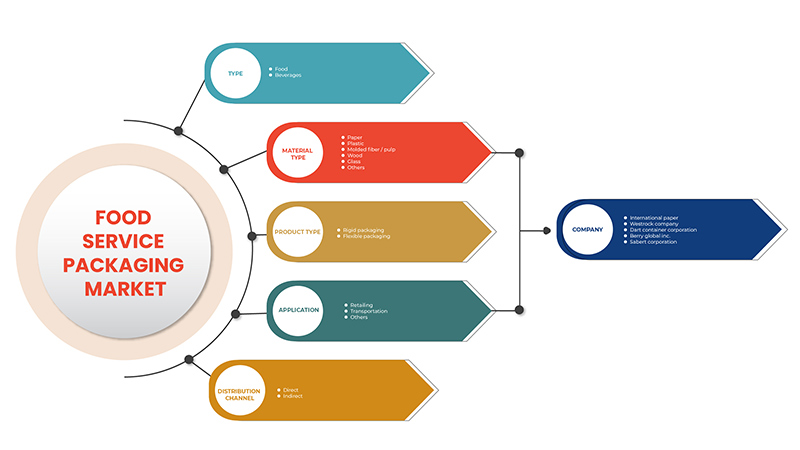

Mercado de embalaje para servicios de alimentos en México, por tipo (alimentos y bebidas), por tipo de material (papel, plástico, fibra moldeada/pulpa, madera, vidrio y otros), tipo de producto (embalaje rígido y embalaje flexible ), aplicación (transporte, venta minorista y otros), canal de distribución (directo e indirecto), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado

Los envases para servicios de alimentación se utilizan ampliamente para envasar productos alimenticios procesados y semiprocesados. Los envases para servicios de alimentación ayudan a mantener la higiene y la calidad y mejoran la seguridad de los productos alimenticios. Los usuarios finales de los envases para servicios de alimentación incluyen restaurantes, servicios de catering, establecimientos de comida rápida y otros. Los envases para alimentos también ayudan a mejorar la vida útil del producto alimenticio y a mantener los alimentos y bebidas frescos durante más tiempo. Se utilizan diferentes materiales para envasar alimentos, incluidos plástico, papel, pulpa de madera, vidrio y otros.

Las bolsas, contenedores y cajas de madera, plástico, papel y otros materiales se utilizan ampliamente para envasar alimentos y bebidas. La creciente demanda de envases prácticos y flexibles afecta significativamente la expansión del mercado de envases para servicios de alimentación. En consonancia con esto, se espera que la creciente adopción de productos ecológicos y biodegradables para el envasado de alimentos impulse el crecimiento del mercado. Sin embargo, las estrictas regulaciones impuestas por los organismos gubernamentales con respecto a los materiales de envasado pueden ser una importante restricción para el crecimiento del mercado de envases para servicios de alimentación.

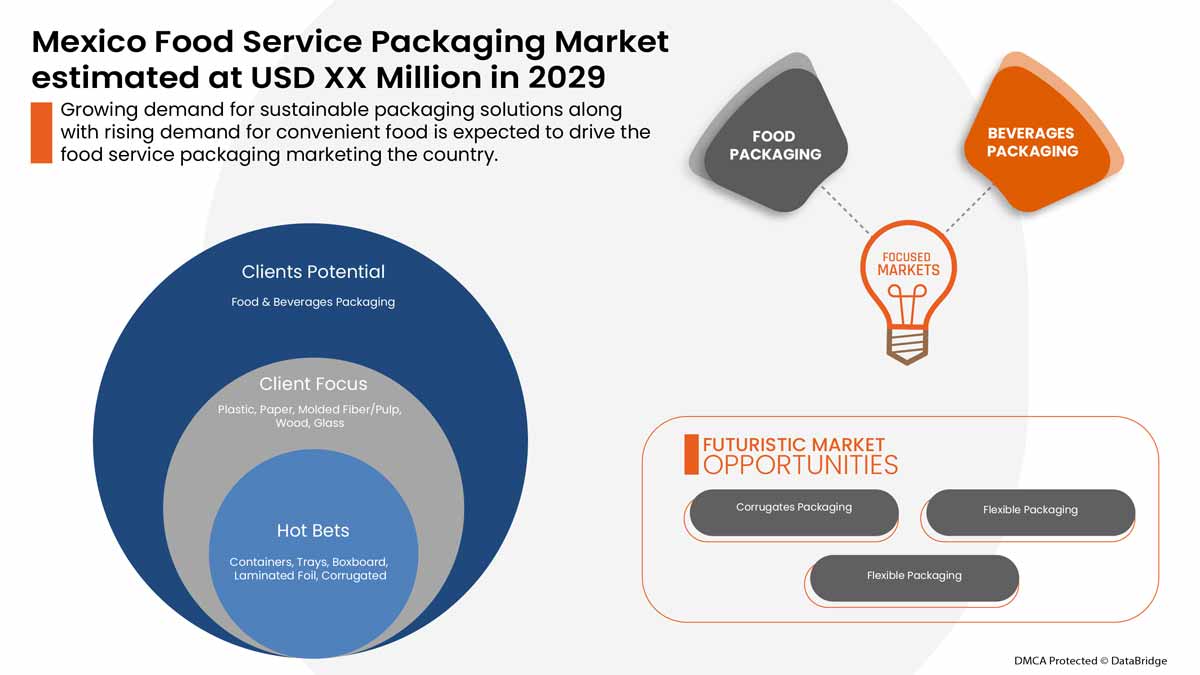

La creciente demanda de soluciones de envasado sostenibles, junto con la creciente adopción de tecnología moderna en la industria del envasado, creará más oportunidades futuras para el mercado de envasado de alimentos. Sin embargo, mantener la calidad estándar de los productos de envasado puede suponer un desafío para el crecimiento del mercado de envasado de alimentos durante el período de pronóstico.

Data Bridge Market Research analiza que el mercado de envases para servicios de alimentos de México crecerá a una CAGR del 4,3% durante el período de pronóstico de 2022 a 2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones, volumen en millones de unidades, precios en USD |

|

Segmentos cubiertos |

Por tipo (alimentos y bebidas), tipo de material (plástico, papel, fibra moldeada/pulpa, madera, vidrio y otros), tipo de producto ( embalaje rígido , embalaje flexible y otros), aplicación (venta minorista, transporte y otros), canal de distribución (directo e indirecto) |

|

Países cubiertos |

México |

|

Actores del mercado cubiertos |

Papel internacional, WestRock Company, Dart Container Corporation, Berry Global Inc., Sabert Corporation, Huhtamaki, Amcor plc, Sealed Air, Fabri-Kal y Genpak LLC |

Definición de mercado

Los envases para servicios de alimentación se utilizan ampliamente para envasar productos alimenticios procesados y semiprocesados. Ayudan a mantener la higiene y la calidad y mejoran la seguridad de los productos alimenticios. Los usuarios finales de los envases para servicios de alimentación incluyen restaurantes, servicios de catering, establecimientos de comida rápida y otros. Los envases para alimentos también ayudan a mejorar la vida útil del producto alimenticio y ayudan a mantener los alimentos y bebidas frescos durante más tiempo. Se utilizan diferentes materiales para envasar alimentos, incluidos plástico, papel, pulpa de madera, vidrio y otros.

Dinámica del mercado de envases para servicios de alimentos en México

Conductores

-

El estilo de vida en movimiento está aumentando la demanda de envases para servicios de alimentos

La demanda de diversos envases, incluidos vasos, cubiertos, platos, bandejas, contenedores de alimentos , bolsas , bolsas y otros, está aumentando en la industria de servicios de alimentos debido a la agitada agenda de vida y la creciente preferencia por productos de alimentos y bebidas para llevar. El estilo de vida agitado y sedentario de las personas en México ha afectado el patrón de compra, lo que los incita a optar por la comida para llevar o solicitar comida para llevar de los restaurantes. El factor, como se mencionó anteriormente, está aumentando la demanda de envases únicos, innovadores y nuevos entre los servicios de alimentos para ofrecer sus productos de alimentos y bebidas, lo que ayudará al crecimiento del mercado de envases de servicios de alimentos de México.

-

Creciente demanda de alimentos preparados y de conveniencia

Recientemente, en México ha aumentado la demanda de productos alimenticios que permitan ahorrar tiempo en la preparación y limpieza de las comidas. El aumento de los ingresos disponibles, junto con la creciente demanda de productos alimenticios preparados y de conveniencia debido a un estilo de vida agitado, aumentará la demanda de productos envasados para servicios de alimentos. Además, los hábitos alimenticios de los consumidores mexicanos están cambiando y prefieren comer en restaurantes de comida rápida o de servicio rápido para ahorrar tiempo al cocinar. El factor mencionado anteriormente está aumentando la demanda de envases para servicios de alimentos, lo que se prevé que impulse el crecimiento del mercado de envases para servicios de alimentos en México. El aumento de la demanda de alimentos preparados y de conveniencia y el aumento del número de restaurantes de servicio rápido o de comida rápida en México contribuirán al crecimiento del mercado.

Oportunidad

-

Creciente demanda de soluciones de embalaje sostenibles

La demanda de envases sostenibles, fiables y respetuosos con el medio ambiente está aumentando entre los proveedores de servicios de alimentación, lo que anima a los fabricantes a introducir tecnologías novedosas y modernas para fabricar productos de envasado. La demanda de materiales de envasado sostenibles, de alta calidad y atractivos para alimentos y bebidas está aumentando, lo que creará inmensas oportunidades para los fabricantes de envases para servicios de alimentación. La tecnología moderna ofrece productos de envasado resistentes y de alta calidad, lo que atrae a los fabricantes de servicios de alimentación. La creciente demanda de soluciones de envasado fiables e innovadoras en la industria de servicios de alimentación está animando a los fabricantes a introducir tecnologías modernas para la fabricación de soluciones de envasado.

Restricción/Desafío

- Regulaciones gubernamentales estrictas sobre los materiales de embalaje

Las regulaciones gubernamentales son fundamentales para influir en el diseño de los envases de muchos fabricantes del mercado. Los fabricantes de productos de envasado deben cumplir con diversas normas y políticas estrictas. Las organizaciones gubernamentales regulan y controlan los productos de envasado de alimentos y bebidas, así como el uso de materias primas, para proteger el medio ambiente y garantizar la seguridad y la confianza de los consumidores.

La mayoría de las soluciones de embalaje actuales son de “usar y tirar” sin ningún factor de reutilización. Esto da como resultado una enorme cantidad de residuos de embalaje, lo que genera contaminación y degradación ambiental. El gobierno está introduciendo normas de embalaje para que los fabricantes diseñen soluciones de embalaje de acuerdo con el enfoque de la economía circular. Además, la importación y exportación de materias primas para la producción de productos de embalaje se está volviendo muy difícil, por lo que los fabricantes se enfrentan a problemas para almacenar las materias primas.

El envasado de alimentos siempre ha sido el tema central de diversas normativas relacionadas con la seguridad alimentaria. El cumplimiento de dichas normativas es importante para que los actores del mercado eviten sanciones. Además, los organismos gubernamentales en México están imponiendo normas y regulaciones estrictas para los materiales de envasado de alimentos y bebidas.

Impacto posterior al COVID-19 en el mercado de envases para servicios alimentarios en México

La COVID-19 ha afectado al mercado en cierta medida. Debido al confinamiento, la industria de alimentos y bebidas se enfrentó a una importante crisis, que inicialmente redujo la demanda de envases para servicios de alimentación. Después de la pandemia, la demanda de envases para servicios de alimentación ha aumentado debido a la creciente demanda de productos alimenticios envasados y preparados. Además, los cambios en los hábitos alimentarios y la creciente inclinación hacia los productos de comida y bebida de conveniencia están aumentando la demanda de envases convenientes en la industria de servicios de alimentación.

Desarrollo reciente

- En noviembre de 2021, WestRock Company obtuvo el Premio a la Sostenibilidad del Año y fue reconocida por la excelencia en el diseño de envases en la 78.ª edición del Concurso Anual de Envases de Cartón de Norteamérica. Esto ha ayudado a la empresa a fortalecer su posición en el mercado norteamericano.

Alcance del mercado de envases para servicios de alimentos en México

El mercado de envases para servicios de alimentos de México está segmentado en función del tipo, tipo de material, tipo de producto, aplicación y canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Alimento

- Bebidas

Según el tipo, el mercado de envases para servicios de alimentos de México está segmentado en alimentos y bebidas.

Tipo de material

- Plástico

- Papel

- Fibra/pulpa moldeada

- Madera

- Vaso

- Otros

Según el tipo de material, el mercado de envases para servicios de alimentos de México está segmentado en plástico, papel, fibra/pulpa moldeada, madera, vidrio y otros.

Tipo de producto

- Embalaje rígido

- Embalaje flexible

Según el tipo de producto, el mercado de envases para servicios de alimentos de México está segmentado en envases rígidos y envases flexibles.

Solicitud

- Venta al por menor

- Transporte

- Otros

Según la aplicación, el mercado de envases para servicios de alimentos de México está segmentado en venta minorista, transporte y otros.

Canal de distribución

- Directo

- Indirecto

Con base en el canal de distribución, el mercado de envases para servicios de alimentos en México se segmenta en directo e indirecto.

Análisis del panorama competitivo y la participación de mercado de los envases para servicios de alimentos en México

El panorama competitivo del mercado de envases para servicios de alimentos de México proporciona detalles sobre los competidores. Los detalles incluyen una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en México, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores solo están relacionados con el enfoque de las empresas en el mercado de envases para servicios de alimentos de México.

Algunos de los principales actores que operan en el mercado de embalajes para servicios de alimentos en México son International Paper, WestRock Company, Dart Container Corporation, Berry Global Inc., Sabert Corporation, Huhtamaki, Amcor plc, Sealed Air, Fabri-Kal., Genpak, LLC, entre otros.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con tamaños de muestra grandes. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen la cuadrícula de posicionamiento de proveedores, el análisis de la línea de tiempo del mercado, la descripción general y la guía del mercado, la cuadrícula de posicionamiento de la empresa, el análisis de la participación de mercado de la empresa, los estándares de medición y el análisis de la participación de los proveedores en México. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MEXICO FOOD SERVICE PACKAGING MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 LABELING AND CLAIMS

4.2 MARKET SHARE OF MOLDED FIBER VS OTHER SUBSTRATES AND ITS PROJECTION

4.3 NEW PRODUCT LAUNCH STRATEGY

4.3.1 OVERVIEW

4.3.2 NUMBER OF PRODUCT LAUNCHES

4.3.2.1 LINE EXTENSION

4.3.2.2 NEW PACKAGING

4.3.2.3 RE-LAUNCHED

4.3.2.4 NEW FORMULATION

4.3.3 DIFFERENTIAL PRODUCT OFFERING

4.3.4 MEETING CONSUMER REQUIREMENT

4.3.5 PACKAGE DESIGNING

4.3.6 PRODUCT POSITIONING

4.3.7 CONCLUSION

4.4 TOP SUPPLIERS INFORMATION

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

4.5.1 FUTURE PERSPECTIVE

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 RAW MATERIAL

4.6.2 PACKAGING TYPE (PROCESSING METHOD)

4.6.2.1 PAPER PACKAGING MANUFACTURING PROCESS

4.6.3 DISTRIBUTION

4.6.4 END-USERS

4.7 VALUE CHAIN ANALYSIS

5 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR CONVENIENT AND FLEXIBLE PACKAGING

6.1.2 INCREASING ADOPTION OF ECO-FRIENDLY AND BIODEGRADABLE PACKAGING

6.1.3 ON-THE-GO LIFESTYLE IS INCREASING THE DEMAND FOR FOODSERVICE PACKAGING

6.1.4 RISING DEMAND FOR CONVENIENCE AND PREPARED FOOD

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENT REGULATIONS ON PACKAGING MATERIALS

6.2.2 USE OF HARMFUL ADDITIVES FOR WATER/OIL RESISTANCE IN FOOD PACKAGING

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FOR SUSTAINABLE PACKAGING SOLUTIONS

6.3.2 EMPHASIS ON MODERN TECHNOLOGIES IN THE PACKAGING INDUSTRY

6.4 CHALLENGES

6.4.1 MANAGING PACKAGING WASTE IS DIFFICULT

6.4.2 MAINTAINING THE STANDARD QUALITY OF PACKAGING PRODUCT

7 MEXICO FOOD SERVICE PACKAGING MARKET, BY TYPE

7.1 OVERVIEW

7.2 FOOD

7.2.1 CONFECTIONERY PRODUCTS

7.2.2 BAKERY PRODUCTS

7.2.3 DAIRY PRODUCTS

7.2.4 MEAT & POULTRY

7.2.5 FRUITS & VEGETABLES

7.2.6 OTHERS

7.3 BEVERAGES

7.3.1 NON-ALCOHOLIC BEVERAGES

7.3.2 ALCOHOLIC BEVERAGES

8 MEXICO FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE

8.1 OVERVIEW

8.2 PAPER

8.3 PLASTIC

8.3.1 POLYETHYLENE TEREPHTHALATE

8.3.2 POLYPROPYLENE (PP)

8.3.3 POLY-VINYL CHLORIDE (PVC)

8.3.4 POLYSTYRENE

8.3.5 ETHYL VINYL ACETATE (EVA)

8.3.6 OTHERS

8.4 MOLDED FIBER / PULP

8.4.1 CARDBOARD

8.4.2 RECYCLED PAPER

8.4.3 NATURAL FIBER

8.4.3.1 SUGARCANE

8.4.3.2 BAMBOO

8.4.3.3 WHEAT STRAW

8.4.3.4 OTHERS

8.4.4 OTHERS

8.5 WOOD

8.6 GLASS

8.7 OTHERS

9 MEXICO FOOD SERVICE PACKAGING MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 RIGID PACKAGING

9.2.1 BOXBOARD

9.2.2 CONTAINERS

9.2.3 TRAYS

9.2.4 OTHERS

9.3 FLEXIBLE PACKAGING

9.3.1 CORRUGATED

9.3.2 LAMINATED FOIL

9.3.3 OTHERS

10 MEXICO FOOD SERVICE PACKAGING MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 TRANSPORTATION

10.2.1 TRANSPORTATION, BY MATERIAL TYPE

10.2.1.1 PLASTIC

10.2.1.2 PAPER

10.2.1.3 MOLDED FIBER/PULP

10.2.1.3.1 MOLDED FIBER/PULP, BY MATERIAL TYPE

10.2.1.3.1.1 RECYCLED PAPER

10.2.1.3.1.2 NATURAL FIBER

10.2.1.3.1.2.1 NATURAL FIBER, BY MATERIAL TYPE

10.2.1.3.1.2.1.1 SUGARCANE

10.2.1.3.1.2.1.2 BAMBOO

10.2.1.3.1.2.1.3 WHEAT STRAW

10.2.1.3.1.2.1.4 OTHERS

10.2.1.4 OTHERS

10.3 RETAILING

10.3.1 RETAILING, BY MATERIAL TYPE

10.3.1.1 PAPER

10.3.1.2 PLASTIC

10.3.1.3 MOLDED FIBER/PULP

10.3.1.3.1 MOLDED FIBER/PULP, BY MATERIAL TYPE

10.3.1.3.1.1 RECYCLED PAPER

10.3.1.3.1.2 NATURAL FIBER

10.3.1.3.1.2.1 NATURAL FIBER, BY MATERIAL TYPE

10.3.1.3.1.2.1.1 BAMBOO

10.3.1.3.1.2.1.2 WHEAT STRAW

10.3.1.3.1.2.1.3 SUGARCANE

10.3.1.3.1.2.1.4 OTHERS

10.3.1.4 OTHERS

10.4 OTHERS

11 MEXICO FOOD SERVICE PACKAGING MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT

11.3 INDIRECT

12 MEXICO FOOD SERVICE PACKAGING MARKET, COUNTRY ANALYSIS

12.1 MEXICO

13 COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MEXICO

14 SWOT ANALYSIS

15 COMPANY SHARE ANALYSIS

15.1 WESTROCK COMPANY

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 INTERNATIONAL PAPER

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 DART CONTAINER CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENT

15.4 BERRY GLOBAL INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 SABERT CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 AMCOR PLC

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 FABRI-KAL

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 GENPACK, LLC

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 HUHTAMAKI

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 SEALED AIR

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

16 QUESTIONNAIRES

17 RELATED REPORTS

Lista de Tablas

TABLE 1 MARKET SHARE OF MOLDED FIBER VS. OTHER SUBSTRATES

TABLE 2 REVENUE OF SUPPLIERS (USD MILLION) (2021)

TABLE 3 TOP SUPPLIERS INFORMATION (2020)

TABLE 4 MEXICO FOOD SERVICE PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 MEXICO FOOD IN FOOD SERVICE PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 MEXICO BEVERAGES IN FOOD SERVICE PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 MEXICO FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 8 MEXICO FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (MILLION UNITS)

TABLE 9 MEXICO PLASTIC IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 10 MEXICO MOLDED FIBER / PULP IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 11 MEXICO NATURAL FIBER IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 12 MEXICO FOOD SERVICE PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 13 MEXICO RIGID PACKAGING IN FOOD SERVICE PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 14 MEXICO FLEXIBLE PACKAGING IN FOOD SERVICE PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 15 MEXICO FOOD SERVICE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 16 MEXICO TRANSPORTATION IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 17 MEXICO MOLDED FIBER / PULP IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 18 MEXICO NATURAL FIBER IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 19 MEXICO RETAILING IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 20 MEXICO MOLDED FIBER / PULP IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 21 MEXICO NATURAL FIBER IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 22 MEXICO FOOD SERVICE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 MEXICO FOOD SERVICE PACKAGING MARKET: SEGMENTATION

FIGURE 2 MEXICO FOOD SERVICE PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 MEXICO FOOD SERVICE PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 MEXICO. FOOD SERVICE PACKAGING MARKET

FIGURE 5 MEXICO FOOD SERVICE PACKAGING MARKET: MEXICO VS. REGIONAL MARKET ANALYSIS

FIGURE 6 MEXICO FOOD SERVICE PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 7 MEXICO FOOD SERVICE PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 MEXICO FOOD SERVICE PACKAGING MARKET

FIGURE 9 MEXICO FOOD SERVICE PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 MEXICO FOOD SERVICE PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 11 MEXICO FOOD SERVICE PACKAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 MEXICO FOOD SERVICE PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MEXICO FOOD SERVICE PACKAGING MARKET: SEGMENTATION

FIGURE 14 INCREASING ADOPTION OF ECO-FRIENDLY AND BIODEGRADABLE PACKAGING IS EXPECTED TO DRIVE THE MEXICO FOOD SERVICE PACKAGING MARKET IN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 15 ON-THE-GO LIFESTYLE IS INCREASING THE DEMAND FOR FOOD SERVICE PACKAGING IS EXPECTED TO DRIVE THE MEXICO FOOD SERVICE PACKAGING MARKET IN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 16 FOOD IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MEXICO FOOD SERVICE PACKAGING MARKET IN 2022 & 2029

FIGURE 17 FOOD IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MEXICO FOOD SERVICE PACKAGING MARKET IN 2022 & 2029

FIGURE 18 MEXICO FOOD SERVICE PACKAGING MARKET: FACTORS AFFECTING NEW PRODUCT LAUNCHES STRATEGY

FIGURE 19 SUPPLY CHAIN OF MEXICO FOOD SERVICE PACKAGING MARKET

FIGURE 20 VALUE CHAIN OF MEXICO FOOD SERVICE PACKAGING MARKET

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MEXICO FOOD SERVICE PACKAGING MARKET

FIGURE 22 MEXICO FOOD SERVICE PACKAGING MARKET: BY TYPE, 2021

FIGURE 23 MEXICO FOOD SERVICE PACKAGING MARKET: BY MATERIAL TYPE, 2021

FIGURE 24 MEXICO FOOD SERVICE PACKAGING MARKET: BY PRODUCT TYPE, 2021

FIGURE 25 MEXICO FOOD SERVICE PACKAGING MARKET: BY APPLICATION, 2021

FIGURE 26 MEXICO FOOD SERVICE PACKAGING MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 27 MEXICO FOODSERVICE PACKAGING MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.