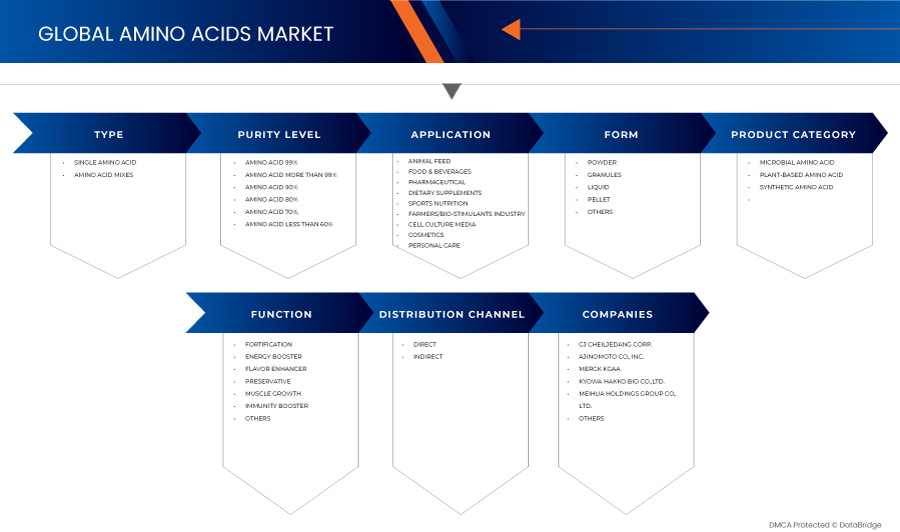

Middle East and Africa Amino Acids Market, By Type of Amino Acid (Glutamic Acid, Methionine, Cysteine, Lysine, Arginine, Tyrosine, Alanine, Leucine, Histidine, Phenylalanine, Valine, Proline, Tryptophan, Glycine, Serine, Isoleucine Threonine, Glutamine, Aspartic Acid, Asparagine, and Others), Purity Level (Amino Acid 99%, Amino Acid More Than 99%, Amino Acid 90%, Amino Acid 80%, Amino Acid 70%, and Amino Acid Less Than 60%), Form (Powder, Granules, Liquid, Pellet, and Others), Product Category (Microbial Amino Acid, Plant-Based Amino Acid, and Synthetic Amino Acid), Function (Fortification, Energy Booster, Flavor Enhancer, Preservative, Muscle Growth, Immunity Booster, and Others), Application (Animal Feed, Food & Beverages, Pharmaceutical, Dietary Supplements, Sports Nutrition, Cell Culture Media, Cosmetic, and Personal Care), Distribution Channel (Direct and Indirect) Industry Trends and Forecast to 2029.

Market Analysis and Insights

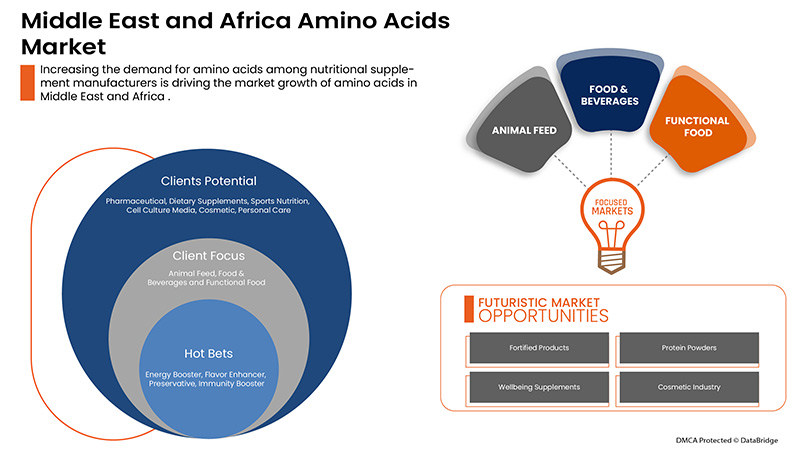

Increasing demand for the amino acid in various industries such as food and beverages, dietary supplements, cosmetics, and animal feed drives the growth of the global amino acids market. In addition, advancement in biotechnology used for amino acid production further enhances market growth. Furthermore, increasing the acceptability of amino acids for medicinal properties is boosting the sales and profit of the players operating in the market, which is expected to drive the market growth of amino acids further.

The major restraint impacting the market growth is the complicated manufacturing process. Further, the high logistic cost of amino acid production will also restrain the market growth. On the other hand, the availability of different types of amino acids is expected to act as an opportunity to grow the global amino acids market. In comparison, the challenge for the market growth is the implementation of strict regulations for the commercialization of amino acid products.

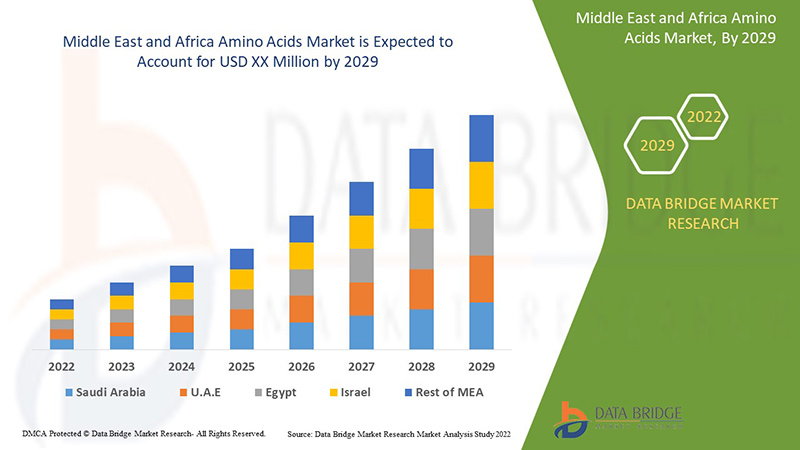

Data Bridge Market Research analyses that the Middle East and Africa amino acids market will grow at a CAGR of 5.1% from 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019 - 2015) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Type of Amino Acid (Glutamic Acid, Methionine, Cysteine, Lysine, Arginine, Tyrosine, Alanine, Leucine, Histidine, Phenylalanine, Valine, Proline, Tryptophan, Glycine, Serine, Isoleucine Threonine, Glutamine, Aspartic Acid, Asparagine, and Others), Purity Level (Amino Acid 99%, Amino Acid More Than 99%, Amino Acid 90%, Amino Acid 80%, Amino Acid 70%, and Amino Acid Less Than 60%), Form (Powder, Granules, Liquid, Pellet, and Others), Product Category (Microbial Amino Acid, Plant-Based Amino Acid, and Synthetic Amino Acid), Function (Fortification, Energy Booster, Flavour Enhancer, Preservative, Muscle Growth, Immunity Booster, and Others), Application (Animal Feed, Food & Beverages, Pharmaceutical, Dietary Supplements, Sports Nutrition, Cell Culture Media, Cosmetic, and Personal Care), Distribution Channel (Direct and Indirect), |

|

Regions Covered |

South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East and Africa |

|

Market Players Covered |

Merck KGaA, Ajinomoto Co., Inc., Kyowa Hakko Bio Co.,Ltd., Evonik Industries AG, ADM, Prinova Group LLC., Daesang, Adisseo, CJ CheilJedang Corp, and Global Bio-chem Technology Group Company Limited |

Market Definition

Amino acids are molecules that combine to form proteins. Amino acids and proteins are the building blocks of life. Amino acids form a substantial part of both animal and human nutrition. In the human body, they are necessary for vital processes such as synthesizing neurotransmitters and hormones. They are advantageous for nourishing the immune system, fighting arthritis and cancer, and treating rectal diseases and tinnitus. Nowadays, the demand for amino acids is increasing as they assist in improving conditions such as depression, sleep disorders, premenstrual dysphoric disorder (PMDD), smoking cessation, bruxism, and attention deficit-hyperactivity disorder (ADHD). Amino acids are also abundant in red meat, seafood, eggs, dairy products, and soy products.

MIDDLE EAST AND AFRICA Amino Acids Market Dynamics

Drivers

- Strong supply chain

As the availability of quality raw materials is vital for the manufacturing of amino acids. To ensure a continuous supply of raw materials, prominent market participants use forward and backward integration techniques to ensure high-quality and reliable raw materials. Such vertical integration processes provide greater reliability of raw material supply and chances for developing new and creative products from current raw materials. Therefore, a robust supply chain is established for the feasible production of amino acids.

Quality checks are also done at every stage of the supply chain. Sustainability is also the Middle East and Africa to ensure the excellent quality of amino acids and comply with the regulations implied by governing bodies. Also, the strong and fast direct and indirect distribution channels established by the manufacturers ensure the timely delivery of products leading to increased demand for amino acids.

Además, los canales de distribución directa e indirecta, sólidos y rápidos, establecidos por los fabricantes garantizan la entrega oportuna de los productos, lo que genera una mayor demanda de aminoácidos. Por lo tanto, la sólida cadena de suministro está impulsando la demanda de aminoácidos en el mercado, ya que garantiza la disponibilidad oportuna.

- Disponibilidad de diferentes tipos de aminoácidos en el mercado.

Los aminoácidos se pueden clasificar en tres grupos: aminoácidos no esenciales, aminoácidos esenciales y aminoácidos condicionales. Estos grupos están compuestos por diferentes tipos de aminoácidos según sus necesidades. Como cada aminoácido esencial tiene una función distinta en el organismo, los síntomas de deficiencia varían en consecuencia. Por lo tanto, la disponibilidad de diferentes aminoácidos y sus diferentes necesidades han llevado a producir productos con varios aminoácidos.

Por lo tanto, la demanda de diferentes tipos de aminoácidos ha llevado a la producción de otros productos con diferentes composiciones y beneficios, lo que eventualmente ha llevado al crecimiento del mercado de aminoácidos.

Oportunidad

-

Aumento del número de iniciativas adoptadas por los fabricantes de aminoácidos

Un aumento en el número de iniciativas tomadas por los fabricantes de aminoácidos, como lanzamientos de productos, expansión, inversiones y otros, creará una excelente oportunidad para el crecimiento del mercado global de aminoácidos.

Por ejemplo,

-

En octubre de 2020, Evonik anunció que concentraría su producción de MetAMINO (DL-metionina) en tres centros internacionales (América, Europa y Asia). La empresa toma medidas, se esfuerza, toma la iniciativa para maximizar las economías de escala y utiliza procesos sólidos. La empresa pretende fortalecer su posición mejorando su posición de costos.

Por lo tanto, se espera que el aumento en el número de lanzamientos de aminoácidos, la expansión, la inversión para aumentar la producción y otras iniciativas de los fabricantes, junto con la creciente demanda de aminoácidos en diferentes industrias, creen una oportunidad masiva para los aminoácidos en el mercado a nivel mundial.

Restricción/Desafío

- Regulaciones gubernamentales estrictas

Se aplican normas a la fabricación de aminoácidos y productos que contienen aminoácidos para mantener la calidad y pureza de los productos. Las normas también se aplican al consumo diario de aminoácidos para evitar sus efectos secundarios. Además, se establecen leyes sobre el uso de aminoácidos en alimentos y suplementos dietéticos para garantizar el consumo adecuado de aminoácidos.

Por lo tanto, la creciente regulación del consumo de aminoácidos podría obstaculizar el crecimiento del mercado, ya que estas regulaciones limitan el uso de aminoácidos en diversos productos y suplementos.

Impacto de la COVID-19 en el mercado de aminoácidos de Oriente Medio y África

Después de la pandemia, la demanda de suplementos para la salud y productos alimenticios saludables ha aumentado, ya que no habrá restricciones de movimiento; por lo tanto, el suministro de productos será fácil. La persistencia de COVID-19 durante un período más prolongado ha afectado a la cadena de suministro, ya que se vio interrumpida y se volvió difícil suministrar productos alimenticios a los consumidores, lo que inicialmente disminuyó la demanda de productos. Sin embargo, después de COVID, la necesidad de productos alimenticios para la salud y el bienestar ha aumentado significativamente debido a una mayor conciencia sobre los beneficios de los aminoácidos en los alimentos saludables y nutritivos a largo plazo, lo que aumenta la demanda de productos de aminoácidos.

Desarrollo reciente

- En enero de 2020, Kemin Industries lanzó una nueva gama de productos llamada KESSENT, una metionina protegida del rumen. La metionina es un aminoácido vital en la dieta de los rumiantes para una alimentación precisa. Se utiliza junto con la lisina. La nueva gama se presenta en la región EMENA

Alcance del mercado de aminoácidos en Oriente Medio y África

El mercado de aminoácidos de Oriente Medio y África está segmentado en segmentos notables basados en siete segmentos importantes: tipos de aminoácidos, nivel de pureza, forma, categoría de producto, función y canal de aplicación y distribución. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipos de aminoácidos

- Ácido glutámico

- Metionina

- Cisteína

- Lisina

- Arginina

- Tirosina

- Alanina

- Leucina

- Histidina

- Fenilalanina

- Valina

- Prolina

- Triptófano

- Glicina

- Serina

- Isoleucina

- Treonina

- Glutamina

- Ácido aspártico

- Asparagina

- Otros

Sobre la base de los tipos de aminoácidos, el mercado de aminoácidos de Oriente Medio y África está segmentado en alanina, arginina, ácido aspártico, cisteína, ácido glutámico, glutamina, glicina, histidina, isoleucina, leucina, lisina, metionina, fenilalanina, prolina, serina, asparagina, treonina, tirosina, triptófano, valina y otros.

Nivel de pureza

- Aminoácido 99%

- Aminoácidos Más del 99%

- Aminoácido 90%

- Aminoácido 80%

- Aminoácido 70%

- Aminoácidos menos del 60%

Sobre la base del nivel de pureza, el mercado de aminoácidos de Medio Oriente y África está segmentado en aminoácidos de menos del 60%, aminoácidos del 70%, aminoácidos del 80%, aminoácidos del 90%, aminoácidos del 99% y aminoácidos de más del 99%.

Forma

- Polvo

- Granulados

- Líquido

- Bolita

- Otros

Sobre la base de la forma, el mercado de aminoácidos de Oriente Medio y África está segmentado en líquido, cristal, polvo, pellets y otros.

Contenido de grasa

- Sin grasa

- Bajo en grasa

- Bajo en grasas

Sobre la base del contenido de grasa, el mercado de alimentos para la salud y el bienestar de Medio Oriente y África se segmenta en sin grasa, bajo en grasa y reducido en grasa.

Categoría de producto

- Aminoácido microbiano

- Aminoácido de origen vegetal

- Aminoácido sintético

Sobre la base de la categoría de producto, el mercado de aminoácidos de Medio Oriente y África está segmentado en aminoácidos de origen vegetal, aminoácidos de origen microbiano y aminoácidos sintéticos.

Función

- Fortificación

- Amplificador de energía

- Potenciador del sabor

- Preservativo

- Crecimiento muscular

- Refuerzo de la inmunidad

- Otros

Sobre la base de su función, el mercado de aminoácidos de Oriente Medio y África se divide en potenciadores de la inmunidad, conservantes, potenciadores del sabor, fortificadores, crecimiento muscular, potenciadores de energía y otros.

Solicitud

- Alimento para animales

- Alimentos y bebidas

- Farmacéutico

- Suplementos dietéticos

- Nutrición deportiva

- Medios de cultivo celular

- Cosmético

- Cuidado personal

Sobre la base de la aplicación, el mercado de aminoácidos de Medio Oriente y África está segmentado en alimentos y bebidas, suplementos dietéticos, productos farmacéuticos, nutrición deportiva, alimentos para animales, cuidado personal, cosméticos y medios de cultivo celular.

Canal de distribución

- Directo

- Indirecto

Sobre la base del canal de distribución, el mercado de aminoácidos de Oriente Medio y África está segmentado en directo e indirecto.

Análisis y perspectivas regionales del mercado de aminoácidos de Oriente Medio y África

Se analiza el mercado de aminoácidos de Oriente Medio y África, y se proporcionan información y tendencias sobre el tamaño del mercado según lo mencionado anteriormente.

Los países cubiertos en el informe del mercado de aminoácidos de Medio Oriente y África son Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Kuwait y el resto de Medio Oriente y África.

Se espera que Sudáfrica domine el mercado de aminoácidos de Medio Oriente y África en términos de participación de mercado e ingresos de mercado y se estima que mantendrá su dominio durante el período de pronóstico debido a un aumento en el número de lanzamientos recientes de productos de aminoácidos por parte de los fabricantes.

La sección de regiones del informe también proporciona factores de impacto de mercado individuales y cambios en las regulaciones que influyen en las tendencias actuales y futuras del mercado. Los puntos de datos, como las ventas nuevas y de reemplazo, la demografía del país, la epidemiología de las enfermedades y los aranceles de importación y exportación, son algunos de los indicadores importantes utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas globales y los desafíos que enfrentan debido a la alta competencia de las marcas locales y nacionales y el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de aminoácidos en Oriente Medio y África

El panorama competitivo del mercado de aminoácidos de Oriente Medio y África proporciona detalles de los competidores. Los detalles incluyen una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos y el dominio de la aplicación. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado de aminoácidos de Oriente Medio y África.

Algunos de los principales actores que operan en el mercado de aminoácidos de Oriente Medio y África son Merck KGaA, Ajinomoto Co., Inc., Kyowa Hakko Bio Co., Ltd., Evonik Industries AG, ADM, Prinova Group LLC., Daesang, Adisseo, CJ CheilJedang Corp y Global Bio-chem Technology Group Company Limited, entre otros.

Metodología de la investigación

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Middle East and Africa Vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA AMINO ACIDS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN ANALYSIS

4.1.1 RAW MATERIAL PROCUREMENT

4.1.2 MANUFACTURING PROCESS

4.1.3 MARKETING AND DISTRIBUTION

4.1.4 END USERS

4.2 SUPPLY SHORTAGE

4.3 TECHNOLOGICAL ADVANCEMENT

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.5.1 MANUFACTURERS ARE DOING EXPANSIONS TO CATER TO THE DEMAND

4.5.2 LAUNCH OF DIFFERENT AMINO ACIDS BY MANUFACTURERS

4.5.3 MANUFACTURERS LAUNCHING NATURAL INGREDIENT BASED/PLANT-BASED AMINO ACIDS

4.5.4 FUTURE PERSPECTIVE

4.6 FACTOR INFLUENCING PURCHASE DECISION (B2B)

4.6.1 HIGH NUTRITIONAL VALUE

4.6.2 PRICING OF THE AMINO ACIDS

4.6.3 HIGH QUALITY

5 REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR AMINO ACIDS IN VARIOUS INDUSTRIES

6.1.2 ADVANCEMENTS IN BIOTECHNOLOGY USED FOR THE PRODUCTION OF AMINO ACIDS

6.1.3 AVAILABILITY OF DIFFERENT TYPES OF AMINO ACIDS IN THE MARKET

6.1.4 STRONG SUPPLY CHAIN

6.2 RESTRAINTS

6.2.1 COMPLICATED MANUFACTURING PROCESS

6.2.2 STRICT GOVERNMENT REGULATIONS

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FOR AMINO ACIDS FOR DIETARY SUPPLEMENTS

6.3.2 RISING DEMAND FOR NUTRITIOUS AND HEALTHY PRODUCTS

6.3.3 INCREASING NUMBER OF INITIATIVES TAKEN BY AMINO ACID MANUFACTURERS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION AMONG THE MARKET PLAYERS

6.4.2 RISING AWARENESS REGARDING THE SIDE EFFECTS OF AMINO ACIDS

7 MIDDLE EAST & AFRICA AMINO ACIDS MARKET, BY TYPE OF AMINO ACID

7.1 OVERVIEW

7.2 GLUTAMIC ACID

7.3 METHIONINE

7.4 CYSTEINE

7.5 LYSINE

7.6 ARGININE

7.7 TYROSINE

7.8 ALANINE

7.9 LEUCINE

7.1 HISTIDINE

7.11 PHENYLALANINE

7.12 VALINE

7.13 PROLINE

7.14 TRYPTOPHAN

7.15 GLYCINE

7.16 SERINE

7.17 ISOLEUCINE

7.18 THREONINE

7.19 GLUTAMINE

7.2 ASPARTIC ACID

7.21 ASPARAGINE

7.22 OTHERS

8 MIDDLE EAST & AFRICA AMINO ACIDS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 ANIMAL FEED

8.2.1 ANIMAL FEED, BY ANIMAL TYPE

8.2.1.1 POULTRY FEED

8.2.1.1.1 BROILERS

8.2.1.1.2 BREEDERS

8.2.1.1.3 LAYERS

8.2.1.2 RUMINANT FEED

8.2.1.2.1 CALVES

8.2.1.2.2 DAIRY CATTLE

8.2.1.2.3 BEEF CATTLE

8.2.1.2.4 OTHERS

8.2.1.3 SWINE FEED

8.2.1.3.1 STARTER

8.2.1.3.2 GROWER

8.2.1.3.3 SOW

8.2.1.4 PET FOOD

8.2.1.4.1 DOGS

8.2.1.4.2 CATS

8.2.1.4.3 BIRDS

8.2.1.4.4 RABBIT

8.2.1.4.5 OTHERS

8.2.1.5 AQUACULTURE

8.2.1.5.1 FISH

8.2.1.5.2 CRUSTACEANS

8.2.1.5.3 MOLLUSKS

8.2.1.5.4 OTHERS

8.2.1.6 OTHERS

8.2.2 ANIMAL FEED, BY PRODUCT CATEGORY

8.2.2.1 PLANT-BASED AMINO ACID

8.2.2.2 MICROBIAL AMINO ACID

8.2.2.3 SYNTHETIC AMINO ACID

8.3 FOOD & BEVERAGES

8.3.1 FOOD & BEVERAGES, BY TYPE

8.3.1.1 BEVERAGES

8.3.1.1.1 BEVERAGES, BY TYPE

8.3.1.1.1.1 JUICES

8.3.1.1.1.2 SPORTS DRINKS

8.3.1.1.1.3 ENERGY DRINKS

8.3.1.1.1.4 DAIRY BASED DRINKS

8.3.1.1.1.4.1 REGULAR PROCESSED MILK

8.3.1.1.1.4.2 FLAVOURED MILK

8.3.1.1.1.4.3 MILK SHAKES

8.3.1.1.1.5 PLANT-BASED BEVERAGES

8.3.1.1.1.5.1 SOY MILK

8.3.1.1.1.5.2 ALMOND MILK

8.3.1.1.1.5.3 OAT MILK

8.3.1.1.1.5.4 CASHEW MILK

8.3.1.1.1.5.5 COCONUT MILK

8.3.1.1.1.5.6 OTHERS

8.3.1.1.1.6 SMOOTHIES

8.3.1.2 PROCESSED FOOD

8.3.1.2.1 PROCESSED FOOD, BY TYPE

8.3.1.2.1.1 SAUCES, DRESSINGS AND CONDIMENTS

8.3.1.2.1.2 JAMS, PRESERVES & MARMALADES

8.3.1.2.1.3 READY MEALS

8.3.1.2.1.4 SOUPS

8.3.1.2.1.5 OTHERS

8.3.1.3 BAKERY

8.3.1.3.1 BAKERY, BY TYPE

8.3.1.3.1.1 BREAD & ROLLS

8.3.1.3.1.2 BISCUIT, COOKIES & CRACKERS

8.3.1.3.1.3 CAKES, PASTRIES & TRUFFLE

8.3.1.3.1.4 TART & PIES

8.3.1.3.1.5 BROWNIES

8.3.1.3.1.6 OTHER

8.3.1.4 DAIRY PRODUCTS

8.3.1.4.1 DAIRY PRODUCTS, BY TYPE

8.3.1.4.1.1 ICE CREAM

8.3.1.4.1.2 CHEESE

8.3.1.4.1.3 YOGURT

8.3.1.4.1.4 OTHERS

8.3.1.5 CONVENIENCE FOOD

8.3.1.5.1 CONVENIENCE FOOD, BY TYPE

8.3.1.5.1.1 SNACKS & EXTRUDED SNACKS

8.3.1.5.1.2 PIZZA & PASTA

8.3.1.5.1.3 INSTANT NOODLES

8.3.1.5.1.4 OTHERS

8.3.1.6 FUNCTIONAL FOOD

8.3.1.7 FROZEN DESSERTS

8.3.1.7.1 FROZEN DESSERTS, BY TYPE

8.3.1.7.1.1 GELATO

8.3.1.7.1.2 CUSTARD

8.3.1.7.1.3 OTHERS

8.3.1.8 CONFECTIONERY

8.3.1.8.1 CONFECTIONARY, BY TYPE

8.3.1.8.1.1 GUMS & JELLIES

8.3.1.8.1.2 HARD-BOILED SWEETS

8.3.1.8.1.3 CHOCOLATE

8.3.1.8.1.4 CHOCOLATE SYRUPS

8.3.1.8.1.5 CARAMELS & TOFFEES

8.3.1.8.1.6 MINTS

8.3.1.8.1.7 OTHERS

8.3.1.9 INFANT FORMULA

8.3.1.9.1 INFANT FORMULA, BY TYPE

8.3.1.9.1.1 FIRST INFANT FORMULA

8.3.1.9.1.2 ANTI-REFLUX (STAY DOWN) FORMULA

8.3.1.9.1.3 COMFORT FORMULA

8.3.1.9.1.4 HYPOALLERGENIC FORMULA

8.3.1.9.1.5 FOLLOW-ON FORMULA

8.3.1.9.1.6 OTHERS

8.3.2 FOOD AND BEVERAGES, BY PRODUCT CATEGORY

8.3.2.1 PLANT-BASED AMINO ACID

8.3.2.2 MICROBIAL AMINO ACID

8.3.2.3 SYNTHETIC AMINO ACID

8.4 PHARMACEUTICAL

8.4.1 PHARMACEUTICAL, BY PRODUCT CATEGORY

8.4.1.1 PLANT-BASED AMINO ACID

8.4.1.2 MICROBIAL AMINO ACID

8.4.1.3 SYNTHETIC AMINO ACID

8.4.2 PHARMACEUTICAL, BY TYPE OF AMINO ACID

8.4.2.1 GLUTAMIC ACID

8.4.2.2 METHIONINE

8.4.2.3 CYSTEINE

8.4.2.4 LYSINE

8.4.2.5 ARGININE

8.4.2.6 TYROSINE

8.4.2.7 ALANINE

8.4.2.8 LEUCINE

8.4.2.9 HISTIDINE

8.4.2.10 PHENYLALANINE

8.4.2.11 VALINE

8.4.2.12 PROLINE

8.4.2.13 TRYPTOPHAN

8.4.2.14 GLYCINE

8.4.2.15 SERINE

8.4.2.16 ISOLEUCINE

8.4.2.17 THREONINE

8.4.2.18 GLUTAMINE

8.4.2.19 ASPARTIC ACID

8.4.2.20 ASPARAGINE

8.4.2.21 OTHERS

8.5 DIETARY SUPPLEMENTS

8.5.1 DIETARY SUPPLEMENTS, BY TYPE

8.5.1.1 IMMUNITY SUPPLEMENTS

8.5.1.2 BONE AND JOINT HEALTH SUPPLEMENTS

8.5.1.3 OVERALL WELLBEING SUPPLEMENTS

8.5.1.4 BRAIN HEALTH SUPPLEMENTS

8.5.1.5 SKIN HEALTH SUPPLEMENTS

8.5.1.6 OTHERS

8.5.2 DIETARY SUPPLEMENTS, BY PRODUCT CATEGORY

8.5.2.1 PLANT-BASED AMINO ACID

8.5.2.2 MICROBIAL AMINO ACID

8.5.2.3 SYNTHETIC AMINO ACID

8.5.3 DIETARY SUPPLEMENTS, BY TYPE OF AMINO ACID

8.5.3.1 GLUTAMIC ACID

8.5.3.2 METHIONINE

8.5.3.3 CYSTEINE

8.5.3.4 LYSINE

8.5.3.5 ARGININE

8.5.3.6 TYROSINE

8.5.3.7 ALANINE

8.5.3.8 LEUCINE

8.5.3.9 HISTIDINE

8.5.3.10 PHENYLALANINE

8.5.3.11 VALINE

8.5.3.12 PROLINE

8.5.3.13 TRYPTOPHAN

8.5.3.14 GLYCINE

8.5.3.15 SERINE

8.5.3.16 ISOLEUCINE

8.5.3.17 THREONINE

8.5.3.18 GLUTAMINE

8.5.3.19 ASPARTIC ACID

8.5.3.20 ASPARAGINE

8.5.3.21 OTHERS

8.6 SPORTS NUTRITION

8.6.1 SPORTS NUTRITION, BY TYPE

8.6.1.1 SPORT DRINK MIXES

8.6.1.2 ENERGY GELS

8.6.1.3 SPORTS NUTRITION BARS

8.6.1.4 PROTEIN POWDERS

8.6.1.5 OTHERS

8.6.2 SPORTS NUTRITION, BY PRODUCT CATEGORY

8.6.2.1 PLANT-BASED AMINO ACID

8.6.2.2 MICROBIAL AMINO ACID

8.6.2.3 SYNTHETIC AMINO ACID

8.6.3 SPORTS NUTRITION, BY TYPE OF AMINO ACID

8.6.3.1 GLUTAMIC ACID

8.6.3.2 METHIONINE

8.6.3.3 CYSTEINE

8.6.3.4 LYSINE

8.6.3.5 ARGININE

8.6.3.6 TYROSINE

8.6.3.7 ALANINE

8.6.3.8 LEUCINE

8.6.3.9 HISTIDINE

8.6.3.10 PHENYLALANINE

8.6.3.11 VALINE

8.6.3.12 PROLINE

8.6.3.13 TRYPTOPHAN

8.6.3.14 GLYCINE

8.6.3.15 SERINE

8.6.3.16 ISOLEUCINE

8.6.3.17 THREONINE

8.6.3.18 GLUTAMINE

8.6.3.19 ASPARTIC ACID

8.6.3.20 ASPARAGINE

8.6.3.21 OTHERS

8.7 CELL CULTURE MEDIA

8.7.1 CELL CULTURE MEDIA, BY PRODUCT CATEGORY

8.7.1.1 PLANT-BASED AMINO ACID

8.7.1.2 MICROBIAL AMINO ACID

8.7.1.3 SYNTHETIC AMINO ACID

8.7.2 CELL CULTURE MEDIA, BY TYPE OF AMINO ACID

8.7.2.1 GLUTAMIC ACID

8.7.2.2 METHIONINE

8.7.2.3 CYSTEINE

8.7.2.4 LYSINE

8.7.2.5 ARGININE

8.7.2.6 TYROSINE

8.7.2.7 ALANINE

8.7.2.8 LEUCINE

8.7.2.9 HISTIDINE

8.7.2.10 PHENYLALANINE

8.7.2.11 VALINE

8.7.2.12 PROLINE

8.7.2.13 TRYPTOPHAN

8.7.2.14 GLYCINE

8.7.2.15 SERINE

8.7.2.16 ISOLEUCINE

8.7.2.17 THREONINE

8.7.2.18 GLUTAMINE

8.7.2.19 ASPARTIC ACID

8.7.2.20 ASPARAGINE

8.7.2.21 OTHERS

8.8 COSMETIC

8.8.1 COSMETIC, BY TYPE

8.8.1.1 FACE SERUMS

8.8.1.2 FACE CREAM

8.8.1.3 LIP CARE AND LIPSTICK PRODUCTS

8.8.1.4 OTHERS

8.8.2 COSMETIC, BY PRODUCT CATEGORY

8.8.2.1 PLANT-BASED AMINO ACID

8.8.2.2 MICROBIAL AMINO ACID

8.8.2.3 SYNTHETIC AMINO ACID

8.8.3 COSMETIC, BY TYPE OF AMINO ACID

8.8.3.1 GLUTAMIC ACID

8.8.3.2 METHIONINE

8.8.3.3 CYSTEINE

8.8.3.4 LYSINE

8.8.3.5 ARGININE

8.8.3.6 TYROSINE

8.8.3.7 ALANINE

8.8.3.8 LEUCINE

8.8.3.9 HISTIDINE

8.8.3.10 PHENYLALANINE

8.8.3.11 VALINE

8.8.3.12 PROLINE

8.8.3.13 TRYPTOPHAN

8.8.3.14 GLYCINE

8.8.3.15 SERINE

8.8.3.16 ISOLEUCINE

8.8.3.17 THREONINE

8.8.3.18 GLUTAMINE

8.8.3.19 ASPARTIC ACID

8.8.3.20 ASPARAGINE

8.8.3.21 OTHERS

8.9 PERSONAL CARE

8.9.1 PERSONAL CARE, BY TYPE

8.9.1.1 SKIN CARE

8.9.1.2 HAIR CARE

8.9.2 PERSONAL CARE, BY PRODUCT CATEGORY

8.9.2.1 PLANT-BASED AMINO ACID

8.9.2.2 MICROBIAL AMINO ACID

8.9.2.3 SYNTHETIC AMINO ACID

9 MIDDLE EAST & AFRICA AMINO ACIDS MARKET, BY PURITY LEVEL

9.1 OVERVIEW

9.2 AMINO ACID 99%

9.3 AMINO ACID MORE THAN 99%

9.4 AMINO ACID 90%

9.5 AMINO ACID 80%

9.6 AMINO ACID 70%

9.7 AMINO ACID LESS THAN 60%

10 MIDDLE EAST & AFRICA AMINO ACIDS MARKET, BY FORM

10.1 OVERVIEW

10.2 POWDER

10.2.1 POWDER, BY TYPE

10.2.1.1 FINE POWDER

10.2.1.2 CRYSTALLINE POWDER

10.2.1.3 GRANULAR POWDER

10.3 GRANULES

10.4 LIQUID

10.5 PELLET

10.6 OTHERS

11 MIDDLE EAST & AFRICA AMINO ACIDS MARKET, BY PRODUCT CATEGORY

11.1 OVERVIEW

11.2 MICROBIAL AMINO ACID

11.2.1 MICROBIAL AMINO ACID, BY TYPE

11.2.1.1 BACTERIA

11.2.1.2 FUNGI

11.2.1.3 YEAST

11.3 PLANT-BASED AMINO ACID

11.4 SYNTHETIC AMINO ACID

12 MIDDLE EAST & AFRICA AMINO ACIDS MARKET, BY FUNCTION

12.1 OVERVIEW

12.2 FORTIFICATION

12.3 ENERGY BOOSTER

12.4 FLAVOR ENHANCER

12.5 PRESERVATIVE

12.6 MUSCLE GROWTH

12.7 IMMUNITY BOOSTER

12.8 OTHERS

13 MIDDLE EAST & AFRICA AMINO ACIDS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT

13.3 INDIRECT

14 MIDDLE EAST & AFRICA AMINO ACIDS MARKET, BY REGION

14.1 MIDDLE EAST & AFRICA

14.1.1 SOUTH AFRICA

14.1.2 SAUDI ARABIA

14.1.3 UAE

14.1.4 KUWAIT

14.1.5 REST OF MIDDLE EAST & AFRICA

15 COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 AJINOMOTO CO., INC.

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 CJ CHEILJEDANG CORP.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 MERCK KGAA

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 FUFENG GROUP

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 DAESANG

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 KYOWA HAKKO BIO CO., LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 COMPANY SHARE ANALYSIS

17.6.4 PRODUCT PORTFOLIO

17.6.5 RECENT DEVELOPMENTS

17.7 ADISSEO

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 ADM

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 AMINO GMBH

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 ASIAMERICA GROUP, INC.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 EVONIK INDUSTRIES AG

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 MIDDLE EAST & AFRICA BIO-CHEM TECHNOLOGY GROUP COMPANY LIMITED.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 KINGCHEM LIFE SCIENCE LLC

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 NIPPON RIKA CO., LTD.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 NOVUS INTERNATIONAL

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 PANGAEA SCIENCES.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 PACIFIC RAINBOW INTERNATIONAL, INC.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 PRINOVA GROUP LLC.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 QINGDAO SAMIN CHEMICAL CO., LTD.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 SICHUAN TONGSHENG AMINO ACID CO., LTD

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 SUMITOMO CHEMICAL.

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENTS

17.22 SUNRISE NUTRACHEM GROUP CO.,LTD

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de figuras

FIGURE 1 MIDDLE EAST & AFRICA AMINO ACIDS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA AMINO ACIDS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA AMINO ACIDS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA AMINO ACIDS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA AMINO ACIDS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA AMINO ACIDS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA AMINO ACIDS MARKET : DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA AMINO ACIDS MARKET : VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA AMINO ACIDS MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA AMINO ACIDS MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 INCREASING USE OF AMINO ACIDS IN FOOD AND BEVERAGES, PERSONAL CARE, COSMETIC PRODUCTS, ANIMAL FEED AND PHARMACEUTICAL DRUGS IS LEADING THE GROWTH OF THE MIDDLE EAST & AFRICA AMINO ACIDS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 TYPE OF AMINO ACID SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA AMINO ACIDS MARKET IN 2022 & 2029

FIGURE 13 SUPPLY CHAIN ANALYSIS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA AMINO ACIDS MARKET

FIGURE 15 MIDDLE EAST & AFRICA AMINO ACIDS MARKET: BY TYPE OF AMINO ACID, 2021

FIGURE 16 MIDDLE EAST & AFRICA AMINO ACIDS MARKET, BY APPLICATION

FIGURE 17 MIDDLE EAST & AFRICA AMINO ACIDS MARKET: BY PURITY LEVEL, 2021

FIGURE 18 MIDDLE EAST & AFRICA AMINO ACIDS MARKET: BY FORM, 2021

FIGURE 19 MIDDLE EAST & AFRICA AMINO ACIDS MARKET: BY PRODUCT CATEGORY, 2021

FIGURE 20 MIDDLE EAST & AFRICA AMINO ACIDS MARKET: BY FUNCTION, 2021

FIGURE 21 MIDDLE EAST & AFRICA AMINO ACIDS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 22 MIDDLE EAST & AFRICA AMINO ACIDS MARKET: SNAPSHOT (2021)

FIGURE 23 MIDDLE EAST & AFRICA AMINO ACIDS MARKET: BY COUNTRY (2021)

FIGURE 24 MIDDLE EAST & AFRICA AMINO ACIDS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 MIDDLE EAST & AFRICA AMINO ACIDS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 MIDDLE EAST & AFRICA AMINO ACIDS MARKET: BY TYPE OF AMINO ACIDS (2022 & 2029)

FIGURE 27 MIDDLE EAST & AFRICA AMINO ACIDS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.