el consumidor, se espera que el mercado de productos químicos aromáticos de Oriente Medio y África mantenga un sólido impulso de crecimiento en los próximos años.

¿Qué factor está obstaculizando el crecimiento del mercado de productos químicos aromáticos?

- El alto costo de los aromas químicos premium naturales y de origen vegetal limita su adopción, en particular para los fabricantes a pequeña escala y los productos sensibles al precio.

- Por ejemplo, durante 2024-2025, las fluctuaciones en los precios de las materias primas, los costos de extracción y el cumplimiento normativo afectaron la producción y los precios de los principales actores.

- Los estrictos requisitos reglamentarios de seguridad, etiquetado de alérgenos y cumplimiento ambiental aumentan la complejidad operativa y los costos.

- La limitada conciencia del consumidor sobre los beneficios de los aromas químicos naturales y funcionales puede restringir su adopción masiva.

- La competencia de los productos químicos aromáticos sintéticos, las alternativas locales de bajo costo y los sustitutos importados crea presión sobre los precios y afecta la penetración en el mercado.

- Para abordar estos desafíos, los fabricantes se están centrando en métodos de extracción rentables, abastecimiento sostenible, productos con certificación ecológica y programas educativos para ofrecer soluciones químicas aromáticas seguras, sostenibles y de alta calidad.

¿Cómo está segmentado el mercado de productos químicos aromáticos?

El mercado está segmentado según el tipo químico, el nodo aromático, el color, la fuente, la forma, la aplicación, el tipo de producto y el canal de distribución .

• Por tipo químico

Según el tipo de sustancia química, el mercado se segmenta en terpenos, bencenoides, almizcles, ésteres, cetonas y otros. El segmento de terpenos dominó el mercado con una participación del 54% en los ingresos en 2025, impulsado por la alta demanda en fragancias finas, cuidado personal y aplicaciones alimentarias gracias a su versatilidad y perfil aromático natural.

Se proyecta que los productos químicos de almizcle crecerán a la tasa de crecimiento anual compuesta (TCAC) más alta entre 2026 y 2033, impulsados por la creciente preferencia por fragancias premium y duraderas en perfumes y productos de cuidado personal de alta gama. La innovación continua en la extracción de terpenos sintéticos y naturales impulsa la expansión del mercado, mientras que los terpenos siguen siendo los preferidos para aplicaciones funcionales y de etiqueta limpia.

• Por Aroma Node

Según el nodo aromático, el mercado se segmenta en Floral, Amaderado, Cítrico, Frutal, Herbal, Tropical y Otros. El segmento Floral dominó con una participación de ingresos del 38,6 % en 2025, gracias a su amplio uso en perfumes, artículos de tocador y productos de cuidado personal.

Se proyecta que los productos químicos con aromas amaderados crecerán a la tasa de crecimiento anual compuesta (TCAC) más alta entre 2026 y 2033, impulsados por la creciente demanda de fragancias cálidas y terrosas en productos de lujo y de nicho. Las innovaciones en técnicas de encapsulación y estabilización garantizan una retención uniforme del aroma en todas las aplicaciones.

• Por color

Según el color, el mercado se segmenta en incoloro, blanco, amarillento y otros. El segmento incoloro dominó el mercado con una participación en los ingresos del 46.2 % en 2025, ya que estos productos químicos son muy versátiles, más fáciles de mezclar y se prefieren en aplicaciones de bebidas, cosméticos y alimentos

Se proyecta que los productos químicos aromáticos amarillentos crecerán a la tasa compuesta anual más rápida entre 2026 y 2033, impulsados por la preferencia de los consumidores por ingredientes visualmente atractivos y de origen natural y por la expansión de las aplicaciones en la perfumería especializada.

• Por fuente

Según la fuente, el mercado se segmenta en natural y sintético. El segmento sintético dominó con una participación de ingresos del 51,3 % en 2025, gracias a su calidad constante, escalabilidad y menor costo en comparación con los extractos naturales.

Se proyecta que los productos químicos aromáticos naturales crecerán a la CAGR más rápida entre 2026 y 2033, impulsados por la creciente preferencia de los consumidores por soluciones de fragancias de etiqueta limpia, orgánicas y sostenibles en los sectores de alimentos, bebidas y cuidado personal.

• Por forma

Según la forma, el mercado se segmenta en líquido y seco. El segmento líquido dominó con una participación en los ingresos del 57.4 % en 2025, impulsado por la facilidad de formulación, la alta solubilidad y la amplia aplicabilidad industrial

Se proyecta que los productos químicos aromáticos secos crecerán a la CAGR más rápida entre 2026 y 2033, respaldados por los avances en encapsulación, mezcla de polvos y tecnologías de estabilidad para alimentos y bebidas funcionales.

• Por aplicación

Según la aplicación, el mercado se segmenta en artículos de tocador, fragancias finas/perfumes, cuidado personal, bebidas, alimentos y otros. El segmento de fragancias finas/perfumes dominó con un 44.7 % de participación en los ingresos en 2025, impulsado por la creciente demanda de productos de fragancias de lujo y de nicho

Se proyecta que las bebidas crecerán a la CAGR más rápida entre 2026 y 2033, impulsadas por bebidas funcionales, agua saborizada y bebidas premium que requieren perfiles de aroma únicos.

• Por tipo de producto

Sobre la base del tipo de producto, el mercado está segmentado en Vainilla Vainas Madagascar, Tixosil 38 x, Vainillin, Carvacrol, Propilenglicol USP, Dipropilenglicol, Dipropilenglicol Metil Eter, Dihidromircenol, Cis-3-Hexenol, Aldehido c-18, Linalool, Lysmeral, Aldehído cinámico, Citronelol, Galaxolida, Iso E Super, Geraniol, Aldehído hexilcinámico, Aldehído C-14, Acetato de isobornilo, Alcohol feniletílico, Anetol, Eugenol, Furaneol, Cetona de frambuesa, Gamma-Decalactona, Timbersilk, Delta-Dodecalactona, Óxido de difenilo, Eucaliptol, Anisaldehído, Cetalox, Hediona // MDJ, Alfa Ionona, Yara Yara, Ionona Beta, Acetato de linalilo, Acetato de isoamilo, Butirato de etilo, Triol 91 Kosher, etil vainillina, canfor, citral, terpinoleonas, bromelia, jasmacicleno / acetato de verdilo, aldehído c-12 MNA, verdox // acetato de OTBC, gamma-octalactona, triacetina, acetato de bencilo, citronelal, alcohol bencílico, heliotropina, gamma metil ionona, terpineoles, bourgeonal, dinascona, bacdanol, timol, cumarina, dihidrocumarina, salicilato de amilo, salicilato de hexilo, salicilato de metilo, propionato de verdilo, undecavertol, citrelil nitrilo, antranilato de metilo, acetato de terpinilo, metil ciclo pentenolona, acetato de PTBC, etilciclopentenolona, ácido butírico, aldehídos c-12 (MOA, MNA, etc.), aldehídos c-11, Rosalina, Óxido de Rosa 90:10, Maltol, Etil Maltol, Triplal, Caproato de Etilo, Hexanoatos y Heptanoatos de Etilo y Metilo, Mentol (Natural, Sintético), Hierbabuena 60% y 80%, Nerol, Exaltolida, Acetato de Estrialilo, Tetrahidrolinalol, Tetrahidromircenol, Glicolato de Alil Amil, Borneol Cristalizado, Isoborneol, Tonalid, Violiff, Tibutirina, Javanol y Otros. El segmento de Vainillina dominó con una participación en los ingresos del 36,8% en 2025, gracias a su amplio uso en confitería, bebidas y perfumería.

Se proyecta que Hedione crecerá a la CAGR más rápida entre 2026 y 2033, respaldada por las tendencias de perfumería de alta gama y la creciente preferencia por composiciones de aromas sofisticadas.

• Por canal de distribución

Según el canal de distribución, el mercado se segmenta en indirecto y directo. El segmento directo dominó con una participación de ingresos del 53,6 % en 2025, ya que los fabricantes suministran aromas químicos directamente a grandes empresas de alimentos, bebidas y cuidado personal, garantizando así la calidad y la trazabilidad.

Se proyecta que los canales indirectos crecerán a la CAGR más rápida entre 2026 y 2033, impulsados por mercados en línea, distribuidores y proveedores especializados que amplían su alcance a las pequeñas y medianas empresas.

¿Qué región posee la mayor participación en el mercado de productos químicos aromáticos?

- Arabia Saudita dominó el mercado de aromaquímicos en Oriente Medio y África con una cuota de mercado del 34,5 % en 2025, impulsada por la creciente adopción de aromaquímicos de alta calidad en las industrias de fragancias, cuidado personal, alimentos y bebidas. La creciente preferencia de los consumidores por perfumes premium, sabores naturales y productos de etiqueta limpia impulsa el crecimiento regional.

- Las regulaciones gubernamentales sobre seguridad, etiquetado y cumplimiento ambiental incentivan a los fabricantes a adoptar el abastecimiento sostenible, formulaciones ecológicas y procesos de producción avanzados. La rápida urbanización, la expansión de las redes minoristas y el desarrollo industrial aceleran aún más la adopción en el mercado de la región.

- Los actores clave están aprovechando los avances tecnológicos en la extracción, encapsulación y producción de aromas químicos sintéticos para mejorar la consistencia, la calidad y el atractivo del producto para el consumidor, particularmente en aplicaciones comerciales y minoristas de alta gama.

Perspectiva del mercado de productos químicos aromáticos de los EAU

Se proyecta que los EAU registren la tasa de crecimiento anual compuesta (TCAC) más rápida, del 9,8 %, entre 2026 y 2033, impulsada por la adopción de productos químicos aromáticos naturales, sostenibles e innovadores en los sectores de la perfumería, el cuidado personal y la alimentación y bebidas. Las inversiones en plantas de producción, las iniciativas de química verde y la fabricación de ingredientes de alta calidad impulsan el crecimiento del mercado a largo plazo en el país.

¿Cuáles son las principales empresas del mercado de productos químicos aromáticos?

La industria de productos químicos aromáticos está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Takasago International Corporation (Japón)

- BASF SE (Alemania)

- DSM (Países Bajos)

- Firmenich SA (Suiza)

- Symrise (Alemania)

- Aromáticos Orientales (India)

- Bordas SA (Francia)

- Privi Speciality Chemicals Limited (India)

- Bell Flavors & Fragrances (EE. UU.)

- Hindustan Mint & Agro Products Pvt. Ltd. (India)

- Treatt Plc (Reino Unido)

- Vigon International, Inc. (EE. UU.)

- Cedarome (EE. UU.)

- INOUE Perfume MFG. CO., LTD. (Japón)

- MANE (Francia)

- De Monchy Aromatics (Países Bajos)

- Givaudan (Suiza)

- Kao Corporation (Japón)

¿Cuáles son los desarrollos recientes en el mercado de productos químicos aromáticos en Oriente Medio y África?

- En abril de 2025, Eternis Fine Chemicals y ChainCraft BV firmaron una alianza estratégica histórica para impulsar el desarrollo de productos químicos aromáticos de origen biológico y bajas emisiones de carbono. Esta colaboración combina la innovadora línea de productos SensiCraft de ChainCraft, impulsada por tecnología de fermentación vegetal, con la experiencia en fabricación y la robusta cadena de suministro de Eternis, estableciendo un nuevo referente de sostenibilidad en la industria de las fragancias. Se espera que esta alianza acelere la adopción de ingredientes de fragancias ecológicos de última generación.

- En abril de 2025, BASF lanzó ingredientes aromáticos con una huella de carbono reducida, lo que permitió a los clientes alcanzar sus objetivos de sostenibilidad y reducir el impacto ambiental en sus formulaciones. Esta iniciativa refuerza el enfoque en productos aromáticos ecológicos y de alto rendimiento.

- En octubre de 2024, Prigiv inició operaciones en su recién fundada Planta de Ingredientes de Fragancia Mahad, una empresa conjunta entre Givaudan (49%) y Privi (51%). La planta está diseñada para producir una amplia gama de fragancias mejoradas, con planes de ampliar sus operaciones en los próximos años, impulsando la expansión del mercado de productos químicos aromáticos de alta calidad.

- En mayo de 2023, Firmenich International SA completó su fusión con DSM, creando así DSM-Firmenich, un socio líder en innovación en nutrición, salud, belleza y aromas químicos. Esta consolidación fortalece las capacidades globales y amplía el desarrollo de ingredientes sostenibles.

- En abril de 2023, Bedoukian Research Inc. se asoció con Inscripta para desarrollar y comercializar ingredientes naturales de calidad superior, consistencia y menor impacto ambiental. Gracias a la plataforma GenoScaler de Inscripta para optimizar las cepas microbianas, BRI ahora puede producir ingredientes ecológicos en grandes volúmenes de forma eficiente, lo que refuerza las prácticas sostenibles en el sector de los aromaquímicos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.