Middle And East Africa Pharmaceutical Solvent Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

367.96 Million

USD

507.46 Million

2024

2032

USD

367.96 Million

USD

507.46 Million

2024

2032

| 2025 –2032 | |

| USD 367.96 Million | |

| USD 507.46 Million | |

|

|

|

|

Segmentación del mercado de disolventes farmacéuticos en Oriente Medio y África, por producto (alcohol, amina, ésteres, éteres, hidrocarburos aromáticos, disolventes clorados, cetonas y otros), aplicación (farmacéutica, laboratorios de investigación, química y otros): tendencias de la industria y pronóstico hasta 2032.

Tamaño del mercado de disolventes farmacéuticos de África Central y Oriental

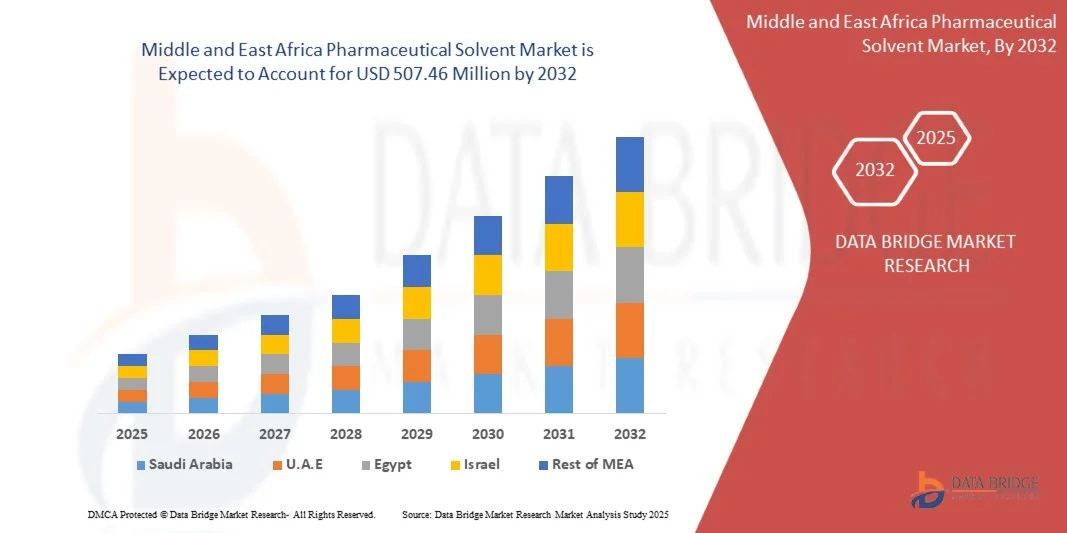

- El tamaño del mercado de disolventes farmacéuticos de África Central y Oriental se valoró en USD 367,96 millones en 2024 y se proyecta que alcance los USD 507,46 millones para 2032, creciendo a una CAGR del 4,10% durante el período de pronóstico.

- La expansión del mercado está impulsada principalmente por el aumento de la fabricación farmacéutica, la creciente demanda de medicamentos genéricos y la creciente infraestructura de atención médica en las economías emergentes de la región.

- Además, el apoyo regulatorio para la formulación de medicamentos de calidad y la creciente inversión en actividades de I+D están impulsando la adopción de solventes de alta pureza, lo que impulsa aún más la sólida trayectoria de crecimiento del mercado.

Análisis del mercado de disolventes farmacéuticos de África Central y Oriental

- Los solventes farmacéuticos, esenciales para la formulación, síntesis y purificación de medicamentos, son cada vez más críticos en el proceso de fabricación farmacéutica en África Central y Oriental debido a la creciente demanda de medicamentos de calidad y la expansión de las instalaciones de producción locales.

- La creciente demanda de solventes farmacéuticos se debe principalmente a la creciente población de la región, la creciente prevalencia de enfermedades crónicas y un enfoque creciente en mejorar el acceso y la infraestructura de la atención médica.

- Los Emiratos Árabes Unidos dominaron el mercado de solventes farmacéuticos de Oriente Medio y África con la mayor participación en los ingresos del 32,7 % en 2024, debido a su sector farmacéutico avanzado, apoyo regulatorio y redes de distribución bien establecidas, mientras que países como Egipto y Arabia Saudita están experimentando un rápido crecimiento debido al aumento de las inversiones extranjeras y las reformas de atención médica de apoyo.

- Se proyecta que los países de Arabia Saudita experimenten el crecimiento más rápido durante el período de pronóstico, impulsado por los esfuerzos de localización liderados por el gobierno, el aumento de las iniciativas de I+D y la expansión estratégica de los centros regionales de fabricación farmacéutica.

- El segmento de alcohol dominó el mercado con la mayor participación en los ingresos del 38,5% en 2024, impulsado por su uso generalizado en la formulación de medicamentos, particularmente en la preparación de medicamentos líquidos orales y agentes tópicos.

Alcance del informe y segmentación del mercado de disolventes farmacéuticos en África Central y Oriental

|

Atributos |

Perspectivas clave del mercado de disolventes farmacéuticos |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de disolventes farmacéuticos en África Central y Oriental

Creciente interés por los disolventes de alta pureza y las tecnologías de formulación avanzadas

- Una tendencia significativa y acelerada en el mercado de solventes farmacéuticos de África Central y Oriental es el énfasis creciente en solventes de alta pureza y tecnologías de formulación avanzadas para cumplir con estándares regulatorios estrictos y mejorar la seguridad y eficacia de los medicamentos en todo el sector farmacéutico en expansión de la región.

- Por ejemplo, proveedores multinacionales como BASF y Merck KGaA ofrecen cada vez más solventes de calidad farmacéutica diseñados para cumplir con los requisitos de Buenas Prácticas de Fabricación (GMP), ayudando a los fabricantes locales a cumplir con las regulaciones de calidad regionales e internacionales.

- El uso de solventes de alta pureza permite una formulación más precisa de medicamentos, reduce el riesgo de contaminación y facilita la producción de genéricos complejos y medicamentos especializados. Las tecnologías avanzadas de formulación que utilizan estos solventes también contribuyen a mejorar la solubilidad y la biodisponibilidad de los ingredientes farmacéuticos activos (API), un factor clave en el tratamiento de enfermedades crónicas e infecciosas generalizadas en la región.

- Además, las compañías farmacéuticas están adoptando sistemas de recuperación y reciclaje de solventes para garantizar la sostenibilidad ambiental y la rentabilidad, especialmente en países como Sudáfrica y Kenia, donde las regulaciones ambientales son cada vez más estrictas.

- Esta tendencia también está impulsando la innovación entre los actores regionales y globales, con empresas como Clariant y Eastman Chemical Company invirtiendo en I+D para desarrollar solventes de próxima generación que combinen rendimiento con perfiles ecológicos.

- La demanda de solventes especiales de alta pureza continúa aumentando en las iniciativas farmacéuticas de los sectores público y privado, mientras los gobiernos y las organizaciones de salud trabajan para ampliar el acceso a medicamentos seguros, efectivos y asequibles en África Central y Oriental.

Dinámica del mercado de disolventes farmacéuticos en África Central y Oriental

Conductor

“La creciente demanda está impulsada por la expansión de la fabricación farmacéutica y las necesidades de atención médica”

- La expansión de la base de fabricación farmacéutica en África Central y Oriental, junto con la creciente demanda de soluciones de atención médica asequibles y accesibles, es un factor clave que alimenta la necesidad de solventes farmacéuticos en la región.

- Por ejemplo, en marzo de 2024, el gobierno sudafricano lanzó iniciativas para aumentar la producción local de medicamentos esenciales, fomentando la inversión en infraestructura farmacéutica e impulsando la demanda de solventes de alta calidad utilizados en la formulación de medicamentos.

- A medida que más países de la región priorizan la autosuficiencia en la producción de medicamentos, especialmente de medicamentos genéricos y esenciales, los solventes farmacéuticos desempeñan un papel vital para garantizar la consistencia, la calidad y el cumplimiento normativo en los procesos de fabricación locales.

- Además, la creciente carga de enfermedades no transmisibles, como la diabetes y los trastornos cardiovasculares, está incrementando la demanda de formulaciones de medicamentos complejas, muchas de las cuales requieren disolventes específicos para su solubilidad y estabilidad.

- Las empresas farmacéuticas globales y regionales también están invirtiendo en instalaciones de producción y operaciones de I+D en África Central y Oriental, aprovechando las ventajas de costos y el acceso a los mercados emergentes. Esto se ve respaldado además por incentivos gubernamentales y alianzas con organizaciones internacionales de salud para mejorar la accesibilidad y la calidad de los medicamentos.

- La tendencia hacia la modernización y automatización en la fabricación de productos farmacéuticos, incluido el uso de sistemas avanzados de formulación y recuperación de solventes, está mejorando la eficiencia e impulsando el consumo de solventes en toda la región.

Restricción/Desafío

“Desafíos regulatorios y acceso limitado a solventes de alta calidad”

- Uno de los desafíos importantes que enfrenta el mercado de solventes farmacéuticos de África Central y Oriental es el panorama regulatorio fragmentado y cambiante, que puede complicar el ingreso al mercado y generar inconsistencias en los estándares de calidad a través de las fronteras.

- Por ejemplo, algunos países de la región carecen de marcos regulatorios farmacéuticos bien establecidos, lo que genera dificultades para garantizar la disponibilidad constante de solventes de calidad farmacéutica que cumplan con los estándares internacionales de GMP.

- La limitada producción local de disolventes de alta pureza y la dependencia de las importaciones también contribuyen a la vulnerabilidad de la cadena de suministro, las fluctuaciones de precios y el acceso limitado en zonas rurales o desatendidas. Esto puede dificultar la producción consistente de medicamentos y retrasar la comercialización de los productos farmacéuticos.

- Además, el alto costo de mantener la pureza del solvente, el almacenamiento y la infraestructura de manejo seguro puede ser una carga financiera para los fabricantes farmacéuticos pequeños y medianos, particularmente en países con bases industriales menos desarrolladas.

- Para abordar estas cuestiones será necesaria una armonización regulatoria regional coordinada, inversión en capacidades locales de producción de solventes y un mayor apoyo a las compañías farmacéuticas para que adopten tecnologías de fabricación y sistemas de control de calidad modernos.

- El fortalecimiento de las alianzas entre los gobiernos, las partes interesadas de la industria y los organismos internacionales de salud será esencial para superar estas barreras y garantizar el crecimiento sostenible del mercado de solventes farmacéuticos en África Central y Oriental.

Alcance del mercado de disolventes farmacéuticos en África Central y Oriental

El mercado de disolventes farmacéuticos de Oriente Medio y África está segmentado en dos segmentos notables que se basan en el producto y la aplicación.

• Por producto

En cuanto al producto, el mercado de disolventes farmacéuticos de África Central y Oriental se segmenta en alcohol, amina, ésteres, éteres, hidrocarburos aromáticos, disolventes clorados, cetonas y otros. El segmento de alcohol dominó el mercado con la mayor participación en los ingresos, con un 38,5 % en 2024, gracias a su amplio uso en la formulación de fármacos, en particular en la preparación de líquidos orales y agentes tópicos. Alcoholes como el etanol y el isopropanol son populares por su alta solvencia, baja toxicidad y compatibilidad con diversos principios activos (API), lo que los hace ideales tanto para la formulación como para la esterilización.

Se prevé que el segmento de cetonas experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por su creciente aplicación en formulaciones complejas, en particular para fármacos poco solubles en agua. Disolventes como la acetona y la metiletilcetona están ganando popularidad gracias a sus superiores índices de evaporación y miscibilidad con otros disolventes, lo que permite un procesamiento eficiente de fármacos. El aumento de las actividades de I+D farmacéuticas impulsa aún más el crecimiento de categorías de disolventes de alto rendimiento como las cetonas.

• Por aplicación

Según su aplicación, el mercado de disolventes farmacéuticos de África Central y Oriental se segmenta en sectores farmacéutico, de laboratorios de investigación, químico y otros. El segmento farmacéutico representó la mayor cuota de mercado en ingresos, con un 66,3 %, en 2024, impulsado principalmente por la creciente demanda de medicamentos genéricos y de marca, el crecimiento de la producción farmacéutica local y las crecientes iniciativas gubernamentales para fortalecer la infraestructura sanitaria regional. Los disolventes de este segmento se utilizan ampliamente en los procesos de síntesis, purificación y formulación, lo que los convierte en componentes esenciales en el ciclo de vida del desarrollo de fármacos.

Se prevé que el segmento de Laboratorios de Investigación registre la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por el aumento de las inversiones en el descubrimiento de fármacos, la investigación en biociencias y la colaboración entre la academia y la industria en países clave como Sudáfrica, Kenia y Nigeria. A medida que se intensifica la I+D en las áreas terapéuticas, la demanda de disolventes de alta pureza para aplicaciones analíticas y experimentales crece rápidamente. Además, las organizaciones internacionales y la financiación del sector privado desempeñan un papel fundamental en la mejora de las capacidades de los laboratorios en la región, impulsando el crecimiento a largo plazo.

Análisis regional del mercado de disolventes farmacéuticos de África Central y Oriental

- Los Emiratos Árabes Unidos dominaron un segmento clave del mercado emergente de solventes farmacéuticos con la mayor participación del 32,7 % en 2024, respaldado por la expansión de la fabricación farmacéutica, la creciente demanda de medicamentos genéricos y el aumento de las inversiones en infraestructura de atención médica local.

- Las compañías farmacéuticas de la región priorizan cada vez más los solventes de alta calidad para la formulación y el procesamiento de medicamentos, impulsadas por estándares regulatorios más estrictos y la necesidad de una calidad de producto consistente en todas las aplicaciones terapéuticas.

- Este crecimiento se ve impulsado aún más por el aumento del gasto en atención médica, las estrategias de localización respaldadas por el gobierno y las asociaciones con empresas farmacéuticas globales, que posicionan a los solventes farmacéuticos como componentes esenciales para alcanzar los objetivos regionales de producción de medicamentos.

Perspectiva del mercado de disolventes farmacéuticos de Sudáfrica

Sudáfrica dominó el mercado de disolventes farmacéuticos de África Central y Oriental, con la mayor cuota de mercado, un 37,8%, en 2024, gracias a su consolidada industria farmacéutica y a un entorno regulatorio favorable. El creciente enfoque del país en la producción local de medicamentos y la capacidad de exportación ha impulsado la demanda de disolventes farmacéuticos de alta calidad. Las inversiones en infraestructura sanitaria y la creciente adopción de tecnologías de fabricación avanzadas impulsan aún más la expansión del mercado. El papel de Sudáfrica como centro farmacéutico regional también facilita la distribución y la eficiencia de la cadena de suministro, fortaleciendo su posición en el mercado.

Análisis del mercado de disolventes farmacéuticos de Arabia Saudita

Se espera que el mercado de disolventes farmacéuticos de Arabia Saudita crezca a una tasa de crecimiento anual compuesta (TCAC) significativa durante el período de pronóstico, impulsado por los ambiciosos planes de modernización de la atención médica del país y las iniciativas de Visión 2030. El aumento de las inversiones en plantas de fabricación farmacéutica, sumado a la creciente demanda de medicamentos genéricos, impulsa el consumo de disolventes. Además, las reformas regulatorias destinadas a mejorar la producción local y reducir la dependencia de las importaciones están impulsando el crecimiento del mercado, en particular en el de disolventes especializados utilizados en la formulación y síntesis de fármacos.

Perspectiva del mercado de disolventes farmacéuticos de los EAU

Se prevé que el mercado de disolventes farmacéuticos de los EAU experimente un crecimiento sostenido, impulsado por su ubicación estratégica como centro logístico y comercial, y el aumento de las inversiones en el sector sanitario. El apoyo del gobierno a la innovación farmacéutica y la creciente demanda de fabricación por contrato y servicios de investigación han incrementado el uso de disolventes. Además, la expansión de las actividades de investigación clínica de los EAU y los esfuerzos por atraer a empresas farmacéuticas multinacionales contribuyen a la creciente demanda de disolventes de alta calidad en la región.

Análisis del mercado de disolventes farmacéuticos de Egipto

Se prevé una expansión sostenida del mercado egipcio de disolventes farmacéuticos, impulsado por el diversificado sector farmacéutico del país y el aumento de las exportaciones a África y Oriente Medio. Las iniciativas gubernamentales para modernizar la infraestructura de fabricación y armonizar las normas regulatorias se alinean con la creciente demanda de disolventes para la producción de medicamentos de calidad. El auge de las empresas farmacéuticas locales y las alianzas con actores globales impulsan aún más las perspectivas del mercado.

Perspectivas del mercado de disolventes farmacéuticos de Israel

El mercado israelí de disolventes farmacéuticos se caracteriza por un rápido crecimiento gracias a su fuerte énfasis en la I+D farmacéutica y la innovación biofarmacéutica. El avanzado ecosistema de investigación del país, sumado al aumento de la actividad de ensayos clínicos, fomenta una alta demanda de disolventes especializados. Además, el floreciente sector de startups en tecnologías farmacéuticas y los incentivos gubernamentales para empresas biotecnológicas contribuyen significativamente a la expansión del mercado de disolventes.

Cuota de mercado de disolventes farmacéuticos en África Central y Oriental

La industria de disolventes farmacéuticos está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- DuPont (EE. UU.)

- Mitsui Chemicals (Japón)

- DOW (EE.UU.)

- Clariant (Suiza)

- Brenntag SE (Alemania)

- Corporación Olin (EE. UU.)

- Merck KGaA (Alemania)

- Royal Dutch Shell Plc (Reino Unido/Países Bajos)

- SK geo centric Co., Ltd. (Corea del Sur)

- Eastman Chemical Company (EE. UU.)

- LyondellBasell Industries Holdings BV (Países Bajos)

- BASF SE (Alemania)

- Exxon Mobil Corporation (EE. UU.)

- Avantor, Inc. (EE. UU.)

¿Cuáles son los desarrollos recientes en el mercado de disolventes farmacéuticos de África Central y Oriental?

- En abril de 2023, Sasol Limited (Sudáfrica), empresa líder en la integración de productos químicos y energéticos, lanzó una iniciativa para ampliar su capacidad de producción de disolventes farmacéuticos y satisfacer la creciente demanda en África Central y Oriental. Esta estrategia busca fortalecer las cadenas de suministro locales y reducir la dependencia de las importaciones, impulsando así el crecimiento de la industria farmacéutica regional. Al aprovechar tecnologías avanzadas de refinación y prácticas sostenibles, Sasol refuerza su compromiso de ofrecer disolventes de alta calidad adaptados a las cambiantes necesidades de la industria farmacéutica en la región.

- En marzo de 2023, Sipchem (Arabia Saudita), empresa clave en el sector de productos químicos especializados, anunció el lanzamiento de una nueva gama de disolventes farmacéuticos ecológicos, diseñados para cumplir con las estrictas normativas ambientales. Este lanzamiento está dirigido a fabricantes farmacéuticos que buscan alternativas más ecológicas sin comprometer el rendimiento. El enfoque de Sipchem en la innovación y la sostenibilidad pone de manifiesto su dedicación a satisfacer las demandas regulatorias y del mercado en los sectores farmacéuticos de Oriente Medio.

- En marzo de 2023, Gulf Pharmaceutical Industries (Julphar) (EAU) inició un proyecto a gran escala para optimizar los procesos de purificación de solventes en sus plantas de fabricación, con el objetivo de mejorar la calidad de los solventes y la eficiencia operativa. Este avance respalda la misión de Julphar de elevar los estándares de producción farmacéutica y garantizar el cumplimiento normativo en Oriente Medio y África, contribuyendo así a la producción de medicamentos más seguros y eficaces.

- En febrero de 2023, EIPICO (Egyptian International Pharmaceutical Industries Company) (Egipto) inició una colaboración con proveedores químicos internacionales para diversificar su cartera de disolventes, centrándose en disolventes especiales para formulaciones farmacéuticas complejas. Esta colaboración busca mejorar la disponibilidad de productos y reducir los plazos de entrega para los fabricantes farmacéuticos locales. La colaboración estratégica de EIPICO subraya su compromiso de fortalecer la posición de Egipto como centro de fabricación farmacéutica en la región.

- En enero de 2023, Teva Pharmaceutical Industries Ltd. (Israel) presentó una nueva iniciativa de investigación destinada a desarrollar nuevos disolventes farmacéuticos optimizados para productos biológicos y sistemas avanzados de administración de fármacos. Esta iniciativa destaca la inversión de Teva en I+D y su liderazgo en innovación farmacéutica en Oriente Medio. Mediante la integración de tecnologías de disolventes de vanguardia, Teva busca mejorar la eficacia de los fármacos y la eficiencia de la fabricación, impulsando aún más el crecimiento del sector farmacéutico regional.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.