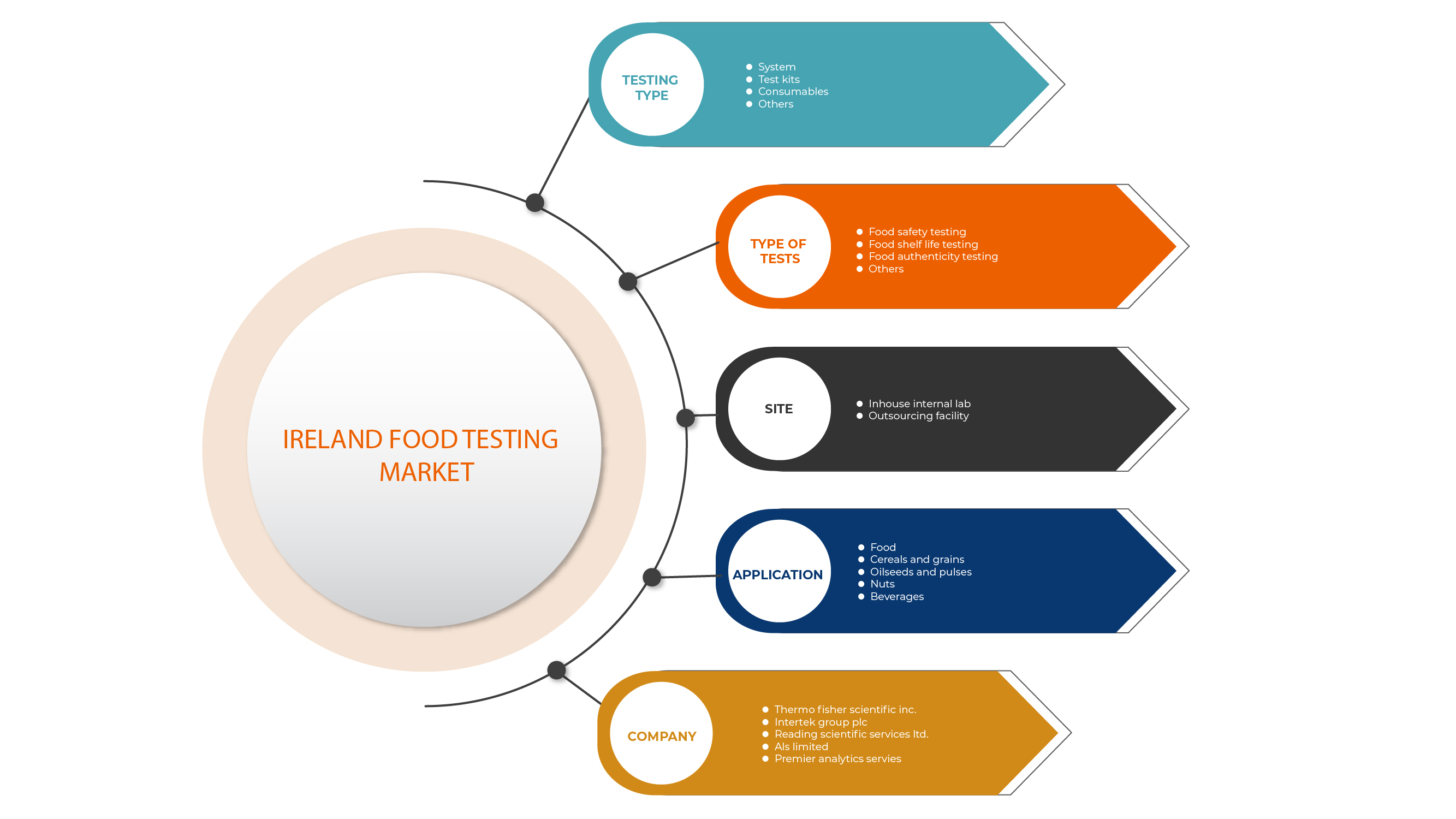

Mercado de pruebas de alimentos de Irlanda, por tipo de prueba (sistema, kits de prueba, consumibles y otros), tipo de pruebas (pruebas de seguridad alimentaria, pruebas de vida útil de los alimentos, pruebas de autenticidad de los alimentos y otros), sitio (laboratorio interno/interno, instalación de subcontratación), aplicación (alimentos, cereales y granos, semillas oleaginosas y legumbres, nueces y bebidas), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado

Las pruebas de productos alimenticios son un paso importante para definir la seguridad de los alimentos para su uso. Las pruebas de productos alimenticios son importantes para confirmar que los alimentos están libres de contaminantes físicos, químicos y biológicos. Los ejemplos comunes de contaminantes alimentarios son bacterias y virus como Escherichia coli, Salmonella, conservantes y pesticidas. Las pruebas de alimentos y la seguridad alimentaria se realizan para analizar científicamente el contenido de nutrientes en los alimentos. Se hace para proporcionar información sobre múltiples características de los alimentos, como comprender la estructura, la composición y las propiedades fisicoquímicas. Otras razones por las que se realizan pruebas de alimentos también son para probar la calidad de los productos alimenticios, el control de calidad y la inspección y clasificación de alimentos. El tipo de pruebas que se implementan para las pruebas de alimentos son las pruebas de autenticidad de los alimentos y las pruebas de vida útil de los alimentos.

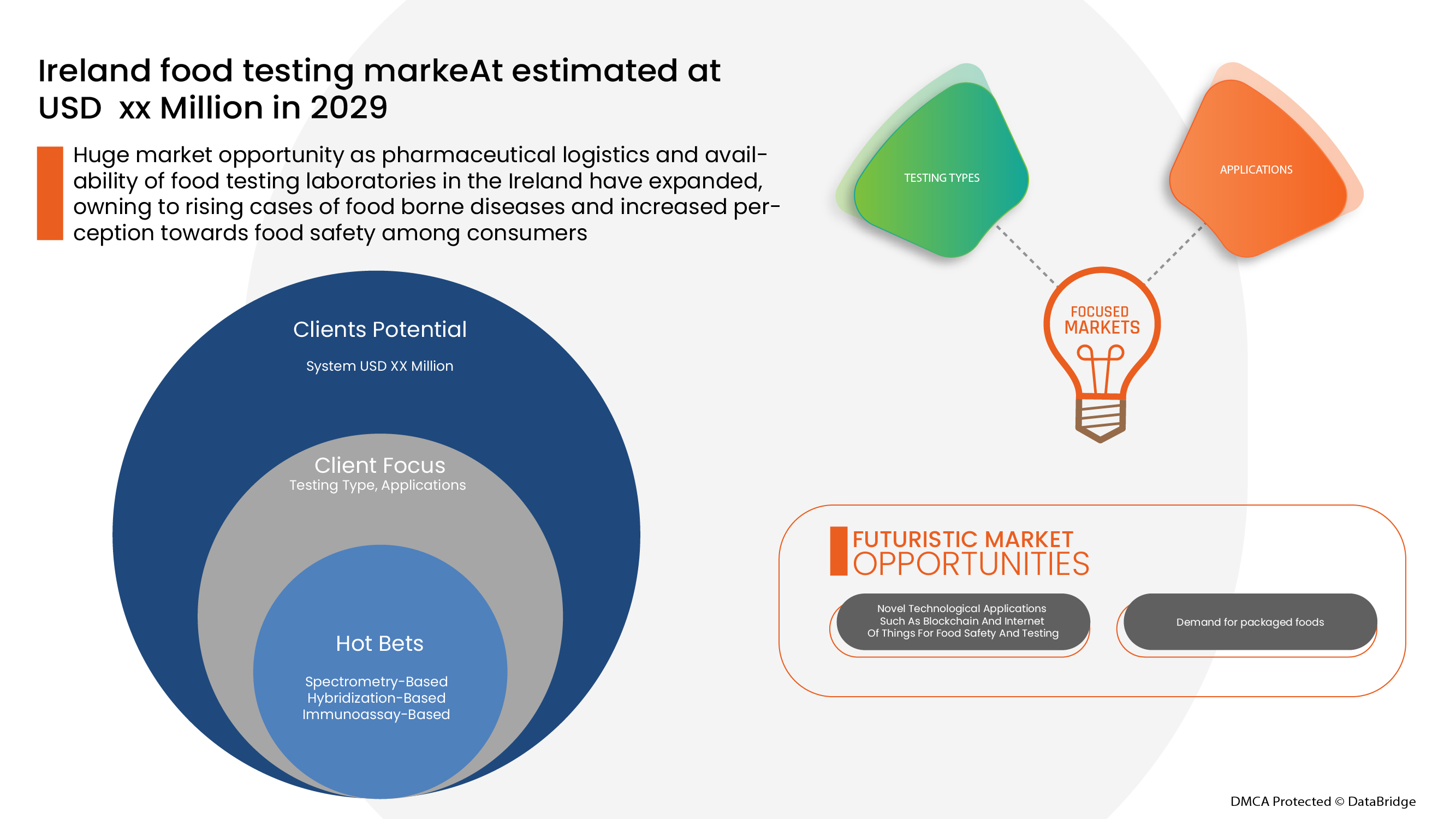

En Irlanda, el aumento de casos de enfermedades transmitidas por alimentos, causadas por patógenos, virus o productos en mal estado, tiene graves consecuencias para los consumidores y las marcas conocidas. Por ello, para proteger la salud pública y cumplir con las normas de seguridad alimentaria, es fundamental realizar pruebas para detectar la presencia y la presencia de microorganismos nocivos.

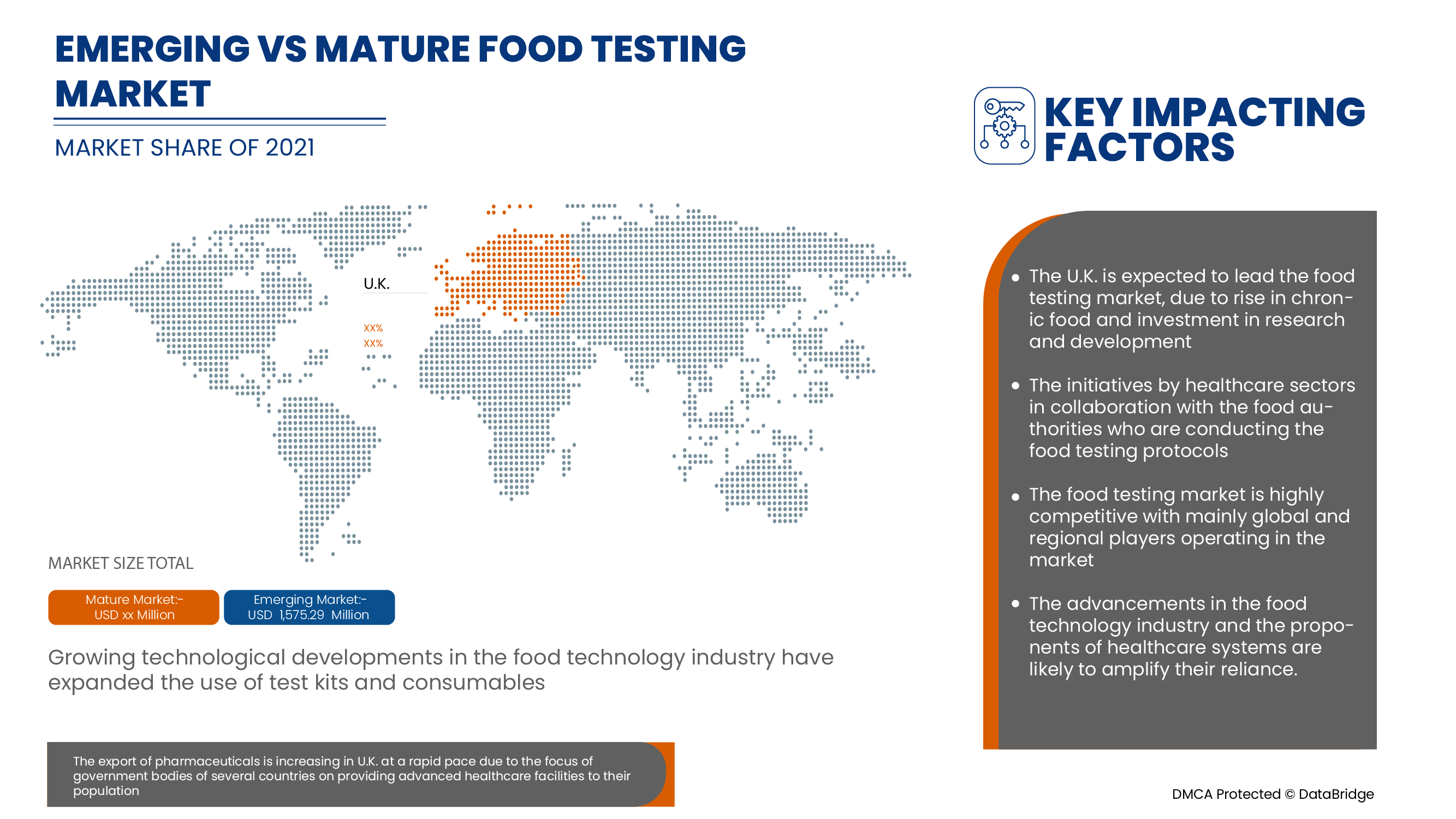

Las pruebas de alimentos en Irlanda brindan apoyo y tienen como objetivo reducir la gravedad de los síntomas. Data Bridge Market Research analiza que el mercado de pruebas de alimentos en Irlanda crecerá a una tasa compuesta anual del 5,0 % durante el período de pronóstico de 2022 a 2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Período de pronóstico |

2022 - 2029 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por tipo de prueba (sistema, kits de prueba, consumibles y otros), tipo de pruebas (pruebas de seguridad alimentaria, pruebas de vida útil de los alimentos, pruebas de autenticidad de los alimentos y otras), sitio (laboratorio interno, instalación subcontratada), aplicación (alimentos, cereales y granos, semillas oleaginosas y legumbres, frutos secos y bebidas), |

|

País cubierto |

Irlanda |

|

Actores del mercado cubiertos |

Thermo Fisher Scientific Inc., Intertek Group plc, Eurofins Scientific, ALS Limited, SGS SA, TUV SUD, NEOGEN Corporation, Microlabs Ltd, Advanced Laboratory Testing (empresa matriz Mérieux NutriSciences) y NSF International |

Dinámica del mercado de pruebas de alimentos en Irlanda

Conductores

- Aumento de la incidencia de enfermedades transmitidas por alimentos en Irlanda

Las enfermedades transmitidas por los alimentos también se producen debido a una variedad de bacterias, parásitos y virus, como por ejemplo Salmonella y Cryptosporidium. La Agencia de Normas Alimentarias afirma que en 2021 se produjeron alrededor de 2,4 millones de casos de enfermedades transmitidas por los alimentos en Irlanda.

Por ejemplo,

- En 2021, los datos de Food Safety News en Irlanda indican que el patógeno Campylobacter causó alrededor de 3.154 casos transmitidos por alimentos, seguido de la criptosporidiosis que causó 845 casos, la bacteria Salmonella que causó 173 casos. El número de casos causados por enfermedades transmitidas por el agua es de 25 y el número de casos que ocurrieron debido al patógeno yersinosis es de 19.

El aumento de casos de enfermedades transmitidas por los alimentos en Irlanda crearía conciencia entre los consumidores sobre la importancia de la seguridad alimentaria y de las pruebas de detección. El concepto permitiría a las organizaciones gubernamentales asociarse con las industrias del mercado para el desarrollo de laboratorios de pruebas de alimentos en los estados en desarrollo de Irlanda.

- Aumento de la concienciación de los consumidores sobre la seguridad alimentaria

La seguridad alimentaria se refiere a la manipulación y el almacenamiento adecuados de los alimentos para evitar la aparición de enfermedades transmitidas por los alimentos que resultan del consumo de alimentos adulterados. La concienciación sobre la seguridad e higiene de los alimentos es de vital importancia para las industrias alimentarias, a fin de proteger la salud de los consumidores frente a las enfermedades transmitidas por los alimentos.

Por ejemplo,

- En Irlanda, la Autoridad de Seguridad Alimentaria de Irlanda (FSAI), se asoció con el Departamento de Agricultura y Seguridad Alimentaria, un organismo subsidiario, para inculcar conciencia sobre la seguridad alimentaria y la higiene en las organizaciones gubernamentales y públicas.

De los puntos anteriores se desprende que se espera que una mayor concienciación de los consumidores genere alianzas con el gobierno y los actores del mercado, con base en la industria alimentaria, en lo que respecta a la seguridad alimentaria y las pruebas. El aumento de la concienciación permitiría encontrar formas de difundir los principios de seguridad alimentaria para los proveedores de servicios alimentarios que se puedan interpretar e implementar fácilmente, lo que se espera que impulse el crecimiento del mercado de pruebas de alimentos .

Oportunidades

- Iniciativas estratégicas de los actores del mercado

La necesidad de laboratorios de análisis de alimentos para las pruebas de alimentos en Irlanda ha aumentado debido al aumento de la prevalencia e incidencia de enfermedades transmitidas por los alimentos y al aumento de la concienciación de los consumidores en Inglaterra e Irlanda sobre la seguridad alimentaria.

Los principales actores también están tratando de diseñar estrategias específicas, como lanzamiento de productos, adquisiciones, aprobaciones, expansiones y asociaciones, para garantizar el buen funcionamiento del negocio, evitar riesgos y aumentar el crecimiento a largo plazo de las ventas del mercado.

Los principales actores también están tratando de diseñar estrategias específicas, como lanzamientos de productos, adquisiciones, aprobaciones, expansiones y asociaciones, para garantizar el buen funcionamiento del negocio, evitar riesgos y aumentar el crecimiento a largo plazo de las ventas del mercado.

Por ejemplo,

- En julio de 2021, Bureau Veritas y The Ascott Limited (Ascott), uno de los principales propietarios y operadores de alojamiento internacionales, firmaron un acuerdo global para proporcionar auditorías y certificación de los estándares de higiene y seguridad de las propiedades de Ascott en todo el mundo. Este acuerdo ayudó a la empresa a fortalecer su negocio.

- En abril de 2021, Thermo Fisher Scientific Inc. anunció un acuerdo definitivo con PPD, Inc., un proveedor líder mundial de servicios de investigación clínica para la industria farmacéutica y biotecnológica. Esto ayudará a la empresa a brindar a los clientes importantes servicios de investigación clínica y ayudarlos de nuevas maneras a convertir una idea científica en un medicamento aprobado rápidamente.

- El crecimiento de los avances tecnológicos en la industria de pruebas de alimentos.

Las restricciones impuestas a la cadena de suministro de alimentos para controlar la pandemia han obstaculizado la producción de alimentos. Los proveedores y fabricantes de cada etapa de la cadena de suministro, ya sean materias primas o productos manufacturados, son legalmente responsables de garantizar que no haya componentes o contaminantes no deseados en sus productos. Existe una demanda creciente de técnicas analíticas sensibles y confiables en toda la industria de alimentos y bebidas. Los avances tecnológicos en la industria de análisis de alimentos son la espectroscopia, la cromatografía y los inmunoensayos. Por lo tanto, para superar los obstáculos, se necesitan los últimos avances tecnológicos en los sistemas de análisis de alimentos para superar estos procesos aberrantes.

Por ejemplo,

- En julio de 2016, Intertek Group plc desarrolló una técnica única para realizar pruebas fiables de autenticidad de la miel , en colaboración con el Instituto de Identificación Botánica, Zoológica y Geográfica (BoogIH) de la mielada. La innovadora tecnología desarrollada por Intertek Group plc apuntaría a estandarizar los métodos de referencia uniformes y respaldar la experiencia técnica y el liderazgo en toda la red de servicios alimentarios de la empresa.

Se espera que el uso de nuevos avances tecnológicos mejore el diagnóstico, la estratificación de riesgos y el seguimiento de enfermedades de las muestras de alimentos. Se espera que las nuevas tecnologías innovadoras desempeñen un papel importante en las pruebas de seguridad alimentaria, ya que afectan directamente a los costos asociados con las pruebas de alimentos. Por lo tanto, se espera que el uso de nuevas tecnologías y avances en la industria de las pruebas de alimentos cree una oportunidad lucrativa para el mercado de pruebas de alimentos de Irlanda.

Restricciones/Desafíos

Complejidad en los métodos de prueba

Los laboratorios de análisis de alimentos proporcionan un control de autenticidad que garantiza la calidad del contenido del producto alimenticio. De esta manera, el análisis de alimentos garantiza que los consumidores no sean víctimas de fraude económico y que la competencia entre los fabricantes de alimentos sea razonable.

Por ejemplo,

- La falta de recursos humanos y la infraestructura obsoleta

- La escasez de productos químicos que se utilizan para realizar pruebas de muestras de alimentos

- La carga de muestra es relativamente alta y la mayoría de los laboratorios no están equipados para realizar pruebas para verificar la presencia de microbios, pesticidas o metales.

Las complejidades de los métodos de prueba darían lugar a una menor disponibilidad de laboratorios e instalaciones de prueba en Irlanda, lo que daría lugar a un aumento de los casos de enfermedades transmitidas por los alimentos y a un tratamiento tardío. Por lo tanto, se espera que las complejidades de los métodos de prueba obstaculicen el crecimiento del mercado.

El informe sobre el mercado de pruebas de alimentos de Irlanda proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de pruebas de alimentos de Irlanda, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Análisis de la epidemiología de los pacientes

La detección de enfermedades de transmisión alimentaria en Irlanda es una enfermedad crónica de los pies que es relativamente poco común y cuya incidencia es desconocida. El estudio del Centro Nacional de Información Biotecnológica (NCBI) afirma que hay 566.000 casos, 74.000 consultas médicas generales y 7.600 ingresos hospitalarios relacionados con enfermedades de transmisión alimentaria causadas por 13 patógenos conocidos en el Reino Unido.

El mercado de pruebas de alimentos de Irlanda también le proporciona un análisis detallado del mercado para el análisis de pacientes, el pronóstico y las curas. La prevalencia, la incidencia, la mortalidad y las tasas de adherencia son algunas de las variables de datos que están disponibles en el informe. Se analizan los análisis de impacto directo o indirecto de la epidemiología en el crecimiento del mercado para crear un modelo estadístico multivariado de cohorte más sólido para pronosticar el mercado en el período de crecimiento.

Impacto de la COVID-19 en el mercado de pruebas de alimentos de Irlanda

El COVID-19 ha afectado negativamente al mercado. Los confinamientos y el aislamiento durante las pandemias complican el diagnóstico, la gestión y el tratamiento. La falta de acceso a centros de atención sanitaria y laboratorios de análisis de alimentos afectará aún más al mercado. El aislamiento social aumenta el estrés, la desesperación y el apoyo social, todo lo cual puede provocar una reducción en el análisis de muestras de alimentos durante la pandemia.

Desarrollo reciente

- En marzo de 2022, ALS Limited anunció la expansión de su negocio en Europa con la adquisición de Controlvet. La adquisición mejoraría los servicios de análisis de alimentos en la región de Irlanda y enfatizaría el compromiso de ALS con el plan estratégico para el crecimiento del negocio de alimentos y productos farmacéuticos como líder del mercado global.

Alcance del mercado de pruebas de alimentos en Irlanda

El mercado de pruebas de alimentos de Irlanda está segmentado en función del tipo de prueba, el tipo de prueba de rendimiento, el sitio y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de prueba

- Sistemas

- Kits de prueba

- Consumibles

- Otros

Según el tipo de prueba , el mercado se segmenta en sistemas, kits de prueba, consumibles y otros.

Tipos de pruebas

- Pruebas de seguridad alimentaria

- Prueba de vida útil de los alimentos

- Prueba de autenticidad de alimentos

- Otros.

Sobre la base de los medicamentos, el mercado se segmentó en pruebas de seguridad alimentaria, pruebas de vida útil de los alimentos , pruebas de autenticidad de los alimentos y otros.

Sitio

- Laboratorio interno y en la empresa

- Instalación de subcontratación.

En función del sitio, el mercado está segmentado en laboratorio interno y externo.

Solicitud

- Alimento

- Cereales y granos

- Semillas oleaginosas y legumbres

- Frutos secos y bebidas

Sobre la base de la vía de aplicación, el mercado de pruebas de alimentos de Irlanda está segmentado en alimentos, cereales y granos, semillas oleaginosas y legumbres, frutos secos y bebidas.

Análisis del panorama competitivo y de la cuota de mercado de las pruebas de alimentos en Irlanda

El panorama competitivo del mercado de pruebas de alimentos de Irlanda proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de pruebas de alimentos de Irlanda.

Algunos de los principales actores que operan en el mercado de pruebas de alimentos de Irlanda son Thermo Fisher Scientific Inc., Intertek Group plc, Reading Scientific Services Ltd., ALS Limited, Premier Analytics Servies, Campden BRI, Bia Analytical, Eurofins Scientific, Food Forensics Limited, SGS SA, Bureau Veritas, TUV SUD, NEOGEN Corporation, NSF International y Romer Labs Division Holding GmbH, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF IRELAND FOOD TESTING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 IRELAND FOOD TESTING MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 OVERVIEW OF RISK PARTNERSHIP SERVICES

4.1.1 CONSULTANCY ADVICE

4.1.2 RISK-BASED TOOLS

4.1.3 SUPPLY CHAIN MANAGEMENT

4.1.4 AUDIT AND TRAINING

4.2 BREAKOUT OF SMALL, MEDIUM, AND LARGE MANUFACTURERS TO UNDERSTAND MARKET DYNAMICS IN THE IRELAND FOOD TESTING MARKET

4.3 EMERGING TREND ANALYSIS IN THE IRELAND FOOD TESTING MARKET

4.4 INTERNAL FOOD TESTING LABORATORY IN THE IRELAND FOOD TESTING MARKET

4.5 LAST FIVE YEARS OF ACQUIRED INTERNAL FOOD TESTING LABORATORIES

4.6 SUPPLY CHAIN ANALYSIS IN IRELAND FOOD SAFETY TESTING MARKET

4.7 COMPARATIVE ANALYSIS OF DIFFERENT TYPES OF THE IRELAND FOOD TESTING TECHNOLOGIES

4.8 TECHNOLOGICAL TRENDS IN IRELAND FOOD TESTING MARKET

4.9 THE IRELAND FOOD SAFETY TESTING MARKET- GROWING FOOD ADULTERATION CASES IN THE IRELAND

4.1 IRELAND FOOD TESTING MARKET- GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.11 IRELAND FOOD TESTING MARKET- INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.12 MANUFACTURER AND RETAIL ASSESSMENTS IN TERMS OF CATEGORY GROWTH/TRENDS,

4.12.1 KEY INNOVATIONS, SPECIFIC GROWTH/STAGNATION/DECLINE CATEGORIES IN THE IRELAND FOOD TESTING MARKET

5 REGULATORY FRAMEWORK AND GUIDELINES

5.1 FOOD AND BEVERAGES SAFETY AND QUALITY REGULATIONS

5.2 FOODBORNE ILLENESS OUTBREAK AND RELEVANT ACTIONS TAKEN BY GOVERNMENT BODIES

5.3 FOOD PRODUCTS RECALLS/WITHDRAWLS

5.4 ANALYSIS OF LAW SUITS RELATED TO FOOD SAFETY TESTING

5.5 RECNTLY FORMED LAWS FOR FOOD SAFETY TESTING BY GOVERNMENT BODIES

5.6 CHANGES IN GLOBAL FOOD SAFETY REGULATIONS

6 SUMMARY WRITE UP (IRELAND)

6.1 OVERVIEW

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN CASES OF FOODBORNE DISEASES IN THE IRELAND

7.1.2 INCREASED CONSUMER AWARENESS ABOUT FOOD SAFETY

7.1.3 ROLE OF GOVERNMENT ON FOOD SAFETY

7.1.4 INCREASE IN DEMAND FOR PACKAGED FOODS

7.1.5 STRICT REGULATIONS FOR FOOD SAFETY

7.2 RESTRAINTS

7.2.1 COMPLEXITY IN TESTING METHODS

7.2.2 LACK OF MAINTENANCE ON SAFETY UNIFORM STANDARDS

7.2.3 RISE IN FOOD RECALLS

7.2.4 HIGH COST ASSOCIATED WITH THE FOOD SAFETY TESTING EQUIPMENT

7.3 OPPORTUNITIES

7.3.1 STRATEGIC INITIATIVE BY MARKET PLAYERS

7.3.2 RISE IN EXPENDITURE

7.3.3 THE GROWTH OF TECHNOLOGICAL ADVANCEMENTS IN THE FOOD TESTING INDUSTRY

7.4 CHALLENGES

7.4.1 LACK OF AWARENESS AND EXPERTISE ON FOOD SAFETY REGARDING HAZARDOUS EFFECTS OF AVOIDING FOOD SAFETY TESTS

7.4.2 LACK OF FOOD MANAGEMENT INFRASTRUCTURE IN THE IRELAND

8 IRELAND FOOD TESTING MARKET, BY TESTING TYPE

8.1 OVERVIEW

8.2 SYSTEM

8.2.1 SPECTROMETRY-BASED

8.2.2 HYBRIDIZATION -BASED

8.2.2.1 POLYMERASE CHAIN REACTION (PCR)

8.2.2.2 MICROARRAYS

8.2.2.3 GENE AMPLIFIERS

8.2.2.4 SEQUENCERS

8.2.3 IMMUNOASSAY-BASED

8.2.4 CHROMATOGRAPHY-BASED

8.2.4.1 LIQUID CHROMATOGRAPHY

8.2.4.2 GAS CHROMATOGRAPHY

8.2.4.3 COLUMN CHROMATOGRAPHY

8.2.4.4 THIN LAYER CHROMATOGRAPHY

8.2.4.5 PAPER CHROMATOGRAPHY

8.2.5 BIOSENSORS/BIOCHIP

8.2.6 ISOTOPE METHODS

8.2.7 OTHERS

8.3 TEST KITS

8.4 CONSUMABLES

8.5 OTHERS

9 IRELAND FOOD TESTING MARKET, BY TYPE OF TESTS

9.1 OVERVIEW

9.2 FOOD SAFETY TESTING

9.2.1 ALLERGEN TESTING

9.2.1.1 PEANUT & SOY

9.2.1.2 GLUTEN

9.2.1.3 MILK

9.2.1.4 EGG

9.2.1.5 TREE NUTS

9.2.1.6 SEAFOOD

9.2.1.7 OTHERS

9.2.2 PATHOGEN TESTING

9.2.2.1 SALMONELLA SPP

9.2.2.2 E. COLI

9.2.2.3 LISTERIA SPP

9.2.2.4 VIBRIO SPP

9.2.2.5 CAMPYLOBACTER

9.2.2.6 OTHERS

9.2.3 GMO TESTING

9.2.3.1 STACKED

9.2.3.2 INSECT RESISTANCE

9.2.3.3 HERBICIDE TOLERANCE

9.2.4 MYCOTOXINS TESTING

9.2.4.1 AFLATOXINS

9.2.4.2 OCHRATOXINS

9.2.4.3 FUMONISINS

9.2.4.4 TRICHOTHECENES

9.2.4.5 DEOXYNIVALENOL

9.2.4.6 ZEARALENONE

9.2.4.7 PATULIN

9.2.5 NUTRITIONAL LABELLING

9.2.6 HEAVY METALS TESTING

9.2.6.1 ARSENIC

9.2.6.2 CADMIUM

9.2.6.3 LEAD

9.2.6.4 MERCURY

9.2.6.5 OTHERS

9.2.7 PESTICIDES TESTING

9.2.7.1 HERBICIDES

9.2.7.2 INSECTICIDES

9.2.7.3 FUNGICIDES

9.2.7.4 OTHERS

9.2.8 ORGANIC CONTAMINANTS TESTING

9.2.9 OTHERS

9.3 FOOD SHELF LIFE TESTING

9.3.1 MICROBIAL CONTAMINATION

9.3.2 CHEMICAL TESTS

9.3.3 RANCIDITY

9.3.3.1 PEROXIDE VALUE (PV)

9.3.3.2 P-ANISIDINE (P-AV)

9.3.3.3 FREE FATTY ACIDS (FFA)

9.3.4 ACIDITY LEVEL

9.3.5 NUTRIENT STABILITY

9.3.6 ORGANOLEPTIC APPEARANCE

9.3.6.1 COLOR

9.3.6.2 TEXTURE

9.3.6.3 AROMA

9.3.6.4 TASTE

9.3.6.5 PACKAGING

9.3.6.6 SEPARATION

9.3.6.7 STRATIFICATION

9.3.7 BROWNING

9.3.7.1 ENZYMATIC BROWNING

9.3.7.2 CHEMICAL BROWNING

9.3.8 FOOD SHELF LIFE TESTING, BY METHOD

9.3.8.1 REAL-TIME SHELF LIFE TESTING

9.3.8.2 ACCELERATED SHELF-LIFE TESTING

9.3.9 FOOD SHELF LIFE TESTING, BY PACKAGED FOOD CONDITION

9.3.9.1 FROZEN (-15°C TO -20°C )

9.3.9.2 REFRIGERATED (2°C TO 8°C )

9.3.9.3 AMBIENT (25°C/60%RH)

9.3.9.4 INTERMEDIATE (30°C/65%RH)

9.3.9.5 ACCELERATED (40°C/75%RH)

9.3.9.6 TROPICAL (30°C/75%RH)

9.3.9.7 OTHERS

9.4 FOOD AUTHENTICITY TESTING

9.4.1.1 ADULTERATION TESTS

9.4.1.2 ORGANIC

9.4.1.3 ALLERGEN TESTING

9.4.1.4 MEAT SPECIATION

9.4.1.5 GMO TESTING

9.4.1.6 HALAL VERIFICATION

9.4.1.7 KOSHER VERIFICATION

9.4.1.8 PROTECTED GEOGRAPHICAL INDICATION (PGI)

9.4.1.9 PROTECTED DENOMINATION OF ORIGIN (PDO)

9.4.1.10 FALSE LABELING

9.5 OTHERS

10 IRELAND FOOD TESTING MARKET, BY SITE

10.1 OVERVIEW

10.2 INHOUSE/INTERNAL LAB

10.3 OUTSOURCING FACILITY

11 IRELAND FOOD TESTING MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FOOD

11.2.1 FOOD, BY TYPE

11.2.1.1 EDIBLE OILS

11.2.1.1.1 SUNFLOWER OIL

11.2.1.1.2 PEANUT OIL

11.2.1.1.3 SOYBEAN OIL

11.2.1.1.4 OLIVE OIL

11.2.1.1.5 COCONUT OIL

11.2.1.1.6 OTHERS

11.2.1.2 EDIBLE OILS, BY TESTING TYPE

11.2.1.2.1 FOOD SAFETY TESTING

11.2.1.2.2 FOOD AUTHENTICITY TESTING

11.2.1.2.3 FOOD SHELF LIFE TESTING

11.2.1.3 SPICES

11.2.1.3.1 SPICES, BY TYPE OF TESTS

11.2.1.3.1.1 FOOD SAFETY TESTING

11.2.1.3.1.2 FOOD AUTHENTICITY TESTING

11.2.1.3.1.3 FOOD SHELF LIFE TESTING

11.2.1.4 DAIRY PRODUCTS

11.2.1.4.1 DAIRY PRODUCTS, BY TYPE

11.2.1.4.1.1 CHEESE

11.2.1.4.1.1.1 CHEESE CAKE

11.2.1.4.1.1.2 CHEESE CREAM

11.2.1.4.1.1.3 CHEESE BASED DESSERTS

11.2.1.4.1.1.4 CHEESE PUDDING

11.2.1.4.1.1.5 OTHERS

11.2.1.4.1.2 PROCESSED CHEESES

11.2.1.4.1.3 ICE CREAM

11.2.1.4.1.4 YOGURT

11.2.1.4.1.5 MILK DESSERT

11.2.1.4.1.6 PUDDING

11.2.1.4.1.7 CUSTARD

11.2.1.4.1.8 OTHERS

11.2.1.5 DAIRY PRODUCTS, BY TYPE OF TESTS

11.2.1.5.1 FOOD SAFETY TESTING

11.2.1.5.2 FOOD AUTHENTICITY TESTING

11.2.1.5.3 FOOD SHELF LIFE TESTING

11.2.1.6 CONFECTIONARY

11.2.1.6.1 CONFECTIONARY, BY TYPE

11.2.1.6.1.1 JAMS AND JELLIES

11.2.1.6.1.2 CANDY BARS

11.2.1.6.1.3 JELLY CANDIES

11.2.1.6.1.4 MARMALADES

11.2.1.6.1.5 FRUIT JELLY DESSERT

11.2.1.6.1.6 MERINGUES

11.2.1.6.1.7 OTHERS

11.2.1.7 CONFECTIONARY, BY TYPE OF TESTS

11.2.1.7.1 FOOD SAFETY TESTING

11.2.1.7.2 FOOD AUTHENTICITY TESTING

11.2.1.7.3 FOOD SHELF LIFE TESTING

11.2.1.8 HERBAL EXTRACTS AND HERBS

11.2.1.8.1 HERBAL EXTRACTS AND HERBS, BY TYPE OF TESTS

11.2.1.8.1.1 FOOD SAFETY TESTING

11.2.1.8.1.2 FOOD AUTHENTICITY TESTING

11.2.1.8.1.3 FOOD SHELF LIFE TESTING

11.2.1.9 MEAT & POULTRY PRODUCTS

11.2.1.9.1 MEAT & POULTRY PRODUCTS, BY TYPE

11.2.1.9.1.1 CHICKEN

11.2.1.9.1.1.1 FROZEN

11.2.1.9.1.1.2 FRESH

11.2.1.9.1.2 PORK

11.2.1.9.1.2.1 FROZEN

11.2.1.9.1.2.2 FRESH

11.2.1.9.1.3 SEAFOOD

11.2.1.9.1.3.1 FROZEN

11.2.1.9.1.3.2 FRESH

11.2.1.9.1.4 BEEF

11.2.1.9.1.4.1 FROZEN

11.2.1.9.1.4.2 FRESH

11.2.1.9.1.5 LAMB

11.2.1.9.1.5.1 FROZEN

11.2.1.9.1.5.2 FRESH

11.2.1.9.1.6 OTHERS

11.2.1.9.1.6.1 FROZEN

11.2.1.9.1.6.2 FRESH

11.2.1.9.2 MEAT AND POULTRY PRODUCTS, BY TYPE OF TESTS

11.2.1.9.2.1 FOOD SAFETY TESTING

11.2.1.9.2.2 FOOD AUTHENTICITY TESTING

11.2.1.9.2.3 FOOD SHELF LIFE TESTING

11.2.1.10 PROCESSED FOOD

11.2.1.10.1.1 CANNED FRUITS & VEGETABLES

11.2.1.10.1.2 JAMS, PRESERVES & MARMALADES

11.2.1.10.1.3 FRUIT & VEGETABLE PUREE

11.2.1.10.1.4 SAUCES, DRESSINGS AND CONDIMENTS

11.2.1.10.1.5 READY MEALS

11.2.1.10.1.6 PICKLES

11.2.1.10.1.7 SOUPS

11.2.1.10.2 PROCESSED FOOD , BY TYPE OF TESTS

11.2.1.10.2.1 FOOD SAFETY TESTING

11.2.1.10.2.2 FOOD AUTHENTICITY TESTING

11.2.1.10.2.3 FOOD SHELF LIFE TESTING

11.2.1.11 HONEY

11.2.1.11.1 HONEY, BY TYPE OF TESTS

11.2.1.11.1.1 FOOD SAFETY TESTING

11.2.1.11.1.2 FOOD AUTHENTICITY TESTING

11.2.1.11.1.3 FOOD SHELF LIFE TESTING

11.2.1.12 BABY FOODS

11.2.1.12.1 BABY FOODS, BY TYPE OF TESTS

11.2.1.12.1.1 FOOD SAFETY TESTING

11.2.1.12.1.2 FOOD AUTHENTICITY TESTING

11.2.1.12.1.3 FOOD SHELF LIFE TESTING

11.2.1.13 PLANT BASED MEAT AND MEAT ALTERNATIVES

11.2.1.13.1 PLANT BASED MEAT AND MEAT ALTERNATIVES, BY TYPE

11.2.1.13.1.1 BURGER & PATTIES

11.2.1.13.1.2 SAUSAGES

11.2.1.13.1.3 STRIPS & NUGGETS

11.2.1.13.1.4 MEATBALLS

11.2.1.13.1.5 TEMPEH

11.2.1.13.1.6 TOFU

11.2.1.13.1.7 SEITEN

11.2.1.13.1.8 OTHERS

11.2.1.13.2 PLANT BASED MEAT AND MEAT ALTERNATIVES, BY TYPE OF TESTS

11.2.1.13.2.1 FOOD SAFETY TESTING

11.2.1.13.2.2 FOOD AUTHENTICITY TESTING

11.2.1.13.2.3 FOOD SHELF LIFE TESTING

11.2.1.14 TOBACCO

11.2.1.14.1 TOBACCO, BY TYPE OF TESTS

11.2.1.14.1.1 FOOD SAFETY TESTING

11.2.1.14.1.2 FOOD AUTHENTICITY TESTING

11.2.1.14.1.3 FOOD SHELF LIFE TESTING

11.2.1.15 CBD PRODUCTS

11.2.1.15.1 CBD, BY TYPE OF TESTS

11.2.1.15.1.1 FOOD SAFETY TESTING

11.2.1.15.1.2 FOOD AUTHENTICITY TESTING

11.2.1.15.1.3 FOOD SHELF LIFE TESTING

11.3 CEREALS & GRAINS

11.3.1 CEREALS & GRAINS, BY TYPE

11.3.1.1 WHEAT

11.3.1.2 MAIZE

11.3.1.3 BARLEY

11.3.1.4 RICE

11.3.1.5 OAT

11.3.1.6 SORGHUM

11.3.1.7 OTHERS

11.3.2 CEREALS & GRAINS, BY TYPE OF TESTS

11.3.2.1 FOOD SAFETY TESTING

11.3.2.2 FOOD AUTHENTICITY TESTING

11.3.2.3 FOOD SHELF LIFE TESTING

11.4 OIL SEEDS & PULSES

11.4.1 OILSEEDS & PULSES, BY TYPE

11.4.1.1 GRAM

11.4.1.2 PEA

11.4.1.3 LENTILS

11.4.1.4 SUNFLOWER

11.4.1.5 SOYABEAN

11.4.1.6 GROUNDNUT

11.4.1.7 SESAME

11.4.1.8 COTTON SEED

11.4.1.9 PALM

11.4.1.10 OTHERS

11.4.2 OILSEEDS & PULSES, BY TYPE OF TESTS

11.4.2.1 FOOD SAFETY TESTING

11.4.2.2 FOOD AUTHENTICITY TESTING

11.4.2.3 FOOD SHELF LIFE TESTING

11.5 NUTS

11.5.1 NUTS, BY TYPE

11.5.1.1 ALMOND

11.5.1.2 WALNUT

11.5.1.3 CASHEW NUT

11.5.1.4 BRAZIL NUT

11.5.1.5 MACADAMIA NUT

11.5.1.6 OTHERS

11.5.2 NUTS, BY TYPE OF TESTS

11.5.2.1 FOOD SAFETY TESTING

11.5.2.2 FOOD AUTHENTICITY TESTING

11.5.2.3 FOOD SHELF LIFE TESTING

11.6 BEVERAGES

11.6.1 BEVERAGES, BY TYPE

11.6.1.1 ALCOHOLIC

11.6.1.1.1 BEER

11.6.1.1.2 WINE

11.6.1.1.3 WHISKY

11.6.1.1.4 VODKA

11.6.1.1.5 TEQUILA

11.6.1.1.6 GIN

11.6.1.1.7 OTHERS

11.6.1.2 NON-ALCOHOLIC

11.6.1.2.1 CARBONATED DRINKS

11.6.1.2.2 MINERAL WATER

11.6.1.2.3 COFFEE

11.6.1.2.4 JUICES

11.6.1.2.5 SMOOTHIES

11.6.1.2.5.1 TEA

11.6.1.2.6 PLANT-BASED MILK

11.6.1.2.6.1 SOY MILK

11.6.1.2.6.2 ALMOND MILK

11.6.1.2.6.3 OAT MILK

11.6.1.2.6.4 CASHEW MILK

11.6.1.2.6.5 RICE MILK

11.6.1.2.6.6 OTHERS

11.6.1.2.7 SPORTS DRINKS

11.6.1.2.8 NUTRITIONAL DRINKS

11.6.1.2.9 OTHERS

11.6.2 BEVERAGES, BY TYPE OF TESTS

11.6.2.1 FOOD SAFETY TESTING

11.6.2.2 FOOD AUTHENTICITY TESTING

11.6.2.3 FOOD SHELF LIFE TESTING

12 IRELAND FOOD TESTING MARKET BY COUNTRY

12.1.1 IRELAND

13 IRELAND FOOD TESTING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: IRELAND

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 EUROFINS SCIENTIFIC (2021)

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 THERMO FISCHER SCIENTIFIC ( (2021)

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 INTERTEK GROUP PLC (2021)

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 BUREAU VERITAS

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 TÜV SÜD (2021)

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 ALS LIMITED (2021)

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 SGS SA (2021)

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 NEOGEN CORPORATION (2021)

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 CAMPDEN BRI (2021)

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 ROMER LABS DIVISION HOLDING GMBH (A SUBSIDIARY OF DSM) (2021)

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 READING SCIENTIFIC SERVICES LIMITED (2021)

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 PREMIER ANALYTICS SERVIES (2021)

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 NSF INTERNATIONAL (2021)

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 ADVANCED LABORATORY TESTING (2021)

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 BIA ANALYTICAL (2021)

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 FOOD FORENSICS LIMITED (2021)

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 MICROLABS LTD (2021)

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 THE MARKET PLAYERS WHICH ARE UNDER THE CATEGORY OF LARGE SCALE MANUFACTURERS

TABLE 2 THE MARKET PLAYERS WHICH ARE UNDER THE CATEGORY OF SMALL AND MEDIUM SCALE MANUFACTURERS

TABLE 3 NAME OF BUSINESSES, LIKELY SCALE OF TESTING/VALUE BASED ON T/O OF BUSINESS, LOCATIONS

TABLE 4 IRELAND FOOD TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 IRELAND SYSTEM IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 IRELAND HYBRIDIZATION -BASED IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 IRELAND CHROMATOGRAPHY -BASED IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 IRELAND FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD THOUSAND)

TABLE 9 IRELAND FOOD SAFETY TESTING IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 10 IRELAND ALLERGEN TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 IRELAND PATHOGEN TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 IRELAND MYCOTOXINS TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 IRELAND HEAVY METALS TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 IRELAND PESTICIDE TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 IRELAND FOOD SHELF LIFE TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 IRELAND RANCIDITY IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 IRELAND ORGANOLEPTIC APPEARANCE IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 IRELAND BROWNING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 IRELAND FOOD SHELF LIFE TESTING IN FOOD TESTING MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 22 IRELAND FOOD AUTHENTICITY TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 IRELAND FOOD TESTING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 IRELAND FOOD IN FOOD TESTING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 IRELAND EDIBLE OILS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 IRELAND EDIBLE OILS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 28 IRELAND SPICES IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 29 IRELAND DAIRY PRODUCTS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 IRELAND CHEESE IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 IRELAND DAIRY PRODUCTS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 32 IRELAND CONFECTIONARY IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 IRELAND CONFECTIONARY IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 34 IRELAND HERBAL EXTRACTS AND HERBS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 35 IRELAND MEAT AND POULTRY PRODUCTS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 IRELAND CHICKEN IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 IRELAND PORK IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 IRELAND SEAFOOD IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 IRELAND BEEF IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 IRELAND LAMB IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 IRELAND OTHERS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 IRELAND MEAT AND POULTRY PRODUCTS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 43 IRELAND PROCESSED FOOD IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 IRELAND PROCESSED FOOD IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 45 IRELAND HONEY IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 46 IRELAND BABY FOODS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 47 IRELAND PLANT BASED MEAT AND MEAT ALTERNATIVES IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 IRELAND PLANT BASED MEAT AND MEAT ALTERNATIVES IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 49 IRELAND TOBACCO IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 50 IRELAND CBD IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 2 IRELAND CEREALS AND GRAINS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 3 IRELAND OILSEEDS & PULSES IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 IRELAND OILSEEDS & PULSES IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 5 IRELAND NUTS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 IRELAND NUTS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 7 IRELAND BEVERAGES IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 IRELAND ALCOHOLIC IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 IRELAND NON-ALCOHOLIC IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 IRELAND PLANT-BASED MILK IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 IRELAND NUTS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 12 IRELAND FOOD TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 13 IRELAND SYSTEM IN FOOD TESTING MARKET, BY TYPE , 2020-2029 (USD MILLION)

TABLE 14 IRELAND HYBRIDIZATION-BASED IN FOOD TESTING MARKET, BY TYPE , 2020-2029 (USD MILLION)

TABLE 15 IRELAND CHROMATOGRAPHY-BASED IN FOOD TESTING MARKET, BY TYPE , 2020-2029 (USD MILLION)

TABLE 16 IRELAND FOOD TESTING MARKET, BY TYPE OF TESTS , 2020-2029 (USD MILLION)

TABLE 17 IRELAND FOOD SAFETY TESTING IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 18 IRELAND ALLERGEN TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 IRELAND PATHOGEN TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 IRELAND GMO TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 IRELAND MYCOTOXINS TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 IRELAND HEAVY METALS TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 IRELAND PESTICIDES TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 IRELAND FOOD SHELF LIFE TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 IRELAND ORGANOLEPTIC AND APPEARANCE IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 IRELAND RANCIDITY IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 IRELAND BROWNING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 IRELAND FOOD SHELF LIFE TESTING IN FOOD TESTING MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 29 IRELAND FOOD SHELF LIFE TESTING IN FOOD TESTING MARKET, BY PACKAGED FOOD CONDITION, 2020-2029 (USD MILLION)

TABLE 30 IRELAND FOOD AUTHENTICITY TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 IRELAND FOOD TESTING MARKET, BY SITE, 2020-2029 (USD MILLION)

TABLE 32 IRELAND FOOD TESTING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 33 IRELAND FOOD IN FOOD TESTING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 IRELAND EDIBLE OILS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 IRELAND EDIBLE OILS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 36 IRELAND SPICES IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 37 IRELAND DAIRY PRODUCTS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 IRELAND CHEESE IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 IRELAND DAIRY PRODUCTS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 40 IRELAND CONFECTIONERY IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 IRELAND CONFECTIONERY IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 42 IRELAND HERBAL EXTRACTS AND HERBS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 43 IRELAND MEAT AND POULTRY PRODUCTS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 IRELAND CHICKEN IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 IRELAND PORK IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 IRELAND SEAFOOD IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 IRELAND BEEF IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 IRELAND LAMB IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 IRELAND OTHERS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 IRELAND MEAT AND POULTRY PRODUCTS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 51 IRELAND PROCESSED FOOD IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 IRELAND PROCESSED FOOD IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 53 IRELAND HONEY IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 54 IRELAND BABY FOOD IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 55 IRELAND PLANT BASED MEAT AND MEAT ALTERNATIVES IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 IRELAND PLANT BASED MEAT AND MEAT ALTERNATIVES IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 57 IRELAND TOBACCO IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 58 IRELAND CBD PRODUCTS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 59 IRELAND CEREALS AND GRAINS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 IRELAND CEREALS AND GRAINS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 61 IRELAND OILSEED AND PULSES IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 IRELAND OILSEED AND PULSES IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 63 IRELAND NUTS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 IRELAND NUTS IN FOOD TESTING MARKET, B TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 65 IRELAND BEVERAGES IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 IRELAND NON-ALCOHOLIC IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 IRELAND PLANT-BASED MILK IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 IRELAND ALCOHOLIC IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 IRELAND BEVERAGES IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 IRELAND FOOD TESTING MARKET: SEGMENTATION

FIGURE 2 IRELAND FOOD TESTING MARKET: DATA TRIANGULATION

FIGURE 3 IRELAND FOOD TESTING MARKET: DROC ANALYSIS

FIGURE 4 IRELAND FOOD TESTING MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 IRELAND FOOD TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 IRELAND FOOD TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 IRELAND FOOD TESTING MARKET: DBMR POSITION GRID

FIGURE 8 IRELAND FOOD TESTING MARKET: APPLICATION COVERAGE GRID

FIGURE 9 IRELAND FOOD TESTING MARKET: SEGMENTATION

FIGURE 10 RISE IN CASES OF FOOD BORNE ILLNESS IN THE IRELAND, RISE IN TECHNOLOGICAL DEVELOPMENTS IN FOOD TESTING KITS AND RISE IN CONSUMER CONSCIOUSNESS ABOUT FOOD TESTING AND SAFETY IS EXPECTED TO DRIVE IRELAND FOOD TESTING MARKET FROM 2022 TO 2029

FIGURE 11 TESTING TYPE SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE IRELAND FOOD TESTING MARKET FROM 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE IRELAND FOOD TESTING MARKET

FIGURE 13 NUMBER OF CASES CAUSED DUE TO FOODBORNE PATHOGENS IN THE U.K. IN 2016

FIGURE 14 NUMBER OF CASES CAUSED DUE TO FOODBORNE PATHOGENS IN IRELAND IN 2021

FIGURE 15 IRELAND FOOD TESTING MARKET: BY TESTING TYPE, 2021

FIGURE 16 IRELAND FOOD TESTING MARKET: BY TESTING TYPE, 2022-2029 (USD THOUSAND)

FIGURE 17 IRELAND FOOD TESTING MARKET: BY TESTING TYPE, CAGR (2022-2029)

FIGURE 18 IRELAND FOOD TESTING MARKET: BY TESTING TYPE, LIFELINE CURVE

FIGURE 19 IRELAND FOOD TESTINGMARKET: BY TYPE OF TESTS, 2021

FIGURE 20 IRELAND FOOD TESTINGMARKET: BY TYPE OF TESTS, 2022-2029 (USD THOUSAND)

FIGURE 21 IRELAND FOOD TESTINGMARKET: BY TYPE OF TESTS, CAGR (2022-2029)

FIGURE 22 IRELAND FOOD TESTINGMARKET: BY TYPE OF TESTS, LIFELINE CURVE

FIGURE 23 IRELAND FOOD TESTING MARKET: BY SITE, 2021

FIGURE 24 IRELAND FOOD TESTING MARKET: BY SITE, 2022-2029 (USD MILLION)

FIGURE 25 IRELAND FOOD TESTING MARKET: BY SITE, CAGR (2022-2029)

FIGURE 26 IRELAND FOOD TESTING MARKET: BY SITE, LIFELINE CURVE

FIGURE 27 IRELAND FOOD TESTING MARKET: BY APPLICATION, 2021

FIGURE 28 IRELAND FOOD TESTING MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 29 IRELAND FOOD TESTING MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 30 IRELAND FOOD TESTING MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 31 IRELAND FOOD TESTING MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.