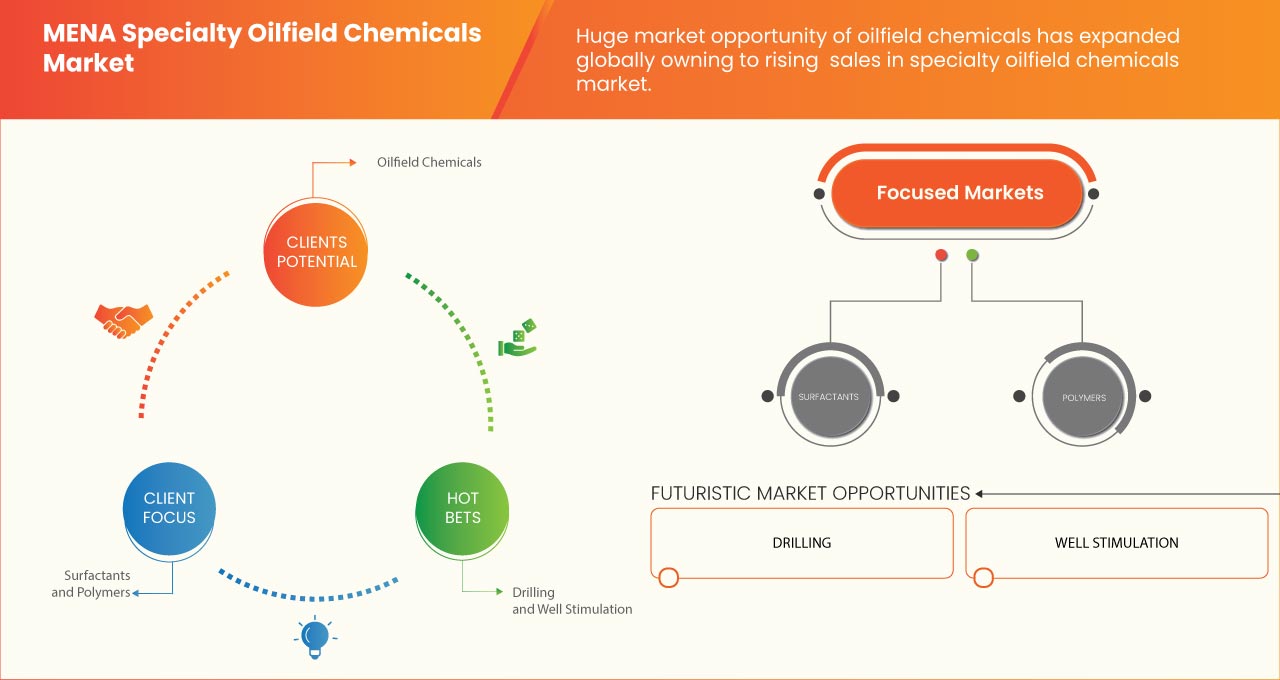

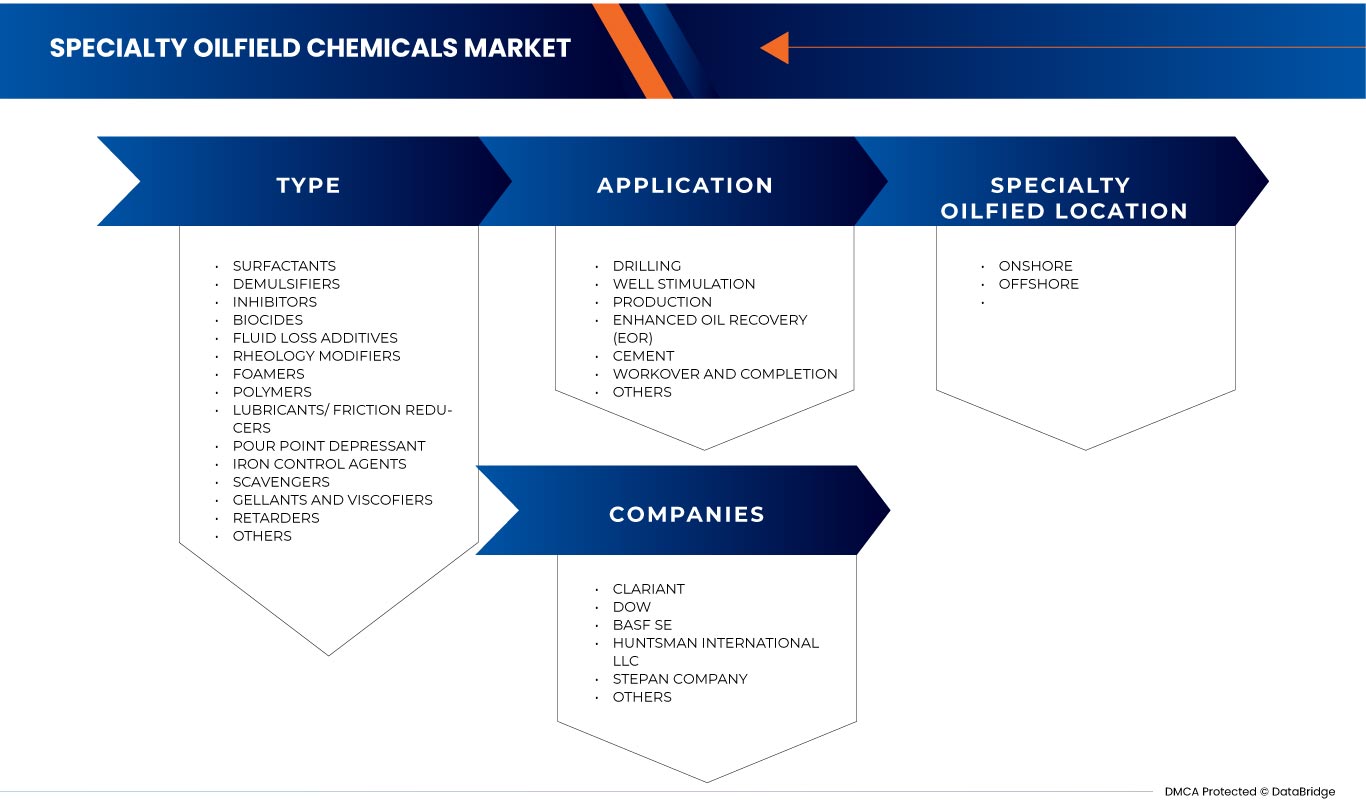

MENA Specialty Oilfield Chemicals Market, By Type (Surfactants, Demulsifiers, Inhibitors, Biocides, Fluid Loss Additives, Rheology Modifiers, Foamers, Polymers, Lubricants/Friction Reducers, Pour Point Depressant, Iron Control Agents, Scavenger, Gellants and Viscofiers, Retarders, and Others), By Application (Drilling, Well Stimulation, Production, and Enhanced Oil Recovery (EOR), Cement, Workover & Completion, and Others), Specialty Oilfield Location (Onshore and Offshore) - Industry Trends and Forecast to 2030.

MENA Specialty Oilfield Chemicals Market Analysis and Insights

The modern chemical industry is highly dependent on crude oil and natural gas feedstocks. Chemical engineering joins petroleum engineering to play an important role in the production of oil and gas products. The use of oil field specialty chemicals is more efficient drill and operate oil and gas wells and enhancing the productivity of the field's reservoirs and will grow as the petroleum industry becomes more dependent on increasing the production of crude oil or petroleum products from existing fields.

Oil field specialty chemicals are manufactured from chemicals that are made up of different chemical compositions which help in separation, bonding, and strengthening. Oil field specialty chemicals are mixtures of natural and synthetic chemical compounds which are used to cool and lubricate the drill, clean the hole bottom of drilling equipment, carry cuttings to the surface, control formation pressures, and control downhole formation pressures. Oil field specialty chemicals products have unique properties which makes products the ideal solution in many different applications. Specialty chemical products are used to reduce the swelling of the subterranean formation in the presence of water.

However, the price of crude oil as it impacts the usage of oil field specialty chemicals products for the extraction of crude oil, and increasing stringent environmental regulations and geopolitical issues may restrain the growth of the market in the forecast period.

The rising strategic initiatives by market players are giving opportunities for the market to grow. However, high competition in the oil industries and long lead times for overseas qualifications are key challenges to market growth. Data Bridge Market Research analyzes that the MENA specialty oilfield chemicals market is expected to reach a value of USD 241.80 million by 2030, at a CAGR of 4.1% during the forecast period. Type accounts for the largest service type segment in the market due to increasing demand for specialty chemicals in oilfield companies for the better treatment of oil and water. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Años históricos |

2021 (Personalizable para 2015 – 2020) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Tipo (surfactantes, demulsionantes, inhibidores, biocidas, aditivos para pérdida de fluidos , modificadores de reología, espumantes, polímeros, lubricantes/reductores de fricción, depresores del punto de fluidez , agentes de control de hierro, depuradores, gelificantes, viscosificadores, retardadores y otros), por aplicación (perforación, estimulación de pozos, producción y recuperación mejorada de petróleo (EOR), cemento, reacondicionamiento y terminación y otros), ubicación del campo petrolífero especializado (en tierra y en alta mar) |

|

Países cubiertos |

Arabia Saudita, Irak, Emiratos Árabes Unidos, Irán, Qatar, Kuwait, Argelia, Libia, Egipto y el resto de MENA |

|

Actores del mercado cubiertos |

Las principales empresas que operan en el mercado de productos químicos especializados para yacimientos petrolíferos son BASF SE, Solvay, Dow, Baker Hughes Company, Clariant, Evonik Industries AG, Kemira, Thermax Limited, Huntsman International LLC, Innospec, Stepan Company, EMEC, Chevron Phillips Chemical Company LLC, Versalis SpA, Halliburton, Albemarle Inc. y ChampionX, entre otras. |

Definición del mercado de productos químicos especializados para yacimientos petrolíferos de MENA

Los productos químicos especiales para yacimientos petrolíferos son aquellos productos químicos que se utilizan habitualmente para recuperar petróleo de manera eficiente de los recursos sin afectar el medio ambiente ni los equipos. Los productos químicos especiales para yacimientos petrolíferos tienen varias funciones positivas, como mejorar la recuperación de petróleo, optimizar la perforación, proteger contra la corrosión, evitar la pérdida de lodo en diferentes formaciones geológicas, estabilizar el fluido de perforación en entornos de alta presión y alta temperatura, entre otras. El uso de estos productos químicos ayuda a aumentar la eficacia operativa, proteger los equipos y mejorar el rendimiento general de las operaciones de los yacimientos petrolíferos en varias fases de exploración, producción, transporte y refinación de petróleo crudo y gas natural.

Dinámica del mercado de productos químicos especializados para yacimientos petrolíferos en la región MENA

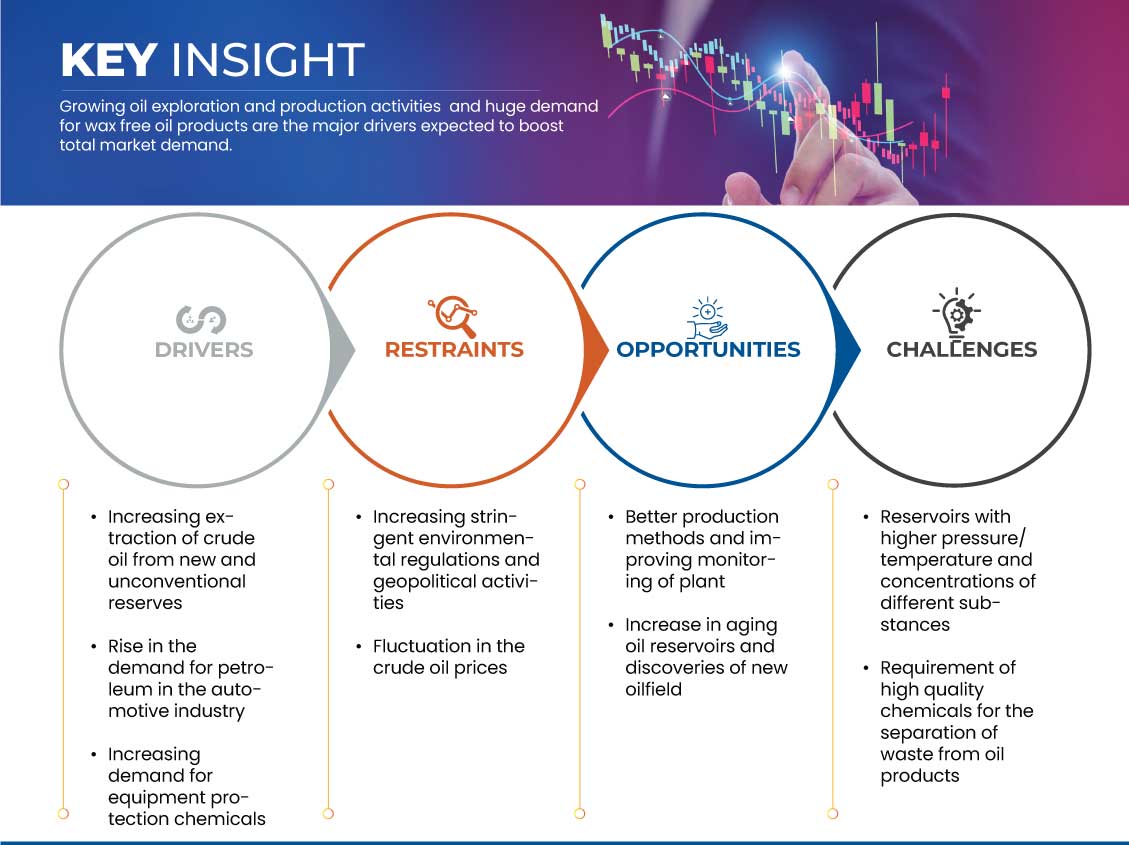

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Aumento de la extracción de petróleo crudo de reservas nuevas y no convencionales

El petróleo crudo se extrae de las profundidades de la tierra mediante varios procesos y máquinas perforadoras gigantes. El petróleo crudo se encuentra en grandes depósitos subterráneos donde antiguamente se encontraban mares. Los depósitos de petróleo crudo se pueden encontrar debajo de la tierra o en el fondo del océano. El petróleo convencional se extrae de depósitos subterráneos mediante métodos tradicionales de perforación y bombeo. El petróleo convencional es un líquido a temperatura y presión atmosféricas. La extracción de petróleo crudo de reservas no convencionales no se puede recuperar mediante métodos tradicionales de perforación y bombeo.

Se están utilizando técnicas de extracción avanzadas, como la extracción y perforación de arenas petrolíferas, para recuperar petróleo más pesado que no fluye de forma independiente. Las reservas no convencionales de petróleo ligero y compacto (LTO) se encuentran a gran profundidad bajo la superficie de la Tierra, principalmente en formaciones rocosas de baja permeabilidad, como yacimientos de esquisto, arenisca y lutita. La extracción de petróleo crudo de las reservas no convencionales utiliza la perforación horizontal y la fracturación hidráulica.

Los productos químicos especiales para yacimientos petrolíferos se utilizan en la maquinaria y el equipo que se utilizan para extraer petróleo crudo para las reservas. También se están llevando a cabo varios tipos de investigaciones para encontrar nuevos recursos de petróleo crudo. A partir del petróleo crudo, se puede crear una amplia gama de productos: gas, gasolina, queroseno, gasóleo y, finalmente, asfalto. Los productos químicos especiales para yacimientos petrolíferos ayudan a la extracción eficaz de petróleo crudo y reducen el desperdicio de material durante los procesos.

Por lo tanto, la creciente extracción de petróleo crudo de reservas no convencionales aumentará la demanda de productos químicos especializados en el campo petrolero en una medida más significativa, lo que se espera que impulse el crecimiento del mercado.

- Aumento de la demanda de petróleo en la industria automotriz

La industria automotriz está en constante crecimiento en todas las regiones. La demanda de automóviles, vehículos pesados y vehículos de dos ruedas ha aumentado, lo que ha impulsado el crecimiento de la industria automotriz. Los motores de los vehículos funcionan con productos derivados del petróleo. La demanda de automóviles ha aumentado en los países en desarrollo, lo que ha impulsado la necesidad de productos derivados del petróleo.

Los productos derivados del petróleo se extraen del petróleo crudo mediante varios procesos. Durante los procesos de separación de los subproductos del petróleo crudo se utilizan varios tipos de productos químicos especiales para yacimientos petrolíferos. Los productos químicos especiales para yacimientos petrolíferos aumentan la eficacia de las operaciones, lo que da como resultado la producción de productos derivados del petróleo de calidad deseable.

En conclusión, la creciente demanda de productos derivados del petróleo para diferentes sectores aumentará la necesidad de productos químicos especializados para yacimientos petrolíferos para la producción de petróleo en las industrias de refinación, lo que se espera que impulse el crecimiento del mercado.

Restricción

- Regulaciones ambientales cada vez más estrictas y cuestiones geopolíticas

Las perforaciones de petróleo y gas tienen un grave impacto en nuestras zonas silvestres y comunidades. Los proyectos de perforación funcionan las 24 horas del día, lo que genera contaminación, fomenta el cambio climático, altera la vida silvestre y daña las tierras públicas. Las normas sobre perforaciones en varias regiones se están volviendo estrictas. Las perforaciones han afectado al medio ambiente en mayor medida. El aumento de las actividades de exploración de petróleo y gas sin suficientes datos de referencia en los ecosistemas de aguas profundas ha planteado desafíos para la gestión ambiental.

La infraestructura construida para la extracción de petróleo y gas puede tener efectos radicales en las zonas silvestres. La construcción de carreteras, instalaciones y sitios de perforación requiere equipo pesado y puede destruir grandes porciones de naturaleza virgen. Los grandes derrames de petróleo son enormes asesinos de la vida silvestre y pueden causar daños duraderos a los ecosistemas marinos.

Se supone que los fluidos de perforación inyectados en los pozos para lubricación deben ser capturados en fosas revestidas para su eliminación. Sin embargo, los productos químicos especiales de los yacimientos petrolíferos a menudo se filtran y salpican en los sitios de perforación, lo que afecta al medio ambiente. El creciente impacto de los yacimientos y los productos químicos en el ecosistema reduce la demanda de productos químicos especiales para los yacimientos petrolíferos.

En conclusión, una mayor fluctuación del precio del petróleo crudo hará que los fabricantes pierdan y no inviertan más en el mercado. Se espera que la inestabilidad en la demanda de productos derivados del petróleo limite el crecimiento del mercado.

Oportunidad

- Mejores métodos de producción y mejora del seguimiento de las plantas

En las industrias del petróleo y el gas, los fabricantes están adoptando mejores métodos y técnicas de producción que pueden mejorar la calidad del producto. El equipo utilizado en la extracción y el procesamiento de petróleo crudo para diversos productos se está automatizando. La alta calidad del equipo se utiliza en la extracción de petróleo crudo. La adopción de nuevas técnicas de producción en la planta de extracción de petróleo aumentará la demanda de productos químicos especiales para yacimientos petrolíferos.

El monitoreo regular de la planta ayudará a reducir el costo de reemplazo del equipo y también las pérdidas. En la producción de productos derivados del petróleo, también se excretan varios tipos de sustancias químicas tóxicas que afectan la vida de la planta. El monitoreo regular de la planta no tendrá ningún impacto en la calidad del producto y la capacidad de producción del equipo también puede aumentar. El químico especial para yacimientos petrolíferos se aplica en la superficie de acuerdo con las sugerencias de monitoreo.

Por lo tanto, la adopción de nuevas técnicas de producción y el monitoreo regular de la planta aumentará la demanda de productos químicos especializados para yacimientos petrolíferos, lo que se espera que cree oportunidades para el crecimiento del mercado.

Desafíos

- Reservorios con mayores presiones/temperaturas y concentraciones de diferentes sustancias

La presencia de yacimientos se encuentra en las profundidades del mar o de la tierra de donde se extrae el crudo. Los charcos están presentes en diferentes zonas que experimentan una presión adicional bajo la tierra. Otros tipos de gases están presentes en el interior de la superficie terrestre, lo que aumenta la temperatura de los yacimientos. La concentración de diferentes sustancias también está presente en los charcos, lo que supone un reto para los productos químicos especiales del campo petrolero.

La fluctuación de la presión y la temperatura del yacimiento afectará el diseño y las operaciones del oleoducto. La presión del yacimiento está directamente relacionada con la presión en boca de pozo, que puede afectar la presión de operación del oleoducto. Una presión de yacimiento muy alta puede requerir una metalurgia especial para las tuberías y productos químicos especiales para yacimientos petrolíferos, lo que puede aumentar drásticamente el costo del material. La presencia de temperaturas extremadamente altas o bajas también puede eliminar la flexibilidad del diseño.

El desafío al que se enfrentan los productos químicos especiales para yacimientos petrolíferos es que deben soportar un entorno hostil. El fluido de perforación debe ser químicamente estable y no corrosivo en condiciones de alta presión y temperatura. El comportamiento físico y químico del cemento cambia significativamente a temperaturas y presiones elevadas.

En conclusión, se espera que las condiciones de alta presión y temperatura y la concentración de diferentes sustancias en los yacimientos supongan un desafío para el crecimiento del mercado.

Acontecimientos recientes

- En agosto de 2021, BASF SE y SINOPEC ampliarán aún más su planta Verbund en Nanjing, China, lo que aumentará la producción de varias plantas químicas posteriores. Este desarrollo ayudó a la empresa a aumentar los ingresos en poco tiempo.

- En noviembre de 2019, Baker Hughes Company decidió ampliar sus capacidades de fabricación de productos químicos con una nueva planta en Arabia Saudita. Este desarrollo ayudó a la empresa a satisfacer la creciente demanda de productos químicos en diferentes aplicaciones.

- En septiembre de 2019, Evonik Industries AG decidió aumentar la capacidad de producción de productos químicos especiales en Alemania y decidió invertir USD 441,00 millones en el proyecto. Este desarrollo ayudó a la empresa a aumentar la capacidad de producción y de instalaciones.

Alcance del mercado de productos químicos especiales para yacimientos petrolíferos en la región MENA

El mercado de productos químicos especiales para yacimientos petrolíferos de la región MENA está segmentado por tipo, ubicación y aplicación. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

Por tipo

- Surfactantes

- Demulsionantes

- Inhibidores

- Biocidas

- Aditivos para la pérdida de fluidos

- Modificadores de reología

- Espumadores

- Polímeros

- Lubricantes/Reductores de Fricción

- Depresor del punto de fluidez

- Agentes de control de hierro

- Basurero

- Gelificantes y viscosificantes

- Retardadores

- Otros

Sobre la base del tipo, el mercado de productos químicos especializados para yacimientos petrolíferos de MENA se segmenta en surfactantes, demulsionantes, inhibidores, biocidas, aditivos para pérdida de fluidos, modificadores de reología, espumantes, polímeros, lubricantes/ reductores de fricción , depresores del punto de fluidez, agentes de control de hierro, depuradores, gelificantes y viscosificadores, retardadores y otros.

Por ubicación

- En tierra

- Costa afuera

Sobre la base de la ubicación de los yacimientos petrolíferos especializados, el mercado de productos químicos especializados para yacimientos petrolíferos de MENA se segmenta en tierra firme y mar adentro.

Por aplicación

- Perforación

- Estimulación de pozos

- Producción

- Recuperación Mejorada de Petróleo (EOP)

- Cemento

- Reacondicionamiento y finalización

- Otros

Sobre la base de la aplicación, el mercado de productos químicos especializados para yacimientos petrolíferos de MENA está segmentado en perforación, estimulación de pozos, producción, recuperación mejorada de petróleo (EOR), cemento, reacondicionamiento y terminación, y otros.

Análisis y perspectivas regionales del mercado de productos químicos especiales para yacimientos petrolíferos de la región MENA

Se analiza el mercado de productos químicos especiales para yacimientos petrolíferos de la región MENA y se proporciona información sobre el tamaño del mercado en cuanto a tipo, ubicación y aplicación. Los países incluidos en este informe de mercado son Arabia Saudita, Irak, Emiratos Árabes Unidos, Irán, Qatar, Kuwait, Argelia, Libia, Egipto y el resto de la región MENA.

Se espera que el segmento de Arabia Saudita domine el mercado de productos químicos especializados para yacimientos petrolíferos de MENA, ya que las empresas están expandiendo sus capacidades de producción y celebrando acuerdos en diferentes regiones para satisfacer la creciente demanda de productos químicos especializados para yacimientos petrolíferos en el alcance de la industria del petróleo y el gas.

La sección de países del informe también proporciona factores de impacto individuales en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas europeas y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, y el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de productos químicos especializados para yacimientos petrolíferos en la región MENA

El panorama competitivo del mercado de productos químicos especiales para yacimientos petrolíferos de la región MENA ofrece detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en I+D, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los ensayos de productos, las aprobaciones de productos, las patentes, la amplitud y amplitud de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa en el mercado de productos químicos especiales para yacimientos petrolíferos de la región MENA.

Algunos de los principales actores que operan en el mercado de productos químicos especializados para yacimientos petrolíferos de MENA son BASF SE, Solvay, Dow, Baker Hughes Company, Clariant, Evonik Industries AG, Kemira, Thermax Limited, Huntsman International LLC, Innospec, Stepan Company, EMEC, Chevron Phillips Chemical Company LLC, Versalis SpA, Halliburton, Albemarle Inc., ChampionX, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MENA SPECIALTY OILFIELD CHEMICALS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER FIVE FORCES ANALYSIS

4.3 RAW MATERIAL COVERAGE

4.3.1 PRODUCTION CONSUMPTION ANALYSIS

4.3.2 IMPORT-EXPORT SCENARIO

4.3.3 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.3.4 VENDOR SELECTION CRITERIA

4.4 REGULATORY COVERAGE

4.4.1 PRODUCT CODES

4.4.2 CERTIFIED STANDARDS

4.4.3 SAFETY STANDARDS

4.4.3.1 MATERIAL AND HANDLING

4.4.3.2 TRANSPORTATION AND PRECAUTION

4.4.3.3 TRANSPORTATION AND PRECAUTION

4.5 PRODUCTION INSIGHTS

5 CLIMATE CHANGE SCENARIO

5.1 ENVIRONMENTAL CONCERNS

5.2 INDUSTRY RESPONSE

5.3 GOVERNMENT’S ROLE

5.4 ANALYST RECOMMENDATIONS

6 PRICING ANALYSIS

7 SUPPLY CHAIN ANALYSIS

7.1 LOGISTIC COST SCENARIO

7.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 INCREASING EXTRACTION OF CRUDE OIL FROM NEW AND UNCONVENTIONAL RESERVES

8.1.2 RISE IN THE DEMAND FOR PETROLEUM IN THE AUTOMOTIVE INDUSTRY

8.1.3 INCREASING DEMAND FOR EQUIPMENT PROTECTION CHEMICALS

8.1.4 HUGE DEMAND FOR WAX-FREE OIL PRODUCTS

8.1.5 GROWING OIL EXPLORATION & PRODUCTION ACTIVITIES

8.2 RESTRAINTS

8.2.1 INCREASING STRINGENT ENVIRONMENTAL REGULATIONS AND GEOPOLITICAL ISSUES

8.2.2 FLUCTUATION IN THE CRUDE OIL PRICES

8.3 OPPORTUNITIES

8.3.1 BETTER PRODUCTION METHODS AND IMPROVING MONITORING OF PLANT

8.3.2 INCREASE IN AGING OIL RESERVOIRS AND DISCOVERIES OF NEW OIL FIELDS

8.3.3 GROWING DEEP-WATER & ULTRA-DEEP-WATER DRILLING PROJECTS

8.4 CHALLENGES

8.4.1 RESERVOIRS HIGHER PRESSURES/TEMPERATURE AND CONCENTRATIONS OF DIFFERENT SUBSTANCES

8.4.2 REQUIREMENT OF HIGH-QUALITY CHEMICALS FOR THE SEPARATION OF WASTE FROM OIL PRODUCTS

9 MENA SPECIALTY OIL FIELD CHEMICALS MARKET, BY TYPE

9.1 OVERVIEW

9.2 SURFACTANTS

9.3 DEMULSIFIERS

9.4 INHIBITORS

9.4.1 SCALE INHIBITORS

9.4.2 ACID COROSSION INHIBITORS

9.5 BIOCIDES

9.6 FLUID LOSS ADDITIVES

9.7 RHEOLOGY MODIFIERS

9.8 FOAMERS

9.9 POLYMERS

9.1 LUBRICANTS/ FRICTION REDUCERS

9.11 POUR POINT DEPRESSANT

9.12 IRON CONTROL AGENTS

9.13 SCAVENGER

9.14 GELLANTS AND VISCOSIFIERS

9.15 RETARDERS

9.16 OTHERS

10 MENA SPECIALTY OIL FIELD CHEMICALS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 DRILLING

10.3 WELL STIMULATION

10.4 PRODUCTION

10.5 ENHANCED OIL RECOVERY (EOR)

10.6 CEMENT

10.7 WORKOVER & COMPLETION

10.8 OTHERS

11 MENA SPECIALTY OIL FIELD CHEMICALS MARKET, BY SPECIALTY OILFIELD LOCATION

11.1 OVERVIEW

11.2 ONSHORE

11.3 OFFSHORE

12 MENA SPECIALTY OILFIELD CHEMICALS MARKET BY COUNTRIES

12.1 SAUDI ARABIA

12.2 IRAQ

12.3 UNITED ARAB EMIRATES

12.4 IRAN

12.5 KUWAIT

12.6 QATAR

12.7 ALGERIA

12.8 LIBYA

12.9 EGYPT

12.1 REST OF MENA

13 MENA SPECIALTY OILFIELD CHEMICALS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MENA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 CLARIANT

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 DOW

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 BASF SE

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 HUNTSMAN INTERNATIONAL LLC

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 STEPAN COMPANY

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 ALBEMARLE INC

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 BAKER HUGHES COMPANY

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 COMPANY SHARE ANALYSIS

15.7.4 PRODUCT PORTFOLIO

15.7.5 RECENT DEVELOPMENT

15.8 CHAMPIONX

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 CHEVRON PHILLIPS CHEMICAL COMPANY LLC

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 EMEC

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 EVONIK INDUSTRIES AG

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 HALLIBURTON

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 COMPANY SHARE ANALYSIS

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPMENT

15.13 INNOSPEC

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 KEMIRA

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 MULTICHEM INDUSTRIES LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 SOLVAY

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 COMPANY SHARE ANALYSIS

15.16.4 PRODUCT PORTFOLIO

15.16.5 RECENT DEVELOPMENT

15.17 THERMAX LIMITED

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 VERSALIS S.P.A.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

16 QUESTIONNAIRES

17 RELATED REPORTS

Lista de Tablas

TABLE 1 U.A.E PRODUCT CODE-

TABLE 2 MENA SPECIALTY OIL FIELD CHEMICALS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 3 MENA SPECIALTY OIL FIELD CHEMICALS MARKET, BY TYPE, 2021-2030 (KILO TONNES)

TABLE 4 MENA INHIBITORS IN SPECIALTY OIL FIELD CHEMICALS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 MENA SPECIALTY OIL FIELD CHEMICALS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 6 MENA SPECIALTY OIL FIELD CHEMICALS MARKET, BY SPECILATY OILFILED LOCATION, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 MENA SPECIALTY OILFIELD CHEMICALS MARKET: SEGMENTATION

FIGURE 2 MENA SPECIALTY OILFIELD CHEMICALS MARKET: DATA TRIANGULATION

FIGURE 3 MENA SPECIALTY OILFIELD CHEMICALS MARKET: DROC ANALYSIS

FIGURE 4 MENA SPECIALTY OILFIELD CHEMICALS MARKET: REGIONAL VS. COUNTRY MARKET ANALYSIS

FIGURE 5 MENA SPECIALTY OILFIELD CHEMICALS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MENA SPECIALTY OILFIELD CHEMICALS MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 MENA SPECIALTY OILFIELD CHEMICALS MARKET: MULTIVARIATE MODELLING

FIGURE 8 MENA SPECIALTY OILFIELD CHEMICALS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MENA SPECIALTY OILFIELD CHEMICALS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MENA SPECIALTY OILFIELD CHEMICALS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MENA SPECIALTY OILFIELD CHEMICALS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MENA SPECIALTY OILFIELD CHEMICALS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MENA SPECIALTY OILFIELD CHEMICALS MARKET: SEGMENTATION

FIGURE 14 INCREASING EXTRACTION OF CRUDE OIL FROM NEW AND UNCONVENTIONAL RESERVES IS EXPECTED TO DRIVE THE MENA SPECIALTY OILFIELD CHEMICALS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 SURFACTANTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MENA SPECIALTY OILFIELD CHEMICALS MARKET IN 2022 & 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MENA SPECIALTY OILFIELD CHEMICALS MARKET

FIGURE 17 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY TYPE, 2022

FIGURE 18 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY TYPE, 2023-2030 (USD MILLION)

FIGURE 19 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 20 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 21 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY APPLICATION, 2022

FIGURE 22 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 23 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 24 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 25 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY SPECILATY OILFILED LOCATION, 2022

FIGURE 26 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY SPECILATY OILFILED LOCATION, 2023-2030 (USD MILLION)

FIGURE 27 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY SPECILATY OILFILED LOCATION, CAGR (2023-2030)

FIGURE 28 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY SPECILATY OILFILED LOCATION, LIFELINE CURVE

FIGURE 29 MENA SPECIALTY OILFIELD CHEMICALS MARKET: SNAPSHOT (2022)

FIGURE 30 MENA SPECIALTY OILFIELD CHEMICALS MARKET: BY COUNTRY (2022)

FIGURE 31 MENA SPECIALTY OILFIELD CHEMICALS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 32 MENA SPECIALTY OILFIELD CHEMICALS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 33 MENA SPECIALTY OILFIELD CHEMICALS MARKET: BY TYPE (2023-2030)

FIGURE 34 MENA SPECIALTY OILFIELD CHEMICALS MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.