Ksa Trucking Road Freight Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

8.61 Billion

USD

13.77 Billion

2024

2031

USD

8.61 Billion

USD

13.77 Billion

2024

2031

| 2025 –2031 | |

| USD 8.61 Billion | |

| USD 13.77 Billion | |

|

|

|

|

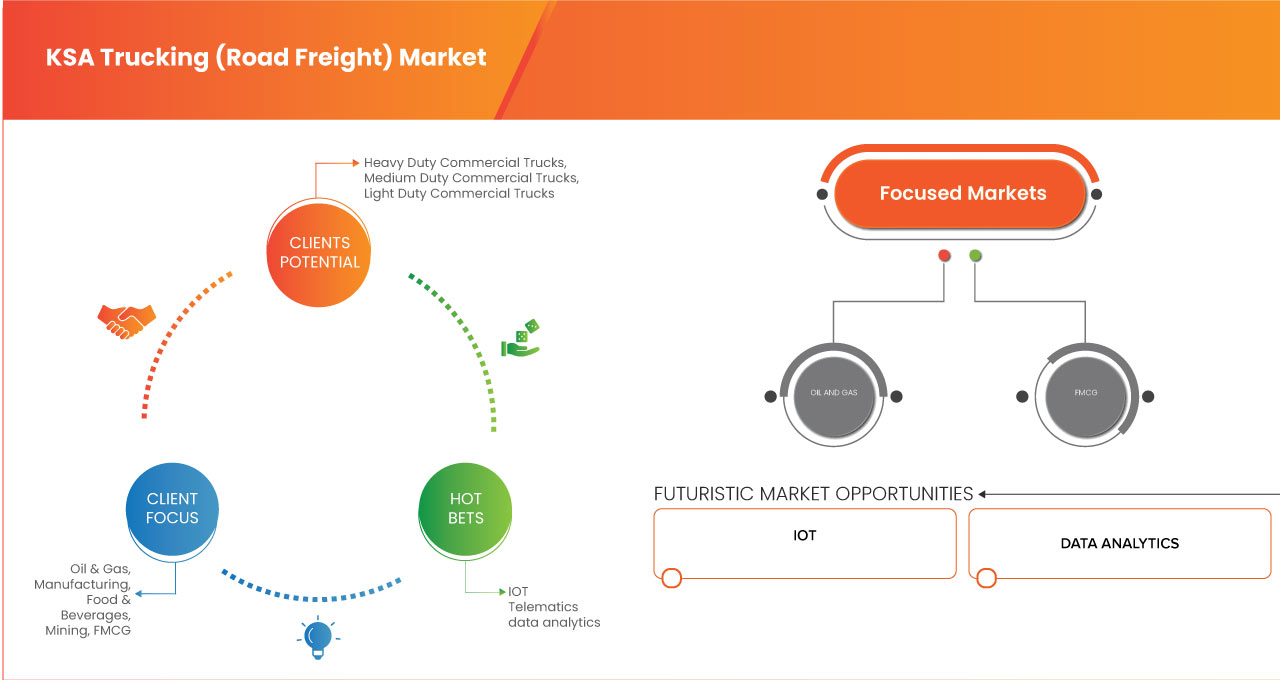

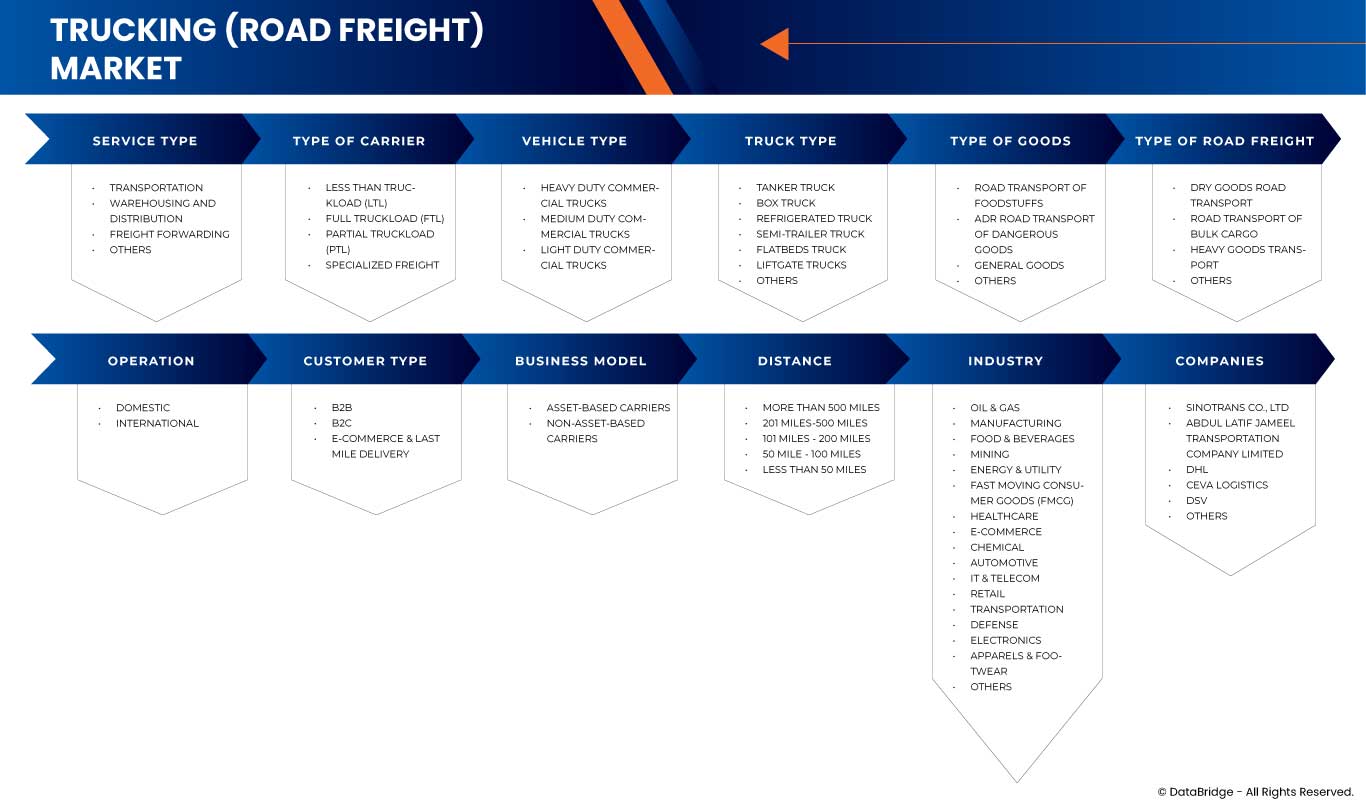

Segmentación del mercado de transporte de mercancías por carretera en Arabia Saudita (KSA), por tipo de servicio (transporte, almacenamiento y distribución, y expedición de mercancías), tipo de transportista (carga parcial (LTL), carga completa (FTL), carga parcial (PTL) y carga especializada), tipo de vehículo (camiones comerciales de servicio pesado, camiones comerciales de servicio mediano y camiones comerciales de servicio ligero), tipo de camión (camión cisterna, camión de caja, camión refrigerado, camión semirremolque, camión de plataforma y camiones con plataforma elevadora), tipo de mercancías (transporte por carretera de productos alimenticios, transporte por carretera de mercancías peligrosas ADR y mercancías generales), tipo de transporte por carretera (transporte por carretera de mercancías secas, transporte por carretera de carga a granel y transporte de mercancías pesadas), operación (nacional e internacional), tipo de cliente (B2B, B2C, comercio electrónico y entrega de última milla), modelo de negocio (transportistas con activos y transportistas sin activos), distancia (más de 500 Millas, 201 Millas-500 Millas, 101 Millas – 200 Millas, 50 Millas – 100 Millas y Menos de 50 Millas), Industria (Petróleo y Gas, Manufactura, Alimentos y Bebidas, Minería, Energía y Servicios Públicos, Bienes de Consumo de Rápida Rotación (FMCG), Salud, Comercio Electrónico, Química, Automotriz, TI y Telecomunicaciones, Comercio Minorista, Transporte, Defensa, Electrónica, Indumentaria y Calzado) - Tendencias de la Industria y Pronóstico hasta 2032

Análisis del mercado de transporte de mercancías por carretera en Arabia Saudita

El mercado del transporte de mercancías por carretera en Arabia Saudí ha experimentado un crecimiento significativo gracias a los avances tecnológicos y a la creciente demanda de datos hídricos precisos en diversas industrias. El mercado abarca una amplia gama de productos, como sistemas de sonar, ecosondas multihaz y monohaz, drones submarinos, sistemas GPS y software de gestión de datos. Sus principales aplicaciones abarcan la navegación marítima, la monitorización ambiental, la ingeniería costera, la exploración de petróleo y gas, y los sectores de defensa. La creciente necesidad de un mapeo preciso del terreno submarino, sumada al crecimiento del comercio marítimo, las actividades offshore y las iniciativas de protección ambiental, sigue impulsando la expansión del mercado. Además, innovaciones como la automatización, la integración de IA y la mejora de la tecnología de sensores están configurando el futuro de los estudios hidrográficos, haciéndolos más eficientes y rentables.

Tamaño del mercado de transporte de mercancías por carretera en Arabia Saudita

Se espera que el mercado de transporte por carretera de Arabia Saudita alcance los 13 770 millones de dólares en 2032, frente a los 8610 millones de dólares de 2024, con una tasa de crecimiento anual compuesta (CAGR) del 6,2 % entre 2025 y 2032. Además de información sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los actores principales, los informes de mercado elaborados por Data Bridge Market Research también incluyen análisis exhaustivos de expertos, epidemiología de pacientes, análisis de cartera de proyectos, análisis de precios y marco regulatorio.

Tendencias del mercado de transporte de mercancías por carretera en Arabia Saudita

“Expansión del comercio marítimo”

La expansión del comercio marítimo es un factor clave para el mercado del transporte por carretera en Arabia Saudita. A medida que crece la actividad marítima internacional, la necesidad de datos marítimos precisos y actualizados se vuelve crucial para la seguridad de la navegación y la eficiencia de las operaciones portuarias. Los levantamientos hidrográficos ayudan a trazar rutas marítimas, identificar peligros sumergidos y garantizar la seguridad de los buques, contribuyendo así al flujo fluido de mercancías en aguas internacionales. Además, la creciente complejidad de las rutas comerciales globales y la necesidad de un desarrollo portuario sostenible requieren tecnologías de levantamiento avanzado. Esta creciente demanda de datos precisos garantiza el crecimiento continuo del mercado del transporte por carretera en Arabia Saudita. Con el aumento del volumen comercial, el mercado está en condiciones de presenciar un aumento de la inversión en tecnologías de levantamiento avanzado. Por ello, los levantamientos hidrográficos desempeñan un papel vital en el sostenimiento de la economía marítima mundial.

Alcance del informe y segmentación del mercado de transporte de mercancías por carretera en Arabia Saudita

|

Atributos |

Perspectivas clave del mercado de transporte de mercancías por carretera en Arabia Saudita |

|

Segmentos cubiertos |

|

|

Actores clave del mercado |

Kuehne+Nagel (Suiza), CEVA Logistics (Francia), DHL (Alemania), DSV (Dinamarca), Abdul Latif Jameel Transportation Company Limited (República Árabe de Arabia Saudita), Sinotrans Co., Ltd (China), GAC (Emiratos Árabes Unidos), FedEx (EE. UU.), SEKO Logistics (EE. UU.), United Parcel Service of America, Inc. (EE. UU.), Hellmann (Alemania), JAS (EE. UU.), DB SCHENKER (Europa), fourwinds (República Árabe de Arabia Saudita), Ardian Global Express LLC. (Emiratos Árabes Unidos), NTF GROUP (República Árabe de Arabia Saudita), Defaf Logistics (República Árabe de Arabia Saudita), WeFreight (Emiratos Árabes Unidos) y Freights Solutions Co. (República Árabe de Arabia Saudita). |

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología de pacientes, análisis de la cartera de productos, análisis de precios y marco regulatorio. |

Definición del mercado de transporte de mercancías por carretera en Arabia Saudita

El mercado del transporte por carretera en Arabia Saudita (KSA) se refiere al sector que abarca el transporte de mercancías por carretera y constituye un componente dinámico y esencial de la industria logística en general. Este mercado gira en torno al movimiento de carga, desde materias primas hasta productos terminados, mediante una flota de camiones a través de extensas redes viales. La industria del transporte por carretera desempeña un papel crucial al conectar diversos puntos de las cadenas de suministro, garantizando la entrega puntual y eficiente de las mercancías. El mercado cuenta con una amplia gama de participantes, como transportistas, expedidores y proveedores de logística externos. El sector del transporte por carretera desempeña un papel clave para facilitar y apoyar el comercio. La dinámica del mercado se ve influenciada por factores como los avances tecnológicos, los marcos regulatorios, los precios del combustible y las tendencias económicas. Estos elementos configuran las estrategias empleadas por las empresas del sector del transporte por carretera. El mercado del transporte por carretera sirve como canal vital para el flujo fluido de mercancías, contribuyendo sustancialmente al movimiento global de productos básicos y al funcionamiento de las economías contemporáneas.

Dinámica del mercado del transporte de mercancías por carretera en Arabia Saudita

Conductores

- El crecimiento del sector del comercio electrónico impulsa los servicios de transporte de mercancías por carretera

La creciente demanda de exploración de petróleo y gas en alta mar está acelerando la necesidad de un mercado avanzado de transporte terrestre en Arabia Saudita para facilitar la cartografía submarina y la recopilación de datos precisos. A medida que las empresas exploran entornos submarinos más profundos y complejos, la precisión de las cartas batimétricas y los datos del fondo marino se vuelve crucial para identificar zonas ricas en recursos, garantizar la seguridad de las operaciones de perforación y minimizar los riesgos ambientales. Se espera que esta creciente actividad en la producción de energía en alta mar impulse la adopción de tecnologías hidrográficas de vanguardia, como ecosondas multihaz, sonares de barrido lateral y sistemas montados en ROV, en el mercado global.

Por ejemplo:

En febrero de 2024, se inició un estudio hidrográfico en un naufragio frente a Cove, Tobago, 21 días después de que un buque que derramaba combustible búnker encallara cerca de la costa. El estudio tuvo como objetivo medir la profundidad del agua y localizar peligros para la navegación para facilitar la retirada de la barcaza volcada, a la vez que se evaluaba la distribución de combustible e hidrocarburos . Se desplegaron especialistas y equipos avanzados para la contención del combustible y la recuperación del buque. Este incidente pone de relieve el papel crucial del transporte por carretera en Arabia Saudí (KSA) en las operaciones de petróleo y gas en alta mar, ya que permite un mapeo preciso, la mitigación de riesgos y una respuesta eficiente ante desastres, impulsando aún más la demanda en el mercado global.

En octubre de 2024, el buque turco de investigación petrolera avanzada, Oruc Reis, inició el primer programa integral de exploración petrolera en alta mar de Somalia, que abarca 15.000 kilómetros cuadrados en tres bloques. Equipado con estudios hidrográficos y capacidades sísmicas de vanguardia, el buque realizará estudios geológicos, geofísicos y oceanográficos durante 5 a 7 meses. Esta iniciativa, en el marco de una colaboración entre Turquía y Somalia, subraya la creciente demanda del mercado de transporte terrestre de Arabia Saudí en la exploración de petróleo y gas en alta mar, a medida que los países buscan herramientas avanzadas para liberar recursos energéticos e impulsar el crecimiento económico en regiones sin explotar.

- Desarrollo rápido de infraestructura en Arabia Saudita

El auge del desarrollo de infraestructura costera impulsa el mercado del transporte de mercancías por carretera en Arabia Saudí, ya que la topografía precisa y detallada de las zonas costeras es crucial para la planificación y construcción de infraestructuras como puertos, dársenas y sistemas de defensa costera. A medida que estos proyectos se expanden globalmente, aumenta la demanda de equipos de levantamiento hidrográfico, incluyendo sistemas de sonar avanzados, tecnologías cartográficas y herramientas de monitoreo ambiental. Estas tecnologías ayudan a evaluar la profundidad del agua, las condiciones del lecho marino y los posibles impactos ambientales, garantizando así que los proyectos de infraestructura costera se ejecuten de forma segura, eficiente y sostenible.

Por ejemplo,

- En octubre de 2024, la Armada de la India recibió el segundo de cuatro buques de investigación (grandes), el Nirdeshak (Astillero 3026), construido por Garden Reach Shipbuilders & Engineers (GRSE) en Calcuta. El Nirdeshak está diseñado para realizar estudios hidrográficos integrales costeros y de aguas profundas, esenciales para evaluar los accesos a puertos y canales de navegación, así como para recopilar datos oceanográficos y geofísicos. El buque está equipado con tecnologías hidrográficas avanzadas, como sonares de barrido lateral, sistemas de posicionamiento DGPS y vehículos submarinos autónomos. A medida que el desarrollo de infraestructuras costeras continúa en aumento a nivel mundial, la demanda de buques de investigación avanzados como el Nirdeshak pone de relieve la creciente necesidad de recopilar y monitorear datos precisos para una planificación y un desarrollo de infraestructura seguros y eficientes.

- En abril de 2021, el nuevo buque de prospección de alta mar de la Armada de Nigeria, el NNS LANA, hizo escala en Las Palmas de Gran Canaria, España, en su viaje de regreso a Nigeria. Este buque, sustituto del NNS LANA, está equipado con equipos hidrográficos, oceanográficos y geofísicos de última generación, incluyendo un sistema de propulsión eléctrica para minimizar la distorsión de los datos. Diseñado para prospecciones hidrográficas y tareas de seguridad marítima, el NNS LANA es un activo clave para las capacidades marítimas de Nigeria. Sus avanzadas capacidades mejorarán la capacidad del país para realizar prospecciones detalladas, apoyando así el desarrollo de la infraestructura costera. Esta creciente demanda de buques de prospección sofisticados contribuye a la creciente demanda del mercado de transporte de mercancías por carretera de Arabia Saudita a nivel mundial, especialmente en proyectos de infraestructura costera y marítima.

Oportunidades

- Iniciativas gubernamentales para apoyar al sector del transporte y la logística

Los avances tecnológicos en equipos de prospección están transformando significativamente el mercado del transporte de mercancías por carretera en Arabia Saudí, al permitir una recopilación de datos más precisa, eficiente y rentable. Innovaciones como los vehículos submarinos autónomos (AUV), los vehículos operados remotamente (ROV), los sistemas de sonar multihaz y las tecnologías de posicionamiento avanzadas han mejorado las capacidades de prospección, permitiendo la cartografía detallada de entornos submarinos complejos. Estos avances impulsan la adopción de equipos más sofisticados, cruciales para la monitorización y la gestión de la infraestructura costera, los entornos marinos y las rutas de navegación. A medida que la tecnología continúa evolucionando, se prevé que el mercado del transporte de mercancías por carretera en Arabia Saudí se expanda, ofreciendo soluciones más fiables y sostenibles para diversas aplicaciones, desde la seguridad marítima hasta la monitorización medioambiental.

Por ejemplo,

En noviembre de 2020, el IIT-Madras, una universidad de la India, desarrolló una embarcación de prospección autónoma no tripulada con energía solar, diseñada para estudios hidrográficos y oceanográficos en puertos y vías navegables interiores de la India. Esta innovadora embarcación, capaz de operar tanto de forma manual como autónoma, ofrece una alternativa autóctona a las costosas embarcaciones de prospección extranjeras. Equipada con ecosondas, GPS y comunicación de banda ancha, la embarcación puede medir la profundidad y la topografía submarina, transmitiendo datos en tiempo real a largas distancias. También ofrece la posibilidad de incorporar sensores adicionales como LiDAR para obtener una topografía y batimetría sin fisuras. Este avance tecnológico se alinea con la creciente demanda de equipos de prospección rentables y eficientes en el mercado de transporte de mercancías por carretera de Arabia Saudita, lo que pone de relieve la transición hacia soluciones más autónomas y sostenibles que mejoran la precisión de los estudios, reducen los costes operativos y permiten una mejor gestión de la infraestructura costera.

- Creciente demanda de logística de cadena de frío

A medida que las organizaciones adoptan el mantenimiento predictivo para mejorar la eficiencia operativa y reducir el tiempo de inactividad, la incorporación de equipos de levantamiento hidrográfico en estos marcos presenta enormes oportunidades. El mantenimiento predictivo utiliza datos de sensores en tiempo real para predecir averías en los equipos antes de que ocurran, y la introducción de métodos de limpieza de sensores en estos sistemas puede mejorar su rendimiento y durabilidad. Esta integración no solo mantiene los sensores en óptimas condiciones, sino que también mejora la propuesta de valor de los programas de mantenimiento predictivo, especialmente en empresas que dependen de maquinaria compleja y sistemas automatizados. Por ejemplo,

Según el artículo de MDPI, mediante el uso de señales de vibración de robots de limpieza, los marcos de mantenimiento predictivo pueden identificar de forma temprana la degradación del rendimiento y posibles problemas de seguridad. Esto permite una intervención proactiva, previniendo fallos operativos en sistemas de limpieza móviles autónomos. La integración del mantenimiento predictivo en las tecnologías de limpieza de sensores ofrece una importante oportunidad de crecimiento, ya que mejora la fiabilidad del sistema y reduce el tiempo de inactividad. A medida que aumenta la demanda de conducción autónoma, las soluciones de limpieza de sensores con capacidades avanzadas de monitorización serán esenciales para mantener un rendimiento óptimo de los sensores. Esto abre un nuevo camino para la innovación y el crecimiento en el mercado de la limpieza de sensores.

- Asociaciones estratégicas y colaboraciones entre actores del mercado

El mercado del transporte por carretera en Arabia Saudita es un componente fundamental del floreciente sector logístico y de transporte del país. Impulsado por una economía en rápida expansión y el aumento de las actividades comerciales, existe una demanda de servicios eficientes de transporte por carretera. El panorama del mercado es diverso e incluye empresas de logística, empresas de transporte y proveedores de tecnología. Abundan las oportunidades para establecer alianzas estratégicas, especialmente en la integración tecnológica, donde las colaboraciones pueden mejorar la optimización de rutas, el seguimiento en tiempo real y la gestión general de la flota, mejorando así la eficiencia y reduciendo los costos operativos. La optimización de los procesos de despacho aduanero mediante alianzas con agencias gubernamentales, agentes de aduanas y proveedores de tecnología ofrece otra vía para optimizar los movimientos transfronterizos y optimizar la experiencia del transporte por carretera.

Las alianzas que abordan soluciones de entrega de última milla atienden la creciente demanda de entregas precisas y puntuales, optimizando rutas y aprovechando las instalaciones de almacenamiento compartidas. Al promover la sostenibilidad ambiental, la colaboración puede centrarse en la adopción de prácticas ecológicas, soluciones de combustibles alternativos y tecnologías verdes, en consonancia con los objetivos de sostenibilidad del país. El intercambio de datos para obtener información del mercado, las colaboraciones transfronterizas, la compartición de capacidad y la expansión de la red, junto con los esfuerzos para superar los desafíos regulatorios y garantizar el cumplimiento normativo, resaltan aún más el abanico de oportunidades. No obstante, las empresas deben afrontar desafíos como las disparidades regulatorias, las preocupaciones sobre la seguridad de los datos y los matices culturales para garantizar colaboraciones exitosas. El mercado del transporte por carretera en Arabia Saudita (KSA) tiene un inmenso potencial para alianzas transformadoras, allanando el camino hacia un ecosistema de transporte por carretera más eficiente, sostenible y con mayor capacidad de respuesta en Arabia Saudita.

Por ejemplo,

- En octubre de 2023, según un artículo publicado por Indian Transport & Logistics News, el gigante suizo de la logística Kuehne+Nagel firmó una alianza exclusiva con Tamer Logistics en Arabia Saudita para reforzar su oferta de servicios y satisfacer la creciente demanda de soluciones logísticas en la región. Esta colaboración amplía las capacidades de Kuehne+Nagel en logística por contrato, complementando sus actividades de transporte de mercancías en el país. Tamer Logistics, parte del Grupo Tamer, aporta una amplia red local de modernas instalaciones de almacenamiento y una sólida flota para reforzar la experiencia de Kuehne+Nagel en logística por contrato, reconocida mundialmente. Kuehne+Nagel busca ofrecer soluciones integrales para la cadena de suministro a clientes nacionales e internacionales. Gianfranco Sgro, vicepresidente ejecutivo de Logística por Contrato de Kuehne+Nagel, expresó su confianza en que Tamer Logistics brindará servicios de calidad, en línea con la Visión 2030 del Reino de consolidarse como un centro logístico clave en la región. Esta alianza representa un hito crucial en el avance del sector logístico de Arabia Saudita, priorizando la eficiencia, la transformación digital y la sostenibilidad. Ayman Albarqawi, director ejecutivo de Tamer Logistics, destacó su compromiso de satisfacer las necesidades de los clientes y alinearse con los estándares internacionales de servicios de alta calidad.

- En octubre de 2023, según un artículo publicado por Locate2u, Neom, el visionario proyecto de megaciudad en Arabia Saudita, unió fuerzas con DSV en una exclusiva empresa conjunta logística de 10 mil millones de dólares. Esta colaboración busca transformar el panorama logístico de Neom, una zona urbana futurista planificada en la provincia noroccidental de Tabuk. La alianza, con Neom y DSV con el 51% de participación mayoritaria, se centra en satisfacer las complejas necesidades logísticas de Neom, contribuir a un rápido desarrollo e impulsar la economía saudí. La empresa, que abarca el transporte terrestre, marítimo y aéreo, generará más de 20,000 empleos. Más allá de la logística tradicional, ambas entidades se comprometen con la innovación, destinando una parte de sus ingresos al desarrollo de soluciones logísticas sostenibles de última generación. Esta alianza marca un momento crucial en el camino de Neom hacia la realización de su ambiciosa visión y demuestra su dedicación a revolucionar el sector logístico de Arabia Saudita.

Restricciones/Desafíos

- Regulaciones gubernamentales estrictas

Las preocupaciones sobre la privacidad y la seguridad de los datos representan un desafío significativo para el mercado del transporte por carretera en Arabia Saudita. A medida que los estudios hidrográficos dependen cada vez más de sistemas digitales, vehículos no tripulados y almacenamiento de datos en la nube, aumenta el riesgo de ciberataques y filtraciones de datos. La información sensible, como la cartografía detallada del fondo marino y los datos marítimos estratégicos, es vulnerable al acceso o la manipulación no autorizados. Garantizar la protección de estos datos, especialmente en aplicaciones de defensa y seguridad, requiere medidas robustas de ciberseguridad y el cumplimiento de las normativas de protección de datos en constante evolución. La complejidad de proteger estas tecnologías avanzadas añade un nivel adicional de dificultad, sobre todo a medida que el volumen de datos recopilados continúa creciendo.

Por ejemplo: -

En octubre de 2024, según el blog publicado por Balbix Inc., la privacidad y seguridad de los datos se han convertido en un desafío importante para los sistemas IoT, lo cual puede estar directamente relacionado con el mercado de transporte de mercancías por carretera de Arabia Saudí. A medida que este mercado integra cada vez más dispositivos IoT, surgen los mismos problemas: protocolos de seguridad deficientes, pruebas de vulnerabilidad deficientes y software sin parches. Muchos dispositivos carecen de medidas de seguridad robustas, lo que los hace vulnerables a ciberataques. La gran cantidad de datos generados por estos sistemas, como la cartografía detallada del fondo marino, también puede suponer importantes riesgos para la privacidad si no se protegen adecuadamente. Estas preocupaciones dificultan la gestión y protección seguras de los datos, lo que pone de relieve la necesidad de medidas de seguridad más robustas en las tecnologías de levantamientos hidrográficos.

- Fluctuaciones en los precios del combustible

La financiación limitada en las regiones en desarrollo representa un desafío significativo para el mercado de transporte de mercancías por carretera en Arabia Saudita. Muchos países de estas regiones tienen dificultades para asignar recursos suficientes a tecnologías avanzadas, como equipos de levantamiento hidrográfico, cruciales para la gestión costera eficaz, el desarrollo de infraestructuras y la vigilancia ambiental. Esta restricción financiera dificulta la adopción de equipos modernos, lo que limita la capacidad de recopilar datos precisos, tomar decisiones informadas y apoyar iniciativas de desarrollo sostenible. Como resultado, estas regiones podrían retrasarse en el desarrollo de capacidades de levantamiento fiables, lo que afecta negativamente su crecimiento y desarrollo general.

Por ejemplo: -

En octubre de 2023, según el blog publicado por la UNCTAD, los 46 países menos adelantados (PMA) se enfrentaron a graves dificultades financieras debido a múltiples crisis mundiales, el aumento de la deuda y la dependencia de materias primas volátiles. Estas restricciones financieras han reducido significativamente su margen fiscal, dificultando la inversión en infraestructura crítica, incluyendo equipos para estudios hidrográficos. La escasez de financiación en estas regiones ha obstaculizado su capacidad para adoptar tecnologías modernas para la monitorización ambiental eficaz y el desarrollo de infraestructura. La escasez financiera, agravada por la emergencia climática y las perturbaciones económicas mundiales, representa un importante obstáculo para el crecimiento del mercado de transporte de mercancías por carretera en Arabia Saudita (KSA) en estos países en desarrollo.

Este informe de mercado proporciona detalles sobre los últimos desarrollos, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, cuota de mercado, impacto de los actores del mercado nacional y local, análisis de oportunidades en términos de nuevas fuentes de ingresos, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimiento de las categorías de mercado, nichos de aplicación y dominio, aprobaciones y lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado, contacte con Data Bridge Market Research para obtener un informe analítico. Nuestro equipo le ayudará a tomar decisiones informadas para impulsar el crecimiento del mercado.

Alcance del mercado del transporte por carretera en Arabia Saudita

El mercado de transporte por carretera de Arabia Saudita se divide en once segmentos clave, según el tipo de servicio, el tipo de transportista, el tipo de vehículo, el tipo de camión, el tipo de mercancía, el tipo de transporte por carretera, la operación, el tipo de cliente, el modelo de negocio, la distancia y el sector. El crecimiento de estos segmentos le permitirá analizar los segmentos con menor crecimiento en las industrias y brindar a los usuarios una valiosa visión general del mercado y perspectivas que les ayudarán a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de servicio

- Transporte

- Almacenamiento y distribución

- Transporte de mercancías

- Otros

Tipo de transportista

- Carga menor a un camión (Ltl)

- Carga completa de camión (FTL)

- Carga parcial de camión (Ptl)

- Carga especializada

Tipo de vehículo

- Camiones comerciales de servicio pesado

- Camiones comerciales de servicio mediano

- Camiones comerciales de servicio ligero

Tipo de camión

- Camión cisterna

- Tipo

- Buques cisterna para líquidos

- Buques cisterna para graneles secos

- Productos de transporte

- Combustible

- Tipo

- Diesel

- Gasolina

- Tipo

- Gases

- Tipo

- GLP

- Propano

- Gas butano licuado

- Nitrógeno

- Oxígeno

- Helio

- Otros

- Tipo

- Productos químicos

- Leche

- Jugos

- Otros

- Combustible

- Presurización

- Sin presurizar

- Presurizado

- Refrigeración

- Sin refrigerar

- Refrigerado

- Aislamiento

- Sin aislamiento

- Aislado

- Tipo

- Camión de caja

- Productos de transporte

- Entrega de comida

- Electrodomésticos y muebles

- Entregas de última milla

- Otros

- Productos de transporte

- Camión refrigerado

- Productos de transporte

- Alimento

- Suministros médicos

- Tipo

- productos farmacéuticos

- Vacunas

- Bancos de sangre

- Otros

- Tipo

- Productos perecederos

- Tipo

- Carne

- Frutas

- Verduras

- Mariscos

- Otros

- Tipo

- Bebidas

- Tipo

- Bebidas carbonatadas

- Bebidas a base de jugo

- Bebidas deportivas y energéticas

- Té

- Café

- Otros

- Tipo

- Otros

- Productos de transporte

- Camión semirremolque

- Camión de plataforma

- Productos de transporte

- Coches

- Material de construcción

- Maquinaria

- Chatarra

- Otros reciclables

- Productos de transporte

- Camiones con plataforma elevadora

- Otros

Tipo de bienes

- Transporte de productos alimenticios por carretera

- Tipo

- Transporte refrigerado con refrigeración

- Transporte refrigerado con congelación

- Tipo

- Adr Transporte por carretera de mercancías peligrosas

- Mercancías generales

- Otros

Tipo de transporte de mercancías por carretera

- Transporte por carretera de mercancías secas

- Transporte por carretera de carga a granel

- Transporte de mercancías pesadas

- Otros

Operación

- Doméstico

- Internacional

Tipo de cliente

- B2B

- B2C

- Comercio electrónico y entrega de última milla

Modelo de negocio

- Transportistas basados en activos

- Transportistas no basados en activos

Distancia

- Más de 500 millas

- 201 millas-500 millas

- 101 millas – 200 millas

- 50 millas – 100 millas

- Menos de 50 millas

Industria

- Petróleo y gas

- Transporte

- Almacenamiento y distribución

- Transporte de mercancías

- Otros

- Fabricación

- Transporte

- Almacenamiento y distribución

- Transporte de mercancías

- Otros

- Alimentos y bebidas

- Transporte

- Almacenamiento y distribución

- Transporte de mercancías

- Otros

- Minería

- Transporte

- Almacenamiento y distribución

- Transporte de mercancías

- Otros

- Energía y servicios públicos

- Transporte

- Almacenamiento y distribución

- Transporte de mercancías

- Otros

- Bienes de consumo de rápido movimiento (FMCG)

- Transporte

- Almacenamiento y distribución

- Transporte de mercancías

- Otros

- Cuidado de la salud

- Transporte

- Almacenamiento y distribución

- Transporte de mercancías

- Otros

- Comercio electrónico

- Transporte

- Almacenamiento y distribución

- Transporte de mercancías

- Otros

- Químico

- Transporte

- Almacenamiento y distribución

- Transporte de mercancías

- Otros

- Automotor

- Transporte

- Almacenamiento y distribución

- Transporte de mercancías

- Otros

- TI y telecomunicaciones

- Transporte

- Almacenamiento y distribución

- Transporte de mercancías

- Otros

- Minorista

- Transporte

- Almacenamiento y distribución

- Transporte de mercancías

- Otros

- Transporte

- Transporte

- Almacenamiento y distribución

- Transporte de mercancías

- Otros

- Defensa

- Transporte

- Almacenamiento y distribución

- Transporte de mercancías

- Otros

- Electrónica

- Transporte

- Almacenamiento y distribución

- Transporte de mercancías

- Otros

- Ropa y calzado

- Transporte

- Almacenamiento y distribución

- Transporte de mercancías

- Otros

- Otros

- Transporte

- Almacenamiento y distribución

- Transporte de mercancías

- Otros

Cuota de mercado del transporte por carretera en Arabia Saudita

El panorama competitivo del mercado ofrece detalles por competidor. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia global, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de las aplicaciones. Los datos anteriores se refieren únicamente al enfoque de mercado de las empresas.

Los líderes del mercado de transporte por carretera de KSA que operan en el mercado son:

- Kuehne+Nagel (Suiza)

- CEVA Logistics (Francia)

- DHL (Alemania)

- DSV (Dinamarca)

- Transporte Abdul Latif Jameel (KSA)

- Sinotrans Co., Ltd (China)

- GAC (EAU)

- FedEx (EE. UU.)

- SEKO Logistics (EE. UU.)

- United Parcel Service of America (EE. UU.)

- Hellmann (Alemania)

- JAS (Estados Unidos)

- DB SCHENKER (Europa)

- Fourwinds (EAU)

- Ardian Global Express LLC. (EAU)

- GRUPO NTF (KSA)

- Defaf Logistics (KSA)

- WEFEX (EAU)

- Freights Solutions Co. (KSA)

Últimos avances en el mercado del transporte de mercancías por carretera en Arabia Saudita

- En febrero de 2024, Applanix lanzó la serie POS MV (Surfmaster, Wavemaster y Oceanmaster), un sistema completo de navegación inercial que ofrece datos precisos de actitud, rumbo, oleaje, posición y velocidad para embarcaciones y sensores marinos. Este avance consolida la reputación de Applanix como líder en equipos para levantamientos hidrográficos, ofreciendo soluciones altamente confiables y precisas que se adaptan a entornos marinos desafiantes, convirtiéndola en la opción preferida de los profesionales del sector.

- En septiembre de 2024, Teledyne Marine designó a iOne Resources Inc. como su distribuidor oficial en Filipinas, ampliando así su presencia en el Sudeste Asiático. Esta colaboración permite a los clientes locales acceder a los avanzados equipos de levantamiento hidrográfico de Teledyne Marine, incluyendo sistemas de sonar multihaz de alta resolución, ecosondas monohaz y un robusto software de adquisición de datos, además de un soporte y servicios mejorados.

- En octubre de 2023, ATLAS ELEKTRONIK e Israel Aerospace Industries presentaron la plataforma BlueWhale ASW para la guerra antisubmarina avanzada. Se trata de un vehículo submarino autónomo avanzado que integra los sofisticados sistemas de sensores de ELTA y el conjunto de sonares pasivos remolcados de ATLAS ELEKTRONIK, diseñado para una detección eficiente de submarinos. Esta colaboración fortalece las capacidades de ambas compañías en defensa naval, aprovechando la experiencia de IAI en sistemas no tripulados y las tecnologías avanzadas de sensores de ELTA, lo que da como resultado una solución ASW de vanguardia y larga duración, ideal para diversas operaciones navales.

- En enero de 2022, Esri India lanzó GeoInnovation 2022 en colaboración con AGNIi para apoyar a startups de sectores como la agricultura, la salud y las ciudades inteligentes mediante el uso de la tecnología de inteligencia de ubicación. El programa integra las soluciones SIG de Esri en el ecosistema de startups, promoviendo la innovación, especialmente en estudios hidrográficos. Al incorporar datos geoespaciales en sectores como la energía marina y la defensa marítima, Esri refuerza su papel en la definición del futuro de las soluciones para estudios hidrográficos, impulsando el crecimiento en este mercado emergente.

- En marzo de 2022, Xylem y UNICEF profundizaron su alianza para abordar los desafíos urgentes de agua y saneamiento en el Cuerno de África, con especial atención a Etiopía, Somalia, Sudán y Uganda. Esta colaboración aborda crisis climáticas como sequías e inundaciones, con el objetivo de mejorar el acceso sostenible al agua y al saneamiento mediante innovaciones como pozos de energía solar y el desarrollo de capacidades para los servicios públicos locales. La iniciativa refuerza el compromiso de Xylem con la seguridad hídrica, mostrando su experiencia y responsabilidad social, a la vez que fomenta la credibilidad de la marca e impulsa soluciones sostenibles a nivel mundial.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF KSA TRUCKING (ROAD FREIGHT) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 SERVICE TYPE TIMELINE CURVE

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ROUTE ANALYSIS FOR COMMODITIES TYPE IN KSA TRUCKING (ROAD FREIGHT) MARKET

4.2 QUICK OUTLOOK FOR COMMODITIES TYPE IN KSA TRUCKING (ROAD FREIGHT) MARKET

4.2.1 BULK

4.2.2 BREAKBULK

4.2.3 PALLETS

4.2.4 LIQUID BULK

4.2.5 CONTAINERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWTH IN E-COMMERCE SECTOR BOOSTING THE ROAD FREIGHT/TRUCKING SERVICES

5.1.2 RAPID INFRASTRUCTURE DEVELOPMENT IN KSA

5.1.3 RISING INVESTMENT IN SMART FREIGHT MANAGEMENT

5.1.4 INCREASING CROSS-BORDER TRADES IN KSA

5.2 RESTRAINTS

5.2.1 STRINGENT GOVERNMENT REGULATIONS

5.2.2 FLUCTUATIONS IN FUEL PRICES

5.3 OPPORTUNITIES

5.3.1 GOVERNMENT INITIATIVES TO SUPPORT TRANSPORTATION AND LOGISTICS SECTOR

5.3.2 INCREASING DEMAND FOR COLD CHAIN LOGISTICS

5.3.3 STRATEGIC PARTNERSHIPS AND COLLABORATIONS AMONG MARKET PLAYERS

5.4 CHALLENGES

5.4.1 AVAILABILITY OF ALTERNATIVE MODES OF TRANSPORTATION

5.4.2 SECURITY CONCERNS RELATED TO CARGO THEFT

6 KSA TRUCKING (ROAD FREIGHT) MARKET, SERVICE TYPE

6.1 OVERVIEW

6.2 TRANSPORTATION

6.3 WAREHOUSING AND DISTRIBUTION

6.4 FREIGHT FORWARDING

6.5 OTHERS

7 KSA TRUCKING (ROAD FREIGHT) MARKET, TYPE OF CARRIER

7.1 OVERVIEW

7.2 LESS THAN TRUCKLOAD (LTL)

7.3 FULL TRUCKLOAD (FTL)

7.4 PARTIAL TRUCKLOAD (PTL)

7.5 SPECIALIZED FREIGHT

8 KSA TRUCKING (ROAD FREIGHT) MARKET, TYPE OF GOODS

8.1 OVERVIEW

8.2 ROAD TRANSPORT OF FOODSTUFFS

8.2.1 REFRIGERATED TRANSPORT WITH REFRIGERATION

8.2.2 REFRIGERATED TRANSPORT WITH FREEZING

8.3 ADR ROAD TRANSPORT OF DANGEROUS GOODS

8.4 GENERAL GOODS

8.5 OTHERS

9 KSA TRUCKING (ROAD FREIGHT) MARKET, BY BUSINESS MODEL

9.1 OVERVIEW

9.2 ASSET-BASED CARRIERS

9.3 NON-ASSET-BASED CARRIERS

10 KSA TRUCKING (ROAD FREIGHT) MARKET, BY DISTANCE

10.1 OVERVIEW

10.2 MORE THAN 500 MILES

10.3 201 MILES-500 MILES

10.4 101 MILES – 200 MILES

10.5 50 MILE – 100 MILES

10.6 LESS THAN 50 MILES

11 KSA TRUCKING (ROAD FREIGHT) MARKET, BY INDUSTRY

11.1 OVERVIEW

11.2 OIL & GAS

11.2.1 BY SERVICE TYPE

11.2.1.1 TRANSPORTATION

11.2.1.2 WAREHOUSING AND DISTRIBUTION

11.2.1.3 FREIGHT FORWARDING

11.2.1.4 OTHERS

11.3 MANUFACTURING

11.3.1 BY SERVICE TYPE

11.3.1.1 TRANSPORTATION

11.3.1.2 WAREHOUSING AND DISTRIBUTION

11.3.1.3 FREIGHT FORWARDING

11.3.1.4 OTHERS

11.4 FOOD & BEVERAGES

11.4.1 BY SERVICE TYPE

11.4.1.1 TRANSPORTATION

11.4.1.2 WAREHOUSING AND DISTRIBUTION

11.4.1.3 FREIGHT FORWARDING

11.4.1.4 OTHERS

11.5 MINING

11.5.1 BY SERVICE TYPE

11.5.1.1 TRANSPORTATION

11.5.1.2 WAREHOUSING AND DISTRIBUTION

11.5.1.3 FREIGHT FORWARDING

11.5.1.4 OTHERS

11.6 ENERGY & UTILITY

11.6.1 BY SERVICE TYPE

11.6.1.1 TRANSPORTATION

11.6.1.2 WAREHOUSING AND DISTRIBUTION

11.6.1.3 FREIGHT FORWARDING

11.6.1.4 OTHERS

11.7 FAST MOVING CONSUMER GOODS (FMCG)

11.7.1 BY SERVICE TYPE

11.7.1.1 TRANSPORTATION

11.7.1.2 WAREHOUSING AND DISTRIBUTION

11.7.1.3 FREIGHT FORWARDING

11.7.1.4 OTHERS

11.8 HEALTHCARE

11.8.1 BY SERVICE TYPE

11.8.1.1 TRANSPORTATION

11.8.1.2 WAREHOUSING AND DISTRIBUTION

11.8.1.3 FREIGHT FORWARDING

11.8.1.4 OTHERS

11.9 E-COMMERCE

11.9.1 BY SERVICE TYPE

11.9.1.1 TRANSPORTATION

11.9.1.2 WAREHOUSING AND DISTRIBUTION

11.9.1.3 FREIGHT FORWARDING

11.9.1.4 OTHERS

11.1 CHEMICAL

11.10.1 BY SERVICE TYPE

11.10.1.1 TRANSPORTATION

11.10.1.2 WAREHOUSING AND DISTRIBUTION

11.10.1.3 FREIGHT FORWARDING

11.10.1.4 OTHERS

11.11 AUTOMOTIVE

11.11.1 BY SERVICE TYPE

11.11.1.1 TRANSPORTATION

11.11.1.2 WAREHOUSING AND DISTRIBUTION

11.11.1.3 FREIGHT FORWARDING

11.11.1.4 OTHERS

11.12 IT & TELECOM

11.12.1 BY SERVICE TYPE

11.12.1.1 TRANSPORTATION

11.12.1.2 WAREHOUSING AND DISTRIBUTION

11.12.1.3 FREIGHT FORWARDING

11.12.1.4 OTHERS

11.13 RETAIL

11.13.1 BY SERVICE TYPE

11.13.1.1 TRANSPORTATION

11.13.1.2 WAREHOUSING AND DISTRIBUTION

11.13.1.3 FREIGHT FORWARDING

11.13.1.4 OTHERS

11.14 TRANSPORTATION

11.14.1 BY SERVICE TYPE

11.14.1.1 TRANSPORTATION

11.14.1.2 WAREHOUSING AND DISTRIBUTION

11.14.1.3 FREIGHT FORWARDING

11.14.1.4 OTHERS

11.15 DEFENSE

11.15.1 BY SERVICE TYPE

11.15.1.1 TRANSPORTATION

11.15.1.2 WAREHOUSING AND DISTRIBUTION

11.15.1.3 FREIGHT FORWARDING

11.15.1.4 OTHERS

11.16 ELECTRONICS

11.16.1 BY SERVICE TYPE

11.16.1.1 TRANSPORTATION

11.16.1.2 WAREHOUSING AND DISTRIBUTION

11.16.1.3 FREIGHT FORWARDING

11.16.1.4 OTHERS

11.17 APPARELS & FOOTWEAR

11.17.1 BY SERVICE TYPE

11.17.1.1 TRANSPORTATION

11.17.1.2 WAREHOUSING AND DISTRIBUTION

11.17.1.3 FREIGHT FORWARDING

11.17.1.4 OTHERS

11.18 OTHERS

11.18.1 BY SERVICE TYPE

11.18.1.1 TRANSPORTATION

11.18.1.2 WAREHOUSING AND DISTRIBUTION

11.18.1.3 FREIGHT FORWARDING

11.18.1.4 OTHERS

12 KSA TRUCKING (ROAD FREIGHT) MARKET, VEHICLE TYPE

12.1 OVERVIEW

12.2 HEAVY DUTY COMMERCIAL TRUCKS

12.3 MEDIUM DUTY COMMERCIAL TRUCKS

12.4 LIGHT DUTY COMMERCIAL TRUCKS

13 KSA TRUCKING (ROAD FREIGHT) MARKET, BY TYPE OF ROAD FREIGHT

13.1 OVERVIEW

13.2 DRY GOODS ROAD TRANSPORT

13.3 ROAD TRANSPORT OF BULK CARGO

13.4 HEAVY GOODS TRANSPORT

13.5 OTHERS

14 KSA TRUCKING (ROAD FREIGHT) MARKET, BY OPERATION

14.1 OVERVIEW

14.2 DOMESTIC

14.3 NON-ASSET-BASED CARRIERS

15 KSA TRUCKING (ROAD FREIGHT) MARKET, BY CUSTOMER TYPE

15.1 OVERVIEW

15.2 B2B

15.3 B2C

15.4 E-COMMERCE & LAST MILE DELIVERY

16 KSA TRUCKING (ROAD FREIGHT) MARKET, BY TRUCK TYPE

16.1 OVERVIEW

16.2 TANKER TRUCK

16.2.1 TANKER TRUCK, BY TYPE

16.2.1.1 LIQUID TANKERS

16.2.1.2 DRY BULK TANKERS

16.2.2 TANKER TRUCK, BY TRANSPORT PRODUCT

16.2.2.1 FUEL

16.2.2.1.1 FUEL, BY TYPE

16.2.2.1.1.1 DIESEL

16.2.2.1.1.2 PETROL

16.2.2.2 GASES

16.2.2.2.1 GASES, BY TYPE

16.2.2.2.1.1 LPG

16.2.2.2.1.2 PROPANE

16.2.2.2.1.3 LIQUEFIED BUTANE GAS

16.2.2.2.1.4 NITROGEN

16.2.2.2.1.5 OXYGEN

16.2.2.2.1.6 HELIUM

16.2.2.3 CHEMICALS

16.2.2.4 MILK

16.2.2.5 JUICES

16.2.2.6 OTHERS

16.2.3 TANKER TRUCK, BY PRESSURIZATION

16.2.3.1 NON-PRESSURIZED

16.2.3.2 PRESSURIZED

16.2.4 TANKER TRUCK, BY REFRIGERATION

16.2.4.1 NON-REFRIGERATED

16.2.4.2 REFRIGERATED

16.2.5 TANKER TRUCK, BY INSULATION

16.2.5.1 NON-INSULATED

16.2.5.2 INSULATED

16.3 BOX TRUCK

16.3.1 BOX TRUCK, BY TRANSPORT PRODUCTS

16.3.1.1 FOOD DELIVERY

16.3.1.2 HOME APPLIANCES AND FURNITURE

16.3.1.3 LAST-MILE DELIVERIES

16.3.1.4 OTHERS

16.4 REFRIGERATED TRUCK

16.4.1 REFRIGERATED TRUCK, BY TRANSPORT PRODUCTS

16.4.1.1 FOOD

16.4.1.2 MEDICAL SUPPLIES

16.4.1.2.1 MEDICAL SUPPLIES, BY TYPE

16.4.1.2.1.1 PHARMACEUTICALS

16.4.1.2.1.2 VACCINES

16.4.1.2.1.3 BLOOD BANKS

16.4.1.2.1.4 OTHERS

16.4.1.3 PERISHABLE GOODS

16.4.1.3.1 PERISHABLE GOODS, BY TYPE

16.4.1.3.1.1 MEAT

16.4.1.3.1.2 FRUITS

16.4.1.3.1.3 VEGETABLES

16.4.1.3.1.4 SEAFOOD

16.4.1.3.1.5 OTHERS

16.4.1.4 BEVERAGES

16.4.1.4.1 BEVERAGES, BY TYPE

16.4.1.4.1.1 CARBONATED BEVERAGES

16.4.1.4.1.2 JUICE BASED BEVERAGES

16.4.1.4.1.3 SPORTS & ENERGY BEVERAGES

16.4.1.4.1.4 TEA

16.4.1.4.1.5 COFFEE

16.4.1.4.1.6 OTHERS

16.4.1.5 OTHERS

16.5 SEMI-TRAILER TRUCK

16.6 FLATBEDS TRUCK

16.6.1 FLATBEDS TRUCK, BY TRANSPORT PRODUCTS

16.6.1.1 CARS

16.6.1.2 CONSTRUCTION MATERIAL

16.6.1.3 MACHINERY

16.6.1.4 SCRAP METAL

16.6.1.5 OTHERS RECYCLABLES

16.7 LIFTGATE TRUCK

16.8 OTHERS

17 KSA TRUCKING (ROAD FREIGHT) MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: KSA

18 SWOT ANALYSIS

19 COMPANY PROFILES

19.1 SINOTRANS LIMITED

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 SERVICE PORTFOLIO

19.1.4 RECENT DEVELOPMENTS

19.2 ABDUL LATIF JAMEEL

19.2.1 COMPANY SNAPSHOT

19.2.2 SERVICE PORTFOLIO

19.2.3 RECENT DEVELOPMENTS

19.3 DEUTSCHE POST AG

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 SOLUTION PORTFOLIO

19.3.4 RECENT DEVELOPMENT

19.4 CEVA LOGISTICS

19.4.1 COMPANY SNAPSHOT

19.4.2 SERVICES PORTFOLIO

19.4.3 RECENT DEVELOPMENTS

19.5 DSV

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 SOLUTION PORTFOLIO

19.5.4 RECENT DEVELOPMENTS

19.6 ARDIAN GLOBAL EXPRESS LLC.

19.6.1 COMPANY SNAPSHOT

19.6.2 SERVICE PORTFOLIO

19.6.3 RECENT DEVELOPMENTS

19.7 DB SCHENKER

19.7.1 COMPANY SNAPSHOT

19.7.2 SERVICES PORTFOLIO

19.7.3 RECENT DEVELOPMENTS

19.8 DEFAF LOGISTICS

19.8.1 COMPANY SNAPSHOT

19.8.2 SERVICE PORTFOLIO

19.8.3 RECENT DEVELOPMENT

19.9 FEDEX

19.9.1 COMPANY SNAPSHOT

19.9.2 REVENUE ANALYSIS

19.9.3 SERVICES PORTFOLIO

19.9.4 RECENT DEVELOPMENTS

19.1 FOURWINDS-KSA.COM

19.10.1 COMPANY SNAPSHOT

19.10.2 SERVICE PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 FREIGHTS SOLUTIONS CO.

19.11.1 COMPANY SNAPSHOT

19.11.2 SERVICE PORTFOLIO

19.11.3 RECENT DEVELOPMENT

19.12 GAC

19.12.1 COMPANY SNAPSHOT

19.12.2 SERVICE PORTFOLIO

19.12.3 RECENT DEVELOPMENTS

19.13 HELLMANN WORLDWIDE LOGISTICS SE & CO. KG

19.13.1 COMPANY SNAPSHOT

19.13.2 SERVICE PORTFOLIO

19.13.3 RECENT DEVELOPMENT

19.14 JAS WORLDWIDE, INC.

19.14.1 COMPANY SNAPSHOT

19.14.2 SERVICE PORTFOLIO

19.14.3 RECENT DEVELOPMENTS

19.15 KUEHNE+NAGEL

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 SERVICE PORTFOLIO

19.15.4 RECENT DEVELOPMENTS

19.16 NTF GROUP

19.16.1 COMPANY SNAPSHOT

19.16.2 SERVICE PORTFOLIO

19.16.3 RECENT DEVELOPMENT

19.17 SEKO LOGISTICS

19.17.1 COMPANY SNAPSHOT

19.17.2 SERVICE PORTFOLIO

19.17.3 RECENT DEVELOPMENTS

19.18 UNITED PARCEL SERVICE OF AMERICA, INC.

19.18.1 COMPANY SNAPSHOT

19.18.2 REVENUE ANALYSIS

19.18.3 SERVICE PORTFOLIO

19.18.4 RECENT DEVELOPMENTS

19.19 WEFREIGHT

19.19.1 COMPANY SNAPSHOT

19.19.2 SERVICES PORTFOLIO

19.19.3 RECENT DEVELOPMENTS

20 QUESTIONNAIRE

21 RELATED REPORTS

Lista de Tablas

TABLE 1 KSA TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 2 KSA TRUCKING (ROAD FREIGHT) MARKET, BY TYPE OF CARRIER, 2018-2032 (USD MILLION)

TABLE 3 KSA TRUCKING (ROAD FREIGHT) MARKET, BY TYPE OF GOODS, 2018-2032 (USD MILLION)

TABLE 4 KSA ROAD TRANSPORT OF FOODSTUFFS IN TRUCKING (ROAD FREIGHT) MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 5 KSA TRUCKING (ROAD FREIGHT) MARKET, BY BUSINESS MODEL, 2018-2032 (USD MILLION)

TABLE 6 KSA TRUCKING (ROAD FREIGHT) MARKET, BY DISTANCE, 2018-2032 (USD MILLION)

TABLE 7 KSA TRUCKING (ROAD FREIGHT) MARKET, BY INDUSTRY, 2018-2032 (USD MILLION)

TABLE 8 KSA OIL & GAS IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 9 KSA OIL & GAS IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 10 KSA MANUFACTURING IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 11 KSA MANUFACTURING IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 12 KSA FOOD & BEVERAGES IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 13 KSA FOOD & BEVERAGES IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 14 KSA MINING IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 15 KSA MINING IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 16 KSA ENERGY & UTILITY IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 17 KSA ENERGY & UTILITY IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 18 KSA FAST MOVING CONSUMER GOODS (FMCG) IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 19 KSA FAST MOVING CONSUMER GOODS (FMCG) IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 20 KSA HEALTHCARE IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 21 KSA HEALTHCARE IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 22 KSA E-COMMERCE IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 23 KSA E-COMMERCE IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 24 KSA CHEMICAL IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 25 KSA CHEMICAL IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 26 KSA AUTOMOTIVE IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 27 KSA AUTOMOTIVE IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 28 KSA IT & TELECOM IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 29 KSA IT & TELECOM IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 30 KSA RETAIL IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 31 KSA RETAIL IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 32 KSA TRANSPORTATION IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 33 KSA TRANSPORTATION IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 34 KSA DEFENSE IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 35 KSA DEFENSE IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 36 KSA ELECTRONICS IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 37 KSA ELECTRONICS IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 38 KSA APPARELS & FOOTWEAR IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 39 KSA APPARELS & FOOTWEAR IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 40 KSA OTHERS IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 41 KSA OTHERS IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 42 KSA TRUCKING (ROAD FREIGHT) MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 43 KSA TRUCKING (ROAD FREIGHT) MARKET, BY TYPE OF ROAD FREIGHT, 2018-2032 (USD MILLION)

TABLE 44 KSA TRUCKING (ROAD FREIGHT) MARKET, BY OPERATION, 2018-2032 (USD MILLION)

TABLE 45 KSA TRUCKING (ROAD FREIGHT) MARKET, BY CUSTOMER TYPE, 2018-2032 (USD MILLION)

TABLE 46 KSA TRUCKING (ROAD FREIGHT) MARKET, BY TRUCK TYPE, 2018-2032 (USD MILLION)

TABLE 47 KSA TANKER TRUCK IN TRUCKING (ROAD FREIGHT) MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 48 KSA TANKER TRUCK IN TRUCKING (ROAD FREIGHT) MARKET, BY TRANSPORT PRODUCT, 2018-2032 (USD MILLION)

TABLE 49 KSA FUEL IN TRUCKING (ROAD FREIGHT) MARKET, BY TYPE 2018-2032 (USD MILLION)

TABLE 50 KSA GASES IN TRUCKING (ROAD FREIGHT) MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 51 KSA TANKER TRUCK IN TRUCKING (ROAD FREIGHT) MARKET, BY PRESSURIZATION, 2018-2032 (USD MILLION)

TABLE 52 KSA TANKER TRUCK IN TRUCKING (ROAD FREIGHT) MARKET, BY REFRIGERATION, 2018-2032 (USD MILLION)

TABLE 53 KSA TANKER TRUCK IN TRUCKING (ROAD FREIGHT) MARKET, BY INSULATION, 2018-2032 (USD MILLION)

TABLE 54 KSA BOX TRUCK IN TRUCKING (ROAD FREIGHT) MARKET, BY TRANSPORT PRODUCTS, 2018-2032 (USD MILLION)

TABLE 55 KSA REFRIGERATED TRUCK IN TRUCKING (ROAD FREIGHT) MARKET, BY TRANSPORT PRODUCTS, 2018-2032 (USD MILLION)

TABLE 56 KSA MEDICAL SUPPLIES IN TRUCKING (ROAD FREIGHT) MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 57 KSA PERISHABLE GOODS IN TRUCKING (ROAD FREIGHT) MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 58 KSA BEVERAGES IN TRUCKING (ROAD FREIGHT) MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 59 KSA FLATBEDS TRUCK IN TRUCKING (ROAD FREIGHT) MARKET, BY TRANSPORT PRODUCTS, 2018-2032 (USD MILLION)

Lista de figuras

FIGURE 1 KSA TRUCKING (ROAD FREIGHT) MARKET: SEGMENTATION

FIGURE 2 KSA TRUCKING (ROAD FREIGHT) MARKET: DATA TRIANGULATION

FIGURE 3 KSA TRUCKING (ROAD FREIGHT) MARKET: DROC ANALYSIS

FIGURE 4 KSA TRUCKING (ROAD FREIGHT) MARKET: COUNTRY-WISE ANALYSIS

FIGURE 5 KSA TRUCKING (ROAD FREIGHT) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 KSA TRUCKING (ROAD FREIGHT) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 KSA TRUCKING (ROAD FREIGHT) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 KSA TRUCKING (ROAD FREIGHT) MARKET: SEGMENTATION

FIGURE 9 FOUR SEGMENTS COMPRISE THE KSA TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE (2024)

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 STRATEGIC DECISIONS

FIGURE 12 GROWTH IN E-COMMERCE SECTOR BOOSTING THE ROAD FREIGHT/TRUCKING SERVICES IS EXPECTED TO DRIVE THE KSA TRUCKING (ROAD FREIGHT) MARKET GROWTH IN THE FORECAST PERIOD 2025-2032

FIGURE 13 TRANSPORTATION IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE KSA TRUCKING (ROAD FREIGHT) MARKET IN 2025 & 2032

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE KSA TRUCKING (ROAD FREIGHT) MARKET

FIGURE 15 KSA TRUCKING (ROAD FREIGHT) MARKET: BY SERVICE TYPE, 2024

FIGURE 16 KSA TRUCKING (ROAD FREIGHT) MARKET: BY TYPE OF CARRIER, 2024

FIGURE 17 KSA TRUCKING (ROAD FREIGHT) MARKET: BY TYPE OF GOODS, 2024

FIGURE 18 KSA TRUCKING (ROAD FREIGHT) MARKET: BY BUSINESS MODEL, 2024

FIGURE 19 KSA TRUCKING (ROAD FREIGHT) MARKET: BY DISTANCE, 2024

FIGURE 20 KSA TRUCKING (ROAD FREIGHT) MARKET: BY INDUSTRY, 2024

FIGURE 21 KSA TRUCKING (ROAD FREIGHT) MARKET: BY VEHICLE TYPE, 2024

FIGURE 22 KSA TRUCKING (ROAD FREIGHT) MARKET: BY TYPE OF ROAD FREIGHT, 2024

FIGURE 23 KSA TRUCKING (ROAD FREIGHT) MARKET: BY OPERATION, 2024

FIGURE 24 KSA TRUCKING (ROAD FREIGHT) MARKET: BY CUSTOMER TYPE, 2024

FIGURE 25 KSA TRUCKING (ROAD FREIGHT) MARKET: BY TRUCK TYPE, 2024

FIGURE 26 KSA TRUCKING (ROAD FREIGHT) MARKET: COMPANY SHARE 2024 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.