Middle East Africa Flow Cytometry Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

79.48 Million

USD

163.04 Million

2024

2032

USD

79.48 Million

USD

163.04 Million

2024

2032

| 2025 –2032 | |

| USD 79.48 Million | |

| USD 163.04 Million | |

|

|

|

|

Segmentación del mercado de citometría de flujo en Oriente Medio y África, por producto (reactivos y consumibles, instrumentos de citometría de flujo, accesorios, servicios y software), tecnología (citometría de flujo basada en células y citometría de flujo basada en microesferas), aplicación (aplicaciones de investigación, aplicaciones clínicas y aplicaciones industriales), usuario final (empresas farmacéuticas y de biotecnología, institutos académicos y de investigación, hospitales, laboratorios de pruebas clínicas, CRO, bancos de sangre, CMO y CDMO, laboratorios forenses y otros), canal de distribución (ventas minoristas y licitaciones directas): tendencias de la industria y pronóstico hasta 2032

Análisis del mercado de citometría de flujo en Oriente Medio y África

La citometría de flujo es una técnica para detectar y cuantificar las propiedades físicas y químicas de una población de células o partículas. Una muestra que contiene células o partículas se suspende en un fluido y se inyecta en el equipo del citómetro de flujo en este proceso. La citometría de flujo es una tecnología bien establecida para identificar células en una solución que se utiliza más comúnmente para evaluar la sangre periférica, la médula ósea y otros fluidos corporales. Las células inmunes se identifican y cuantifican mediante citometría de flujo, que también se utiliza para describir neoplasias hematológicas. La evaluación de células a través de esta técnica tiene un papel clave en el diagnóstico de muchas enfermedades crónicas. Analiza las actividades biológicas dentro de las células, la apoptosis, la necrosis, el ciclo celular, la membrana celular, la proliferación celular y la medición del ADN por célula.

Las principales aplicaciones diagnósticas incluyen procesos hematológicos benignos, cáncer, SIDA, deficiencias inmunológicas, hematología benigna y la detección de estas enfermedades mediante fluorescencia. En este proceso, las células se tiñen con fluoróforos para detectar la luz emitida y producir la intensidad mediante el marcado de proteínas específicas (inmunofenotipado) para diagnosticar leucemias y linfomas.

Tamaño del mercado de citometría de flujo en Oriente Medio y África

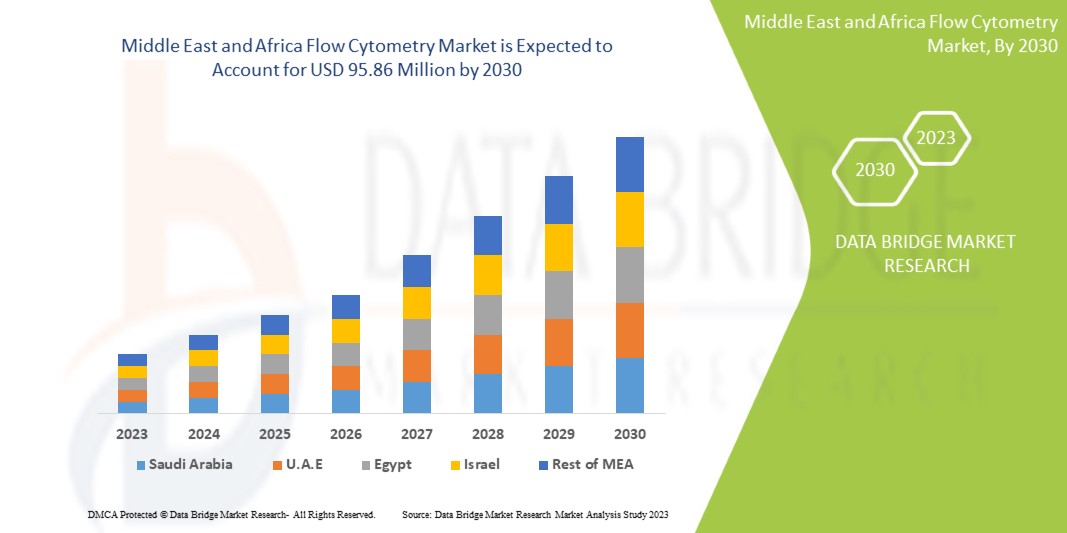

El tamaño del mercado de citometría de flujo de Oriente Medio y África se valoró en USD 79,48 millones en 2024 y se proyecta que alcance los USD 163,04 millones para 2032, con una CAGR del 9,4% durante el período de pronóstico de 2025 a 2032. Además de la información sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas / consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio.

Tendencias del mercado de citometría de flujo en Oriente Medio y África

“Aumento de la adopción de capacidades de análisis multiparamétrico”

Una tendencia importante en el mercado de citometría de flujo de Oriente Medio y África es la creciente adopción de capacidades de análisis de múltiples parámetros, impulsada por los avances tecnológicos que permiten la medición simultánea de numerosos marcadores celulares. Esta tendencia se ve impulsada en gran medida por la creciente demanda de caracterización celular detallada en áreas como la investigación del cáncer, la inmunología y la medicina personalizada, donde es necesario comprender interacciones celulares complejas. Las innovaciones en sistemas láser, detectores y software están haciendo posible analizar más parámetros con mayor sensibilidad y resolución, lo que permite a los investigadores y médicos obtener conocimientos más profundos de los procesos biológicos y mejorar la precisión del diagnóstico. Este cambio hacia sistemas de citometría de flujo más sofisticados está transformando las metodologías de investigación y ampliando la aplicabilidad de la citometría de flujo en varios campos.

Alcance del informe y segmentación del mercado de citometría de flujo en Oriente Medio y África

|

Atributos |

Perspectivas del mercado de citometría de flujo en Oriente Medio y África |

|

Segmentos cubiertos |

|

|

Región cubierta |

EE. UU., Canadá, México, Alemania, Francia, Reino Unido, Italia, España, Rusia, Países Bajos, Suiza, Turquía, Bélgica, Austria, Irlanda, Noruega, Polonia, Resto de Europa, Japón, China, India, Corea del Sur, Australia, Singapur, Tailandia, Malasia, Indonesia, Vietnam, Filipinas, Resto de Asia-Pacífico, Brasil, Argentina, Perú, Resto de Sudamérica, Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Egipto, Kuwait, Israel y Resto de Medio Oriente y África. |

|

Actores clave del mercado |

BD (EE. UU.), Agilent Technologies, Inc. (EE. UU.), Thermo Fisher Scientific Inc. (EE. UU.), Bio-Rad Laboratories, Inc. (EE. UU.), Sartorius AG (Alemania), Bennubio Inc. (EE. UU.), Enzo Biochem Inc. (EE. UU.), Apogee Flow Systems Ltd. (Reino Unido), Beckman Coulter, Inc. (EE. UU.), Coherent Corp. (EE. UU.), Cell Signaling Technology, Inc. (EE. UU.), Cytek Biosciences (EE. UU.), Biomérieux. (Francia), Cytonome/ST LLC (EE. UU.), entre otros.

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis de consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Definición del mercado de citometría de flujo en Oriente Medio y África

El mercado de citometría de flujo de Oriente Medio y África se refiere a la industria que abarca el desarrollo, la producción y la distribución de equipos, reactivos, software y servicios de citometría de flujo utilizados para analizar y clasificar células y otras partículas suspendidas en una corriente de fluido. La citometría de flujo es una técnica poderosa que permite la medición simultánea de múltiples características físicas y químicas de células individuales, como el tamaño, la complejidad y la expresión de proteínas. Esta tecnología se emplea ampliamente en diversas aplicaciones, incluidas la inmunología, la oncología, la microbiología y el desarrollo de fármacos, lo que la convierte en una herramienta esencial tanto en el diagnóstico clínico como en los entornos de investigación.

Dinámica del mercado de citometría de flujo en Oriente Medio y África

Conductores

- Aumento de la prevalencia de enfermedades crónicas

La citometría de flujo es una técnica para detectar y cuantificar las propiedades físicas y químicas de una población de células o partículas. Una muestra que contiene células o partículas se suspende en un fluido y se inyecta en el equipo del citómetro de flujo en este proceso. La citometría de flujo es una tecnología bien establecida para identificar células en una solución que se utiliza más comúnmente para evaluar la sangre periférica, la médula ósea y otros fluidos corporales. Las células inmunes se identifican y cuantifican mediante citometría de flujo, que también se utiliza para describir neoplasias hematológicas. La evaluación de células a través de esta técnica tiene un papel clave en el diagnóstico de muchas enfermedades crónicas. Analiza las actividades biológicas dentro de las células, la apoptosis, la necrosis, el ciclo celular, la membrana celular, la proliferación celular y la medición del ADN por célula.

Las principales aplicaciones diagnósticas incluyen procesos hematológicos benignos, cáncer, SIDA, deficiencias inmunológicas, hematología benigna y la detección de estas enfermedades mediante fluorescencia. En este proceso, las células se tiñen con fluoróforos para detectar la luz emitida y producir la intensidad mediante el marcado de proteínas específicas (inmunofenotipado) para diagnosticar leucemias y linfomas.

La creciente prevalencia de enfermedades crónicas ha creado una demanda creciente de técnicas de citometría de flujo que puedan ayudar a los investigadores y médicos a comprender mejor los mecanismos subyacentes de estas enfermedades y desarrollar tratamientos más efectivos.

- Aumento de la aplicación de instrumentos de citometría

La citometría de flujo es una potente herramienta analítica que se utiliza para analizar y cuantificar células o partículas individuales en una mezcla heterogénea. Utiliza láseres y óptica para detectar y medir células o partículas, como el tamaño, la forma y la intensidad de la fluorescencia. Esta técnica implica el marcado de células o partículas con colorantes fluorescentes o anticuerpos que se unen a marcadores específicos de la superficie celular o moléculas intracelulares. Las células o partículas marcadas se pasan a continuación a través de un citómetro de flujo, que detecta y mide la fluorescencia emitida por cada célula o partícula. La citometría de flujo se utiliza ampliamente en muchos campos de investigación, incluidos la inmunología, la microbiología, la investigación con células madre, la investigación del cáncer, el descubrimiento y desarrollo de fármacos y el diagnóstico clínico. La técnica evoluciona constantemente con nuevas aplicaciones y mejoras de hardware y software, lo que la convierte en una herramienta importante en el estudio de los sistemas biológicos.

Por ejemplo,

- En julio de 2023, según el artículo publicado por NCBI, la creciente aplicación de la citometría de flujo en diversos campos, incluidos la inmunofenotipificación, los ensayos de viabilidad, el análisis del ciclo celular y la identificación de células raras, impulsa el mercado de la citometría de flujo en Oriente Medio y África. Su capacidad para analizar células individuales a nivel de célula única y clasificar poblaciones específicas para la investigación avanzada alimenta la demanda. Esta versatilidad acelera el crecimiento tanto de la investigación académica como clínica, impulsando la expansión del mercado.

- En junio de 2020, según el artículo publicado por la biblioteca en línea de Wiley, la citometría de flujo se puede utilizar para identificar y caracterizar diferentes subconjuntos de células inmunes en pacientes con enfermedades autoinmunes como el lupus eritematoso sistémico (LES). El estudio concluyó que la citometría de flujo podría proporcionar información valiosa sobre la patogenia de estas enfermedades y ayudar a desarrollar terapias más específicas. Esto acelera el crecimiento tanto de la investigación académica como clínica, impulsando la expansión del mercado.

Uso creciente de la citometría de flujo en el descubrimiento de fármacos

- Se prevé que la expansión de las actividades de investigación impulse el crecimiento de la citometría de flujo, que se ha convertido en la clave principal para explorar los procesos de descubrimiento y desarrollo de fármacos. Debido a su capacidad excepcional para analizar poblaciones heterogéneas de células, la citometría de flujo presenta una promesa atractiva para las vías de descubrimiento y desarrollo de fármacos, ya que proporciona información de mayor resolución sobre la información biológica y funcional multiparamétrica de una sola célula. Además, el progreso continuo en los enfoques de citometría de flujo, como el análisis multifactorial de alto rendimiento, las mejoras en la clasificación celular y la detección y resolución rápidas de eventos, garantiza una mayor eficiencia en la búsqueda y caracterización de nuevos medicamentos bioactivos.

- Por ejemplo;-

- En marzo de 2024, según el artículo publicado por NCBI, el uso creciente de la citometría de flujo en el descubrimiento de fármacos, en particular para la modulación de biomarcadores en ensayos clínicos tempranos, impulsará el mercado de la citometría de flujo en Oriente Medio y África. Su capacidad para proporcionar información valiosa sobre la progresión de las moléculas y la traducción inversa de los datos de los pacientes acelera los descubrimientos en el desarrollo terapéutico. Esta creciente aplicación en el descubrimiento de fármacos impulsa la demanda de tecnologías avanzadas de citometría de flujo en los sectores sanitario y farmacéutico.

- En noviembre de 2021, según el artículo publicado por News Medical Life Sciences, el aumento del uso de la citometría de flujo en el descubrimiento de fármacos, desde la identificación de objetivos hasta el desarrollo de productos principales, está impulsando el mercado de Oriente Medio y África. Permite el análisis de diversas estructuras biomoleculares, incluidas las membranas celulares, las proteínas, el ADN y el ARNm, lo que permite una orientación precisa en el desarrollo de fármacos. Esta amplia aplicabilidad en la comprensión de procesos biológicos complejos acelera la demanda de tecnologías de citometría de flujo en la investigación farmacéutica.

Oportunidades

- Aumento de la adopción de técnicas de citometría de flujo en la investigación y el ámbito académico

La citometría de flujo es una técnica sofisticada para medir células individuales y otras partículas en suspensión a una velocidad de miles de células por segundo. La citometría de flujo se ha extendido a las investigaciones ambientales, el análisis de vesículas extracelulares y la capacidad de utilizar más de 30 parámetros diferentes para realizar análisis más exhaustivos. Se utiliza con mayor frecuencia en el ámbito de la inmunología. Los citómetros de flujo proporcionan capacidades excepcionales, datos de alta calidad y una plataforma fácil de usar que ahorra tiempo a los investigadores a la hora de recopilar y evaluar datos.

El aumento de la prevalencia e incidencia de enfermedades crónicas e infecciosas ha abierto amplias oportunidades para una enorme investigación y desarrollo de nuevas aplicaciones diagnósticas y terapéuticas.

Por ejemplo,

- En febrero de 2021, según un estudio publicado en PLOS ONE, los investigadores utilizaron la citometría de flujo para analizar la respuesta inmunitaria de los pacientes con COVID-19. El estudio concluyó que la citometría de flujo era una herramienta fiable y eficaz para caracterizar la respuesta inmunitaria al virus, lo que podría ayudar a orientar las estrategias de tratamiento.

- En abril de 2021, según un estudio publicado en Frontiers in Immunology, los investigadores utilizaron la citometría de flujo para estudiar la respuesta inmunitaria a la infección por VIH. El estudio descubrió que la citometría de flujo era una herramienta eficaz para caracterizar la respuesta inmunitaria al virus, lo que podría conducir al desarrollo de nuevos tratamientos y vacunas.

Creciente desarrollo de las industrias farmacéutica y biotecnológica

Los instrumentos de citometría de flujo se han convertido en una parte integral del descubrimiento y desarrollo de fármacos en las industrias farmacéutica y biotecnológica. El desarrollo de nuevos equipos de citometría de flujo ha ayudado a los investigadores a analizar y clasificar las células de forma más rápida, precisa y eficiente, lo que ha ayudado a acelerar el cronograma de desarrollo de fármacos. Por ejemplo, Beckman Coulter, un fabricante líder de equipos de citometría de flujo, ha desarrollado el citómetro de flujo CytoFLEX LX con detección rápida, sensibilidad mejorada y un tamaño reducido. CytoFLEX LX está diseñado para ayudar a los investigadores a analizar poblaciones de células raras de forma más rápida y eficiente.

En general, el desarrollo de nuevos dispositivos de citometría de flujo está ayudando a las empresas farmacéuticas y biotecnológicas a acelerar los plazos de desarrollo de fármacos al permitir un análisis más rápido y preciso de poblaciones celulares complejas. Con el aumento de la población geriátrica y de los casos de enfermedades crónicas, el crecimiento de las empresas biotecnológicas y farmacéuticas también se está expandiendo. En todo el mundo, las actividades de investigación y desarrollo están aumentando debido al gasto en salud pública con el desempeño económico.

Por ejemplo,

- En octubre de 2024, Ardena anunció una importante expansión de su área de bioanálisis en los Países Bajos. Además, se centró en ampliar sus capacidades en inmunoquímica, citometría de flujo y plataformas de qPCR, aumentando su capacidad de LC-MS/MS y añadiendo nuevos sistemas automatizados Hamilton para mejorar la eficiencia y abordar los desafíos bioanalíticos en constante evolución.

- En abril de 2021, según datos proporcionados por la CBO (Oficina de Presupuesto del Congreso), el sector farmacéutico gastó 83.000 millones de dólares en investigación y desarrollo. Estos costos se incurrieron en diversas operaciones, incluido el descubrimiento y prueba de nuevos medicamentos, el desarrollo de avances incrementales como expansiones de productos y pruebas clínicas para monitoreo de seguridad y comercialización.

Restricciones/Desafíos

- Alto costo de los instrumentos de citometría de flujo

La importante inversión inicial que se requiere para los instrumentos de citometría de flujo, junto con los costos continuos de reactivos, colorantes y mantenimiento, crea barreras financieras, en particular para los laboratorios más pequeños o aquellos en entornos con recursos limitados. Además, la complejidad técnica de la citometría de flujo exige personal capacitado para su funcionamiento, con capacitación especializada necesaria para utilizar adecuadamente la tecnología. Esto limita su accesibilidad en regiones donde falta experiencia, lo que reduce su tasa de adopción. Además, los sistemas de citometría de flujo requieren mantenimiento, calibración y resolución de problemas regulares, lo que aumenta los costos operativos y puede resultar en tiempo de inactividad, lo que afecta aún más la eficiencia del laboratorio. Los estrictos requisitos regulatorios para la aprobación de estos dispositivos médicos también crean demoras en la entrada al mercado y costos de cumplimiento adicionales. Estos factores obstaculizan colectivamente la adopción generalizada de la citometría de flujo, especialmente en los mercados emergentes donde las limitaciones financieras, la falta de profesionales capacitados y los procesos regulatorios lentos actúan como barreras significativas para el crecimiento, lo que en última instancia restringe la expansión potencial del mercado.

Por ejemplo -

- En enero de 2024, según el artículo publicado por Excedr, el alto costo de los instrumentos de citometría de flujo, que oscilan entre 100.000 y 1,5 millones de dólares, actúa como una importante restricción para el mercado de Oriente Medio y África. Estos gastos limitan el acceso a laboratorios e instituciones más pequeños, lo que les dificulta la adopción de tecnología avanzada. Como resultado, los altos costos iniciales de inversión y mantenimiento obstaculizan el uso generalizado y frenan el crecimiento del mercado, especialmente en entornos con recursos limitados.

- En noviembre de 2023, según el artículo publicado por NCBI, el alto costo de los instrumentos de citometría de flujo, que oscilan entre USD 50.000 y USD 750.000 o más, actúa como una restricción significativa en el mercado de Medio Oriente y África. Esta importante inversión financiera requerida para funciones y especificaciones avanzadas limita la accesibilidad, especialmente para laboratorios de investigación más pequeños e instituciones con presupuestos limitados. En consecuencia, el alto costo ralentiza la adopción y obstaculiza el crecimiento del mercado, particularmente en entornos con recursos limitados.

La inversión inicial en instrumentos y los gastos continuos en reactivos y mantenimiento generan desafíos financieros para los laboratorios más pequeños y aquellos que se encuentran en áreas con recursos limitados. La complejidad de la tecnología también requiere personal capacitado, lo que limita su uso en regiones que carecen de experiencia. Además, la necesidad de mantenimiento y calibración regulares aumenta los costos operativos y provoca posibles tiempos de inactividad. Los estrictos requisitos regulatorios retrasan aún más la aprobación del producto y la entrada al mercado. Estos factores limitan la adopción de la citometría de flujo, especialmente en los mercados emergentes, lo que restringe el crecimiento general del mercado.

- Limitaciones de la citometría de flujo

La citometría de flujo tiene limitaciones inherentes, como su incapacidad para analizar tejidos fijados con formalina, lo que restringe su uso en ciertas aplicaciones clínicas y de investigación. El método está diseñado para muestras frescas o congeladas, y la fijación con formalina puede alterar la estructura celular y la expresión de marcadores, volviéndolas inadecuadas para el análisis. Además, la citometría de flujo tiene dificultades para capturar por completo interacciones celulares complejas o vías de señalización de múltiples capas. Estas restricciones limitan el alcance de su uso en varios campos y actúan como una restricción en el mercado de citometría de flujo de Oriente Medio y África al limitar su aplicabilidad, particularmente en entornos clínicos y patológicos.

Por ejemplo-

- En junio de 2021, según el artículo publicado por LearnHaem, la citometría de flujo requiere que las muestras frescas se procesen inmediatamente después de la recolección, ya que el almacenamiento inadecuado o prolongado conduce a la apoptosis natural, lo que disminuye la precisión de los resultados. Además, la citometría de flujo no se puede utilizar en tejidos fijados con formalina, lo que limita su aplicación en ciertos entornos clínicos y de investigación. Estas limitaciones actúan como una restricción en el mercado de citometría de flujo de Oriente Medio y África al reducir su versatilidad y aplicabilidad en algunas áreas.

- En marzo de 2020, según el artículo publicado por NCBI, la citometría de flujo enfrentaba limitaciones debido al desenfoque óptico causado por el alto movimiento celular, que afecta la claridad de la imagen. Además, la detección de objetos raros y atípicos, como las células tumorales circulantes (CTC), plantea un desafío a pesar de su importancia pronóstica. Estos problemas limitan la capacidad de capturar y analizar con precisión biomarcadores críticos, lo que restringe el crecimiento y la aplicación de la citometría de flujo en ciertas áreas de diagnóstico e investigación.

La citometría de flujo enfrenta limitaciones, como su incapacidad para analizar tejidos fijados con formalina, que se utilizan comúnmente en patología y diagnósticos clínicos. El proceso requiere muestras frescas o congeladas, y el proceso de fijación química altera los marcadores celulares, volviéndolos incompatibles con el análisis citométrico de flujo. Además, la técnica tiene dificultades para capturar por completo interacciones celulares intrincadas o vías de señalización complejas. Estas limitaciones restringen la aplicación más amplia de la tecnología, actuando como una restricción en el mercado de citometría de flujo de Oriente Medio y África al reducir su versatilidad en entornos clínicos y de investigación.

Alcance del mercado de citometría de flujo en Oriente Medio y África

El mercado está segmentado en función del producto, la aplicación, la tecnología, el canal de distribución y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Producto

- Reactivos y consumibles

- Teñir

- Anticuerpos

- Rosario

- Otros

- Instrumentos de citometría de flujo

- Analizadores de células

- Por tipo

- Citómetros de flujo para obtención de imágenes

- Citómetros de flujo sin formación de imágenes

- Por rango

- Analizadores de células de alto rango

- Analizadores de células de gama media

- Analizadores de células de bajo rango

- Por modalidad

- Mesa de trabajo

- Autónomo

- Por tipo

- Clasificadores de células

- Por modalidad

- Mesa de trabajo

- Autónomo

- Por rango

- Analizadores de células de alto rango

- Analizadores de células de gama media

- Analizadores de células de bajo rango

- Por modalidad

- Analizadores de células

- Accesorios

- Filtros

- Detectores

- Otros

- Servicios

- Software

Tecnología

- Citometría de flujo basada en células

- Instrumentos de citometría de flujo

- Reactivos y consumibles

- Accesorios

- Citometría de flujo basada en microesferas

- Instrumentos de citometría de flujo

- Reactivos y consumibles

- Accesorios

Solicitud

- Aplicaciones de investigación

- Análisis del ciclo celular

- Clasificación/cribado de células

- Transfección/viabilidad celular

- Farmacéutica y biotecnología

- Descubrimiento de fármacos

- Investigación con células madre

- Pruebas de toxicidad in vitro

- Inmunología

- Apoptosis

- Conteo de células

- Otros

- Aplicaciones clínicas

- Hematología

- Cáncer

- Enfermedades por inmunodeficiencia

- Trasplante de órganos

- Otras aplicaciones clínicas

- Aplicaciones industriales

Usuario final

- Empresas farmacéuticas y biotecnológicas

- Institutos académicos y de investigación

- Hospitales

- Laboratorios de pruebas clínicas

- Cro

- Banco de sangre

- Cmo y Cdmo

- Laboratorios forenses

- Otros

Canal de distribución

- Ventas al por menor

- Desconectado

- En línea

- Licitaciones directas

Análisis regional del mercado de citometría de flujo en Oriente Medio y África

Se analiza el mercado y se proporcionan información y tendencias del tamaño del mercado por país, producto, aplicación, tecnología, canal de distribución y usuario final como se menciona anteriormente.

Los países cubiertos en el mercado son Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Qatar, Egipto, Kuwait, Bahréin, Omán, resto de Medio Oriente y África.

Sudáfrica posee la mayor participación del mercado, debido a su avanzada infraestructura de atención médica, sólidas instituciones académicas y de investigación, un creciente sector de biotecnología y una creciente demanda de aplicaciones de diagnóstico. Además, la inversión del país en tecnología de atención médica y su papel como centro regional de investigación médica y ensayos clínicos impulsan aún más la adopción de la citometría de flujo.

Se espera que Sudáfrica sea testigo del mercado de citometría de flujo más rápido en Medio Oriente y África debido a la expansión de la infraestructura de atención médica, un sector biotecnológico en crecimiento, crecientes aplicaciones de investigación, inversión gubernamental y una creciente demanda de tecnologías de diagnóstico.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas arriba y aguas abajo, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Medio Oriente y África y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales al proporcionar un análisis de pronóstico de los datos del país.

Cuota de mercado de citometría de flujo en Oriente Medio y África

El panorama competitivo del mercado proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Oriente Medio y África, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado.

Los líderes del mercado de citometría de flujo de Oriente Medio y África que operan en el mercado son:

- BD (Estados Unidos)

- Agilent Technologies, Inc. (Estados Unidos)

- Thermo Fisher Scientific Inc. (Estados Unidos)

- Laboratorios Bio-Rad, Inc. (Estados Unidos)

- Sartorius AG (Alemania)

- Bennubio Inc. (Estados Unidos),

- Enzo Biochem Inc. (Estados Unidos),

- Apogee Flow Systems Ltd. (Reino Unido),

- Beckman Coulter, Inc. (Estados Unidos),

- Coherent Corp. (Estados Unidos),

- Tecnología de señalización celular, Inc. (EE. UU.),

- Cytek Biosciences (EE. UU.),

- Biomérieux. (Francia),

- Cytonome/ST LLC (Estados Unidos)

Últimos avances en el mercado de citometría de flujo en Oriente Medio y África

- En julio de 2024, Agilent Technologies anunció la adquisición de la empresa canadiense de servicios farmacéuticos BioVectra por 925 millones de dólares. Esta operación amplía las capacidades de Agilent en edición genética, específicamente en la fabricación de oligonucleótidos y péptidos, mejorando su papel en terapias basadas en ARN y tecnologías de edición genética como CRISPR-Cas

- En junio de 2024, Thermo Fisher celebró la inauguración de una ampliación de 72.500 pies cuadrados en su campus de Middleton, que servirá como laboratorio para pruebas farmacéuticas. El proyecto creará 350 puestos de trabajo en los próximos dos años, y los créditos fiscales estatales respaldarán la iniciativa.

- En noviembre de 2024, Sartorius Stedim Biotech ha abierto un nuevo Centro de Innovación en Bioprocesos en Marlborough, Massachusetts, cuyo objetivo es avanzar en el desarrollo de terapias de próxima generación. La instalación de 63.000 pies cuadrados ofrecerá optimización de procesos, capacitación y suites GMP para la producción clínica a partir de 2025.

- En marzo de 2024, Beckman Coulter Life Sciences lanzó el citómetro de flujo CytoFLEX nano, un gran avance en el análisis de nanopartículas que permite la detección de partículas tan pequeñas como 40 nm. Este sistema mejora la sensibilidad y ofrece hasta un 50 % más de datos para la investigación de vesículas extracelulares y objetivos de menor abundancia.

- En marzo de 2024, Beckman Coulter Life Sciences recibió la autorización 510(k) de la FDA para distribuir su citómetro de flujo clínico DxFLEX en los EE. UU. Esto simplifica las pruebas de alta complejidad con una sensibilidad mejorada y una compensación automatizada, lo que hace que la citometría de flujo multicolor sea más accesible y eficiente para los laboratorios.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

5 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF CHRONIC DISEASES

6.1.2 INCREASING APPLICATION OF CYTOMETRY INSTRUMENTS

6.1.3 GROWING USE OF FLOW CYTOMETRY IN DRUG DISCOVERY

6.1.4 GROWING RESEARCH FUNDING

6.2 RESTRAINTS

6.2.1 HIGH COST OF FLOW CYTOMETRY INSTRUMENTS

6.2.2 LIMITATIONS OF FLOW CYTOMETRY

6.3 OPPORTUNITIES

6.3.1 INCREASE IN ADOPTION OF FLOW CYTOMETRY TECHNIQUES IN RESEARCH AND ACADEMIA

6.3.2 RISING DEVELOPMENT OF PHARMACEUTICAL AND BIOTECHNOLOGY INDUSTRIES

6.3.3 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 DIFFICULTY IN THE DEVELOPMENT AND VALIDATION OF FLOW CYTOMETRY ASSAYS

6.4.2 COMPLEXITIES RELATED TO REAGENT DEVELOPMENT

7 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 REAGENTS AND CONSUMABLES

7.2.1 DYE

7.2.2 ANTIBODIES

7.2.3 BEADS

7.2.4 OTHERS

7.3 FLOW CYTOMETRY INSTRUMENTS

7.3.1 CELL ANALYZERS

7.3.1.1 CELL ANALYZERS, BY TYPE

7.3.1.1.1 IMAGING FLOW CYTOMETERS

7.3.1.1.2 NON-IMAGING FLOW CYTOMETERS

7.3.1.2 CELL ANALYZERS, BY RANGE

7.3.1.2.1 HIGH-RANGE CELL ANALYZERS

7.3.1.2.2 MID-RANGE CELL ANALYZERS

7.3.1.2.3 LOW-RANGE CELL ANALYZERS

7.3.1.3 CELL ANALYZERS, BY MODALITY

7.3.1.3.1 BENCHTOP

7.3.1.3.2 STANDALONE

7.3.2 CELL SORTERS

7.3.2.1 BENCHTOP

7.3.2.2 STANDALONE

7.3.3 CELL SORTERS

7.3.3.1 HIGH-RANGE CELL ANALYZERS

7.3.3.2 MID-RANGE CELL ANALYZERS

7.3.3.3 LOW-RANGE CELL ANALYZERS

7.4 ACCESSORIES

7.4.1 FILTERS

7.4.2 DETECTORS

7.4.3 OTHERS

7.5 SERVICES

7.6 SOFTWARE

8 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 CELL-BASED FLOW CYTOMETRY

8.2.1 FLOW CYTOMETRY INSTRUMENTS

8.2.2 REAGENTS & CONSUMABLES

8.2.3 ACCESSORIES

8.3 BEAD-BASED FLOW CYTOMETRY

8.3.1 FLOW CYTOMETRY INSTRUMENTS

8.3.2 REAGENTS & CONSUMABLES

8.3.3 ACCESSORIES

9 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 RESEARCH APPLICATIONS

9.2.1 CELL CYCLE ANALYSIS

9.2.2 CELL SORTING/SCREENING

9.2.3 CELL TRANSFECTION/VIABILITY

9.2.4 PHARMACEUTICAL AND BIOTECHNOLOGY

9.2.4.1 DRUG DISCOVERY

9.2.4.2 STEM CELL RESEARCH

9.2.4.3 IN VITRO TOXICITY TESTING

9.2.5 IMMUNOLOGY

9.2.6 APOPTOSIS

9.2.7 CELL COUNTING

9.2.8 OTHERS

9.3 CLINICAL APPLICATIONS

9.3.1 HAEMATOLOGY

9.3.2 CANCER

9.3.3 IMMUNODEFICIENCY DISEASES

9.3.4 ORGAN TRANSPLANTATION

9.3.5 OTHER CLINICAL APPLICATION

9.4 INDUSTRIAL APPLICATIONS

10 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 RETAIL SALES

10.2.1 OFFLINE

10.2.2 ONLINE

10.3 DIRECT TENDERS

11 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET, BY END USER

11.1 OVERVIEW

11.2 PHARMACEUTICALS AND BIOTECHNOLOGY COMPANIES

11.3 ACADEMIC & RESEARCH INSTITUTES

11.4 HOSPITALS

11.5 CLINICAL TESTING LABORATORIES

11.6 CRO

11.7 BLOOD BANK

11.8 CMO & CDMO

11.9 FORENSIC LABORATORIES

11.1 OTHERS

12 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SOUTH AFRICA

12.1.2 SAUDI ARABIA

12.1.3 U.A.E.

12.1.4 EGYPT

12.1.5 KUWAIT

12.1.6 ISRAEL

12.1.7 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 BD

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 AGILENT TECHNOLOGIES, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 THERMO FISHER SCIENTIFIC INC

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 BIO-RAD LABORATORIES, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 SARTORIUS AG

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 APOGEE FLOW SYSTEMS LTD.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 BECKMAN COULTER, INC. (A SUBSIDIARY OF DANAHER CORPORATION)

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 BIOMÉRIEUX

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 BIOLEGEND, INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 BENNUBIO INC

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 COHERENT CORP.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 CYTONOME/ST, LLC

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 CYTOBUOY

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 CELL SIGNALING TECHNOLOGY, INC

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 CYTEK BIOSCIENCES

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 DIASORIN S.P.A.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 ELABSCIENCE BIONOVATION INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 ENZO BIOCHEM, INC

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 MILTENYI BIOTEC AND/OR ITS AFFILIATES

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 MERCK KGAA

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 NANOCELLECT BIOMEDICAL

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

15.22 NEOGENOMICS LABORATORIES

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENT

15.23 ON-CHIP BIOTECHNOLOGIES CO., LTD. CORPORATION

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.24 ORLFO TECHNOLOGIES

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

15.25 STRATEDIGM, INC

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENTS

15.26 SONY BIOTECHNOLOGY INC

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 SYSMEX ASIA PACIFIC PTE LTD (PART OF SYSMEX CORPORATION)

15.27.1 COMPANY SNAPSHOT

15.27.2 REVENUE ANALYSIS

15.27.3 PRODUCT PORTFOLIO

15.27.4 RECENT DEVELOPMENT

15.28 TAKARA BIO INC.

15.28.1 COMPANY SNAPSHOT

15.28.2 PRODUCT PORTFOLIO

15.28.3 RECENT DEVELOPMENT

15.29 UNION BIOMETRICA, INC.

15.29.1 COMPANY SNAPSHOT

15.29.2 PRODUCT PORTFOLIO

15.29.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 2 MIDDLE EAST AND AFRICA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 3 MIDDLE EAST AND AFRICA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 4 MIDDLE EAST AND AFRICA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 5 MIDDLE EAST AND AFRICA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 7 MIDDLE EAST AND AFRICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 9 MIDDLE EAST AND AFRICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 12 MIDDLE EAST AND AFRICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 13 MIDDLE EAST AND AFRICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 14 MIDDLE EAST AND AFRICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 16 MIDDLE EAST AND AFRICA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 19 MIDDLE EAST AND AFRICA SERVICES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA SOFTWARE IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA CELL-BASED FLOW CYTOMETRY IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA CELL-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA BEAD-BASED FLOW CYTOMETRY IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA INDUSTRIAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA PHARMACEUTICALS & BIOTECHNOLOGY COMPANIES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA ACADEMIC & RESEARCH INSTITUTES COMPANIES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA HOSPITALS IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA CLINICAL TESTING LABORATORIES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA CRO IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA BLOOD BANK IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA CMO&CDMO IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA FORENSIC LABORATORIES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA OTHERS IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA FLOW CYTOMETRY, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 51 MIDDLE EAST AND AFRICA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 52 MIDDLE EAST AND AFRICA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 55 MIDDLE EAST AND AFRICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 56 MIDDLE EAST AND AFRICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFRICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 59 MIDDLE EAST AND AFRICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 60 MIDDLE EAST AND AFRICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 62 MIDDLE EAST AND AFRICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 63 MIDDLE EAST AND AFRICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 64 MIDDLE EAST AND AFRICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 65 MIDDLE EAST AND AFRICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 66 MIDDLE EAST AND AFRICA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 67 MIDDLE EAST AND AFRICA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 68 MIDDLE EAST AND AFRICA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 69 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 70 MIDDLE EAST AND AFRICA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 71 MIDDLE EAST AND AFRICA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 72 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 73 MIDDLE EAST AND AFRICA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 74 MIDDLE EAST AND AFRICA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 75 MIDDLE EAST AND AFRICA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 76 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 77 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 78 MIDDLE EAST AND AFRICA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 79 SOUTH AFRICA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 80 SOUTH AFRICA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 81 SOUTH AFRICA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 82 SOUTH AFRICA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 83 SOUTH AFRICA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 84 SOUTH AFRICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 85 SOUTH AFRICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 86 SOUTH AFRICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 87 SOUTH AFRICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 88 SOUTH AFRICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 89 SOUTH AFRICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 90 SOUTH AFRICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 91 SOUTH AFRICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 92 SOUTH AFRICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 93 SOUTH AFRICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 94 SOUTH AFRICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 95 SOUTH AFRICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 96 SOUTH AFRICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 97 SOUTH AFRICA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 98 SOUTH AFRICA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 99 SOUTH AFRICA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 100 SOUTH AFRICA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 101 SOUTH AFRICA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 102 SOUTH AFRICA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 103 SOUTH AFRICA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 104 SOUTH AFRICA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 105 SOUTH AFRICA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 106 SOUTH AFRICA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 107 SOUTH AFRICA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 108 SOUTH AFRICA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 109 SOUTH AFRICA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 110 SAUDI ARABIA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 111 SAUDI ARABIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 112 SAUDI ARABIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 113 SAUDI ARABIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 114 SAUDI ARABIA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 115 SAUDI ARABIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 116 SAUDI ARABIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 117 SAUDI ARABIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 118 SAUDI ARABIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 119 SAUDI ARABIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 120 SAUDI ARABIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 121 SAUDI ARABIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 122 SAUDI ARABIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 123 SAUDI ARABIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 124 SAUDI ARABIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 125 SAUDI ARABIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 126 SAUDI ARABIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 127 SAUDI ARABIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 128 SAUDI ARABIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 129 SAUDI ARABIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 130 SAUDI ARABIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 131 SAUDI ARABIA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 132 SAUDI ARABIA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 133 SAUDI ARABIA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 134 SAUDI ARABIA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 135 SAUDI ARABIA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 136 SAUDI ARABIA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 137 SAUDI ARABIA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 138 SAUDI ARABIA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 139 SAUDI ARABIA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 140 SAUDI ARABIA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 141 U.A.E. FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 142 U.A.E. REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 143 U.A.E. REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 144 U.A.E. REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 145 U.A.E. FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 146 U.A.E. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 147 U.A.E. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 148 U.A.E. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 149 U.A.E. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 150 U.A.E. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 151 U.A.E. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 152 U.A.E. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 153 U.A.E. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 154 U.A.E. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 155 U.A.E. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 156 U.A.E. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 157 U.A.E. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 158 U.A.E. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 159 U.A.E. ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 160 U.A.E. ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 161 U.A.E. ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 162 U.A.E. FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 163 U.A.E. CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 164 U.A.E. BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 165 U.A.E. FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 166 U.A.E. RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 167 U.A.E. PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 168 U.A.E. CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 169 U.A.E. FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 170 U.A.E. FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 171 U.A.E. RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 172 EGYPT FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 173 EGYPT REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 174 EGYPT REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 175 EGYPT REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 176 EGYPT FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 177 EGYPT CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 178 EGYPT CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 179 EGYPT CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 180 EGYPT CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 181 EGYPT CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 182 EGYPT CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 183 EGYPT CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 184 EGYPT CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 185 EGYPT CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 186 EGYPT CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 187 EGYPT CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 188 EGYPT CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 189 EGYPT CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 190 EGYPT ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 191 EGYPT ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 192 EGYPT ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 193 EGYPT FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 194 EGYPT CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 195 EGYPT BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 196 EGYPT FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 197 EGYPT RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 198 EGYPT PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 199 EGYPT CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 200 EGYPT FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 201 EGYPT FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 202 EGYPT RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 203 KUWAIT FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 204 KUWAIT REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 205 KUWAIT REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 206 KUWAIT REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 207 KUWAIT FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 208 KUWAIT CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 209 KUWAIT CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 210 KUWAIT CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 211 KUWAIT CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 212 KUWAIT CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 213 KUWAIT CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 214 KUWAIT CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 215 KUWAIT CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 216 KUWAIT CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 217 KUWAIT CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 218 KUWAIT CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 219 KUWAIT CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 220 KUWAIT CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 221 KUWAIT ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 222 KUWAIT ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 223 KUWAIT ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 224 KUWAIT FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 225 KUWAIT CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 226 KUWAIT BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 227 KUWAIT FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 228 KUWAIT RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 229 KUWAIT PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 230 KUWAIT CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 231 KUWAIT FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 232 KUWAIT FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 233 KUWAIT RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 234 ISRAEL FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 235 ISRAEL REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 236 ISRAEL REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 237 ISRAEL REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 238 ISRAEL FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 239 ISRAEL CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 240 ISRAEL CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 241 ISRAEL CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 242 ISRAEL CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 243 ISRAEL CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 244 ISRAEL CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 245 ISRAEL CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 246 ISRAEL CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 247 ISRAEL CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 248 ISRAEL CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 249 ISRAEL CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 250 ISRAEL CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 251 ISRAEL CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 252 ISRAEL ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 253 ISRAEL ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 254 ISRAEL ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 255 ISRAEL FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 256 ISRAEL CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 257 ISRAEL BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 258 ISRAEL FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 259 ISRAEL RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 260 ISRAEL PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 261 ISRAEL CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 262 ISRAEL FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 263 ISRAEL FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 264 ISRAEL RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 265 REST OF MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

Lista de figuras

FIGURE 1 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: SEGMENTATION

FIGURE 10 FIVE SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET, BY PRODUCT

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 RISING PREVALENCE OF CHRONIC DISEASES IS DRIVING THE GROWTH OF THE MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET FROM 2025 TO 2032

FIGURE 14 THE REAGENTS AND CONSUMABLES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET IN 2025 AND 2032

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET

FIGURE 16 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: BY PRODUCT, 2024

FIGURE 17 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: BY PRODUCT, 2025-2032 (USD MILLION)

FIGURE 18 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: BY PRODUCT, CAGR (2025-2032)

FIGURE 19 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 20 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: BY TECHNOLOGY, 2024

FIGURE 21 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: BY TECHNOLOGY, 2025-2032 (USD MILLION)

FIGURE 22 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: BY TECHNOLOGY, CAGR (2025-2032)

FIGURE 23 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 24 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: BY APPLICATION, 2024

FIGURE 25 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: BY APPLICATION, 2025-2032 (USD MILLION)

FIGURE 26 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 27 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 28 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 29 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD MILLION)

FIGURE 30 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 31 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 32 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: BY END USER, 2024

FIGURE 33 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: BY END USER, 2025-2032 (USD MILLION)

FIGURE 34 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: BY END USER, CAGR (2025-2032)

FIGURE 35 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: BY END USER, LIFELINE CURVE

FIGURE 36 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: SNAPSHOT (2024)

FIGURE 37 MIDDLE EAST AND AFRICA FLOW CYTOMETRY MARKET: COMPANY SHARE 2024 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.