Middle East Africa Polyurethane Foam Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

2.20 Billion

USD

3.37 Billion

2024

2032

USD

2.20 Billion

USD

3.37 Billion

2024

2032

| 2025 –2032 | |

| USD 2.20 Billion | |

| USD 3.37 Billion | |

|

|

|

Segmentación del mercado de espuma de poliuretano en Oriente Medio y África, por producto (espuma flexible, espuma rígida y espuma en aerosol), categoría (celda abierta y celda cerrada), composición por densidad (composición de baja densidad, composición de densidad media y composición de alta densidad), proceso (espuma moldeada, espuma en losas, pulverización y laminación), usuario final (ropa de cama y muebles, construcción y edificación, automoción, electrónica, embalaje, calzado y otros): tendencias de la industria y pronóstico hasta 2032.

Análisis del mercado de espuma de poliuretano

El mercado de la espuma de poliuretano experimenta un crecimiento constante, impulsado por la creciente demanda de sectores como la construcción, la automoción y el mueble, gracias a sus excelentes propiedades de aislamiento y amortiguación. El mercado se divide, a grandes rasgos, en espumas rígidas y flexibles. Las espumas rígidas se están adoptando con fuerza en aplicaciones de aislamiento, mientras que las flexibles se utilizan ampliamente en ropa de cama y muebles. La creciente preocupación por la sostenibilidad y las regulaciones ambientales están impulsando el desarrollo de alternativas de origen biológico y bajas emisiones. La región de Asia-Pacífico lidera el mercado, impulsada por la rápida urbanización, la expansión de la infraestructura y el crecimiento industrial. Además, las innovaciones en soluciones de espuma ligeras y energéticamente eficientes siguen moldeando el futuro de la industria.

Tamaño del mercado de espuma de poliuretano

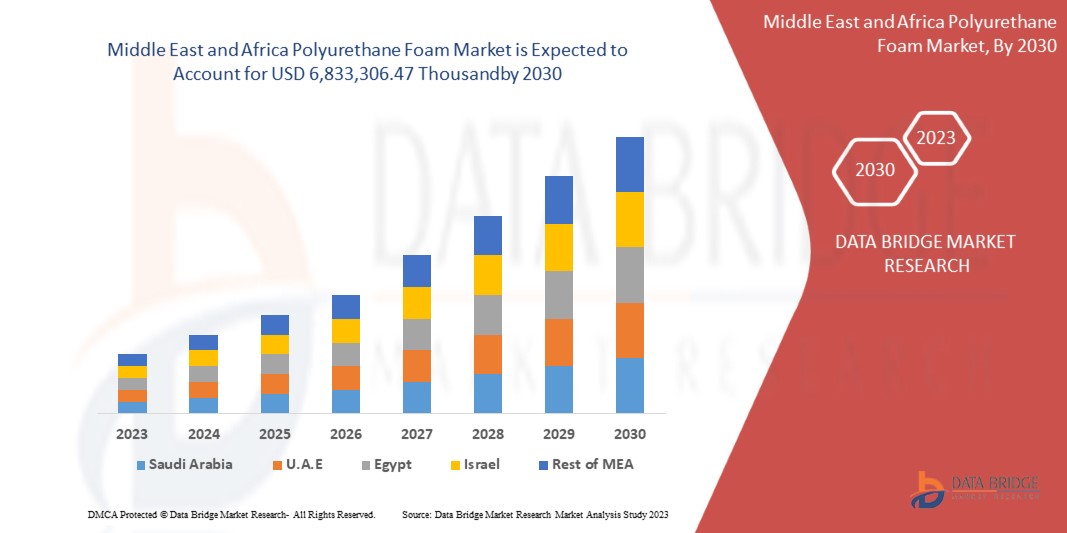

Se espera que el mercado de espuma de poliuretano de Oriente Medio y África alcance los 3.370 millones de dólares en 2032, desde los 2.200 millones de dólares en 2024, con un crecimiento anual compuesto (CAGR) sustancial del 5,6 % durante el período de pronóstico de 2025 a 2032. Además de la información sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis Porter y marco regulatorio.

Tendencias del mercado de la espuma de poliuretano

Perspectivas positivas para el sector de la construcción

La industria de la construcción puede ser un importante impulsor de la expansión del mercado de la espuma de poliuretano. Las actividades relacionadas con la construcción están en auge gracias a la inversión extranjera directa en las economías emergentes. El cemento, la madera, el vidrio, los metales y la arcilla son algunos de los materiales más comunes en la industria de la construcción. El poliuretano se utiliza en la construcción para crear productos de alto rendimiento, resistentes pero ligeros, funcionales, duraderos y adaptables. La espuma de poliuretano es un producto químico flexible que se utiliza en numerosas aplicaciones típicas de la construcción, como la unión, el relleno, el sellado y el aislamiento. Su alta capacidad de aislamiento térmico y acústico la convierte en un producto ideal para el aislamiento de tuberías de agua, la unión y el sellado de techos y paredes, y, sobre todo, la instalación de marcos de ventanas y puertas. Este crecimiento de las actividades relacionadas con la construcción y la amplia aplicación de la espuma de poliuretano en la industria de la construcción han impulsado el crecimiento del mercado de la espuma de poliuretano.

Alcance del informe y segmentación del mercado de espuma de poliuretano

|

Atributos |

Perspectivas del mercado de la espuma de poliuretano |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Egipto, Israel y el resto de Oriente Medio y África |

|

Actores clave del mercado |

Henkel AG & Co. KGaA (Alemania), Saint-Gobain (Francia), Huntsman International LLC (EE. UU.), BASF (Alemania), INOAC CORPORATION (Japón), Dow (EE. UU.), SEKISUI CHEMICAL CO., LTD. (Japón), Sunpreeth Engineers (India), Recticel NV/SA (Bélgica), Sheela Foam Ltd. (India), Eurofoam Srl (Italia), Rogers Corporation (EE. UU.), UFP Technologies, Inc. (EE. UU.), General Plastics Manufacturing Company, Inc. (EE. UU.), Meenakshi Polymers Pvt. Ltd. (India), Foamcraft Inc. (EE. UU.), ALSTONE INDUSTRIES PVT. LTD. (India), Wisconsin Foam Products (EE. UU.), Tirupati Foam Ltd (India). |

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis de consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Definición del mercado de espuma de poliuretano

La espuma de poliuretano es un polímero que se obtiene mediante la reacción de diisocianato y poliol. Generalmente, se la conoce como espuma de PU o espuma de PUR. Proporciona aislamiento y protección a los materiales contra la corrosión externa. El tipo de reactivo o catalizador utilizado con isocianato en la producción de espuma de poliuretano depende de su aplicación. Existen tres tipos de espuma de poliuretano: rígida, flexible y en aerosol.

Dinámica del mercado de la espuma de poliuretano

Conductores

- Creciente aceptación en el sector automotriz y de aviación

La espuma de poliuretano es un material polimérico con alta resistencia a la tracción, bajo peso, resistencia química, procesabilidad y características mecánicas que se ha utilizado en diversas aplicaciones. Debido a sus propiedades distintivas, ha aumentado la demanda de materiales ligeros y de alto rendimiento en las industrias aeroespacial y automotriz. En la industria automotriz, la espuma desempeña un papel fundamental, ya que contribuye significativamente a la seguridad y comodidad de los pasajeros, desde los asientos hasta las bases de las alfombras. La espuma de poliuretano se utiliza en la industria automotriz para molduras, asientos, reposacabezas, aislamiento acústico y filtros de aire acondicionado. Esto se debe a que la espuma es un material que ofrece una amplia gama de propiedades, como el bloqueo de vibraciones, la absorción acústica y el aislamiento. Tanto las espumas de celda abierta como las de celda cerrada se pueden utilizar en la amortiguación y los asientos de los automóviles modernos. La espuma de poliuretano en los automóviles actuales ofrece a los vehículos un mayor kilometraje gracias a su durabilidad y extrema ligereza, lo que reduce aún más el peso total del vehículo. Como resultado, se mejora la eficiencia del combustible y se reduce el impacto ambiental. Estas aplicaciones de alto nivel en el sector automotriz impulsarán el crecimiento del mercado de la espuma de poliuretano.

Las aplicaciones de la espuma de poliuretano en la industria aeroespacial son muy diversas. Se utiliza en piezas estructurales como paredes de cabinas de pasajeros, secciones de equipaje, techos, elementos de baños, almohadillas de cabina de vuelo y separadores de clases y secciones. La espuma puede proteger la aeronave y a los pasajeros de fluctuaciones excesivas de temperatura. La densidad de la espuma aeroespacial también ayuda a prevenir fugas de aire dentro y fuera de la aeronave, preservando así la presión de la cabina. También puede servir como barrera acústica que protege a los pasajeros de los altos niveles de decibelios de los motores de los aviones. Por ejemplo, en junio de 2022, según un artículo publicado por Linden Industries, LLC, la espuma de poliuretano se utiliza ampliamente en interiores de automóviles por sus propiedades de amortiguación, durabilidad y reducción de ruido. Mejora la comodidad y el soporte en asientos y reposacabezas, a la vez que proporciona absorción de impactos. Los tableros y paneles de las puertas la utilizan para aislar y minimizar el ruido de la carretera. Su durabilidad garantiza una larga vida útil incluso con un uso frecuente. Esencial para mejorar la seguridad y la experiencia de los pasajeros, sigue siendo un material clave en la construcción de vehículos.

- Creciente demanda de diversas aplicaciones de decoración del hogar

El mobiliario del hogar se compone de objetos que se colocan en una habitación para hacerla más cómoda y agradable. Esto incluye cualquier elemento móvil, como muebles, cortinas, alfombras y artículos de decoración, que complementan el diseño de la habitación. Las espumas de poliuretano se utilizan ampliamente en la decoración del hogar debido a sus características únicas, como su baja densidad, sus altas propiedades mecánicas y su baja conductividad térmica. Las espumas de poliuretano son materiales porosos y ligeros con un rendimiento prometedor. Estos materiales también se utilizan en aplicaciones finales como cojines para muebles como sofás y sillas, lo que impulsa el crecimiento del mercado de la espuma de poliuretano.

Factores como el aumento de la población, la creciente urbanización, la preferencia por colchones de calidad y la mejora de la infraestructura institucional impulsan las ventas de colchones en los segmentos inmobiliario y hotelero. La espuma flexible de poliuretano tiene una estructura celular que permite cierta compresión y resiliencia, lo que proporciona un efecto amortiguador. Esta característica se utiliza ampliamente en muebles, colchones, almohadas y alfombras. El crecimiento de sectores como la vivienda, la hostelería y el ferrocarril también es un factor para el crecimiento del mercado de colchones de espuma de poliuretano. Por ejemplo, Según la ISPF, la investigación fue realizada por la Federación India de Productos para el Sueño. En India, el mercado general de colchones rondaba los 18,6 millones de unidades, con una nueva demanda prevista de colchones de 7 millones de unidades al año. Además, el ciclo promedio de reemplazo de colchones era de 12 años y la demanda de reemplazo de colchones era de 11,6 millones de unidades. El estudio también reveló que el canal de muebles es esencial para la nueva demanda, representando el 50% de las ventas totales de colchones. Además, los colchones a base de espuma representaron el 52,6% de las ventas totales, mientras que los colchones a base de muelles representaron el 13,5 por ciento y los colchones a base de fibra de coco el 34 por ciento.

Oportunidades

- Perspectivas lucrativas para las espumas respetuosas con el medio ambiente

Las espumas de poliuretano se han convertido en uno de los materiales más esenciales de la industria, ya que se encuentran entre los polímeros más adaptables. Se emplean en la industria automotriz para asientos, tapicería y parachoques; en muebles como material de relleno para cojines, sofás y colchones; en el sector del embalaje; en la construcción para aislamiento térmico y acústico; entre otras aplicaciones. Además de su baja densidad, baja conductividad térmica y excelentes características mecánicas, una de las principales ventajas de las espumas de poliuretano es la capacidad de ajustar su densidad y rigidez a los requisitos del mercado.

Sin embargo, este polímero se basa principalmente en el petróleo. La preocupación por el medio ambiente exige que los poliuretanos se fabriquen de forma más sostenible, mediante el uso de materias primas renovables o el reciclaje de las espumas de poliuretano. El cambio en el comportamiento del consumidor hacia el uso de materiales sostenibles, las estrictas normas y regulaciones gubernamentales y las medidas de los fabricantes para reducir el uso de materias primas derivadas del petróleo en la producción de espumas son algunos de los factores que han impulsado la perspectiva positiva hacia las espumas ecológicas. Estas medidas conducirán al desarrollo de espumas de poliuretano biodegradables y respetuosas con el medio ambiente. Los fabricantes también están colaborando con otras empresas y desarrollando instalaciones para el reciclaje de espuma de poliuretano. Por ejemplo, en septiembre de 2023, según un artículo publicado por Crain Communications, Inc., Covestro colaboró con Selena Group para desarrollar espumas de poliuretano (PU) sostenibles para el aislamiento de edificios. Utilizó el MDI de origen biológico de Covestro en una espuma Ultra-Fast 70 mejorada, reduciendo su huella de carbono en un 60 %. La espuma se curó en 90 minutos y ofreció un rendimiento de 70 litros por contenedor. Igualó la calidad de las espumas de origen fósil y facilitó una integración perfecta. Selena incluyó polioles de origen biológico y materiales de PET reciclado en su gama de espumas.

- Políticas gubernamentales de apoyo a la inversión en los mercados nacionales

El aumento de la renta disponible, la rápida urbanización, la diversidad de aplicaciones industriales, el alto consumo, el aumento de la inversión extranjera directa y el prometedor potencial de exportación son algunos de los factores que impulsan el crecimiento de la industria química en economías en desarrollo como India y China. Las diversas oportunidades emergentes para la fabricación de productos químicos especializados y polímeros generarán una enorme demanda interna. Los países en desarrollo serán autosuficientes en la producción de materias primas y del producto final. Además, la inversión de países desarrollados o la instalación de plantas químicas en economías emergentes puede ofrecer una amplia oportunidad para el crecimiento del mercado de espuma de poliuretano en Oriente Medio y África.

La espuma de poliuretano tiene aplicaciones en diversas industrias, como la automotriz, la del mueble, la construcción, el embalaje, la textil y el calzado, entre otras. El crecimiento del mercado en estas industrias impulsará aún más la economía de los países en desarrollo. Las actividades de investigación y desarrollo, los avances tecnológicos, el aumento de la demanda de las industrias de consumo final y las políticas y marcos favorables han influido en el crecimiento de la industria química en dichos países. Por ejemplo, en septiembre de 2022, según Arab News, con una inversión total de 1,1 billones de dólares en proyectos de infraestructura e inmobiliarios desde el anuncio de la Visión 2030 de Arabia Saudita en 2016, el país está en camino de convertirse en el mayor sitio de construcción del mundo. Arabia Saudita se convertirá fácilmente en el mayor sitio de construcción del mundo, con más de 555.000 unidades residenciales, más de 275.000 habitaciones de hotel, más de 4,3 millones de metros cuadrados de espacio comercial y más de 6,1 millones de metros cuadrados de espacio de oficinas planificados para el reino. Una infraestructura de tal envergadura propiciará el uso generalizado de espuma de poliuretano en el sector de la construcción en los próximos años.

Restricciones/Desafíos

- Uso de sustancias químicas nocivas en la producción de espuma de poliuretano

Las espumas de poliuretano se utilizan en diversas aplicaciones, desde muebles hasta aislamientos. Sin embargo, el uso de diversos productos químicos en su producción plantea riesgos ambientales y de salud para los trabajadores involucrados. El poliuretano es un producto de la polimerización entre diversos polioles y diisocianatos derivados del petróleo crudo. En el proceso intervienen diversos agentes de expansión, curativos, retardantes de llama, surfactantes y catalizadores. Los polioles más utilizados son el polietilenglicol, el polipropilenglicol y el politetrametilenglicol. Asimismo, el diisocianato de tolueno (TDI) y el diisocianato de metileno difenilo (MDI) son diisocianatos de uso común. Por ejemplo, en marzo de 2023, según la Agencia de Protección Ambiental de Estados Unidos (EPA), se afirma que diisocianatos como el MDI y el TDI causan asma, daño pulmonar e incluso la muerte, en algunos casos, a los trabajadores involucrados. La EPA ha diseñado un plan de acción para su control en las unidades de trabajo. Se dice que la liberación de compuestos orgánicos volátiles en el proceso de producción crea preocupaciones ambientales.

- Volatilidad en los precios de las materias primas

El proceso de fabricación en cualquier sector depende del precio de las materias primas. Cuanto mayor sea la volatilidad del precio de las materias primas, mayor será la probabilidad de fluctuación en el coste del producto y el crecimiento del mercado.

Las principales materias primas para la producción de espuma de poliuretano son los polioles y diisocianatos derivados del petróleo crudo. Diversos factores, como el clima, la cadena de suministro, la demanda, la disponibilidad, las limitaciones y la situación económica del país, determinan el precio de estas materias primas. Por ejemplo, en noviembre de 2024, según un artículo publicado por Polymerupdate, las empresas procesadoras de petróleo experimentaron una importante caída de la rentabilidad en el tercer trimestre de 2024 debido a los bajos márgenes de refinación, con un GRM que descendió a USD 1,3 por barril en septiembre de 2024, el nivel más bajo desde el pico de la COVID-19. Esto se debió a los bajos precios del petróleo crudo, la mayor disponibilidad de crudo ruso y la escasa demanda, especialmente de China. El crecimiento económico de Oriente Medio y África se mantuvo estable en el 3,1 % en 2024, con riesgos a la baja derivados de las tensiones geopolíticas y del sector inmobiliario chino. También se vio afectado por la reducción de la demanda de combustibles derivados del petróleo en Asia y Europa debido a la adopción de vehículos eléctricos, biocombustibles y GNL. La nueva capacidad de refinación presionó aún más los márgenes.

Impacto y situación actual del mercado ante la escasez de materias primas y retrasos en los envíos

Data Bridge Market Research ofrece un análisis de alto nivel del mercado y brinda información teniendo en cuenta el impacto y el entorno actual del mercado en relación con la escasez de materias primas y los retrasos en los envíos. Esto se traduce en la evaluación de posibilidades estratégicas, la creación de planes de acción efectivos y la asistencia a las empresas para tomar decisiones importantes.

Además del informe estándar, también ofrecemos un análisis en profundidad del nivel de adquisiciones a partir de retrasos de envío previstos, mapeo de distribuidores por región, análisis de productos básicos, análisis de producción, tendencias de mapeo de precios, abastecimiento, análisis del desempeño de categorías, soluciones de gestión de riesgos de la cadena de suministro, evaluación comparativa avanzada y otros servicios para adquisiciones y soporte estratégico.

Impacto esperado de la desaceleración económica en los precios y la disponibilidad de los productos

Cuando la actividad económica se desacelera, las industrias comienzan a sufrir. Los efectos previstos de la crisis económica sobre los precios y la accesibilidad de los productos se tienen en cuenta en los informes de conocimiento del mercado y los servicios de inteligencia que ofrece DBMR. Con esto, nuestros clientes pueden normalmente mantenerse un paso por delante de sus competidores, proyectar sus ventas e ingresos y estimar sus gastos de ganancias y pérdidas.

Alcance del mercado de la espuma de poliuretano

El mercado está segmentado por producto, categoría, composición de densidad, proceso y usuario final. El crecimiento de estos segmentos le permitirá analizar segmentos de crecimiento reducido en las industrias y brindar a los usuarios una valiosa visión general del mercado y perspectivas que les ayudarán a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Producto

- Espuma flexible

- Espuma rígida

- Espuma en aerosol

Categoría

- Celda abierta

- Celda cerrada

Composición de densidad

- Composición de baja densidad

- Composición de densidad media

- Composición de alta densidad

Proceso

- Espuma moldeada

- Espuma en losas

- Pulverización

- Laminación

Usuario final

- Ropa de cama y muebles

- Construcción y edificación

- Automotor

- Electrónica

- Embalaje

- Calzado

- Otros

Análisis regional del mercado de espuma de poliuretano

Se analiza el mercado y se proporcionan información sobre el tamaño del mercado y las tendencias por producto, categoría, composición de densidad, proceso y usuario final como se menciona anteriormente.

Los países cubiertos en el mercado son Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Egipto, Israel y el resto de Medio Oriente y África.

Se espera que Sudáfrica domine el mercado del poliuretano en Oriente Medio y África gracias a sus desarrolladas industrias de la construcción, la automoción y el mueble. El país cuenta con una sólida base manufacturera, respaldada por una creciente demanda de materiales duraderos y energéticamente eficientes. Además, la presencia de importantes productores de poliuretano y el acceso a materias primas consolidan aún más el liderazgo de Sudáfrica en la región.

Se prevé que Sudáfrica sea uno de los mercados con mayor crecimiento debido a la rápida urbanización, el desarrollo de infraestructura y la creciente demanda de materiales de alto rendimiento en diversas industrias. Las iniciativas gubernamentales que promueven el crecimiento industrial y la inversión extranjera en el sector manufacturero también contribuyen a la expansión del mercado del poliuretano en el país.

La sección de países del informe también presenta los factores que impactan el mercado individual y los cambios en la regulación del mercado nacional, los cuales impactan las tendencias actuales y futuras. Datos como el análisis de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de caso son algunos de los indicadores utilizados para pronosticar el escenario del mercado en cada país. Asimismo, se considera la presencia y disponibilidad de marcas de Oriente Medio y África, así como los desafíos que enfrentan debido a la alta o escasa competencia de marcas locales y nacionales, el impacto de los aranceles internos y las rutas comerciales, al proporcionar un análisis de pronóstico de los datos del país.

Cuota de mercado de la espuma de poliuretano

El panorama competitivo del mercado proporciona detalles por competidores. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia en Oriente Medio y África, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de las aplicaciones. Los datos anteriores se refieren únicamente al enfoque de mercado de las empresas.

Los líderes del mercado de espuma de poliuretano que operan en el mercado son:

- Henkel AG & Co. KGaA (Alemania)

- Saint-Gobain (Francia)

- Huntsman International LLC (EE. UU.)

- BASF (Alemania)

- INOAC CORPORATION (Japón)

- Dow (EE.UU.)

- SEKISUI CHEMICAL CO., LTD. (Japón)

- Ingenieros Sunpreeth (India)

- Recticel NV/SA (Bélgica)

- Sheela Foam Ltd. (India)

- Eurofoam Srl (Italia)

- Rogers Corporation (EE. UU.)

- UFP Technologies, Inc. (EE. UU.)

- General Plastics Manufacturing Company, Inc. (EE. UU.)

- Meenakshi Polymers Pvt. Ltd. (India)

- Foamcraft Inc. (EE. UU.)

- ALSTONE INDUSTRIAS PVT. LTD. (India)

- Productos de espuma de Wisconsin (EE. UU.)

- Tirupati Foam Ltd (India)

Últimos avances en el mercado de espuma de poliuretano:

- En septiembre de 2022, Saint-Gobain recibió todas las aprobaciones necesarias de las autoridades competentes para la adquisición de GCP Applied Technologies Inc. (una empresa líder en productos químicos para la construcción en Oriente Medio y África). Esta adquisición consolida el reconocimiento de la empresa en el sector de los productos químicos para la construcción.

- En mayo de 2020, Huntsman Corporation anunció el cambio de nombre de su negocio líder mundial de espuma de poliuretano en aerosol a Huntsman Building Solutions. Huntsman Building Solutions es una plataforma global de la división de Poliuretanos de Huntsman. Este cambio de nombre ayudó a la empresa a expandir su negocio en el sector de la espuma de poliuretano.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS:

4.1.2 ECONOMIC FACTORS:

4.1.3 SOCIAL FACTORS:

4.1.4 TECHNOLOGICAL FACTORS:

4.1.5 LEGAL FACTORS:

4.1.6 ENVIRONMENTAL FACTORS:

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT'S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 OVERVIEW

4.4.2 LOGISTIC COST SCENARIO

4.4.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.5 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.6 VENDOR SELECTION CRITERIA

4.6.1 RAW MATERIAL COVERAGE

4.7 PRICING ANALYSIS

4.8 PRODUCTION CONSUMPTION ANALYSIS

4.9 PRODUCTION CAPACITY ANALYSIS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 POSITIVE OUTLOOK TOWARD THE CONSTRUCTION SECTOR

6.1.2 GROWING ACCEPTANCE IN THE AUTOMOTIVE AND AVIATION SECTOR

6.1.3 RISING DEMAND FOR VARIOUS HOME FURNISHING APPLICATIONS

6.1.4 INCREASING DEMAND FOR PROTECTIVE PACKAGING

6.1.5 RISING ADOPTION OF POLYURETHANE FOAMS IN THE TEXTILE AND FOOTWEAR INDUSTRY

6.2 RESTRAINTS

6.2.1 ENVIRONMENTAL AND HEALTH HAZARDS ASSOCIATED WITH THE USAGE OF POLYURETHANE FOAM

6.2.2 AVAILABILITY OF SUBSTITUTES IN MARKET

6.3 OPPORTUNITIES

6.3.1 LUCRATIVE OUTLOOK TOWARDS ENVIRONMENTALLY FRIENDLY FOAMS

6.3.2 SUPPORTIVE GOVERNMENT POLICIES REGARDING INVESTMENT IN DOMESTIC MARKETS, INCLUDING CHINA AND INDIA

6.4 CHALLENGES

6.4.1 HARMFUL CHEMICAL USAGE IN POLYURETHANE FOAM PRODUCTION

6.4.2 VOLATILITY IN RAW MATERIAL PRICES

6.4.3 STRINGENT RULES AND REGULATIONS FOR POLYURETHANE FOAMS

7 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 FLEXIBLE FOAM

7.3 RIGID FOAM

7.4 SPRAY FOAM

8 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY CATEGORY

8.1 OVERVIEW

8.2 OPEN CELL

8.3 CLOSED CELL

9 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION

9.1 OVERVIEW

9.2 LOW-DENSITY COMPOSITION

9.3 MEDIUM-DENSITY COMPOSITION

9.4 HIGH-DENSITY COMPOSITION

10 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY PROCESS

10.1 OVERVIEW

10.2 MOLDED FOAM

10.3 SLABSTOCK FOAM

10.4 SPRAYING

10.5 LAMINATION

11 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY END-USER

11.1 OVERVIEW

11.2 BEDDING & FURNITURE

11.3 BUILDING & CONSTRUCTION

11.4 AUTOMOTIVE

11.5 ELECTRONICS

11.6 PACKAGING

11.7 FOOTWEAR

11.8 OTHERS

12 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SOUTH AFRICA

12.1.2 SAUDI ARABIA

12.1.3 UNITED ARAB EMIRATES

12.1.4 EGYPT

12.1.5 QATAR

12.1.6 OMAN

12.1.7 KUWAIT

12.1.8 BAHRAIN

12.1.9 REST OF MIDDLE EAST & AFRICA

13 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 COMPANY PROFILES

14.1 HENKEL AG & CO. KGAA

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 SWOT ANALYSIS

14.1.4 COMPANY SHARE ANALYSIS

14.1.5 PRODUCT PORTFOLIO

14.1.6 RECENT DEVELOPMENTS

14.2 SAINT-GOBAIN

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 SWOT ANALYSIS

14.2.6 RECENT DEVELOPMENT

14.3 HUNTSMAN INTERNATIONAL LLC

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 SWOT ANALYSIS

14.3.5 PRODUCT PORTFOLIO

14.3.6 RECENT DEVELOPMENTS

14.4 BASF

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 SWOT ANALYSIS

14.4.6 RECENT DEVELOPMENT

14.5 INOAC CORPORATION

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 SWOT ANALYSIS

14.5.5 RECENT DEVELOPMENT

14.6 ALSTONE INDUSTRIES PVT. LTD.

14.6.1 COMPANY SNAPSHOT

14.6.2 SWOT ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 DOW

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.8 EUROFOAM S.R.L.

14.8.1 COMPANY SNAPSHOT

14.8.2 SWOT ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 FOAMCRAFT, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 SWOT ANALYSIS

14.9.4 RECENT DEVELOPMENTS

14.1 GENERAL PLASTICS MANUFACTURING COMPANY, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 SWOT ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 MEENAKSHI POLYMERS PVT. LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 SWOT ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 RECTICEL NV/SA

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 SWOT ANALYSIS

14.12.4 PRODUCT PORTFOLIO

14.12.5 RECENT DEVELOPMENT

14.13 ROGERS CORPORATION

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 REVENUE ANALYSIS

14.13.4 SWOT ANALYSIS

14.13.5 RECENT DEVELOPMENTS

14.14 SEKISUI CHEMICAL CO., LTD.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 SWOT ANALYSIS

14.14.5 RECENT DEVELOPMENT

14.15 SHEELA FOAM LTD.

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 SWOT ANALYSIS

14.15.4 PRODUCT PORTFOLIO

14.15.5 RECENT DEVELOPMENTS

14.16 SUNPREETH ENGINEERS

14.16.1 COMPANY SNAPSHOT

14.16.2 SWOT ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 TIRUPATI FOAM LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 SWOT ANALYSIS

14.17.4 PRODUCT PORTFOLIO

14.17.5 RECENT DEVELOPMENTS

14.18 UFP TECHNOLOGIES, INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 SWOT ANALYSIS

14.18.5 RECENT DEVELOPMENT

14.19 WISCONSIN FOAM PRODUCTS

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 SWOT ANALYSIS

14.19.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 REGULATORY COVERAGE

TABLE 2 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY PRODUCT, 2018-2032 (TONS)

TABLE 4 MIDDLE EAST AND AFRICA FLEXIBLE FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA FLEXIBLE FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 6 MIDDLE EAST AND AFRICA RIGID FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA RIGID FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 8 MIDDLE EAST AND AFRICA SPRAY FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA SPRAY FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 10 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY CATEGORY, 2018-2032 (TONS)

TABLE 12 MIDDLE EAST AND AFRICA OPEN CELL IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA OPEN CELL IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 14 MIDDLE EAST AND AFRICA CLOSED CELL IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA CLOSED CELL IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 16 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 18 MIDDLE EAST AND AFRICA LOW-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA LOW-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 20 MIDDLE EAST AND AFRICA MEDIUM-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA MEDIUM-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 22 MIDDLE EAST AND AFRICA HIGH-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA HIGH-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 24 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY PROCESS, 2018-2032 (TONS)

TABLE 26 MIDDLE EAST AND AFRICA MOLDED FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA MOLDED FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 28 MIDDLE EAST AND AFRICA SLABSTOCK FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA SLABSTOCK FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 30 MIDDLE EAST AND AFRICA SPRAYING IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA SPRAYING IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 32 MIDDLE EAST AND AFRICA LAMINATION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA LAMINATION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 34 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY END-USER, 2018-2032 (TONS)

TABLE 36 MIDDLE EAST AND AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 38 MIDDLE EAST AND AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 42 MIDDLE EAST AND AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 46 MIDDLE EAST AND AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 50 MIDDLE EAST AND AFRICA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 53 MIDDLE EAST AND AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 57 MIDDLE EAST AND AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA OTHERS IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA OTHERS IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 61 MIDDLE EAST AND AFRICA OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 64 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 66 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 68 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 69 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 70 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 72 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 73 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 74 MIDDLE EAST & AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 75 MIDDLE EAST & AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 MIDDLE EAST & AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST & AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST & AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 79 MIDDLE EAST & AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST & AFRICA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 MIDDLE EAST & AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 82 MIDDLE EAST & AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST & AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 84 MIDDLE EAST & AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 MIDDLE EAST & AFRICA OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 87 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 88 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 89 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 90 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 91 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 92 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 93 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 94 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 95 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 96 SOUTH AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 97 SOUTH AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 SOUTH AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 99 SOUTH AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 SOUTH AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 101 SOUTH AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 SOUTH AFRICA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 SOUTH AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 104 SOUTH AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 SOUTH AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 106 SOUTH AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 SOUTH AFRICA OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 109 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 110 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 111 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 112 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 113 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 114 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 115 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 116 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 117 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 118 SAUDI ARABIA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 119 SAUDI ARABIA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 SAUDI ARABIA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 121 SAUDI ARABIA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 SAUDI ARABIA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 123 SAUDI ARABIA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 SAUDI ARABIA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 SAUDI ARABIA PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 126 SAUDI ARABIA PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 SAUDI ARABIA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 128 SAUDI ARABIA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 SAUDI ARABIA OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 131 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 132 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 133 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 134 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 135 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 136 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 137 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 138 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 139 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 140 UNITED ARAB EMIRATES BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 141 UNITED ARAB EMIRATES BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 UNITED ARAB EMIRATES BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 143 UNITED ARAB EMIRATES BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 UNITED ARAB EMIRATES AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 145 UNITED ARAB EMIRATES AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 UNITED ARAB EMIRATES ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 UNITED ARAB EMIRATES PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 148 UNITED ARAB EMIRATES PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 UNITED ARAB EMIRATES FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 150 UNITED ARAB EMIRATES FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 UNITED ARAB EMIRATES OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 EGYPT POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 153 EGYPT POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 154 EGYPT POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 155 EGYPT POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 156 EGYPT POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 157 EGYPT POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 158 EGYPT POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 159 EGYPT POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 160 EGYPT POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 161 EGYPT POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 162 EGYPT BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 163 EGYPT BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 EGYPT BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 165 EGYPT BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 EGYPT AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 167 EGYPT AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 EGYPT ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 EGYPT PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 170 EGYPT PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 EGYPT FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 172 EGYPT FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 EGYPT OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 QATAR POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 175 QATAR POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 176 QATAR POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 177 QATAR POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 178 QATAR POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 179 QATAR POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 180 QATAR POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 181 QATAR POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 182 QATAR POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 183 QATAR POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 184 QATAR BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 185 QATAR BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 QATAR BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 187 QATAR BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 QATAR AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 189 QATAR AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 QATAR ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 QATAR PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 192 QATAR PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 QATAR FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 194 QATAR FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 QATAR OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 OMAN POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 197 OMAN POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 198 OMAN POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 199 OMAN POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 200 OMAN POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 201 OMAN POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 202 OMAN POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 203 OMAN POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 204 OMAN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 205 OMAN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 206 OMAN BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 207 OMAN BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 OMAN BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 209 OMAN BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 OMAN AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 211 OMAN AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 OMAN ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 OMAN PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 214 OMAN PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 OMAN FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 216 OMAN FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 OMAN OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 KUWAIT POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 219 KUWAIT POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 220 KUWAIT POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 221 KUWAIT POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 222 KUWAIT POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 223 KUWAIT POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 224 KUWAIT POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 225 KUWAIT POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 226 KUWAIT POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 227 KUWAIT POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 228 KUWAIT BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 229 KUWAIT BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 KUWAIT BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 231 KUWAIT BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 KUWAIT AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 233 KUWAIT AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 KUWAIT ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 KUWAIT PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 236 KUWAIT PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 KUWAIT FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 238 KUWAIT FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 KUWAIT OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 BAHRAIN POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 241 BAHRAIN POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 242 BAHRAIN POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 243 BAHRAIN POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 244 BAHRAIN POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 245 BAHRAIN POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 246 BAHRAIN POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 247 BAHRAIN POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 248 BAHRAIN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 249 BAHRAIN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 250 BAHRAIN BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 251 BAHRAIN BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 BAHRAIN BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 253 BAHRAIN BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 BAHRAIN AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 255 BAHRAIN AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 BAHRAIN ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 BAHRAIN PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 258 BAHRAIN PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 BAHRAIN FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 260 BAHRAIN FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 BAHRAIN OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 REST OF MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 263 REST OF MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

Lista de figuras

FIGURE 1 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET

FIGURE 2 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: SEGMENTATION

FIGURE 13 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET EXECUTIVE SUMMARY

FIGURE 14 THREE SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 A POSITIVE OUTLOOK TOWARDS THE BUILDING AND CONSTRUCTION SECTOR IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET IN THE FORECAST PERIOD

FIGURE 17 THE FLEXIBLE FOAM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET IN 2025 AND 2032

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 ESTIMATED PRODUCTION CONSUMPTION ANALYSIS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET

FIGURE 21 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY PRODUCT, 2024

FIGURE 22 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY CATEGORY, 2024

FIGURE 23 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY DENSITY COMPOSITION, 2024

FIGURE 24 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY PROCESS, 2024

FIGURE 25 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY END-USER, 2024

FIGURE 26 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: SNAPSHOT (2024)

FIGURE 27 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: COMPANY SHARE 2024 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.