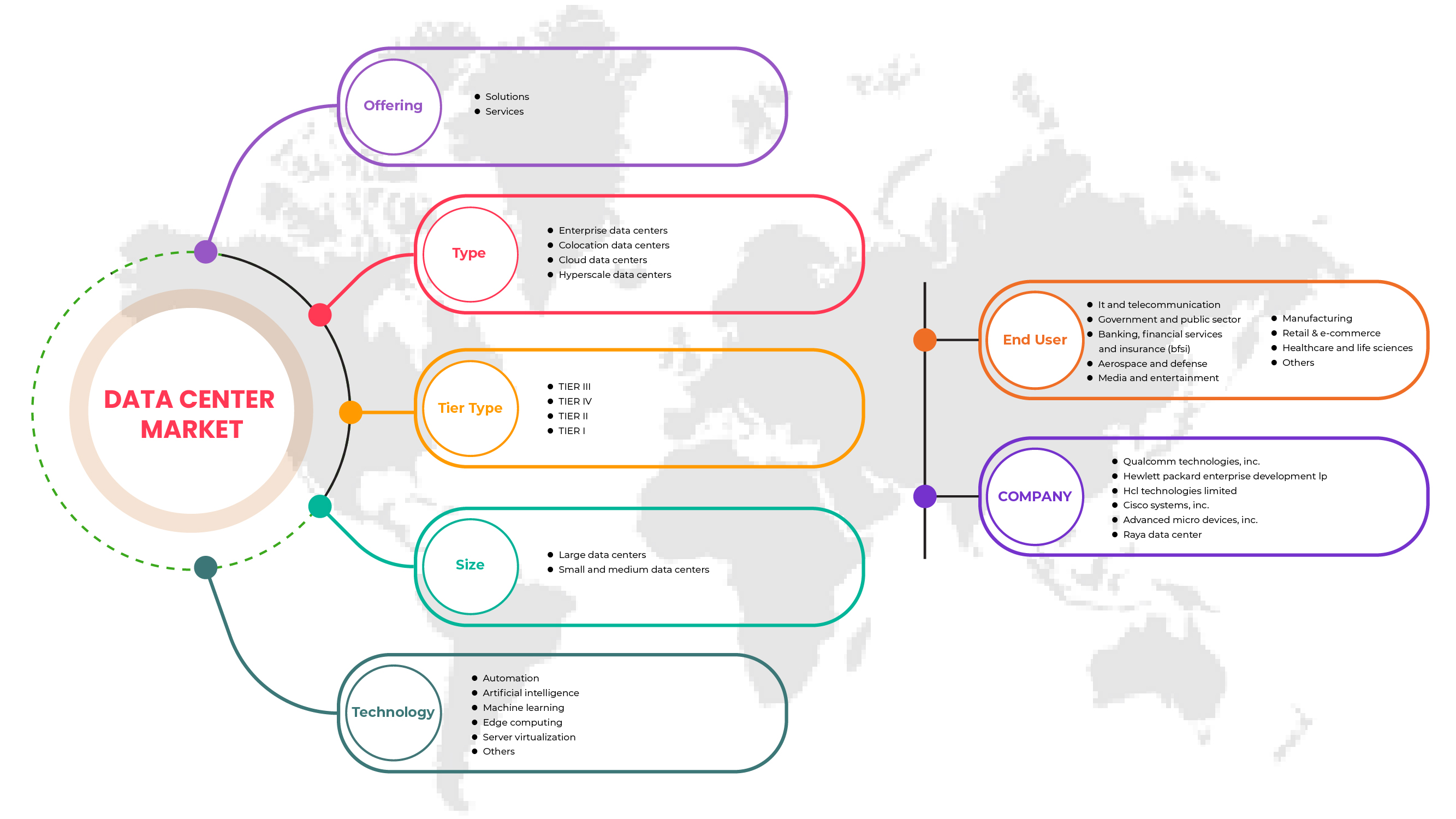

Mercado de centros de datos de Irak, por oferta (soluciones y servicios), tipo (centros de datos empresariales, centros de datos de colocación , centros de datos en la nube y centros de datos de hiperescala ), tipo de nivel (nivel III, nivel IV, nivel II y nivel I), tamaño (centros de datos grandes y centros de datos pequeños y medianos), tecnología ( automatización , inteligencia artificial, aprendizaje automático, computación de borde, virtualización de servidores y otros), usuario final (TI y telecomunicaciones, gobierno y sector público, banca, servicios financieros y seguros (BFSI), aeroespacial y defensa, medios y entretenimiento, fabricación, venta minorista y comercio electrónico, atención médica y ciencias de la vida, y otros) - Tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado de centros de datos de Irak

El centro de datos se utiliza para la gestión de datos, el flujo fluido y la seguridad, garantizando que todos los recursos estén funcionando en el momento y lugar correctos. La previsión, la programación, la gestión de habilidades, la gestión de recursos, el procesamiento, el cálculo y la clasificación de los datos son aspectos comunes de los centros de datos.

Las soluciones y los centros de datos empresariales están impulsando el crecimiento del mercado de centros de datos en todas las industrias de uso final posibles en todo el mundo. Actualmente, los centros de datos de nivel 3 tienen una gran demanda en una amplia gama de industrias, como TI y telecomunicaciones, gobierno y sector público, banca, servicios financieros y seguros (BFSI), entre otras. La alta competencia en el mercado global exige un rápido desarrollo de nuevos productos para sobrevivir en el mercado. La demanda continua de avances tecnológicos como la tecnología, la automatización, la Internet de las cosas y otros ayuda a aumentar la demanda de centros de datos.

Data Bridge Market Research analiza que se espera que el mercado de centros de datos de Irak alcance un valor de USD 1.021,73 millones para 2029, con una CAGR del 20,3 % durante el período de pronóstico. "Soluciones" representa el segmento de componentes más grande en el mercado de centros de datos que proporciona instalaciones básicas y una amplia gama de funciones con diferentes plataformas.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019-2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Por oferta (soluciones y servicios), tipo (centros de datos empresariales, centros de datos de coubicación, centros de datos en la nube y centros de datos de hiperescala), tipo de nivel (nivel III, nivel IV, nivel II y nivel I), tamaño (centros de datos grandes y centros de datos pequeños y medianos), tecnología (automatización, inteligencia artificial, aprendizaje automático, computación de borde, virtualización de servidores y otros), usuario final (TI y telecomunicaciones, gobierno y sector público, banca, servicios financieros y seguros (BFSI), aeroespacial y defensa, medios y entretenimiento, fabricación, comercio minorista y electrónico, atención médica y ciencias biológicas y otros), |

|

Países cubiertos |

Irak |

|

Actores del mercado cubiertos |

AL-NABAA, Equinix, Inc., FUTURE DIGITAL DATA SYSTEMS, Khazna, GIGA-BYTE Technology Co., Ltd., eHosting DataFort, Qualcomm Technologies, Inc., Advanced Micro Devices, Inc., Arista Networks, Inc., Quantum Switch, MEEZA, Delta Electronics, Inc., ABB, Siemens, Eaton, Schneider Electric, HCL Technologies Limited, Cisco Systems, Inc., Hewlett Packard Enterprise Development LP, Raya Data Center y Huawei Technologies Co., Ltd., entre otros. |

Definición de mercado

Un centro de datos es una instalación de última generación que administra los sistemas y equipos informáticos relacionados con TI. Los centros de datos conectan los estándares de infraestructura con los requisitos del entorno operativo de varias industrias de usuarios finales. El centro de datos se subcontrata a muchas empresas en todo el mundo que proporcionan la instalación en función de los requisitos del usuario final y del cliente. Este tipo de soluciones o los servicios ofrecidos a los clientes dependen de las condiciones de trabajo y de los componentes utilizados en los centros de datos, que utilizan diferentes tipos de tecnologías y componentes electrónicos en función del tamaño de los datos gestionados y almacenados. El mercado de los centros de datos garantiza la gestión, el almacenamiento, el procesamiento y la computación de los datos, incluidos los tiempos de respuesta de los componentes para replicar el flujo de datos.

Dinámica del mercado de los centros de datos

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- El aumento de la demanda de digitalización en las operaciones comerciales

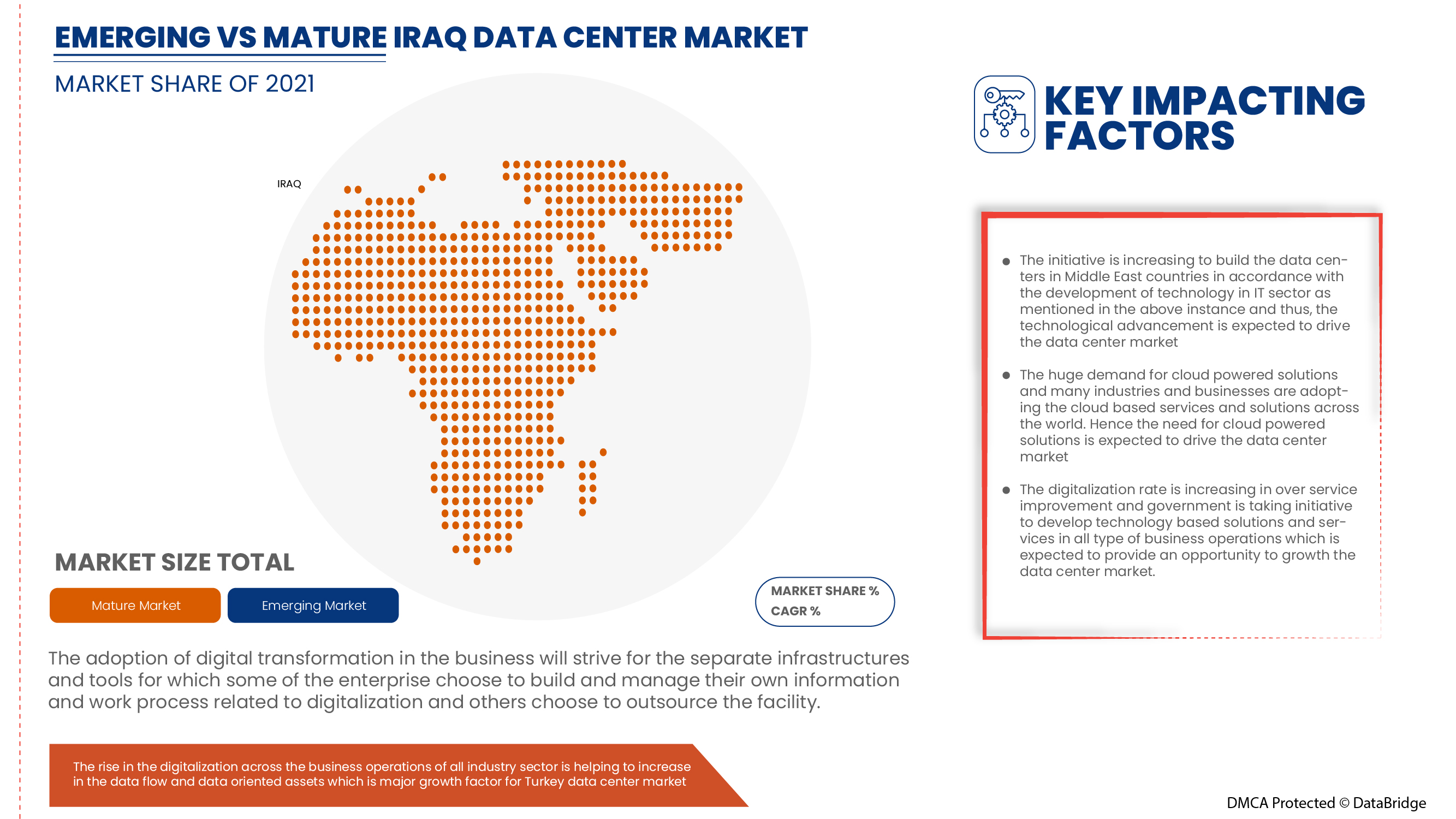

La necesidad de digitalización ha ido creciendo en toda la región a lo largo de los años, lo que ha beneficiado a la población del país y, por lo tanto, la demanda aumentará en el futuro. La adopción de la transformación digital en las empresas buscará infraestructuras y herramientas independientes para las cuales algunas empresas optarán por construir y gestionar su información y procesos de trabajo relacionados con la digitalización, mientras que otras optarán por externalizar las instalaciones. Esto replica la adopción y el uso de los centros de datos en toda la región y muestra la expectativa de la necesidad de los centros de datos en la región.

- Avances tecnológicos en el sector TI

El avance tecnológico ha creado soluciones y productos innovadores que han tenido un impacto en la demanda de conectividad fácil y fluida, por lo que se requiere la cantidad perfecta de infraestructura denominada centros de datos. Además, la iniciativa de construir centros de datos en los países de Oriente Medio está aumentando tras el desarrollo de la tecnología en el sector de TI, como se mencionó en el ejemplo anterior. Por lo tanto, se espera que el avance tecnológico impulse el mercado de los centros de datos.

- La creciente popularidad de las soluciones basadas en la nube

Los gobiernos de muchos países de Oriente Medio están apoyando muchas iniciativas para que las personas inicien un negocio tecnológico, lo que está impulsando a las pequeñas y medianas empresas a transformarse digitalmente. La enorme demanda de soluciones basadas en la nube y muchas industrias y empresas están adoptando servicios y soluciones basados en la nube no solo en Oriente Medio y los países del CCG, sino en todo el mundo. Por lo tanto, se espera que la necesidad de soluciones basadas en la nube impulse el mercado de los centros de datos.

- Demanda creciente de instalaciones de trabajo y aprendizaje remotos

La pandemia ha alterado la educación en más de 150 países y ha afectado a 1.600 millones de estudiantes. Por ello, numerosos países han implementado algún tipo de aprendizaje a distancia. La respuesta educativa durante la etapa inicial de la COVID-19 se centró en implementar modalidades de aprendizaje a distancia como respuesta a la crisis. Sin embargo, no siempre fueron eficaces, pero a medida que la pandemia se ha desarrollado, también lo han hecho las respuestas educativas.

Restricciones

- Infraestructura poco fiable en los países en desarrollo

En particular, en los países en desarrollo, las infraestructuras de las ciudades siguen ofreciendo formas de asistencia problemáticas y son vulnerables a los impactos externos, incluidos los peligros naturales. Además, las inundaciones suelen afectar a toda la economía metropolitana, incluso más allá de las zonas directamente afectadas por las inundaciones. Cuando las calles se desbordan, el transporte público y todo el tráfico se paralizan. Las personas no pueden llegar a sus lugares de trabajo, las cadenas de suministro se interrumpen, se pierden entregas y se pierden acuerdos. El suministro eléctrico también se ve afectado con frecuencia, lo que provoca apagones y pone fin a la actividad económica. Por lo tanto, se espera que la falta de infraestructuras fiables en los países en desarrollo limite el crecimiento del mercado de los centros de datos.

- Complejidades involucradas en la integración de diferentes herramientas de centros de datos

La integración de los centros de datos y el big data implica una amplia gama de requisitos y está asociada a estrategias de trabajo complejas que no se pueden eliminar, pero que se pueden simplificar mediante diversas herramientas y soluciones, que requieren costos de instalación y mantenimiento adicionales con frecuencia y, por lo tanto, la integración de diferentes herramientas de centros de datos implica complejidades. Se espera que frene el mercado de centros de datos.

Impacto posterior al COVID-19 en el mercado de centros de datos

La COVID-19 ha tenido un gran impacto en el mercado de los centros de datos, ya que casi todos los países han optado por cerrar todas las instalaciones de producción, excepto las que se dedican a la producción de bienes esenciales. El gobierno ha tomado algunas medidas estrictas, como el cierre de la producción y la venta de bienes no esenciales, el bloqueo del comercio internacional y muchas otras para evitar la propagación de la COVID-19. Las únicas empresas que han tenido que hacer frente a esta situación de pandemia han sido los servicios esenciales a los que se les ha permitido abrir y ejecutar los procesos.

El COVID-19 ha afectado al mercado de los centros de datos. Los limitados costos de inversión y la falta de empleados obstaculizaron las ventas y la producción de los centros de datos. Sin embargo, el gobierno y los actores clave del mercado adoptaron nuevas medidas de seguridad para desarrollar las prácticas. Los avances en la tecnología aceleraron la tasa de crecimiento del mercado de los centros de datos, ya que se dirigieron a la audiencia adecuada. Se espera que el mercado de la construcción de centros de datos recupere su ritmo durante el escenario posterior a la pandemia debido a la flexibilización de las restricciones.

Acontecimientos recientes

- En junio de 2022, Schneider Electric anunció una nueva investigación sobre la innovación de las infraestructuras de TI para operaciones netas cero para la industria de TI y de centros de datos. Este desarrollo ayudará a la empresa a exponer la brecha de acción en los centros de datos e innovar con nuevas soluciones para llenar el vacío y mejorar la eficiencia de los centros de datos.

- En diciembre de 2021, Equinix, Inc. anunció una asociación de varios años con Nasdaq, Inc. para ampliar el uso del centro de datos de la empresa. Esta asociación ayudará a la empresa a fortalecer su posición en el mercado y atraer nuevos clientes al ganarse la confianza gracias a la asociación con una empresa de prestigio.

Alcance del mercado de centros de datos de Irak

El mercado de centros de datos está segmentado en función de las ofertas, el tipo, el tipo de nivel, el tamaño, la tecnología y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Ofrenda

- Soluciones

- Servicios

Sobre la base de la oferta, el mercado de centros de datos de Irak está segmentado en soluciones y servicios .

Tipo

- Centros de datos empresariales

- Centros de datos de coubicación

- Centros de datos en la nube

- Centros de datos a hiperescala

Según el tipo, el mercado de centros de datos de Irak está segmentado en centros de datos de colocación, centros de datos empresariales, centros de datos en la nube y centros de datos de hiperescala.

Tipo de nivel

- Nivel I

- Nivel II

- Nivel III

- Nivel IV

Según el tipo de nivel, el mercado de centros de datos de Irak se segmenta en nivel I, nivel II, nivel III y nivel IV.

Tamaño

- Grandes centros de datos

- Centros de datos pequeños y medianos

En función del tamaño, el mercado de centros de datos de Irak está segmentado en centros de datos grandes y centros de datos pequeños y medianos.

Tecnología

- Automatización

- Inteligencia artificial

- Aprendizaje automático

- Computación de borde

- Virtualización de servidores

- Otros

Sobre la base de la tecnología, el mercado de centros de datos de Irak está segmentado en computación de borde, virtualización de servidores, automatización, inteligencia artificial, aprendizaje automático y otros.

Usuario final

- Informática y telecomunicaciones

- Gobierno y sector público

- Banca, servicios financieros y seguros (BFSI)

- Aeroespacial y Defensa

- Medios y entretenimiento

- Fabricación

- Venta minorista y comercio electrónico

- Salud y ciencias de la vida

- Otros

Sobre la base del usuario final, el mercado de centros de datos de Irak está segmentado en TI y telecomunicaciones, gobierno y sector público, banca, servicios financieros y seguros (BFSI), aeroespacial y defensa, medios y entretenimiento, manufactura, venta minorista y comercio electrónico, atención médica y ciencias de la vida, y otros.

Análisis y perspectivas regionales del mercado de centros de datos

Se analiza el mercado de centros de datos y se proporcionan información y tendencias del tamaño del mercado por país, oferta, tipo, tipo de nivel, tamaño, tecnología y usuario final, como se menciona anteriormente.

El país cubierto en el informe del mercado de centros de datos es Irak.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas arriba y aguas abajo, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Medio Oriente y sus desafíos afrontados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles internos y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los centros de datos

El panorama competitivo del mercado de centros de datos proporciona detalles sobre el competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en la región, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos proporcionados anteriormente solo están relacionados con el enfoque de las empresas en relación con el mercado de centros de datos.

Algunos de los principales actores que operan en el mercado de centros de datos son AL-NABAA, Equinix, Inc., FUTURE DIGITAL DATA SYSTEMS, Khazna, GIGA-BYTE Technology Co., Ltd., eHosting DataFort, Qualcomm Technologies, Inc., Advanced Micro Devices, Inc., Arista Networks, Inc., Quantum Switch, MEEZA, Delta Electronics, Inc., ABB, Siemens, Eaton, Schneider Electric, HCL Technologies Limited, Cisco Systems, Inc., Hewlett Packard Enterprise Development LP, Raya Data Center y Huawei Technologies Co., Ltd., entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF IRAQ DATA CENTER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 IRAQ OFFERING TIMELINE CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCE ANALYSIS

4.2 BENEFITS OF DATA CENTER SOLUTIONS FOR BUSINESSES

4.3 MACHINE LEARNING APPLICATIONS FOR DATA CENTER OPTIMIZATION

4.4 TRENDS TO SHAPE THE DATA CENTER INDUSTRY

4.4.1 GREEN DATA CENTERS

4.4.2 ENERGY STORAGE

4.4.3 AUTOMATION AND ROBOTICS

4.4.4 SUSTAINABILITY

4.5 VALUE CHAIN ANALYSIS

4.5.1 OVERVIEW OF VALUE CHAIN ANALYSIS OF IRAQ DATA CENTER MARKET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FOR DIGITALIZATION IN BUSINESS OPERATIONS

5.1.2 TECHNOLOGICAL ADVANCEMENTS IN THE IT SECTOR

5.1.3 INCREASING POPULARITY OF CLOUD-POWERED SOLUTIONS

5.1.4 RISING DEMAND FOR REMOTE WORKING AND LEARNING FACILITIES

5.2 RESTRAINTS

5.2.1 UNRELIABLE INFRASTRUCTURE IN DEVELOPING COUNTRIES

5.2.2 COMPLEXITIES INVOLVED IN THE INTEGRATION OF DIFFERENT DATA CENTER TOOLS

5.3 OPPORTUNITIES

5.3.1 INCREASING DEMAND FROM GOVERNMENT AND PRIVATE SECTOR FOR SERVICE IMPROVEMENT

5.3.2 SURGE IN THE ADOPTION OF ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

5.3.3 RISE IN THE E-COMMERCE BUSINESS ACROSS THE REGION

5.4 CHALLENGES

5.4.1 HINDRANCE IN DATA CENTER SUPPLY CHAIN

5.4.2 CHALLENGES IN DATA CLASSIFICATION AND PROCESSING

6 IRAQ DATA CENTER MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTIONS

6.3 SERVICES

7 IRAQ DATA CENTER MARKET, BY TYPE

7.1 OVERVIEW

7.2 ENTERPRISE DATA CENTERS

7.3 COLOCATION DATA CENTERS

7.4 CLOUD DATA CENTERS

7.5 HYPERSCALE DATA CENTERS

8 IRAQ DATA CENTER MARKET, BY TIER TYPE

8.1 OVERVIEW

8.2 TIER III

8.3 TIER IV

8.4 TIER II

8.5 TIER I

9 IRAQ DATA CENTER MARKET, BY SIZE

9.1 OVERVIEW

9.2 LARGE DATA CENTERS

9.3 SMALL AND MEDIUM DATA CENTERS

10 IRAQ DATA CENTER MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 AUTOMATION

10.3 ARTIFICIAL INTELLIGENCE

10.4 MACHINE LEARNING

10.5 EDGE COMPUTING

10.6 SERVER VIRTUALIZATION

10.7 OTHERS

11 IRAQ DATA CENTER MARKET, BY END USER

11.1 OVERVIEW

11.2 IT AND TELECOMMUNICATION

11.3 GOVERNMENT AND PUBLIC SECTOR

11.4 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

11.5 AEROSPACE AND DEFENSE

11.6 MEDIA AND ENTERTAINMENT

11.7 MANUFACTURING

11.8 RETAIL & E-COMMERCE

11.9 HEALTHCARE AND LIFE SCIENCES

11.1 OTHERS

12 IRAQ DATA CENTER MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: IRAQ

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 ADVANCED MICRO DEVICES, INC

14.1.1 COMPANY SNAPSHOT

14.1.1 REVENUE ANALYSIS

14.1.2 PRODUCT PORTFOLIO

14.1.3 RECENT DEVELOPMENTS

14.2 CISCO SYSTEMS, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 QUALCOMM TECHNOLOGIES, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 HCL TECHNOLOGIES LIMITED

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 ABB

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 AL-NABAA

14.7.1 COMPANY SNAPSHOT

14.7.2 SOLUTIONS PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 ARISTA NETWORKS, INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 DELTA ELECTRONICS, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 EATON

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 EHOSTING DATAFORT

14.11.1 COMPANY SNAPSHOT

14.11.2 SERVICE PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 EQUINIX, INC.

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 SOLUTION PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 FUTURE DIGITAL DATA SYSTEMS

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 GIGA-BYTE TECHNOLOGY CO., LTD.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 HUAWEI TECHNOLOGIES CO., LTD.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 KHAZNA

14.16.1 COMPANY SNAPSHOT

14.16.2 SERVICE PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 MEEZA

14.17.1 COMPANY SNAPSHOT

14.17.2 SERVICE PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 QUANTUM SWITCH

14.18.1 COMPANY SNAPSHOT

14.18.2 SERVICE PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 RAYA DATA CENTER

14.19.1 COMPANY SNAPSHOT

14.19.2 SERVICE PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

14.2 SCHNEIDR ELECTRIC

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENTS

14.21 SIEMENS

14.21.1 COMPANY SNAPSHOT

14.21.2 REVENUE ANALYSIS

14.21.3 PRODUCT PORTFOLIO

14.21.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 IRAQ DATA CENTER MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 IRAQ SOLUTIONS IN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 IRAQ POWER DISTRIBUTION IN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 IRAQ SERVICES IN DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 IRAQ DATA CENTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 IRAQ DATA CENTER MARKET, BY TIER TYPE, 2020-2029 (USD MILLION)

TABLE 7 IRAQ DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 8 IRAQ DATA CENTER MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 9 IRAQ DATA CENTER MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 10 IRAQ IT AND TELECOMMUNICATION IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 11 IRAQ GOVERNMENT AND PUBLIC SECTOR IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 12 IRAQ BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 13 IRAQ AEROSPACE AND DEFENSE IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 14 IRAQ MEDIA AND ENTERTAINMENT IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 15 IRAQ MANUFACTURING IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 16 IRAQ RETAIL & E-COMMERCE IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 17 IRAQ HEALTHCARE AND LIFE SCIENCES IN DATA CENTER MARKET, BY SIZE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 IRAQ DATA CENTER MARKET: SEGMENTATION

FIGURE 2 IRAQ DATA CENTER MARKET: DATA TRIANGULATION

FIGURE 3 IRAQ DATA CENTER MARKET: DROC ANALYSIS

FIGURE 4 IRAQ DATA CENTER MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 IRAQ DATA CENTER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 IRAQ DATA CENTER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 IRAQ DATA CENTER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 IRAQ DATA CENTER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 IRAQ DATA CENTER MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 IRAQ DATA CENTER MARKET: SEGMENTATION

FIGURE 11 RISE IN THE ADOPTION OF CLOUD BASED SOLUTIONS IS EXPECTED TO DRIVE IRAQ DATA CENTER MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 THE SOLUTIONS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF IRAQ DATA CENTER MARKET IN 2022 & 2029

FIGURE 13 PORTER'S FIVE FORCE ANALYSIS

FIGURE 14 VALUE CHAIN ANALYSIS FRAMEWORK

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF IRAQ DATA CENTER MARKET

FIGURE 16 UNEMPLOYMENT RATE IN THE MIDDLE EAST & NORTH AFRICA REGION

FIGURE 17 PENETRATION OF 3G-OR-GREATER MOBILE INTERNET IN THE MIDDLE EAST

FIGURE 18 SIZING CLOUD SHIFT, WORLDWIDE, 2019 – 2025

FIGURE 19 IRAQ DATA CENTER MARKET, BY OFFERING, 2021

FIGURE 20 IRAQ DATA CENTER MARKET, BY TYPE, 2021

FIGURE 21 IRAQ DATA CENTER MARKET, BY TIER TYPE, 2021

FIGURE 22 IRAQ DATA CENTER MARKET, BY SIZE, 2021

FIGURE 23 IRAQ DATA CENTER MARKET, BY TECHNOLOGY, 2021

FIGURE 24 IRAQ DATA CENTER MARKET, BY END USER, 2021

FIGURE 25 IRAQ DATA CENTER MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.