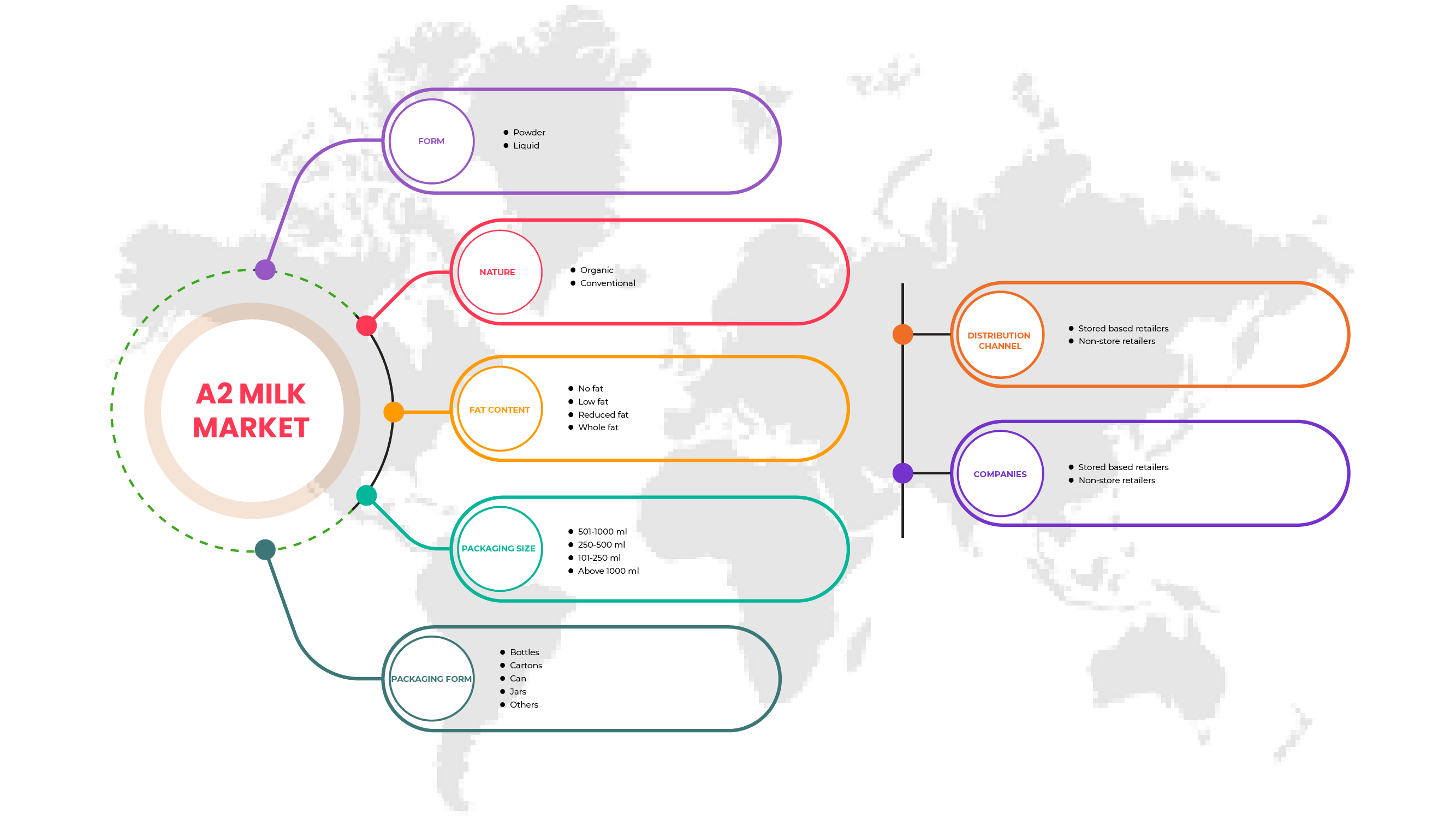

Mercado de leche A2 en Oriente Medio y África, por forma (polvo y líquido), naturaleza (orgánica y convencional), contenido de grasa (sin grasa, bajo en grasa, reducido en grasa y entera), tamaño del envase (101-250 ml/g, 250-500 ml/g, 501-1000 ml/g y más de 1000 ml/g), forma del envase (botellas, cartones, latas, tarros y otros), canal de distribución (minoristas con sede en tiendas y minoristas sin tiendas): tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado de leche A2 en Oriente Medio y África

La leche A2 ayuda al desarrollo de la inmunidad, estimula el metabolismo y aporta ácidos grasos Omega 3. La leche A2 está creciendo de forma significativa debido a la creciente conciencia de los consumidores sobre su salud y a su alto contenido nutricional en comparación con la leche normal. Está disponible en varias formas y es fácil de conseguir en el mercado. Sin embargo, se espera que los altos precios de la leche A2 y sus productos limiten el crecimiento del mercado de la leche A2 durante el período previsto.

Algunos de los factores que impulsan el crecimiento del mercado son el aumento de la tecnología de la leche A2, la creciente aplicación de la leche A2 en fórmulas infantiles que están impulsando el mercado y la creciente conciencia sobre la salud entre los consumidores. Sin embargo, se espera que las limitaciones en los altos precios de la leche A2 obstaculicen el crecimiento del mercado.

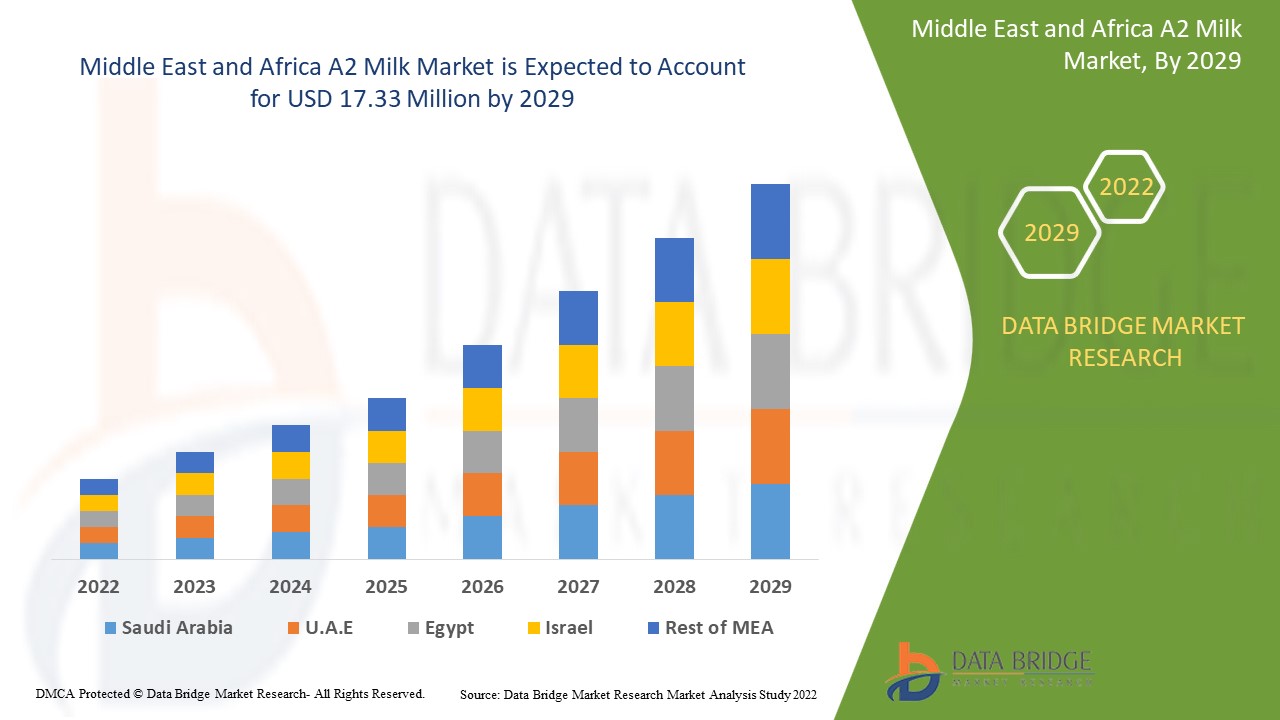

Data Bridge Market Research analiza que se espera que el mercado de leche A2 alcance los USD 17,33 millones para 2029, con una CAGR del 14,8% durante el período de pronóstico.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Año histórico |

2020 (Personalizable para 2019-2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por forma (polvo y líquido), naturaleza (orgánica y convencional), contenido de grasa (sin grasa, bajo en grasa, reducido en grasa y con grasa entera), tamaño del envase (101-250 ml/g, 250-500 ml/g, 501-1000 ml/g y más de 1000 ml/g), forma del envase (botellas, cartones, latas, frascos y otros) y canal de distribución (minoristas con sede en tiendas y minoristas sin tiendas) |

|

Países cubiertos |

Sudáfrica, Emiratos Árabes Unidos, Arabia Saudita, Kuwait y el resto de Oriente Medio y África. |

|

Actores del mercado cubiertos |

-------- |

Definición de mercado

La leche A2 es un tipo de leche de vaca que carece de la forma A1 de las proteínas de la beta-caseína y que contiene principalmente la forma A2. La proteína beta-caseína A2 de la leche A2 se descompone rápidamente en aminoácidos para una digestión rápida, lo que mejora nuestra salud general y aumenta el valor nutricional de la leche de vaca. La leche de vaca A2 contiene minerales como calcio, potasio y fósforo, que son necesarios para tener huesos y dientes fuertes, una mejor función muscular, la regulación de la presión arterial, el crecimiento de los tejidos y las células y la mejora del colesterol bueno (HDL), además de mantener la nutrición general y el bienestar del cuerpo.

Dinámica del mercado de la leche A2

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores:

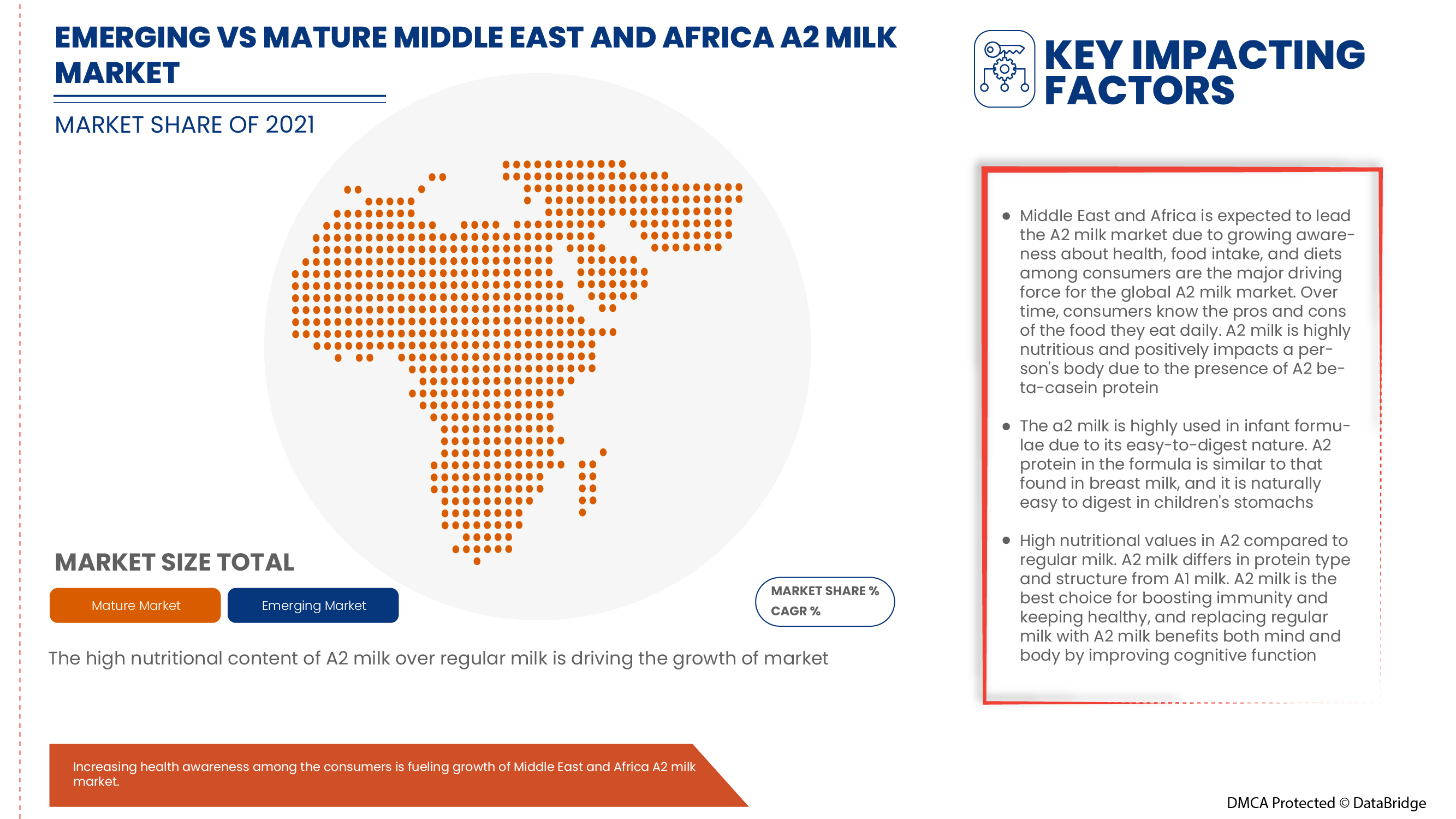

- Mayor conciencia sobre la salud entre los consumidores

La creciente conciencia de los consumidores sobre la salud, la ingesta de alimentos y las dietas es la principal fuerza impulsora del mercado de la leche A2 en Oriente Medio y África. Con el tiempo, los consumidores conocen los pros y los contras de los alimentos que consumen a diario. La leche A2 es muy nutritiva y tiene un impacto positivo en el cuerpo de una persona debido a la presencia de la proteína beta-caseína A2. Esta proteína A2 previene diversas enfermedades cardíacas, diabetes y autismo. Con esto, las personas consumen leche A2 y la prefieren para el consumo habitual. Se espera que este cambio en la preferencia y el desarrollo de la conciencia hacia la salud impulse el crecimiento del mercado mundial de la leche A2.

Por lo tanto, la creciente concienciación sobre la salud y los cambios en los hábitos alimentarios de los usuarios finales están generando una mayor demanda de leche A2. Se espera que esta creciente demanda de leche A2 impulse el mercado de leche A2 en Oriente Medio y África.

- Altos valores nutricionales en a2 en comparación con la leche normal

La leche A2 difiere en el tipo de proteína y la estructura de la leche A1. La leche A2 es la mejor opción para reforzar la inmunidad y mantenerse saludable. Reemplazar la leche normal por leche A2 beneficia tanto la mente como el cuerpo al mejorar la función cognitiva y nutrir la piel y el cabello. Además, la leche A2 previene problemas como enfermedades cardíacas, intolerancia a la lactosa, diabetes y autismo. Con una nutrición abundante y numerosos beneficios para la salud, la demanda de leche A2 por parte de los consumidores está aumentando rápidamente. Los usuarios finales prefieren la leche A2 a la leche normal en diferentes productos lácteos para mantener una buena salud. Por lo tanto, se ha demostrado que la leche A2 es más nutritiva que la leche normal.

Por lo tanto, el alto valor nutricional y el mayor contenido mineral de la leche A2 están generando una mayor demanda y ventas de leche A2 en el mercado. Con esta creciente demanda, se espera que el mercado de leche A2 en Oriente Medio y África crezca significativamente.

Restricción

- Precios altos de la leche a2

Los altos precios de la leche A2 en comparación con la leche normal son un importante factor limitante para el crecimiento del mercado. La leche A2 y los productos lácteos tienen un rango de precios que duplica el de la leche normal en el mercado. La producción de leche A2 sigue siendo limitada, ya que las razas de vacas lecheras A2 producen menos leche por día y, debido a esto, las empresas cobran altos costos por la leche A2 para generar mayores ingresos. Los usuarios finales de la leche A2 son la gente común y la presencia de leche A2 en el mercado con un rango más alto no es asequible para mucha gente. Debido a los grados más altos, la gente prefiere la leche normal a la leche A2 y sus productos. Estos altos precios de la leche son un factor limitante importante en el crecimiento del mercado.

Por lo tanto, los altos precios de la leche y los productos lácteos de categoría A2 permiten a los consumidores utilizar leche normal, lo que, a su vez, se espera que frene el crecimiento del mercado de leche de categoría A2 en Oriente Medio y África.

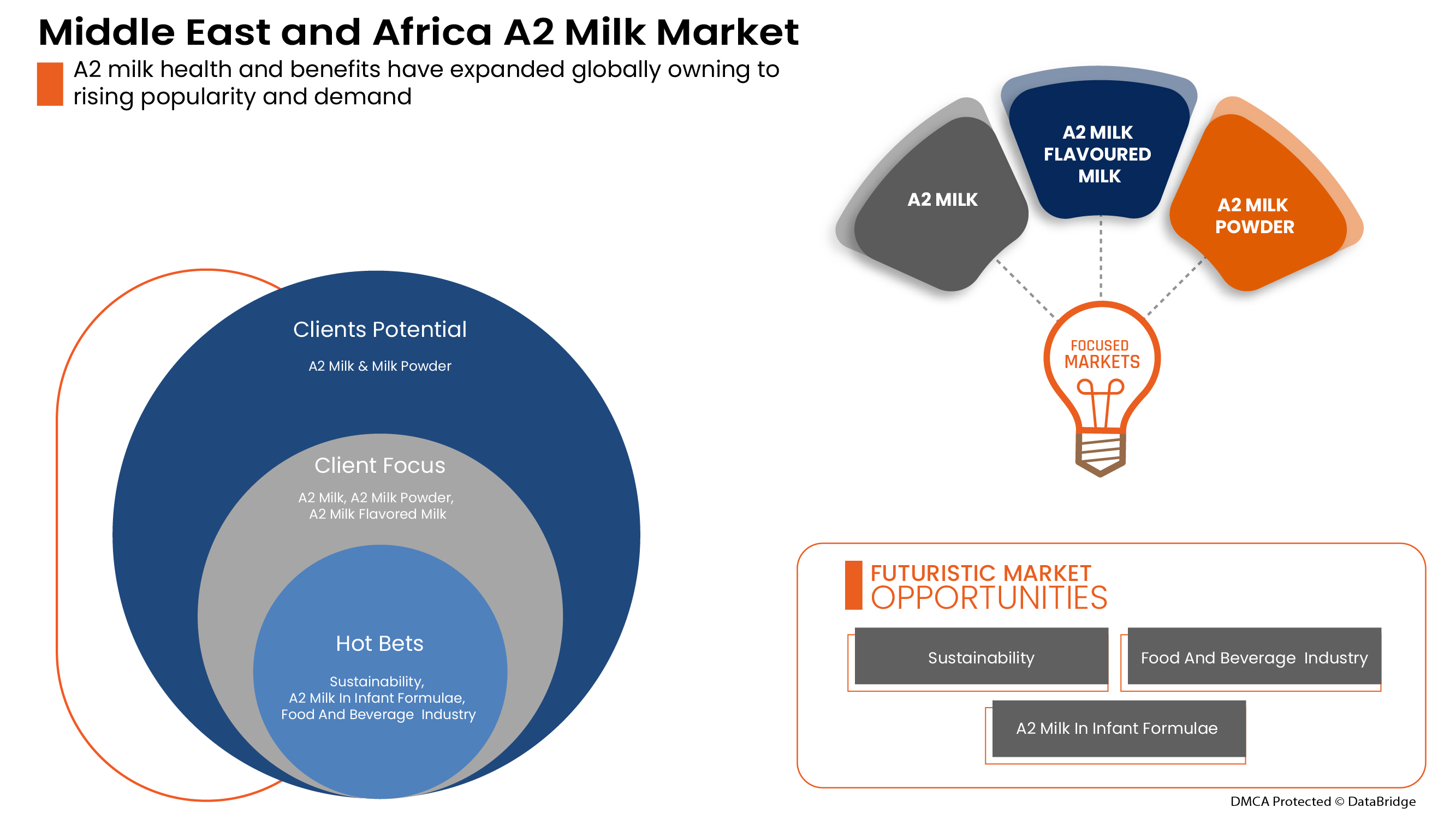

Oportunidad

- Inclinación de los consumidores por la producción sostenible de leche a2

La sostenibilidad protege la salud y la biocapacidad del medio ambiente. El bienestar individual y comunitario se ve favorecido por la sostenibilidad. La sostenibilidad promueve una mejor economía con menos contaminación y residuos, menos emisiones, más empleo y una distribución equitativa de la riqueza. Un enfoque sostenible de la producción de leche A2 reduce el impacto ambiental de la ganadería lechera, al tiempo que aumenta el bienestar animal y el respaldo social del sector lácteo. Los consumidores con estándares morales más elevados tienen más probabilidades de estar interesados en comprar productos lácteos A2 que utilicen innovaciones sostenibles. Los consumidores orgánicos habituales tienen una actitud más favorable hacia los productos lácteos que utilizan innovaciones sostenibles. Como resultado, muchas empresas basadas en leche A2 se centran en la sostenibilidad en su producción, procesamiento, envasado y otros procesos.

Por lo tanto, la implementación de enfoques sustentables en casi todas las etapas de la producción de leche A2 y productos lácteos A2 ha brindado varias oportunidades para el crecimiento del mercado incluso en el período previsto porque los consumidores prefieren principalmente productos sustentables y orgánicos.

Desafíos

- Crecimiento de la tendencia del veganismo entre las personas

El veganismo es un estilo de vida que aboga por eliminar los productos animales de la dieta, en especial los lácteos, la carne y las aves de corral. El veganismo se ha convertido en una tendencia hacia una vida más saludable a medida que más personas se vuelven conscientes del daño que está causando al medio ambiente y a las especies animales. La lógica del veganismo es dejar de estresar, explotar y matar a los animales para poner fin a su especie. Esta tendencia vegana trae consigo alternativas a la leche más naturales, por lo que la mayoría de las personas que adoptan el veganismo evitan los productos a base de leche A2, a pesar de que la leche A2 tiene un mayor beneficio nutricional que otros. Dado que la leche A2 es un producto de origen animal, la tendencia vegana planteará un desafío significativo para el crecimiento del mercado de la leche A2.

Por lo tanto, la tendencia al veganismo lleva a una opción mínima por los productos lácteos por parte de los consumidores, por lo que se espera que esta tendencia del veganismo entre las personas sea un desafío importante para el crecimiento del mercado mundial de la leche A2.

- Alta inversión en I+D para productos lácteos a2

Las empresas invierten en I+D por diversas razones, entre ellas, una mayor participación en el mercado, ahorros de costes, avances de marketing y adaptación a las tendencias. La I+D puede ayudar a una empresa a seguir o mantenerse a la vanguardia de las tendencias del mercado, manteniendo así su relevancia. Algunos beneficios de la I+D son obvios, como la posibilidad de una mayor producción o de nuevas líneas de productos. Pero la inversión necesaria para la I+D de los productos lácteos A2 es muy alta, pero también es necesaria para el lanzamiento de nuevos productos. Por ello, muchas empresas son incapaces de destinar grandes activos a este departamento de I+D y no lanzan ningún producto nuevo que sea útil para el crecimiento del mercado mundial de la leche A2.

Además, se puede afirmar que la elevada inversión en I+D de las empresas de leche A2 actúa como un importante desafío que restringe el crecimiento del mercado. La falta continua de lanzamientos de nuevos productos y avances en productos de leche A2 limita aún más el cambio en el mercado y también restringe la entrada de nuevos actores.

Impacto posterior a la COVID-19 en el mercado de cultivo de hongos en los Emiratos Árabes Unidos

Después de la pandemia, la demanda de leche A2 ha aumentado, ya que no habrá restricciones de movimiento; por lo tanto, el suministro de productos será fácil. La persistencia de COVID-19 durante un período más largo ha afectado a la cadena de suministro, ya que se vio interrumpida y se volvió difícil suministrar productos alimenticios a los consumidores, lo que inicialmente aumentó la demanda de productos. Sin embargo, después de COVID, la necesidad de leche A2 ha aumentado significativamente debido al buen contenido de proteínas y otros nutrientes disponibles.

Mercado de leche A2 en Oriente Medio y África

El mercado de leche A2 de Oriente Medio y África está segmentado en función de la forma, la naturaleza, el contenido de grasa, el tamaño del envase, la forma del envase y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Forma

- Polvo

- Líquido

Sobre la base de la forma, el mercado de leche A2 en Oriente Medio y África está segmentado en polvo y líquido.

Naturaleza

- Orgánico

- Convencional

Sobre la base de la naturaleza, el mercado de leche A2 en Medio Oriente y África está segmentado en orgánico y convencional.

Contenido de grasa

- Sin grasa

- Bajo en grasas

- Grasa reducida

- Grasa entera

Sobre la base del contenido de grasa, el mercado de leche A2 en Oriente Medio y África se segmenta en sin grasa, bajo en grasa, reducido en grasa y entera.

Tamaño del embalaje

- 101-250 ml/g

- 250-500 ml/g

- 501-1000 ml/g

- Más de 1000 ml/g

Sobre la base del tamaño del envase, el mercado de leche A2 de Medio Oriente y África está segmentado en 50-100 mg/g, 101-250 ml/g, 250-500 ml/g, 501-1000 ml/g y más de 1000 ml/g.

Forma de embalaje

- Botellas

- Cajas de cartón

- Poder

- Paso

- Otros

Sobre la base de la forma del embalaje, el mercado de leche A2 de Oriente Medio y África está segmentado en botellas, cartones, latas, frascos y otros.

Canal de distribución

- Minoristas basados en tiendas

- Minoristas sin tiendas

Sobre la base del canal de distribución, el mercado de leche A2 de Medio Oriente y África está segmentado en minoristas con base en tiendas y minoristas sin base en tiendas.

Análisis y perspectivas regionales del mercado de leche A2

Se analiza el mercado de la leche A2 y se proporcionan información y tendencias del tamaño del mercado por país, forma, naturaleza, contenido de grasa, tamaño del envase, forma del envase y canal de distribución.

Los países cubiertos en el informe del mercado de leche A2 de Medio Oriente y África son Sudáfrica, Emiratos Árabes Unidos, Arabia Saudita, Kuwait y el resto de Medio Oriente y África.

Sudáfrica es el país con mayor crecimiento en el mercado de la leche A2. La creciente conciencia de los beneficios para la salud de la leche A2 en comparación con la leche A1 entre los consumidores es la principal razón del crecimiento del mercado de la leche A2 en Oriente Medio y África. El desarrollo de este mercado afectará directamente el crecimiento del mercado de la leche A2. Sin embargo, es probable que los altos precios de la leche A2 restrinjan el crecimiento del mercado.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que influyen en las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias tecnológicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de la leche A2

El panorama competitivo del mercado de la leche A2 proporciona detalles sobre un competidor. Los componentes incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores solo se relacionan con el enfoque de las empresas en el mercado de la leche A2.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA A2 MILK MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TREATMENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING PURCHASE DECISION

4.1.1 PRODUCT NUTRITIONAL QUALITY

4.1.2 PRODUCT PRICING

4.1.3 AUTHENTICITY OF PRODUCT

4.2 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.3 TRADE ANALYSIS

4.3.1 IMPORTS-EXPORTS OF THE MIDDLE EAST & AFRICA A2 MILK MARKET

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF MIDDLE EAST & AFRICA A2 MILK MARKET

4.4.1 INDUSTRY TRENDS

4.4.2 FUTURE PERSPECTIVE

4.5 RAW MATERIAL SOURCING ANALYSIS: MIDDLE EAST & AFRICA A2 MILK MARKET

4.6 SUPPLY CHAIN OF THE MIDDLE EAST & AFRICA A2 MILK MARKET

4.6.1 RAW A2 MILK PRODUCTION

4.6.2 PROCESSING AND PACKAGING

4.6.3 TRANSPORTATION AND DISTRIBUTION

4.6.4 END USERS

4.7 TECHNOLOGICAL ADVANCEMENTS

4.8 VALUE CHAIN ANALYSIS: MIDDLE EAST & AFRICA A2 MILK MARKET

4.9 PORTER'S FIVE

4.9.1 PORTER'S FIVE FORCES ANALYSIS FOR MIDDLE EAST & AFRICA A2 MILK MARKET

4.9.2 BARGAINING POWER OF SUPPLIERS

4.9.3 BARGAINING POWER OF BUYERS/CONSUMERS

4.9.4 THREAT OF NEW ENTRANTS

4.9.5 THREAT OF SUBSTITUTE PRODUCTS

4.9.6 INTENSITY OF COMPETITIVE RIVALRY

5 REGULATORY FRAMEWORK AND LABELLING FOR THE MIDDLE EAST & AFRICA A2 MILK MARKET

6 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET –MIDDLE EAST & AFRICA A2 MILK MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY'S STRATEGIC DECISIONS

7 PRICING INDEX

7.1 FOB & B2B PRICES - MIDDLE EAST & AFRICA A2 MILK MARKET

7.2 B2B PRICES - MIDDLE EAST & AFRICA A2 MILK MARKET

8 PRODUCTION CAPACITY OF KEY MANUFACTURERS

9 BRAND OUTLOOK

9.1 PRODUCT VS BRAND OVERVIEW

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 GROWING AWARENESS ABOUT HEALTH AMONG CONSUMERS

10.1.2 INCREASING APPLICATIONS OF A2 MILK IN INFANT FORMULAE

10.1.3 HIGH NUTRITIONAL VALUES IN A2 COMPARED TO REGULAR MILK

10.1.4 CONSUMERS EXPERIENCING HEALTH ISSUES DUE TO CONSUMPTION OF REGULAR MILK

10.2 RESTRAINT

10.2.1 HIGH PRICES OF A2 MILK

10.3 OPPORTUNITY

10.3.1 INCLINATION OF CONSUMERS OVER SUSTAINABLE PRODUCTION OF A2 MILK

10.4 CHALLENGES

10.4.1 GROWING TREND OF VEGANISM AMONG PEOPLE

10.4.2 HIGH INVESTMENT IN R&D FOR A2 MILK PRODUCTS

11 MIDDLE EAST & AFRICA A2 MILK MARKET, BY FORM

11.1 OVERVIEW

11.2 LIQUID

11.3 POWDER

12 MIDDLE EAST & AFRICA A2 MILK MARKET, BY NATURE

12.1 OVERVIEW

12.2 CONVENTIONAL

12.3 ORGANIC

13 MIDDLE EAST & AFRICA A2 MILK MARKET, BY FAT CONTENT

13.1 OVERVIEW

13.2 WHOLE FAT

13.3 LOW FAT

13.4 REDUCED FAT

13.5 NO FAT

14 MIDDLE EAST & AFRICA A2 MILK MARKET, BY PACKAGIING SIZE

14.1 OVERVIEW

14.2 501-1000 ML

14.3 250-500 ML

14.4 101-250 ML

14.5 ABOVE 1000 ML

15 MIDDLE EAST & AFRICA A2 MILK MARKET, BY PACKAGING FORM

15.1 OVERVIEW

15.2 BOTTLES

15.2.1 PLASTIC

15.2.2 GLASS

15.3 CARTONS

15.4 CAN

15.5 JARS

15.6 OTHERS

16 MIDDLE EAST & AFRICA A2 MILK MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 NON-STORE RETAILERS

16.2.1 ONLINE

16.2.2 VENDING MACHINE

16.3 STORE BASED RETAILERS

16.3.1 SUPERMARKETS/HYPERMARKETS

16.3.2 CONVENIENCE STORES

16.3.3 GROCERY STORES

16.3.4 SPECIALTY STORES

17 MIDDLE EAST & AFRICA A2 MILK MARKET, BY REGION

17.1 MIDDLE EAST AND AFRICA

17.1.1 SOUTH AFRICA

17.1.2 UAE

17.1.3 REST OF MIDDLE EAST AND AFRICA

18 COMPANY LANDSCAPE: MIDDLE EAST & AFRICA A2 MILK MARKET

18.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 THE A2 MILK COMPANY LIMITED

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 COMPANY SHARE ANALYSIS

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENTS

20.2 GCMMF

20.2.1 COMPANY SNAPSHOT

20.2.2 COMPANY SHARE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENT

20.3 CAPTAIN’S FARM

20.3.1 COMPANY SNAPSHOT

20.3.2 COMPANY SHARE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENT

20.4 VEDAAZ ORGANICS PVT. LTD.

20.4.1 COMPANY SNAPSHOT

20.4.2 COMPANY SHARE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENT

20.5 URBAN FARMS MILK

20.5.1 COMPANY SNAPSHOT

20.5.2 COMPANY SHARE ANALYSIS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT DEVELOPMENT

20.6 AUSTRALIA'S OWN

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 AVTARAN MILK

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENT

20.8 AYUDA ORGANICS

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 RECENT DEVELOPMENT

20.9 DOFE

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENT

20.1 ERDEN CREAMERY PRIVATE LIMITED

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENT

20.11 KSHEERDHAM

20.11.1 COMPANY SNAPSHOT

20.11.2 PRODUCT PORTFOLIO

20.11.3 RECENT DEVELOPMENT

20.12 PROVILAC DAIRY FARMS PVT. LTD

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENT

20.13 RIPLEY FARMS LLC

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 TAW RIVER DAIRY

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENT

20.15 VECO ZUIVEL B.V.

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

Lista de Tablas

TABLE 1 FREE ON BOARD (FOB) OF A2 MILK

TABLE 2 BRAND COMPARATIVE ANALYSIS OF THE MIDDLE EAST & AFRICA A2 MILK MARKET

TABLE 3 MIDDLE EAST & AFRICA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA LIQUID IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA POWDER IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA CONVENTIONAL IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA ORGANIC IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA WHOLE FAT IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA LOW FAT IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA REDUCED FAT IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA NO FAT IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA 501-1000 ML IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA 250-500 ML IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA 101-250 ML IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA ABOVE 1000 ML IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA BOTTLES IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA CARTONS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA CAN IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA JARS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA OTHERS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA NON-STORE RETAILERS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA STORE BASED RETAILERS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE-EAST AND AFRICA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE-EAST AND AFRICA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE-EAST AND AFRICA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 SOUTH AFRICA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 42 SOUTH AFRICA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 43 SOUTH AFRICA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 44 SOUTH AFRICA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 45 SOUTH AFRICA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 46 SOUTH AFRICA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 SOUTH AFRICA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 48 SOUTH AFRICA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 SOUTH AFRICA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 UAE A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 51 UAE A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 52 UAE A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 53 UAE A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 54 UAE A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 55 UAE BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 UAE A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 57 UAE STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 UAE NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 REST OF MIDDLE EAST AND AFRICA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 MIDDLE EAST & AFRICA A2 MILK MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA A2 MILK MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA A2 MILK MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA A2 MILK MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA A2 MILK MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA A2 MILK MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA A2 MILK MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA A2 MILK MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA A2 MILK MARKET: SEGMENTATION

FIGURE 10 INCREASING APPLICATION OF A2 MILK IN THE FOOD INDUSTRY IS EXPECTED TO DRIVE THE GROWTH OF THE MIDDLE EAST & AFRICA A2 MILK MARKET IN THE FORECAST PERIOD

FIGURE 11 LIQUID SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA A2 MILK MARKET IN 2022 & 2029

FIGURE 12 SUPPLY CHAIN OF THE MIDDLE EAST & AFRICA A2 MILK MARKET

FIGURE 13 VALUE CHAIN OF A2 MILK

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA A2 MILK MARKET

FIGURE 15 MIDDLE EAST & AFRICA A2 MILK MARKET: BY FORM, 2021

FIGURE 16 MIDDLE EAST & AFRICA A2 MILK MARKET: BY NATURE, 2021

FIGURE 17 MIDDLE EAST & AFRICA A2 MILK MARKET: BY FAT CONTENT, 2021

FIGURE 18 MIDDLE EAST & AFRICA A2 MILK MARKET: BY PACKAGING SIZE, 2021

FIGURE 19 MIDDLE EAST & AFRICA A2 MILK MARKET: BY PACKAGING FORM, 2021

FIGURE 20 MIDDLE EAST & AFRICA A2 MILK MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 21 MIDDLE EAST AND AFRICA A2 MILK MARKET: SNAPSHOT (2021)

FIGURE 22 MIDDLE EAST AND AFRICA A2 MILK MARKET: BY COUNTRY (2021)

FIGURE 23 MIDDLE EAST AND AFRICA A2 MILK MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 MIDDLE EAST AND AFRICA A2 MILK MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 MIDDLE EAST AND AFRICA A2 MILK MARKET: BY FORM (2022 & 2029)

FIGURE 26 MIDDLE EAST & AFRICA A2 MILK MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.